Professional Documents

Culture Documents

Brands On The Run

Brands On The Run

Uploaded by

Geena Mary GeorgeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Brands On The Run

Brands On The Run

Uploaded by

Geena Mary GeorgeCopyright:

Available Formats

Brands on the Run: In Fashion World, the Anonymous Catch the Fabulous.

NEW YORK -- For eight years, it was a partnership between a big name and a no-name. Ralph Lauren, a master of marketing his glamorous all-American image, supplied his design direction and cachet to a line of clothes aimed at department stores. Jones Apparel Group Inc. was the behind-the-scenes workhorse that oversaw production and delivery of affordably priced sweaters, pants and shirts carrying the designer's famous logo. Together, they produced the hugely successful Lauren line, racking up sales of $547 million last year. So it came as a shock to the fashion industry this summer, when Jones slapped Mr. Lauren's company, Polo Ralph Lauren Corp., with a $550 million breach-of-contract lawsuit in New York State Supreme Court and abruptly halted production of the Lauren line. The two companies were fighting over control of the line -- and instead of quietly caving in to what it thought were unreasonable demands, as suppliers often did; Jones was making a public stink. Jones quickly took the fight a step further and announced it was launching its own clothing line to compete with Polo's offerings. The lawsuit put the fashion world on notice: Suddenly, an anonymous clothing supplier such as Jones was prepared to play hardball with an illustrious fashion designer. It also underscored a shift in the balance of power under way on Seventh Avenue. Celebrity designers, long the undisputed commanders of the fashion industry, are losing leverage to manufacturers. Consumers are partly to blame. Once hungry for the status of brand names, American women fueled the designer boom of the late-1980s and 1990s, transforming the likes of Mr. Lauren, Calvin Klein and Donna Karan into superstars. But more recently, tastes have shifted away from many expensive and over-exposed designer labels, making it chic to shop at chains such as the Gap and mass-marketers such as Target. An even more important factor in the shift has been retail consolidation amid a slowdown in sales. As retailers get bigger through mergers, they're increasingly demanding the kind of sophisticated distribution that only big vendors can provide. So, over the past several years, suppliers such as Jones, VF Corp. and Liz Claiborne Inc. started bulking up with acquisitions to boost revenue and negotiating clout with giant chains such as Federated Department Stores Inc. and May Co. No longer content to license designer names and pay royalties, Jones and other clothing suppliers now are on the prowl to buy them. These new fashion conglomerates are seeking a mix of offerings so they aren't too dependent on one designer, especially with Wall Street watching. Many established designers, meanwhile, see that their brands have a better shot at growth if they team up with a conglomerate. To be sure, Polo has kept growing overall during this period, and its brand cachet is as strong as it has ever been. Moreover, new designers, such as Marc Jacobs, part of LVMH Moet Hennessey Louis Vuitton, have seen their stars rise. Still, on the whole, it's a buyer's market. In February, Calvin Klein sold his closely held firm for $430 million to shirt maker Phillips-Van Heusen Corp. -- less than half the $1 billion the designer was asking three years ago. In July, VF gobbled up Nautica for $600

