Professional Documents

Culture Documents

A Study of Performes in Indian Sofware and Services Industry

A Study of Performes in Indian Sofware and Services Industry

Uploaded by

Soumya AminCopyright:

Available Formats

You might also like

- Chapter 2Document5 pagesChapter 2Su Jiun Soon100% (3)

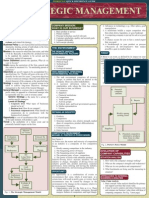

- (A. Thomas Fenik) Strategic Management (Quickstudy PDFDocument4 pages(A. Thomas Fenik) Strategic Management (Quickstudy PDFZewdu Tsegaye100% (4)

- Strategy-02-RRK Sharma, Rahul Sharma, H Hazaria FinalDocument13 pagesStrategy-02-RRK Sharma, Rahul Sharma, H Hazaria FinalHải Dương PhạmNo ratings yet

- The Resource-Based ModelDocument3 pagesThe Resource-Based ModelMulazim HussainNo ratings yet

- MBA NBS8126 Strategic Management Assignment 2021-22Document12 pagesMBA NBS8126 Strategic Management Assignment 2021-22Abhishek KohliNo ratings yet

- 20085ipcc Paper7B Vol2 Cp3Document17 pages20085ipcc Paper7B Vol2 Cp3Piyush GambaniNo ratings yet

- Strategy Course - AMMARDocument9 pagesStrategy Course - AMMARhercule5005No ratings yet

- Sequential Manner Then Answer Them As A Story With Mention: Hany Seadawy Comprehensive TemplateDocument43 pagesSequential Manner Then Answer Them As A Story With Mention: Hany Seadawy Comprehensive TemplateMarco IbrahimNo ratings yet

- A Study On Promotioanl Strategies of Bharti AirtelDocument61 pagesA Study On Promotioanl Strategies of Bharti AirtelDharmendra DwivediNo ratings yet

- Business EnviromentDocument40 pagesBusiness EnviromentMalav NanavatiNo ratings yet

- Integrated Case Study NotesDocument68 pagesIntegrated Case Study Notesdimuthu suranjanaNo ratings yet

- Strategic Management Unit - IDocument24 pagesStrategic Management Unit - Inirthya2006No ratings yet

- Strategic Mngt.Document49 pagesStrategic Mngt.Precious AlvaroNo ratings yet

- Regional Formation 27133-141Document10 pagesRegional Formation 27133-141Victor DiasNo ratings yet

- Ba 2 08Document43 pagesBa 2 08Andy KrawczykNo ratings yet

- Topic 2Document6 pagesTopic 2Darlene SeguritanNo ratings yet

- ITC Strategic Management ProjetcDocument41 pagesITC Strategic Management ProjetcHarshal GohilNo ratings yet

- Business Credit Solutions: Get A Credit Report Get A D&B D-U-N-S Number Monitor My Business Credit - FREE TRIAL!Document14 pagesBusiness Credit Solutions: Get A Credit Report Get A D&B D-U-N-S Number Monitor My Business Credit - FREE TRIAL!Harleen KaurNo ratings yet

- MGT489 - Exam 1 NotesDocument35 pagesMGT489 - Exam 1 NotesJonathan QuachNo ratings yet

- Department of Manangement Sciences Hazara Univesrity MansehraDocument5 pagesDepartment of Manangement Sciences Hazara Univesrity MansehraSyed NomanNo ratings yet

- Strategic Management of Declining Industries - A Literature ReviewDocument7 pagesStrategic Management of Declining Industries - A Literature Reviewc5r9j6zjNo ratings yet

- BTA Exam Week 5Document13 pagesBTA Exam Week 5h9rkbdhx57No ratings yet

- JARDCS PortersFiveForcesModelDocument14 pagesJARDCS PortersFiveForcesModelSRISHTI MULTANINo ratings yet

- Porter ContributionDocument8 pagesPorter ContributionZubair ChNo ratings yet

- 17-2-71-812-011 Md. Farid Hasan PDFDocument18 pages17-2-71-812-011 Md. Farid Hasan PDFmiraj hossenNo ratings yet

- Business EXTERNAL & INTERNAL ENVIRONMENTSDocument44 pagesBusiness EXTERNAL & INTERNAL ENVIRONMENTSm abdullahNo ratings yet

- HeryalDocument4 pagesHeryalDe ChaneNo ratings yet

- Orientation: On The Requirements Contained in The SyllabusDocument24 pagesOrientation: On The Requirements Contained in The SyllabusMakoy BixenmanNo ratings yet

- 1 (1) D PDFDocument10 pages1 (1) D PDFToobaNo ratings yet

- Strategic Management Segemetnation in ConstructionDocument16 pagesStrategic Management Segemetnation in ConstructionAnuran GayaliNo ratings yet

- Unattractive Industries Are More Attractive Than The Attractive Ones "Discuss"?Document5 pagesUnattractive Industries Are More Attractive Than The Attractive Ones "Discuss"?Sa LaNo ratings yet

- Surprise Test - IEDocument12 pagesSurprise Test - IEpsychshetty439No ratings yet

- AF Summative ReportDocument18 pagesAF Summative ReportABDOU FADIMATOUNo ratings yet

- Group 4 ReportDocument22 pagesGroup 4 ReportPhụngĐàmNo ratings yet

- Lecture #4 - Business StrategyDocument21 pagesLecture #4 - Business StrategyxxDantasticxxNo ratings yet

- Case Study On Strategic PlanningDocument20 pagesCase Study On Strategic PlanningNayamot100% (1)

- JARDCS PortersFiveForcesModelDocument14 pagesJARDCS PortersFiveForcesModelnghipbgbd201769No ratings yet

- Strategic Management Short NotesDocument5 pagesStrategic Management Short NoteshjkdskjchNo ratings yet

- Operations Strategies: Oland ChmuckDocument9 pagesOperations Strategies: Oland Chmuckahmadbader1No ratings yet

- Operations Strategies PDFDocument9 pagesOperations Strategies PDFIris TitoNo ratings yet

- Strategy in Global Context: Session 1Document17 pagesStrategy in Global Context: Session 1Louis-Kevin EtchiNo ratings yet

- Chapter 3 Industry and Competitive AnalysisDocument44 pagesChapter 3 Industry and Competitive AnalysisNesley Vie LamoNo ratings yet

- StrategyDocument482 pagesStrategyorida nala100% (13)

- Strategy Analysis - External Business Environment (Techniques 1-2)Document8 pagesStrategy Analysis - External Business Environment (Techniques 1-2)Toni Rose Hernandez LualhatiNo ratings yet

- Different Principles Tools and Techniques in Creating A BusinessDocument5 pagesDifferent Principles Tools and Techniques in Creating A BusinessLuna LedezmaNo ratings yet

