Professional Documents

Culture Documents

Bad en

Uploaded by

Manal ElkhoshkhanyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bad en

Uploaded by

Manal ElkhoshkhanyCopyright:

Available Formats

19.

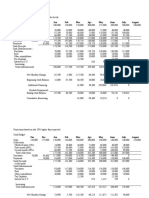

Problem 4 On December 31, 2003 the adjusted trial balance of Baden Personnel Agency shows the following selected data: Commission Receivable, $12,000 Commission Revenue, $80,000 Interest Expense, $15,500 Interest Payable, $1,500 Utilities Expense, $4,500 Accounts Payable, $2,200 Analysis indicates that adjusting entries were made for (a) $12,000 of employment commission revenue earned but not billed, (b) $1,500 of accrued but unpaid interest, and (c) $2,200 of utilities expense accrued but not paid. Instructions (a) Prepare the closing entries at December 31, 2003. (b) Prepare the reversing entries on January 1, 2004. (c) Enter the adjusted trial balance data in T-accounts. Post the entries in (a) and (b) and rule and balance the accounts. (d) Prepare the entries to record (1) the collection of the accrued commission on January 8, (2) payment of the utility bill on January 10, and (3) payment of all the interest due ($2,500) on January 15. (e) Post the entries in (d) to the temporary accounts. (f) What is the interest expense for the month of January 2004? 20. Problem 5 Carey Company sells many products. Gummo is one of its popular items. Below is an analysis of the inventory purchases and sales of Gummo for the month of March. Carey Company uses the periodic inventory system. Units 100 60 200 Purchases Unit Cost $60 $78 $82 80 60 50 40 $90 $130 $130 $130 Units 70 Sales Selling Price/Unit $120

3/1 3/3 3/4 3/10 3/16 3/19 3/25 3/30

Beginning inventory Purchase Sales Purchase Sales Sales Sales Purchase

Instructions (a) Using the FIFO assumption, calculate the amount charged to cost of goods sold for March. (Show computations) (b) Using the LIFO assumption, calculate the amount assigned to the inventory on hand on March 31. (Show computations)

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Parent, Inc Actual Financial Statements For 2012 and OlsenDocument23 pagesParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyNo ratings yet

- Fashion ShoeDocument5 pagesFashion ShoeManal ElkhoshkhanyNo ratings yet

- 50 Multiple Choice, T/F, & Essay QuestionsDocument24 pages50 Multiple Choice, T/F, & Essay QuestionsManal Elkhoshkhany100% (1)

- Egypt Revolution Inc.Document4 pagesEgypt Revolution Inc.Manal ElkhoshkhanyNo ratings yet

- Auditing SP 2008 CH 5 SolutionsDocument13 pagesAuditing SP 2008 CH 5 SolutionsManal ElkhoshkhanyNo ratings yet

- Auditing SP 2008 CH 6 SolutionsDocument19 pagesAuditing SP 2008 CH 6 SolutionsManal ElkhoshkhanyNo ratings yet

- Chapters 11 & 12Document4 pagesChapters 11 & 12Manal ElkhoshkhanyNo ratings yet

- Hightower ServiceDocument3 pagesHightower ServiceManal Elkhoshkhany100% (2)

- Omaha 1Document7 pagesOmaha 1Manal ElkhoshkhanyNo ratings yet

- Omaha 1Document7 pagesOmaha 1Manal ElkhoshkhanyNo ratings yet

- Financial AccountingDocument3 pagesFinancial AccountingManal Elkhoshkhany100% (1)

- Accounting For Managers FinalDocument4 pagesAccounting For Managers FinalManal ElkhoshkhanyNo ratings yet

- Managerial AccountingDocument5 pagesManagerial AccountingManal ElkhoshkhanyNo ratings yet

- Project A Project B Probability Net Cash Flow Probability Net Cash FlowDocument1 pageProject A Project B Probability Net Cash Flow Probability Net Cash FlowManal ElkhoshkhanyNo ratings yet

- Comprehensive Problem 2Document3 pagesComprehensive Problem 2Manal ElkhoshkhanyNo ratings yet

- Reed Clothier Income StatementDocument4 pagesReed Clothier Income StatementManal ElkhoshkhanyNo ratings yet

- Gray HouseDocument2 pagesGray HouseManal ElkhoshkhanyNo ratings yet

- Summertime Corporation Statement of Owner's Equity For The Year Ending 12/31/2012Document2 pagesSummertime Corporation Statement of Owner's Equity For The Year Ending 12/31/2012Manal ElkhoshkhanyNo ratings yet

- Finance QuizDocument3 pagesFinance QuizManal ElkhoshkhanyNo ratings yet

- Nov Dec Jan Feb Mar Apr May June July AugustDocument9 pagesNov Dec Jan Feb Mar Apr May June July AugustManal ElkhoshkhanyNo ratings yet

- JanDocument1 pageJanManal ElkhoshkhanyNo ratings yet

- StatsDocument1 pageStatsManal ElkhoshkhanyNo ratings yet

- Finance QuizDocument2 pagesFinance QuizManal ElkhoshkhanyNo ratings yet