Professional Documents

Culture Documents

Banking, Money Supply and Monetary Policy

Uploaded by

Siti Nurul Alia RazaliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking, Money Supply and Monetary Policy

Uploaded by

Siti Nurul Alia RazaliCopyright:

Available Formats

CHAPTER 3 : MONEY, BANKING AND MONETARY POLICY After studying this chapter, you should be able to: define

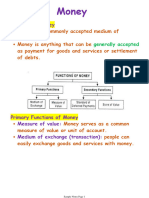

what money is and explain the functions of money define the money supply outline and discuss the functions of Central Bank explain the money creation process explain different tools used to alter the supply of money explain how money market achieves equilibrium analyse how monetary policy affects interest rates, prices, output, and employment MONEY 3.1.1. Definition of Money The set of assets in an economy that people regularly use to buy goods and services from other people. 3.1.2. Three Functions of Money 1. Medium of exchange 2. Unit of account 3. Store of value Money as a Medium of Exchange An item that buyers give to sellers when they want to purchase goods and services. If there were no money, goods would have to be exchanged through the process of barter; that is, goods would be traded for other goods in transactions arranged on the basis of mutual need and there must be a double coincidence of wants. That is I have to find someone who has what I want and that person must also want what I have. Money eliminates the need for such arrangements. In a money economy, money, rather than goods, is the medium of exchange via which transactions are made. It eliminates the double coincidence of wants problem. Money as a Unit of Account The yardstick people use to post prices and record debts. A consistent way of quoting prices. In a money economy, all goods, services, and debts are valued in terms of money. As such, money is the unit of account-the common standard by which value is determined Money as a Store of Value An item that people can use to transfer purchasing power from the present to the future. It refers to moneys ability to retain its value over time. Since all transactions are made in money, and all values are based on money, money should also retain its value as money. For e.g. if you raise chickens and at the end of the month sell them for more than you want to spend and consume immediately, you may keep some of your earnings in the form of money until the time you want to spend. Liquidity: the ease with which an asset can be converted into the economys medium of exchange. Money is the most liquid asset available. Other assets (such as stocks, bonds, and real estate) vary in their liquidity. When people decide in what forms to hold their wealth, they have to balance the liquidity of each possible asset against the assets usefulness as a store of value. Characteristics of money Acceptability -- people must be willing to accept it as a means of payment and in settlement of a debt Durability -- must last a reasonable length of time before deteriorating

Divisibility -- to function as money an asset must be capable of division into smaller units to accommodate transactions of differing value Portability / Convenience -- to function as money an asset must be portable and easy to use, it must be light, small to carry around and easy to transfer ownership Uniformity -- money of the same value must be of uniform quality Stability of Value -- in order to fulfil its various functions (especially as a store of wealth and as a means of evaluating future payment), it must retain its value Hard for Individuals to Produce Themselves -- it must be hard to forge 3.1.3. Forms of Money Commodity Money money that takes the form of a commodity with intrinsic value. Something that performs the function of money and also has alternative, non-monetary uses, e.g., gold, silver, cigarettes. For hundreds of years gold could be used directly to buy things, but it also had other uses ranging from jewelry to dental fillings. Fiat Money/token money -- money without intrinsic value that is used as money because of government decree. Something that serves as money but has no other important uses, e.g., Coins, currency and checkable deposits (current account) 3.1.4. Definition of Money Supply (M1, M2 and M3) Definition of Money Supply: the quantity of money available in the economy Definition of Monetary Policy: the setting of the money supply by policymakers in the central bank M1 the narrowest definition of money supply, consists of currency outside banks plus checking accounts plus travelers checks Currency held outside banks includes coins and paper money in the hands of public Checking accounts balances can be withdrawn by using check Travelers check issued in specific denominations, these are treated as cash M1 = currency held outside banks + checking accounts + travelers check M2 A broader definition of money supply, it includes all of the components of M1 plus time deposits and savings deposits Time deposits (fixed deposits) interest-earning deposits with a specified maturity, which are subject to penalty for early withdrawal Savings deposits interest-earning deposits with no specific maturity M2 = M1 + time deposits + saving deposits M3 = M2 + deposits with non-bank financial institution (e.g., deposits of finance companies and post office saving) Credit card is not a form of money; when a person uses a credit card, he or she is simply deferring payment for the item serves as a temporary medium of exchange but not a store of value 3.2. BANKING 3.2.1. Structure of Banking System the structure of banking system differs from one country depending on factors such as level of development central bank : an institution designed to oversee the banking system and regulate the quantity of money in the economy financial institution : privately owned institutions that serve the general public

intermediaries that stand between savers from whom they accept deposits ; and investors to whom they make loans