- Project On EIC Analysis & Summary: Lesson 8: Module 1 SapmDocument22 pagesProject On EIC Analysis & Summary: Lesson 8: Module 1 SapmSurabhi SumanNo ratings yet

- Miles and SnowDocument7 pagesMiles and SnowGLOBOPOINT CONSULTANTSNo ratings yet

- Strategic GroupingDocument4 pagesStrategic Groupingr2119181hNo ratings yet

- You Have A Choice of Two Assignments. COMPLETE ONLY ONE!Document4 pagesYou Have A Choice of Two Assignments. COMPLETE ONLY ONE!Nischith KashyapNo ratings yet

- Assignment Guidelines - Pared PresentationDocument6 pagesAssignment Guidelines - Pared PresentationNazha MujahidNo ratings yet

- Oup Assignment GuidelinesDocument4 pagesOup Assignment GuidelinesTrương M ÁnhNo ratings yet

- Strategic Management Revision Final Exam: Porter's 5 ForcesDocument4 pagesStrategic Management Revision Final Exam: Porter's 5 ForcesMaryam Fellous MelnykNo ratings yet

- MPM8107 - MMPPM 2022 - Session 3Document16 pagesMPM8107 - MMPPM 2022 - Session 3sallykimeuNo ratings yet

- Unit 03Document17 pagesUnit 03Shah Maqsumul Masrur TanviNo ratings yet

- Sumarry of ManagementDocument12 pagesSumarry of Managementrthhjgbrhefb²No ratings yet

- CBAC Material 2Document30 pagesCBAC Material 2Mitche GaleciaNo ratings yet

- Strategic Management - Sample Assignment Material & Discussion seriesFrom EverandStrategic Management - Sample Assignment Material & Discussion seriesNo ratings yet

- Strategic Analysis of Internal Environment of a Business OrganisationFrom EverandStrategic Analysis of Internal Environment of a Business OrganisationNo ratings yet

- CS 5226: Database Administration and Performance TuningDocument14 pagesCS 5226: Database Administration and Performance TuningSatyarth GaurNo ratings yet

- Balance Sheet Prepare and AnalyseDocument9 pagesBalance Sheet Prepare and AnalyseSatyarth GaurNo ratings yet

- Junit: A Tool For Test-Driven DevelopmentDocument16 pagesJunit: A Tool For Test-Driven DevelopmentSatyarth GaurNo ratings yet

- MBAD/F 617: Optimization and Financial EngineeringDocument17 pagesMBAD/F 617: Optimization and Financial EngineeringSatyarth GaurNo ratings yet

- The Head and Shoulders Strategy: CharacteristicsDocument12 pagesThe Head and Shoulders Strategy: CharacteristicsChiedozie OnuegbuNo ratings yet

- ASSIGNMENT A - LawDocument4 pagesASSIGNMENT A - LawKath Lea Sanchez AbrilNo ratings yet

- ICOS New Co Op Business Plan TemplateDocument8 pagesICOS New Co Op Business Plan TemplateKirthana SubramaniamNo ratings yet

- SMM 1Document27 pagesSMM 1nsubbuadigaNo ratings yet

- ACC 401week 8 QuizDocument17 pagesACC 401week 8 QuizEMLNo ratings yet

- Citibank-Bank StatementDocument2 pagesCitibank-Bank Statementhoving.ppl1330% (1)

- Chapter 3 - The Economic Models and The Flow of ProductionDocument16 pagesChapter 3 - The Economic Models and The Flow of Productionancaye1962No ratings yet

- Dsi NewDocument22 pagesDsi NewayeshmanthabroNo ratings yet

- The Impact of Covid-19 ENGLISHDocument14 pagesThe Impact of Covid-19 ENGLISHNilton ValdimiroNo ratings yet

- Oliver vs. Macon Hardware Co It Was Held That in Determining Whether A Particular Laborer orDocument1 pageOliver vs. Macon Hardware Co It Was Held That in Determining Whether A Particular Laborer orana ortizNo ratings yet

- DBF UgandaDocument15 pagesDBF Ugandakumargaurav01No ratings yet

- Document 4Document17 pagesDocument 4Syahirah AidaNo ratings yet

- The Degree of Responsiveness of Quantity Demanded of A Commodity To The Change in Price Is Called Elasticity of DemandDocument2 pagesThe Degree of Responsiveness of Quantity Demanded of A Commodity To The Change in Price Is Called Elasticity of Demandkalpna_prestigeNo ratings yet

- InfosysDocument10 pagesInfosysManisha SinghNo ratings yet

- CBRE - Retail Occupier SurveyDocument10 pagesCBRE - Retail Occupier SurveyAgustín QuerolNo ratings yet

- 09 Chapter 1Document39 pages09 Chapter 1Rajesh PattanaikNo ratings yet

- Parking MemoDocument13 pagesParking MemojaneprendergastNo ratings yet

- MBA Prospectus 2016Document244 pagesMBA Prospectus 2016Rohit SinghNo ratings yet

- The Time Dimension of ManagementDocument1 pageThe Time Dimension of ManagementJorrian GelinkNo ratings yet

- Anjenna Soap RoposalDocument24 pagesAnjenna Soap RoposalDaksha GroupNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLoan LoanNo ratings yet

- ACCT CODE VOL-III (Guide Part 6) PDFDocument13 pagesACCT CODE VOL-III (Guide Part 6) PDFshekarj88% (8)

- Background Reading Material: Elementary Basics ofDocument22 pagesBackground Reading Material: Elementary Basics ofSaloni MalhotraNo ratings yet

- Namma Kalvi 11th Commerce Full Study Material emDocument101 pagesNamma Kalvi 11th Commerce Full Study Material emThariq AlomarNo ratings yet

- FAC 2602 - 2023 - S1 - Assessment 3 SolutionDocument9 pagesFAC 2602 - 2023 - S1 - Assessment 3 SolutionlennoxhaniNo ratings yet

- Hotel Swagath GrandDocument1 pageHotel Swagath GrandYuvarajNo ratings yet

- Confirmation - For - Booking - ID - # - 745119793 (1) - MergedDocument3 pagesConfirmation - For - Booking - ID - # - 745119793 (1) - MergedRajkishor YadavNo ratings yet

- Sap S4hana State of The Market ReportDocument38 pagesSap S4hana State of The Market ReportKoushik BanikNo ratings yet

- 4P's of Marketing in Services and Additional 3 P'sDocument16 pages4P's of Marketing in Services and Additional 3 P's4 99No ratings yet

- Managing People For PerformanceDocument6 pagesManaging People For PerformanceSteve JonesNo ratings yet

A Study of Performes in Indian Sofware and Services Industry

A Study of Performes in Indian Sofware and Services Industry

Uploaded by

Soumya AminOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study of Performes in Indian Sofware and Services Industry

A Study of Performes in Indian Sofware and Services Industry

Uploaded by

Soumya AminCopyright:

Available Formats

Regional and Sectoral Economic Studies. AEEADE.

