Professional Documents

Culture Documents

4 Business Government

Uploaded by

Preethish Reddy GaddamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 Business Government

Uploaded by

Preethish Reddy GaddamCopyright:

Available Formats

BUSINESS GOVERNMENT INCORPORATION

YES IN INDIA BUSINESSESS ARE ALLOWED TO INCORPORATE THE TYPES OF BUSINESSESS ALLOWED TO INCORPORATE ARE

y y y y y y y y y y y

Private Limited Company Public Limited Company Unlimited Company Limited Liability Partnership Partnership Sole Proprietorship Liaison Office/Representative Office Project Office Branch Office Joint Venture Company Subsidiary Company

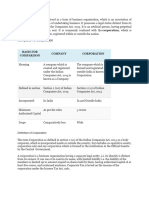

THE PROCEDURE FOR INCORPORATING A COMPANY Incorporation of Companies in India and setting up of branch offices of foreign corporations in India are regulated by the Companies Act, 1956. The Companies Act of 1956 sets down rules and regulations for the establishment of both public and private companies in India.

For the purpose of incorporation in India under the Companies Act, 1956, the first step for the formation of a company is the approval of the name by the Registrar of Companies (hereinafter referred as ROC) in the State/Union Territory in which the company will maintain its registered office. This approval is subject to certain conditions. For instance, there should not be an existing company by the same name. Further, the last words in the name are required to be "Private Ltd." in the case of a private company and "Limited" in the case of a Public Company. YES CORPORATIONS ARE CONSIDERED PERSONS IN INDIA.

A number of provisions put forth by the Companies Act govern the incorporation of a company and the practices by which incorporated companies must abide. Banking partnerships of 10 or more people and business partnerships involving 20 or more parties, must be registered as corporations with the Indian government. All memoranda produced by an incorporated company in India must bear the name of the corporation, the state the corporation is located in and be broken into numbered paragraphs that detail corporate activity. The government will use these memoranda for proof of incorporation and subsequent corporate activities.

You might also like

- LLC: What You Need to Know About Starting a Limited Liability Company along with Tips for Dealing with Bookkeeping, Accounting, and Taxes as a Small BusinessFrom EverandLLC: What You Need to Know About Starting a Limited Liability Company along with Tips for Dealing with Bookkeeping, Accounting, and Taxes as a Small BusinessRating: 5 out of 5 stars5/5 (26)

- Punjabi University Patiala: Topic Legal Environment Course Mba (Regular) Sem-1 Subject Business EnvironmentDocument22 pagesPunjabi University Patiala: Topic Legal Environment Course Mba (Regular) Sem-1 Subject Business EnvironmentPriya SharmaNo ratings yet

- Company Vs CorporationDocument2 pagesCompany Vs CorporationGITANJALI MISHRANo ratings yet

- Unit 1Document27 pagesUnit 1GITANJALI MISHRANo ratings yet

- Types of Business Entities in IndiaDocument13 pagesTypes of Business Entities in IndiaDipali MahalleNo ratings yet

- Company and FormationDocument24 pagesCompany and FormationSneha RochlaniNo ratings yet

- Types of CompanyDocument17 pagesTypes of CompanyKritesh PatelNo ratings yet

- Company Law & Secretarial PracticeDocument13 pagesCompany Law & Secretarial PracticecitiNo ratings yet

- How Is A Company Registered by The RocDocument3 pagesHow Is A Company Registered by The RocRahul GuptaNo ratings yet

- Unit 1 - Introduction To Company LawDocument4 pagesUnit 1 - Introduction To Company Lawgillian soonNo ratings yet

- Indian Companies ACT (PART 1)Document80 pagesIndian Companies ACT (PART 1)asmitamittal1998No ratings yet

- The Framework For Foreign Direct Investment (FDI) in IndiaDocument6 pagesThe Framework For Foreign Direct Investment (FDI) in IndiaSameer KumarNo ratings yet

- Unit 2 Company LawDocument34 pagesUnit 2 Company LawPriya SekarNo ratings yet

- Procedure To Setup Business in IndiaDocument30 pagesProcedure To Setup Business in IndiaNitin JainNo ratings yet

- Cla Chap 1Document9 pagesCla Chap 1mmmmNo ratings yet

- UNIT-4 Companies Act, 1956 (Part-I) : The Characteristics of The CompanyDocument11 pagesUNIT-4 Companies Act, 1956 (Part-I) : The Characteristics of The CompanyČhâïthü ChaithuNo ratings yet

- Procedure For Incorporating A Company in India "A Snap Shot"Document3 pagesProcedure For Incorporating A Company in India "A Snap Shot"Abhishek SrivastavaNo ratings yet

- Lab Study Note-2021Document78 pagesLab Study Note-2021elizabeth shrutiNo ratings yet

- Lab Mba Sem 1Document6 pagesLab Mba Sem 1Gunjan LalwaniNo ratings yet

- Private Limited Company Nature of BusinessDocument14 pagesPrivate Limited Company Nature of BusinesskaavyaNo ratings yet

