Professional Documents

Culture Documents

12 TH

12 TH

Uploaded by

Mohamed Gamal0 ratings0% found this document useful (0 votes)

19 views1 pageYou have $200,000 saved for retirement split evenly between two stocks, X and Y. The expected returns and risks of each stock is provided under different economic states. You must calculate: 1) the expected return of each stock, 2) the risk of each stock, 3) the expected return of the portfolio, and 4) the risk of the portfolio.

Original Description:

Original Title

12th

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentYou have $200,000 saved for retirement split evenly between two stocks, X and Y. The expected returns and risks of each stock is provided under different economic states. You must calculate: 1) the expected return of each stock, 2) the risk of each stock, 3) the expected return of the portfolio, and 4) the risk of the portfolio.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views1 page12 TH

12 TH

Uploaded by

Mohamed GamalYou have $200,000 saved for retirement split evenly between two stocks, X and Y. The expected returns and risks of each stock is provided under different economic states. You must calculate: 1) the expected return of each stock, 2) the risk of each stock, 3) the expected return of the portfolio, and 4) the risk of the portfolio.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

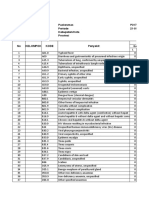

Question (1) : You have saved $ 200,000 for retirement. The money is invested in a diversified portfolio of U.S.

stocks (X & Y), assume a two stock portfolio with 100,000 in (X) and 100,000 (Y) and you have the following information about 2 securities (X & Y): State of the economy Probability X Y Recession 0.25 -0.22 0.28 Average 0.50 0.20 0.00 Boom 0.25 0.60 -0.20 a. Calculate the expected rate of return on X & Y. b. Calculate the stand-alone risk ( ) of X & Y. c. Calculate the expected rate of return on portfolio. d. Calculate the portfolio risk ( ).

You might also like

- 20 Ways To Make 100 Per Day OnlineDocument247 pages20 Ways To Make 100 Per Day Onlinehugo789No ratings yet

- Financial Stability: Fraud, Confidence and the Wealth of NationsFrom EverandFinancial Stability: Fraud, Confidence and the Wealth of NationsNo ratings yet

- Isl202 QuizDocument6 pagesIsl202 Quiznoor ain89% (9)

- Portrait of The Artist As A Young Man Study GuideDocument22 pagesPortrait of The Artist As A Young Man Study GuideIoanaAna50% (2)

- Ratio ReviewerDocument45 pagesRatio ReviewerEdgar Lay75% (8)

- M 6 Problem Set SolutionsDocument8 pagesM 6 Problem Set SolutionsNiyati ShahNo ratings yet

- UMG8900Document0 pagesUMG8900Americo HuertaNo ratings yet

- Module 3 and 4 Only QuestionsDocument169 pagesModule 3 and 4 Only QuestionslovishNo ratings yet

- Ken Black QA ch19Document42 pagesKen Black QA ch19Rushabh VoraNo ratings yet

- Is Your Child Doctor or Engineer? - : Combinations For Medical ProfessionDocument4 pagesIs Your Child Doctor or Engineer? - : Combinations For Medical ProfessionjanakrajchauhanNo ratings yet

- Joseph W. Bendersky - Carl Schmitt Confronts The English Speaking WorldDocument11 pagesJoseph W. Bendersky - Carl Schmitt Confronts The English Speaking Worldrlm2101No ratings yet

- Chapter 7 Capital Allocation Between The Risky Asset and The Risk-Free AssetDocument47 pagesChapter 7 Capital Allocation Between The Risky Asset and The Risk-Free AssetLika ChanturiaNo ratings yet

- Chap 06Document32 pagesChap 06Mihai StoicaNo ratings yet

- Lesson Plan On DysmenorreaDocument8 pagesLesson Plan On DysmenorreaBHUKYA USHARANINo ratings yet

- Elictation and CollaborationDocument28 pagesElictation and CollaborationalisterjosephNo ratings yet

- HR Standard Assessment ToolDocument18 pagesHR Standard Assessment ToolnafizNo ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- Chapter 11 Report Writing For High Tech InvestigationDocument28 pagesChapter 11 Report Writing For High Tech InvestigationAin AnuarNo ratings yet

- Audit Committee EY-Staying-on-course-guide-for-audit-committeesDocument80 pagesAudit Committee EY-Staying-on-course-guide-for-audit-committeesVeena HingarhNo ratings yet

- Historical ImaginationDocument10 pagesHistorical ImaginationFernandaPiresGurgelNo ratings yet

- Alex Nicholson FIN5401 Investments Assignment 4 Fall 2021Document4 pagesAlex Nicholson FIN5401 Investments Assignment 4 Fall 2021Alex NicholsonNo ratings yet

- Test 6 and 7B AP Statistics Name:: Y - 1 0 1 2 - P (Y) 3C 2C 0.4 0.1Document5 pagesTest 6 and 7B AP Statistics Name:: Y - 1 0 1 2 - P (Y) 3C 2C 0.4 0.1Elizabeth CNo ratings yet