Vol. 4-1(2004)

A STUDY OF PERFORMES IN INDIAN SOFWARE AND SERVICES INDUSTRY MISHRA, Vishal* Abstract: The paper focuses upon the performance of the five major software companies of India with a Strategy perspective. There has been a separate focus on the strategies followed by each Individual organization strategies over the period of years, and how have they been able to make mark for themselves riding on their respective strengths. A SWOT analysis has also been done for each organization separately and for the Industry as a whole to identify the plusses and minuses, the opportunities available and threats present in the external environment. JEL classification: O3, O32, Key words: Management, Sofware, Joint venturing, Tomorrow always arrives. It is always different. And even the mightiest company is in trouble if it has not worked for the future. Being surprised by what happens is a risk that even the largest and the richest company cannot afford, and even the smallest business need not run. - Peter Drucker 1. Literature Survey The objective for the literature survey was to identify the structure for the study. This was accomplished through study of various texts related to the subject (Strategic Management: Competitiveness and Globalization by Michael A. Hitt, R. Duane Irela nd, Robert E. Hoskisson, Robert E. Hosk, Readings In Strategic Management by Arthur Thompson(1997), Jr. A. J. Strickland III Tracy Kramer and Strategic Management by Fred David, 2003 ). The structure thus finalized was the study of various decisions, steps and moves taken by

Vishal Mishra is Research Scholar at ICFAI Institute for Management Teachers, Hyderabad-24, India. E-mail: mishrav@rediffmail.com

45

Regional and Sectoral Economic Studies. AEEADE.

Vol. 4-1(2004)

the organizations on the path to growth and finally developing a SWOT analysis map in the light of the former. The papers written in the area are mostly concerned either with the study of the sector/industry as a whole or the study(case analysis) of an individual organization.The paper by Patibandla and Peterson (2002) on the role of TNCs in the domestic software industry provides some interesting points to ponder on the performance issues of the organizations. A paper by Heeks (1998) also gave a good insight into the genesis and growth of the Indian software industry. The work by Malley and Gorman (1999) highlighting the competitive advantages and other characteristics of Irish software industry provides a good study in contrast. 2. Methodology The methodology followed is extensive data collection from various sources (Reports and Publications) followed by a study of Strategic initiatives and SWOT analysis. Theoretical Underpinnings: Strategies represent the actions to be executed after proper thought and planning to accomplish the long term objectives of the organization. These objectives should be realistic, clear, understandable, quantifiable and measurable with a very inherent time orientation. A) Integration Strategies (Vertical Integration strategies) Forward Integration: would involve the control or ownership of intermediaries involved in delivery of the product or service viz. distributors, retailers etc. Backward Integration: would involve the control or ownership of intermediaries involved in creation of the product or service viz. suppliers to the organization. Pursued when: 1) Present intermediaries are expensive, unreliable or incapable. 2) The industry is growing and is expected to grow in future. 3) Present intermediaries in the industry have high margins Horizontal Integration: would involve the control or ownership of similar organization / competitors. Pursued when: 1)There is a chance of attaining a situation of clear cut leader in the industry. 2)Increased 46

Mishra, V.

Performers in Indian Software & Services Industry

economies of scale provide competitive advantages. 3)Industry is growing B) Intensive Strategies Market Penetration: Involves greater effort in marketing for increasing the market share of the current offerings (products/services) in the current market. Pursued when: 1)Present market have still more scope/potential for sales. 2) Usage rate of current customers can be increased. 3) Industry sales are increasing (though of competitors may be declining) Market Development: Involves greater effort in marketing for launch/introduction of current offerings (products/services) in the new market. Pursued when: 1) New untapped or unsaturated market exists. 2)There is excess production capacity. 3)Basic industry is assuming global status Product Development: Involves perking up the sale s performance by enhancing /improving upon the current offerings (products/services) or developing new ones. Pursued when: 1)Current products are in maturity stage. 2) The industry is very dynamic and high growth. 3) Competitors have better products/ services. 4)Organization has strong R & D base C) Diversification Strategies Concentric Diversification: Involves augmenting the organization sales by addition of new but related products into the portfolio. Pursued when: 1)Industry is slow-growth or no-growth. 2)Introduction of new products/service would increase the consumption of current offerings. 3) New offerings have seasonal sales cycle, which would counterbalance the cycles of current/present offerings.4) Current offerings have matured Horizontal Diversification: Involves augmenting the organization sales by addition of new and unrelated products into the portfolio for the current customers. Pursued when: 1) Industry is slow-growth or nogrowth. 2) Introduction of new products/service would increase the consumption of current offerings. 3) New offerings have seasonal sales cycle, which would counterbalance the cycles of current/present offerings. 4)Current offerings have matured 47

Regional and Sectoral Economic Studies. AEEADE.

Vol. 4-1(2004)

Conglomerate Diversification: Involves augmenting the organization sales by addition of new and unrelated products into the portfolio. Pursued when: Present markets for present products have saturated. Organizations core industry is on decline (in terms of sales and profits) D) Defensive Strategies (reactive) Retrenchment: Involves the various measures (when sales and profits are already declining) for turnaround and regrouping through reduction in assets and costs. Divestiture: Involves hiving/selling off a function/division/unit of an organization. (Often used to raise capital or as a part of retrenchment strategy) Liquidation: Involves selling off all the assets and tangible resources of the organization when it is no longer viable to do business. E) Porters Generic Strategies Cost Leadership Strategies: Involves producing very low cost product/service for price conscious market. Differentiation Strategies: Involves production/creation of product/service which are very unique (have no substitutes/alternatives) Focus Strategies: Involves the production/creation of product/servic e for the niche market. Note that a primary input for pursuing any or all if the mentioned strategies is the presence of resources required for the same, the primary ones being the availability of CAPITAL and HUMAN RESOURCE Means for achieving strategies: A) Joint venturing/Partnerships. Reasons: 1) Domestic organization with foreign organization: opportunity for making inroads in new market and culture through local expertise. 2) When diverse expertise and distinct competencies are in a position to complement the mutual strengths. 3) When risks/stakes are very high in some particular market/project. 4) In face of a big competitor two or more smaller firms can opt to compete together. 5) In case of a rapid response to some market situation which would require more than one specialty/expertise (new technology 48

Mishra, V.

