Professional Documents

Culture Documents

CDS JPM1

CDS JPM1

Uploaded by

varunhomeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CDS JPM1

CDS JPM1

Uploaded by

varunhomeCopyright:

Available Formats

New York October 24, 2001

JPMorgan Securities Inc. Credit Derivatives

Par Credit Default Swap Spread Approximation from Default Probabilities

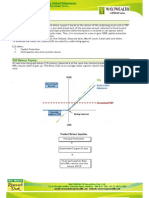

Purpose: There have been considerable client inquiries on how default probabilities are calculated from credit default swap spreads using our pricing analytic 1. This is a quantitative process that is not easy to explain intuitively. As such, rather than explain the calculation of default probabilities from credit default swap spreads, this paper focuses on the reverse approximating par credit default swap spreads from default probabilities. Definition: A credit default swap is an agreement in which one party buys protection for losses occurring due to a credit event of a reference entity up to the maturity date of the swap. The buyer of protection on a bond, a loan, or a class of bonds or loans, will typically buy protection on the notional of the asset and, upon the occurrence of a credit event, would deliver an obligation of the reference credit in exchange for the protection payout. The protection buyer pays a periodic fee for this protection up to the maturity date, unless a credit event triggers the contingent payment. If such trigger happens, the buyer of protection only needs to pay the accrued fee up to the day of the credit event (standard credit default swap). Determining the Par Spread: A credit default swap has two valuation legs: fee and contingent. For a par spread, the net present value of both legs must equal to zero. The valuation of the fee leg is approximated by: The valuation of the contingent leg is approximated by:

PV of Contingent = ContingentN =

N i =1

(1 R ) DFi (PND i 1 PND i )

where, R is the Recovery Rate of the reference obligation Therefore, for a par credit default swap, or

Valuation of Fee Leg =Valuation of Contingent Leg

S N DFi PND i i + S N DF i ( PND i 1 PND i )

i =1 i =1 N N

i = 2

(1 R ) DFi (PNDi 1 PNDi )

i =1

or

SN =

(1 R) DFi ( PNDi1 PNDi )

i =1

DF

i =1

30%

PNDi i + DFi (PNDi 1 PNDi )

i 2

Example:

Recovery Default AccrualN 0.004 0.008 0.012 0.016 0.019 0.022 0.025 0.028 0.030 0.032 0.034 0.036 0.037 0.038 0.039 0.040 0.040 0.040 0.040 0.040 Approx SN (A/360) 1008 988 995 998 972 945 915 896 863 837 813 794 763 737 714 695 665 639 615 594

PV of No Default Fee Pmts = S N Annuity N =

Period (i) 0.25 0.5 0.75 1 1.25 1.5 1.75 2 2.25 2.5 2.75 3 3.25 3.5 3.75 4 4.25 4.5 4.75 5

S N DFi PNDi i

i =1

Yldi DF i PNDi 2.35% 99.41% 96.43% 2.33% 98.84% 93.05% 2.39% 98.25% 89.76% 2.52% 97.63% 86.56% 2.70% 96.98% 83.91% 2.87% 96.28% 81.51% 3.05% 95.55% 79.41% 3.22% 94.78% 77.30% 3.37% 93.99% 75.79% 3.52% 93.17% 74.32% 3.67% 92.31% 72.87% 3.82% 91.44% 71.45% 3.92% 90.55% 70.66% 4.02% 89.64% 69.90% 4.12% 88.72% 69.14% 4.22% 87.79% 68.37% 4.30% 86.85% 68.22% 4.37% 85.91% 68.06% 4.45% 84.96% 67.91% 4.52% 84.00% 67.76%

AnnuityN 0.240 0.470 0.690 0.901 1.104 1.300 1.490 1.673 1.851 2.024 2.192 2.355 2.515 2.672 2.825 2.975 3.123 3.269 3.413 3.555

ContingentN 0.025 0.048 0.071 0.093 0.111 0.127 0.141 0.155 0.165 0.175 0.184 0.193 0.198 0.203 0.208 0.213 0.214 0.215 0.216 0.217

where, SN is the Par Spread for maturity N DFi is the Riskless Discount Factor from To to Ti PNDi is the No Default Probability from To to Ti i is the Accrual Period from Ti-1 to Ti If accrual fee is paid upon default, then the valuation of the fee leg is approximated by:

PV of No Default Fee Pmts + PV of Default Accruals = S N Annuity N + S N Default AccrualN =

N N i =1 i =1

S N DF i PND i i + S N DFi (PND i 1 PND i )

where, (PNDi-1 PNDi) is the Probability of a Credit Event occurring during period Ti-1 to Ti

i 2

i is the Average Accrual from Ti-1 to Ti 2

Our pricing analytic is available on Orbit ( www.morgancredit.com) or on Bloomberg ([ticker] [coupon] [maturity]<Corp>CDSW<Go> ).

