Professional Documents

Culture Documents

I Am An Attorney So I Decided To Sue My Lender

Uploaded by

Ron MamitaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

I Am An Attorney So I Decided To Sue My Lender

Uploaded by

Ron MamitaCopyright:

Available Formats

IN THE CHANCERY COURT OF SHELBY COUNTY TENNESSEE FOR THE 30TH JUDICAL DISTRICT AT MEMPHIS _____________________________________________________________

DAVID G. MILLS & JULIA MILLS, Plaintiffs, v. No. CH-09-0662-2

FIRST HORIZON HOME LOAN CORPORATION D/B/A FIRST TENNESSEE HOME LOANS & MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC. Defendants. ________________________________________________________________________

FIRST AMENDED COMPLAINT TO QUIET TITLE

_______________________________________________________________________

TO THE HONORABLE CHANCELLOR OF SAID COURT: COMES NOW, David G. Mills and Julia Mills (Plaintiffs), complaining of Defendant First Horizon Home Loan Corporation, d/b/a First Tennessee Home Loans (FHHLC), and Defendant Mortgage Electronic Registration Systems, Inc. (MERS), and for cause of action would respectfully show unto this Honorable Court the following: JURISDICTION AND VENUE 1. Plaintiffs are husband and wife and are resident citizens of Cordova, Shelby

County, Tennessee, and have been residents there at all times relevant to the events that form the basis of Plaintiffs Complaint. 2. This basis of this case arises out of a dispute between the parties concerning the

first and second mortgages on Plaintiffs residence located at 1403 Cedar Run, Cordova, Shelby County, Tennessee.

-1-

3.

Both Defendants have been served and have filed a joint Motion to Dismiss and

Plaintiffs have filed a Response to that Motion to Dismiss. 4. This court has jurisdiction of the matter pursuant to T.C.A. 16-11-101 et seq. FACTS 5. In January 2008, Mr. Mills requested, by telephone, payoff information on the

second mortgage from FHHLC, and paid the balance of that account (approximately $30,000.00) in late January or early February of 2008. 6. In that January 2008 telephone call, FHHLCs representative told Mr. Mills that

within four to six weeks of receipt of full payment, Plaintiffs would be receiving documentation that their second mortgage loan had been paid off and that the second mortgage lien had been released. 7. From the statements of FHHLCs representative, Mr. Mills, based upon his

previous experience with buying and selling houses, expected to receive within a reasonable time, the original of the filed Release of Deed of Trust for the second mortgage and the return of the original note for the second mortgage marked paid or paid in full or other words to that effect. 8. On June 30, 2008, a reasonable time period having elapsed, Mr. Mills called

FHHLC to check on the status of the documentation he expected to receive. 9. FHHLCs representative stated that FHHLC had received the payoff on Plaintiffs

second mortgage and that FHHLC had released the lien on the second mortgage in February of 2008.

-2-

10.

In this June 30, 2008 telephone conversation, Mr. Mills requested that FHHLC

send him the original of the second mortgage note, but FHHLCs representative declined, stating, We dont do that anymore. 11. In that same telephone conversation, Mr. Mills told FHHLCs representative that

Plaintiffs were entitled to have the original returned, and that in all his prior dealings with mortgage companies, he had received the original note showing it paid or paid in full when the loan had been paid. (Obviously, Mr. Mills had these prior experiences of having paid-infull notes returned because that is what the Uniform Commercial Code requires). FHHLCs representative merely repeated, We dont do that anymore. 12. Shortly after that telephone conversation, FHHLCs representative sent a copy of

the release of the second mortgage, by facsimile transmission to Mr. Mills, and Plaintiffs have since confirmed that the release was filed with the Shelby County, Tennessee deed registrar. 13. 14. A copy of that release is attached to this complaint as Exhibit A. Having been refused the return of the documents regarding the second mortgage

and the debt related thereto, Mr. Mills determined he needed to locate the original second mortgage note, and to determine the validity of the original release of the second mortgage deed of trust. 15. Based upon the foregoing facts, Mr. Mills feared he would also not receive the

original note for the primary mortgage or the original release of the primary mortgage deed of trust, when the obligations in those instruments were satisfied. 16. Therefore, in late July 2008, Mr. Mills demanded in writing that FHHLC send

him the original second mortgage note, of which Plaintiffs had fully paid, and the original release

