Professional Documents

Culture Documents

LTA - Form - Vedanta

Uploaded by

Huzefa HussainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LTA - Form - Vedanta

Uploaded by

Huzefa HussainCopyright:

Available Formats

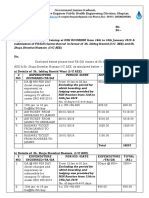

Vedanta Aluminium Limited

Jharsuguda, Orissa

CLAIM FOR LEAVE TRAVEL CONCESSION FOR THE YEAR 2011

NAME

HUZEFA HUSSAIN 210474 02/11/1998

DESIGNATION: AGM BASIC DOC : 57,450/: 01/05/2000

EMP NO : DOJ :

PLACE VISITED

JAMNAGAR, AHEMADABAD & MUMBAI

I HEREBY CERTIRY THAT I WAS ON LEAVE FROM TO VISIT JAMNAGAR, AHEMADABAD & MUMBAI MAY BE REIMBURSED RS. 57,450 (RUPEES

29/08/2011

TO

08/09/2011

WITH MY FAMILY.HENCE I Fifty Seven Thousand and four fifty )

AS PER THE LEAVE TRAVEL CONCESSION RULES OF THE COMPANY.

DATE: CERTIFICATION OF THE HRD DEPARTMENT YES HE HAS AVAILED PL FROM

SIGNATURE OF THE EMPLOYEE

TO

HRD DEPARTMENT FOR ACCOUNTS DEPARTMENT USE APPROVING AUTHORITY

CHECKED BY

GENERAL MANAGER(F&A)

DECLARATION UNDER RULE 2-B OF THE INCOME TAX RULES ,1962 1. Name of the Employee Huzefa Hussain

2.

Name of the family members whose travelling Expenses are claimed indicating the relationship With the employee (if parent, brother or sisters, it Should be declared whether they are solely or mainly Dependent on the employee) Whether this is first or second journey during the Block period and whether it is carried over from the Last back. i) ii) Place to which journey undertaken (Destination) Period of leave from 29/08/11

Fatima Hussain Zahra Hussain

3.

4.

Jamnagar to 08/09/11 29.08.2011 30.08.2011 07.09.2011 08.09.2011

5.

Date of departure from Head Quarter Date of arrival at destination Date of commencement of return journey Date of return to Head Quarter

6. 7. 8.

Route taken (if it is not shortest route) Distance of actual route of the shortest route Whichever is lesser. Actual mode of travel by Air/Rail/Bus/Car/ Ship if more than one mode is used state Separately the mode and distance. Amount of reimbursement eligible and other Companies rule. Actual expenses incurred by the employee On travel alone during the above journey to And fro. Amount eligible for exemption with reference To the permitted mode of travel by the shortest Route indicating such distance and the rate Adapted limited to actual expenses. 4200 km Car

9. 10.

57,450/58,800/-

11.

57,450/-

It is certified that the information furnished above are true and correct that the amount claimed by way of exemption under Section 10(V) has been actually spent as expenses on travel fares Signature of the employee

You might also like

- LTA - FormDocument3 pagesLTA - FormpowermuruganNo ratings yet

- T AllowanceDocument3 pagesT AllowanceiTouch4UNo ratings yet

- Deputy Controller, Legal Metrology, Odisha BhubaneswarDocument6 pagesDeputy Controller, Legal Metrology, Odisha Bhubaneswarthe creationNo ratings yet

- Leave Travel Concession Bill: (To Be Filled by The Government Servant)Document4 pagesLeave Travel Concession Bill: (To Be Filled by The Government Servant)Vemajala GaneshNo ratings yet

- Approval Cum Delivery OrderDocument2 pagesApproval Cum Delivery OrderAnonymous e1FLFOPGUXNo ratings yet

- Ta BillDocument1 pageTa BilladepuharinathNo ratings yet

- Dhanasekaran Covering LeterDocument10 pagesDhanasekaran Covering LeterAgotNo ratings yet

- Sumit Chauhan - Bhopal-DELDocument1 pageSumit Chauhan - Bhopal-DELMONISH NAYARNo ratings yet

- Claim Formats For Medical Fuel LTA and Telephone BillsDocument5 pagesClaim Formats For Medical Fuel LTA and Telephone Billsabhi852004No ratings yet

- Form MH PCOPDocument2 pagesForm MH PCOPSHREE MOTOR DRIVING SCHOOLNo ratings yet

- Discount-1 Year Insurance Free Cash Discount-2,500/ - Exchange Bonous - 10,000/ - Hyundai Happy Hour - 2000Document1 pageDiscount-1 Year Insurance Free Cash Discount-2,500/ - Exchange Bonous - 10,000/ - Hyundai Happy Hour - 2000Ranjan Kumar PandabNo ratings yet

- Farzi Ticket Udit SinghDocument2 pagesFarzi Ticket Udit SinghPankaj Kumar SinghNo ratings yet

- By Speed Post/ Registered Post: Without PrejudiceDocument3 pagesBy Speed Post/ Registered Post: Without PrejudiceSharjeel AhmadNo ratings yet

- Foreign Tour-New Zea Land Ta ClaimDocument2 pagesForeign Tour-New Zea Land Ta Claimraja471No ratings yet

- Leave Travel Concession BillDocument5 pagesLeave Travel Concession BillRahul SinghNo ratings yet

- TS08UL1294Document1 pageTS08UL1294nedurikalyan9No ratings yet

- TA Bill Hometown ManishDocument2 pagesTA Bill Hometown Manishssachin_sonawaneNo ratings yet

- It Is Certified That The Information Given Above Is True To The Best of My Knowledge and BeliefDocument2 pagesIt Is Certified That The Information Given Above Is True To The Best of My Knowledge and Beliefnkc63No ratings yet

- Sanction Letter For Hucchesab BagwanDocument1 pageSanction Letter For Hucchesab BagwanSwapnil GohaneNo ratings yet

- Wa0000.Document4 pagesWa0000.Chetan SinghNo ratings yet

- LTC Advance and Final Claims FormsDocument27 pagesLTC Advance and Final Claims Formsseeyem2000100% (3)

- A Banu Prakash vs. Thimma Setty & Ors. ( (Principle of Pay & Recover) Statutory Right of Third Party To Be Compensated Under Section 149 MV Act Even If Vehicle Owner Contests Claim Karnataka HC)Document13 pagesA Banu Prakash vs. Thimma Setty & Ors. ( (Principle of Pay & Recover) Statutory Right of Third Party To Be Compensated Under Section 149 MV Act Even If Vehicle Owner Contests Claim Karnataka HC)BIRENDER SINGHNo ratings yet

- Claim Form: Company Ijm Corporation BerhadDocument6 pagesClaim Form: Company Ijm Corporation BerhadMohd MohdNo ratings yet

- TA Bill in ExcelDocument6 pagesTA Bill in ExcelAniket SinhaNo ratings yet

- Name Designation Department Date of Joining Address: Final Settlement Form Personnel InformationDocument8 pagesName Designation Department Date of Joining Address: Final Settlement Form Personnel InformationFarrukh TouheedNo ratings yet

- TA ClaimDocument2 pagesTA ClaimShuja ShowkatNo ratings yet

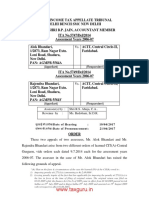

- Alok Bhandari Anr. vs. ACIT ITAT DelhiDocument7 pagesAlok Bhandari Anr. vs. ACIT ITAT DelhivedaNo ratings yet

- Application Form For Grant of LTC AdvanceApplication Form For Grant of LTC AdvanceDocument7 pagesApplication Form For Grant of LTC AdvanceApplication Form For Grant of LTC AdvanceJitendra Suraaj TripathiNo ratings yet

- Central Civil Services (Leave Travel Concession) Rules, 1988 - Relaxation To Travel by Private Airlines To Visit Jammu & Kashmir-Extension RegDocument4 pagesCentral Civil Services (Leave Travel Concession) Rules, 1988 - Relaxation To Travel by Private Airlines To Visit Jammu & Kashmir-Extension Regrakeshambasana100% (1)

- Abhii SlotDocument4 pagesAbhii SlotAjay RaghavNo ratings yet

- Travel Call For Quotes 2021Document3 pagesTravel Call For Quotes 2021Himanshu SahaniNo ratings yet

- Office of The Comptroller Sindh House Islamabad, DATED: - / /2016Document337 pagesOffice of The Comptroller Sindh House Islamabad, DATED: - / /2016Muhammad MehrbanNo ratings yet

- LTC TA GPF Medical Forms For Central Govt EmployeesDocument27 pagesLTC TA GPF Medical Forms For Central Govt Employeesrkthbd5845No ratings yet

- RD THDocument2 pagesRD THRizwan PathanNo ratings yet

- Directorate General of Vigilance, Customs and Central Excise, West Zonal Unit, MumbaiDocument6 pagesDirectorate General of Vigilance, Customs and Central Excise, West Zonal Unit, Mumbaifandyanu1No ratings yet

- Airworthiness 6.3.13Document16 pagesAirworthiness 6.3.13Sri Ashok PerumallaNo ratings yet

- Final Reply 425-8 IMTDocument2 pagesFinal Reply 425-8 IMTGirish SharmaNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument5 pagesBajaj Allianz General Insurance Company LTDRahul KumarNo ratings yet

- Ishida India Pvt. Ltd.Document2 pagesIshida India Pvt. Ltd.Reshmi VarmaNo ratings yet

- Feeder Pole DegienDocument20 pagesFeeder Pole DegienDEBLEENA VIJAYNo ratings yet

- Awasthi Brothers CaseDocument3 pagesAwasthi Brothers CaseChakravarthi B ANo ratings yet

- Tenderer/ Bulk Buyer Details For Tender Sale of Wheat Under OMSS (D)Document21 pagesTenderer/ Bulk Buyer Details For Tender Sale of Wheat Under OMSS (D)Sheetal PandiyaNo ratings yet

- Updates (Company Update)Document4 pagesUpdates (Company Update)Shyam SunderNo ratings yet

- Leave Travel Allowance Policy Effective April 2020Document6 pagesLeave Travel Allowance Policy Effective April 2020Ajay MaryaNo ratings yet

- Aditya Southbay OfferDocument4 pagesAditya Southbay Offeranon_627785879No ratings yet

- Application No.: LLR Fresh AcknowledgementDocument1 pageApplication No.: LLR Fresh AcknowledgementAlapati RajasekharNo ratings yet

- Father Agnel+l&t+Bio DataDocument3 pagesFather Agnel+l&t+Bio DataSHUBHAM PANDEY100% (1)

- Rajasthan HC Rampal Samdani - 148 - Change of Opinion - After 4 YearsDocument10 pagesRajasthan HC Rampal Samdani - 148 - Change of Opinion - After 4 YearsSubramanyam SettyNo ratings yet

- S-56ACIT v. Narendra I BhuvaDocument16 pagesS-56ACIT v. Narendra I BhuvaeurokidsshastringrjodNo ratings yet

- Munda Clothing Private LimitedDocument1 pageMunda Clothing Private LimitedAnoopNo ratings yet

- Domestic Travel Entitlement Sheet: Company NameDocument15 pagesDomestic Travel Entitlement Sheet: Company NameRita GohilNo ratings yet

- Election Duty Ta Proforma For Delhi Govt-2020Document1 pageElection Duty Ta Proforma For Delhi Govt-2020Ashish SharmaNo ratings yet

- LoofilsDocument5 pagesLoofilsAthul jithNo ratings yet

- LTC Bill FormDocument4 pagesLTC Bill FormANJAN DASNo ratings yet

- Suman Joshi - 2319200460984200000Document1 pageSuman Joshi - 2319200460984200000Harsh Sahrawat100% (3)

- Shree ChaudharyDocument23 pagesShree Chaudharykhushi sethiaNo ratings yet