Professional Documents

Culture Documents

SJC - Payroll Specialist Fact Sheet-03-2012 (2) ABE Grant

SJC - Payroll Specialist Fact Sheet-03-2012 (2) ABE Grant

Uploaded by

Tina PalomaresOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SJC - Payroll Specialist Fact Sheet-03-2012 (2) ABE Grant

SJC - Payroll Specialist Fact Sheet-03-2012 (2) ABE Grant

Uploaded by

Tina PalomaresCopyright:

Available Formats

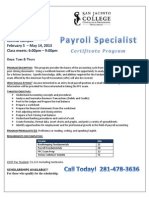

Central Campus May 22 July 19, 2012 Class meets: 6:00pm 10:00pm

Tues & Thurs

PROGRAM DESCRIPTION: This program provides the basics of the accounting cycle from the source documents to the

post-closing documents. Using a workbook learners will have the opportunity to analyze, record, journalize, post, etc. for a fictious business. Specific knowledge, skills, and abilities required for the Fundamental Payroll Certification (FPC) exam offered by the American Payroll Association (APA) will also be covered.

WHO SHOULD ATTEND? Anyone interested in an entry-level payroll position at a small to mid-size organization.

Information will be provided for those interested in taking the FPC exam.

TARGETED OBJECTIVES:

Understand Accounting concepts and procedures Analyze and Journalize Business Transactions (Debits and Credits) Post to the Ledger and Prepare the trail balance Prepare a worksheet Prepare the financial statements from the worksheet Post adjusting entries and closing entries Prepare a Post-Closing trail balance Understand banking procedures and control of cash Create formulas, format data, insert charts and graphs, and print a variety of spreadsheets documents using a windows based Excel program Apply computerized payroll procedures using QuickBooks Identify opportunities for employment and for professional growth in the field of payroll accounting

PROGRAM PREREQUISITE (S): Proficiency in reading, writing, and speaking English. REQUIREMENTS FOR COMPLETION:

COURSE Bookkeeping Fundamentals Payroll Fundamentals QuickBooks for Payroll Professionals TOTAL CONTACT HOURS HRS 15 45 15 75

COST Per Student: $1,313 including textbooks.

SCHOLARSHIPS AVAILABLE!!

For those who qualify for the scholarship.

You might also like

- Tts Core 2015Document6 pagesTts Core 2015Gianluca TurrisiNo ratings yet

- Tts Financial Modeling 0406Document2 pagesTts Financial Modeling 0406JohnNo ratings yet

- SJC - Payroll Specialist Fact Sheet-03-2012 (2) ABE GrantDocument1 pageSJC - Payroll Specialist Fact Sheet-03-2012 (2) ABE GrantTina PalomaresNo ratings yet

- SJC - Payroll SpecialistDocument1 pageSJC - Payroll SpecialistTina PalomaresNo ratings yet

- Myob Ace Payroll: Accounting &Document2 pagesMyob Ace Payroll: Accounting &Muhammad RamadhanNo ratings yet

- IB Scotia477BR CoverletterDocument3 pagesIB Scotia477BR Coverletterphuongdpl2s4518No ratings yet

- Finance Resume Relevant CourseworkDocument7 pagesFinance Resume Relevant Courseworkguj0zukyven2100% (2)

- Diploma in Applied Finance and AccountsDocument4 pagesDiploma in Applied Finance and AccountsKashvihaNo ratings yet

- Financial Accounting Thesis PDFDocument7 pagesFinancial Accounting Thesis PDFfupbxmjbf100% (2)

- Thesis Internship FinanceDocument8 pagesThesis Internship Financekatieharrisannarbor100% (2)

- Business Administration Accounting GuideDocument3 pagesBusiness Administration Accounting Guideapi-320101320No ratings yet

- TLEP AFM Batch-2022-24Document26 pagesTLEP AFM Batch-2022-24Devesh YadavNo ratings yet

- Program Profile PFM Weekend Class 2016Document8 pagesProgram Profile PFM Weekend Class 2016Bayu PrasetiaNo ratings yet

- ENT 11 Business Plan Preparation: Prelim-ModulesDocument17 pagesENT 11 Business Plan Preparation: Prelim-ModulesDena AmorNo ratings yet

- PA Accountants - Accounting Opportunity (2024)Document3 pagesPA Accountants - Accounting Opportunity (2024)dennisNo ratings yet

- Diploma in Accounting Program BUSI 293 I PDFDocument10 pagesDiploma in Accounting Program BUSI 293 I PDFSheena MachinjiriNo ratings yet

- Subrat Tripathi Sap Fico Consultant345681318598114Document6 pagesSubrat Tripathi Sap Fico Consultant345681318598114riteshNo ratings yet

- Financial Modeling & Equity Valuation (Finatics)Document3 pagesFinancial Modeling & Equity Valuation (Finatics)Gyana Sahoo0% (1)

- Resume R0W$HANDocument3 pagesResume R0W$HANPavan ReddyNo ratings yet

- Irrbb JDDocument3 pagesIrrbb JDbarmanarijit4321No ratings yet

- IrfmDocument2 pagesIrfmSuresh Kumar SainiNo ratings yet

- Financial ModelingDocument8 pagesFinancial ModelingBishaw Deo MishraNo ratings yet

- Bookkeeping Skills ResumeDocument5 pagesBookkeeping Skills Resumec2yv821v100% (1)

- LinkedIn Learning Assignment - Financial AccountingDocument5 pagesLinkedIn Learning Assignment - Financial AccountingRamizNo ratings yet

- IB Semester 2 HandbookDocument17 pagesIB Semester 2 HandbookFranciscoJavierVazquezPachonNo ratings yet