- UntitledDocument3 pagesUntitledAobakwe Rose TshupeloNo ratings yet

- Prob 3 Macro IDocument3 pagesProb 3 Macro IArnau CanelaNo ratings yet

- An Introduction To Decision TheoryDocument14 pagesAn Introduction To Decision TheoryMohammad Raihanul HasanNo ratings yet

- Chapt 9 Exam FinaDocument7 pagesChapt 9 Exam FinaNirmal PatelNo ratings yet

- E120 Fall14 HW8Document1 pageE120 Fall14 HW8kimball_536238392No ratings yet

- Reading 1 Estimating Market Risk Measures - An Introduction and Overview - AnswersDocument22 pagesReading 1 Estimating Market Risk Measures - An Introduction and Overview - AnswersDivyansh ChandakNo ratings yet

- Terso P. Gregorio Jr. BSF 2B Exercise #2Document5 pagesTerso P. Gregorio Jr. BSF 2B Exercise #2Terso GregorioNo ratings yet

- Finance 261 Tutorial Week 6Document4 pagesFinance 261 Tutorial Week 6Manuel BoahenNo ratings yet

- Submission Deadline:-07-01-2021 Module: - Handwritten Submission Via - MoodleDocument1 pageSubmission Deadline:-07-01-2021 Module: - Handwritten Submission Via - MoodleSnehaja RL ThapaNo ratings yet

- AEB301-Financial Management-27JAN2022Document3 pagesAEB301-Financial Management-27JAN2022MIRUGI STEPHEN GACHIRINo ratings yet

- Financial Advisor - Mutual FundDocument3 pagesFinancial Advisor - Mutual FundVanessa Camille SantosNo ratings yet

- Aps U6 Test Review 2016 KeyDocument4 pagesAps U6 Test Review 2016 Keynuoti guanNo ratings yet

- Assignment 4 - Answer Key Econ 1p92Document6 pagesAssignment 4 - Answer Key Econ 1p92hmmmmmmnoideaNo ratings yet

- Problem Set 1 SolutionsDocument32 pagesProblem Set 1 Solutionsale.ili.pauNo ratings yet

- CH 9 VaRDocument76 pagesCH 9 VaRjackNo ratings yet

- Tutorial 1 - MacroDocument3 pagesTutorial 1 - MacroJiahui XiongNo ratings yet

- Past Examination Problems With Suggested Solutions Topic 2: Financial Markets ECON 303: Intermediate Economic Theory (Macroeconomics I)Document21 pagesPast Examination Problems With Suggested Solutions Topic 2: Financial Markets ECON 303: Intermediate Economic Theory (Macroeconomics I)Zack CoyNo ratings yet

- Assignment - English Aggregated Demand and Related Concepts A. Short Answer Type Questions: (1 Mark)Document2 pagesAssignment - English Aggregated Demand and Related Concepts A. Short Answer Type Questions: (1 Mark)akankasha thakurNo ratings yet

- Financial Economics QuizzDocument3 pagesFinancial Economics QuizzSam DykNo ratings yet

- Chapter 3 Excercise With SolutionDocument18 pagesChapter 3 Excercise With SolutionSyed Ali100% (1)

- Ac.f215 Exam 2018-2019 PDFDocument6 pagesAc.f215 Exam 2018-2019 PDFWilliam NogueraNo ratings yet

- Investment Management - Exam Example: Problem 1 (13 PT.)Document5 pagesInvestment Management - Exam Example: Problem 1 (13 PT.)Lan NgoNo ratings yet

- Probability ConceptsDocument5 pagesProbability ConceptsAslam HossainNo ratings yet

- Name: - Mba 8415 - Managerial Finance Assignment 5: Due May 31, 2001 at The Beginning of Class Dr. David A. StangelandDocument4 pagesName: - Mba 8415 - Managerial Finance Assignment 5: Due May 31, 2001 at The Beginning of Class Dr. David A. Stangelandnhidiepnguyet08112004No ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument6 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerYash GoklaniNo ratings yet

- Isi 2021 ADocument8 pagesIsi 2021 Aiamphilospher1No ratings yet

- RTP Group3 Paper 11 June2012Document48 pagesRTP Group3 Paper 11 June2012Sudha SatishNo ratings yet

- Behavioral Finance - Tutorial2Document4 pagesBehavioral Finance - Tutorial2imran_omiNo ratings yet

- PSMOD - Chapter 7 - Decision Making TechniquesDocument6 pagesPSMOD - Chapter 7 - Decision Making TechniquesKanagi RajandranNo ratings yet

- TaskDocument1 pageTaskKhaerunnisaNo ratings yet

- TaskDocument1 pageTaskKhaerunnisaNo ratings yet

- PS 2 Fall2022Document4 pagesPS 2 Fall20221227352812No ratings yet

- 03 PS8 CapmDocument2 pages03 PS8 Capmahsan13790% (1)