3.2.2. Functions of Bank Negara Malaysia (BNM) 1. Banker to commercial banks (bankers bank) they accept deposits for commercial banks these deposits also called reserves , are of strategic importance in managing the economic money supply (reserve requirements) acts as clearing house for check also makes short term loans to commercial banks as a way of providing temporarily liquidity to them the rate of interest that central bank charges on such loans is called discount rate 2. 3. 4. Banker for the government to help service its financial dealings to hold its fund in an account which it can make deposits and against which it can write cheques thus , government have some forms of checking deposits with BNM furthermore , when tax collections are inadequate to finance expenditure , the government may choose to borrow from BNM by selling securities to the bank Controller of money supply by exercising control of the supply of money i.e. Monetary Policy to increase the money supply, the BNM buys government bonds from the public to decrease the money supply, the BNM sells government bonds to the public Lender of last resort BNM plays the important role of ensuring smooth, orderly markets by upholding confidence in the countrys financial system and preventing serious disruptions such as panics and bank failures if banking system is short of liquidity , the BNM will always be prepared to lend it helps maintain confidence and hence the well-being of the countrys financial system

5. Others regulate the private banking industry to make sure banks follow laws intended to promote safe and sound banking practices (e.g. BAFIA 1989) sole note issuing authority 3.2.3. Credit Creation To explore a process on how banks create money. To understand this process, you need to be familiar with some basic principles of accounting. Assets are things a firm owns that are worth something. Most important among a banks assets are its loans. A firms liabilities are its debts-what it owes. A banks most important liabilities are its deposits. deposits in banks are considered as liability in banks balance sheet as deposits are held in banks, the behaviour of banks can influence the quantity of deposits in the economy, and therefore, the money supply

Simple Case of 100-Percent-Reserve Banking Definition of Reserves: deposits that banks have received but have not loaned out. assumption: currency is the only form of money total quantity of currency is RM100, and therefore the supply of money is RM100 First National Bank (first bank in a world) was established as a depository institution the bank accepts deposits but does not make loans

the bank will keep the deposits until the depositor comes to withdraw or write a check against his balances therefore, all deposits are held as reserves 100-percent-reserve banking FIRST NATIONAL BANK RM Liabilities 100 Deposits RM 100

Assets Reserves

implications: before bank was created, the money supply consisted of RM100 worth of currency with the bank, the money supply consists of RM100 worth of deposits each deposit in the bank reduces currency and raise deposits by exactly the same amount, leaving the money supply unchanged if banks hold all deposits in reserve, banks do not influence the supply of money

Money Creation with Fractional-Reserve Banking Definition of fractional reserve banking: a banking system in which banks hold only a fraction of deposits as reserves Definition of Reserve Ratio: the fraction of deposits that banks hold as reserves bank reserves consist of cash in the bank plus its deposits at central bank (BNM) the required reserve ratio is the ratio of reserves to deposit that banks are required , by law , to hold A banks required reserve = deposits x required reserve ratio Therefore, actual reserves - required reserves = excess reserves the reserve system implies that funds of commercial banks (e.g. bank A) which are not kept as reserves can be loaned out to the public. A bank can make loans only if it has excess reseves. if the public subsequently deposits these loans in their account of another bank (e.g. bank B) , of which a fraction has to be kept as reserves, the remainder can be further loaned out to other customer, who would then deposit the loan to bank C, the process goes on therefore, the money supply increases when a bank makes a loan when one bank loans money, that money is generally deposited into another or the same bank thus creating more deposits and more reserves to be lent out when banks hold only a fraction of deposits in reserve, banks create money. assumption: banks have one kind of liability - demand deposits and can invest in one kind of asset - loans banks are subject to the same fixed , required reserve ratio , say 10% e.g. for every RM100 of deposits , banks must hold RM10 in required reserve suppose an individual opens an account with First National Bank (FNB) and deposits the RM100 in an account, and the required reserve ratio is 10%, so RM10 is set aside as required reserves by FNB, and the remaining RM90 becomes excess reserves, the effect of these transaction on the banks balance sheet is as below: Assets Required reserves Excess reserves First National Bank RM Liabilities +10 Deposits +90 RM +100