Performers in Indian Software & Services Industry

introduction). B) Mergers/Acquisitions/Takeovers. Reasons: 1) Economies of scale. 2) Better resource utilization (manpower resources, production facilities). 3) Combating seasonality and various other trends in demand of the product/service. 4) For access to new products/services, new technology, new markets, suppliers, distributors. 3. The organizations: data and strategies The Organizations selected were on the basis of their performance and their visibility in the national Software/IT map. (For the reasons of information and data availability only the Public Limited companies were finally short listed for the purpose of the study. To cover the wider genre a product company was also made a part of this study, which incidentally is also the lone world-class player from the product segment: 1). Infosys Technologies Limited. 2). Wipro (Technologies) Limited. 3) HCL Technologies Limited. 4) Satyam Computer Services Limited. 5) I-Flex Solutions Limited Infosys TechnologiesLlimited: Start-up Year: 1981. Chairman/CEO/M.D: Mr. N Nandan Nilekani No. Of Employees: 21000+ Industry: Software Products/Services: Customized software services and software products, ITES Services: Content management, Application servers, Security infrastructure, Middleware / Adapters, Personalization technologies, Industry-specific business applications, Product engineering services, Storage area network, BPM, CRM, KM, Mobile computing and M strategy, SCM, IT strategy, Infrastructure management services, Consulting and Strategy,Architecture and Integration,Custom Systems Development,Re-engineering and migration services,Maintenance and Support Product: Enterprise Banking solution, Finacle Turnover: Mar 2003, 36226.90 Rs. Million Profit: 9579.30 Rs. Million No. Of Customers: 350+ 49

Regional and Sectoral Economic Studies. AEEADE.

Vol. 4-1(2004)

Share Holding Pattern as on '31/12/2003' Major Holder Number Of share Promoters 17691470 Institutional Investors 32191448 Other Investors 10593207 General Public 5979867 *source : www.indiainfoline.com Major Strategies Adopted over the years:

Percentage 26.62 48.44 15.94 9.00

Infy followed the strategy of concentric diversification where in it started with purely consulting business and then widened its portfolio to software maintenance, re-engineering and downsizing applications in the existing market segment. Another act of this diversification strategy was the entry into distribution (DMAP) and banking product (Finacle) segments. Establishment of a separate software testing unit which would cater to self , competitors as well as the customers is another example of the such strategy. Figures (in Rs. Crores, Adjusted for inflation based on CPI) *Authors computation. One Crore=10 million.

Infosys Technologies Limited 4000 3000 2000 1000 0

19 97 19 99 20 01 20 03 19 95

Rs. Crore

Sales Profits

Year

50

Mishra, V.

Performers in Indian Software & Services Industry

Figures (in Rs).*Authors computation

InfosysTechnologies Limited

200 150 100 50 0 1997 1998 1999 2000 2001 2002 2003 2004 Years

An example of horizontal/conglomerate diversification is Infosyss entry into BPO/BPM segment through its subsidiary Progeon. Various market penetration strategies have been a constant fixture of Infosyss strategic maneuvers over the years. It has expanded its market from U.S to Europe, Middle -East & Far-East Markets and to Africa, Australia etc. (this include setting of f-shore development centers, support & maintenance offices, Sales & Marketing offices to Liaison centers). An excellent example of market development is Infys foray in Automotive systems & life sciences from its traditional stronghold in verticals like & Distribution, Banking, Telecommunication and Manufacturing sectors. Acquisition (Integration Strategy) has been the most popular mode of development/growth being pursued by the Indian companies including Infosys (stake in Onmobile, USA, Expert Information services, Australia etc.) SWOT Analysis: Strength: Excellent Brand Image, Reservoir Of Best Human Resource, One Of the most Respected Organizations, Best HR Policies, Very Good Knowledge bank, Great returns to shareholders, Increasing profits and EPS Weakness: Large Bench may lead to high carrying costs, High costs of Training & Skill Up gradation

51

Regional and Sectoral Economic Studies. AEEADE.

Vol. 4-1(2004)

Opportunity: Leveraging the performance in U.S & Few European Markets to capture other markets of Europe, China, Australia, Japan, Middle-East & Far East. Threat: Strong Local and International Competition, with the similar strengths and delivery models and may be lower costs/billing rates. Wipro Technologies: Start-up Year: 1994 Chairman/CEO/M.D: Mr. Azim Premji No. Of Employees: 11000+ Industry: Software Products/Services: Customized software solutions/services and software products, ITES Services: IT services (Application development and maintenance, Architecture consulting, B2E, BI & DW, BPM, CRM, e -Business, ERP, e-procurement, B2B, Enterprise security, Package implementation, PLM, SI, SCM, EAI, Technology infrastructure services, web services, Product Design Services (Hardware services, system software development, Testing verification and validation, support services), BPO (customer interaction services, finance and accounting services, payment services, Industry application services, HR processing services, supply chain services, knowledge services) Turnover: Mar 2003, 11,000+ Rs. Million (Mar 2004 11500+) Profit: Rs. Million. No. Of customers: 300+ Share Holding Pattern as on '31/12/2003' Major Holder Number Of share Promoters 195127110 Institutional Investors 10770201 Other Investors 11194813 General Public 15536435 *source : www.indiainfoline.com

Percentage 83.88 4.63 4.81 6.68

52

Mishra, V.

Performers in Indian Software & Services Industry

Figures (In Rs. Crores, Adjusted for inflation based on CPI) *Authors computation

Wipro Limited 5000 4000 3000 2000 1000 0

19 95 19 97 19 99 20 01 20 03

Rs. Crore

Sales Profits

Year

Figures (In Rs.)*Authors computation

Wipro Limited 40 30 20 10 0

19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04

EPS

Years

Major Strategies Adopted over the years: Wipro Ltd. is one of the most versatile IT organization in India, starting with its presence in the hardware segment it has quickly identified the opportunity in the software field and has been making the most of the head start. Thus by following the (conglomerate) diversification route it has strived to become a complete IT solutions company. Another example of diversification (horizontal) is expansion of services (called service line expansion) from IT & IS consulting to EBusiness Transformation, e-commerce, Web Enabling ERP, Data 53

Regional and Sectoral Economic Studies. AEEADE.

Vol. 4-1(2004)

warehousing, CRM and SCM. It has also diversified to the field of Internet service providers. Apart from the above Wipro has several marketing arrangement with some of the major players in the software industry for sales/marketing & servicing of their applications in various markets, an example of horizontal diversification strategy (NAVISION,For ERP solutions, CITRIX systems US for networking softwares, Witness systems US for eQuality browser based solutions, Sistina Software Inc For services to their customersin India , Asia Pacific & West Asia). Foray into the BPO sector through the acquisition of Spectramind is a growth strategy by the route of conglomerate diversification while launching of 01markets.com as a portal for IT industry is the pursuance of horizontal diversification path to growth. Wipro has actively followed the market development strategy through out its life cycle, a sure shot way to increased revenues and profits it has expanded its operations from U.S, to European countries, Asia-Pacific, Middle East, China and Australia specially after the 9/11 tragedy. SWOT Analysis: Strength: World Class Quality Processes, Core Technology Focus, Dynamic Top Management, Excellent Relationship Management, Brand Image Weakness: Very Diversified Businesses, Organizational complexity can cost it the first mover advantage, Reducing profits and reducing EPS a cause of concern, More than 80 % of the shares with the promoters could be a cause of concern Opportunity: With competitive billing rates, the slowdown is actually a time when the company can distance itself from the competition Threat: Competition from both traditional and new players both Local and Foreign HCL Technologies Limited: Start-up Year: 1994 Chairman/CEO/M.D: Mr. Shiv Nadar No. Of Employees: 12000+ 54

Mishra, V.

