Professional Documents

Culture Documents

Hellhound of Wall Street - Prologue Fall 2011

Uploaded by

Prologue MagazineCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hellhound of Wall Street - Prologue Fall 2011

Uploaded by

Prologue MagazineCopyright:

Available Formats

AUTHORS ON THE RECORD

the hellhound of wall street

by hilary parkinson

In 1933, the United States was gripped by the Great Depression. The countrys financial system teetered on the verge of collapse. Thirty-eight states had closed their banks, and one in four families had lost their life savings. Reform was needed, and it would begin with Ferdinand Pecora, who investigated the causes of the 1929 crash in his role as chief counsel for the Senate Committee on Banking and Currency. For 10 days, the officers of National City Bank were grilled by Pecora. And 10 days later, Charles E. Mitchellchairman of that bank and former adviser to three Presidentsresigned in disgrace. Ultimately, the results of the investigation would lead to stronger federal oversight on the activities of banks and the stock market. Michael Perino is the Dean George W. Matheson Professor of Law at St. Johns University School of Law in New York. He is also a former Wall Street litigator. He has testified in both the United States Senate and the House of Representatives and has written extensively on regulation, securities fraud, and class action litigation. His website is www.michaelperino.com.

Michael Perino

Although he was responsible for sweeping reform in the United States banking system, the name Ferdinand Pecora is unknown to most Americans. What made you decide to tell his story? I actually set out to write an entirely different book. The subject is unimportant, but it tangentially involved the Pecora hearings. I knew that Pecora had given his oral history in the early 1960s as part of the Columbia University oral history project, and although I didnt think it was going to be terribly relevant to my book, I decided I should read it. By page 10, I was completely hooked. Pecora had such an incredible life storyhe immigrated to the United States from Sicily in the late 1800s when he was five years old. He grew up in a basement tenement on the west side of Manhattan and quit school when he was just 15 when his father was injured in an industrial accident. Over the next four decades, Pecora supported his family, went to night law school, became a prominent New York prosecutor, and eventually took on Wall Street in one of the most successful congressional investigations ever conducted. It really is a classic American success story. I felt compelled to tell the world about this unsung legal hero. in your acknowledgements, you thank Richard McCulley and William H. Davis, national Archives staff who helped you with your requests for records from the Senate Banking and Currency Committee hearings. Were you familiar with these records before you started research for this book? or was this your first experience at the national Archives? This was my first experience at the Archives, and Richard and Bill

were enormously helpful. Although I spent many days there, I still feel that I only scratched the surface of what is available in these records. There are, I believe, over 170 boxes of documents at the National Archives from the investigation. It is a treasure trove for anyone interested in the inner workings of the financial industry during the 1920s and 1930s. Ferdinand Pecora was an excellent lawyer, but not a Wall Street expert. You are a professor of law at St. Johns University whose area of expertise is in securities regulation and securities fraud. How do you think Pecora fared in terms of understanding the complicated issues of securities? Pecora didnt know much about Wall Street, which made his performance in the hearings all the more remarkable. He was a quick study, with a phenomenal memory. One of his aides said that the staff looked with astonishment at this man who, through the intricate mazes of banking syndicates, market deals, chicanery of all sorts, in a field new to him, never forgot a name, never made an error in a figure, and never lost his temper. Of course, Pecora was far from infallible. His ignorance about the finer details of Wall Street practice occasionally led him astray. A few times, he was flat-out wrong. But given the quick pace of the investigation, its actually surprising how accurate he was. In the end, I dont think his few missteps mattered very much. Pecora tried not to get lost in the arcane details. He had spent a dozen years as a prosecutor in New York, and he knew that the way to win over a jury was not to dwell