- Lecture 3 Portfolio TheoryDocument5 pagesLecture 3 Portfolio TheoryAgha ImranNo ratings yet

- Disprob PDFCKFCFKCDocument2 pagesDisprob PDFCKFCFKCFranco VillaromanNo ratings yet

- 14.02 Principles of Macroeconomics Fall 2004: Quiz 3 Thursday, December 2, 2004 7:30 PM - 9 PMDocument15 pages14.02 Principles of Macroeconomics Fall 2004: Quiz 3 Thursday, December 2, 2004 7:30 PM - 9 PMHassam ShahidNo ratings yet

- Spring 2024. CM5.ANSWER KEY.1012 A B. CH 8 and CH 9Document5 pagesSpring 2024. CM5.ANSWER KEY.1012 A B. CH 8 and CH 9RobloxArushi SethNo ratings yet

- Quantitative FinanceDocument3 pagesQuantitative FinanceaishNo ratings yet

- PRE Board ECONOMICS SET B 2022-23Document10 pagesPRE Board ECONOMICS SET B 2022-23easytoearnmoneyguideNo ratings yet

- RR Problems SolutionsDocument5 pagesRR Problems SolutionsShaikh FarazNo ratings yet

- Practice 1cDocument11 pagesPractice 1csalmapratyush0% (1)

- #1 - Midterm Self Evaluation SolutionsDocument6 pages#1 - Midterm Self Evaluation SolutionsDionizioNo ratings yet

- Final 2008jhffDocument3 pagesFinal 2008jhffAnu AmruthNo ratings yet

- 2700 Advance MicroeconomicsDocument3 pages2700 Advance Microeconomicsmeelas123No ratings yet

- Latihan Soal Sesi 3 - Nastiti Kartika DewiDocument26 pagesLatihan Soal Sesi 3 - Nastiti Kartika DewiNastiti KartikaNo ratings yet

- EC202 Written AssignmentDocument3 pagesEC202 Written Assignmentklm klmNo ratings yet

- Fnce100 PS3Document18 pagesFnce100 PS3Denisa KollcinakuNo ratings yet

- Macro Tutorial SetDocument3 pagesMacro Tutorial SetFlavious AcquahNo ratings yet

- Fei2123PS2 Soln PDFDocument9 pagesFei2123PS2 Soln PDFMarco ChanNo ratings yet

- IUFM - Lecture 5 and Lecture 6 - Homework HandoutsDocument6 pagesIUFM - Lecture 5 and Lecture 6 - Homework Handoutsnhu1582004No ratings yet

- Laporan Bulanan Lb1: 0-7 HR Baru LDocument20 pagesLaporan Bulanan Lb1: 0-7 HR Baru LOla SarlinaNo ratings yet

- LRO Election DataDocument117 pagesLRO Election DataSatvinder Deep Singh0% (1)

- 5 MANOVA Presentation StatsDocument32 pages5 MANOVA Presentation StatsVaibhav BaluniNo ratings yet

- History Summary - Juan Domingo PerónDocument11 pagesHistory Summary - Juan Domingo PerónArianna SánchezNo ratings yet

- Sample Interview Questions For Freshers Self-IntroductionDocument2 pagesSample Interview Questions For Freshers Self-IntroductionThakur Abhishek SinghNo ratings yet

- Letter To Samoa and TalamuaDocument3 pagesLetter To Samoa and TalamuaJames RobertsonNo ratings yet

- Gab0 4610 Service MST PDFDocument118 pagesGab0 4610 Service MST PDFEd SaNo ratings yet

- Shadow of The ForestDocument2 pagesShadow of The ForestAnita StankovicNo ratings yet

- Pages From MOTW-Tome-PlaybooksDocument2 pagesPages From MOTW-Tome-PlaybooksAdrian GNo ratings yet

- 01 Task Performance 1Document2 pages01 Task Performance 1master simbadNo ratings yet

- Kerygma Magazine January 2018Document52 pagesKerygma Magazine January 2018Andre Gere AdsuaraNo ratings yet

- Extended ECM For Office 365: Product Overview & RoadmapDocument40 pagesExtended ECM For Office 365: Product Overview & RoadmapPhil JohnsonNo ratings yet

- First Quarter Module: Introduction!Document48 pagesFirst Quarter Module: Introduction!Ha KDOG100% (1)

- 1170774357Document9 pages1170774357أحمد حمدىNo ratings yet

- Transpo CasesDocument141 pagesTranspo CasesKaren Gina DupraNo ratings yet

- Dias Novita Utami (C1AA19027) Bahasa Inggris IDocument9 pagesDias Novita Utami (C1AA19027) Bahasa Inggris IDias Novita UtamiNo ratings yet

- 十二生肖Zodiac and Names of YearsanimalsDocument31 pages十二生肖Zodiac and Names of YearsanimalsyueNo ratings yet

- Putnam08 10aaaDocument2 pagesPutnam08 10aaaSebastian IlincaNo ratings yet