-3-

thereof. Mr. Mills further demanded therein that FHHLC show him proof that FHHLC also held Plaintiffs note on Plaintiffs first mortgage. 17. 18. 19. That letter making that demand is attached to this complaint as Exhibit B. FHHLC failed to respond in writing to that demand. After numerous phone calls to various places and to various persons who seemed

to know nothing about his demand letter, Mr. Mills was finally able to get in touch with another representative of FHHLC at FHHLCs home office who knew something about it. This

particular representative acknowledged receipt of the demand letter and told Mr. Mills that Plaintiffs would not be getting the original note that had been paid off, nor would Plaintiffs be allowed to see the first mortgage note they were still paying on. Based upon this representatives statements, the Plaintiffs deemed a suit was necessary, and filed their Original Complaint. 20. Subsequent to the filing of Plaintiffs Original Complaint, Mr. Mills was

contacted by house counsel for FHHLC who confirmed that the second mortgage note was probably destroyed and unavailable to be returned to the Plaintiffs. 21. Subsequent to the filing of Plaintiffs Original Complaint, Mr. Mills was also told

by the same house counsel for FHHLC, that his first note had been sold, and that FHHLC was only servicing the note but that the note was believed to still be in FHHLCs possession (a copy of that correspondence is attached to this complaint as Exhibit C). 22. Plaintiffs first mortgage deed of trust, which is attached as Exhibit D to this

complaint, states that FHHLC is the lender but that MERS is a separate corporation that is acting solely as nominee (our italics) for Lender and Lenders successor and assigns. It further states that, MERS is the beneficiary under this security instrument.

-4-

23.

Moreover, a search of the Shelby county deed records indicates that there was

never a recordation of an assignment of the first mortgage Deed of Trust. 24. Plaintiffs continue to make payments on their first mortgage note and have every

intention to do so during the pendency of this litigation.

DISCUSSION OF RECENT LEGAL HISTORY OF MISSING MORTGAGE NOTES AND ITS APPLICATION TO THE INSTANT CASE 25. In jurisdictions where judicial foreclosures are required and have recently

occurred, MERS, as nominee for the lender, has often been the party seeking foreclosure. 26. In jurisdictions where judicial foreclosures are required, the inability of MERS,

and/or the trustee and/or lender, to produce the original note in question has become a recent and unfortunate pattern and practice. 27. Affidavits of lost notes have also become a recent pattern and practice, and many

judges in these jurisdictions are putting foreclosure proceedings in abeyance until such time as MERS, the trustee, and/or lender can produce the original note. 28. In these foreclosure cases, the usual reason given for the inability to produce the

original notes is that the notes have been sold off to secondary mortgage market entities, which have bundled the notes in traunches, and sold them as part of a mortgage-backed security trust to investors. 29. Many of such trusts, or their owners, have become insolvent or have just gone out

of business; in short, the original notes have simply vanished and cant be found, or their owners no longer exist or no effort is made to find them. 30. In many of these foreclosure actions brought by MERS, the actions have been

dismissed for lack of standing, because MERS is little more than a shell entity, which is made up

-5-

of a group of members who are primarily loan originators, used to facilitate the flipping of loans, from a loan originator to a secondary mortgage market entity, who then packages the loans as part of a mortgage-backed security trust. 31. MERS members decided it was too costly to pay recordation fees on loans that

might be flipped numerous times, so according to MERS, MERS was chosen as nominee for the lender and its assigns in these deeds of trust, for the purpose of immobilizing the mortgage lien while transfers of the promissory notes and servicing rights could continue to occur without the expense of recordation (MERS own explanation of what it does, from the reported case, Mortgage Electronic Systems, Inc. v. Nebraska Department of Banking and Finance, 704 N.W. 2d. 884, 786 (2005), a copy of which is attached hereto as Exhibit E. 32. This immobilization of the mortgage lien now makes it terribly difficult for a

borrower to track the holder of his note because deeds of trust are no longer assigned; and therefore, new holders of the notes do not record assignments of the deeds of trust when they purchase mortgages. 33. But the fact that MERS is a shell entity, means MERS never holds these notes

(again citing from the reported case of Mortgage Electronic Systems, Inc. v. Nebraska Department of Banking and Finance, supra where MERS explains what it does), and means that Defendant MERS cant legitimately claim it has lost notes that were never in its possession, and means Defendant MERS cant legitimately file affidavits of lost notes; and therefore, numerous courts have held it lacks standing to bring a foreclosure action when it cant produce the original note or show that it holds it. [Attached to this Amended Complaint as Exhibit F is a copy of Mortgage Electronic Registration System, Inc. v. Southwest Homes of Arkansas (Ark. Sup.Ct. slip opinion March 23, 2009), where the Supreme Court of Arkansas held that MERS, which