62 Prologue

Fall 2011

on the minutiae. His jury was the American public, and I think he knew that presenting endless testimony about the ins and outs of Wall Street would be counter-productive. If he really wanted public support for reform, he had to tell them a story that was easy to understand. Pecora was the master of the telling anecdotehe was able to spin compelling narratives out of the most confusing welter of complex details. That was how he created the clamor for reform. His genius was his ability to convert complex economic problems into simple morality plays. The hearings take place at the very end of the Hoover administration, days before the inauguration of Roosevelt. The outgoing and incoming Presidents were in contact with each other. Were you able to explore the archives at both Presidential libraries? I spent a good deal of time at the Roosevelt Library in Hyde Park, and I did research in a number of other archival collections as well. I did not make it out to the Hoover Library, but fortunately I was able to rely on previously compiled primary documents from the Hoover administration and the rich body of secondary material that has been written about the interregnum. Although the banks were in their death throes during the 10 days of hearings, Roosevelt remains a background figure until his inauguration. His focus seems to be on creating an inaugural speech that will motivate and comfort Americans while addressing the financial disaster. Did your time at the Roosevelt library shed any new light on Roosevelts motivations? When President Obama took office in the wake of the 2008 financial crisis, his then chief of staff, Rahm Emanuel, said that politicians should never let a good crisis go to waste. Roosevelt understood that maxim perhaps better than anyone else. When Roosevelt took office in March 1933, there was not a single federal law that regulated how Wall Street operated. The wrongdoing Pecora uncovered and the desperate condition of the country gave Roosevelt the political climate he needed to change that. The first federal securities laws, federal deposit insurance (a reform Roosevelt initially opposed), and the creation of the Securities and Exchange Commission all flow from the abuses Pecora uncovered. Roosevelts motivation to capitalize on the crisis is well known. What surprised me was Roosevelts close personal connection

to the scandal. My book focuses on the few weeks after Pecoras appointment as committee counsel in the winter of 1933. The investigation had started the previous March and had largely been ineffective. But Pecora turned it all around when he subpoenaed one of the leading bankers of the day, Charles E. Mitchell, the chairman of the National City Bank of New York (todays Citigroup). Over the course of just 10 days, Pecora showed that the bank and its securities trading arm had engaged in all sorts of unsavory behavior. It sold worthless bonds to investors without fully disclosing the risks, manipulated its stock price and the stock prices of other companies, and lavishly compensated its executives as the country plunged into depression. It all hit close to home for Roosevelt because he had a long personal banking relationship with City Bank. There was one Roosevelt quote that really stood out for me. Shortly after he took office, Roosevelt told a visitor from another Wall Street firm: My gosh, I feel Charlie took my money. Anyone reading this book cant help but wonder why history seems to be repeating itself recently when it comes to banks and investment firms. After researching and writing this book, do you think the Senate will be looking for another Hellhound? I think there have already been some attempts to recreate the success of the Pecora hearings. Senator Carl Levin held hearings in the spring of 2010 on Goldman Sachs and released a scathing report on the investigation earlier this year. Congress created the Financial Crisis Inquiry Commission to investigate the causes of the financial crisis, although that independent commission was more closely modeled on the 9/11 Commission than the Pecora investigation. The more relevant question, I think, is why these efforts did not have the same success. Pecora was a gifted courtroom lawyer, and he certainly deserves the lions share of the credit. But he was also the beneficiary of impeccable timing. He decided to put the leader of the largest bank in the country on the stand in Washington at the peak of the banking crisis of 1933. It was the Washington equivalent of the perfect stormthe precise combination of crisis and scandal necessary to pass major reform legislation. Those political moments, however, are ephemeral. As the 2008 financial crisis slips farther and farther into the past, it looks increasingly likely that we have missed our opportunity for meaningful reform.

Authors on the Record

Prologue 63

You might also like

- Doing the China Tango: How to Dance Around Common Pitfalls in Chinese Business RelationshipsFrom EverandDoing the China Tango: How to Dance Around Common Pitfalls in Chinese Business RelationshipsNo ratings yet

- Banker to the World: Leadership Lessons From the Front Lines of Global FinanceFrom EverandBanker to the World: Leadership Lessons From the Front Lines of Global FinanceRating: 3 out of 5 stars3/5 (2)

- The Rise of Private Equity in China - A Case Study of Successful ADocument82 pagesThe Rise of Private Equity in China - A Case Study of Successful Auygh gNo ratings yet

- The Age of MerchantsDocument246 pagesThe Age of Merchantssergio dezorziNo ratings yet