If FNB decided to loan out the excess reserves RM90 to Jenny, who then deposits that RM90 in her account with Second National Bank (SNB). The effect of these transaction on the FNBs balance sheet is that the excess reserves on the assets side is now changed to loan as follow:

Assets Required reserves Loan

First National Bank RM Liabilities +10 Deposits +90

RM +100

When SNB receives the deposits from Jenny, at this point, the money supply has increased. If SNB put aside 10% of RM90 (i.e. RM9) as required reserves, and loan out the remaining 90% excess reserves (i.e.RM81), the effect on SNBs balance sheet is as follow: Second National Bank Assets RM Liabilities RM Required reserves +9 Deposits +90 Loans +81 again firms and individuals who take this loan of RM81 now deposit it in their own banks, called Third National Bank. Third National Bank now need to loan out RM72.90 (90% of RM81) while maintaining RM8.10(10% of RM81) as required reserves, and so the process goes on Assets Required reserves Excess reserves Third National Bank RM Liabilities +8.10 Deposits +72.90 81.00 RM +81 81.00 Addition to Required Reserves (RM) 10 9 8.1 7.29

Process of money creation: no cash leakages and zero excess reserves Bank New deposits New Loans (RM) (RM) First National Bank 100 90 Second National Bank 90 81 Third National Bank 81 72.9 Forth National Bank 72.9 65.61

Total 3.2.3.3 The Money Multiplier

1,000

900

100

the total effect is that the system as a whole creates deposits money by a multiple of the initial deposit the deposit multiplier = 1 / required reserve ratio = 1/r in above example, r = 0.10 , hence deposit multiplier = 1 / 0.1 = 10 thus, the banking system as a whole can create in deposit money 10 times the amount of any increase in reserves that it receives total increase in deposits = (1/r) x change in total reserves = 10 x RM100 = RM1,000 The Money Multiplier is the amount of money that the banking system generates with each dollar of reserves, similarly, if the reserve ratio were 1/5 or 20%, the banking system must have five times as much in deposits as in reserves, implying a money multiplier of 5 if original deposit is RM1000, money supply = 5 @ RM1000 = RM5,000 money created = RM5,000 - RM1,000 = RM4,000 therefore, money created = money supply - original deposit

the higher the reserve ratio, the less of each deposit banks loan out, and the smaller the money multiplier

MONETARY POLICY Definition of Monetary Policy: the setting of the money supply by policymakers in the central bank. the mechanics of monetary policy include all the measures which influence the supply of money the price of money (the rate of interest) 2 types of monetary policy contractionary, restrictive or tight monetary policy expansionary or cheap monetary policy aims of monetary policy to maintain stability of domestic prices fluctuating prices will cause disturbances in economy to achieve higher rates of economic growth to eliminate fluctuations in productions and employment if demand is too low, workers will be retrenched; unemployment will occur to achieve full employment of resources 3.2.4. Tools of Monetary Control

Quantitative tools - includes the required reserve ratio, the discount rate and open market operations where the central bank can estimate what amount of money supply will be affected. Open-Market Operation (OMO) Definition of Open Market Operations: the purchase and sale of government securities in financial market so as to influence the size of bank deposits. Government has authorized the BNM to buy and sell government securities. to increase the money supply, BNM buys bonds from the market (firms and households), and pays with cheques drawn against the BNM and payable to the households or firms who sold the bonds households and firms deposit the cheques in their own banks banks present the cheques to BNM for payment BNM then makes book entry, increasing the deposit of the banks at BNM since required reserve ratio has not changed, the increase deposits or reserves with BNM increases the excess reserves of the banks banks are likely to lend out the excess reserves as reserves typically earn very low or no interest this leads to a rise in deposit money and an expansion of the money supply

to reduce the money supply, BNM sells bonds to the market (firms and households), and individuals or firms who purchase government securities pay by writing cheques drawn against their own banks, and make payable to BNM the amount on the cheque shows how much the bank owes the BNM the payment of this amount owed to the BNM is made by a book entry that reduces the banks deposits at BNM as a result, cash reserves of the banks are reduced; so as the quantity of lending banks cannot create credit easily this leads to a decline of the money supply

