Professional Documents

Culture Documents

Jeffrey S Sutton Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jeffrey S Sutton Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

,40 I0 Rev.

1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization Sixth Circuit Court of Appeals

5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. ,~,~ 101-111)

I. Person Reporting (last name, first, middle initial) Sutton, Jeffrey S. 4. Title (Article Ill judge~ Indicate active or senior status; magistrate judges indicate full- or pata-time)

3. Date of Report 05/12/201 I 6. Reporting Period 01/01/2010 to 12/31/2010

U.S. Circuit Judge

5b. [] Amended Report

7. Chamber~ or Off~ce Address 85 Marconi Boulevard Columbus, OH 43215

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations.

Revie,~ing O~ficer

Date

IMPORTANT NOTES: The instructions accompanying this form must be followetL Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. tRepo,~,g i,a~v~d,at o.~: see rp. 9-t3 of filing instructions.)

D

NONE (No reportablepositions.) POSITION

NAME OF ORGANIZATION/ENTITY The Ohio State University College of Law

1. 2.

Adjunct Faculty

II. AGREEMENTS. m,~,o,n,g i.d~v~aunt o,ty; ~,,~,~. 14-16 of filing instructions.) D NONE (No reportable agreements.) DATE

1.1995 2. 1997 3. PARTIES AND TERMS Ohio Public Employees Retirement System; vested retirement account. Ohio State Teachers Retirement System; vested retirement account.

Sutton, Jeffrey S.

FINANCIAL DISCLOSURE REPORT Page 2 of 8

Name of Person Reporting Sutton, Jeffrey S.

Date of Repor~ 05/12/201 I

III. NON-INVESTMENT INCOME. meporti.g i.divi~ua!o.dspouse; seepg

A. Fliers Non-Investment Income []

NONE

(No reportable non-investment income.)

DATE SOURCE AND TYPE

INCOME (yours, not spouses)

$26,955.00

1. 2010 2. 3. 4.

The Ohio State University College of Law

B. Spouses Non-Investment Income - If you were married during any portion of the reportlng year, complete this section.

(Dollar amount not required except for honoraria.)

NONE (TVo reportable non-investment income.)

DATE I. 2010

SOURCE AND TYPE

The Columbus Academy - teacher

2. 3. 4.

IV. REIMBURSEMENTS - transportation, lodging, food, entertainment

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions,)

[]

NONE

(No reportable reimbursements.) DATES.

2/2-3/10

SOURCE

1. The Federalist Society

LOCATION

New Haven, CT

PURPOSE

Speech at Yale Law School. Participate in event. Moot Court Competition. Moot Court Competition.

ITEMS PAID OR PROVIDED

Transportation, Meals, Room

2. 3. 4.

Stanford Law School Williams College Marquette University Law School William & Mary Laxv School Williams College

2/5-7/10 2/9-12/10 4/6-7/10

Stanford, CA Williamstown, MA Milwaukee, Wl

Transportation, Meals, Room Transportation, Meals, Room Transportation, Meals, Room

5. 6.

9/23-26/10 10/21-24/10

Williamsburg, VA Williamstown, MA

Participate in event. Speech at Williams College.

Transportation, Meals, Room Transportation, Meals, Room

FINANCIAL DISCLOSURE REPORT Page 3 of 8

7. SMU Dedman School of Law 11/19/10

Name of Person Reporting Sutton, Jeffrey S.

Date of Report 05/12/201 I

Dallas, TX

Participate in event.

Transportation, Meals, Room

FINANCIAL DISCLOSURE REPORT Page 4 of 8

Name of Person Reporting Sutton, Jeffrey S.

Date of Report 05/12/2011

V. GI FTS. anclod~ those to spouse and dependent children; see p[~ 28-31 of filing instructions.)

NONE (No reportable gifts.) SOURCE

I. 2. 3. 4.

DESCRIPTION

VALUE

5.

VI. LIABILITIES. ancludes those of spouse ond dependent children; see pp. 32-33 of filing instructions.)

NONE (No reportable liabifities.) CREDITOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUECODE

FINANCIAL DISCLOSURE REPORT Page 5 of 8

Name of Person Reporting Sutton, Jeffrey S.