Performers in Indian Software & Services Industry

Industry: IT solutions Products/Services: Technology development, networking, software product engineering and applications engineering Services: Technology-led services (digital signal processing , embedded software, storage area network , system software, VOIP, middleware, wireless technology, product data management, content delivery management, security, validation and verification services) ,Practice-led services (ERP, CRM , B2B, SCM EAI, EAT enterprise application integration & testing, IT infrastructure services, Internet technology) Application-led services (application development, application management), ITES (process support services, contact center, sales and marketing services). Turnover: Mar 2003, 8717.30 Rs. Million Profit: 3124.70 Rs. Million No. Of customers: 385+ Share Holding Pattern as on '31/12/2003' Major Holder Number Of share Promoters 225846968 Institutional Investors 42204214 Other Investors 16837772 General Public 10709406 *source : www.indiainfoline.com

Percentage 76.40 14.28 5.70 3.62

Figures (In Rs. Crores Adjusted for inflation based on CPI).*Authors computation

HCL Technologies Limited

1000 Rs. Crores 800 600 400 200 0 2000 2001 2002 Years 2003 2004 Sales Profits

55

Regional and Sectoral Economic Studies. AEEADE.

Vol. 4-1(2004)

Figures (In Rs.).*Authors computation

HCL Technologies Limited 20 15 EPS 10 5 0 2000 2001 2002 Years 2003 2004

Major Strategies Adopted over the years: HCL is one organization, which is in a way similar to Wipro in the sense that it too had a strong presence in the hardware segment before it joined the software wagon. Unlike wipro IT has been sole area of focus for the Shiv Nadar controlled company. Diversification into software industry was the first big step the organization took and even though it has a decent presence in the IT H/W map of India it is the IT and ITES units which have been the main divers in recent years. It started its software practices as a technology development service provider and subsequently forayed into strategic management consulting, Internet service providers business, increased its product and service base(Product Development Strategy), and also gone for distribution, support and maintenance of other players solutions and services (Broad Vision Inc.,USA and Questa Corp.,). Diversification strategies at work (Concentric, Horizontal, and Conglomerate). Design and application support for Vitesse, Demand Chain management solutions as a part of web enabling applications business, entry into retail verical and entry in ITES business (E-Serve, the BPO outfit) are other examples of Product/Service Development (i.e Intensive Strategy) and Diversification strategies followed by HCL technologies. HCL technologies has also strived for market development strategy for growth and have expanded into various markets of Americas, Europe, China and Japan.

56

Mishra, V.

Performers in Indian Software & Services Industry

SWOT Analysis: Strength: Proven high-end technology capabilities and strong offshore business model, Wide Portfolio (Hardware & Software Expertise) Weakness: High dependence on US-centric clients, exposed to client risk with more than 30% revenues coming from Top 10, high % of shares with the promoters a cause of concern, Reducing profits despite revenue growth (Imply high costs) and EPS Opportunity: European Markets, Moving up the value chain, from application development to software engineering, networking services and technology development to strategy consulting. Threat: Strong Local and International Competition for The Same Target Market Satyam Computer Services Limited: Start-up Year: 1987 Chairman/CEO/M.D: Mr. B Ramalinga Raju No. Of Employees: 9000+ Industry: Software Products/Services: Software solutions and services Services: Technology Solutions, Data warehousing& Business Intelligence, BPO, Consulting and Enterprise solutions, Embedded services, Engineering solutions, ERP, GIS, IT Outsourcing, Managed IT services, Network and system Integration, Quality Consulting, Silicon design services, Enterprise storage solutions. Turnover: Mar 2003, 20236.51 Rs. Million Profit: 4598.80 Rs. Million No. Of customers: 260+ in 43 countries Share Holding Pattern as on '31/12/2003' Major Holder Number Of share Promoters 57796901 Institutional Investors 199715338 Other Investors 43163912 General Public 15216696

*source : www.indiainfoline.com

Percentage 18.30 63.22 13.66 4.82

57

Regional and Sectoral Economic Studies. AEEADE.

Vol. 4-1(2004)

Figures (In Rs. Crores Adjusted for inflation).*Authors computation

Satyam Computer Services Limited

2500 2000 Rs. Crore 1500 1000 500 0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Year Sales Profits

Figures (In Rs.),*Authors computation

Satyam Computer Services Limited 25 20 15 10 5 0 1997 1998 1999 2000 2001 2002 2003 2004 Years

Major Strategies Adopted over the years: Satyam comp services started its operations as a software development and services outfit and later on it has diversified its operations to product maintenance and support services. As with all other major software cos in India it has also identified the ITES as the future area of growth joined the ITES/BPO bandwagon through launching of Nipuna services limited. Over the period of years Satyam has followed the path of growth (Diversification) by expansion of its operations in different verticals and now it covers various areas in Finance markets, Automotive, Aviation, Insurance, Healthcare and bio-informatics industry. Growth has also been in terms of markets/geographies (Market Development) where the operations have increased from US, Canada (Americas), Sweden, Germany 58

EPS

Mishra, V.

Performers in Indian Software & Services Industry

(Europe) to Japan Australia, China, UAE (Middle -East), Singapore & Malaysia (Far-East). It has also entered in online shopping through www.sifymall.com which was earlier a portal SWOT Analysis: Strength: Expertise on wide range of technologies, Management Focus, Organization Structure Weakness: Non-performing units/subsidiaries, Lacking International Brand Image, Reducing profits show a high TCO, Reducing EPS depict a non-favorable shareholder return may result in a negative market image. Opportunity: Various Markets In Europe, Listing on the NYSE should give a better branding in the US Threat: Industry slowdown could reflect poorly on margins and growth. I-FLEX SOLUTIONS LIMITED: Start-up Year: 1989 Chairman/CEO/M.D: Mr. Rajesh Hukku No. Of Employees: 2700+ Industry: Software & Services Products/Services: Banking and financial software products, and related consultancy and development services Products: Flexcube, Reveleus, Promotr, Microbanker Services: Turnkey Solutions, ASP Services, Technology Deployment and management services, e-business, CRM, Business Intelligence Turnover: Mar 2003, 3200.91 Rs. Million Profit: 1743.75 Rs. Million No. Of Customers: 450+ in 100 countries Share Holding Pattern as on '31/12/2003' Major Holder Number Of share Promoters 32236000 Institutional Investors 9745712 Other Investors 7061024 General Public 25632264

*source : www.indiainfoline.com

Percentage 43.17 13.05 9.46 34.33

59

Regional and Sectoral Economic Studies. AEEADE.

