Professional Documents

Culture Documents

2010jan04 Stockquote

2010jan04 Stockquote

Uploaded by

Paolo BernardoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2010jan04 Stockquote

2010jan04 Stockquote

Uploaded by

Paolo BernardoCopyright:

Available Formats

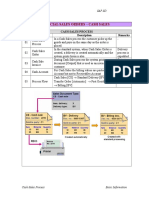

Report date: 01/04/2010 12:10 PM

Trade date: Monday 01/04/2010

PHILIPPINE STOCK EXCHANGE

DAILY QUOTATIONS REPORT

Page:

NET FOREIGN

TRADE (Peso)

BUYING (SELLING)

-----------------------------------------------------------------------------------------------------------------------------------NAME

SYMBOL

BID

ASK

OPEN

HIGH

LOW

CLOSE

VOLUME

VALUE

F I N A N C I A L

**** BANKS ****

ASIATRUST DEV. BANK, INC.

BANCO DE ORO UNIBANK,INC

BANK OF THE PHIL. ISLANDS

CHINA BANKING CORP.

CHINATRUST COMM. BANK

CITYSTATE SAVINGS BANK

METROPOLITAN BANK & TRUST

PHIL. BANK OF COMM. "A"

PHILIPPINE NATIONAL BANK

PHIL. SAVINGS BANK

PHILIPPINE TRUST CO.

RIZAL COMM. BANKING CORP.

SECURITY BANK CORPORATION

UNION BANK OF THE PHIL.

5.20

38.50

46.50

362.5

16.00

27.50

43.50

32.00

23.50

54.00

50.00

17.00

53.00

36.00

5.60

39.00

47.00

365.0

25.00

28.00

44.00

45.00

23.75

57.00

17.25

53.50

36.50

5.20

39.00

47.50

365.0

44.00

24.50

17.25

54.00

36.50

5.2

39

47.5

367.5

44

24.5

17.25

54

36.5

5.2

38.5

46.5

365

43.5

23.75

17

53

36.5

5.2!

38.5!

46.5!

365!

44!

23.75!

17!

53.5!

36.5!

5,000

482,400

421,500

28,410

525,700

425,700

65,100

430,900

97,000

26,000

18,739,800

19,702,100

10,373,150

23,129,800

10,207,850

1,115,475

23,053,700

3,540,500

**** OTHER FINANCIAL INSTITUTIONS ****

ATR KIMENG FIN. CORP.

ATRK

BANKARD, INC.

BKD

1.04

BDO LEASING & FIN., INC. BLFI

1.30

CITISECONLINE.COM, INC.

COL

10.25

FIRST ABACUS FINANCIAL

FAF

.8000

FILIPINO FUND, INC

FFI

5.60

FIRST METRO INVEST. CORP FMIC

25.50

I-REMIT, INC.

I

5.80

MEDCO HOLDINGS

MED

.4700

MANULIFE FINANCIAL CORP. MFC

770.0

NAT'L REINSURANCE CORP.

NRCP

1.58

PHIL. STOCK EXCHANGE INC. PSE

307.5

SUN LIFE FINANCIAL, INC. SLF

1200

VANTAGE EQUITIES, INC.

V

1.28

3.95

1.20

1.36

10.75

.8500

29.50

6.00

.4800

800.0

1.60

310.0

1260

1.30

10.50

.8000

6.10

.3800

770.0

312.5

1.30

10.5!

.85

6!

.47"

770

307.5!

1.3

23,200

150,000

266,000

4,860,000

180

3,940

1,752,000

243,600

122,500

1,574,900

2,188,500

138,600

1,211,850

2,277,600

ASIA

BDO

BPI

CHIB

CHTR

CSB

MBT

PBC

PNB

PSB

PTC

RCB

SECB

UBP

10.5

.85

-

10.5

.8

-

6.1

.48

770

312.5

1.3

5.9

.38

770

307.5

1.3

(

(

(

(

335,100

7,898,000)

5,782,100)

2,425)

519,225)

18,350,500

1,051,200)

541,200

-

I N D U S T R I A L

**** ELECTRICITY, ENERGY,

ALSONS CONS. RES., INC.

ABOITIZ POWER CORPORATION

ENERGY DEV'T (EDC) CORP.

FIRST GEN CORPORATION

FIRST PHIL HLDGS CORP

MANILA ELECTRIC COMPANY

MANILA WATER CO., INC.

PETRON CORPORATION

PHOENIX PETROLEUM PHILS.

EAST ASIA POWER RES. CORP

SPC POWER CORPORATION

TRANS-ASIA OIL AND ENERGY

VIVANT CORPORATION

POWER & WATER ****

ACR

1.22

AP

8.60

EDC

4.45

FGEN

9.40

FPH

46.00

MER

200.0

MWC

15.50

PCOR

5.20

PNX

6.90

PWR

.2100

SPC

2.75

TA

1.18

VVT

4.00

**** FOOD, BEVERAGE & TOBACCO ****

ALASKA MILK CORPORATION

AMC

AGRINURTURE, INC.

ANI

BOGO MEDELLIN MILLING CO. BMM

CEN AZUCAR DE TARLAC

CAT

GINEBRA SAN MIGUEL, INC. GSMI

JOLLIBEE FOODS CORP.