-6-

claimed to be both a nominee and beneficiary, had no interest in the Deed of Trust in question, was not a beneficiary despite language in the Deed of Trust stating it was, did not possess any rights as a lender, did not hold any legal title, and was therefore not entitled to be a party to a foreclosure action where the lender, its principal, was a party]. 34. Even foreclosure suits brought by originating lenders, who have retained service

rights to the notes, also fail to qualify as a party with standing to sue when the notes are lost, because they too fail to qualify to make proper affidavits of lost notes, or make other proper proof of the lost notes enforceability; and moreover, when pressed, these loan originators cant even show that they have any deed of trust rights because their interests in the notes have been previously assigned. 35. Although the instant case is not a foreclosure action, many of the same problems

arise in it, as have occurred in judicial foreclosure cases of other jurisdictions, because Tennessee law requires: (1) that original notes must be kept, (2) that original notes must returned to the borrower upon payment in full, (3) that original notes must be produced when the lender or its representative has demanded payment and the borrower requests to see proof of an original notes existence, and (4) that a lenders representative show proof of authority to demand payment when the borrower requests the lenders representative to do so. 36. Moreover, in the event a mortgage lender or its representative cannot prove that a

Tennessee mortgage original note still exists, Tennessee law requires proof of certain things before a lost note will be deemed enforceable, just as the jurisdictions requiring judicial foreclosures do; and furthermore, Tennessee courts also require compliance with the Tennessee laws of trusts, assignments, and agency as they pertain to real estate cases.

-7-

CAUSES OF ACTION AND REQUESTS FOR RELIEF 37. Regarding Plaintiffs second mortgage note, Defendant FHHLC was required,

pursuant to T.C.A. 47-3-501(b), to surrender said note upon full payment of it, and FHHLC has wholly failed to do so; and since it has failed to do so, there is a presumption that the note is not enforceable, unless proven to be so by FHHLC, who has the burden to prove its enforceability. 38. Given Defendant FHHLCs admission by its agent that it can not return Plaintiffs

second mortgage note as required by T.C.A. 47-3-501(b), Plaintiffs either demand that FHHLC prove the second mortgage notes enforceability, as is required by T.C.A. 47-3-309(a) for a lost or destroyed note, or return their second note payments. 39. The release that Defendant FHHLC gave Plaintiffs for their second mortgage,

recites that Defendant FHHLC is the legal owner and holder of the note described in and secured by said deed of trust, and Plaintiffs demand that FHHLC prove that this statement was true when made, by first proving under T.C.A. 47-3-309(a) that FHHLC was entitled to enforce the note when the note went missing. 40. Should FHHLC meet its burden of proof by showing the second mortgage note is

enforceable under T.C.A. 47-3-309(a) when said note went missing, Plaintiffs would show that FHHLC must also give Plaintiffs adequate protection against any loss that might occur to them, by reason of a claim by another person, in accordance with T.C.A. 47-3-309(b) to prevent FHHLC from being required to refund Plaintiffs second mortgage note payments. 41. However, should FHHLC be unable to meet its burden of proving it was entitled

to enforce the second mortgage note when said note went missing, then Plaintiffs would request that the court order the FHHLC to make an accounting of all of Plaintiffs payments to FHHLC, and to enter a judgment that FHHLC return all monies to Plaintiffs from the date the note went

-8-

missing, or from the date of first payment, if the date the note went missing cannot be accurately ascertained. 42. Finally, with regard to this second mortgage note, Plaintiffs request that after a

determination of whether FHHLC was entitled to enforce said note when it went missing, the court enter an order that clears Plaintiffs title with respect to the second Deed of Trust. 43. Regarding Plaintiffs first mortgage note, Plaintiffs would show that the first

mortgage note is also not presumed to be enforceable, and that the Defendants have the minimum burden of proving its enforceability under T.C.A. 47-3-501 and perhaps have the greater burden of proving its enforceability under T.C.A. 47-3-309 if the first mortgage note is also missing. 44. FHHLC, through its house counsel, has admitted in writing that FHHLC has sold

Plaintiffs first mortgage note, but claims it still possesses the note, and still claims it has the right to make demand for payment under said note as the servicer for the holder of the note. 45. Though Plaintiffs have made repeated demands on FHHLC to exhibit the first

mortgage note, and to present Plaintiffs with reasonable evidence that FHHLC has the authority to make demands upon the Plaintiffs if it does not own the first mortgage note, both being required by T.C.A. 47-3-501(b)(2), FHLLC continually refuses to comply with both requirements of this statute. 46. Plaintiffs would show that because FHHLC refuses to comply with T.C.A. 47-

3-501(b)(2), Plaintiffs are entitled to the relief provided to them pursuant to T.C.A. 47-3501(b)(3). They therefore request that this court enter an order determining that Plaintiffs can refuse to make payment on the first mortgage note without dishonor, until such time as FHHLC