- Presentation 1Document14 pagesPresentation 1Sourabh VerdiaNo ratings yet

- Ingenious IPOServices 4feb2018 v3Document4 pagesIngenious IPOServices 4feb2018 v3William DuNo ratings yet

- Kauffman Foundation We Have Met The Enemy and He Is UsDocument52 pagesKauffman Foundation We Have Met The Enemy and He Is UsUzair UmairNo ratings yet

- Private Equity's Dirty Dozen: How 12 Firms Are Fueling the Climate Crisis Through Billions in Fossil Fuel InvestmentsDocument56 pagesPrivate Equity's Dirty Dozen: How 12 Firms Are Fueling the Climate Crisis Through Billions in Fossil Fuel InvestmentsAnonymousNo ratings yet

- Bretton Woods ProceedingsDocument685 pagesBretton Woods ProceedingsgottsundaNo ratings yet

- Start Up What We May Still Learn From Silicon Valley LebretDocument68 pagesStart Up What We May Still Learn From Silicon Valley LebretHerve LebretNo ratings yet

- In the Black: A History of African Americans on Wall StreetFrom EverandIn the Black: A History of African Americans on Wall StreetRating: 3.5 out of 5 stars3.5/5 (1)

- Making Money For Business: Currencies, Profit, and Long-Term Thinking by B. Lietaer and G. HallsmithDocument6 pagesMaking Money For Business: Currencies, Profit, and Long-Term Thinking by B. Lietaer and G. Hallsmithuser909No ratings yet

- Brave New World Economy: Global Finance Threatens Our FutureFrom EverandBrave New World Economy: Global Finance Threatens Our FutureNo ratings yet

- Response to "The IdealistDocument2 pagesResponse to "The IdealistkukuduxuNo ratings yet

- Private Equity Insider 051210Document8 pagesPrivate Equity Insider 051210tonyspringNo ratings yet

- Biz Plan TemplateDocument7 pagesBiz Plan TemplatealiztradeNo ratings yet

- How Foundations Exercise Power by Joan RoelofsDocument22 pagesHow Foundations Exercise Power by Joan RoelofsGringaNo ratings yet

- Reshaping Governance Post-PandemicDocument2 pagesReshaping Governance Post-PandemicMIKAELA BEATRICE LOPEZ100% (1)

- Private Equity: Vietnam 2020Document21 pagesPrivate Equity: Vietnam 2020Jenny PhuongNo ratings yet

- Indian Ed-tech attracts $2.22B amid pandemic-driven online learning boomDocument19 pagesIndian Ed-tech attracts $2.22B amid pandemic-driven online learning boomRishika VatsNo ratings yet

- Koo - Richard Balance Sheet RecesionDocument32 pagesKoo - Richard Balance Sheet Recesionszymszy100% (1)

- Who Are The Shareholders?Document24 pagesWho Are The Shareholders?Roosevelt InstituteNo ratings yet

- Blair For War Crimes Icc3Document130 pagesBlair For War Crimes Icc3Her Royal Highness Queen Valerie I100% (1)

- FinTech 2021: How Financial Technology Modifies Financial Institutions in MalaysiaDocument24 pagesFinTech 2021: How Financial Technology Modifies Financial Institutions in MalaysiaSophia RazaliNo ratings yet

- George Soros - The Bubble of American SupremacyDocument7 pagesGeorge Soros - The Bubble of American SupremacyAshraf BorzymNo ratings yet

- Cia y Contras PDFDocument71 pagesCia y Contras PDFAnonymous UN5tKJpffYNo ratings yet

- CFA Institute Reviews the Conglomerate CorporationDocument13 pagesCFA Institute Reviews the Conglomerate CorporationPal SaruzNo ratings yet

- Start-up City: Ten Tales of Exceptional Entrepreneurship from Bangalore's Software MiracleFrom EverandStart-up City: Ten Tales of Exceptional Entrepreneurship from Bangalore's Software MiracleNo ratings yet

- Adam Smith PDFDocument112 pagesAdam Smith PDFKhairul Faiz100% (1)

