Professional Documents

Culture Documents

Fannie Mae Admits It Owns Nothing

Uploaded by

Star GazonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fannie Mae Admits It Owns Nothing

Uploaded by

Star GazonCopyright:

Available Formats

FANNIE MAE, BY ITS OWN ADMISSION, OWNS NOTHING

LIBERTY ROAD MEDIA

Wouldn't you like just to be free ?

MERS, PAPER TERRORISM, BARBARA BRATTON

FREE MONEY SCAMS: Fractional Reserve Banking

Posted on July 11, 2013 by eggsistense

In the latest smackdown of the big banks making the rounds, namel y JP Morgan Chase Bank, Natl. Assn. v Butler , heroic Judge Arthur Schack puts Fannie Mae in her place more than any other judge Im currentl y aware of. He takes Fannie to task over a portion of Fannies Servicing Guide (Part VIII, Chapter 1, Section 1 0 2 ) t h a t I h a v e a l w a ys f o u n d s h o c k i n gl y a r r o g a n t a n d a t o d d s w i t h t h e l a w .

NOTE: Double Click on Icon to Right to View Doc

Schack quotes the whole offending section, but Ill just give the most arrogant parts:

Fannie Mae is at all ti mes th e owner of the mo rtga ge note, wheth er the note is in our portfolio or whether we own it as trustee for an MBS trust. In addition, Fannie Mae at all times has possession of and is the holder of the mortgage note, except in the limited circumstances expressly described below. [SNIP]

[Schack italicizes the following section] In any jurisdiction in which our servicer must be the holder of the note in order to conduct the foreclosure, we temporarily transfer our possession of the note to our servicer, effective automatically and immediately before commencement of the foreclosure proceeding. When we transfer our possession, our servicer becomes the holder of the note during the foreclosure proceedings. [SNIP]

[Schack also italicizes the following section] This Guide provision may be relied upon by a court to establish that the servicer conducting the foreclosure proceeding has possession, and is the holder, of the note during the foreclosure proceeding, unless the court is otherwise notified by Fannie Mae.

Schack correctly concludes that FANNIE MAEs Servicing Guide, with its deceptive practices to fool courts, does not supercede New York law. I had the same thought when I first encountered this fiat decree of Fannie Maes when researching my own lawsuit against Fannie Mae and others a couple of years ago. It is a relief to hear a judge articulate this so starkly. However, I am somewhat dismayed to read that Schack refers to Fannie Mae as the owner of the note and mortgage throughout his decision. Schack appears to be relying on affidavits from Fannie Mae/Chase types for this information, as he must. I havent read the affidavits on which Schack relied, but I have read information from Fannie Maes own trust documentation and website that puts the lie to the idea that Fannie Mae owns anything .

Fannie Mae Tells Us It Owns Nothing

A PDF from Fannie Maes own website entitled Basics of Fannie Mae MBS explains Fannie Maes lack of ownership very simply and succinctly: NOTE: Double Click on Icon to Left to View Doc In gen eral, mo rtg age-backed securities a re commonly called MBS or Pools but they can also be called mortgag e pass-through certificates.

An investor in a mortgage-backed security the certificate holder owns an undivided interest in a pool of mortgages that serves as the underlying asset for the security. Interest payments and principal repayments from the individual mortgage loans are grouped and paid out to investors. The mortgages that back a Fannie Mae MBS are held in a trust on behalf of Fannie Mae MBS investors and are not Fannie Mae assets. As a Fannie Mae MBS investor, the certificate holder receives a pro rata share of the scheduled principal and interest from mortgagors on the loans backing the security. Interest is paid at a specific interest rate. The certificate holder also receives any unscheduled payments of principal. So from the above, we see that Fannie itself says that certificate holdersnot Fannieown the beneficial interest in the mortgage pool (Fannie says in other documentation that it can also purchase these types of certificates, although I havent seen any indication that Fannie smokes its own dope). Even more importantly, we see that Fannie itself says that the mortgages (i.e., the promissory notes) that are supposedly in the pools/trusts are NOT Fannie assets. The very definition of the term asset of course involves ownership, as spelled out at Investopedias definition of asset, which it defines as:

A resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit.