-9-

exhibits the note as required by the statute and shows reasonable evidence it possesses the authority to make demand on the note owners behalf. 47. Moreover, should FHHLC be unable to exhibit the first mortgage note as required

by T.C.A. 47-3-501(b)(2), because the first mortgage note has been lost or destroyed, Plaintiffs would again demand that before FHHLC be permitted to make further demand for payment upon the Plaintiffs, that FHHLC first prove that the note is enforceable under T.C.A. 47-3-309(a) and give Plaintiffs adequate protection under T.C.A. 47-3-309(b) before they are permitted to show authority to demand payment; and, Plaintiffs aver it is FHHLCs burden to do so. 48. Should FHHLC be unable to exhibit the first note but nevertheless be able to meet

its burden of proving the enforceability of the first mortgage note under T.C.A. 47-3-309(a), and should FHHLC be able to meet its burden of showing the authority to continue to demand payment of the Plaintiffs, Plaintiffs still request the court to enter an order that Plaintiffs be given adequate protection against any loss Plaintiffs might have by reason of a claim of another person in accordance with T.C.A. 47-3-309(b). 49. Should FHHLC fail to produce the original first mortgage note for Plaintiffs

inspection, or should FHLLC fail to meet its burden of proving the enforceability of the first mortgage note, or should it fail to meet its burden of proving it has the authority to demand payment of the Plaintiffs on said note, or should it fail to give any adequate protection the court requires, the Plaintiffs request this court issue a cease and desist order to FHLLC from further demanding payment of Plaintiffs on said note. 50. Additionally, should FHHLC fail to meet its burden of proving the enforceability

of the first mortgage note, or should it fail to meet its burden of proving that it has the authority to make demands for payment, then Plaintiffs request the court order the FHHLC to make an

- 10 -

accounting of all of Plaintiffs payments to FHHLC on the first mortgage note and to enter a judgment that FHHLC return all monies to Plaintiffs from the date the note went missing, or from the date of first payment, if the date the note went missing cannot be accurately ascertained, or from the date the note was sold. 50. Lastly, Plaintiffs would show that there is no presumption of the validity or

enforceability of Plaintiffs first mortgage Deed of Trust and demand strict proof thereof by Defendants who have the burden of proving its enforceability. 51. Plaintiffs would show the Court that the interest FHHLC had in Plaintiffs first

mortgage Deed of Trust as lender, was derived from its interest in Plaintiffs first mortgage note. Plaintiffs would show that when FHHLC sold Plaintiffs first mortgage note (as FHHLCs house counsel has indicated it has done), FHHLC lost all interest it might have had as lender in Plaintiffs Deed of Trust. Moreover, since FHHLC did not assign its interest as lender in the Deed of Trust at the time it sold the note, Plaintiffs would show that it cannot do so now, since it no longer has any interest as lender to assign. 52. Moreover, Plaintiffs would also show that MERS, as nominee for FHHLC as

lender in the Plaintiffs first mortgage Deed of Trust, only had the rights of an agent whose principal was FHLLC. The rights to act as nominee are the rights of an agent. Plaintiffs would show that MERS rights to act as an agent of FHHLC were solely derived from the rights of FHHLC who was its principal. Since FHHLC no longer has any rights as a principal, because its rights of those as a lender were lost (if FHHLCs house counsels representations that the note has been transferred are correct), MERS has no rights as nominee.

- 11 -

53.

Plaintiffs would show that since neither FHHLC nor MERS have rights of a

lender and there has been no assignment of these rights, any rights given by Plaintiffs to the lender in their first mortgage Deed of Trust no longer exist. 54. Moreover, Plaintiffs would also show that the Deed of Trust in Southwest Homes,

supra, has language identical to the Plaintiffs first mortgage Deed of Trust stating that MERS is the beneficiary. However, just like in Southwest Homes, MERS cannot be a beneficiary of Plaintiffs first mortgage Deed of Trust despite the language, because MERS has never had any rights to Plaintiffs first mortgage note payments. 55. Plaintiffs would also show that FHHLC was not named as beneficiary in

Plaintiffs first mortgage Deed of Trust, so since neither MERS nor FHHLC is a beneficiary, there is no beneficiary of the trust. 56. Plaintiffs would therefore show that neither FHHLC nor MERS has any interest

whatsoever in Plaintiffs first mortgage Deed of Trust, either as lenders or as beneficiaries; but regardless, Plaintiffs aver that it is the Defendants who have the burden of proving they have any interest in any capacity in the first mortgage Deed of Trust. 57. Plaintiffs would further show that when FHHLC sold Plaintiffs first mortgage

note without an assignment of the Deed of Trust at the time of the notes sale, Plaintiffs first mortgage note became an unsecured note. 58. Plaintiffs therefore pray for a judgment against MERS and FHHLC setting aside

the first mortgage Deed of Trust and removing any cloud on Plaintiffs property due to the first mortgage Deed of Trust.