in Malaysia, OMO is not effective as the public holds very little government securities (less than 3%) because low rate of interest the largest buyers are the insurance companies Read page 497-main reference Reserve Requirements Definition of Reserve Requirements: regulations on the minimum amount of reserves that banks must hold against deposits BNM has the power by law to alter the required minimum reserve ratio reserve requirements influence how much money the banking system can create with each RM of reserves an increase in reserve requirements means that banks must hold more reserves and can loan out less of each RM that is deposited as a result, it raises the reserve ratio, lowers the money multiplier, and decreases the money supply a decrease in reserve requirements means that lowers the reserve ratio banks hold less reserves have excess reserves to be lent out as a result, it raises the money multiplier and increases the money supply if r = 20% and original deposit RM1,000, then money supply = 1/r @ RM1,000 = RM5,000 money created = RM4,000 (money supply - original deposit) if r = 50% and original deposit RM1,000, then money supply = RM2,000; money created = RM1,000 thus, an increase in required reserve ratio leads to a decrease in money supply, and a decrease in the required reserve ration leads to an increase in money supply there is an inverse relationship between the required reserve ratio and the money supply Read page 494-main reference Discount Rate Banks may borrow from BNM the interest rate on the loans that BNM makes to banks is called the discount rate a bank borrows from BNM when it has too few reserves to meet reserve requirements this might occur because the bank made too many loans or it has experienced recent withdrawals therefore, the banking system has more reserves and this allow to create more money BNM can alter the money supply by changing the discount rate a higher discount rate discourages banks from borrowing reserves from BNM because the cost of borrowing is higher reduces the quantity of reserves in the banking system reduces the money supply a lower discount rate encourages bank borrowing from BNM increases the quantity of reserves increases the money supply Read page 495-main reference Funding term given to the conversion of short term loans to medium term loans or long term loans

objective to lengthen the payment so that the bank cannot create multiple credits

Special Deposits commercial banks are sometimes required to deposit in the central bank an additional percentage of their deposits however, this tool is not used in Malaysia Qualitative Tools Selective Credit Controls a) Hire-purchase controls restriction of consumer credit by fixing regulations for minimum down-payment and maximum repaying period for hire purchase agreements b) Capital Issue Control issuing directives to commercial banks to give loans only for certain purposes give loans for productive purposes rather than for speculative and unproductive purposes Moral Suasion is used selectively by the central bank to influence the total supply of money and credit by urging banks to tighten or loosen lending and credit accordingly. The pressure exerted by the BNM on member banks to discourage them from borrowing heavily from the BNM. Special Directives BNM sets up directives and instructions to the commercial banks asking to reduce the volume of loans given to clients Interest Rate Policy persuade commercial banks to increase their rate of interest on deposits during inflation attract more deposit and hence level of saving increases Mortgage Control increase rate of interest on mortgage for housing - reduce availability of loans therefore, credit creation will decrease Monetary Policy and Money Market Firstly, it is important to understand what the interest rate is. Once we have understand the meaning of interest rate, we can turn to how the BNM affects the interest rate through monetary policy. Interest is the fee borrowers pay to lenders for the use of their funds. Firms and government borrow funds by issuing bond, and they pay interest to the firms and households (the lenders) that purchase those bonds. Households and firms that have borrowed from a bank must pay interest on those loans to the bank. The Demand for Money represents the inverse relationship between the quantity demanded of money balances and the price of holding money balances demand for money refers to the desire on money holding there are 3 motives for holding money, which earns zero interest: Transaction Demand for Money money held for transactions e.g. to pay the bill, to spend on groceries etc. transaction balances tend to vary positively with the money value of income

Precautionary Demand for Money money held to protect themselves against adverse happenings (some unforeseen events e.g. car breakdown) The greater the degree of uncertainty or risk, the larger is precautionary demand precautionary balances tend to vary positively with the money value of income e.g. if a households volume of payments per month is RM900, a 10% precautionary balance of RM90 may be sufficient to meet unexpected contingencies; but the RM90 would be inadequate for another household whose monthly payments are RM9,000! when the rate of interest falls, the opportunity cost of holding money falls this leads to more money being held for the precautionary motive of reducing risks caused by uncertainty about the timing of payments and receipts Speculative Demand for Money money held to take advantage of expected future changes in the price of bonds, stocks, or other non-money financial assets it stresses the store of value role of money speculative balance is determined by the interest rate inverse relationship if interest rate falls, the opportunity cost of holding money falls, this will encourage households to hold more of money conversely, as the interest rate rises, the cost of holding speculative money increases and people will reduce their demand for speculative balances total demand for money consists of the 3 motives for holding money Since transaction demand for money (DT) is dependent on nominal income rather than the interest rate, a vertical schedule is derived, which shows that at every rate of interest, the transaction demand for money is RM90 (Figure1a) the speculative and precautionary demand for money (DSP) yield a downward sloping schedule against interest rate (Figure 1b)