- COMPANY LAW UpDocument95 pagesCOMPANY LAW UpAshesh DasNo ratings yet

- Company Law UpDocument95 pagesCompany Law UpAshesh DasNo ratings yet

- IncorporationDocument23 pagesIncorporationDevendra BhagyawantNo ratings yet

- Business Law: Submitted To: Brig. (R) Muhammad Saleem Submitted By: Hashim Khan Roll No: L-21203 Class: MBA-4 (Morning)Document9 pagesBusiness Law: Submitted To: Brig. (R) Muhammad Saleem Submitted By: Hashim Khan Roll No: L-21203 Class: MBA-4 (Morning)Wazeeer AhmadNo ratings yet

- Company Law and Secretarial Practices. Proj ECTDocument31 pagesCompany Law and Secretarial Practices. Proj ECTRahul GuptaNo ratings yet

- Taxguru - In-How To Incorporate A One Person CompanyDocument16 pagesTaxguru - In-How To Incorporate A One Person CompanyRam IyerNo ratings yet

- Adctx02 - 21 Paper 1Document7 pagesAdctx02 - 21 Paper 1Soumya swarup MohantyNo ratings yet

- Types of Legal Business Structure in IndiaDocument18 pagesTypes of Legal Business Structure in IndiaROHAN SHELKENo ratings yet

- Unit - IiDocument110 pagesUnit - IisubakarthiNo ratings yet

- Indian Companies Act UPSC NotesDocument3 pagesIndian Companies Act UPSC NotesAvik PodderNo ratings yet

- Company Act 1956Document31 pagesCompany Act 1956Saurabh Rinku100% (4)

- Elements of Company Law..FinalDocument99 pagesElements of Company Law..FinalsagarsavlaNo ratings yet

- T.Y.Bcom: Name: Arshiya Shaikh Class: Division: 1 Roll No: 14 Topic: Registration ProcedureDocument6 pagesT.Y.Bcom: Name: Arshiya Shaikh Class: Division: 1 Roll No: 14 Topic: Registration ProcedureArshiya ShaikhNo ratings yet

- Complete Notes - Unit IVDocument33 pagesComplete Notes - Unit IVDhruv SainiNo ratings yet

- Index: 2. Memorandum of Company 3. Steps in Incorporation of A Company 4. Certificate of Incorporation 5. ConclusionDocument8 pagesIndex: 2. Memorandum of Company 3. Steps in Incorporation of A Company 4. Certificate of Incorporation 5. ConclusionSahil SaharanNo ratings yet

- Genesis of The Companies ACT, 1956:: The Main Objects and Purposes of Statutes Relating To Companies Are As FollowsDocument49 pagesGenesis of The Companies ACT, 1956:: The Main Objects and Purposes of Statutes Relating To Companies Are As FollowsAriful Hassan SaikatNo ratings yet

- Unit 1 Nature and Types of Companies: StructureDocument34 pagesUnit 1 Nature and Types of Companies: StructureM A HussainNo ratings yet

- Business Setup in IndiaDocument10 pagesBusiness Setup in IndiaCompany Legal GroupNo ratings yet

- Incorporation of CompanyDocument16 pagesIncorporation of CompanyAashina GuptaNo ratings yet

- Company LawDocument26 pagesCompany LawAlways OPNo ratings yet

- Registration of Company in IndiaDocument13 pagesRegistration of Company in IndiaRajesh RanjanNo ratings yet

- One Person Company: Under New Companies Act, 2013Document11 pagesOne Person Company: Under New Companies Act, 2013Aadil KakarNo ratings yet

- Module 5Document39 pagesModule 5you • were • trolledNo ratings yet

- Essential Features of A CompanyDocument17 pagesEssential Features of A CompanySujata MansukhaniNo ratings yet

- 1.introduction, Features & Formation of CopaniesDocument35 pages1.introduction, Features & Formation of CopaniesIshan GuptaNo ratings yet

- Company Law: Holding and Subsidiary Company - Tata CompanyDocument41 pagesCompany Law: Holding and Subsidiary Company - Tata CompanyVanshdeep Singh SamraNo ratings yet

- Lab - Study Note - 1-MergedDocument84 pagesLab - Study Note - 1-MergedAAYUSH MODI IPM 2020 -25 BatchNo ratings yet

- Aims and ObjectivesDocument12 pagesAims and ObjectivesdeepakNo ratings yet

- Aims and ObjectivesDocument10 pagesAims and ObjectivesdeepakNo ratings yet

- Aims and ObjectivesDocument10 pagesAims and Objectivesdeepak goyalNo ratings yet

- Chapter # 01: Salman Masood SheikhDocument29 pagesChapter # 01: Salman Masood Sheikhsohail merchantNo ratings yet

- Company Law FullDocument206 pagesCompany Law FullThrishul MaheshNo ratings yet

- Assignment Business LawDocument6 pagesAssignment Business LawAndy ChilaNo ratings yet

- COMPANY ActDocument7 pagesCOMPANY ActtabrezNo ratings yet

- Forms of Business EnterpriseDocument29 pagesForms of Business EnterpriseMd. FaisalNo ratings yet

- Corporate Law AssignmentDocument15 pagesCorporate Law Assignmentsandeep Gurjar100% (1)

- Business Law AssignmentDocument24 pagesBusiness Law AssignmentShailesh KhodkeNo ratings yet

- Companies Act 2013: Meaning of A CompanyDocument7 pagesCompanies Act 2013: Meaning of A CompanyMohit RanaNo ratings yet