Professional Documents

Culture Documents

4Q08 and 2008 Results March

Uploaded by

Klabin_RIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4Q08 and 2008 Results March

Uploaded by

Klabin_RICopyright:

Available Formats

4Q08 and 2008 Results March 13th, 2009

Sales Volume Slide 2 Thousand tonnes

10%

1,579 1,437 39%

15%

393 341 37% 43%

38%

62% 63% 57%

61%

4Q07

4Q08

2007

2008

Domestic Market

Foreign Market

2

Net Revenue Slide 3 R$ Million

10%

3,097 2,796 28%

20%

806 669 23% 35%

26%

74% 77% 65%

72%

4Q07

4Q08

2007

2008

Domestic Market

Foreign Market

3

COGS Slide 4 R$ / tonnes *

-6%

1,509 1,461

-3%

1,420

1,420

3Q08

4Q08

4Q07

4Q08

Unit COGS (R$ / tonnes)

* Excluding wood volume

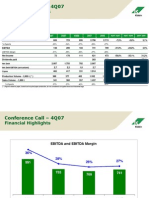

EBITDA Slide 5 R$ Million

EBITDA and EBITDA margin

30% 28% 28% 30% 26% 191 20% 155 242 18% 141 108

210

199

201 16%

1Q07

2Q07

3Q07 EBITDA

4Q07

1Q08

2Q08

3Q08

4Q08

EBITDA Margin (%)

EBITDA conciliation with Law 6,404/76

R$ Million EBITDA Law 11,638/07 Law 11,638/07 Adjustments EBITDA Law 6,404/76 4Q08 242 (42) 200 3Q08 155 (0) 155 4Q07 108 30 138 2008 729 9 738 2007 718 23 741

Financial Result - Slide 6 R$ Million

R$ Million Financial Revenues and Expenses Net Exchange Variations Financial Result Exchange Rate (R$/US$ sell, EOP) Variation (previous period)

4Q08 (142) (447) (619) 2.34 22%

3Q08 (66) (385) (451) 1.91 20%

4Q07 (33) 73 40 1.77 -4%

2008 (231) (674) (905) 2.34 32%

2007 50 301 351 1.77 -17%

The financial losses generated by local currency devaluation have no cash effect.

Indebtedness Slide 7 R$ Million

The current cash position covers more than 30 months of debt maturities

1,931

228

725

1,206

727

479

1,703

479

Loans

2009 2010

Cash

2011

Investment Slide 8 R$ Million

Investments and allocation in 2008

1,674 1.674

Corrugated Boxes, Industrial Bags and Others 9%

Forestry 52%

587 400 250

Paper 39%

2007

2008

2009*

* Forecast

Closing Remarks Slide 9

Operations at the Ponte Nova Unit (MG), which produces recycled paper, were temporarily suspended, with 118 employees laid off; Forest planting in 2009 will be reviewed; Celebration of our 110th anniversary in April 2009; maintaining a unique competitive position; Priorities placed on current investments; Implementation of reductions in fixed and variable costs.

Investor Relations: Tel: +55 (11) 3046-8404 / 8415 / 8416 www.klabin.com.br invest@klabin.com.br

You might also like

- 1Q09 Results: 30 Years in The Brazilian Stock ExchangeDocument10 pages1Q09 Results: 30 Years in The Brazilian Stock ExchangeKlabin_RINo ratings yet

- Klabin Webcast 20092 Q09Document10 pagesKlabin Webcast 20092 Q09Klabin_RINo ratings yet

- KPresentation2009 3Q IngDocument32 pagesKPresentation2009 3Q IngKlabin_RINo ratings yet

- Klabin Webcast 20101 Q10Document10 pagesKlabin Webcast 20101 Q10Klabin_RINo ratings yet

- Quarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginDocument17 pagesQuarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginKlabin_RINo ratings yet

- Klabin Webcast 3 Q11 INGDocument8 pagesKlabin Webcast 3 Q11 INGKlabin_RINo ratings yet

- 2009 24446 ArDocument60 pages2009 24446 ArnnasikerabuNo ratings yet

- Call 4T09 ENG FinalDocument10 pagesCall 4T09 ENG FinalFibriaRINo ratings yet

- Conference Call - 3Q07: Financial HighlightsDocument4 pagesConference Call - 3Q07: Financial HighlightsKlabin_RINo ratings yet

- Earnings ReleaseDocument15 pagesEarnings ReleaseMultiplan RINo ratings yet

- News Release: Arcelormittal Reports Full Year and Fourth Quarter 2008 ResultsDocument25 pagesNews Release: Arcelormittal Reports Full Year and Fourth Quarter 2008 ResultsRobert Edward BallNo ratings yet