Date of Report 05112/2011

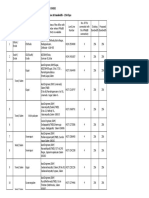

VII. INVESTMENTS and TRUSTS - ~.co,,,e, vatu,, t,a,~anio,~ a.clud,~ thos, o/spouse una de~,,ndont children: see pp. 34-60 of filing instructio.~)

~

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period ! (I) (2) Amount Type (e.g., Code I div., [ (A-H) or int.) Gross value at end of reporling period (I) (2) Value Value Method Code 2 O-P) Code 3 (Q-W) J T (I) Type (e.g., buy, sell, redemption) Transactions during reporting period (2) (3) (4) Date Value Gain mm/dd,~yy Code 2 Code 1 (J-P) (A-H) (5) Identity of buyer/seller (if private transaction)

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. II. 12. 13. 14. 1.5. 16.

Chase checking account Fidelity cash reserves account Ohio deferred comp plan/S&P 500 Index Ohio deferred comp plan - Bond Fund Fidelity Investment Grade Bond Fund (IRA) Fidelity Cash Reserves Mutual Fund (IRA) Fidelity Select Health Care Mutual Fund

A A A A A A A A A A A A A A B B A

Interest Interest Dividend Interest Interest Interest Dividend Dividend Interest Interest Dividend Dividend Dividend Dividend Interest Dividend Interest

Closed Closed Closed

J K K K J T T T T T

12/01/10 J 06/01/10 J 06/01/10 J

(IRA)

Fidelity Spartan .500 Index Mutual Fund (IRA) Fidelity Strategic Bond Fund (IRA) Fidelity Cash Reserves Mutual Fund (IRA) Fidelity Magellan Mutual Fund (IRA) Fidelity Overseas Mutual Fund (IRA) Fidelity Blue Chip Mutual Fund Fidelity Growth & Income Mutual Fund Vanguard Ohio Tax-Exempt Money Market Fund Vanguard S&P.500 Index Fund (IRA)

Closed

J J T T Closed Closed K N T T Closed

12/01/10 J

01/01/10 J Ol/OI/lO J

17. Household Finance Corporation bonds

12/01/10 J

1. Income Gain Codes: (Sc Columns BI and IM) 2. Value Codes (See Columrts CI and D3) 3. Value Method Codes (See Colnran C2)

A =$1.000 or less F =$50.001 - $100.000 J =$15.000 or I~.~s N =$250.001 - $500.000 P3 -$25.000.001 - $50.0~O.000 Q =Appraisal U -Book Value

B =$1,001 - $2,500 G =$100.001 - $1.000.000 K =$I 5,001 - $50.000 O =$50~.001 - $1.000.000 R -~osl (Real Estate Only) V =Olhcr

C =$2,501 o $5.000 III =$1.000.001 - $5.000.000 L =$50.001 - $100.000 PI =$1.000.001 - $5.1)00.000 P4 =More than $50.0~).000 S =Assessment W =Eslimatcd

D =$5.001 - $15.000 112 =More than $5.000.000 M ~$10~.001 - $250.1300 P2 =$5.000.001 - $25.000.000 T =Cash Market

E =$15.001 - $50.000

FINANCIAL DISCLOSURE REPORT Page 6 of 8

Name of Person Reporting Sutton, Jeffrey S.

Date of Report 05/12/2011

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust asset.s) Income during reporting period (I) (2) Amount Type (e.g., Code I div., rent, (A-H) or int.) Gross value at end of reporting period Transactions during reporting period

O)

Value Code 2

(J-P)

(2)

Value Method

Code 3

Place "(X)" after each asset exempt from prior disclosure

Typ~ (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mm/dd~yy Code 2 Code I (J-P) (A-tt)

(Q-W)

18. 19. Vanguard S&P 500 Index Fund Admiral Treasury Money Market B C A Dividend Interest Int./Div. M K T T Closed

12/01/10

(5) Identity of buyer/seller (if private transaction)

