Professional Documents

Culture Documents

1Q09 Results: 30 Years in The Brazilian Stock Exchange

Uploaded by

Klabin_RIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1Q09 Results: 30 Years in The Brazilian Stock Exchange

Uploaded by

Klabin_RICopyright:

Available Formats

1Q09 Results

May 6, 2009

30 years in the Brazilian Stock Exchange

Sales Volume * Slide 2 Thousand tonnes

-9%

393 356

43% 42%

-8%

386

42%

356

42% 58%

57%

58%

58%

Domestic Market

Foreign Market

* Excluding wood volumes

Net Revenue Slide 3 R$ million

-3%

740 28% 31% 722 806

-10%

722 35% 31%

72%

69%

65%

69%

1Q08

1Q09 Domestic Market Foreign Market

COGS Slide 4 R$ million

-1%

558 525 521

-7%

521

1Q08

1Q09

4Q08

1Q09

EBITDA Slide 5 R$ million

EBITDA and EBITDA Margin

30% 28% 28% 30%

26% 20%

242

18% 141

25%

210

199

201

16% 108

191

180 155

1Q07

2Q07

3Q07

4Q07

1Q08

2Q08

3Q08

4Q08

1Q09

EBITDA

EBITDA Margin (%)

Financial Result and Net Income Slide 6 - R$ million

R$ Million Financial Expenses Financial Revenues Net exchange variation Financial Result 1Q09 -99 47 13 -38 1Q08 -88 58 20 -10 4Q08 -149 7 -477 -619

Net Income (Loss) R$ million

69 29

With the exchange rate stable in the quarter, Klabin reversed the losses posted in 4Q08

-314

1Q09 1Q08 4Q08

Indebtedness Slide 7 R$ million

Current cash position covers 29 months of debt maturities

-1% 21%

4,446 5,373 5,451 5,373

Investments Slide 8 R$ million

Investments and allocation in 1Q09

1,674

Corrugated Boxes Industrial Bags Others 19%

587 300 83

Paper Mills 32%

Forestry 49%

2007

2008

1Q09

2009*

* Forecast

Closing Remarks Slide 9

Focus on cash generation and preservation; Reduction in indebtedness (net debt/EBITDA); Implementation of measures to cut fixed and variable costs; Expectation of a new growth cycle starting in 2015.

Investor Relations: Tel: +55 (11) 3046-8404 / 8415 / 8416 www.klabin.com.br invest@klabin.com.br 10

You might also like

- 3Q09 Results: October 28, 2009Document10 pages3Q09 Results: October 28, 2009Klabin_RINo ratings yet

- Klabin Webcast 20092 Q09Document10 pagesKlabin Webcast 20092 Q09Klabin_RINo ratings yet

- 4Q08 and 2008 Results MarchDocument10 pages4Q08 and 2008 Results MarchKlabin_RINo ratings yet

- Klabin Webcast 20101 Q10Document10 pagesKlabin Webcast 20101 Q10Klabin_RINo ratings yet

- Quarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Document16 pagesQuarterly Report 2Q09: Net Income of R$ 306 Million in The 2Q09 and R$ 335 Million in The First Half, 52% Above 1H08Klabin_RINo ratings yet

- KPresentation2009 3Q IngDocument32 pagesKPresentation2009 3Q IngKlabin_RINo ratings yet

- Quarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginDocument19 pagesQuarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginKlabin_RINo ratings yet

- Klabin Webcast 20102 Q10Document11 pagesKlabin Webcast 20102 Q10Klabin_RINo ratings yet

- HSBC Luxury ConferenceDocument38 pagesHSBC Luxury Conferencesl7789No ratings yet

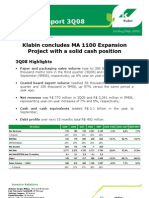

- Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionDocument15 pagesQuarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionKlabin_RINo ratings yet

- 3q2009release BRGAAP InglesnaDocument24 pages3q2009release BRGAAP InglesnaFibriaRINo ratings yet

- 2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineDocument19 pages2Q10 Quarterly Report: Klabin Selected "Best Pulp and Paper Company of 2009" by Exame MagazineKlabin_RINo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Document16 pagesQuarterly Release: Klabin Reports Net Profit of R$ 261 Million in 1H06, Up 19% Over 1H05Klabin_RINo ratings yet

- Quarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginDocument18 pagesQuarterly Report 3Q09: 3Q09 EBITDA Reaches R$ 199 Million, With 27% MarginKlabin_RINo ratings yet

- Klabin Webcast 20111 Q11Document8 pagesKlabin Webcast 20111 Q11Klabin_RINo ratings yet