Vol. 4-1(2004)

Figures (In Rs. Crores Adjusted for inflation based on CPI) *Authors computation

I-Flex Solutions Limited 600 400 200 0

19 95 19 97 19 99 20 01 20 03

Rs. Crore

Sales Profits

Year

Figures (In Rs.)*Authors computation

I-Flex Solutions Limited 60 EPS 40 20 0 2003 Years 2004

Major Strategies Adopted over the years: The only world class product firm from India (known as the product king), it has the the maximum no. for clients and maximum installations worldwide for its banking solution. An offshoot of Citibank, the company enjoys a considerable muscle and backing in term of assured market (>30%) from its parent company. Primarily recognized for its product the organization has leveraged its strength and diversified into providing turnkey Solutions, ASP Services (through Flexcube), Technology Deployment and 60

Mishra, V.

Performers in Indian Software & Services Industry

management services, e-business. Of particular significance is its foray into the ASP market Starting from access to various markets provided through Citibank i flex has its presence in over 100 countries across the globe. Separation of Product division from Business Intelligence and analytics division (Reveleus) not only served as a means of growth but also helped i-flex to have distinct focus on each of these areas SWOT Analysis: Strength: A very powerful global brand, Numero Uno in its product segment, An extremely resourceful back-up/ parent company, Financial muscle Weakness: Expertise in one industry vertical only, Relative small size (as compared to other product companies) Opportunity: Global Market, Scope for diversification in related areas Threat: Competitive alliances 4. Stages of growth of this industry Based on the study done on the performance of top players in the Indian software industry which represent the character of the industry to a great extent we can say that the strategies adopted by the Indian organization in software products/services Industry, primarily consist of the following two major heads, which focus upon the product/services offering of the organization and its target market(s)viz. Intensive Strategies and Diversification Strategies. This industry is also characterized by various alliances, tie -ups, joint ventures, strategic alliances and Acquisitions (Integration Strategy) both in domestic and foreign markets in related as well as unrelated product/service segment. Market Development strategy to growth has been the mantra for most of the software organizations who have primarily been US centric, consequently we see a lot of interest in European, Middle-East & far East Asia, Africa, Australian and other markets world over The genesis and the growth of this industry can be divided into following Stages: Stage I: Starting UP. 61

Regional and Sectoral Economic Studies. AEEADE.

Vol. 4-1(2004)

Prevailing conditions: 1) Command and control economy. 2)Import restrictions. 3) Taxes. 4) Poor infrastructure Strategy: 1) Onsite focus. 2) Few large customers. 3) Indirect sales through multiple channels Stage II: The Growth Prevailing situation: 1) Rationalization of taxes & tariffs. 2)Export incentives. 3) Abolishing Licenses and abolishing wealth tax on productive assets. 4) Foreign exchange reforms. 5)Free pricing of issues and entry of FIIs Strategy: 1) Global benchmarking. 2) Global delivery model: a)Do work where it makes economic sense and reduce the total cost of ownership. b)Efficient management of resources spread across different geographical locations. 3) Employee retention. 4)Investment in sales and marketing. 5) Developing attractiveness for investors, customers as well as employees. Stage III: The Acceleration Prevailing Conditions: 1) Market: a) Globalization, deregulation & consolidation are changing business fundamentally. b)Increasing competition from low cost economies. 2)Technology: a) Availability of higher bandwidth and popularity of Wireless access applications and devices. b) Increased work and development in the field of web connected non-pc devices. 3)Focus on Outsourcing because of following considerations: a)Time-to-market. b)Internal resource shortage. c)Cost control. d)Complexity of IT. d) Improved vendor capabilities. e)Focus on core-competency. Strategy: 1) Growth through Mergers /Acquisitions and Partnerships. 2) Move towards the top-end of the value chain 5. The indian software industry present and the future Following is the SWOT analysis of the software industry as a whole in India which clearly provides not only an overview of the current situation but also a future roadmap for Indian companies Strengths: 1) Large Availability of Skilled manpower. 2) Low TCO (Total cost of operations). 3) Government Support. 4) Management Experience. 5) Global Delivery Model. 6) Time Zone Benefits. 7) Growing Domestic Market 62

Mishra, V.

Performers in Indian Software & Services Industry

Weaknesses: 1) Small Share of World Market. 2) Very High reliance on the U.S Market. 3) Low Financial Muscle. 4) Small Size. 5) Majority of Work Focused on The Low End of Value Chain. 6) Little or No Presence In The World Software Product Map. 7) Bureaucracy. Opportunities: 1) Whole World As A Target Market. 2) Outsourcing. 3) New verticals. 4) Moving Towards High-End Of Value Chain (Cutting Edge & Mission Critical Application Development Greater Source Of Revenue, Differentiation & Competitive Advantage). 5) Exploiting The Brand Image Threats: 1) Increased Competition (from similar economies e.g China, Philippines, Ireland). 2) Political And Public Pressure Against Out sourcing. 3) MNCs successfully copying the outsourcing model. 4) Increasing fight for skilled Human Resource and related HR Issues. The picture, which emerges from the above analysis, very clearly shows that the Indian software industry is very firmly on its road to maturity. This is more than evident from the rise, which the major Indian organizations are making on the value curve. A very remarkable performance in the software product segment by the current crop of India n organizations coupled with work done by software majors on the cutting edge technologies on real time applications. All the software majors of the world setting their development units in India (which are) working on the latest applications and outsourcing of a part of such work to Indian organizations is a testimony to the growing stature of these organizations. The apparent concern surrounding the threats from economies like China, specially in areas of outsourcing is actually nothing more than a wake up call for future challenge; the reason as we have seen from the above is that Indian companies are far ahead of China in terms of the position in the value curve and the quality of work. Though this is true but this truth is variable not lasting enough for Indian companies to be complacent because of the huge efforts put by the economies like China who want a bigger share of the pie. Thus Indian organizations have to continuously strive to get higher (on the curve), better (in productivity/output) and bigger (worldwide presence) on the road to exponential growth and to thwart any potential threats.

63

Regional and Sectoral Economic Studies. AEEADE.