20. TIAA/CREF Retirement Plan

1. Income Gain Codes: (See Columns BI and IM) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1.000 or less F =$50,001 - $100,000 J =$15.000 o less N =$250.001 - $500.000 P3 =$25,000.001 - $50.0(30.000 Q =Appraisal U =Book Value

B =$1,001 - $2.500 G =$100,001 - $1.000.000 K =$15.001 . $50.000 O =$500.001 - $I,000.000 R =Cost (Real Estate Only) V =Other

C -$2.501 I I I =$ 1.000.001 - $5.000.000 L =$50.001 - $100.000 PI =$1,000.001 - $5.000.000 P4 =More lhan $50.000,000

D =$5.001 - $15.000 112 =More Ihan $5.000.000 M =$10~.001 - 1250.000 P2 =$5,000,001 - $25.000.000 T =Cash Market

E =$15,00L - $50.000

FINANCIAL DISCLOSURE REPORT Page 7 of 8

Name of Person Reporting Sutton, Jeffrey S.

Date of Report 05/12/201 I

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (Indicate part of reporh)

Part Vll. Investments and Trusts Items 17 through 20 are part of a trust.

FINANCIAL DISCLOSURE REPORT Page 8 of 8 IX. CERTIFICATION.

Name of Person Reporting Sutton, Jeffrey S.

Date of Report 05/12/2011

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Jeffrey S. Sutton

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FALLS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- DPWH V CMCDocument4 pagesDPWH V CMCAnonymous yEnT80100% (2)

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- Presidential Decree No. 715 - Amended Anti-Dummy LawDocument2 pagesPresidential Decree No. 715 - Amended Anti-Dummy LawAustin Viel Lagman Medina0% (2)