In terest rate

in terest rate

in terest rate

10

DT

DM = DT + DS P DS P 0 90 tran sac tio n d em an d fo r m o n ey F ig u re 1 a 0 150 0 90

q ty 4 0o n edyd 2m

sp ec u lativ e a n d p rec au tio n a ry d e m a n d fo r m o n e y F ig u re 1 b

D e m a n d fo r m o n e y F ig u re 1 c

the total demand for money (DM) is derived by horizontally adding the DT to DSP and would be the downward sloping schedule depicted in Figure c when the rate is 10%, total demand for money is RM90 (RM90 for DT, and zero for DSP) when interest rate is zero, total money demand is RM240 (RM90 for DT and Rm150 for DSP) in Figure 1c demand for money curve shows the quantity of money people wish to hold at various interest rates As interest rates rises, the quantity of money demanded is less than when interest rate is lower a change in interest rate will lead to a move along money demand curve however, a change in money demand caused by something other than interest rate (such as real income or price level) will cause the curve to shift e.g. an increase in the price level will shift the money demand curve to the right i.e. at each interest rate, more money will be demanded

The Supply of Money quantity of money supplied does not depend on economic variables such as interest rates it is largely determined by BNM policy the BNM can control the money supply by changing the discount rate, by changing the required reserve ratio or by engaging in open market operations. Figure 21.5 (textbook page 500) shows a fixed money supply with a vertical supply curve i.e. quantity of money supplied is the same regardless of the interest rate Equilibrium in the Money Market equilibrium exists in money market when quantity demanded of money equals the quantity supplied In Figure 22.6 (main reference page 514), equilibrium exists at the interest rate r* Excess Supply of Money at higher interest rate r1, quantity supplied of money is greater than quantity demanded excess supply of money (too much money) to reduce money balances, people will move out of cash and checkable deposits by buying bonds increase in demand for bonds will drive up the price of bond and lower interest rate as interest rate falls, quantity of money demanded increases as people become more willing to hold money Excess Demand for Money at lower interest rate r2, quantity of money demanded is greater than quantity supplied excess demand for money (too little money) to increase money balances, people will sell bonds or other non-money assets there is an increase in the supply of bonds, consequently the price of bonds falls, and interest rate rises

10

How Monetary Policy Affects the Interest Rate With an understanding of equilibrium in the money market, we can now see how the BNM can affect the interest rates. Increasing Money Supply

Interest rate MS1 MS2

i1 i2 MD 0 M1 M2 Qty of money

Figure 2 suppose BNM increases the money supply by reducing the required reserve ratio this monetary injection shifts the money supply curve to the right from MS1 to MS2 the immediate effect is to create an excess supply of money; the quantity of money supplied exceeds the quantity demanded, at prevailing interest rate i1 people try to get rid of this excess supply of money by buying bond increase demand for bond drives price of bonds higher and interest rate lower as interest rate falls, there is an increase in the quantity money demanded until new equilibrium at i2 is reached Decreasing Money Supply suppose BNM decreases the money supply by raising the required reserve ratio the result is that the money supply curve shifts to the left from MS1 to MS2 the immediate effect is to create a shortage of money; the quantity of money demanded exceeds the quantity money supplied, at prevailing interest rate i1 thus, people sell their bonds for cash, increase supply of bonds and lowers bond prices, causing the rate of interest to rise

11

Interest rate MS2 MS1

i2 i1 MD 0 M2 M1 Qty of money

Figure 3 3.2.5. Monetary Policy and Aggregate Demand 3.2.5.1. How Monetary Policy Affects Prices, Output, And Employment refer to Figure 4 below. suppose BNM increases money supply by reducing the required reserve ratio an increase in money supply will bring on a lower interest rate a fall in interest rate will stimulate investment, thus investment rises from I1 to I2 rising investment increases total spending in the economy and shift the AD curve to the right as a result real GDP rises and unemployment falls