million. And last month, Jones agreed to pay nearly $217 million for the maker of Anne Klein sportswear, Kasper A.S.L. Ltd. "The most successful long-term model is how diversified and balanced you can be," says Jones CEO Peter Boneparth. "I don't think the landscape allows the meteoric growth of a designer that it once did." The success of the Lauren clothing line "was a freak," he adds. Mr. Lauren, the last American high-fashion icon to head up his own public company, argues that there's plenty of room for growth in the Lauren brand. Polo Ralph Lauren, he points out, has roughly doubled in size since it went public in 1997, with sales rising every year. "Our brand is stronger than it's ever been," the designer bragged this summer. So far, the market is betting on Mr. Lauren. Year to date, Polo's stock has risen 29%, while Jones's has fallen 12%. The Bronx-born Mr. Lauren, 63 years old, turned a simple tie business into a global powerhouse with fiscal 2003 sales of $2.44 billion. He says clothing manufacturers that think they can succeed simply by buying up new lines face risks. "It's not about acquisitions," says Mr. Lauren in an interview. "It's about companies that are really special." He adds, "You buy a company, it looks good for a minute, and then all of a sudden, the management is weak. The product is weak." If you want the business to grow, he asks, "who better than the guy who conceived the business?" It was a very different era when Polo and Jones became partners in 1995. At the time, Mr. Lauren, who had tapped into America's aspirations to an upper-crust lifestyle, was looking to expand in the high-volume department store business. Jones, by contrast, was a maker of midpriced clothes for women to wear to work under the Jones New York and Evan Picone labels. Much like other clothing suppliers at the time, Jones wasn't part of the glamorous designer scene. The son of a West Philadelphia cab driver, Jones Chairman Sidney Kimmel had built Jones from a division of chemical giant W.R. Grace & Co. into a respected apparel supplier. Jones went public in 1991 and by 1995 had sales of almost $780 million. Polo and Jones worked out a licensing deal for the new Lauren line: Jones would produce the women's sportswear brand and pay Lauren a 7% royalty rate on sales. Lauren became a centerpiece of department stores nationwide, translating Polo's allAmerican image into sweaters, pants and tops ordinary women could afford. In its first year, Lauren racked up sales of $48 million. In its second year, sales jumped to $270 million. By 2000, sales topped $500 million. The runaway success of Lauren marked the beginning of a period of expansion for Jones and the entire fashion industry. In 1998, Mr. Kimmel began an acquisition spree, branching into denim, footwear, jewelry, trendy junior fashions and clothing and shoe retailing. In 2001, Jones bought McNaughton Apparel Group, a maker of moderately priced women's sportswear -- and got Peter Boneparth in the bargain. A financial whiz who was McNaughton's CEO at the time, Mr. Boneparth stayed on to run the division under Jones and took a seat on the company's board. By the time Mr. Kimmel tapped Mr. Boneparth in 2002 to be CEO, Jones owned brands ranging from Jones to Nine West to Gloria Vanderbilt. It boasted $4.3 billion in annual sales.

Mr. Boneparth, 43, was one of a new breed of professionally trained managers hired to run big fashion businesses, far different from the street-smart "garmentos" that long dominated the rag trade. An investment banker who took fashion companies public in the 1990s, Mr. Boneparth knows some fashionistas worry that he's merely a "financial geek." "Of course, it's a design-driven process, that is a prerequisite," he says, but adds that financial expertise is just as important in running a publicly traded conglomerate. His no-nonsense approach with Wall Street also set him apart from some other managers, who were often more deferential to big-name designers and more discreet when discussing poor results. During quarterly conference calls, he gave frank assessments of Lauren's performance, telling analysts it had reached a peak at department stores. This candor didn't sit well with Polo. In one meeting, Mr. Lauren himself lectured Mr. Boneparth, telling him to stop describing the Lauren business to analysts as "mature," people familiar with the conversation say. Mr. Lauren told Mr. Boneparth he believed the brand still had plenty of room for growth. The relationship began to fray last year when Lauren's sales dipped for the first time -by 5% to $547 million -- mirroring a downturn in department-store apparel sales. Polo executives publicly blamed Jones for the decline, saying the line had strayed from its original style and become too bland and that Jones had taken short cuts, such as using cheaper fabrics. Privately, they accused Jones of steering Lauren away from popular office styles to favor its own Jones New York label. Whoever was to blame, Polo was under pressure to show growth. Its menswear sales were falling, and its share price was barely above its 1997 initial offering price. Polo began to plot its next move. The Lauren license with Jones wasn't due to expire until 2006, but Polo wanted better terms. The 7% rate was on the low end of industry norms. Analysts believed the $36 million in license fees Polo collected last year was more or less pure profit. But Polo executives estimated that Jones itself was making more than $160 million in operating profit from the brand. Jones declines to comment on Lauren's profitability. At first, Polo, which produces its high-end Blue Label and Purple Label lines without Jones, wanted to push -- but not too hard. It wanted Jones to continue producing the collection because it wasn't yet ready to take on the logistical headaches of managing production and delivery of a high-volume clothing line, say people in the Polo camp. In November, Polo Chief Operating Officer Roger Farah went to Mr. Boneparth and told him about a clause in the contract called a "cross default" agreement, say people familiar with the meeting. This clause purportedly allowed Polo to take back the Lauren license in 2003, three years ahead of the date stipulated by the contract, if Jones missed minimum sales targets on Ralph, another Ralph Lauren brand handled by Jones. Sales of Ralph, a line aimed at young women, were $37 million last year, far short of its $100 million minimum. Mr. Farah made it clear that he was prepared to invoke the cross-default agreement, but he could be persuaded not to if Jones would more than double its royalties to 15%, an unusually high rate even for a popular brand such as Lauren. Mr. Boneparth was surprised -- he didn't even know the cross-default agreement existed, say people close to him. But Jones executives interpreted the agreement differently, arguing their rights to the Lauren line were still intact. Polo also wanted a 15% royalty for Polo Jeans -- another line licensed by Jones -- and minimum royalty payments from Jones of $125 million, people close to Jones say. Polo declines to comment.