- Lacey A Collier Financial Disclosure Report For 2010Document6 pagesLacey A Collier Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Scott O Wright Financial Disclosure Report For 2010Document6 pagesScott O Wright Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Rosemary S Pooler Financial Disclosure Report For 2010Document7 pagesRosemary S Pooler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Joseph E Irenas Financial Disclosure Report For 2010Document11 pagesJoseph E Irenas Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Samuel Conti Financial Disclosure Report For 2010Document7 pagesSamuel Conti Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- John R Smoak Financial Disclosure Report For 2010Document7 pagesJohn R Smoak Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Gregory M Sleet Financial Disclosure Report For 2010Document6 pagesGregory M Sleet Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Donald W Molloy Financial Disclosure Report For 2010Document6 pagesDonald W Molloy Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William B Enright Financial Disclosure Report For 2010Document6 pagesWilliam B Enright Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert B Propst Financial Disclosure Report For 2010Document7 pagesRobert B Propst Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William C Lee Financial Disclosure Report For 2010Document6 pagesWilliam C Lee Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Bobby E Shepherd Financial Disclosure Report For 2010Document7 pagesBobby E Shepherd Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Susan O Mollway Financial Disclosure Report For 2010Document7 pagesSusan O Mollway Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David S Doty Financial Disclosure Report For 2010Document7 pagesDavid S Doty Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard L Nygaard Financial Disclosure Report For 2010Document7 pagesRichard L Nygaard Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James L Edmondson Financial Disclosure Report For 2010Document6 pagesJames L Edmondson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Rebecca F Doherty Financial Disclosure Report For 2010Document7 pagesRebecca F Doherty Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Delwen L Jensen Financial Disclosure Report For 2010Document6 pagesDelwen L Jensen Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Gilbert S Merritt Financial Disclosure Report For 2010Document28 pagesGilbert S Merritt Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James C Turk Financial Disclosure Report For 2010Document7 pagesJames C Turk Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Henry F Floyd Financial Disclosure Report For 2010Document6 pagesHenry F Floyd Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Michael R Murphy Financial Disclosure Report For 2010Document6 pagesMichael R Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William J Ditter JR Financial Disclosure Report For 2010Document7 pagesWilliam J Ditter JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Michael A Chagares Financial Disclosure Report For 2010Document6 pagesMichael A Chagares Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Carolyn R Dimmick Financial Disclosure Report For 2010Document6 pagesCarolyn R Dimmick Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Leonard D Wexler Financial Disclosure Report For 2010Document6 pagesLeonard D Wexler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Alan D Lourie Financial Disclosure Report For 2010Document7 pagesAlan D Lourie Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- JR Louis Guirola Financial Disclosure Report For 2010Document6 pagesJR Louis Guirola Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Lee R West Financial Disclosure Report For 2010Document6 pagesLee R West Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Sam A Lindsay Financial Disclosure Report For 2010Document6 pagesSam A Lindsay Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Alicemarie Stotler Financial Disclosure Report For 2010Document6 pagesAlicemarie Stotler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William R Furgeson Financial Disclosure Report For 2010Document9 pagesWilliam R Furgeson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Ment Ira de Financial Disclosure Report For 2010Document12 pagesMent Ira de Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James R Hall Financial Disclosure Report For 2010Document6 pagesJames R Hall Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Carol E Jackson Financial Disclosure Report For 2010Document6 pagesCarol E Jackson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Berle M Schiller Financial Disclosure Report For 2010Document7 pagesBerle M Schiller Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Harold D Vietor Financial Disclosure Report For 2010Document6 pagesHarold D Vietor Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard A Schell Financial Disclosure Report For 2010Document7 pagesRichard A Schell Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Ronald E Longstaff Financial Disclosure Report For 2010Document6 pagesRonald E Longstaff Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Alan B Johnson Financial Disclosure Report For 2010Document7 pagesAlan B Johnson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Eugene E Siler Financial Disclosure Report For 2010Document7 pagesEugene E Siler Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Donald M Middlebrooks Financial Disclosure Report For 2010Document7 pagesDonald M Middlebrooks Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Norma L Shapiro Financial Disclosure Report For 2010Document8 pagesNorma L Shapiro Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- David M Lawson Financial Disclosure Report For 2010Document20 pagesDavid M Lawson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Eric F Melgren Financial Disclosure Report For 2010Document6 pagesEric F Melgren Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Robert S Lasnik Financial Disclosure Report For 2010Document7 pagesRobert S Lasnik Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Charles N Clevert Financial Disclosure Report For 2010Document6 pagesCharles N Clevert Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stephen Anderson Financial Disclosure Report For 2010Document7 pagesStephen Anderson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Raymond J Dearie Financial Disclosure Report For 2010Document7 pagesRaymond J Dearie Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Garland E Burrell JR Financial Disclosure Report For 2010Document6 pagesGarland E Burrell JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Clarence A Beam Financial Disclosure Report For 2010Document7 pagesClarence A Beam Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Brian S Miller Financial Disclosure Report For 2010Document6 pagesBrian S Miller Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- William R Wilson JR Financial Disclosure Report For 2010Document9 pagesWilliam R Wilson JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Stanley T Anderson Financial Disclosure Report For 2010Document6 pagesStanley T Anderson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Malcom J Howard Financial Disclosure Report For 2010Document6 pagesMalcom J Howard Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Kimberly J Muller Financial Disclosure Report For Muller, Kimberly JDocument6 pagesKimberly J Muller Financial Disclosure Report For Muller, Kimberly JJudicial Watch, Inc.No ratings yet

- Ancer L Haggerty Financial Disclosure Report For 2010Document7 pagesAncer L Haggerty Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Richard Linn Financial Disclosure Report For 2010Document18 pagesRichard Linn Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Royce C Lamberth Financial Disclosure Report For 2010Document6 pagesRoyce C Lamberth Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Opinion - JW V NavyDocument7 pagesOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- Holder Travel Records CombinedDocument854 pagesHolder Travel Records CombinedJudicial Watch, Inc.No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Gitmo Water Test ReportDocument2 pagesGitmo Water Test ReportJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JW Cross Motion v. NavyDocument10 pagesJW Cross Motion v. NavyJudicial Watch, Inc.No ratings yet

- Visitor Tent DescriptionDocument3 pagesVisitor Tent DescriptionJudicial Watch, Inc.No ratings yet

- Navy Water Safety ProductionDocument114 pagesNavy Water Safety ProductionJudicial Watch, Inc.No ratings yet

