Professional Documents

Culture Documents

Volatilidades Acoes

Volatilidades Acoes

Uploaded by

Wagner ArnholdtOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Volatilidades Acoes

Volatilidades Acoes

Uploaded by

Wagner ArnholdtCopyright:

Available Formats

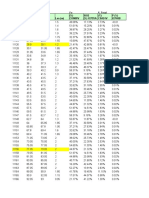

Data Inicial

Data Final

lambda vol.

lambda beta

7/19/2007

7/30/2008

0.9400

1.0000

Fechamento

IBOV

ALLL11

AMBV4

CSAN3

ARCZ6

BBAS3

BBDC4

BRAP4

BRKM5

BRTO4

BRTP3

BRTP4

CCRO3

CESP6

CGAS5

CLSC6

CYRE3

CMIG4

CPLE6

CRUZ3

CSNA3

GOLL4

LAME4

NATU3

ELET3

ELET6

ELPL6

EMBR3

GGBR4

GOAU4

ITAU4

ITSA4

KLBN4

LIGT3

NETC4

PETR3

PETR4

PRGA3

TAMM4

SBSP3

SDIA4

TCSL3

TCSL4

TLPP4

TMAR5

TMCP4

TNLP3

TNLP4

TRPL4

UBBR11

USIM5

VALE3

VALE5

VCPA4

VIVO4

59997.00

20.61

92.49

31.22

10.76

25.28

33.45

36.30

13.80

18.43

50.75

24.29

32.20

29.38

45.99

48.00

23.20

37.19

31.69

46.00

63.40

16.63

11.70

17.87

30.18

26.30

37.49

12.28

34.30

47.10

33.40

10.28

5.27

25.55

19.24

44.61

36.50

42.91

32.60

39.01

11.51

5.45

4.18

45.09

90.80

45.60

40.50

36.23

52.75

21.22

70.80

48.10

41.61

37.41

8.84

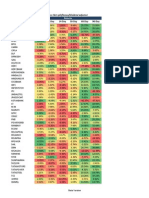

Retorno

Mdio

Dirio

0.02%

-0.13%

-1.08%

-0.04%

-0.06%

-0.07%

-0.18%

-0.33%

-0.11%

0.02%

0.02%

-0.05%

-0.05%

-0.08%

-0.91%

0.08%

0.01%

-0.04%

-0.02%

-0.02%

-0.20%

-0.45%

-0.16%

-0.13%

-0.23%

-0.28%

-0.46%

-0.24%

-0.16%

-0.14%

-0.40%

-0.09%

-0.11%

-0.08%

-0.21%

-0.15%

-0.17%

0.06%

-0.20%

-0.07%

0.07%

-0.27%

-0.20%

-0.16%

0.18%

0.87%

-0.23%

-0.03%

0.12%

-0.05%

-0.04%

-0.27%

-0.27%

-0.10%

0.00%

Desvio

Padro

Dirio

4.23%

3.90%

15.02%

4.33%

5.33%

4.91%

5.21%

6.71%

3.09%

4.73%

2.58%

4.06%

3.89%

3.69%

14.56%

2.37%

5.95%

2.74%

2.62%

5.35%

9.27%

8.54%

5.56%

3.93%

6.70%

5.35%

9.33%

7.05%

18.60%

18.38%

11.97%

4.13%

4.49%

61.80%

5.90%

6.52%

7.41%

5.65%

4.49%

4.08%

5.52%

5.41%

4.86%

2.72%

2.88%

14.43%

4.72%

3.54%

3.29%

4.97%

5.39%

10.15%

9.75%

5.65%

5.27%

Retorno

Ajustado

Dirio

0.41%

-3.34%

-7.21%

-1.03%

-1.18%

-1.36%

-3.47%

-4.95%

-3.53%

0.46%

0.60%

-1.33%

-1.39%

-2.16%

-6.24%

3.25%

0.22%

-1.38%

-0.81%

-0.39%

-2.17%

-5.21%

-2.80%

-3.36%

-3.42%

-5.17%

-4.88%

-3.39%

-0.87%

-0.76%

-3.38%

-2.16%

-2.46%

-0.12%

-3.62%

-2.28%

-2.36%

1.07%

-4.51%

-1.73%

1.27%

-4.93%

-4.05%

-5.98%

6.11%

6.04%

-4.97%

-0.83%

3.66%

-0.92%

-0.80%

-2.67%

-2.74%

-1.81%

-0.09%

Volatilidade

(DP)

anual

67.09%

61.91%

238.38%

68.72%

84.64%

77.98%

82.75%

106.52%

49.11%

75.08%

40.99%

64.40%

61.79%

58.50%

231.08%

37.63%

94.42%

43.50%

41.52%

84.95%

147.13%

135.51%

88.33%

62.41%

106.39%

84.90%

148.17%

111.96%

295.32%

291.79%

189.99%

65.61%

71.21%

981.04%

93.63%

103.47%

117.55%

89.76%

71.33%

64.84%

87.56%

85.91%

77.14%

43.10%

45.65%

229.00%

74.93%

56.15%

52.20%

78.91%

85.57%

161.18%

154.84%

89.77%

83.66%

Volatilidade

(EWMA)