- 12 -

PRE-JUDGMENT AND POST-JUDGMENT INTEREST, COSTS AND ATTORNEYS FEES 59. Plaintiffs request this Court enter judgment against Defendants for both pre-

judgment and post-judgment interest at the maximum rate allowed by law on each and every element of damages awarded. 60. Plaintiffs requests this Court find Defendants liable to pay all costs of Court

which Plaintiffs incur or become obligated to pay as a result of the instigation, filing, and prosecution of this lawsuit. 61. It was necessary for one of the Plaintiffs, Julia Mills, to employ an attorney to

represent her in this cause of action and she requests an award of attorneys fees for representation of her interests. PRAYER WHEREFORE PREMISES CONSIDERED, Plaintiffs pray for the relief requested in this complaint and pray for costs of court, pre-and post judgment interest as provided by law, and reasonable attorneys fees.

Respectfully submitted, Mills & Associates By: ______________________________ David G. Mills, Tennessee BPR #17640 Pro Se and Attorney for Plaintiff Julia Mills 1403 Cedar Run Cordova, Tennessee 38016 (901) 818-1999 telephone (901) 624-0684 facsimile

- 13 -

CERTIFICATE OF SERVICE I hereby certify that a true and correct copy of this document has been emailed to and received by Kristine L. Roberts and Robert F. Tom, at their offices on 165 Madison Avenue, Suite 2000, Memphis, TN, 38103 on this 8th day of September 2009.

______________________________ David G. Mills

- 14 -

You might also like

- Defeat Foreclosure: Save Your House,Your Credit and Your Rights.From EverandDefeat Foreclosure: Save Your House,Your Credit and Your Rights.No ratings yet

- Basic Foreclosure Litigation Defense ManualDocument155 pagesBasic Foreclosure Litigation Defense ManualCarrieonic100% (14)

- Treat Every Foreclosure Like A Crime Scene!Document64 pagesTreat Every Foreclosure Like A Crime Scene!MYBLIFEGUARDNo ratings yet

- Request For Production of Note and Mortgage For Forensic Testing SupplementDocument7 pagesRequest For Production of Note and Mortgage For Forensic Testing Supplementjohngault100% (2)

- Foreclosure Offense and DefenseDocument12 pagesForeclosure Offense and DefenseCarrieonic100% (3)

- Cover Letter and Brief To Court 08-15-11 12-30 Am - 10Document2 pagesCover Letter and Brief To Court 08-15-11 12-30 Am - 10jack1929No ratings yet

- Lender Processing Services' DOCX Document Fabrication Price SheetDocument3 pagesLender Processing Services' DOCX Document Fabrication Price SheetForeclosure Fraud100% (2)

- Mortgage Fraud Lawsuits 2-19-2014Document87 pagesMortgage Fraud Lawsuits 2-19-2014Kelly L. HansenNo ratings yet

- CasesDocument137 pagesCasesAlex M Tabuac100% (1)

- Foreclosure Fraud For DummiesDocument15 pagesForeclosure Fraud For DummiesPhil100% (2)

- Fannie - Mae.Admits - It.owns - Nothing 2013-07-11Document2 pagesFannie - Mae.Admits - It.owns - Nothing 2013-07-11Star GazonNo ratings yet

- Stop Foreclosure NowDocument2 pagesStop Foreclosure Nowmugman100% (1)

- Mortgage Fraud PresentationDocument5 pagesMortgage Fraud Presentation92589258No ratings yet

- Tim Bulloch Email On Object To Everything and Related From Neil Garfield 10132017Document5 pagesTim Bulloch Email On Object To Everything and Related From Neil Garfield 10132017api-293779854No ratings yet

- Mers and Merscorp Agree To A Cease and Desist Order - Occ Involved - 4-13-2011Document31 pagesMers and Merscorp Agree To A Cease and Desist Order - Occ Involved - 4-13-201183jjmack100% (7)

- Killer Foreclosure DiscoveryDocument27 pagesKiller Foreclosure DiscoveryMike Rothermel100% (10)

- Bank of America Robo-Signer List!Document6 pagesBank of America Robo-Signer List!Mark Anaya92% (13)

- Using RICO To Combat Mortgage FraudDocument41 pagesUsing RICO To Combat Mortgage Fraudkunim62No ratings yet

- Wow Wow Win For Homeowner Wallace - Appeal Decision - Dismissal Reversed!! Used FdcpaDocument7 pagesWow Wow Win For Homeowner Wallace - Appeal Decision - Dismissal Reversed!! Used Fdcpa83jjmack100% (4)

- Copies and The Affidavit TrapDocument29 pagesCopies and The Affidavit TrapJeff Wilner93% (29)

- Foreclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Document50 pagesForeclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Foreclosure FraudNo ratings yet

- Foreclosure DefenseDocument76 pagesForeclosure Defenseluke17100% (9)

- Foreclosure Mill Albertelli LawDocument12 pagesForeclosure Mill Albertelli LawAlbertelli_Law100% (3)

- Guidelines For Quiet TitleDocument7 pagesGuidelines For Quiet TitleKelley SullivanNo ratings yet