Vol. 4-1(2004)

Source of Data: CMIE (Centre For Monitoring Of Indian Economy) www.indiainfoline.com NASSCOM publications and reports (2003&2003) Dataquest Publications, (August 2002) www.infy.com www.wipro.com www.hcltech.com www.satyam.com www.iflexsolutions.com References David, F. (2003) Strategic Management, Pearson (LPE) Publications, (2003) Heeks R. (1998), The Uneven Profile Of Indian Software Exports, Development Informatics, Institute for Development policy and Management, University Of Manchester. Hitt, M.A., Ireland, R., and Hoskisson, R.(2002) Strategic Management: Competitiveness and Globalization Infotrac College Publications. OMalley, E. & OGorman, C. (1999) Competitive Advantage in the Irish Software Indigenous Software Industry and the role of FDI, European Planning Studies (Vol.9, No.3, 2001). Patlibandla, M. and Peterson, B. (2002) Role of Transnational Corporations in the Evolution of a High-Tech Industry: The Case of Indias Software Industry, Copenhagen Business School, Frederiksberg, Denmark. Thompson Jr., A., Strickland III, A. J., and Kramer, T.(1997), Readings In Strategic Management, McGraw-Hill-Irwin. _______________________________

Revista publicada por la Asociacin Euro-Americana de Estudios de Desarrollo Econmico. www.usc.es/economet/eaa.htm

64

You might also like

- Chapter 2Document5 pagesChapter 2Su Jiun Soon100% (3)

- (A. Thomas Fenik) Strategic Management (Quickstudy PDFDocument4 pages(A. Thomas Fenik) Strategic Management (Quickstudy PDFZewdu Tsegaye100% (4)

- Strategy-02-RRK Sharma, Rahul Sharma, H Hazaria FinalDocument13 pagesStrategy-02-RRK Sharma, Rahul Sharma, H Hazaria FinalHải Dương PhạmNo ratings yet

- The Resource-Based ModelDocument3 pagesThe Resource-Based ModelMulazim HussainNo ratings yet

- MBA NBS8126 Strategic Management Assignment 2021-22Document12 pagesMBA NBS8126 Strategic Management Assignment 2021-22Abhishek KohliNo ratings yet

- 20085ipcc Paper7B Vol2 Cp3Document17 pages20085ipcc Paper7B Vol2 Cp3Piyush GambaniNo ratings yet

- Strategy Course - AMMARDocument9 pagesStrategy Course - AMMARhercule5005No ratings yet

- Sequential Manner Then Answer Them As A Story With Mention: Hany Seadawy Comprehensive TemplateDocument43 pagesSequential Manner Then Answer Them As A Story With Mention: Hany Seadawy Comprehensive TemplateMarco IbrahimNo ratings yet

- A Study On Promotioanl Strategies of Bharti AirtelDocument61 pagesA Study On Promotioanl Strategies of Bharti AirtelDharmendra DwivediNo ratings yet

- Business EnviromentDocument40 pagesBusiness EnviromentMalav NanavatiNo ratings yet

- Integrated Case Study NotesDocument68 pagesIntegrated Case Study Notesdimuthu suranjanaNo ratings yet

- Strategic Management Unit - IDocument24 pagesStrategic Management Unit - Inirthya2006No ratings yet

- Strategic Mngt.Document49 pagesStrategic Mngt.Precious AlvaroNo ratings yet

- Regional Formation 27133-141Document10 pagesRegional Formation 27133-141Victor DiasNo ratings yet

- Ba 2 08Document43 pagesBa 2 08Andy KrawczykNo ratings yet

- Topic 2Document6 pagesTopic 2Darlene SeguritanNo ratings yet

- ITC Strategic Management ProjetcDocument41 pagesITC Strategic Management ProjetcHarshal GohilNo ratings yet

- Business Credit Solutions: Get A Credit Report Get A D&B D-U-N-S Number Monitor My Business Credit - FREE TRIAL!Document14 pagesBusiness Credit Solutions: Get A Credit Report Get A D&B D-U-N-S Number Monitor My Business Credit - FREE TRIAL!Harleen KaurNo ratings yet

- MGT489 - Exam 1 NotesDocument35 pagesMGT489 - Exam 1 NotesJonathan QuachNo ratings yet

- Department of Manangement Sciences Hazara Univesrity MansehraDocument5 pagesDepartment of Manangement Sciences Hazara Univesrity MansehraSyed NomanNo ratings yet

- Strategic Management of Declining Industries - A Literature ReviewDocument7 pagesStrategic Management of Declining Industries - A Literature Reviewc5r9j6zjNo ratings yet

- BTA Exam Week 5Document13 pagesBTA Exam Week 5h9rkbdhx57No ratings yet

- JARDCS PortersFiveForcesModelDocument14 pagesJARDCS PortersFiveForcesModelSRISHTI MULTANINo ratings yet

- Porter ContributionDocument8 pagesPorter ContributionZubair ChNo ratings yet

- 17-2-71-812-011 Md. Farid Hasan PDFDocument18 pages17-2-71-812-011 Md. Farid Hasan PDFmiraj hossenNo ratings yet

- Business EXTERNAL & INTERNAL ENVIRONMENTSDocument44 pagesBusiness EXTERNAL & INTERNAL ENVIRONMENTSm abdullahNo ratings yet

- HeryalDocument4 pagesHeryalDe ChaneNo ratings yet

- Orientation: On The Requirements Contained in The SyllabusDocument24 pagesOrientation: On The Requirements Contained in The SyllabusMakoy BixenmanNo ratings yet

- 1 (1) D PDFDocument10 pages1 (1) D PDFToobaNo ratings yet

- Strategic Management Segemetnation in ConstructionDocument16 pagesStrategic Management Segemetnation in ConstructionAnuran GayaliNo ratings yet

- Unattractive Industries Are More Attractive Than The Attractive Ones "Discuss"?Document5 pagesUnattractive Industries Are More Attractive Than The Attractive Ones "Discuss"?Sa LaNo ratings yet

- Surprise Test - IEDocument12 pagesSurprise Test - IEpsychshetty439No ratings yet

- AF Summative ReportDocument18 pagesAF Summative ReportABDOU FADIMATOUNo ratings yet

- Group 4 ReportDocument22 pagesGroup 4 ReportPhụngĐàmNo ratings yet

- Lecture #4 - Business StrategyDocument21 pagesLecture #4 - Business StrategyxxDantasticxxNo ratings yet

- Case Study On Strategic PlanningDocument20 pagesCase Study On Strategic PlanningNayamot100% (1)

- JARDCS PortersFiveForcesModelDocument14 pagesJARDCS PortersFiveForcesModelnghipbgbd201769No ratings yet

- Strategic Management Short NotesDocument5 pagesStrategic Management Short NoteshjkdskjchNo ratings yet

- Operations Strategies: Oland ChmuckDocument9 pagesOperations Strategies: Oland Chmuckahmadbader1No ratings yet

- Operations Strategies PDFDocument9 pagesOperations Strategies PDFIris TitoNo ratings yet

- Strategy in Global Context: Session 1Document17 pagesStrategy in Global Context: Session 1Louis-Kevin EtchiNo ratings yet

- Chapter 3 Industry and Competitive AnalysisDocument44 pagesChapter 3 Industry and Competitive AnalysisNesley Vie LamoNo ratings yet

- StrategyDocument482 pagesStrategyorida nala100% (13)

- Strategy Analysis - External Business Environment (Techniques 1-2)Document8 pagesStrategy Analysis - External Business Environment (Techniques 1-2)Toni Rose Hernandez LualhatiNo ratings yet