anual

128.30%

109.70%

123.68%

109.22%

171.96%

150.46%

143.65%

187.02%

68.73%

130.37%

29.96%

105.47%

67.35%

59.20%

33.20%

33.14%

182.80%

47.21%

57.43%

144.92%

187.50%

320.20%

154.18%

97.75%

88.58%

56.98%

60.04%

227.17%

612.73%

600.68%

312.83%

112.77%

138.04%

95.49%

154.79%

146.18%

156.45%

176.27%

134.44%

108.85%

165.79%

148.11%

128.86%

56.63%

64.47%

48.86%

138.32%

90.14%

70.05%

155.33%

158.36%

191.78%

171.86%

187.26%

149.81%

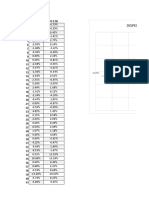

Volatilidade

EWMA/DP

Beta

Obs.

1.9124

1.7719

0.5189

1.5893

2.0315

1.9295

1.7360

1.7557

1.3995

1.7364

0.7310

1.6376

1.0900

1.0118

0.1437

0.8808

1.9361

1.0853

1.3831

1.7059

1.2744

2.3629

1.7456

1.5661

0.8326

0.6712

0.4052

2.0290

2.0748

2.0586

1.6465

1.7188

1.9384

0.0973

1.6532

1.4128

1.3308

1.9638

1.8848

1.6788

1.8935

1.7241

1.6705

1.3138

1.4123

0.2134

1.8460

1.6054

1.3419

1.9685

1.8507

1.1898

1.1099

2.0861

1.7906

1.0000

0.6046

0.7051

(0.1619)

0.9902

0.9740

0.9979

0.9825

0.3411

0.8005

0.2145

0.6104

0.0690

0.2238

0.2336

0.0603

0.9285

0.1877

(0.0178)

0.8739

1.2074

1.3987

0.9042

0.5367

(0.0748)

0.1552

0.1325

1.1717

2.5365

3.0327

1.3886

0.8017

0.7051

0.1483

0.9783

0.8865

0.9572

0.8914

0.6520

0.5942

0.8301

0.8418

0.8452

0.3119

0.2927

0.0344

0.6550

0.4464

(0.0314)

0.8119

0.6708

0.8091

0.7537

0.9873

0.6755

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

251

You might also like

- Charting Filter - 02242018Document115 pagesCharting Filter - 02242018Titus Keith CaddauanNo ratings yet

- StockDocument6 pagesStockLalit mohan PradhanNo ratings yet

- Planilha (Aulas Iniciais) Curso Avançado de ExcelDocument8 pagesPlanilha (Aulas Iniciais) Curso Avançado de ExcelluanaNo ratings yet

- Ações AtualDocument18 pagesAções Atualyatan001No ratings yet

- Ações OdsDocument12 pagesAções OdsMaul CarlosNo ratings yet

- Bisi Day TradingDocument38 pagesBisi Day TradingMaiquel de CarvalhoNo ratings yet

- Inchang ElectronicsDocument4 pagesInchang ElectronicsVicenteAMartinezGNo ratings yet

- Sample # From (M) To (M) Len (M) Fe (%) Con08V Sio2 (%) Icp95A S - Total (%) Csa24V P (%) Icp40BDocument6 pagesSample # From (M) To (M) Len (M) Fe (%) Con08V Sio2 (%) Icp95A S - Total (%) Csa24V P (%) Icp40BjuliaNo ratings yet

- Sample # From (M) To (M) Len (M) Fe (%) Con08V Sio2 (%) Icp95A S - Total (%) Csa24V P (%) Icp40BDocument6 pagesSample # From (M) To (M) Len (M) Fe (%) Con08V Sio2 (%) Icp95A S - Total (%) Csa24V P (%) Icp40BjuliaNo ratings yet

- CorregidoDocument31 pagesCorregidoEleonor de PortillaNo ratings yet

- DerivativekitDocument71 pagesDerivativekitMohit SoniNo ratings yet

- Carhart 4 Factor DataDocument26 pagesCarhart 4 Factor Datadheeraj agarwalNo ratings yet

- Carhart 4 Factor DataDocument26 pagesCarhart 4 Factor DataDilshadNo ratings yet

- Stocks Last Change %change Open Low High Close: Psei Hold PropDocument160 pagesStocks Last Change %change Open Low High Close: Psei Hold PropAndress PadillaNo ratings yet

- HistoricalinvestDocument10 pagesHistoricalinvestranvijaygalgotias27No ratings yet

- BoostrapDocument6 pagesBoostrapNatchanon ChaipongpatiNo ratings yet

- Front End Dashboard YTD APPL (99) - 240516 - 083846Document1 pageFront End Dashboard YTD APPL (99) - 240516 - 083846jorgemiguel.rosas.1No ratings yet