- State V Nationwide Title Clearing No 12CH03602 02 Feb 2012Document29 pagesState V Nationwide Title Clearing No 12CH03602 02 Feb 2012William A. Roper Jr.No ratings yet

- FEIN SUCH & CRANE,.Foreclosure Fraud, No Evidence, No Proof of ClaimDocument6 pagesFEIN SUCH & CRANE,.Foreclosure Fraud, No Evidence, No Proof of ClaimKingGeorgeIXNo ratings yet

- Congressional Foreclosure ReportDocument26 pagesCongressional Foreclosure ReportNetClarity100% (1)

- Affidavit of Lynn e Szymoniak Esq Defendant's ExpertDocument7 pagesAffidavit of Lynn e Szymoniak Esq Defendant's ExpertSampall100% (3)

- Huge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New CenturyDocument33 pagesHuge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New Century83jjmack0% (1)

- Your Mortgage Was Paid in Full If It Was SecuritizedDocument10 pagesYour Mortgage Was Paid in Full If It Was Securitized83jjmack95% (22)

- MERS Admits It Can't Assign NoteDocument11 pagesMERS Admits It Can't Assign Notejohngault100% (5)

- FORECLOSURE CASE DISMISSED ON APPEAL - Opinion U S Bank National Association V KimballDocument8 pagesFORECLOSURE CASE DISMISSED ON APPEAL - Opinion U S Bank National Association V Kimball83jjmack100% (2)

- Assignment FraudDocument43 pagesAssignment FraudAllen Carlton Jr.93% (41)

- The Original Source Mark Stopa Fraud Dossier - Learn The Real Truth About Mark Stopa Crimes and Fake News Mark Stopa BookDocument202 pagesThe Original Source Mark Stopa Fraud Dossier - Learn The Real Truth About Mark Stopa Crimes and Fake News Mark Stopa BookScrewed HomeownerNo ratings yet

- Recordation FraudDocument42 pagesRecordation FraudJeff Wilner78% (9)

- Foreclosing On Nothing, Dale WhitmanDocument51 pagesForeclosing On Nothing, Dale WhitmanMarie McDonnellNo ratings yet

- Too Young to Run?: A Proposal for an Age Amendment to the U.S. ConstitutionFrom EverandToo Young to Run?: A Proposal for an Age Amendment to the U.S. ConstitutionNo ratings yet

- Beating Banks At Their Own Game: Don't fear Big Brother; fear Big BanksFrom EverandBeating Banks At Their Own Game: Don't fear Big Brother; fear Big BanksNo ratings yet

- The Foreclosure Workbook: The Complete Guide to Understanding Foreclosure and Saving Your HomeFrom EverandThe Foreclosure Workbook: The Complete Guide to Understanding Foreclosure and Saving Your HomeNo ratings yet

- Quantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetFrom EverandQuantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetNo ratings yet

- Where Credit is Due: Bringing Equity to Credit and Housing After the Market MeltdownFrom EverandWhere Credit is Due: Bringing Equity to Credit and Housing After the Market MeltdownNo ratings yet

- The Artificial Dictionary of Secret Words, Secret Code and License Plate Game and Old English: Also Helps with SpellingFrom EverandThe Artificial Dictionary of Secret Words, Secret Code and License Plate Game and Old English: Also Helps with SpellingNo ratings yet

- The Complete Guide to Preventing Foreclosure on Your Home: Legal Secrets to Beat Foreclosure and Protect Your Home NOWFrom EverandThe Complete Guide to Preventing Foreclosure on Your Home: Legal Secrets to Beat Foreclosure and Protect Your Home NOWRating: 4.5 out of 5 stars4.5/5 (4)

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryFrom EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryNo ratings yet

- Navigating Failure: Bankruptcy and Commercial Society in Antebellum AmericaFrom EverandNavigating Failure: Bankruptcy and Commercial Society in Antebellum AmericaRating: 2 out of 5 stars2/5 (3)

- Chain of Title: How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure FraudFrom EverandChain of Title: How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure FraudRating: 3 out of 5 stars3/5 (1)

- Successfully Defending Your Credit Card Lawsuit: What to Do If You Are Sued for a Credit Card DebtFrom EverandSuccessfully Defending Your Credit Card Lawsuit: What to Do If You Are Sued for a Credit Card DebtRating: 3.5 out of 5 stars3.5/5 (2)

- Commonwealth Prop. Advocates v. Mortgage Elec. Reg. Sys., 10th Cir. (2011)Document21 pagesCommonwealth Prop. Advocates v. Mortgage Elec. Reg. Sys., 10th Cir. (2011)Scribd Government DocsNo ratings yet

- Answer - Foreclosure Katsman FinalDocument34 pagesAnswer - Foreclosure Katsman FinalAlexander LevkovichNo ratings yet