- Karen Hudes Dropped The J Word On Russia TodayDocument6 pagesKaren Hudes Dropped The J Word On Russia TodaybetancurNo ratings yet

- Desert-Storm Irc 3Document157 pagesDesert-Storm Irc 3Costas ColombusNo ratings yet

- Failure by Design: The Story behind America's Broken EconomyFrom EverandFailure by Design: The Story behind America's Broken EconomyRating: 4 out of 5 stars4/5 (2)

- The Evil Axis of Finance: The US-Japan-China Stranglehold on the Global FutureFrom EverandThe Evil Axis of Finance: The US-Japan-China Stranglehold on the Global FutureNo ratings yet

- Chinese Financial System Elliott YanDocument44 pagesChinese Financial System Elliott YanAbel ChanNo ratings yet

- Ponzi Scheme (10485,10157,9921)Document30 pagesPonzi Scheme (10485,10157,9921)Murtaza AbidiNo ratings yet

- History of Big OilDocument73 pagesHistory of Big Oildennis ridenourNo ratings yet

- Taking On The World's Repressive Regimes: The Ford Foundation's International Human Rights Policies and PracticesDocument312 pagesTaking On The World's Repressive Regimes: The Ford Foundation's International Human Rights Policies and Practicesmdog222No ratings yet

- A History of Venture Capital - LebretDocument66 pagesA History of Venture Capital - LebretHerve LebretNo ratings yet

- Economic Warfare Risks and Responses by Kevin D FreemanDocument111 pagesEconomic Warfare Risks and Responses by Kevin D FreemanYedidiahNo ratings yet

- GS Reasonable DoubtDocument5 pagesGS Reasonable DoubtZerohedgeNo ratings yet

- Peter Thiel, Scourge of Silicon Valley - The EconomistDocument8 pagesPeter Thiel, Scourge of Silicon Valley - The EconomistGANESHNo ratings yet

- Mark Warner the Dealmaker: From Business Success to the Business of GoverningFrom EverandMark Warner the Dealmaker: From Business Success to the Business of GoverningRating: 1 out of 5 stars1/5 (1)

- Baseeds 15-25Document4 pagesBaseeds 15-25api-276766667No ratings yet

- The Birth of The CFR (1920s) : Woodrow Wilson WilsonDocument7 pagesThe Birth of The CFR (1920s) : Woodrow Wilson WilsonKeith KnightNo ratings yet

- Barron 39 S - Aug 16 2021Document72 pagesBarron 39 S - Aug 16 2021Hud DentNo ratings yet

- Engines PDFDocument240 pagesEngines PDFvikram1322No ratings yet

- A Shaky Foundation, A Potential Threat: Analyzing Colorado State Union "Employee Partnerships"Document17 pagesA Shaky Foundation, A Potential Threat: Analyzing Colorado State Union "Employee Partnerships"Independence InstituteNo ratings yet

- A Capitalist Manifesto: Analysis of Causes and a Cure for Economic Failures of the Twentieth CenturyFrom EverandA Capitalist Manifesto: Analysis of Causes and a Cure for Economic Failures of the Twentieth CenturyNo ratings yet

- The Bailout's New Financial OligarchyDocument17 pagesThe Bailout's New Financial OligarchyvanathelNo ratings yet

- Memo To Oversight Committee Members and Various DocumentsDocument86 pagesMemo To Oversight Committee Members and Various DocumentsDealBookNo ratings yet

- Amatori Business HistDocument443 pagesAmatori Business HistMedya Topluluğu100% (3)

- War in Cambodia: A Somber Parallel To The Vietnam ConflictDocument6 pagesWar in Cambodia: A Somber Parallel To The Vietnam ConflictThanh Dat TranNo ratings yet

- IJCCR 2015 Special Issue - Complementary Currencies MagazineDocument174 pagesIJCCR 2015 Special Issue - Complementary Currencies MagazineLocal MoneyNo ratings yet

- Baseeds 15-11Document3 pagesBaseeds 15-11api-276766667No ratings yet

- Fake Fox News FilthDocument45 pagesFake Fox News FilthTheFreeSchool100% (1)