- Klabin Webcast 20102 Q10Document11 pagesKlabin Webcast 20102 Q10Klabin_RINo ratings yet

- Presentation - 4Q09 and 2009 ResultsDocument19 pagesPresentation - 4Q09 and 2009 ResultsLightRINo ratings yet

- Top Glove Corporation BHD Corporate PresentationDocument21 pagesTop Glove Corporation BHD Corporate Presentationalant_2280% (5)

- 2 Annual Latam Fixed Income: March 2014Document39 pages2 Annual Latam Fixed Income: March 2014FibriaRINo ratings yet

- Results Conference CallDocument14 pagesResults Conference CallLightRINo ratings yet

- Call 1T10 ENG FINAL 17Document10 pagesCall 1T10 ENG FINAL 17FibriaRINo ratings yet

- Third Quarter 2008 Earnings Review: October 16, 2008Document29 pagesThird Quarter 2008 Earnings Review: October 16, 2008Mark ReinhardtNo ratings yet

- Klabin Webcast 20074 Q07Document2 pagesKlabin Webcast 20074 Q07Klabin_RINo ratings yet

- 3Q 2008 PerformanceDocument31 pages3Q 2008 PerformanceAlex TefovNo ratings yet

- Maruti Suzuki: Performance HighlightsDocument13 pagesMaruti Suzuki: Performance HighlightsAngel BrokingNo ratings yet

- Economic Outlook For EC2Document22 pagesEconomic Outlook For EC2Shishka7No ratings yet

- Business in Portuguese BICDocument26 pagesBusiness in Portuguese BICRadu Victor TapuNo ratings yet

- Schlumberger Announces Third-Quarter 2018 ResultsDocument12 pagesSchlumberger Announces Third-Quarter 2018 ResultsYves-donald MakoumbouNo ratings yet

- Indian Oil Corporation LTD: Key Financial IndicatorsDocument4 pagesIndian Oil Corporation LTD: Key Financial IndicatorsBrinda PriyadarshiniNo ratings yet

- 3Q09 Results: October 28, 2009Document10 pages3Q09 Results: October 28, 2009Klabin_RINo ratings yet

- Maruti India Limited: SuzukiDocument13 pagesMaruti India Limited: SuzukiHemant Raj DixitNo ratings yet

- Quarterly Release: Start Up of Paper Machine # 9Document19 pagesQuarterly Release: Start Up of Paper Machine # 9Klabin_RINo ratings yet

- Astra Agro Lestari: AALI's January ProductionDocument7 pagesAstra Agro Lestari: AALI's January ProductionerlanggaherpNo ratings yet

- 3q2009release BRGAAP InglesnaDocument24 pages3q2009release BRGAAP InglesnaFibriaRINo ratings yet

- Conference Call: 3rd Quarter 2013Document26 pagesConference Call: 3rd Quarter 2013LightRINo ratings yet

- Ambuja Cements: Performance HighlightsDocument11 pagesAmbuja Cements: Performance HighlightsAngel BrokingNo ratings yet

- 3Q16 - WebcastDocument16 pages3Q16 - WebcastUsiminas_RINo ratings yet

- Presentation - 4Q08 and 2008 ResultsDocument17 pagesPresentation - 4Q08 and 2008 ResultsLightRINo ratings yet

- Tata Motors: AccumulateDocument5 pagesTata Motors: AccumulatepaanksNo ratings yet

- PTTEP FinalDocument27 pagesPTTEP FinalBancha WongNo ratings yet

- JK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDocument4 pagesJK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDeepa GuptaNo ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- Light S.A. Corporate Presentation: Citi's 16th Annual Latin America ConferenceDocument26 pagesLight S.A. Corporate Presentation: Citi's 16th Annual Latin America ConferenceLightRINo ratings yet

- GAIL 2QF12 Result ReviewDocument6 pagesGAIL 2QF12 Result ReviewdikshitmittalNo ratings yet

- Results 2002: March, 2003Document34 pagesResults 2002: March, 2003Klabin_RINo ratings yet

- MANDO.2Q11 Earnings PresentationDocument8 pagesMANDO.2Q11 Earnings PresentationSam_Ha_No ratings yet

- 2Q14 Presentation of ResultsDocument27 pages2Q14 Presentation of ResultsMillsRINo ratings yet

- UOB Kayhian Hartalega 1Q2014Document4 pagesUOB Kayhian Hartalega 1Q2014Piyu MahatmaNo ratings yet