- 4Q09 Quarterly Report: Record Coated Board Sales in 2009Document19 pages4Q09 Quarterly Report: Record Coated Board Sales in 2009Klabin_RINo ratings yet

- Earnings ReleaseDocument15 pagesEarnings ReleaseMultiplan RINo ratings yet

- KPresentation2009 1Q IngDocument34 pagesKPresentation2009 1Q IngKlabin_RINo ratings yet

- Quarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioDocument18 pagesQuarterly Report 4Q08: Klabin Posts Margin Expansion Despite International Crisis ScenarioKlabin_RINo ratings yet

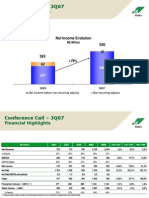

- Conference Call - 3Q07: Financial HighlightsDocument4 pagesConference Call - 3Q07: Financial HighlightsKlabin_RINo ratings yet

- Schlumberger Announces Third-Quarter 2018 ResultsDocument12 pagesSchlumberger Announces Third-Quarter 2018 ResultsYves-donald MakoumbouNo ratings yet

- Sound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Document18 pagesSound Export Performance, Despite Adverse Exchange Rate: T H I R D Q U A R T e R R e S U L T S o F 2 0 0 5Klabin_RINo ratings yet

- Bm&Fbovespa 2Q09 Earnings Conference Call: August 11th, 2009Document27 pagesBm&Fbovespa 2Q09 Earnings Conference Call: August 11th, 2009BVMF_RINo ratings yet

- Economic Outlook For EC2Document22 pagesEconomic Outlook For EC2Shishka7No ratings yet

- 2009 Results: February 26, 2010Document11 pages2009 Results: February 26, 2010Klabin_RINo ratings yet

- Klabin Webcast 3 Q11 INGDocument8 pagesKlabin Webcast 3 Q11 INGKlabin_RINo ratings yet

- Maruti India Limited: SuzukiDocument13 pagesMaruti India Limited: SuzukiHemant Raj DixitNo ratings yet

- Autogrill Group - 1H2011 Financial Results: Milan, 29 July 2011Document66 pagesAutogrill Group - 1H2011 Financial Results: Milan, 29 July 2011subiadinjaraNo ratings yet

- 4q2009release BRGAAP InglesnaDocument22 pages4q2009release BRGAAP InglesnaFibriaRINo ratings yet

- Quarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginDocument17 pagesQuarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginKlabin_RINo ratings yet

- Business in Portuguese BICDocument26 pagesBusiness in Portuguese BICRadu Victor TapuNo ratings yet

- Signet Reports Third Quarter Profit: WWW - Hsamuel.co - Uk WWW - Ernestjones.co - UkDocument25 pagesSignet Reports Third Quarter Profit: WWW - Hsamuel.co - Uk WWW - Ernestjones.co - Ukpatburchall6278No ratings yet

- Quarterly Release: Start Up of Paper Machine # 9Document19 pagesQuarterly Release: Start Up of Paper Machine # 9Klabin_RINo ratings yet

- Quarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Document17 pagesQuarterly Report 1Q09: 1Q09 EBITDA of R$ 180 Million, With EBITDA Margin of 25%Klabin_RINo ratings yet

- Argentina: Economic Activity and EmploymentDocument4 pagesArgentina: Economic Activity and EmploymentBelen GuevaraNo ratings yet

- Cash Generation Reaches R$ 613 Million in 2002: July/September 2002Document15 pagesCash Generation Reaches R$ 613 Million in 2002: July/September 2002Klabin_RINo ratings yet

- Release 2Q15Document17 pagesRelease 2Q15Klabin_RINo ratings yet

- Group - 21 - Country Risk Analysis - Brazil V1.0Document26 pagesGroup - 21 - Country Risk Analysis - Brazil V1.0aloksrivastava2No ratings yet

- 1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Document18 pages1Q10 Quarterly Report: EBITDA in 1Q10 of R$242 Million, Up 35% From 1Q09, With EBITDA Margin of 29%Klabin_RINo ratings yet

- 9m11 PPT FinalDocument29 pages9m11 PPT FinalMarcelo FrancoNo ratings yet

- Usim Webcast 3q06 VersDocument18 pagesUsim Webcast 3q06 VersUsiminas_RINo ratings yet

- Annual Financial Ratios StndaloneDocument4 pagesAnnual Financial Ratios Stndalonecutie_pixieNo ratings yet

- 3q2015 CemproDocument16 pages3q2015 Cemproapi-307565920No ratings yet

- Alicorp Earnings Report 3Q23 EN VFDocument23 pagesAlicorp Earnings Report 3Q23 EN VFADRIAN ANIBAL ENCISO ARKNo ratings yet

- Results Conference CallDocument14 pagesResults Conference CallLightRINo ratings yet