- HHRG 117 BA00 Wstate GillK 20210218Document5 pagesHHRG 117 BA00 Wstate GillK 20210218Joseph Adinolfi Jr.No ratings yet

- Baseball: The National Pastime in The National ArchivesDocument137 pagesBaseball: The National Pastime in The National ArchivesPrologue MagazineNo ratings yet

- The Meaning and Making of EmancipationDocument215 pagesThe Meaning and Making of EmancipationPrologue Magazine100% (6)

- Postcard From The Lady Bird SpecialDocument1 pagePostcard From The Lady Bird SpecialPrologue MagazineNo ratings yet

- Lady Bird and Lyndon B. Johnson in MinnesotaDocument1 pageLady Bird and Lyndon B. Johnson in MinnesotaPrologue MagazineNo ratings yet

- Truman at Union StationDocument1 pageTruman at Union StationPrologue MagazineNo ratings yet

- Jimmy Carter Campaign FlyerDocument1 pageJimmy Carter Campaign FlyerPrologue Magazine100% (1)

- The Woman Who VotesDocument1 pageThe Woman Who VotesPrologue MagazineNo ratings yet

- Will You Vote?Document1 pageWill You Vote?Prologue MagazineNo ratings yet

- Truman Campaign CarDocument1 pageTruman Campaign CarPrologue MagazineNo ratings yet

- Ronald and Nancy Reagan in ColumbiaDocument1 pageRonald and Nancy Reagan in ColumbiaPrologue MagazineNo ratings yet

- Nixon Greets StudentsDocument1 pageNixon Greets StudentsPrologue MagazineNo ratings yet

- Housewives For TrumanDocument1 pageHousewives For TrumanPrologue MagazineNo ratings yet

- Jimmy Carter, 1976Document1 pageJimmy Carter, 1976Prologue MagazineNo ratings yet

- George Bush CampaignsDocument1 pageGeorge Bush CampaignsPrologue MagazineNo ratings yet

- George W and Laura Bush CampaignDocument1 pageGeorge W and Laura Bush CampaignPrologue MagazineNo ratings yet

- George and Barbara Bush Aboard Air Force IIDocument1 pageGeorge and Barbara Bush Aboard Air Force IIPrologue MagazineNo ratings yet

- Gerald Ford Campaign SwagDocument1 pageGerald Ford Campaign SwagPrologue MagazineNo ratings yet

- FDR Campaigns in Hyde ParkDocument1 pageFDR Campaigns in Hyde ParkPrologue MagazineNo ratings yet

- Depression-Era Democratic Party Campaign PhotoDocument1 pageDepression-Era Democratic Party Campaign PhotoPrologue MagazineNo ratings yet

- FDR Campaigns in AtlantaDocument1 pageFDR Campaigns in AtlantaPrologue MagazineNo ratings yet

- Betty and Gerald Ford at The RNCDocument1 pageBetty and Gerald Ford at The RNCPrologue MagazineNo ratings yet

- Dwight and Mamie Eisenhower Whistle Stop TourDocument1 pageDwight and Mamie Eisenhower Whistle Stop TourPrologue MagazineNo ratings yet

- Clinton Whistle Stop TourDocument1 pageClinton Whistle Stop TourPrologue MagazineNo ratings yet

- This Is AmericaDocument1 pageThis Is AmericaPrologue MagazineNo ratings yet

- Clinton at A Get Out The Vote Rally in Los AngelesDocument1 pageClinton at A Get Out The Vote Rally in Los AngelesPrologue MagazineNo ratings yet

- Anti-FDR Campaign ButtonsDocument1 pageAnti-FDR Campaign ButtonsPrologue MagazineNo ratings yet

- Petition For Universal SuffrageDocument1 pagePetition For Universal SuffragePrologue MagazineNo ratings yet

- SUBCONTRACTOR PREQUALIFICATION QUESTIONNAIREDocument18 pagesSUBCONTRACTOR PREQUALIFICATION QUESTIONNAIREEy-ey ChioNo ratings yet

- How To Invest in Treasury BillsDocument3 pagesHow To Invest in Treasury BillskisasharifhNo ratings yet