Therefore, Fannie admits it neither owns nor controls the promissory notes. So if Fannie Mae itself admits that it does not own the notes and mortgages in the pools, why are Fannies goons swearing to Schack that Fannie does own them ? Some people may not be satisfied with such an admission in the text of a website meant to simplify matters. OK, well how about these jewels from the Fannie Mae Amended and Restated 2007 Single-Family Master Trust Agreement for Guaranteed Mortgage Pass-Through Certificates evidencing undivided beneficial interests in Pools of Residential Mortgage Loans dated January 1, 2009: By delivering at least one Certificate of a Trust in the manner described in Section 3.1, the Issuer [i.e. Fannie Mae] unconditionally, absolutely and irrevocably sets aside, transfers, assigns, sets over and otherwise conveys to the Trustee [i.e., Fannie Mae], on behalf of related Holders, all of the Issuers [Fannie Mae] right, title and interest in and to the Mortgage Loans in the related Pool, together with any Pool Proceeds. Concurrently with the Issuers [Fannie Mae] setting aside, transferring, assigning, setting over and otherwise conveying Mortgage Loans to the Trustee for a Trust: (a) the Trustee [Fannie Mae] acknowledges that it holds all of the related Trust Fund in trust for the exclusive benefit of the related Holders [of certificates issued by the Trust] Note that Fannie Mae as Issuer irrevocably transfers all of its interest to Fannie as Trustee, and that Fannie Mae as Trustee says that it holds all the money in the trust for the exclusive benefit of the certificate holders. So again, Fannie Mae admits it doesnt own notes.

Fannies DuplicityAll Things To All People?

Notice the duplicity of Fannie Mae made plain in these documents. In the Fannie Servicing Guide, Fannies intended audience is obviously its servicers, so they want the servicers to believe that Fannie Mae is at all times both the owner and holder of promissory notes. However, in the other two documents (the Basics of Fannie Mae MBS website excerpt and the Amended 2007 Trust Agreement) excerpted above, Fannies intended audience is investors and potential investors, both of whom Fannie wants to believe that they (the investors or potential investors)and not Fannieare the owners of the promissory notes.

So why is anyone letting Fannie Mae get away with saying that it owns promissory notes (and by extension the deeds of trust/mortgages) and can foreclose due to that ownership? Please Spread This Article (Info) Far and Wide.

Article Source: http://LibertyRoadMedia.wordpress.com/2013/07/11/fannie-mae-by-its-own-admission-owns-nothing

Page 2 of 2

You might also like

- The Foreclosure Workbook: The Complete Guide to Understanding Foreclosure and Saving Your HomeFrom EverandThe Foreclosure Workbook: The Complete Guide to Understanding Foreclosure and Saving Your HomeNo ratings yet

- Transferring Rights To A NoteDocument6 pagesTransferring Rights To A NoteDavid Hernandez100% (2)

- MERS Report Chain of Title ProblemsDocument85 pagesMERS Report Chain of Title ProblemsharoldebealeNo ratings yet

- Foreclosure Case Killer! - An Allonge Is Not Admissable Evidence of Bank's OwnershipDocument12 pagesForeclosure Case Killer! - An Allonge Is Not Admissable Evidence of Bank's OwnershipForeclosure Fraud97% (31)

- Your Mortgage Was Paid in Full If It Was SecuritizedDocument10 pagesYour Mortgage Was Paid in Full If It Was Securitized83jjmack95% (22)

- Sui JurisDocument188 pagesSui JurisStar Gazon100% (8)

- Foreclosure - Defense.guidebook Vince - Khan (Searchable)Document112 pagesForeclosure - Defense.guidebook Vince - Khan (Searchable)Star Gazon100% (2)

- Foreclosure Fraud Fighters Motion To Disqualify CounselDocument10 pagesForeclosure Fraud Fighters Motion To Disqualify CounselForeclosure Fraud67% (3)

- Quiet Title Actions - Suit For Quiet TitleDocument5 pagesQuiet Title Actions - Suit For Quiet TitleRK Corbes25% (4)

- Mortgage Satisfaction Procedure 8 April 2015Document8 pagesMortgage Satisfaction Procedure 8 April 2015cfinley19100% (3)

- Defeat Foreclosure: Save Your House,Your Credit and Your Rights.From EverandDefeat Foreclosure: Save Your House,Your Credit and Your Rights.No ratings yet

- FDIC Banking PrinciplesDocument4 pagesFDIC Banking PrinciplesOrganicman77100% (10)

- Basic Foreclosure Litigation Defense ManualDocument155 pagesBasic Foreclosure Litigation Defense ManualCarrieonic100% (13)

- Lack of Standing Case DismissalsDocument18 pagesLack of Standing Case DismissalsStar Gazon100% (4)

