Professional Documents

Culture Documents

Incometax Calcualtor

Uploaded by

prakash_pkOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Incometax Calcualtor

Uploaded by

prakash_pkCopyright:

Available Formats

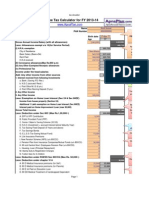

Enter the values only in these cells

NAME : PAN :

Dont enter anything

STATEMENT OF TOTAL INCOME FOR THE PERIOD 01-04-2006 TO 31-03-2007 INCOME FROM SALARIES

Salary Received 0 LESS : Allowance Exempt U/s 10 U/s 10(14) towards Conveyance U/s 10(13A) towards HRA 0 0 LESS : Deduction U/s 16 Professional Tax U/s 16(iii) 0 0 ADD : Any other income as reported by the employee LESS : Interest paid for Housing Loan on Self Occupied Property ( Restricted to Rs 1,50,000/= maxm.) LESS: DEDUCTION U/S ( C ) 1 2 3 4 5 6 7 8 PF - Employee's contrbn. Life Insurance Premium PPF NSC / NSS Children's Education Housing Loan Repayment Educational Exp Investment in Mutual Fund 0 LESS: DEDUCTION U/S ( CCC )- Pension Fund Total Total Deductions U/s 80 (C ), 80 (CCC) & 80 (CCD) LESS: DEDUCTION U/S ( D ) for Mediclaim LESS: DEDUCTION U/S ( G ) for Donations Sub Total 0 0 0 0 0 0 0 0

Taxable Total Income Tax Liability ADD: Educational Cess @ 2 % Total Tax Payable Less: Tax deducted if any in the previous months @ CIT Balance Tax to be deducted

0 0 0 0 0 0 0

Name: GROSS SALARY Convey Night Shift Employer's Spl. Allwn. ance Allowance PF Contrn. 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Month

Basic+DA

HRA

Incentive

Total Salary

April May June July Aug Sept Oct Nov Dec Jan Feb March Total

12000 12000 12000 12000 12000 12000 12000 12000 12000 12000 12000 12000 144000

0 0 0 0 0 0 0 0 0 0 0 0 0 0

Less : Non Taxable Items Employer's PF Contribution Non Taxable Allowances Taxable income Actual Rent Paid 0 0 0

PAN : DEDUCTIONS Total Net Paid Deductions 0 0 0 0 0 0 0 0 0 0 0 0 0 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0

Prof. Tax

P F Contbn. Income Tax

Others

0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0 0 0 0

You might also like

- PayslipDocument1 pagePayslipHimanshu_Sharm_749150% (4)

- Taxation for Australian Businesses: Understanding Australian Business Taxation ConcessionsFrom EverandTaxation for Australian Businesses: Understanding Australian Business Taxation ConcessionsNo ratings yet

- Income Tax StatementDocument2 pagesIncome Tax StatementgdNo ratings yet

- Income Tax Calculator For MaleDocument19 pagesIncome Tax Calculator For MaleAlok SaxenaNo ratings yet

- Free Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Document16 pagesFree Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Bijender Pal ChoudharyNo ratings yet

- Income Tax (Master)Document1 pageIncome Tax (Master)nareshjangra397No ratings yet

- Tax CalculatorDocument10 pagesTax Calculatorgsagar879No ratings yet

- Income Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxDocument16 pagesIncome Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxshikhaxohebkhanNo ratings yet

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDocument9 pagesTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNo ratings yet

- Form 16 For AY 2015-16 CAknowledge - inDocument16 pagesForm 16 For AY 2015-16 CAknowledge - inKiranNo ratings yet

- Front - Maintain Training FacilitiesDocument5 pagesFront - Maintain Training FacilitiesRechie Gimang AlferezNo ratings yet

- Employee Cost FormDocument3 pagesEmployee Cost FormMuhammad A IsmaielNo ratings yet

- Calculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10Document10 pagesCalculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10api-19754583No ratings yet

- UNIT 2 Income From SalaryDocument146 pagesUNIT 2 Income From Salaryeasy mailNo ratings yet