Polo's aggressive actions reflected its confidence in its position: Polo was Jones's largest licensing partner. In January, Jones offered a royalty rate of 10%. The Polo camp considered this "unacceptable," according to people close to Polo, especially since they felt Jones had indicated it would go as high as 12.5%. Polo executives were also taken aback when Jones decided to disclose the impasse in a Feb. 4 news release, just ahead of its earnings announcement. Jones shares sank 8% to $29.50 that day, while Polo's shares fell less than 1% to $21.09. Mr. Boneparth had sent a message -- he was willing to risk Wall Street's wrath to stand up to Polo. By March, the two companies realized they couldn't agree on the value of the Lauren line and decided to go their separate ways. Their plan called for an orderly transition that would allow Jones to operate Lauren until June 2004. Polo also would buy back Polo Jeans for more than $300 million in cash. But in late May, Mr. Boneparth got news that was a surprise to him, people close to Jones say: The tax consequences of a Polo Jeans sale would be too great for Jones to absorb. On June 3, Mr. Boneparth and several Jones advisers walked into Polo headquarters prepared for a showdown. In a conference room just off the mahogany-paneled lobby, Mr. Boneparth reiterated to Polo executives that there was a tax problem with Polo Jeans and asked for a last-minute change in terms. Polo's executives, enraged, wouldn't budge, according to people familiar with the meeting. Mr. Boneparth called for a recess. After Polo's executives left the room, Mr. Boneparth gave the nod to an adviser to call the New York State Supreme Court, where a lawyer was waiting. When the Polo executives filed back in, Mr. Boneparth turned to Mr. Farah. "We just sued you," he announced, according to people familiar with the meeting. The suit sought $550 million in damages, claiming that Polo never had the right to take back the line early, and its efforts to do so amounted to "legal jujitsu." Polo later filed its own complaint, asking the court to affirm its rights to take back the Lauren license. In addition to the suit, Mr. Boneparth said Jones would stop production of Lauren right away. He had another surprise in store for Polo as well. In January, as a hedge against the possible loss of Lauren, Jones had quietly begun work on a new "Jones Signature" line, aimed at Lauren customers. This brand would have stayed on the drawing board if the Lauren relationship had continued, but now, Mr. Boneparth ordered all Jones's Lauren designers, pattern makers and production teams to shift their energies into the new line. Due to be delivered in stores early next year, Jones is targeting first-year sales of $200 million. "It was sort of like an epiphany," says one person familiar with a Jones board meeting ahead of the showdown with Polo. Earlier talk of making an orderly transition with Polo evaporated. "We thought, why are we helping them?" The lawsuit is still pending, and Polo Jeans remains controlled by Jones. Polo has taken back the Lauren line and plans to manufacture and distribute the line itself as part of an overall strategy to take back certain licenses and assume more operating responsibility. Last week, Jones unveiled its new Jones Signature line to retailers. At the same time, Polo showed off its Lauren line. They will go head-to-head in the marketplace next spring.