- Foreclosure DefenseDocument80 pagesForeclosure Defense83jjmack100% (8)

- Understand securitisation and enforce rights in bank loansDocument7 pagesUnderstand securitisation and enforce rights in bank loansteachezi100% (2)

- How To Write A Wrongful Foreclosure ComplaintDocument4 pagesHow To Write A Wrongful Foreclosure ComplaintCarrieonic100% (13)

- RICO Prosecution of Large-Scale Mortgage FraudDocument41 pagesRICO Prosecution of Large-Scale Mortgage Fraudkunim62No ratings yet

- Where Credit is Due: Bringing Equity to Credit and Housing After the Market MeltdownFrom EverandWhere Credit is Due: Bringing Equity to Credit and Housing After the Market MeltdownNo ratings yet

- Copies and The Affidavit TrapDocument29 pagesCopies and The Affidavit TrapJeff Wilner93% (29)

- Real Estate Exam Study GuideDocument53 pagesReal Estate Exam Study Guideitzmsmichelle100% (3)

- Wow Wow Win For Homeowner Wallace - Appeal Decision - Dismissal Reversed!! Used FdcpaDocument7 pagesWow Wow Win For Homeowner Wallace - Appeal Decision - Dismissal Reversed!! Used Fdcpa83jjmack100% (4)

- Motion Against Wells Fargo's Standing Based On Bad DocsDocument34 pagesMotion Against Wells Fargo's Standing Based On Bad DocsAC Field100% (6)

- Is The Promissory Note Even Enforceable?: Deadly ClearDocument7 pagesIs The Promissory Note Even Enforceable?: Deadly ClearStar GazonNo ratings yet

- Is The Promissory Note Even Enforceable?: Deadly ClearDocument7 pagesIs The Promissory Note Even Enforceable?: Deadly ClearStar GazonNo ratings yet

- Le Handbook PDFDocument44 pagesLe Handbook PDFStar Gazon100% (1)

- Real Estate Forms PortfolioDocument57 pagesReal Estate Forms PortfolioDustin Humphreys100% (4)

- MERS Explanation of Broken Title ChainDocument3 pagesMERS Explanation of Broken Title Chainjoycej2003No ratings yet

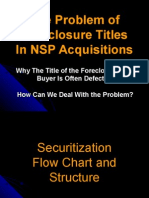

- The Problem of Foreclosure Titles Securitized by MERSDocument25 pagesThe Problem of Foreclosure Titles Securitized by MERSForeclosure Fraud100% (8)

- CTC Cracking - The.Code-IndexDocument4 pagesCTC Cracking - The.Code-IndexStar Gazon100% (4)

- Letter of Objection To Trustee in Non Judicial Sale StatesDocument2 pagesLetter of Objection To Trustee in Non Judicial Sale Statesraiders4life100% (3)

- Mortgage Assignment Fraud - U.S. Bank National Assoc., As Trustee v. Ernest E. Harpster Sl-2007-CA-6684-ESDocument4 pagesMortgage Assignment Fraud - U.S. Bank National Assoc., As Trustee v. Ernest E. Harpster Sl-2007-CA-6684-ESForeclosure Fraud100% (3)

- False Claims Act Used in This Newly Unsealed Complaint Lynn Szymoniak The Federal Government and Many State Governments August 2013 Names All The BDocument145 pagesFalse Claims Act Used in This Newly Unsealed Complaint Lynn Szymoniak The Federal Government and Many State Governments August 2013 Names All The BThom Lee Chapman100% (1)

- Mortgage Assignment FraudDocument1 pageMortgage Assignment FraudMark Anaya100% (1)

- Request For Production of Note and Mortgage For Forensic Testing SupplementDocument7 pagesRequest For Production of Note and Mortgage For Forensic Testing Supplementjohngault100% (2)

- Foreclosure Answer W Counterclaim, DiscoveryDocument17 pagesForeclosure Answer W Counterclaim, Discoverywinstons2311100% (9)

- Foreclosure Case Wins Misc 48 PagesDocument46 pagesForeclosure Case Wins Misc 48 Pagestraderash1020100% (3)

- Ocwen Loan Servicing Complaint For Wrongful Foreclosure and FraudDocument14 pagesOcwen Loan Servicing Complaint For Wrongful Foreclosure and FraudLenoreAlbert100% (1)