Interest rate S1 S2

Interest rate

Price level

i1 i2 D

i1 AS i2 AD1 AD2

M1 Qty of money

M2

I1

I2

Q1

Q2 Real GDP

Investment

Figure 4

12

Quantity Theory of Money Do changes in the money supply affect the price level in the economy? Qty theory of money is used to see how changes in money supply affect output and prices states that an increase in the quantity of money (changes in money supply) will bring about a proportional increase in the price level. key to the quantity theory of money is the equation of exchange MV = PY where M = money supply V = the velocity of money , or the average number of times per year each dollar is used to purchase final goods and services P = price level Y = real national output or real GDP the equation of exchange says that total spending (M x V) is always equal to total receipts ( P x Y ) given the assumption that , (1) V changes very little in the short run ,and (2) real GDP is fixed in the short run, then the equation of exchange can be used to predict the effects of changes in money supply on price level if V and Y are constant, we would predict that changes in M will bring about strictly proportional changes in P. In other words, the simple qty theory of money predicts that changes in the money supply will bring about strictly proportional changes in the price level. since the theory assumes that V is constant and that real GDP is not affected by the quantity of money , hence P = ( V / Y ) M ( 1 ) where ( V / Y ) constant thus , P = ( V / Y ) M ..( 2 ) divide ( 2 ) with ( 1 ) gives P /P = M / M the percentage increase in the price level equals the percentage increase in the quantity of money therefore, when money supply increased rapidly, the result is a high rate of inflation

13

You might also like

- Money, Banking, & Monetary PolicyDocument31 pagesMoney, Banking, & Monetary PolicyAkmal HamdanNo ratings yet

- 3.1 Money & BankingDocument28 pages3.1 Money & BankingappletransactionsNo ratings yet

- lecture4Document69 pageslecture4Edward Gabada JnrNo ratings yet

- Eco noteDocument3 pagesEco noteShun Lae MonNo ratings yet

- Topic 9 - Money Banking (Week8)Document40 pagesTopic 9 - Money Banking (Week8)Wei SongNo ratings yet

- Monetary EconomicsDocument12 pagesMonetary Economicsrealmadridramos1902No ratings yet

- ECODEV Money ModuleDocument34 pagesECODEV Money ModuleJane Clarisse SantosNo ratings yet

- Money and Banking: IgcseDocument19 pagesMoney and Banking: IgcseEntertainment IS EntertainmentNo ratings yet

- Money MattersDocument34 pagesMoney MattersirsamNo ratings yet

- Benedict Korboi Econ NoteDocument11 pagesBenedict Korboi Econ NoteVanjah JohnsonNo ratings yet

- Chapter 29 ReviewDocument18 pagesChapter 29 ReviewTata NozadzeNo ratings yet

- Week 3Document44 pagesWeek 3Maqsood AhmadNo ratings yet

- MoneyDocument18 pagesMoneyAkshit KansalNo ratings yet

- Money and BankingDocument4 pagesMoney and Bankingnakulshali1No ratings yet

- Lecture 7 Banking, Money and Monetary PolicyDocument36 pagesLecture 7 Banking, Money and Monetary PolicyAvinash PrashadNo ratings yet

- Money and Banking Chapter-11Document30 pagesMoney and Banking Chapter-11Tanvir IslamNo ratings yet

- Functions of MoneyDocument7 pagesFunctions of MoneyShayan YasirNo ratings yet

- Money and The Central Bank SystemDocument9 pagesMoney and The Central Bank SystemKEZIAH REVE B. RODRIGUEZNo ratings yet

- Lecture 7 Banking, Money and Monetary PolicyDocument37 pagesLecture 7 Banking, Money and Monetary Policyshajea aliNo ratings yet

- Module 1 FMGT 80Document41 pagesModule 1 FMGT 80Novel LampitocNo ratings yet

- Chapter 4Document46 pagesChapter 4Nessrine NebliNo ratings yet

- Unit 3 The Monetary Sector: ObjectivesDocument15 pagesUnit 3 The Monetary Sector: ObjectivesTapiwaNicholasNo ratings yet

- InfoDocument18 pagesInfoKeshiva RamnathNo ratings yet

- Macroeconomics Class 12 Money and BankingDocument11 pagesMacroeconomics Class 12 Money and BankingstudentNo ratings yet

- Lesson 1: Concept and Functions of MoneyDocument31 pagesLesson 1: Concept and Functions of MoneyFind DeviceNo ratings yet