- Response To Motion For Summary Judgment of Foreclosure (Florida)Document11 pagesResponse To Motion For Summary Judgment of Foreclosure (Florida)Robert Lee Chaney86% (7)

- Mills Response To First Horizon's Motion To DismissDocument38 pagesMills Response To First Horizon's Motion To DismissForeclosure Fraud100% (3)

- Alabama Association of Realtors, Et Al.,: ApplicantsDocument19 pagesAlabama Association of Realtors, Et Al.,: ApplicantsForeclosure FraudNo ratings yet

- Alabama Association of Realtors, Et Al.,: ApplicantsDocument52 pagesAlabama Association of Realtors, Et Al.,: ApplicantsForeclosure FraudNo ratings yet

- SCOTUS Docket No. 21A23Document16 pagesSCOTUS Docket No. 21A23Chris GeidnerNo ratings yet

- Foreclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Document50 pagesForeclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Foreclosure FraudNo ratings yet

- Response in OppositionDocument36 pagesResponse in OppositionForeclosure FraudNo ratings yet

- Hyper Vac AnyDocument41 pagesHyper Vac AnyForeclosure FraudNo ratings yet

- Fhfa Hud Mou - 8122021Document13 pagesFhfa Hud Mou - 8122021Foreclosure FraudNo ratings yet

- D C O A O T S O F: Caryn Hall Yost-RudgeDocument6 pagesD C O A O T S O F: Caryn Hall Yost-RudgeForeclosure Fraud100% (1)

- Sixth Circuit Rent MoratoriumDocument13 pagesSixth Circuit Rent Moratoriumstreiff at redstateNo ratings yet

- Et Al. Plaintiffs-Appellees v. Et Al. Defendants-AppellantsDocument18 pagesEt Al. Plaintiffs-Appellees v. Et Al. Defendants-AppellantsForeclosure FraudNo ratings yet

- ResponseDocument27 pagesResponseForeclosure FraudNo ratings yet

- Complaint CD Cal La Eviction MoratoriumDocument27 pagesComplaint CD Cal La Eviction MoratoriumForeclosure Fraud100% (1)

- Ny Tenant Scot Us RLG 081221Document5 pagesNy Tenant Scot Us RLG 081221Foreclosure FraudNo ratings yet

- Et Al.,: in The United States District Court For The District of ColumbiaDocument8 pagesEt Al.,: in The United States District Court For The District of ColumbiaRHTNo ratings yet

- Not For Publication Without The Approval of The Appellate DivisionDocument9 pagesNot For Publication Without The Approval of The Appellate DivisionForeclosure FraudNo ratings yet

- D C O A O T S O F: Merlande Richard and Elie RichardDocument5 pagesD C O A O T S O F: Merlande Richard and Elie RichardDinSFLANo ratings yet

- Eviction MoratoriumDocument20 pagesEviction MoratoriumZerohedgeNo ratings yet

- Bills 115s2155enrDocument73 pagesBills 115s2155enrForeclosure FraudNo ratings yet

- Out Reach: The High Cost of HousingDocument284 pagesOut Reach: The High Cost of HousingForeclosure Fraud100% (1)

- MFPO AlbertelliDocument13 pagesMFPO AlbertelliForeclosure Fraud100% (3)

- Cfa Letter Fidelity Stewart MergerDocument3 pagesCfa Letter Fidelity Stewart MergerForeclosure FraudNo ratings yet

- MSJ MotionDocument66 pagesMSJ MotionDinSFLANo ratings yet

- Securitizing SuburbiaDocument105 pagesSecuritizing SuburbiaForeclosure FraudNo ratings yet

- Robo Witness DestroyedDocument8 pagesRobo Witness DestroyedForeclosure Fraud100% (4)

- Class Action V Invitation HomesDocument17 pagesClass Action V Invitation HomesForeclosure Fraud100% (4)

- Order Granting in Part Denying in Part MSJDocument11 pagesOrder Granting in Part Denying in Part MSJDinSFLA100% (1)

- Ocwen ComplaintDocument39 pagesOcwen ComplaintForeclosure Fraud100% (3)

- Earnings Release: AND Supplemental InformationDocument35 pagesEarnings Release: AND Supplemental InformationForeclosure FraudNo ratings yet

- Filing# 60827161 E-Filed 08/23/2017 06:54:56 PMDocument47 pagesFiling# 60827161 E-Filed 08/23/2017 06:54:56 PMForeclosure FraudNo ratings yet

- Fox SuitDocument33 pagesFox Suitmlcalderone100% (1)

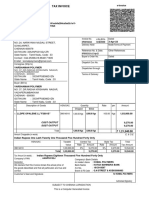

- Tax InvoiceDocument2 pagesTax InvoiceTechnetNo ratings yet

- Theories of International BusinessDocument6 pagesTheories of International Businessrgayathri16100% (2)