- Conspiracy Against Rights: TITLE 18, U.S.C., SECTION 241Document1 pageConspiracy Against Rights: TITLE 18, U.S.C., SECTION 241Star GazonNo ratings yet

- Conspiracy Against Rights: TITLE 18, U.S.C., SECTION 241Document1 pageConspiracy Against Rights: TITLE 18, U.S.C., SECTION 241Star GazonNo ratings yet

- TONS OF ROBOSIGNERS! HSBC, FRAUD, MERS, OCWEN, Western Progressive, Robo-Signers. Exhibits A-JDocument44 pagesTONS OF ROBOSIGNERS! HSBC, FRAUD, MERS, OCWEN, Western Progressive, Robo-Signers. Exhibits A-JDivine Matrix SOULutions100% (3)

- Federal Court Rulings Against Wells FargoDocument35 pagesFederal Court Rulings Against Wells FargoPAtty Barahona100% (3)

- FRAUD Upon The Court Motion - BOA V Julme-FL Case#CACE09-21933-051 - 2010-09-29 PDFDocument30 pagesFRAUD Upon The Court Motion - BOA V Julme-FL Case#CACE09-21933-051 - 2010-09-29 PDFStar Gazon100% (2)

- FRAUD Upon The Court Motion - BOA V Julme-FL Case#CACE09-21933-051 - 2010-09-29 PDFDocument30 pagesFRAUD Upon The Court Motion - BOA V Julme-FL Case#CACE09-21933-051 - 2010-09-29 PDFStar Gazon100% (2)

- Max Gardner's Dirty Dozen Rules For Ownership of Mortgage Note (Complete Baker's Dozen) 2008Document6 pagesMax Gardner's Dirty Dozen Rules For Ownership of Mortgage Note (Complete Baker's Dozen) 2008Star GazonNo ratings yet

- Survival - How ToDocument7 pagesSurvival - How ToAllen Carlton Jr.90% (10)

- Supreme Court Foreclosure MotionDocument14 pagesSupreme Court Foreclosure MotionHarry Davidoff100% (6)

- Construction Companies KenyaDocument12 pagesConstruction Companies KenyaYashpal Msis67% (3)

- APPEAL WIN FOR HOMEOWNER - Reversal and Remand Nevada Supreme Court - FOUST V WELLS FARGO, MERS Et Al. July 2011Document7 pagesAPPEAL WIN FOR HOMEOWNER - Reversal and Remand Nevada Supreme Court - FOUST V WELLS FARGO, MERS Et Al. July 201183jjmack100% (2)

- Mortgage Auditing Report For Mr. and Mrs. Homeowner - Audit-TemplateDocument11 pagesMortgage Auditing Report For Mr. and Mrs. Homeowner - Audit-TemplateRicharnellia-RichieRichBattiest-Collins100% (2)

- American Foreclosure: Everything U Need to Know About Preventing and BuyingFrom EverandAmerican Foreclosure: Everything U Need to Know About Preventing and BuyingNo ratings yet

- 05 Mortgage Assignments As Evidence of FraudDocument3 pages05 Mortgage Assignments As Evidence of FraudRicharnellia-RichieRichBattiest-Collins100% (1)

- Chain of Title: How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure FraudFrom EverandChain of Title: How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure FraudRating: 3 out of 5 stars3/5 (1)

- Deconstruction of The Typical MortgageDocument3 pagesDeconstruction of The Typical MortgageJulie Hatcher-Julie Munoz Jackson100% (1)

- Motion To Vacate Rev2Document57 pagesMotion To Vacate Rev2John Reed100% (1)

- Quantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetFrom EverandQuantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetNo ratings yet

- Bank's ArgumentDocument85 pagesBank's ArgumentAC Field100% (4)

- HJR.192 5th - June.1933 PDFDocument4 pagesHJR.192 5th - June.1933 PDFStar GazonNo ratings yet

- Legal Due Diligence in Real Estate Transactions - Its Significance and Methodology PDFDocument5 pagesLegal Due Diligence in Real Estate Transactions - Its Significance and Methodology PDFsantu359No ratings yet

- Judge Scheck Robo-Dismissal - Makes It Clear On 10-27-2010 - Onewwest Bank V DraytonDocument32 pagesJudge Scheck Robo-Dismissal - Makes It Clear On 10-27-2010 - Onewwest Bank V Drayton83jjmack100% (1)

- Commercial Sublease AgreementDocument10 pagesCommercial Sublease AgreementAngelica GomezNo ratings yet