- Signet Reports Third Quarter Profit: WWW - Hsamuel.co - Uk WWW - Ernestjones.co - UkDocument25 pagesSignet Reports Third Quarter Profit: WWW - Hsamuel.co - Uk WWW - Ernestjones.co - Ukpatburchall6278No ratings yet

- 2009 Results: February 26, 2010Document11 pages2009 Results: February 26, 2010Klabin_RINo ratings yet

- Conference Call Presentation? 3Q14Document11 pagesConference Call Presentation? 3Q14FibriaRINo ratings yet

- Quarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Document16 pagesQuarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Klabin_RINo ratings yet

- Analyst Presentation 9M 2011Document18 pagesAnalyst Presentation 9M 2011gupakosNo ratings yet

- Usim Webcast 3q06 VersDocument18 pagesUsim Webcast 3q06 VersUsiminas_RINo ratings yet

- 1 Preliminary Results 020310Document44 pages1 Preliminary Results 020310Ksarda1963No ratings yet

- KPMG Budget BriefDocument52 pagesKPMG Budget BriefAsad HasnainNo ratings yet

- Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionDocument15 pagesQuarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionKlabin_RINo ratings yet

- 9m11 PPT FinalDocument29 pages9m11 PPT FinalMarcelo FrancoNo ratings yet

- Group Ariel S.A. Parity Conditions and Cross Border ValuationDocument13 pagesGroup Ariel S.A. Parity Conditions and Cross Border Valuationmatt100% (1)

- Everest Industries Limited: Investor Presentation 29 April 2011Document12 pagesEverest Industries Limited: Investor Presentation 29 April 2011vejendla_vinod351No ratings yet

- Brantford 2011 Financial ReportsDocument168 pagesBrantford 2011 Financial ReportsHugo RodriguesNo ratings yet

- Corporate Presentation: November, 2012Document22 pagesCorporate Presentation: November, 2012FibriaRINo ratings yet

- Presentation - 4Q11 and 2011 ResultsDocument14 pagesPresentation - 4Q11 and 2011 ResultsLightRINo ratings yet

- Plywood, Millwork & Wood Panel Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandPlywood, Millwork & Wood Panel Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Rating Klabin - Fitch RatingsDocument1 pageRating Klabin - Fitch RatingsKlabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Free Translation Klabin 31 03 2017 Arquivado Na CVMDocument70 pagesFree Translation Klabin 31 03 2017 Arquivado Na CVMKlabin_RINo ratings yet

- Press Klabin Downgrade Mai17Document5 pagesPress Klabin Downgrade Mai17Klabin_RINo ratings yet

- Itr 1Q17Document70 pagesItr 1Q17Klabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Notice To Shareholders - Dividend PaymentDocument2 pagesNotice To Shareholders - Dividend PaymentKlabin_RINo ratings yet

- Release 1Q17Document19 pagesRelease 1Q17Klabin_RINo ratings yet

- Notice To Shareholders - Payment of DividendsDocument2 pagesNotice To Shareholders - Payment of DividendsKlabin_RINo ratings yet

- Management Change (MATERIAL FACT)Document1 pageManagement Change (MATERIAL FACT)Klabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- Recommedation To New Chief Executive OfficerDocument1 pageRecommedation To New Chief Executive OfficerKlabin_RINo ratings yet

- DFP 2016Document87 pagesDFP 2016Klabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- UntitledDocument75 pagesUntitledKlabin_RINo ratings yet

- Notice To The Market - New Structure of The Executive BoardDocument2 pagesNotice To The Market - New Structure of The Executive BoardKlabin_RINo ratings yet

- Presentation APIMEC 2016Document44 pagesPresentation APIMEC 2016Klabin_RINo ratings yet

- Institutional Presentation 2016Document28 pagesInstitutional Presentation 2016Klabin_RINo ratings yet

- Release 4Q16Document18 pagesRelease 4Q16Klabin_RINo ratings yet

- Notice To Shareholders - Dividend PaymentDocument2 pagesNotice To Shareholders - Dividend PaymentKlabin_RINo ratings yet

- Notice To Debenture HoldersDocument1 pageNotice To Debenture HoldersKlabin_RINo ratings yet

- UntitledDocument75 pagesUntitledKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- Release 3Q16Document19 pagesRelease 3Q16Klabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Notice To Shareholders - Payment of DividendsDocument2 pagesNotice To Shareholders - Payment of DividendsKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCDocument26 pagesComunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCKlabin_RINo ratings yet