You are required to identify two examples each of (1) any of the five forces in the apparel industry and (2) macro environmental forces operating in the apparel industry. For each of the two questions in Section A, please format your answer as given below: Identify the phenomena or events in the article that you think provides respective examples. Provide a brief summary of the information in the article that supports your arguments. Briefly explain the effect that the forces have on the potential profitability of the industry. Q1. Identify two examples of any of the five forces in the apparel industry as described in the article. For each example, format your discussion as outlined above. Q2. Identify two examples of macro environmental forces affecting the apparel industry as described in the article. For each example, format your discussion as outlined above.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- WZZ Cabin Attendant Workwear Regulations Revision 02Document55 pagesWZZ Cabin Attendant Workwear Regulations Revision 02Alex RoșuNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pattern BlocksDocument29 pagesPattern BlocksErica Arthur Auguste100% (10)

- On Vero ModaDocument9 pagesOn Vero ModaSalil Rai0% (1)

- Caroline Molloy - Resume OfficialDocument2 pagesCaroline Molloy - Resume OfficialCaroline MolloyNo ratings yet

- Tips On New Styles For Punjabi SuitsDocument2 pagesTips On New Styles For Punjabi SuitsPakistani DressesNo ratings yet

- BRMDocument11 pagesBRMSatish TripathiNo ratings yet

- Contoh Announcement TextDocument2 pagesContoh Announcement TextLystia PrimandhaniNo ratings yet

- Ffashion Figure TemplatesDocument29 pagesFfashion Figure TemplatesSteve Todd100% (5)

- Vocabulary Worksheet: STUDENT'S NAME: - DATEDocument5 pagesVocabulary Worksheet: STUDENT'S NAME: - DATEJesus RodriguezNo ratings yet

- Sabyasachi Mukherjee - WikipediaDocument32 pagesSabyasachi Mukherjee - WikipediaSahil DabhoyaNo ratings yet

- Plus Size Pants Patterns Round Up - XLSX Sheet1 2Document26 pagesPlus Size Pants Patterns Round Up - XLSX Sheet1 2adi mer100% (1)

- Zalando SE - Investor Factbook - 3Document110 pagesZalando SE - Investor Factbook - 3HjraNo ratings yet

- 1 Fashion BlueprintDocument5 pages1 Fashion Blueprintapi-283745735No ratings yet

- International Journey of History and Culture Studies BatikDocument12 pagesInternational Journey of History and Culture Studies BatikZalinah Mohd YusofNo ratings yet

- Luna Lapin TemplatesDocument30 pagesLuna Lapin Templates7c7hdvhcbjNo ratings yet

- Arome Alternative 2012Document2 pagesArome Alternative 2012Irimia AlexandruNo ratings yet

- Assignment Name:: History of CostumesDocument9 pagesAssignment Name:: History of CostumesDiksha JaiswalNo ratings yet

- Generation Gap ProjectDocument28 pagesGeneration Gap Projecti222519 Altaf UrNo ratings yet

- Section A Reading (20 Marks) : Sample Question PaperDocument7 pagesSection A Reading (20 Marks) : Sample Question PaperLakshya DhawanNo ratings yet

- Third Periodical Test 2020Document3 pagesThird Periodical Test 2020Wendy ArnidoNo ratings yet

- Nivesh PWC SDocument8 pagesNivesh PWC Spushpak maggoNo ratings yet

- Add Magic 2024Document1 pageAdd Magic 2024Samveg MehtaNo ratings yet

- Week-4Document1 pageWeek-4KARISHMA RAJNo ratings yet

- Week 7 Practice ExamDocument4 pagesWeek 7 Practice ExamZwollywoodsNo ratings yet

- Members List of Garment IndustryDocument9 pagesMembers List of Garment IndustryRapalla Shriniwas100% (1)

- John WickDocument11 pagesJohn Wicksandra perez100% (2)

- CERTIFICATEDocument5 pagesCERTIFICATEArchie SrivastavaNo ratings yet

- Luxeire PlanbookDocument121 pagesLuxeire PlanbookZack SmithNo ratings yet

- Simplicity 2207 PDFDocument1 pageSimplicity 2207 PDFClaudiaUrrutiaNo ratings yet

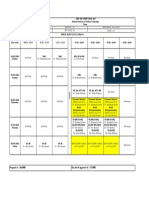

- A B C D E F G H I: Monday Tuesday Wednesday Thursday FridayDocument1 pageA B C D E F G H I: Monday Tuesday Wednesday Thursday Fridayapi-327218830No ratings yet