- Motion To Vacate Foreclosure-CaseDocument23 pagesMotion To Vacate Foreclosure-Casemortgageabuse697067% (3)

- Assignments - Explained v1Document2 pagesAssignments - Explained v1Star GazonNo ratings yet

- The Most Reviled Law Firm in Florida and The "Unowned Mortgage Loans" Scheme By: LYNN SZYMONIAK, ESQ.Document7 pagesThe Most Reviled Law Firm in Florida and The "Unowned Mortgage Loans" Scheme By: LYNN SZYMONIAK, ESQ.DinSFLANo ratings yet

- Realtor%20 Excel%20 SpreadsheetDocument93 pagesRealtor%20 Excel%20 SpreadsheetMuhammad Uzair PanhwarNo ratings yet

- Why - Judges.are - Scowling.at - Banks NYtimes - Com 2013-09-28Document2 pagesWhy - Judges.are - Scowling.at - Banks NYtimes - Com 2013-09-28Star Gazon100% (1)

- Why - Judges.are - Scowling.at - Banks NYtimes - Com 2013-09-28Document2 pagesWhy - Judges.are - Scowling.at - Banks NYtimes - Com 2013-09-28Star Gazon100% (1)

- Robo - Signer.List SalemDeeds - Com Updated.2012-06-12 PDFDocument3 pagesRobo - Signer.List SalemDeeds - Com Updated.2012-06-12 PDFStar GazonNo ratings yet

- John Doe Sues Rico Bank for Trespass and Quiet Title Over Foreclosure of Los Angeles PropertyDocument67 pagesJohn Doe Sues Rico Bank for Trespass and Quiet Title Over Foreclosure of Los Angeles Propertyrhouse_1No ratings yet

- Substitution of Trustee/Robosigners OCWEN & HSBCDocument2 pagesSubstitution of Trustee/Robosigners OCWEN & HSBCDivine Matrix SOULutions100% (1)

- Judgments Which Are Void at The OutsetDocument1 pageJudgments Which Are Void at The OutsetFASTLOANS007No ratings yet

- April Charney - Motion To Dismiss Florida ForeclosureDocument3 pagesApril Charney - Motion To Dismiss Florida Foreclosurewinstons2311No ratings yet

- Navigating Failure: Bankruptcy and Commercial Society in Antebellum AmericaFrom EverandNavigating Failure: Bankruptcy and Commercial Society in Antebellum AmericaRating: 2 out of 5 stars2/5 (3)

- BONY FannieMasterCustodialAgreementDocument21 pagesBONY FannieMasterCustodialAgreementNye LavalleNo ratings yet

- Fannie Mae Subordination Agreement SummaryDocument16 pagesFannie Mae Subordination Agreement SummaryrapiddocsNo ratings yet

- Why NO Bankers Are Going To Jail - Judge Rakoff Objects (Bloomberg Reports 2013-11-17)Document2 pagesWhy NO Bankers Are Going To Jail - Judge Rakoff Objects (Bloomberg Reports 2013-11-17)Star Gazon100% (1)

- 10 Signs The Global Elite Are Losing Control PDFDocument2 pages10 Signs The Global Elite Are Losing Control PDFStar GazonNo ratings yet

- 2013 09 20 SC - Court.upholds - Supreme.court - Ruling Foreclosing - Party.must - Own.both - the.note.&.MORTGAGEDocument1 page2013 09 20 SC - Court.upholds - Supreme.court - Ruling Foreclosing - Party.must - Own.both - the.note.&.MORTGAGEStar GazonNo ratings yet

- Foreclosure News: A Watershed Moment in Foreclosure BattleDocument1 pageForeclosure News: A Watershed Moment in Foreclosure BattleStar GazonNo ratings yet

- Where has my bank goneDocument2 pagesWhere has my bank goneStar GazonNo ratings yet

- The Wall Street Journal.: Foreclosure Prevention Services, by StateDocument2 pagesThe Wall Street Journal.: Foreclosure Prevention Services, by StateStar GazonNo ratings yet

- Marriage - License.bureau - Official Enlightening - ConversationDocument4 pagesMarriage - License.bureau - Official Enlightening - ConversationStar GazonNo ratings yet

- Conversation With A Marriage License BureauDocument4 pagesConversation With A Marriage License BureauGary KrimsonNo ratings yet

- Why - Is.syria - In.the - Cross Hairs Making - The.world - Safe.for - BankstersDocument3 pagesWhy - Is.syria - In.the - Cross Hairs Making - The.world - Safe.for - BankstersStar GazonNo ratings yet