- Money and BankingDocument10 pagesMoney and BankingIsha KembhaviNo ratings yet

- Micro Mid Terms Revision (EC1101E)Document6 pagesMicro Mid Terms Revision (EC1101E)ongnigel88No ratings yet

- FI - M Lecture 8-Central Banks-Monetary Policy - PartialDocument49 pagesFI - M Lecture 8-Central Banks-Monetary Policy - PartialMoazzam ShahNo ratings yet

- Macro Economics: Institution of Money & Modern EconomicsDocument36 pagesMacro Economics: Institution of Money & Modern EconomicsApeksha ShaniNo ratings yet

- Lecture 10money and Monetary PolicyDocument15 pagesLecture 10money and Monetary PolicyashwanisonkarNo ratings yet

- Lecture 1 - Introduction To BankingDocument23 pagesLecture 1 - Introduction To BankingLeyli MelikovaNo ratings yet

- Unit 4 MoneyDocument39 pagesUnit 4 MoneyTARAL PATELNo ratings yet

- 1 - Money, Banking, and The Financial SectorDocument138 pages1 - Money, Banking, and The Financial SectorMacNo ratings yet

- MACRO 12 Money+and+BankingDocument21 pagesMACRO 12 Money+and+BankingАліса ВолочайNo ratings yet

- Money & BankingDocument33 pagesMoney & BankingGeeta GhaiNo ratings yet

- ECO 242 Monetary Economics OmnibusDocument159 pagesECO 242 Monetary Economics OmnibusOluwasegun OdofinNo ratings yet

- UNIT 5 Money The Central Bank and Interest RateDocument5 pagesUNIT 5 Money The Central Bank and Interest RateNguyễn Phương LinhNo ratings yet

- Macroeconomics: Lecture 4-5: Functions of MoneyDocument7 pagesMacroeconomics: Lecture 4-5: Functions of MoneyАдамNo ratings yet

- Lu 2 - CH14Document50 pagesLu 2 - CH14bison3216No ratings yet

- Commercial Banks EcoDocument15 pagesCommercial Banks EcojinNo ratings yet

- Sample NotesDocument20 pagesSample NotesKenpin EteNo ratings yet

- Monetary Economics - CH 4Document18 pagesMonetary Economics - CH 4Tesfaye GutaNo ratings yet

- Answer Key Ch – Money & Banking, Government BudgetDocument11 pagesAnswer Key Ch – Money & Banking, Government Budgetrahaque01No ratings yet

- MONEY AND BANKING, Notes 12Document4 pagesMONEY AND BANKING, Notes 12MEETH T M JASWANI 12L 2022-2023No ratings yet

- MONEYDocument5 pagesMONEYShazia SadhikaliNo ratings yet

- Banks Explained: Types, Functions and RolesDocument13 pagesBanks Explained: Types, Functions and RolesmohdportmanNo ratings yet

- Philippine Financial System ExplainedDocument24 pagesPhilippine Financial System ExplainedMarjorie TacordaNo ratings yet

- Unit 15: BanksDocument13 pagesUnit 15: BanksmohdportmanNo ratings yet

- Unit 1: Money and BankingDocument48 pagesUnit 1: Money and BankingAbhikaam SharmaNo ratings yet

- Unit VII - Money Stock Determination-5Document23 pagesUnit VII - Money Stock Determination-5Tshering JangchukNo ratings yet

- Money & Banking NotesDocument15 pagesMoney & Banking Noteslarissa nazarethNo ratings yet

- Introduction To Money Payment System-2Document42 pagesIntroduction To Money Payment System-2lawwrrance chanNo ratings yet

- Basit Central BankDocument32 pagesBasit Central BankMahwish RanaNo ratings yet

- Overview of The Study On Money, Banking and Financial MarketsDocument36 pagesOverview of The Study On Money, Banking and Financial MarketsFarapple24No ratings yet

- Financial Institutions & Financial Markets Module - 1: by Sanjeev TamhaneDocument35 pagesFinancial Institutions & Financial Markets Module - 1: by Sanjeev TamhaneSwagatJagtapNo ratings yet

- Unit 5 CMDocument22 pagesUnit 5 CMASHISH KUMARNo ratings yet

- Banking Unit 6Document32 pagesBanking Unit 6ALAN WALKER PIANONo ratings yet

- Chapter 4 UpdatedDocument80 pagesChapter 4 Updatedrajan20202000No ratings yet