Professional Documents

Culture Documents

Dead Link

Dead Link

Uploaded by

Shazia SayedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dead Link

Dead Link

Uploaded by

Shazia SayedCopyright:

Available Formats

A capital market is a market for securities (debt or equity), where business enterprises (companies) and governments can raise

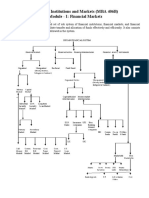

long-term funds. It is defined as a market in which money is provided for [1][dead link] periods longer than a year, as the raising of short-term funds takes place on other markets (e.g., the money market). The capital market includes the stock market (equity securities) and the bond market (debt). Money markets and capital markets are parts of financial markets. Financial regulators, such as the UK's Financial Services Authority (FSA) or the U.S. Securities and Exchange Commission(SEC), oversee the capital markets in their designated jurisdictions to ensure that investors are protected against fraud, among other duties. Capital markets may be classified as primary markets and secondary markets. In primary markets, new stock or bond issues are sold to investors via a mechanism known as underwriting. In the secondary markets, existing securities are sold and bought among investors or traders, usually on a securities exchange, over-the-counter, or elsewhere.

You might also like

- Global Finance and Electronic BankingDocument16 pagesGlobal Finance and Electronic BankingKrishaNo ratings yet

- Introduction To Finacial Markets Final With Refence To CDSLDocument40 pagesIntroduction To Finacial Markets Final With Refence To CDSLShoumi Mahapatra100% (1)

- Capital MarketDocument1 pageCapital MarketRizwan SiddiquiNo ratings yet

- Capital MarketDocument2 pagesCapital MarketShail DoshiNo ratings yet

- Asm Capital MRKTDocument1 pageAsm Capital MRKTRohit KumarNo ratings yet

- FMI NotesDocument93 pagesFMI Notesjain_ashish_19888651No ratings yet

- Key Takeaways: Understanding The Financial MarketsDocument4 pagesKey Takeaways: Understanding The Financial MarketsAk LelouchKaiNo ratings yet

- Intro To Fin MarketsDocument3 pagesIntro To Fin Markets65xykwtn8rNo ratings yet

- Capital MarketDocument66 pagesCapital MarketPriya SharmaNo ratings yet

- Financial Markets: Kashis Chakma ID-20IUT0360029Document23 pagesFinancial Markets: Kashis Chakma ID-20IUT0360029Ak LelouchKaiNo ratings yet

- Financial Market & InstrumentDocument73 pagesFinancial Market & InstrumentSoumya ShettyNo ratings yet

- Capital MarketDocument1 pageCapital MarketVishal MoyalNo ratings yet

- Financial MarketsDocument2 pagesFinancial MarketsSaira Ishfaq 84-FMS/PHDFIN/F16No ratings yet

- A Quanittative Study of Nepalese Stock ExchangeDocument87 pagesA Quanittative Study of Nepalese Stock ExchangenirajNo ratings yet

- MarketDocument7 pagesMarketVerlyn ElfaNo ratings yet

- UP1Document1 pageUP1Khushal GargNo ratings yet

- Capital Markets Are: Financial Markets Debt Equity SecuritiesDocument2 pagesCapital Markets Are: Financial Markets Debt Equity SecuritiesDeana PhillipsNo ratings yet

- Capital MarketDocument1 pageCapital MarketmaggyfinNo ratings yet

- What Are Capital Markets?Document2 pagesWhat Are Capital Markets?Luise MauieNo ratings yet

- A Capital Market Is A Market For SecuritiesDocument3 pagesA Capital Market Is A Market For SecuritiesDarshana PatilNo ratings yet

- Risk Management in Financial MarketDocument49 pagesRisk Management in Financial MarketAashika ShahNo ratings yet

- 1.1 Introduction of Financial MarketDocument5 pages1.1 Introduction of Financial MarketAbdul NomanNo ratings yet

- Hanna Hussan 1bbads Cia1 IfsDocument16 pagesHanna Hussan 1bbads Cia1 Ifslakshya lashkariNo ratings yet

- Black Book: What Are Financial Markets?Document20 pagesBlack Book: What Are Financial Markets?Shubh shahNo ratings yet

- Types of Financial MarketsDocument2 pagesTypes of Financial MarketsMher Edrolyn Cristine LlamasNo ratings yet

- Intro To Financial MarketsDocument2 pagesIntro To Financial MarketsarmskhatriNo ratings yet

- FM 02 - Mfis NotesDocument7 pagesFM 02 - Mfis NotesCorey PageNo ratings yet

- International Financial MarketDocument36 pagesInternational Financial MarketSmitaNo ratings yet

- What Are Financial Markets?: Key TakeawaysDocument2 pagesWhat Are Financial Markets?: Key Takeawayskate trishaNo ratings yet

- Types of Financial MarketsDocument3 pagesTypes of Financial Marketskate trishaNo ratings yet

- 6-Functions of Financial MarketsDocument4 pages6-Functions of Financial MarketsTahir RehmaniNo ratings yet

- 3.1 Industry Profile: Different Types of Financial MarketsDocument2 pages3.1 Industry Profile: Different Types of Financial MarketsShivamitra ChiruthaniNo ratings yet

- Notes On Financial SystemsDocument62 pagesNotes On Financial SystemsamitNo ratings yet

- Copy of SS-BF-II-12 WEEK 3 Lecture NotesDocument3 pagesCopy of SS-BF-II-12 WEEK 3 Lecture NotesSheanne GuerreroNo ratings yet

- Ramirez, Christine Marie T. - Financial MarketsDocument5 pagesRamirez, Christine Marie T. - Financial MarketsChristine Marie T. RamirezNo ratings yet

- Money MarketDocument25 pagesMoney Marketvicky_n007No ratings yet

- Financial Markets and Financial InstrumentsDocument80 pagesFinancial Markets and Financial Instrumentsabhijeit86100% (2)

- 3.the Money Market Refers To A Segment of The Financial Market Where ShortDocument6 pages3.the Money Market Refers To A Segment of The Financial Market Where Shortkhageswarsingh865No ratings yet

- Industry Profile: Financial MarketDocument17 pagesIndustry Profile: Financial MarketAprameya kowshikNo ratings yet

- Ralph Joseph Sandoval FIN 111-0 AY01Document2 pagesRalph Joseph Sandoval FIN 111-0 AY01raprapNo ratings yet

- The Financial Markets, MoneyDocument8 pagesThe Financial Markets, MoneyNirmal ShresthaNo ratings yet

- Bafin ReportingDocument12 pagesBafin ReportingKen Ivan HervasNo ratings yet

- Financial Markets TheoryDocument4 pagesFinancial Markets TheorySandeep Singh SikerwarNo ratings yet

- Chapter 20 Reaction PaperDocument3 pagesChapter 20 Reaction PaperSteven Sanderson100% (4)

- Finl Markets and FinDocument24 pagesFinl Markets and FinLunaNo ratings yet

- Types of Financial Markets Stock Markets: Secondary Market NasdaqDocument6 pagesTypes of Financial Markets Stock Markets: Secondary Market NasdaqLuise MauieNo ratings yet

- Drive: Summer 2016 Program: MBA Semester: 3 Subject Code: MB0036 Subject Name: Financial System and Commercial BankingDocument21 pagesDrive: Summer 2016 Program: MBA Semester: 3 Subject Code: MB0036 Subject Name: Financial System and Commercial BankingPalash DaveNo ratings yet

- Topic 1Document7 pagesTopic 1Jeffrey RiveraNo ratings yet

- Lesson 2 FM: Money MarketDocument4 pagesLesson 2 FM: Money MarketChristina MalaibaNo ratings yet

- Capital Markets - Module 4 - Week 4Document8 pagesCapital Markets - Module 4 - Week 4Jha Jha CaLvez100% (2)

- Presentation On Financial Markets and Its TypesDocument7 pagesPresentation On Financial Markets and Its TypesMohd AtifNo ratings yet

- Money Market and Capital MarketDocument3 pagesMoney Market and Capital MarketV. SrimathiNo ratings yet

- Financial Markets and Their Role in EconomyDocument6 pagesFinancial Markets and Their Role in EconomyMuzammil ShahzadNo ratings yet

- Ifim Units 3&4Document19 pagesIfim Units 3&4kushalNo ratings yet

- Financial Market SEM-3Document5 pagesFinancial Market SEM-3naomiNo ratings yet

- Financial MarketsDocument5 pagesFinancial MarketsMichael BrownNo ratings yet

- Financial SystemDocument98 pagesFinancial SystembharathNo ratings yet

- Financial MarketsDocument5 pagesFinancial MarketsMichael BrownNo ratings yet

- Introduction To Financial MarketsDocument7 pagesIntroduction To Financial MarketsMuhammad Azhar SaleemNo ratings yet