- 10 Signs The Global Elite Are Losing Control PDFDocument2 pages10 Signs The Global Elite Are Losing Control PDFStar GazonNo ratings yet

- Colorado - Voters.oust - Democratic.state - Senators Reuters - Com 2013-09-11Document3 pagesColorado - Voters.oust - Democratic.state - Senators Reuters - Com 2013-09-11Star GazonNo ratings yet

- AuthorizationDocument3 pagesAuthorizationJune Delfino DeluteNo ratings yet

- 5000 Lakewood RD, Stanwood, WA Lease Contract FormDocument8 pages5000 Lakewood RD, Stanwood, WA Lease Contract Formjason walterNo ratings yet

- Building level and material list detailsDocument1 pageBuilding level and material list detailsEdi CahyadiNo ratings yet

- Buildings - 1 - High-RiseDocument20 pagesBuildings - 1 - High-RiseqsultanNo ratings yet

- Ntanya Boq FinalDocument7 pagesNtanya Boq Finalmadhusudan GNo ratings yet

- L&T Seawoods ResidencesDocument5 pagesL&T Seawoods ResidencesMD IRSHAD ALAMNo ratings yet

- Imran Ahmed CV (Civil - Structural Engineer, 17 Years Experience2) - RevDocument4 pagesImran Ahmed CV (Civil - Structural Engineer, 17 Years Experience2) - RevImran AhmedNo ratings yet

- Suphaa Adaadii Rate HaaraaDocument6 pagesSuphaa Adaadii Rate HaaraaBorana Asnake KumsaNo ratings yet

- Uc Booking W.E.F. 01.01.2019 To 30.09.2019 EE (B) - I-WZDocument18 pagesUc Booking W.E.F. 01.01.2019 To 30.09.2019 EE (B) - I-WZBALAJI ASSOCIATESNo ratings yet

- Tenancy Agreement SummaryDocument5 pagesTenancy Agreement SummaryUche Nmaduka IbekweNo ratings yet

- SHOP LEASE CONTRACT (Telewik)Document2 pagesSHOP LEASE CONTRACT (Telewik)JEPH Manliguez EnteriaNo ratings yet

- Co-owner's Right to Transfer Property ShareDocument23 pagesCo-owner's Right to Transfer Property ShareDeeptangshu KarNo ratings yet

- BLDG Constr-Assgn PDFDocument10 pagesBLDG Constr-Assgn PDFHarsh BhansaliNo ratings yet

- General Closing Requirements - GuideDocument29 pagesGeneral Closing Requirements - GuideRicharnellia-RichieRichBattiest-CollinsNo ratings yet

- 0000 Residential Compiled 00Document128 pages0000 Residential Compiled 00Jet ToledoNo ratings yet

- CAI Restoration ServicesDocument4 pagesCAI Restoration Servicesapi-255869822No ratings yet

- Echeverria Vs Bank of America Et Al Judicial Notice Doc.55 Exhibit ADocument71 pagesEcheverria Vs Bank of America Et Al Judicial Notice Doc.55 Exhibit AIsabel SantamariaNo ratings yet

- A Posterior Claim Based On Execution Sale Cannot Defeat An Anterior Claim of Adverse ClaimDocument4 pagesA Posterior Claim Based On Execution Sale Cannot Defeat An Anterior Claim of Adverse ClaimHangul Si Kuya AliNo ratings yet

- Base de Datos de Ensayos de Índices RWDocument6 pagesBase de Datos de Ensayos de Índices RWGianella chapoñan rojasNo ratings yet

- The Transfer of Property Act 1882Document83 pagesThe Transfer of Property Act 1882CA Sairam BalasubramaniamNo ratings yet

- Duke Realty RezoningDocument79 pagesDuke Realty RezoningZachary HansenNo ratings yet

- Rent control and slum clearance exam questionsDocument2 pagesRent control and slum clearance exam questionsbbs_tarunNo ratings yet

- Engr. Renvil M. Pedernal, So2 Licensed Civil Engineer-May 2018 Cosh-OSH N 1807-22Document2 pagesEngr. Renvil M. Pedernal, So2 Licensed Civil Engineer-May 2018 Cosh-OSH N 1807-22Reden Mejico PedernalNo ratings yet

- Chapter 1 Timber FloorDocument17 pagesChapter 1 Timber FloorNikhil Joshi0% (1)