Additional information is available upon request. Information herein is believed to be reliable but JPMorgan does not warrant its completeness or accuracy. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results. The investments and strategies discussed here may not be suitable for all investors; if you have any doubts you should consult your investment advisor. The investments discussed may fluctuate in price or value. Changes in rates of exchange may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. JPMorgan and/or its affiliates and employees may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as underwriter, placement agent, advisor or lender to such issuer. Copyright 2001 J.P. Morgan Chase & Co. All rights reserved. JPMorgan is the marketing name for J.P. Morgan Chase & Co., and its subsidiaries and affiliates worldwide. J.P. Morgan Securities Inc. (JPMSI), member of NYSE and SIPC. JPMorgan Chase Bank is a member of FDIC. J.P. Morgan Securities (Asia Pacific) Limited, is regulated by the Hong Kong Securities & Futures Commission. JPMorgan Securities Asia Pte. Ltd (JPMSA) is regulated by the Monetary Authority of Singapore and the Financial Services Agency in Japan. J.P. Morgan Futures Inc., is a member of the NFA. Issued and approved for distribution in the U.K. and the European Economic Area by J.P. Morgan Securities Ltd., Chase Manhattan International Limited and J.P. Morgan plc, members of the London Stock Exchange and regulated by the FSA. Issued and distributed in Australia by Chase Securities Australia Limited and J.P. Morgan Australia Securities Limited which accept responsibility for its contents and are regulated by the Australian Securities and Investments Commission. J.P. Morgan Markets Australia Pty Ltd. is a licensed investment adviser and futures broker member of the Sydney Futures Exchange. Clients should contact analysts at and execute transactions through a JPMorgan entity in their home jurisdiction unless governing law permits otherwise. European Economic Area: Issued for distribution in the European Economic Area (the EEA) by J.P. Morgan Securities Ltd. and Chase Manhattan International Limited (CMIL), a firm regulated in the conduct of investment business in the United Kingdom by the Securities and Futures Authority Limited. This report has been issued, in the UK, only to persons of a kind described in Article 11(3) of the Financial Services Act 1986 (Investment Advertisements) (Exemptions) Order 1997 (as amended) and, in other EEA countries, to persons regarded as professional investors (or equivalent) in their home jurisdiction. It is intended for use by the recipient only and may not be published, copied or distributed to any other person. Any EEA persons wanting further information on, or services in relation to, anything contained in this report should contact CMIL (telephone 44 171 777 4945). This report has been prepared by an entity which may have its own specific interest in relation to the issuer, the financial instruments or the transactions which are the subject matter of the report. We do not make investments mentioned herein available to any EEA persons other than professional or institutional investors. This report should not be distributed to others or replicated in any form without prior consent of JPMorgan

You might also like

- Atlas of The MoonDocument117 pagesAtlas of The MoonDwayne Branch100% (3)

- Essar Enegry ProspectusDocument672 pagesEssar Enegry ProspectusAnkur JainNo ratings yet

- 23 Risk Management and Hedging Strategies PDFDocument24 pages23 Risk Management and Hedging Strategies PDFemmadavisons100% (1)

- Scream 1x01 - PilotDocument53 pagesScream 1x01 - PilotvinifdNo ratings yet

- EEA Fact Sheet April 2010Document2 pagesEEA Fact Sheet April 2010maxamsterNo ratings yet

- Equity Tips and Market Analysis For 11 JulyDocument7 pagesEquity Tips and Market Analysis For 11 JulySurbhi JoshiNo ratings yet

- CH - 2 InvestmentDocument7 pagesCH - 2 Investmentnatnaelsleshi3No ratings yet

- Chapter 11Document42 pagesChapter 11Sajid NazirNo ratings yet

- Derivatives Report 04 Sep 2012Document3 pagesDerivatives Report 04 Sep 2012Angel BrokingNo ratings yet

- Knowledge Series : Typical Payoff Scenario Typical Payoff ScenarioDocument2 pagesKnowledge Series : Typical Payoff Scenario Typical Payoff ScenarioAvinash NairNo ratings yet

- CHAPTER 1 Risk Analysis and ManagementDocument95 pagesCHAPTER 1 Risk Analysis and Managementyebegashet0% (1)

- Lecture 5Document21 pagesLecture 5Mahina NozirovaNo ratings yet

- Derivatives Report 07 Dec 2012Document3 pagesDerivatives Report 07 Dec 2012Angel BrokingNo ratings yet

- Mini Bull Certificates - Arques Industries AGDocument6 pagesMini Bull Certificates - Arques Industries AGsh2k2kNo ratings yet

- Basic Financial Concepts - FinalDocument34 pagesBasic Financial Concepts - FinalDu Baladad Andrew MichaelNo ratings yet

- Derivatives Report 23 Oct 2012Document3 pagesDerivatives Report 23 Oct 2012Angel BrokingNo ratings yet

- Key Information Document SyntheticIndex ZumamarketsDocument4 pagesKey Information Document SyntheticIndex ZumamarketsCarlos Campuzano CalvoNo ratings yet

- Bond3 - PGBF Prospectus PDFDocument53 pagesBond3 - PGBF Prospectus PDFChes CitadelNo ratings yet

- March I.F. Solution 9833088336: (2 Hours) (Total Marks: 60)Document8 pagesMarch I.F. Solution 9833088336: (2 Hours) (Total Marks: 60)Omkar ShingareNo ratings yet

- Interest Rate Derivatives Credit Default Swaps Currency DerivativesDocument30 pagesInterest Rate Derivatives Credit Default Swaps Currency DerivativesAtul JainNo ratings yet

- Derivatives & Risk MGMTDocument24 pagesDerivatives & Risk MGMTRox31No ratings yet

- Cappuccino Notes: An Investment Offering A Enhanced Exposure To A Portfolio of Underlying AssetsDocument3 pagesCappuccino Notes: An Investment Offering A Enhanced Exposure To A Portfolio of Underlying AssetsLameuneNo ratings yet

- Currency SwapDocument5 pagesCurrency SwapSachin RanadeNo ratings yet

- Interest Rate Swap ThesisDocument5 pagesInterest Rate Swap Thesisdwham6h1100% (2)

- Derivatives Report 2nd JanDocument3 pagesDerivatives Report 2nd JanAngel BrokingNo ratings yet

- Fresh Highs To Come: Newedge ResearchDocument3 pagesFresh Highs To Come: Newedge Researchapi-26289577No ratings yet

- Kid Deriv CFD Synthetic IndicesDocument5 pagesKid Deriv CFD Synthetic IndicesSamir Ciro Acosta100% (1)

- MaximDocument31 pagesMaximForexProNo ratings yet

- Derivatives Report, 04 Apr 2013Document3 pagesDerivatives Report, 04 Apr 2013Angel BrokingNo ratings yet

- Derivatives Report, 14 March 2013Document3 pagesDerivatives Report, 14 March 2013Angel BrokingNo ratings yet

- Unit 6Document16 pagesUnit 6Nigussie BerhanuNo ratings yet

- Unit 6Document16 pagesUnit 6Abrham TamiruNo ratings yet

- 3.1.2. If Gasoline Trades in A Competitive Market, Would A Transportation Company That Has A UseDocument16 pages3.1.2. If Gasoline Trades in A Competitive Market, Would A Transportation Company That Has A UseJair Azevedo JúniorNo ratings yet

- Non Deliverable Forward TransactDocument17 pagesNon Deliverable Forward TransactBadal Shah100% (1)

- Confident Guidance CG 09-2013Document4 pagesConfident Guidance CG 09-2013api-249217077No ratings yet

- Derivatives Report, 06 Jun 2013Document3 pagesDerivatives Report, 06 Jun 2013Angel BrokingNo ratings yet

- Eagle Investor Presentation FinalDocument20 pagesEagle Investor Presentation Finalandrew1181987No ratings yet

- Chapter-03 - Structure of Interest RatesDocument26 pagesChapter-03 - Structure of Interest RatesZareen TasfiahNo ratings yet

- Derivaties CNDocument34 pagesDerivaties CNMarshNo ratings yet

- Derivatives Report 28 Aug 2012Document3 pagesDerivatives Report 28 Aug 2012Angel BrokingNo ratings yet

- Citi - Convertible Bond Calcs CheatsheetDocument1 pageCiti - Convertible Bond Calcs Cheatsheetchuff6675No ratings yet

- 435x Lecture 2 Futures and Swaps VFinalDocument41 pages435x Lecture 2 Futures and Swaps VFinalMari Tafur BobadillaNo ratings yet

- Managing Transaction ExposureDocument30 pagesManaging Transaction ExposureImtiaz MasroorNo ratings yet

- 1 P.G Apte International Financial ManagementDocument42 pages1 P.G Apte International Financial ManagementrameshmbaNo ratings yet

- Interest Rates, Bond Valuation, and Stock ValuationDocument57 pagesInterest Rates, Bond Valuation, and Stock Valuationnandita3693No ratings yet

- CH 11Document34 pagesCH 11PetersonNo ratings yet

- Deirvatives Report 27th DecDocument3 pagesDeirvatives Report 27th DecAngel BrokingNo ratings yet

- Financial MnagementDocument16 pagesFinancial MnagementbirhanuNo ratings yet

- Session 4: Bond Yield Internal Rate of Return (IRR)Document4 pagesSession 4: Bond Yield Internal Rate of Return (IRR)gigiNo ratings yet

- Session 4: Bond Yield Internal Rate of Return (IRR)Document4 pagesSession 4: Bond Yield Internal Rate of Return (IRR)adiNo ratings yet

- Risk 1211 Brigo NewDocument5 pagesRisk 1211 Brigo NewevanderstraetenbisNo ratings yet

- Derivatives Report 09 Aug 2012Document3 pagesDerivatives Report 09 Aug 2012Angel BrokingNo ratings yet

- Bonds ValuationsDocument57 pagesBonds ValuationsarmailgmNo ratings yet

- Derivatives Report 06 Dec 2012Document3 pagesDerivatives Report 06 Dec 2012Angel BrokingNo ratings yet

- Derivatives - Zell Education 2024Document67 pagesDerivatives - Zell Education 2024harshNo ratings yet

- Econ 122 Lecture 8 Debt Securities 4Document27 pagesEcon 122 Lecture 8 Debt Securities 4cihtanbioNo ratings yet

- Chapter 4 - MinicaseDocument4 pagesChapter 4 - MinicaseMuhammad Aditya TMNo ratings yet

- Final FX Risk & Exposure ManagementDocument33 pagesFinal FX Risk & Exposure ManagementkarunaksNo ratings yet

- Homework 6Document4 pagesHomework 6Chang Chun-MinNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Linear Programming Excel Solver ExampleDocument7 pagesLinear Programming Excel Solver ExampleDwayne Branch100% (1)

- 052176727X AstronomDocument504 pages052176727X AstronomCcneneNo ratings yet

- Canadian Crude SpecsDocument24 pagesCanadian Crude SpecsDwayne BranchNo ratings yet

- Risk in The BoardroomDocument2 pagesRisk in The BoardroomDwayne BranchNo ratings yet

- Nova Scotia Electrical ApprenticeshipDocument6 pagesNova Scotia Electrical ApprenticeshipDwayne BranchNo ratings yet

- 166 Twenty Principles For Good Spreadsheet PracticeDocument20 pages166 Twenty Principles For Good Spreadsheet PracticesatstarNo ratings yet

- Paradise Lost: John MiltonDocument367 pagesParadise Lost: John MiltonDwayne BranchNo ratings yet

- Construction of Free Cash Flows A Pedagogical Note. Part IDocument23 pagesConstruction of Free Cash Flows A Pedagogical Note. Part IDwayne BranchNo ratings yet

- American Replication in The Presence of User Defined Smile DynamicsDocument29 pagesAmerican Replication in The Presence of User Defined Smile DynamicsDwayne BranchNo ratings yet

- Leo Strauss - ''Why We Remain Jews, Hillel House 1962'' (1993 Version)Document37 pagesLeo Strauss - ''Why We Remain Jews, Hillel House 1962'' (1993 Version)Docteur LarivièreNo ratings yet

- Bridging The 14 Domains Across LanguagesDocument2 pagesBridging The 14 Domains Across LanguagesJhedyann Amores100% (5)

- Positive Force: Design As ADocument4 pagesPositive Force: Design As ASelim RezaNo ratings yet

- Acid RainDocument16 pagesAcid RainManogjna SinguluriNo ratings yet

- Calculating The Mean, Median, Mode and Range For Simple DataDocument2 pagesCalculating The Mean, Median, Mode and Range For Simple DataAnonymous hYMWbANo ratings yet

- Waves and Sound AssignmentDocument3 pagesWaves and Sound AssignmentTakunda T. NgorimaNo ratings yet

- Influence - Theory and PracticeDocument327 pagesInfluence - Theory and PracticeBubi Sutomo100% (2)

- The Problem of Partnership Business in NigeriaDocument7 pagesThe Problem of Partnership Business in NigeriarochaNo ratings yet

- AI Machine Learning Complete Course: For PHP & Python DevsDocument96 pagesAI Machine Learning Complete Course: For PHP & Python DevsAmr Shawqy100% (1)

- PT Polythene-Builders-Film PDSDocument2 pagesPT Polythene-Builders-Film PDSGloria ZhuNo ratings yet

- AttackingDocument1 pageAttackingapi-448184356No ratings yet

- (2011) - Nezlek, J. B. Multilevel Modeling For Social and Personality PsychologyDocument122 pages(2011) - Nezlek, J. B. Multilevel Modeling For Social and Personality Psychologytem o0pNo ratings yet

- CONCRETE Book SubmissionDocument41 pagesCONCRETE Book SubmissionAminah KamranNo ratings yet

- ExamplesDocument5 pagesExamplesRahul RawatNo ratings yet

- Avoiding Design Errors: Lessons From Forensics and Their Application To Engineering DesignDocument2 pagesAvoiding Design Errors: Lessons From Forensics and Their Application To Engineering Designjentayu_putih3459No ratings yet

- MASTERING AMERICAN ENGLISH - Hayden, Pilgrim and Haggard PunctuationDocument7 pagesMASTERING AMERICAN ENGLISH - Hayden, Pilgrim and Haggard PunctuationSILVANANo ratings yet

- Recommended Standard Operations Procedure ForDocument12 pagesRecommended Standard Operations Procedure Forprasadjoshi781429No ratings yet

- Naming Organic MoleculesDocument47 pagesNaming Organic MoleculesSandeep BadarlaNo ratings yet

- Practical Aspectsof HPLCDocument23 pagesPractical Aspectsof HPLCtantri ayu lestariNo ratings yet

- FCB V DFC, SSB - Judgment - FinalDocument81 pagesFCB V DFC, SSB - Judgment - Finalanahh ramakNo ratings yet

- Drug Use During Pregnancy and LactationDocument50 pagesDrug Use During Pregnancy and LactationJuveria Fatima75% (4)

- Test HK2 K11 22-23 IiiDocument4 pagesTest HK2 K11 22-23 IiiDuy PhạmNo ratings yet

- Byzantine Art and ArchitectureDocument5 pagesByzantine Art and Architectureestefany ladanNo ratings yet

- 02 CT Apfelbaum On HalbwachsDocument17 pages02 CT Apfelbaum On HalbwachsAndrea Cruz HernándezNo ratings yet

- Rainer Werner Fassbinder - Ed Lawrence KardishDocument114 pagesRainer Werner Fassbinder - Ed Lawrence KardishDéborah García89% (9)

- Adi Sankara Viracita Subramanya Bhujanga StavamDocument5 pagesAdi Sankara Viracita Subramanya Bhujanga StavamRamars AmanchyNo ratings yet

- List of Cases - 2Document4 pagesList of Cases - 2raffy carreteroNo ratings yet

- ENGLISH A1 01 Greet People and Introduce YourselfDocument15 pagesENGLISH A1 01 Greet People and Introduce YourselfNayaraNo ratings yet

- Philippine Studies Segment 4Document27 pagesPhilippine Studies Segment 4Lenoff Cornelius ArceNo ratings yet