- May 2007 BulletinDocument7 pagesMay 2007 BulletinJudicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- Charge of The Light BrigadeDocument2 pagesCharge of The Light BrigadeYong Bao NiNo ratings yet

- The Estate of The Late Juan B Gutierrez vs. Heirs of Spouses Jose and Gracita CabangonDocument9 pagesThe Estate of The Late Juan B Gutierrez vs. Heirs of Spouses Jose and Gracita CabangonRustom IbañezNo ratings yet

- 40 Hadith On The QuranDocument48 pages40 Hadith On The QuranSaleem Bhimji100% (4)

- Umeh, Chigbo Peter Et Al S8 IndictmentDocument19 pagesUmeh, Chigbo Peter Et Al S8 IndictmentmaryjacobyNo ratings yet

- Compiled Consti2 Digests Part2Document97 pagesCompiled Consti2 Digests Part2cmv mendozaNo ratings yet

- Sahagun Vs CADocument3 pagesSahagun Vs CAVictoria Melissa Cortejos PulidoNo ratings yet

- Patriots Redcoats and SpiesDocument47 pagesPatriots Redcoats and SpiesZondervanNo ratings yet

- Mmiw Research NoellejDocument4 pagesMmiw Research Noellejapi-341711989No ratings yet

- Rasmus Wandal - Danish LawDocument7 pagesRasmus Wandal - Danish LawConstantin ZahariaNo ratings yet

- Tax Collection On GST Portal 2019 2020Document16 pagesTax Collection On GST Portal 2019 2020Disha MohantyNo ratings yet

- Abortion Laws in Ancient PersiaDocument8 pagesAbortion Laws in Ancient Persiadominikus28No ratings yet

- Bouncing Checks NotesDocument3 pagesBouncing Checks NotesRyDNo ratings yet

- Oparel Vs AbariaDocument8 pagesOparel Vs AbariaRap PatajoNo ratings yet

- The Virtues of Syeda FatimaDocument71 pagesThe Virtues of Syeda FatimaMubahilaTV Books & Videos OnlineNo ratings yet

- Coal or Lignite Based Thermal Power Plants in India - UPSC GuideDocument5 pagesCoal or Lignite Based Thermal Power Plants in India - UPSC Guidejaved alamNo ratings yet

- Prince ConsortDocument376 pagesPrince ConsortLilyMollyNo ratings yet

- Dictionary of Canon LawDocument258 pagesDictionary of Canon LawLon Mega100% (3)

- Law Art. 1776-1783 Quiz 1 CoverageDocument9 pagesLaw Art. 1776-1783 Quiz 1 CoverageJahz Aira GamboaNo ratings yet

- ROPA For Sale August 1, 2019Document4 pagesROPA For Sale August 1, 2019April NNo ratings yet

- INS ShivajiDocument3 pagesINS ShivajiSambit ParhiNo ratings yet

- Persons and Family Relations Case DigestDocument23 pagesPersons and Family Relations Case DigestVanessa RambaudNo ratings yet

- General Garments v. PuritanDocument1 pageGeneral Garments v. Puritank santosNo ratings yet

- Writing: A Film ReviewDocument2 pagesWriting: A Film ReviewMihaela DodiNo ratings yet

- Full Download Test Bank For Nutrition For Life 3 e Janice J Thompson Melinda Manore PDF Full ChapterDocument34 pagesFull Download Test Bank For Nutrition For Life 3 e Janice J Thompson Melinda Manore PDF Full Chapterthribbleromeward44i1100% (19)

- Insurance Code". Commissioner". Chanrobles Virtual LawDocument9 pagesInsurance Code". Commissioner". Chanrobles Virtual LawDairen CanlasNo ratings yet

- Case Studies On Unjust DismissalDocument8 pagesCase Studies On Unjust DismissalHimanshu AhujaNo ratings yet

- 004 RAYOS China Banking Corp V CADocument3 pages004 RAYOS China Banking Corp V CATelle MarieNo ratings yet

- ErodeDocument26 pagesErodeRamesh SakthyNo ratings yet