- Different Principles Tools and Techniques in Creating A BusinessDocument5 pagesDifferent Principles Tools and Techniques in Creating A BusinessLuna LedezmaNo ratings yet

- Project On EIC Analysis & Summary: Lesson 8: Module 1 SapmDocument22 pagesProject On EIC Analysis & Summary: Lesson 8: Module 1 SapmSurabhi SumanNo ratings yet

- Miles and SnowDocument7 pagesMiles and SnowGLOBOPOINT CONSULTANTSNo ratings yet

- Strategic GroupingDocument4 pagesStrategic Groupingr2119181hNo ratings yet

- You Have A Choice of Two Assignments. COMPLETE ONLY ONE!Document4 pagesYou Have A Choice of Two Assignments. COMPLETE ONLY ONE!Nischith KashyapNo ratings yet

- Assignment Guidelines - Pared PresentationDocument6 pagesAssignment Guidelines - Pared PresentationNazha MujahidNo ratings yet

- Oup Assignment GuidelinesDocument4 pagesOup Assignment GuidelinesTrương M ÁnhNo ratings yet

- Strategic Management Revision Final Exam: Porter's 5 ForcesDocument4 pagesStrategic Management Revision Final Exam: Porter's 5 ForcesMaryam Fellous MelnykNo ratings yet

- MPM8107 - MMPPM 2022 - Session 3Document16 pagesMPM8107 - MMPPM 2022 - Session 3sallykimeuNo ratings yet

- Unit 03Document17 pagesUnit 03Shah Maqsumul Masrur TanviNo ratings yet

- Sumarry of ManagementDocument12 pagesSumarry of Managementrthhjgbrhefb²No ratings yet

- CBAC Material 2Document30 pagesCBAC Material 2Mitche GaleciaNo ratings yet

- Strategic Management - Sample Assignment Material & Discussion seriesFrom EverandStrategic Management - Sample Assignment Material & Discussion seriesNo ratings yet

- Strategic Analysis of Internal Environment of a Business OrganisationFrom EverandStrategic Analysis of Internal Environment of a Business OrganisationNo ratings yet

- CS 5226: Database Administration and Performance TuningDocument14 pagesCS 5226: Database Administration and Performance TuningSatyarth GaurNo ratings yet

- Balance Sheet Prepare and AnalyseDocument9 pagesBalance Sheet Prepare and AnalyseSatyarth GaurNo ratings yet

- Junit: A Tool For Test-Driven DevelopmentDocument16 pagesJunit: A Tool For Test-Driven DevelopmentSatyarth GaurNo ratings yet

- MBAD/F 617: Optimization and Financial EngineeringDocument17 pagesMBAD/F 617: Optimization and Financial EngineeringSatyarth GaurNo ratings yet

- The Head and Shoulders Strategy: CharacteristicsDocument12 pagesThe Head and Shoulders Strategy: CharacteristicsChiedozie OnuegbuNo ratings yet

- ASSIGNMENT A - LawDocument4 pagesASSIGNMENT A - LawKath Lea Sanchez AbrilNo ratings yet

- ICOS New Co Op Business Plan TemplateDocument8 pagesICOS New Co Op Business Plan TemplateKirthana SubramaniamNo ratings yet

- SMM 1Document27 pagesSMM 1nsubbuadigaNo ratings yet

- ACC 401week 8 QuizDocument17 pagesACC 401week 8 QuizEMLNo ratings yet

- Citibank-Bank StatementDocument2 pagesCitibank-Bank Statementhoving.ppl1330% (1)

- Chapter 3 - The Economic Models and The Flow of ProductionDocument16 pagesChapter 3 - The Economic Models and The Flow of Productionancaye1962No ratings yet

- Dsi NewDocument22 pagesDsi NewayeshmanthabroNo ratings yet

- The Impact of Covid-19 ENGLISHDocument14 pagesThe Impact of Covid-19 ENGLISHNilton ValdimiroNo ratings yet

- Oliver vs. Macon Hardware Co It Was Held That in Determining Whether A Particular Laborer orDocument1 pageOliver vs. Macon Hardware Co It Was Held That in Determining Whether A Particular Laborer orana ortizNo ratings yet

- DBF UgandaDocument15 pagesDBF Ugandakumargaurav01No ratings yet

- Document 4Document17 pagesDocument 4Syahirah AidaNo ratings yet

- The Degree of Responsiveness of Quantity Demanded of A Commodity To The Change in Price Is Called Elasticity of DemandDocument2 pagesThe Degree of Responsiveness of Quantity Demanded of A Commodity To The Change in Price Is Called Elasticity of Demandkalpna_prestigeNo ratings yet

- InfosysDocument10 pagesInfosysManisha SinghNo ratings yet

- CBRE - Retail Occupier SurveyDocument10 pagesCBRE - Retail Occupier SurveyAgustín QuerolNo ratings yet

- 09 Chapter 1Document39 pages09 Chapter 1Rajesh PattanaikNo ratings yet

- Parking MemoDocument13 pagesParking MemojaneprendergastNo ratings yet

- MBA Prospectus 2016Document244 pagesMBA Prospectus 2016Rohit SinghNo ratings yet

- The Time Dimension of ManagementDocument1 pageThe Time Dimension of ManagementJorrian GelinkNo ratings yet

- Anjenna Soap RoposalDocument24 pagesAnjenna Soap RoposalDaksha GroupNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLoan LoanNo ratings yet

- ACCT CODE VOL-III (Guide Part 6) PDFDocument13 pagesACCT CODE VOL-III (Guide Part 6) PDFshekarj88% (8)

- Background Reading Material: Elementary Basics ofDocument22 pagesBackground Reading Material: Elementary Basics ofSaloni MalhotraNo ratings yet

- Namma Kalvi 11th Commerce Full Study Material emDocument101 pagesNamma Kalvi 11th Commerce Full Study Material emThariq AlomarNo ratings yet

- FAC 2602 - 2023 - S1 - Assessment 3 SolutionDocument9 pagesFAC 2602 - 2023 - S1 - Assessment 3 SolutionlennoxhaniNo ratings yet

- Hotel Swagath GrandDocument1 pageHotel Swagath GrandYuvarajNo ratings yet

- Confirmation - For - Booking - ID - # - 745119793 (1) - MergedDocument3 pagesConfirmation - For - Booking - ID - # - 745119793 (1) - MergedRajkishor YadavNo ratings yet

- Sap S4hana State of The Market ReportDocument38 pagesSap S4hana State of The Market ReportKoushik BanikNo ratings yet

- 4P's of Marketing in Services and Additional 3 P'sDocument16 pages4P's of Marketing in Services and Additional 3 P's4 99No ratings yet

- Managing People For PerformanceDocument6 pagesManaging People For PerformanceSteve JonesNo ratings yet