- Release 3Q15Document17 pagesRelease 3Q15Klabin_RINo ratings yet

- Review of Pakistan's Balance of Payments July 2009-June 2010Document8 pagesReview of Pakistan's Balance of Payments July 2009-June 2010faheem0305No ratings yet

- Inflation Inflation: Second Quarter 2009 Second Quarter 2009Document24 pagesInflation Inflation: Second Quarter 2009 Second Quarter 2009Klein MoNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document1 pageFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Document19 pagesQuarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Klabin_RINo ratings yet

- 3Q16 - WebcastDocument16 pages3Q16 - WebcastUsiminas_RINo ratings yet

- 3Q12 - Earnings ReleaseDocument18 pages3Q12 - Earnings ReleaseUsiminas_RINo ratings yet

- 1Q15 Presentation of ResultsDocument20 pages1Q15 Presentation of ResultsMillsRINo ratings yet

- Grendene - 2nd Qquarter 2007 Earnings - Presentation TranscriptDocument5 pagesGrendene - 2nd Qquarter 2007 Earnings - Presentation TranscriptpbchapsNo ratings yet

- Klabin Reduces Debt: April/June 2003Document16 pagesKlabin Reduces Debt: April/June 2003Klabin_RINo ratings yet

- 1st Half Report - June 30, 2010Document75 pages1st Half Report - June 30, 2010PiaggiogroupNo ratings yet

- Mills 3Q16 ResultsDocument17 pagesMills 3Q16 ResultsMillsRINo ratings yet

- Results 2002: March, 2003Document34 pagesResults 2002: March, 2003Klabin_RINo ratings yet

- Release 3Q13Document16 pagesRelease 3Q13Klabin_RINo ratings yet

- Outboard Motorboats World Summary: Market Sector Values & Financials by CountryFrom EverandOutboard Motorboats World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Rating Klabin - Fitch RatingsDocument1 pageRating Klabin - Fitch RatingsKlabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Free Translation Klabin 31 03 2017 Arquivado Na CVMDocument70 pagesFree Translation Klabin 31 03 2017 Arquivado Na CVMKlabin_RINo ratings yet

- Press Klabin Downgrade Mai17Document5 pagesPress Klabin Downgrade Mai17Klabin_RINo ratings yet

- Itr 1Q17Document70 pagesItr 1Q17Klabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Notice To Shareholders - Dividend PaymentDocument2 pagesNotice To Shareholders - Dividend PaymentKlabin_RINo ratings yet

- Release 1Q17Document19 pagesRelease 1Q17Klabin_RINo ratings yet

- Notice To Shareholders - Payment of DividendsDocument2 pagesNotice To Shareholders - Payment of DividendsKlabin_RINo ratings yet

- Management Change (MATERIAL FACT)Document1 pageManagement Change (MATERIAL FACT)Klabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- Recommedation To New Chief Executive OfficerDocument1 pageRecommedation To New Chief Executive OfficerKlabin_RINo ratings yet

- DFP 2016Document87 pagesDFP 2016Klabin_RINo ratings yet

- DFP Klabin S A 2016 EM INGLSDocument87 pagesDFP Klabin S A 2016 EM INGLSKlabin_RINo ratings yet

- UntitledDocument75 pagesUntitledKlabin_RINo ratings yet

- Notice To The Market - New Structure of The Executive BoardDocument2 pagesNotice To The Market - New Structure of The Executive BoardKlabin_RINo ratings yet

- Presentation APIMEC 2016Document44 pagesPresentation APIMEC 2016Klabin_RINo ratings yet

- Institutional Presentation 2016Document28 pagesInstitutional Presentation 2016Klabin_RINo ratings yet

- Release 4Q16Document18 pagesRelease 4Q16Klabin_RINo ratings yet

- Notice To Shareholders - Dividend PaymentDocument2 pagesNotice To Shareholders - Dividend PaymentKlabin_RINo ratings yet

- Notice To Debenture HoldersDocument1 pageNotice To Debenture HoldersKlabin_RINo ratings yet

- UntitledDocument75 pagesUntitledKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumDocument30 pagesComunicado Ao Mercado Sobre Bradesco's 6th Annual CEO ForumKlabin_RINo ratings yet

- Release 3Q16Document19 pagesRelease 3Q16Klabin_RINo ratings yet

- Notice To Debentures HoldersDocument1 pageNotice To Debentures HoldersKlabin_RINo ratings yet

- Notice To Shareholders - Payment of DividendsDocument2 pagesNotice To Shareholders - Payment of DividendsKlabin_RINo ratings yet

- Comunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCDocument26 pagesComunicado Ao Mercado Sobre Apresenta??o Confer?ncia Jefferies - NYCKlabin_RINo ratings yet