JFC

PANCAKE HOUSE, INC.

PCKH

SAN MIGUEL PURE FOODS "A" PF

PEPSI-COLA PRODUCTS PHILS PIP

ROXAS AND COMPANY, INC.

RCI

RFM CORPORATION

RFM

ROXAS HOLDINGS, INC.

ROX

SWIFT FOOD, INC.

SFI

SAN MIGUEL BREWERY, INC. SMB

SAN MIGUEL CORP. "A"

SMC

SAN MIGUEL CORP. "B"

SMCB

TANDUAY HOLDINGS, INC.

TDY

ALLIANCE TUNA INT'L. INC. TUNA

UNIVERSAL ROBINA CORP.

URC

VITARICH CORPORATION

VITA

7.00

24.25

27.00

8.50

19.75

55.00

40.00

2.34

1.08

.5500

2.00

.1450

9.50

67.50

68.00

2.65

2.02

15.75

.3700

1.24

8.70

4.50

9.50

46.50

203.0

15.75

5.30

7.00

.2600

3.40

1.22

7.10

1.24

8.60

4.70

9.70

48.00

206.0

15.75

5.30

7.00

1.20

-

1.28

8.7

4.7

9.7

48

208

15.75

5.3

7

1.2

-

1.22

8.6

4.45

9.4

46.5

200

15.5

5.2

6.9

1.2

-

1.22

8.6

4.45!

9.5!

46.5!

200!

15.5!

5.2!

7

1.2"

-

3,439,000

1,938,000

25,226,000

3,338,000

632,700

127,740

710,000

1,864,000

410,000

677,000

-

4,292,580

16,672,300 (

113,784,650

31,871,500

29,485,850

25,743,350 (

11,137,175

9,709,800

2,831,500

812,400

-

4,193,500)

574,550

4,137,600

1,839,600

12,025,950)

6,077,500

-

7.10

24.50

10.50

21.75

55.50

9.00

80.00

2.36

.5800

3.45

.1500

9.60

68.00

69.00

3.05

2.04

16.00

.4000

25.00

21.75

55.50

2.32

.5500

.1450

9.60

69.00

68.50

2.08

16.25

.3100

24.5

21.75

55

2.32

.55

.14

9.5

68

67.5

2

15.75

.31

24.5!

21.75

55.5"

2.36"

.55!

.15"

9.6!

68!

68.5!

2.04!

15.75!

.4"

162,900

3,500

263,900

154,000

170,000

250,000

22,000

52,800

51,900

4,178,000

281,500

80,000

4,071,775

76,125

14,598,650

360,340

93,500

35,600

210,200

3,610,900

3,553,050

8,421,420

4,453,025

29,000

301,950)

4,889,250

257,400

5,500

470,550)

208,120)

1,417,500)

-

10"

6,000

110,000

86,000

13,000

60,000

93,900

209,860

62,000

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

BACNOTAN CONS INDUS INC. BCI

9.30 10.00

10.00

CONCRETE AGGREGATES "A"

CA

49.00 81.00

CONCRETE AGGREGATES "B"

CAB

15.00

SOUTHEAST ASIAN CEMENT

CMT

.8200 .8600 .8500

ENGINEERING EQUIP. INC.

EEI

2.44

2.46

2.46

FEDERAL RES. INV. GROUP

FED

8.10 11.75

HOLCIM PHILIPPINES, INC. HLCM

4.75

4.80

4.75

25.5

21.75

55.5

2.36

.55

.15

9.6

69

68.5

2.08

16.25

.4

10

10

.86

2.46

.85

2.44

4.8

4.75

.86

2.44

-

4.8

(

(

(

Report date: 01/04/2010 12:10 PM

Trade date: Monday 01/04/2010

PHILIPPINE STOCK EXCHANGE

DAILY QUOTATIONS REPORT

Page:

NET FOREIGN

TRADE (Peso)

BUYING (SELLING)

-----------------------------------------------------------------------------------------------------------------------------------REPUBLIC CEMENT CORP.

RCM

3.05

3.20

3.05

3.05

3.05

3.05

9,000

27,450

SUPERCITY RLTY DEV. CORP. SRDC

.6200

TKC STEEL CORPORATION

T

3.70

3.85

3.70

3.75

3.7

3.7

80,000

296,250

250,000

152,500 (

152,500)

VULCAN IND'L

VUL

.6200 .7000 .6100

.61

.61

.61!

NAME

**** CHEMICALS ****

CHEMREZ TECHNOLOGIES, INC

EURO-MED LAB. PHIL., INC.

MANCHESTER INTERNATIONAL

MANCHESTER INT'L "B"

MABUHAY VINYL CORP.

SYMBOL

COAT

EURO

MIH

MIHB

MVC

**** DIVERSIFIED INDUSTRIALS ****

ACTIVE ALLIANCE, INC.

AAI

IONICS, INC.

ION

MACONDRAY PLASTICS, INC. MRAY

MUSX CORPORATION

MUSX

PANASONIC MFG PHIL CORP

PMPC

SPLASH CORPORATION

SPH

**** HOLDING FIRMS ****

ASIA AMALGAMATED HOLDINGS

ABACUS CONS. RES. & HLDG.