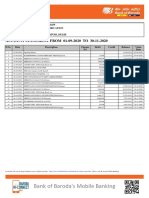

- Estatement20230706 000233440Document3 pagesEstatement20230706 000233440Mia NahilaNo ratings yet

- Chapter 1 Financial AccountingDocument10 pagesChapter 1 Financial AccountingMarcelo Iuki HirookaNo ratings yet

- A Study On Credit Management of Sahayogi Bikas Bank LTDDocument31 pagesA Study On Credit Management of Sahayogi Bikas Bank LTDShivam KarnNo ratings yet

- Tarun Project FileDocument32 pagesTarun Project FileTushar SikarwarNo ratings yet

- FINA2001 PortfolioDocument2 pagesFINA2001 PortfolioJoshNo ratings yet

- Glossary of Financial Terms English Traditional ChineseDocument160 pagesGlossary of Financial Terms English Traditional ChinesehwmawNo ratings yet

- Project Report of Bank of KathmanduDocument30 pagesProject Report of Bank of Kathmandushyamranger85% (27)

- Sample MotionDocument3 pagesSample MotionRizza Angela Mangalleno100% (1)

- BECIL Registration Portal: How To ApplyDocument2 pagesBECIL Registration Portal: How To ApplySoul BeatsNo ratings yet

- Industry: Bankingproject Title: CRM in Axis Bank Group Members: Mangesh Jadhav Rajnish Dubey Sadiq Quadricsonia Sharmavarun GuptaDocument12 pagesIndustry: Bankingproject Title: CRM in Axis Bank Group Members: Mangesh Jadhav Rajnish Dubey Sadiq Quadricsonia Sharmavarun GuptaBhakti GuravNo ratings yet

- Hotel Banquet QuotationDocument4 pagesHotel Banquet QuotationeriismailNo ratings yet

- Great DepressionDocument32 pagesGreat DepressionBerenice MondilloNo ratings yet

- Banking in 2035 Three Possible Futures Briefing Paper PDFDocument27 pagesBanking in 2035 Three Possible Futures Briefing Paper PDFDhiraj MagadeNo ratings yet

- Name: Fany Fayyaz Major: Bba Section: B Post Mid Assignment 2 Submission Date: 9 July, 2020Document3 pagesName: Fany Fayyaz Major: Bba Section: B Post Mid Assignment 2 Submission Date: 9 July, 2020aruba anwarNo ratings yet

- Foundations of Financial Management Canadian 10th Edition Block Solutions Manual DownloadDocument33 pagesFoundations of Financial Management Canadian 10th Edition Block Solutions Manual DownloadPeter Coffey100% (22)

- The Future of Commerce Payme 441515Document12 pagesThe Future of Commerce Payme 441515HungNo ratings yet

- Security DB by LinkedinDocument2 pagesSecurity DB by LinkedinNazim KhanNo ratings yet

- Integrated Payments APIDocument41 pagesIntegrated Payments APIsebichondoNo ratings yet

- 17 Soriano v. BSPDocument6 pages17 Soriano v. BSPChester BryanNo ratings yet

- DRDADocument8 pagesDRDAworld_best284562100% (1)

- Premium Credit Card UsersDocument54 pagesPremium Credit Card UserscityNo ratings yet

- Thesis On Debt FinancingDocument8 pagesThesis On Debt Financingheidimaestassaltlakecity100% (2)

- Dockers Inc Proof of CashDocument1 pageDockers Inc Proof of CashJoemar LegresoNo ratings yet

- Internship Report On Js Bank LimitedDocument58 pagesInternship Report On Js Bank Limitedbbaahmad8973% (11)

- Arb PanelDocument46 pagesArb PanelKarthik VelletiNo ratings yet

- CSR ProjectDocument33 pagesCSR ProjectAdil AslamNo ratings yet

- Online Banking Project FinalDocument55 pagesOnline Banking Project FinalSANTOSH GAIKWADNo ratings yet

- ICC Users Handbook For Documentary Credits Under UCP 600 PDFDocument10 pagesICC Users Handbook For Documentary Credits Under UCP 600 PDFnmhiri80% (10)