- Coursework For Accounting DegreeDocument7 pagesCoursework For Accounting Degreef5d7ejd0100% (2)

- AccountingSyllabus Fall 2016 RWEDocument4 pagesAccountingSyllabus Fall 2016 RWEkennyNo ratings yet

- Syllabus FIN 425 2012Document4 pagesSyllabus FIN 425 2012Abdullah M. ShooNo ratings yet

- Admission Orientation Manual May 2021Document9 pagesAdmission Orientation Manual May 2021Deepak JohnyNo ratings yet

- 301 Tikman ChungDocument5 pages301 Tikman Chung19900926gyNo ratings yet

- Business AccountingDocument2 pagesBusiness AccountingVatsal ShahNo ratings yet

- Omni Academy - Com LessonsDocument4 pagesOmni Academy - Com LessonsMuhammad NaeemNo ratings yet

- Resume Maheswar SAP FICODocument4 pagesResume Maheswar SAP FICOTushar GawandeNo ratings yet

- Accounting I Syllabus: Instructor's Name and Contact InformationDocument6 pagesAccounting I Syllabus: Instructor's Name and Contact InformationDino DizonNo ratings yet

- Corporate Bridge - Investement Banking Prep GuideDocument93 pagesCorporate Bridge - Investement Banking Prep GuideDharmish ShahNo ratings yet

- Ham IdDocument4 pagesHam IdMohammed Junaid0% (1)

- Assistant Controller ResumeDocument7 pagesAssistant Controller Resumehggrgljbf100% (2)

- Financial ModelingDocument8 pagesFinancial ModelingAmit GuptaNo ratings yet

- Finance Intern ResumeDocument8 pagesFinance Intern Resumec2yns01b100% (1)

- MBA Orientation Manual March 2021Document9 pagesMBA Orientation Manual March 2021SaranyaNo ratings yet

- Coursework of AccountingDocument7 pagesCoursework of Accountingzys0vemap0m3100% (2)

- Resume Format in Word File For AccountantDocument6 pagesResume Format in Word File For Accountantafiwfrvtf100% (2)

- Excel For Auditors Sept, 2014Document2 pagesExcel For Auditors Sept, 2014Godfrey KakalaNo ratings yet

- Level7 BusinessRSCH V02Document1 pageLevel7 BusinessRSCH V02abcNo ratings yet

- Financial Modeling Training PDFDocument8 pagesFinancial Modeling Training PDFVaneet Singh AroraNo ratings yet

- FSA Course Outline 10-06-2016Document6 pagesFSA Course Outline 10-06-2016Supreet NarangNo ratings yet

- Mergers Acquisitions Valuation With ExcelDocument4 pagesMergers Acquisitions Valuation With ExcelTazeen Islam0% (1)

- Management 301: Management Career LecturesDocument4 pagesManagement 301: Management Career LecturesSherry ZhuNo ratings yet

- Best Resume Format Finance JobsDocument7 pagesBest Resume Format Finance Jobssbbftinbf100% (2)

- Becker Bec Homework ScoresDocument6 pagesBecker Bec Homework Scoresdbafojwlf100% (2)

- Academic Planning OverviewDocument4 pagesAcademic Planning OverviewWanshan ChenNo ratings yet

- Finance Intern Resume ExampleDocument8 pagesFinance Intern Resume Examplef634dexc100% (2)

- SAP FICO Resume FormatDocument4 pagesSAP FICO Resume Formatchaitu215No ratings yet

- 186 Syllabus MCOM-1Document30 pages186 Syllabus MCOM-1Md Sharif HossainNo ratings yet

- ECON 007 Course OutlineDocument4 pagesECON 007 Course OutlineLê Chấn PhongNo ratings yet

- F2 TranscriptDocument16 pagesF2 TranscriptKevin KausiyoNo ratings yet

- Resume For Finance StudentDocument4 pagesResume For Finance Studentafllxjwyf100% (1)

- Resume For Finance Internship ObjectiveDocument6 pagesResume For Finance Internship Objectivevapmwbyhf100% (1)

- Benefits Realisation Management: The Benefit Manager's Desktop Step-by-Step GuideFrom EverandBenefits Realisation Management: The Benefit Manager's Desktop Step-by-Step GuideNo ratings yet

- Reset Your Thinking Before Presenting to Executive LeadershipFrom EverandReset Your Thinking Before Presenting to Executive LeadershipNo ratings yet

- SpringBreakFlyer ColorDocument1 pageSpringBreakFlyer ColorTina PalomaresNo ratings yet

- SJC - Certified Associate in Project Management Certification Preparation GrantDocument1 pageSJC - Certified Associate in Project Management Certification Preparation GrantTina PalomaresNo ratings yet

- Tax Season Flyer Eng/SpanDocument2 pagesTax Season Flyer Eng/SpanTina PalomaresNo ratings yet

- SJC - A+ PC Tech Flyer Tpeg Spring 2013Document1 pageSJC - A+ PC Tech Flyer Tpeg Spring 2013Tina PalomaresNo ratings yet

- Fall 2012 After School Program CRDocument1 pageFall 2012 After School Program CRTina PalomaresNo ratings yet

- PC Support Technician A+ CertificationDocument1 pagePC Support Technician A+ CertificationTina PalomaresNo ratings yet

- San Jacinto College TPEG FlyerDocument1 pageSan Jacinto College TPEG FlyerTina PalomaresNo ratings yet

- CRNC August Program List 081012Document4 pagesCRNC August Program List 081012Tina PalomaresNo ratings yet

- LPNC Computer Workshop August 17 RVSDDocument1 pageLPNC Computer Workshop August 17 RVSDTina PalomaresNo ratings yet