AYALA CORPORATION

ABOITIZ EQUITY VENTURES

ALLIANCE GLOBAL GROUP INC

AJO.NET HOLDINGS, INC.

A. SORIANO CORPORATION

ALCORN GOLD RES. CORP.

ANGLO PHIL HOLDINGS CORP.

ATN HOLDINGS, INC.

ATN HOLDINGS, INC. "B"

BHI HOLDINGS, INC.

BENPRES HOLDINGS CORP.

DMCI HOLDINGS, INC.

FILINVEST DEV. CORP.

F&J PRINCE HOLDINGS CORP.

F&J PRINCE HLDGS. "B"

HOUSE OF INVESTMENTS,INC.

J.G. SUMMIT HOLDINGS, INC

JOLLIVILLE HOLDINGS CORP.

KEPPEL HOLDINGS

KEPPEL HOLDINGS "B"

LODESTAR INVT.HLDG.CORP

MABUHAY HOLDINGS CORP.

MINERALES INDUSTRIAS CORP

MJC INVESTMENTS CORP.

UEM DEVELOPMENT PHILS INC

METRO PACIFIC INV. CORP.

PACIFICA

PRIME ORION PHILS., INC.

PRIME MEDIA HOLDINGS, INC

REPUBLIC GLASS HLDG. CORP

SOLID GROUP, INC.

SINOPHIL CORPORATION

SM INVESTMENTS CORP.

SOUTH CHINA RESOURCES INC

SEAFRONT RESOURCES CORP.

UNIOIL RES. & HOLDINGS CO

WELLEX INDUSTRIES, INC.

ZEUS HOLDINGS, INC.

AAA

ABA

AC

AEV

AGI

AJO

ANS

APM

APO

ATN

ATNB

BH

BPC

DMC

FDC

FJP

FJPB

HI

JGS

JOH

KPH

KPHB

LIHC

MHC

MIC

MJIC

MK

MPI

PA

POPI

PRIM

REG

SGI

SINO

SM

SOC

SPM

UNI

WIN

ZHI

BID

ASK

OPEN

HIGH

2.20

1.02

.4400

.5600

1.00

2.26

1.94

1.00

1.02

2.30

-

10.50

1.24

58.00

.1150

6.30

3.35

12.00

1.30

60.00

.1200

3.40

56.00

.1150

6.50

3.50

.4000

.8600

297.5

9.00

4.05

.0440

2.04

.0075

1.12

4.90

10.50

210.0

3.40

9.50

2.00

1.00

2.16

6.20

1.70

1.64

1.64

9.30

.3600

3.80

1.80

2.60

2.55

.0725

.4100

1.46

1.60

.8600

.2350

322.5

2.26

.9200

.1000

.1050

.2000

.5000

.8700

302.5

9.10

4.10

.0450

2.06

.0085

1.18

5.00

11.25

250.0

3.45

9.60

2.10

1.18

1.70

2.26

6.30

2.38

2.50

2.75

9.50

.4200

3.85

2.60

.0750

.4500

1.86

1.66

.9000

.2500

325.0

2.30

1.48

.1300

.1200

.2050

2.3

60

.12

6.5

3.5

LOW

CLOSE

2.26

-

2.26!

-

VALUE

172,000

-

393,060

-

60"

.12

6.5

3.4

10,300

12,100,000

5,000

9,000

610,150

1,392,000

32,500

30,800

.57"

.87!

300!

9

4.1!

.044

2.04!

.0075!

1.12!

5

11.25

3.45!

9.5!

2!

2.16

6.3!

9.5

.51"

3.85

1.8

2.6

.0725!

1.48!

.25"

325

2.26"

.0975!

.12"

.2!

10,000

360,000

697,450

65,000

31,260,000

10,900,000

128,000

2,000,000

1,058,000

106,000

73,100

2,484,000

418,000

495,000

3,000

173,000

267,000

10,000

110,000

3,000

11,114,000

2,900,000

79,000

100,000

385,670

1,898,000

150,000

300,000

240,000

5,700

310,600

209,511,125

585,000

127,958,450 (

479,200

261,320

15,000

1,184,960

524,300

796,375

8,580,150

3,971,600

990,020

6,480

1,095,400 (

2,513,600

5,100

420,000

5,400

28,811,450 (

210,250

115,920

25,000

124,975,700

4,330,820

14,625

36,000

48,000

17,400

145,636,225

16,793,150)

6,619,600

2,876,800

2,000

200,600)

23,100

12,418,400)

101,147,700

-

52,167,075

12,900

1,937,300

55,500

75,500

9,600

56,100

159,700

-

16,795,175

-

56

.115

6.5

3.4

H O L D I N G

F I R M S

.5700

.9000

302.5

9.00

4.10

.0450

2.04

.0075

1.12

4.90

10.50

3.50

9.60

2.00

2.16

6.50

9.50

.5100

4.00

1.80

2.60

.0725

1.48

.2500

327.5

2.20

.0975

.1200

.2000

.57

.86

300

9

4.05

.043

2.04

.0075

1.12

4.9

10.5

3.45

9.4

2

2.16

6.3

9.3

.51

3.8

1.8

2.55

.0725

1.46

.25

322.5

2.2

.0975

.12

.2

.57

.9

302.5

9

4.15

.045

2.06

.0075

1.12

5

11.25

3.5

9.6

2.02

2.16

6.6

9.5

.51

4

1.8

2.65

.0725

1.48

.25

327.5

2.32

.0975

.12

.2

VOLUME

P R O P E R T Y

**** PROPERTY ****

ARTHALAND CORPORATION

ANCHOR LAND HOLDINGS,INC.