- Tax Slab RatesDocument12 pagesTax Slab RatesTony JosephNo ratings yet

- Annual Income Tax Statement For The Financial Year 2013Document4 pagesAnnual Income Tax Statement For The Financial Year 2013Manoj SankaranarayanaNo ratings yet

- Salary Structure For 2008-2009Document28 pagesSalary Structure For 2008-2009anon-289280No ratings yet

- 35 - Salary Slip FormatDocument1 page35 - Salary Slip FormatNeeraj GuptaNo ratings yet

- Income Tax CalculationDocument1 pageIncome Tax Calculationsoumyadeep1947No ratings yet

- FORM No. 16Document31 pagesFORM No. 16sebastianksNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11LordEnigma18No ratings yet

- IncometaxDocument12 pagesIncometaxje-ann montejoNo ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Taxability of Employer's Contribution To An Approved Superannuation Fund Vs NPSDocument7 pagesTaxability of Employer's Contribution To An Approved Superannuation Fund Vs NPSRaviteja GNo ratings yet

- 12ba KishanDocument11 pages12ba KishanChaitanya SwaroopNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- QUA05891 SepSalarySlipwithTaxDetailsDocument1 pageQUA05891 SepSalarySlipwithTaxDetailssrajput66No ratings yet

- Investment Declaration Form F.Y. 2016-17Document2 pagesInvestment Declaration Form F.Y. 2016-17Sanjeev Kumar50% (2)

- IT Calculator, Mohandas 2013Document36 pagesIT Calculator, Mohandas 2013DEEPTHISAINo ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- 35 - Salary Slip FormatDocument1 page35 - Salary Slip FormatAsif Rahman0% (1)

- Delhi Information Technology Park, Shastri Park, INDIA: Income Tax Worksheet For The Financial Year APRIL-2011 - MARCH-2012Document1 pageDelhi Information Technology Park, Shastri Park, INDIA: Income Tax Worksheet For The Financial Year APRIL-2011 - MARCH-2012tippu09No ratings yet

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNo ratings yet

- Salary Slip (31563893 September 2019)Document1 pageSalary Slip (31563893 September 2019)Asif AliNo ratings yet

- IT Calculator 14 15 Taxguru - inDocument16 pagesIT Calculator 14 15 Taxguru - inanirbanpwd76No ratings yet

- Enter Necessary Data For Income Tax CalculationDocument12 pagesEnter Necessary Data For Income Tax CalculationAnzi25No ratings yet

- Investment Declaration Form 2012-13 PDFDocument1 pageInvestment Declaration Form 2012-13 PDFnovalhemantNo ratings yet

- Muthoot Finance Limited: Sarabjeet KaurDocument2 pagesMuthoot Finance Limited: Sarabjeet KaurYashapujaNo ratings yet

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- Tax Decl Ration For 2011 - 2012Document1 pageTax Decl Ration For 2011 - 2012palavanish89No ratings yet

- Pay Less Tax,: Ways To LegallyDocument1 pagePay Less Tax,: Ways To LegallyGauravNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Annualized Witholding TaxDocument9 pagesAnnualized Witholding TaxShairaCerenoNo ratings yet

- Income Tax Calculator FY 2016 17Document11 pagesIncome Tax Calculator FY 2016 17JITENDRA SHERKHANENo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarNo ratings yet

- Null 3Document2 pagesNull 3bibhuti bhusan routNo ratings yet

- Salary1 2022 DisDocument45 pagesSalary1 2022 Disparinita raviNo ratings yet

- What Is Annualized Withholding TaxDocument7 pagesWhat Is Annualized Withholding TaxMarietta Fragata RamiterreNo ratings yet

- TDS (Tax Deducted at Source) : ST STDocument6 pagesTDS (Tax Deducted at Source) : ST STRuchiRangariNo ratings yet

- Salary Slip (20157656 June, 2019)Document1 pageSalary Slip (20157656 June, 2019)ahmedullahNo ratings yet

- Details of Investment Declaration For The Financial Year 2014-2015Document1 pageDetails of Investment Declaration For The Financial Year 2014-2015Abhinav AgnihotriNo ratings yet

- Money Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2From EverandMoney Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2No ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet