Professional Documents

Culture Documents

December 2011

December 2011

Uploaded by

utkarshupsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

December 2011

December 2011

Uploaded by

utkarshupsCopyright:

Available Formats

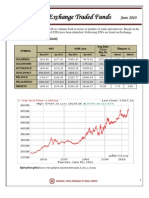

Exchange Traded Funds

December 2011

ETF have shown consistent growth in volumes both in terms of number of trade and turnover. Based on the underlying asset different types of ETFs have been identified. The turnover and price of each class of ETF listed on NSE is given below. % Turnover

72.83% November 2011

ETF Based on Asset Total T/O ( ` Lacs) %

10.36% 16.57% 0.24%

Gold Indian Stock Market Money Market International Stock Market

Gold Money Market Equity Market International Equity Market Total

101474.57 23092.5 14428.69 337.99 139333.75

72.83% 16.57% 10.36% 0.24% 100.00%

ETF based on Gold

SYMBOL AXISGOLD BSLGOLDETF GOLDBEES GOLDSHARE HDFCMFGETF IDBIGOLD IPGETF KOTAKGOLD QGOLDHALF RELGOLD RELIGAREGO SBIGETS AXIS BIRLA SUN LIFE GOLDMAN SACS UTI HDFC IDBI ICICI KOTAK QUANTUM RELIANCE RELIGARE SBI AMC Nov-11 NAV Oct-11 Avg T/O ` lacs Return % 1Month 3Months

2839.61 2905.86 2774.33 2787.31 2841.99 2909.16 2859.40 2785.92 1386.27 2712.57 2862.93 2840.24

2687.11 2749.48 2625.34 2636.34 2688.76 NA 2706.44 2635.37 1311.60 2566.34 2708.61 2686.63

28.73 8.62 3240.84 224.45 144.69 23.23 28.63 807.45 12.88 329.58 26.83 197.81

5.67 5.69 5.68 5.73 5.70 NA 5.65 5.71 5.69 5.70 5.70 5.72

7.25 7.48 7.43 7.51 7.47 NA 7.34 7.49 7.52 7.53 7.49 7.52

Spot price gold (Source: http://goldprice.org/charts/history/gold_5_year_o_inr.png)

250000

Gold ETF Monthly T/O ` Lacs

200000

3500 3000

Avg Daily T/O Rs lacs

AXISGOLD GOLDBEES BSLGOLDETF GOLDSHARE IDBIGOLD KOTAKGOLD RELGOLD SBIGETS

150000

2500 2000 1500

HDFCMFGETF IPGETF QGOLDHALF RELIGAREGO

100000

50000

1000

0

500 0

Gold ETF turnover over a period (since Mar 2007)

Gold ETF turnover - November 2011 (` lacs)

Among 12 Gold ETFs the top 3 gold ETF contributed 86.28% of the total trading volumes during the month. The total trading volume for the month was `101474.57 lacs and the top 3 securities were GOLDBEES, KOTAKGOLD & RELGOLD.

ETF based on Money Market Instrument (Government Securities)

50000 45000 40000 35000 30000 25000 20000 15000 10000 5000 0

Average Daily T/O ` Lacs SYMBOL LIQUIDBEES Nov-11 1154.63 Oct-11 1025.78

% Change in T/o 12.56

Source: www.nseindia.com & www.amfinidia.com

The highest turnover in LIQUIDBEES for the month of November 2011 was ` 21.46 Crs. with total traded quantity of 214642 on 30th November 2011.

ETF based on International Index

The highest turnover in HNGSNGBEES for the month was ` 2.36 lacs, on 9th November 2011 whereas the highest turnover in N100 for the month was ` 126.83 lacs, on 02nd November 2011.

Symbol AMC Goldman Sachs MOTILAL OSWAL NAV Nov-11 1259.77 114.98 Oct-11 1297.26 116.87 Avg T/O ` Lacs 7.31 9.59 1Month -2.89 -1.62 Return % 3Months 1.80 12.31

HNGSNGBEES N100

Source: www.nseindia.com & www.amfinidia.com

ETF based on Equity (Index)

Symbol BANKBEES RELBANK INFRABEES M100 KOTAKPSUBK PSUBNKBEES JUNIORBEES M50 IIFLNIFTY KOTAKNIFTY NIFTYBEES QNIFTY RELGRNIFTY BSLNIFTY UTISUNDER SHARIABEES

Underlying Nov-11 BANK NIFTY BANK NIFTY CNX INFRASTRUCTURE CNX MIDCAP CNX PSU BANK CNX PSU BANK JUNIOR NIFTY MOST50 NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY SHARIAH 867.59 890.38 242.20 6.74 313.96 304.12 91.19 64.69 482.39 490.78 492.93 491.81 484.57 48.43 531.36 114.03

NAV Oct-11 1011.90 1034.59 267.99 7.36 341.88 331.13 100.83 72.02 531.56 541.09 543.29 542.22 534.11 53.34 580.98 122.44

Average Daily T/O ` lacs 33.00 1.07 2.01 11.35 14.35 7.17 34.60 22.16 48.84 1.74 539.11 0.48 0.74 0.47 4.17 0.17 -14.26 -13.94 -9.62 -8.54 -8.17 -8.15 -9.56 -10.18 -9.25 -9.30 -9.27 -9.30 -9.27 -9.20 -8.54 -6.87

Return % 1Month 3Months -10.24 -9.95 -12.82 -8.82 -8.84 -8.84 -9.03 -4.55 NA -3.34 -3.30 -3.32 -3.41 -3.28 -2.59 2.04

Source: www.nseindia.com & www.amfinidia.com

4 2 0 -2 -4 -6 -8 -10 -12 -14 -16

1Month

3 MONTH RETURN

BANKBEES KOTAKPSUBK IIFLNIFTY RELGRNIFTY

RELBANK PSUBNKBEES KOTAKNIFTY BSLNIFTY

INFRABEES JUNIORBEES NIFTYBEES UTISUNDER

M100 M50 QNIFTY SHARIABEES

The top 3 equity oriented ETF Viz. NIFTYBEES, IIFLNIFTY & JUNIORBEES accounted for 74.73%, 6.77% & 4.80% respectively of the total trading volumes during the month.

Disclaimer: Market conditions can lead to substantial profit or loss. Investors are advised to seek adequate product and market knowledge as well as proper investment advice before trading. The material provided here is for general information purpose only. While care has been taken to ensure accuracy, the information furnished to reader with no warranty as to accuracy or completeness of its contents and on condition that any changes, omissions or errors shall not be made the basis for any claim, demand or cause for action

NSE web site

: www.nseindia.com

Online ETF price watch : http://www.nseindia.com/content/etfsparks.htm NSE circulars : http://nseindia.com/circulars/circular.htm

NSE member directory : http://nseindia.com/membership/dynaContent/find_a_broker.htm

Head- Office

National Stock Exchange of India Ltd

Exchange Plaza, C-1 Block G, Bandra - Kurla Complex, Bandra (E), Mumbai 400051 Tel: 022 26598100 Fax: 022 26598120

Email: nsecrm@nse.co.in

Regional Offices

National Stock Exchange of India Ltd 4th Floor, Jeevan Vihar Building Parliament Street New Delhi- 110001 Phone No 011- 23344313 to 327 Fax No. - 011- 23366658

New Delhi Cash

ETF

Ahmedabad

National Stock Exchange of India Ltd 406, Sakar II Near Ellisbridge Ahmedabad 380006 Tel No: 079-26580212/13 Fax: 079-26576123

Kolkata

National Stock Exchange of India Ltd 1st floor, Park View Apartments, 99 Rash Behari Avenue, Kolkata-700029 Tel No: 033-40400400 Fax No: 033-40400440

Chennai

National Stock Exchange of India Limited 2nd floor, Ispahani centre 123-124, Nungambakkam High Road, Nungambakkam, Next to Indian Oil Bhawan, Chennai -600 034 Tel: 044-28332500/01 Fax: 044-28332510/21

Hyderabad

National stock exchange of India limited, H.No:3-6-322, Mahavir house, 2nd floor, Chamber No 203 & 204, Basheerbagh, Hyderabad- 500029, India Tel No: 040-23227084/85 Fax No: 040-23227086

You might also like

- Daily Market Note: EquitiesDocument7 pagesDaily Market Note: Equitiesapi-166532035No ratings yet

- August ETF ReportDocument5 pagesAugust ETF ReportzoetechocNo ratings yet

- Premarket Technical&Derivative Ashika 18.11.16Document4 pagesPremarket Technical&Derivative Ashika 18.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Weekly Market Monitor - No. 34/2012: Genghis Capital Research: Equities, Fixed Income, Currency, CommoditiesDocument13 pagesWeekly Market Monitor - No. 34/2012: Genghis Capital Research: Equities, Fixed Income, Currency, Commoditiesapi-166532035No ratings yet

- Monthly Newsletter ETFsDocument5 pagesMonthly Newsletter ETFsAmit JainNo ratings yet

- Daily Market Note: EquitiesDocument7 pagesDaily Market Note: Equitiesapi-166532035No ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument56 pagesIndex Movement:: National Stock Exchange of India LimitedAniket KumarNo ratings yet

- Domestic Equity Outlook - Indices Continue To Gain Ground Amidst VolatilityDocument9 pagesDomestic Equity Outlook - Indices Continue To Gain Ground Amidst Volatilitygaganbiotech20No ratings yet

- Daily Market Note: EquitiesDocument7 pagesDaily Market Note: Equitiesapi-166532035No ratings yet

- Premarket Technical&Derivative Ashika 23.11.16Document4 pagesPremarket Technical&Derivative Ashika 23.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Derivatives Market 150Document27 pagesDerivatives Market 150kegnataNo ratings yet

- Daily Market Note: EquitiesDocument7 pagesDaily Market Note: Equitiesapi-166532035No ratings yet

- Most Market Roundup: Daily Technical AnalysisDocument7 pagesMost Market Roundup: Daily Technical AnalysisBhupendra_Rawa_1185No ratings yet

- International Commodities Evening Update November 8Document3 pagesInternational Commodities Evening Update November 8Angel BrokingNo ratings yet

- Premarket Technical&Derivative Ashika 30.11.16Document4 pagesPremarket Technical&Derivative Ashika 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Daily Market Note: EquitiesDocument7 pagesDaily Market Note: Equitiesapi-166532035No ratings yet

- 15 Sept 2014 PDFDocument8 pages15 Sept 2014 PDFRandora LkNo ratings yet

- Genghis Capital - Daily Market Report - 4th November 2014Document7 pagesGenghis Capital - Daily Market Report - 4th November 2014PhilipGandleNo ratings yet

- Daringderivatives-Nov11 11Document3 pagesDaringderivatives-Nov11 11Shahid IbrahimNo ratings yet

- International Commodities Evening Update November 14Document3 pagesInternational Commodities Evening Update November 14Angel BrokingNo ratings yet

- Daily Market Note: EquitiesDocument7 pagesDaily Market Note: Equitiesapi-166532035No ratings yet

- Scope of India Stock MarketDocument1 pageScope of India Stock MarketRajesh JoshiNo ratings yet

- Daily Trade Journal - 31.12Document14 pagesDaily Trade Journal - 31.12ran2013No ratings yet

- Weekly Market Outlook 08.10.11Document5 pagesWeekly Market Outlook 08.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Rupee Karvy 130911Document3 pagesRupee Karvy 130911jitmNo ratings yet

- Weekly Market Monitor - No. 36/2012: Genghis Capital Research: Equities, Fixed Income, Currency, CommoditiesDocument13 pagesWeekly Market Monitor - No. 36/2012: Genghis Capital Research: Equities, Fixed Income, Currency, Commoditiesapi-166532035No ratings yet

- Premarket Technical&Derivative Angel 15.12.16Document5 pagesPremarket Technical&Derivative Angel 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Daily Trade Journal - 11.06.2013Document7 pagesDaily Trade Journal - 11.06.2013Randora LkNo ratings yet

- India Infoline Weekly WrapDocument8 pagesIndia Infoline Weekly WrappasamvNo ratings yet

- IER Project Work ON: A Study On Recent Development in Indian Stock MarketDocument17 pagesIER Project Work ON: A Study On Recent Development in Indian Stock MarketRahul OjhaNo ratings yet

- Dividend Oppt: Corporate BondsDocument2 pagesDividend Oppt: Corporate Bondsabc889798789789No ratings yet

- BRS Market Report: Week IV: 21Document7 pagesBRS Market Report: Week IV: 21Sudheera IndrajithNo ratings yet

- BRS Market Report: Week IV: 19Document7 pagesBRS Market Report: Week IV: 19Sudheera IndrajithNo ratings yet

- Most Derivatives Daily 120906Document6 pagesMost Derivatives Daily 120906mkmanish1No ratings yet

- ReportDocument17 pagesReportMadhur YadavNo ratings yet

- Panafrican Daily Market Report (03-July-2014)Document1 pagePanafrican Daily Market Report (03-July-2014)Oladipupo Mayowa PaulNo ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - Weeklyapi-182070220No ratings yet

- Currency Daily Report October 12Document4 pagesCurrency Daily Report October 12Angel BrokingNo ratings yet

- Daily Market Note: EquitiesDocument7 pagesDaily Market Note: Equitiesapi-166532035No ratings yet

- Currency Daily Report November 9Document4 pagesCurrency Daily Report November 9Angel BrokingNo ratings yet

- Daily Market Note: EquitiesDocument7 pagesDaily Market Note: Equitiesapi-166532035No ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - Weeklyapi-198466611No ratings yet

- IISL UpdateDocument11 pagesIISL Updateanalyst_anil14No ratings yet

- Presented By: Presented To: Reg#: Class:: Raja Nadeem Asghar Kayani Mam Asiya Sohail 032 Bba 7 ADocument6 pagesPresented By: Presented To: Reg#: Class:: Raja Nadeem Asghar Kayani Mam Asiya Sohail 032 Bba 7 ANadeem KianiNo ratings yet

- Index Flat Deals in JKH Boost Turnover : Tuesday, July 30, 2013Document6 pagesIndex Flat Deals in JKH Boost Turnover : Tuesday, July 30, 2013Randora LkNo ratings yet

- Iisl Marketupdate - September2012: Market StatisticsDocument11 pagesIisl Marketupdate - September2012: Market StatisticshitekshaNo ratings yet

- Daily Market Note: EquitiesDocument7 pagesDaily Market Note: Equitiesapi-166532035No ratings yet

- Indian Stock Exchange NSE and How Their Indices Are CalculatedDocument46 pagesIndian Stock Exchange NSE and How Their Indices Are CalculatednikhilNo ratings yet

- Currency Daily Report October 18Document4 pagesCurrency Daily Report October 18Angel BrokingNo ratings yet

- A Lecture On Securities Market: Presented byDocument52 pagesA Lecture On Securities Market: Presented byrobinkapoor100% (3)

- Daily Trade Journal - 28.01.2014Document6 pagesDaily Trade Journal - 28.01.2014Randora LkNo ratings yet

- Indian Stock Exchange NSE and How Their Indices Are CalculatedDocument46 pagesIndian Stock Exchange NSE and How Their Indices Are CalculatedUrvashi SharmaNo ratings yet

- Corporate Bonds Retail Debt MarketDocument1 pageCorporate Bonds Retail Debt MarketdeepakaggarwalcaNo ratings yet

- Currency Daily Report October 22Document4 pagesCurrency Daily Report October 22Angel BrokingNo ratings yet

- Index Dipped Amidst Profit Taking : Tuesday, April 30, 2013Document7 pagesIndex Dipped Amidst Profit Taking : Tuesday, April 30, 2013Randora LkNo ratings yet

- National Stock Exchange of India - An OverviewDocument12 pagesNational Stock Exchange of India - An OverviewArtz TakNo ratings yet

- International Commodities Evening Update November 12Document3 pagesInternational Commodities Evening Update November 12Angel BrokingNo ratings yet

- Alankit Assignments LTD: 1 - PageDocument14 pagesAlankit Assignments LTD: 1 - Pagertaneja008No ratings yet

- Selective Forex Trading: How to Achieve Over 100 Trades in a Row Without a LossFrom EverandSelective Forex Trading: How to Achieve Over 100 Trades in a Row Without a LossNo ratings yet