AYALA LAND INC.

ARANETA PROPERTIES, INC.

BELLE CORPORATION

A BROWN COMPANY, INC.

CITYLAND DEVELOPMENT CORP

CROWN EQUITIES, INC.

CEBU HOLDINGS, INC.

CEBU PROP. VENT. "A"

CEBU PROP. VENT "B"

CYBER BAY CORPORATION

EMPIRE EAST LAND INC.

ETON PROP. PHILS., INC.

EVER-GOTESCO RESOURCES

ALCO

ALHI

ALI

ARA

BEL

BRN

CDC

CEI

CHI

CPV

CPVB

CYBR

ELI

ETON

EVER

.1600

8.30

10.75

.4200

1.40

3.60

1.44

.0410

2.16

1.70

1.80

.5000

.4000

2.44

.1000

.1800

8.70

11.00

.4700

1.42

3.70

1.56

.0450

2.48

1.92

2.00

.5100

.4400

2.65

.1200

11.25

.4300

1.42

3.70

2.14

1.92

.5100

.4000

-

11.25

.43

1.42

3.7

2.16

1.92

.51

.41

-

10.75

.43

1.4

3.7

2.14

1.92

.51

.4

-

11!

.43"

1.42!

3.7!

2.16!

1.92"

.51

.41!

-

4,731,200

30,000

1,365,000

15,000

35,000

5,000

110,000

390,000

-

Report date: 01/04/2010 12:10 PM

Trade date: Monday 01/04/2010

PHILIPPINE STOCK EXCHANGE

DAILY QUOTATIONS REPORT

Page:

NET FOREIGN

TRADE (Peso)

BUYING (SELLING)

-----------------------------------------------------------------------------------------------------------------------------------1,790,000

1,594,400

419,000

FILINVEST LAND, INC.

FLI

.8800 .8900 .9000

.9

.89

.89!

INTERPORT RES.

IRC

.6500 .8200

100,000

71,000

INTERPORT RES. "B"

IRCB

.7100 .8300 .7100

.71

.71

.71!

KEPPEL PHILS. PROP., INC. KEP

1.10

1.60

CITY & LAND DEVELOPERS

LAND

1.32

1.48

FIL-ESTATE LAND, INC.

LND

.3000 .3300

56,733,000

82,315,780

68,544,620

MEGAWORLD CORPORATION

MEG

1.42

1.46

1.46

1.46

1.42

1.46!

86,770,000

42,348,900 (

419,200)

MRC ALLIED IND., INC.

MRC

.5400

.3700

.54

.37

.54"

60,000

6,350

PHILIPPINE ESTATES CORP. PHES

.0975 .1050 .1050

.11

.105

.11"

POLAR PROPERTY HOLDINGS

PO

2.55

3.40

PRIMEX CORPORATION

PRMX

3.15

2,054,500

26,195,200

25,524,200

ROBINSONS LAND CORP.

RLC

12.75 13.00 13.00

13.25 12.75

12.75!

2,220,000

1,625,000 (

44,400)

PHIL REALTY AND HOLDINGS RLT

.7300 .7400 .7400

.74

.73

.73!

147,000

254,240

SHANG PROPERTIES, INC.

SHNG

1.72

1.76

1.76

1.76

1.72

1.72!

STA. LUCIA LAND, INC.

SLI

.7400 .8500

SM DEVELOPMENT CORP.

SMDC

3.70

3.75

4.00

4

3.75

3.75!

751,000

2,883,500

920,000

SAN MIGUEL PROP., INC.

SMP

38.50

1,585,000

15,417,000 (

4,924,700)

SM PRIME HOLDINGS, INC.

SMPH

9.70

9.80

9.80

9.8

9.6

9.7!

SUNTRUST HOME DEV., INC. SUN

.4800 .5200 .4900

.49

.49

.49

160,000

78,400

UNIWIDE HOLDINGS, INC.

UW

.1050 .1200 .1350

.135

.105

.13"

300,000

37,000

1,552,000

2,948,900 (

39,900)

VISTA LAND & LIFESCAPES

VLL

1.88

1.90

1.92

1.92

1.9

1.9"

NAME

SYMBOL

BID

ASK

OPEN

HIGH

LOW

CLOSE

VOLUME

VALUE

S E R V I C E

**** MEDIA ****

ABS-CBN BROADCASTING CORP

GMA NETWORK, INC.

MANILA BULLETIN PUB. CORP

MLA. BROADCASTING CO.

ABS

GMA7

MB

MBC

28.50

7.60

.4800

1.00

29.00

7.80

.5900

-

29.00

7.70

-

**** TELECOMMUNICATIONS ****

DIGITAL TELECOM PHILS INC DGTL

GLOBE TELECOM, INC.

GLO

LIBERTY TELECOMS HOLDINGS LIB

PILIPINO TEL. CORP.

PLTL

PHIL. LONG DIS TEL CO.

TEL

1.32

915.0

2.90

8.30

2550

1.36

920.0

2.95

8.40

2600

1.32

915.0

2.75

8.40

2620

1.32

920

2.9

8.4

2625

**** INFORMATION TECHNOLOGY ****

BOULEVARD HOLDINGS, INC. BHI

DFNN INC.

DFNN

IMPERIAL RES.

IMP

IMPERIAL RES. "B"

IMPB

IPVG CORPORATION

IP

ISLAND INFO AND TECH INC. IS

ISM COMMUNICATIONS CORP. ISM

TRANSPACIFIC BROADBAND

TBGI

PHILWEB CORPORATION

WEB

.0875

7.80

5.50

5.00

1.56

.0675

.0600

3.35

17.75

.0900

8.10

9.90

1.60

.0750

.0625

3.40

18.00

.0925

8.70

.0650

3.20

18.25

**** TRANSPORTATION SERVICES ****

ASIAN TERMINALS, INC.

ATI

ABOITIZ TRANS. SYS. CORP. ATS

INT'L CONTAINER TERM'L SV ICT

KEPPEL PHILS. MARINE, INC KPM

LORENZO SHIPPING CORP.

LSC

MACROASIA CORPORATION

MAC

PAL HOLDINGS, INC.

PAL

METRO PACIFIC TOLLWAYS

TOL

4.00

1.14

22.25

1.30

1.00

2.75

2.85

6.00

4.15

1.22

22.50

1.48

2.95

2.95

9.00

**** HOTEL & LEISURE ****

ACESITE PHILS HOTEL CORP.

GRAND PLAZA HOTEL CORP.

LEISURE & RESORTS CORP.

MANILA JOCKEY CLUB

PREMIERE ENT. PHILS.,INC.

PHILIPPINE RACING CLUB

WATERFRONT PHILS., INC.

DHC

GPH

LR

MJC

PEP

PRC

WPI

2.80

23.00

1.34

2.95

.3500

2.12

.2100

**** EDUCATION ****

CENTRO ESCOLAR UNIVERSITY CEU

FAR EASTERN UNIVERSITY

FEU

IPEOPLE, INC

IPO

**** DIVERSIFIED SERVICES

APC GROUP, INC.

EASYCALL PHILS., INC.-COM

INFORMATION CAPITAL TECH.

JTH DAVIES HOLDINGS, INC.

PACIFIC ONLINE SYS. CORP.

MIC HOLDINGS CORPORATION

PAXYS, INC.

PRIME GAMING PHILS., INC.

PHILIPPINE SEVEN CORP.

****

APC

ECP

ICTV

JTH

LOTO

MET

PAX

PGPI

SEVN

30

7.7

29"

7.7!

20,800

129,000

-

1.32

915

2.75

8.3

2600

1.32!

920"

2.9"

8.4

2600!

50,000

118,810

789,000

808,000

83,420

66,000 (

109,031,900

2,245,600

6,786,900 (

218,485,150

66,000)

81,989,000

6,392,400)

5,738,400

.0925

8.7

.065

3.45

18.25

.0875

7.9

.0625

3.2

17.75

.0875!

8.1!

.0625!

3.4"

18!

3,600,000

117,000

96,800,000

879,000

558,600

320,000

959,400

6,144,750

2,983,200 (

10,186,825 (

226,000

18,750

33,500)

8,688,700)

22.25

-

22.25

-

22.5

-

113,900

-

2,534,300 (

-

1,223,750)

-

3.50

50.00

1.36

3.30

.3600

2.65

.3000

1.36

.3500

2.70

.3000

1.36

.35

2.7

.3

1.36!

.35!

2.7

.3"

639,000

200,000

1,000

10,000

869,040

70,100 (

2,700

3,000

24,480

38,500)

-

8.10

725.0

3.25

8.90

800.0

3.30

775.0

-

.3400

2.10

.7800

1.36

16.25

105.0

2.80

20.00

6.10

.3500

3.30

.9000

1.38

16.50

2.85

27.00

7.20

16.25

2.85

27.50

7.10

22.5

1.36

.36

2.7

.3

29

7.6

775

16.5

2.85

27.5

7.1

775

16.25

2.75

27.5

7.1

775

16.25

2.8

27.5"

7.1"

608,200

993,100

-

20

-

15,500

-

15,500

-

11,600

336,000

1,000

25,000

189,275

940,050

27,500

177,500

Report date: 01/04/2010 12:10 PM

Trade date: Monday 01/04/2010

PHILIPPINE STOCK EXCHANGE

DAILY QUOTATIONS REPORT

Page:

NET FOREIGN

TRADE (Peso)

BUYING (SELLING)

-----------------------------------------------------------------------------------------------------------------------------------NAME

SYMBOL

BID

ASK

OPEN

HIGH

M I N I N G

LOW

&

CLOSE

AB

ABB

APX

APXB

AR

AT

BC

BCB

CPM

DIZ

GEO

LC

LCB

MA

MAB

NI

OM

ORE

PX

SCC

UPM

95.00

98.00

2.85

2.70

.0042

9.40

14.00

18.00

6.50

3.45

.7800

.2450

.2500

.0250

.0260

4.25

.0080

.8000

15.25

53.50

.0070

100.0

102.0

2.90

3.00

.0044

9.50

14.75

19.00

6.60

4.05

.7900

.2500

.2600

.0260

.0270

4.30

.0085

.8800

15.50

55.00

.0080

97.00

98.00

2.85

9.20

14.50

19.00

6.60

3.85

.8000

.2500

.2500

.0260

.0260

4.30

.0080

.8100

15.75

54.50

.0075

**** OIL ****

BASIC ENERGY CORPORATION

ORIENTAL PET. & MIN. "A"

ORIENTAL PET. & MIN. "B"

THE PHILODRILL CORP.

PNOC EXPLORATION CORP.-A

PNOC EXPLORATION CORP.-B

PETROENERGY RES. CORP.

BSC

OPM

OPMB

OV

PEC

PECB

PERC

.1500

.0140

.0140

.0140

10.25

12.25

7.20

.1600

.0150

.0150

.0150

17.25

7.50

.0140

.0140

.0150

7.50

AYALA CORP. PREF. "A"

AYALA CORP. PREF. "B"

ATS CORP. - PREFERRED

BENGUET CORP. CON. PREF

FIRST PHIL HLDGS. - PREF.

GLOBE TELECOM - PREF. "A"

PLDT (10% PREF) SERIES A

PLDT (10% PREF) SERIES B

PLDT (10% PREF) SERIES C

PLDT (10% PREF) SERIES D

PLDT (10% PREF) SERIES E

PLDT (10% PREF) SERIES F

PLDT (10% PREF) SERIES G

PLDT (10% PREF) SERIES H

PLDT (10% PREF) SERIES I

PLDT (10% PREF) SERIES J

PLDT (10% PREF) SERIES K

PLDT (10% PREF) SERIES L

PLDT (10% PREF) SERIES M

PLDT (10% PREF) SERIES N

PLDT (10% PREF) SERIES O

PLDT (10% PREF) SERIES P

PLDT (10% PREF) SERIES Q

PLDT (10% PREF) SERIES R

PLDT (10% PREF) SERIES S

PLDT (10% PREF) SERIES T

PLDT (10% PREF.) SERIES U

PLDT (10% PREF) SERIES V

PLDT (10% PREF) SERIES W

PLDT (10% PREF) SERIES X

PLDT (10% PREF) SERIES Y

PLDT (10% PREF) SERIES Z

PLDT 10% PREF SERIES "AA"

PLDT 10% PREF SERIES "BB"

PLDT 10% PREF SERIES "CC"

PLDT 10% PREF SERIES "DD"

PLDT 10% PREF SERIES "EE"

ACPA

ACPR

ATSP

BCP

FPHP

GLO-PA

TELA

TELB

TELC

TELD

TELE

TELF

TELG

TELH

TELI

TELJ

TELK

TELL

TELM

TELN

TELO

TELP

TELQ

TELR

TELS

TELT

TELU

TELV

TELW

TELX

TELY

TELZ

TLAA

TLBB

TLCC

TLDD

TLEE

520.0

105.0

1.20

46.00

100.0

4.00

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.75

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

530.0

107.0

101.0

11.00

11.00

11.00

-

107.0

100.0

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

10.50

-

ABS-CBN HLDGS. CORP (PDR)

GMA HOLDINGS, INC. (PDR)

MEGAWORLD CORP. WARRANTS

OMICO CORP-WARRANTS

ABSP

GMAP

MEGW1

OMW2

29.00

7.70

.5800

.0022

WARRANTS, PHIL. DEPOSIT RECEIPTS, ETC.

29.50 29.00

29

29

29

7.80

7.90

7.9

7.7

7.8!

.5900 .5900

.59

.57

.58!

.0030

-

MAKATI FINANCE CORP.

MFIN

1.28

9.6

14.5

19

6.6

3.85

.8

.25

.25

.026

.026

4.45

.008

.81

15.75

55

.008

-

.014

.014

.015

7.6

VALUE

O I L

**** MINING ****

ATOK-BIG WEDGE CO., INC.

ATOK-BIG WEDGE.,INC. B

APEX MINING CO., INC. "A"

APEX MINING CO., INC "B"

ABRA MINING & INDUSTRIAL

ATLAS CONS. MIN & DEV'T

BENGUET CORP. "A"

BENGUET CORP. "B"

CENTURY PEAK METALS HLDGS

DIZON COPPER SILVER MINES

GEOGRACE RES. PHIL., INC.

LEPANTO CONS MNG. CO. "A"

LEPANTO CONS. MNG. CO "B"

MANILA MINING CORP. "A"

MANILA MINING CORP. "B"

NIHAO MINERAL RESOURCES

OMICO CORPORATION

ORIENTAL PENINSULA RES.

PHILEX MINING CORPORATION

SEMIRARA MINING CORP.

UNITED PARAGON MINING CO.

100

98

2.85

VOLUME

95

98

2.85

9.2

14

18

6.5

3.4

.78

.245

.25

.025

.026

4.25

.008

.8

15.25

54.5

.0075

100!

98!

2.85

9.4"

14!

19"

6.6"

3.4!

.79!

.25!

.25

.025!

.026

4.3"

.008

.8!

15.5!

55

.0075

10,850

1,000

1,000

2,277,000

33,400

1,100

12,741,000

77,000

2,190,000

14,340,000

2,240,000

32,700,000

25,500,000

2,687,000

66,000,000

20,000

726,500

35,200

24,000,000

1,060,345

98,000

2,850

21,451,500

467,750

20,000

83,934,200

270,800

1,716,200

3,546,200

560,000

844,000

663,000

11,670,050

528,000

16,100

11,248,175

1,924,500

185,000

.014

.014

.014

7.5

.014

.014

.015

7.6"

12,600,000

200,000

11,500,000

32,000

176,400

2,800

166,100

240,100

8,160

5,000

100

200

100

100

100

700

100

100

100

-

861,120

500,000

1,050

2,100

1,050

1,050

1,050

7,350

1,050

1,050

1,050

-

566,050

-

805,300

94,000

3,640,000

-

23,353,700

724,800

2,103,400

-

290,000

-

P R E F E R R E D

107

105

100

100

10.5

10.5

10.5

10.5

10.5

10.5

10.5

10.5

10.5

10.5

10.5

10.5

10.5

10.5

10.5

10.5

10.5

10.5

-

105!

100

10.5!

10.5

10.5

10.5

10.5

10.5

10.5

10.5

10.5

-

SMALL AND MEDIUM ENTERPRISES

-

(

(

(

(

(

2,446,000)

5,500)

39,950,500)

686,650)

1,365,000)

-

Report date: 01/04/2010 12:10 PM

Trade date: Monday 01/04/2010

PHILIPPINE STOCK EXCHANGE

DAILY QUOTATIONS REPORT

Page:

NET FOREIGN

TRADE (Peso)

BUYING (SELLING)

-----------------------------------------------------------------------------------------------------------------------------------RIPPLE E-BUSINESS INT'L. RPL

2.85

4.50

NAME

SYMBOL

Financial

655.24

Industrial

4,519.29

Holding Firms

1,596.72

Property

1,058.91

Service

1,500.18

Mining & Oil

10,527.09

All Shares Index

1,896.86

PSEi

3,005.01

GRAND TOTALS :

SPECIAL BLOCK SALES:

APEX MINING CO., INC. "B"

NO. OF ADVANCES:

NO. OF TRADED ISSUES:

NO. OF TRADES:

31

159

5,388

NON-SECTORAL VOLUME :

NON-SECTORAL VALUE :

HIGH

NO. OF DECLINES:

HIGH

LOW

669.21

4,647.98

1,614.80

1,077.21

1,511.78

10,639.28

1,919.57

3,052.28

655.24

4,519.29

1,591.45

1,054.04

1,500.18

10,387.82

1,896.86

3,005.01

108,281,760

726,781,710.00

0

0.00

4,554,060

27,559,820.00

TOTAL FOREIGN BUYING : P 1,025,523,083.36

TOTAL FOREIGN SELLING : P

610,760,048.50

EXCHANGE NOTICE:

Companies Under Suspension by the Exchange as of December 29, 2009

SYMBOL

AGP,AGPB

BF,BFC &

BFNC

CBC

EIBA,EIBB

ETEL

FC

FPI

FYN & FYNB

GO,GOB

MC,MCB

MAH & MAHB

MON

NXT

PHC

PNC

PTT

PCP

PMT

PPC

STN

SWM

UP

VMC

WHI,WHIB

COMPANY

AGP Industrial Corp.

Banco Filipino Savings and Mortgage Bank

Cosmos Bottling Corporation

Export and Industry Bank, Inc.

eTelecare Global Solutions, Inc.

Fil-Estate Corporation

Forum Pacific, Inc.

Filsyn Corporation

Gotesco Land, Inc.

Marsteel Consolidated, Inc.

Metro Alliance Holdings & Equities Corp.

Mondragon International Philippines, Inc.

NextStage, Inc.

Philcomsat Holdings Corporation

Philippine National Construction Corporation

Philippine Telegraph & Telephone Corporation

Picop Resources, Inc.

Primetown Property Group, Inc.

Pryce Corporation

Steniel Manufacturing Corporation

Sanitary Wares Manufacturing Corporation

Universal Rightfield Property Holdings, Inc.

Victorias Milling Co., Inc.

Wise Holdings, Inc.

Companies Under Rehabilitation

LOW

CLOSE

VOLUME

VALUE

9,537,030

56,883,990

67,787,220

160,903,700

105,291,150

421,447,856

117,645,925.00

289,365,160.00

517,787,545.00

230,249,345.00

363,639,990.00

190,892,070.76

821,850,946

1,709,580,035.76

50,100,000.7590

--------------------TOTAL (P50,100,000.7590)

%MKT

=====================

693,540

184,157.95

MAIN BOARD CROSS VOLUME :

MAIN BOARD CROSS VALUE :

BONDS VOLUME :

BONDS VALUE :

OPEN

211,534,806 @ P0.2368

669.21

4,632.85

1,614.76

1,074.84

1,508.62

10,639.28

1,918.94

3,051.30

ODD LOTS VOLUME :

ODD LOTS VALUE :

ASK

DOWN 14.73

DOWN 109.40

DOWN 14.80

DOWN 17.41

DOWN

8.74

DOWN 235.75

DOWN 21.78

DOWN 47.67

OPEN

Financial

Industrial

Holding Firms

Property

Service

Mining & Oil

All Shares

PSEi

BID

76

2.93

NO. OF UNCHANGED:

52

Report date: 01/04/2010 12:10 PM

Trade date: Monday 01/04/2010

PHILIPPINE STOCK EXCHANGE

DAILY QUOTATIONS REPORT

Page:

NET FOREIGN

TRADE (Peso)

BUYING (SELLING)

-----------------------------------------------------------------------------------------------------------------------------------PMT

Primetown Property Group, Inc.

VMC

Victorias Milling Co., Inc.

NAME

SYMBOL

BID

ASK

OPEN

HIGH

LOW

**** END OF REPORT ****

CLOSE

VOLUME

VALUE

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- SM: Red Batch-Group 9Document20 pagesSM: Red Batch-Group 9anandhuNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Lotto MSNDocument2 pagesLotto MSNMentaru Hack100% (1)

- Vtiger 504 ManualDocument106 pagesVtiger 504 ManualRodrigo Menenghel TamborindeguyNo ratings yet

- Texol Price List 2007 - 2Document10 pagesTexol Price List 2007 - 2CML78No ratings yet

- Media Kit Final - UpdatedDocument12 pagesMedia Kit Final - Updatedapi-4904187010% (1)

- Cash Sales - Session 10Document4 pagesCash Sales - Session 10arvindNo ratings yet

- Sap SDDocument34 pagesSap SDAbhinavsamNo ratings yet

- Presentation1 (BATA)Document8 pagesPresentation1 (BATA)sahoo_pradipkumarNo ratings yet

- Jose Rizal University: College Ob Business Administration and AccountancyDocument2 pagesJose Rizal University: College Ob Business Administration and AccountancykmarisseeNo ratings yet

- Chadha Papers Limited 2005Document10 pagesChadha Papers Limited 2005Siddharth KumarNo ratings yet

- 4388 17565 1 PBpharmDocument10 pages4388 17565 1 PBpharmVinceNo ratings yet

- Jood Aamal PackagesDocument3 pagesJood Aamal PackagesRehmatullah NadeemNo ratings yet

- Hooters v. Raising Cane's - Fresh Never Frozen Declaratory Judgment PDFDocument22 pagesHooters v. Raising Cane's - Fresh Never Frozen Declaratory Judgment PDFMark JaffeNo ratings yet

- ATENA StudioDocument20 pagesATENA StudioAtelier Albania100% (2)

- Corporate SponsorsDocument30 pagesCorporate SponsorsvivektonapiNo ratings yet

- Appreciation LetterDocument3 pagesAppreciation LetterkhushbookayasthNo ratings yet

- Mutual NDADocument4 pagesMutual NDARetwik MukherjeeNo ratings yet

- Social Media: Policies & Procedures For Use of Social Media at Your Home CenterDocument17 pagesSocial Media: Policies & Procedures For Use of Social Media at Your Home CenterAnonymous 3I74YiANo ratings yet

- Partner Relationship Management - Strategic PerspectiveDocument25 pagesPartner Relationship Management - Strategic Perspectiverastogi parag100% (1)

- Bharat Glass Tube Limited Vs Gopal Glass Works LimitedDocument23 pagesBharat Glass Tube Limited Vs Gopal Glass Works LimitedprakashprabumNo ratings yet

- NEW Chapter 11 - CRMDocument13 pagesNEW Chapter 11 - CRMamber leeNo ratings yet

- Accounting Standard Board (IASB)Document20 pagesAccounting Standard Board (IASB)AbhishekNo ratings yet

- Solar Philippines Calatagan Corporation: (A Wholly Owned Subsidiary of Solar Philippines Power Project Holdings, Inc.)Document81 pagesSolar Philippines Calatagan Corporation: (A Wholly Owned Subsidiary of Solar Philippines Power Project Holdings, Inc.)Kent Bryan RamirezNo ratings yet

- 1 Background To The StudyDocument3 pages1 Background To The StudyNagabhushana0% (1)

- AUDITING Mcqs..Document21 pagesAUDITING Mcqs..kamal sahabNo ratings yet

- Ins Npa AdvertDocument3 pagesIns Npa AdvertejoghenetaNo ratings yet

- Acca (F4)Document4 pagesAcca (F4)Christian Awukutsey100% (1)

- MazikGlobal Technologies Acquires Atharvan Business Consulting To Expand Microsoft Dynamics Practice GloballyDocument2 pagesMazikGlobal Technologies Acquires Atharvan Business Consulting To Expand Microsoft Dynamics Practice GloballyAlexandra HartNo ratings yet

- Ufone Advertisement Review MarketingDocument16 pagesUfone Advertisement Review MarketingMohsyn Syed100% (6)

- CAD Forum - How To Find The Map Coordinate System of A DrawingDocument2 pagesCAD Forum - How To Find The Map Coordinate System of A DrawingFeteneNo ratings yet