Professional Documents

Culture Documents

TDS Payment Challan

Uploaded by

mejarirajeshOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TDS Payment Challan

Uploaded by

mejarirajeshCopyright:

Available Formats

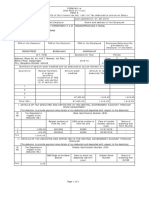

FORM 405 (See rule 40(1)(a) & (d) Return showing Tax Deduction at Source by an employer under-section 31 of the

Maharashtra Value Added Tax Act, 2002. 1) 2) 3) 4) M.V.A.T. R.C. No. (TIN), if any C. S.T. R.C. No. , If any Permanent Account Number Period Covered by Return FROM DATE MONTH YEAR DATE TO MONTH YEAR

Name and Address of the Dealer Name Address

TELEPHONE/MOBILE NUMBER

E-mail Id of the Employer

5) (A)

Details of the sum payable/paid to the contractors and amount of tax deducted/deductible at source during the period of this return If the contractor is Registered under MVAT Act, 2002. R.C. No./TIN of the contractor Amount Paid/Payable to the Contractor or Subcontractor Amount of Tax Deducted/ Deductible

Sr. No.

Name of the Contractor

Address of the Contractor

B. Sr. No.

Total -A If the contractor is un-registered under the MVAT Act, 2002 Amount Address of the Paid/Payable to the Name of the Contractor Contractor Contractor or Subcontractor

Amount of Tax Deducted/ Deductible

6) (a) (b) (c) 7) (a) (b) 8)

Total -B Total amount Deducted/Deductible (A+B) Payment made or Tax Deducted at Source Tax Deducted or Deductible at Source and payable in Chalan in Form 210. Add:- Interest payable Total Amount Payable (a+b) Total Amount Paid in Chalan in Form 210 Amount (in Figures) Rs.__________________________________________ Amount (in Words) Rs._________________________________________ _________________________________________

Amount paid as per Rs.__________________________________________ Revised or Fresh Return The Statements contained in this return in Boxes 1 to 8 are true to the best of my knowledge and belief. Date of Filing Return Date Month Year Name and the Authorised person

Designation Place

Signature of the Tax payer or of Authorised person.

You might also like

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNo ratings yet

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNo ratings yet

- Form 16 TDS SummaryDocument4 pagesForm 16 TDS SummarySushma Kaza DuggarajuNo ratings yet

- FORM 16 TAX DEDUCTION CERTIFICATEDocument3 pagesFORM 16 TAX DEDUCTION CERTIFICATEdugdugdugdugiNo ratings yet

- (See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NDocument6 pages(See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NRavi PrakashNo ratings yet

- Form No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument2 pagesForm No. 16: Details of Salary Paid and Any Other Income and Tax DeductedSundaresan ChockalingamNo ratings yet

- Form 16 TDS CertificateDocument3 pagesForm 16 TDS CertificateBijay TiwariNo ratings yet

- Form 16Document6 pagesForm 16Pulkit Gupta100% (1)

- Form2FandInstructions 06062006Document11 pagesForm2FandInstructions 06062006Mnaoj PatelNo ratings yet

- Mvat f231Document5 pagesMvat f231pgotaphoeNo ratings yet

- See Section 194C and Rule 37Document5 pagesSee Section 194C and Rule 37Trans TradesNo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNo ratings yet

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461No ratings yet

- Form12B (Past Employer Salary Certificate)Document3 pagesForm12B (Past Employer Salary Certificate)Jackiee1983No ratings yet

- IT Decl Form12BDocument3 pagesIT Decl Form12BPavan KumarNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahNo ratings yet

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Document4 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilNo ratings yet

- 1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Document12 pages1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Ganesh ChavanNo ratings yet

- Form No 16Document5 pagesForm No 16Rabiul KhanNo ratings yet

- Form 16 TDS CertificateDocument2 pagesForm 16 TDS CertificateHari Krishnan ElangovanNo ratings yet

- Form 16 Salary CertificateDocument2 pagesForm 16 Salary CertificateGopal TrivediNo ratings yet

- FORM 16 TDS CERTIFICATE DECODEDDocument4 pagesFORM 16 TDS CERTIFICATE DECODEDSuman HalderNo ratings yet

- Form Astr-2 (Application For Filing A Claim of Rebate of Duty Paid On Inputs, Service Tax and Cess Paid On Input Services)Document1 pageForm Astr-2 (Application For Filing A Claim of Rebate of Duty Paid On Inputs, Service Tax and Cess Paid On Input Services)Krishan ChanderNo ratings yet

- As Approved by Income Tax DepartmentDocument5 pagesAs Approved by Income Tax DepartmentRicha JoshiNo ratings yet

- Form 16Document3 pagesForm 16api-247505461No ratings yet

- Cit (TDS) : Emp CodeDocument3 pagesCit (TDS) : Emp CodeMahaveer DhelariyaNo ratings yet

- Form 16Document2 pagesForm 16orkid2100No ratings yet

- VAT ChallanDocument2 pagesVAT Challanrajeshutkur0% (1)

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNo ratings yet

- Form VAT ReturnDocument3 pagesForm VAT ReturnYf WoonNo ratings yet

- Form16fy10 11Document3 pagesForm16fy10 11atishroyNo ratings yet

- MVAT Payment Form 210Document3 pagesMVAT Payment Form 210Nilesh AadavNo ratings yet

- Umesh C-Form16 - 2020-21Document10 pagesUmesh C-Form16 - 2020-21Umesh CNo ratings yet

- Form No 16Document4 pagesForm No 16Md ZhidNo ratings yet

- Anspg5953f 2018-19Document3 pagesAnspg5953f 2018-19virajv1No ratings yet

- New Form No 15GDocument4 pagesNew Form No 15GDevang PatelNo ratings yet

- Trinidad and Tobago Emolument Income Tax 2012Document5 pagesTrinidad and Tobago Emolument Income Tax 2012Anand RockerNo ratings yet

- PF Form No 12a, 10,5Document6 pagesPF Form No 12a, 10,5Hareesh Kumar Reddy100% (1)

- Form 13 CDocument1 pageForm 13 CTrans TradesNo ratings yet

- Format PF 5.10.12Document6 pagesFormat PF 5.10.12hdpanchal86No ratings yet

- Form 16Document4 pagesForm 16neel721507No ratings yet

- Summary of Tax Deducted at Source: TotalDocument2 pagesSummary of Tax Deducted at Source: Totaladithya604No ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- IT FormDocument8 pagesIT Formapi-3829020No ratings yet

- Form No.16: Part ADocument3 pagesForm No.16: Part AYogesh DhekaleNo ratings yet

- Form of SamichaDocument17 pagesForm of SamichaAbdi BiyaNo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet