Professional Documents

Culture Documents

UP1

UP1

Uploaded by

Khushal Garg0 ratings0% found this document useful (0 votes)

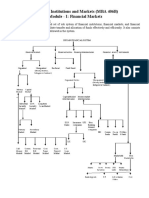

2 views1 pageThe financial market consists of several components that facilitate the exchange of financial assets and securities. It includes the capital market for buying and selling long-term instruments like stocks and bonds. The money market deals in short-term borrowing and lending of funds using liquid instruments under one year. The derivatives market trades contracts deriving value from underlying assets. The foreign exchange market enables currency exchange. The commodity market trades physical goods such as agricultural products, metals, and energy resources. Overall, the financial system raises capital, enables investment and trade, and manages risks through these various financial markets.

Original Description:

Original Title

UP1 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe financial market consists of several components that facilitate the exchange of financial assets and securities. It includes the capital market for buying and selling long-term instruments like stocks and bonds. The money market deals in short-term borrowing and lending of funds using liquid instruments under one year. The derivatives market trades contracts deriving value from underlying assets. The foreign exchange market enables currency exchange. The commodity market trades physical goods such as agricultural products, metals, and energy resources. Overall, the financial system raises capital, enables investment and trade, and manages risks through these various financial markets.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageUP1

UP1

Uploaded by

Khushal GargThe financial market consists of several components that facilitate the exchange of financial assets and securities. It includes the capital market for buying and selling long-term instruments like stocks and bonds. The money market deals in short-term borrowing and lending of funds using liquid instruments under one year. The derivatives market trades contracts deriving value from underlying assets. The foreign exchange market enables currency exchange. The commodity market trades physical goods such as agricultural products, metals, and energy resources. Overall, the financial system raises capital, enables investment and trade, and manages risks through these various financial markets.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Financial market and it's components.

Functions of financial system financial market refers

to a broad term that encompasses various institutions, The instruments, and systems that

facilitate the exchange of financial assets and securities. It serves as a platform where

individuals, businesses, and governments can raise capital, invest, trade, and manage

financial risks. The financial market has several components, which can be categorized as

follows: 1. Capital Market: This includes the buying and selling of long-term financial

instruments, such as stocks, bonds, and other securities. The capital market can be further

divided into primary and secondary markets. The primary market is where new securities are

issued and sold for the first time, while the secondary market involves the trading of

previously issued securities. 2. Money Market: The money market deals with short-term

borrowing and lending of funds. It focuses on low-risk, highly liquid instruments with

maturities typically less than one year, such as Treasury bills, certificates of deposit (CDs),

commercial paper, and repurchase agreements. 3. Derivatives Market: The derivatives

market involves the trading of financial contracts whose value derives from an underlying

asset or benchmark. Derivatives can include options, futures, swaps, and forward contracts.

They are used for hedging, speculation, and arbitrage. 4. Foreign Exchange Market: This

market facilitates the buying and selling of different currencies. It provides a mechanism for

participants to exchange one currency for another, allowing international trade and

investment. 5. Commodity Market: Commodity markets involve the trading of physical goods,

such as agricultural products (e.g., wheat, corn), energy resources (e.g., oil, natural gas),

metals (e.g., gold, silver), and other raw materials. Commodity markets enable producers,

consumers, and investors to manage price risks associated with these goods. The financial

system plays a crucial role in an economy by performing se

You might also like

- Global Finance and Electronic BankingDocument16 pagesGlobal Finance and Electronic BankingKrishaNo ratings yet

- Introduction To Finacial Markets Final With Refence To CDSLDocument40 pagesIntroduction To Finacial Markets Final With Refence To CDSLShoumi Mahapatra100% (1)

- 3.the Money Market Refers To A Segment of The Financial Market Where ShortDocument6 pages3.the Money Market Refers To A Segment of The Financial Market Where Shortkhageswarsingh865No ratings yet

- Intro To Fin MarketsDocument3 pagesIntro To Fin Markets65xykwtn8rNo ratings yet

- Types of Financial MarketsDocument2 pagesTypes of Financial MarketsMher Edrolyn Cristine LlamasNo ratings yet

- 1.1 Introduction of Financial MarketDocument5 pages1.1 Introduction of Financial MarketAbdul NomanNo ratings yet

- International Financial MarketDocument36 pagesInternational Financial MarketSmitaNo ratings yet

- Abstract of Financial Market 1Document8 pagesAbstract of Financial Market 1mmkrishnan94100% (1)

- Financial MarketDocument13 pagesFinancial MarketRajeswari KuttimaluNo ratings yet

- Bafin ReportingDocument12 pagesBafin ReportingKen Ivan HervasNo ratings yet

- FMI NotesDocument93 pagesFMI Notesjain_ashish_19888651No ratings yet

- Financial MarketDocument2 pagesFinancial Marketnysasunuwar44No ratings yet

- UntitledDocument2 pagesUntitledLimery TabiosNo ratings yet

- Ramirez, Christine Marie T. - Financial MarketsDocument5 pagesRamirez, Christine Marie T. - Financial MarketsChristine Marie T. RamirezNo ratings yet

- Module 04 Financial Markets and InstrumentsDocument13 pagesModule 04 Financial Markets and InstrumentsGovindNo ratings yet

- Financial Market & InstrumentDocument73 pagesFinancial Market & InstrumentSoumya ShettyNo ratings yet

- Cppy of FM-1Document70 pagesCppy of FM-1Rishika ParmarNo ratings yet

- Module 2 Financial Markets and Instruments Group 1 FM7Document23 pagesModule 2 Financial Markets and Instruments Group 1 FM7hikunanaNo ratings yet

- Finl Markets and FinDocument24 pagesFinl Markets and FinLunaNo ratings yet

- Financial Market SEM-3Document5 pagesFinancial Market SEM-3naomiNo ratings yet

- Copy of SS-BF-II-12 WEEK 3 Lecture NotesDocument3 pagesCopy of SS-BF-II-12 WEEK 3 Lecture NotesSheanne GuerreroNo ratings yet

- Financial Markets and Financial InstrumentsDocument80 pagesFinancial Markets and Financial Instrumentsabhijeit86100% (2)

- Financial Management (FIN 4)Document3 pagesFinancial Management (FIN 4)carinaNo ratings yet

- Risk Management in Financial MarketDocument49 pagesRisk Management in Financial MarketAashika ShahNo ratings yet

- Assignmen 1Document5 pagesAssignmen 1urooj fatimaNo ratings yet

- Financial MarketDocument5 pagesFinancial MarketSaif AhmedNo ratings yet

- 6-Functions of Financial MarketsDocument4 pages6-Functions of Financial MarketsTahir RehmaniNo ratings yet

- Topic 1Document7 pagesTopic 1Jeffrey RiveraNo ratings yet

- Ralph Joseph Sandoval FIN 111-0 AY01Document2 pagesRalph Joseph Sandoval FIN 111-0 AY01raprapNo ratings yet

- Financial Markets and Institutionschap 2Document8 pagesFinancial Markets and Institutionschap 2Ini IchiiiNo ratings yet

- CM Notes FinalDocument75 pagesCM Notes FinalkamaltrilochanNo ratings yet

- Dead LinkDocument1 pageDead LinkShazia SayedNo ratings yet

- Financial MarketsDocument2 pagesFinancial MarketsSaira Ishfaq 84-FMS/PHDFIN/F16No ratings yet

- MarketDocument7 pagesMarketVerlyn ElfaNo ratings yet

- Financial MarketDocument48 pagesFinancial MarketAHUTI SINGHNo ratings yet

- Financial Market TypesDocument1 pageFinancial Market Typeslalisst9905No ratings yet

- Finantial Institution by ADDocument27 pagesFinantial Institution by ADDaniyal AwanNo ratings yet

- Assignment: 3 (Medha Singh 127/3A2) : Types of Financial MarketDocument5 pagesAssignment: 3 (Medha Singh 127/3A2) : Types of Financial MarketMedha SinghNo ratings yet

- IFS Unit-1 Notes - 20200717114457Document9 pagesIFS Unit-1 Notes - 20200717114457Vignesh C100% (1)

- Financial Market TopicDocument31 pagesFinancial Market TopicGautam MahtoNo ratings yet

- BY: Osama Tariq. Sajawal. Adnan Shahzad. Shaikh Ahmed AliDocument36 pagesBY: Osama Tariq. Sajawal. Adnan Shahzad. Shaikh Ahmed Alishaikh ahmedNo ratings yet

- Notes On Financial SystemsDocument62 pagesNotes On Financial SystemsamitNo ratings yet

- Introduction To Financial MarketsDocument7 pagesIntroduction To Financial MarketsMuhammad Azhar SaleemNo ratings yet

- A Quanittative Study of Nepalese Stock ExchangeDocument87 pagesA Quanittative Study of Nepalese Stock ExchangenirajNo ratings yet

- Module-1: Financial MarketsDocument41 pagesModule-1: Financial MarketsPeeYush SahuNo ratings yet

- Types of Financial MarketsDocument3 pagesTypes of Financial Marketskate trishaNo ratings yet

- Financial Markets and Their Role in EconomyDocument6 pagesFinancial Markets and Their Role in EconomyMuzammil ShahzadNo ratings yet

- FM 02 - Mfis NotesDocument7 pagesFM 02 - Mfis NotesCorey PageNo ratings yet

- Chap 1 - FinanceDocument2 pagesChap 1 - FinanceCherry Ann TalabocNo ratings yet

- Financial MarketDocument5 pagesFinancial MarketRoxanne Jhoy Calangi VillaNo ratings yet

- FMDocument7 pagesFMA.K.S.PNo ratings yet

- Capital Markets - Module 4 - Week 4Document8 pagesCapital Markets - Module 4 - Week 4Jha Jha CaLvez100% (2)

- FIN 6030A US2018 Course OutlineDocument34 pagesFIN 6030A US2018 Course OutlineNadya SavageNo ratings yet

- Differences Between Money Market and Capital MarketDocument1 pageDifferences Between Money Market and Capital MarketZhichang Zhang100% (1)

- Capital MarketDocument29 pagesCapital MarketFebie Gayap FelixNo ratings yet

- Chapter-01 Overview of Financial System and Financial Markets and InstitutionsDocument5 pagesChapter-01 Overview of Financial System and Financial Markets and InstitutionsDibakar DasNo ratings yet

- Big Picture in Focus: Ulob. Differentiate The Types of Financial MarketsDocument10 pagesBig Picture in Focus: Ulob. Differentiate The Types of Financial MarketsJohn Stephen PendonNo ratings yet

- Chapter-2-Indian Capital MarketDocument70 pagesChapter-2-Indian Capital MarketGowtham SrinivasNo ratings yet

- Financial MarketsDocument5 pagesFinancial MarketsMichael BrownNo ratings yet

- UP2Document1 pageUP2Khushal GargNo ratings yet

- Screenshot 20230310 102559-MinDocument1 pageScreenshot 20230310 102559-MinKhushal GargNo ratings yet

- Binomial TheoremDocument7 pagesBinomial TheoremKhushal GargNo ratings yet

- Unit 123Document22 pagesUnit 123Khushal GargNo ratings yet

- Unit 2Document6 pagesUnit 2Khushal GargNo ratings yet