- 2005kkpds SorulariDocument17 pages2005kkpds Sorularidina masaripowaNo ratings yet

- S. No. Name of Circle Name of Advocate Postal Address Contact No./Mobile Email Address Work AssignedDocument21 pagesS. No. Name of Circle Name of Advocate Postal Address Contact No./Mobile Email Address Work AssignedSkkaoNo ratings yet

- Problem 1 (Wholly Owned Subsidiary) :: Holding Companies: Problems and SolutionsDocument9 pagesProblem 1 (Wholly Owned Subsidiary) :: Holding Companies: Problems and SolutionsRafidul IslamNo ratings yet

- People v. Yanson-DumancasDocument20 pagesPeople v. Yanson-DumancasBea MarañonNo ratings yet

- Lea3 GRP7Document17 pagesLea3 GRP7Khela MelicioNo ratings yet

- Certificate Private Hire 2020Document2 pagesCertificate Private Hire 2020raj6912377No ratings yet

- IBD Module 3 Rev RLDocument20 pagesIBD Module 3 Rev RLGeorge BerberiNo ratings yet

- 7) Shangri-La v. Developers Group Case DigestDocument2 pages7) Shangri-La v. Developers Group Case DigestIvan Dizon100% (1)

- Level 5 Certificate in Adjudication in The Construction IndustryDocument4 pagesLevel 5 Certificate in Adjudication in The Construction IndustryMuhammad Anamul HoqueNo ratings yet

- CES 6 Common Elements of Statistical Legislation Guidance For Consultation For UploadDocument187 pagesCES 6 Common Elements of Statistical Legislation Guidance For Consultation For UploadErnesto GuiñazuNo ratings yet

- World Current Affairs Mcqs For NTS TEST, FPSC TEST and PMS CSSDocument3 pagesWorld Current Affairs Mcqs For NTS TEST, FPSC TEST and PMS CSSYasin CNo ratings yet

- M/S Best Sellers Retail (I) P.Ltdvs M/S Aditya Birla Nuvo Ltd.&Ors (2012) 6 SCC 792Document4 pagesM/S Best Sellers Retail (I) P.Ltdvs M/S Aditya Birla Nuvo Ltd.&Ors (2012) 6 SCC 792sai kiran gudisevaNo ratings yet

- Transfer On Death - JointDocument1 pageTransfer On Death - JointJuan Carlos Chemello JimenezNo ratings yet

- And Classroom Surveillance: Prepared By: John Ernest J. BunuanDocument8 pagesAnd Classroom Surveillance: Prepared By: John Ernest J. BunuanHu T. BunuanNo ratings yet

- Adorna Properties SDN BHD V Boonsom Boonyanit at Sun Yok EngDocument6 pagesAdorna Properties SDN BHD V Boonsom Boonyanit at Sun Yok EngqilaNo ratings yet

- Syariah Subordinate CourtDocument1 pageSyariah Subordinate CourtIrah ZinirahNo ratings yet

- Question Paper - BBA - 404 IRDocument2 pagesQuestion Paper - BBA - 404 IRbaset75305No ratings yet

- Attendance-1 Feb 2023 To 16 Mar 2023Document10 pagesAttendance-1 Feb 2023 To 16 Mar 2023Ayank NaritaNo ratings yet

- Bank Voor Handel en Scheepvaart N. v. V Slatford and Another (1953) - 1-Q.B.-248Document52 pagesBank Voor Handel en Scheepvaart N. v. V Slatford and Another (1953) - 1-Q.B.-248Tan KSNo ratings yet

- Generality - If The Accused Attacks The Jurisdiction of The CourtDocument2 pagesGenerality - If The Accused Attacks The Jurisdiction of The CourtSincerely YoursNo ratings yet

- FIDP TemplateDocument3 pagesFIDP Templatemarlon anzanoNo ratings yet

- Public Corporation Case DistributionDocument38 pagesPublic Corporation Case DistributionRESUELLO DIVINA MAENo ratings yet

- MRCP (UK) Regulations October 2023 UpdateDocument18 pagesMRCP (UK) Regulations October 2023 Updateniamul islamNo ratings yet

- 10Document4 pages10Rosario BacaniNo ratings yet

- Cathay Land, Inc. v. Ayala Land, IncDocument3 pagesCathay Land, Inc. v. Ayala Land, IncSarah Jane UsopNo ratings yet

- Fire Chief Bill Bogari Refuses To Provide $19,725 Invoice For New Roof at Fire StationDocument7 pagesFire Chief Bill Bogari Refuses To Provide $19,725 Invoice For New Roof at Fire StationTricia PhillipsNo ratings yet

- Constructive TrustDocument2 pagesConstructive TrustPia SagsagoNo ratings yet

- United States District Court For The District of ColumbiaDocument4 pagesUnited States District Court For The District of ColumbiaLaw&CrimeNo ratings yet