- Roa Der Eps PBV Saham AktifDocument2 pagesRoa Der Eps PBV Saham Aktiftirakirana17No ratings yet

- Georgia State Proposed Map For Voting DistrictDocument9 pagesGeorgia State Proposed Map For Voting DistrictWSB-TV Assignment DeskNo ratings yet

- Empresas de EnergiaDocument2 pagesEmpresas de EnergiaBruno Henrique CardosoNo ratings yet

- Port. de InvDocument7 pagesPort. de InvAdrian Duran ValenciaNo ratings yet

- Copia de EjercicioDocument6 pagesCopia de EjercicioWilson Jose Soto De LeonNo ratings yet

- EjercicioDocument6 pagesEjercicioWilson Jose Soto De LeonNo ratings yet

- Taller 2 MFDocument16 pagesTaller 2 MFLeidy23No ratings yet

- Stock Vichhar Volume ScannerDocument14 pagesStock Vichhar Volume ScannerAkash PattanshettyNo ratings yet

- Front End Dashboard YTD APPL (82) 2024Document1 pageFront End Dashboard YTD APPL (82) 2024jorgemiguel.rosas.1No ratings yet

- DerivativekitDocument69 pagesDerivativekitLISHA AVTANI100% (1)

- Breakout Stock: Thursday, September 16, 2021Document1 pageBreakout Stock: Thursday, September 16, 2021Imran KhanNo ratings yet

- PiñerazoDocument8 pagesPiñerazomatiasNo ratings yet

- District Summary PRESIDENT FINAL 2021Document6 pagesDistrict Summary PRESIDENT FINAL 2021Naghib BogereNo ratings yet

- Technidex: Stock Futures IndexDocument3 pagesTechnidex: Stock Futures IndexRaya DuraiNo ratings yet

- Nifty: Date Rel Nav Sahara NavDocument8 pagesNifty: Date Rel Nav Sahara Navmayankco84No ratings yet

- Assignment Regression Beta 03Document5 pagesAssignment Regression Beta 03John DummiNo ratings yet

- Kuala Lumpur Stock Exchange KLSE Main Board 24-Sep-08Document14 pagesKuala Lumpur Stock Exchange KLSE Main Board 24-Sep-08starchaser082243No ratings yet

- 3.2.2b Tính Beta Và Chi Phi Von ChuDocument10 pages3.2.2b Tính Beta Và Chi Phi Von ChuLê TiếnNo ratings yet

- Simple ScreeningDocument2 pagesSimple ScreeningJeffry KurniadiNo ratings yet

- Nopri Herlinda (1984202017) Soal 3Document2 pagesNopri Herlinda (1984202017) Soal 3Nopri HerlindaNo ratings yet

- 4PCFINANZASParte II.0Document30 pages4PCFINANZASParte II.0xiomaraNo ratings yet

- ProjectDocument14 pagesProjectSameer BhattaraiNo ratings yet

- BreakdownDocument103 pagesBreakdownhandiNo ratings yet

- Book 2Document1,004 pagesBook 2ss3428448No ratings yet

- Nifty Beat 02 Nov 2010Document1 pageNifty Beat 02 Nov 2010FountainheadNo ratings yet

- Resumen de Registro de Perforación de Diamante - Bob1 ZoneDocument8 pagesResumen de Registro de Perforación de Diamante - Bob1 ZoneJhonny Carrasco TaipeNo ratings yet

- Date Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfDocument5 pagesDate Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfJohn DummiNo ratings yet

- Actividad 4 - Taller Análisis Horizontal y VerticalDocument3 pagesActividad 4 - Taller Análisis Horizontal y Verticalrobinson martinezNo ratings yet

- Ranvijay BaDocument5 pagesRanvijay Baranvijaygalgotias27No ratings yet

- Dashboard 13 MAY 24Document5 pagesDashboard 13 MAY 24jorgemiguel.rosas.1No ratings yet

- Fay PengukuranDocument4 pagesFay PengukuranMaman SomantriNo ratings yet

- Bigote Basic Screener - Updtd.04.02.20Document87 pagesBigote Basic Screener - Updtd.04.02.20Erjohn PapaNo ratings yet

- WarrantsDocument2 pagesWarrantstok janggutNo ratings yet

- BVB - Indicatori 2015-20Document8 pagesBVB - Indicatori 2015-20Viorica Madalina ManuNo ratings yet

- Rendimiento de AccionesDocument6 pagesRendimiento de AccionesFrancis Ariana Cervantes BermejoNo ratings yet

- CP22 - Nepra 062022 4QTRDocument25 pagesCP22 - Nepra 062022 4QTRGYAAN-E-NAFSIYATNo ratings yet

- Trabajo ColaborativoDocument103 pagesTrabajo ColaborativoLady OrtegaNo ratings yet

- Book 2Document1,014 pagesBook 2ss3428448No ratings yet

- Guia EstadisticaDocument304 pagesGuia EstadisticaYesica RosasNo ratings yet

- AnnexuresDocument23 pagesAnnexuresMohit AnandNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet