Professional Documents

Culture Documents

NO 3 Payment of Wages Act

NO 3 Payment of Wages Act

Uploaded by

Devabrata PaponCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NO 3 Payment of Wages Act

NO 3 Payment of Wages Act

Uploaded by

Devabrata PaponCopyright:

Available Formats

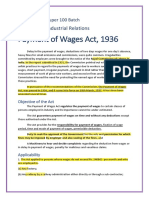

Payment Of Wages Act, 1936

Applicability i) Every person employed in any factory, upon any railway or through subcontractor in a railway and a person employed in an industrial or other establishment. ii) The State Government may by notification extend the provisions to any class of person employed in any establishment or class of establishments.

Eligibility Every person who is employed in any of the above mentioned establishments and who is drawing less than Rs. 1,600 per month.

Benefits : the Act prescribes for i) The regular and timely payment of wages (on or before 7th day or 10th day after last day of the wage period in respect of which the wages are payable) ii) Preventing unauthorised deductions being made from wages and arbitrary fines.

Penal Provisions Penalties are from Rs. 200-1000. Repeat offenses attract 1 to 6 months imprisonment and fine from Rs. 5003000. Delay wage payments attract penalty of Rs. 100 per day of delay.

Minimum Wages Act, 1936

Applicability Any person who directly or through another person, whether for himself or for any other person employs one or more employees in any scheduled employment in respect of which minimum rates of wages have been fixed under this Act.

Eligibility Any person who is employed for hire or reward to do any work in a scheduled employment and includes an outdoor worker to whom any articles or materials are given for either doing some work either at home or at any other premises.

Benefits The Act prescribes the minimum rates of wages payable to employees for different scheduled employment for different class of work and for adults, adolescents, children and apprentices depending upon different localities.

Penal Provisions Imprisonment up to 6 months and/or fine up to Rs. 500 is imposable for contravention.

You might also like

- Minimum Wages Rate - Approach and ApplicationsDocument22 pagesMinimum Wages Rate - Approach and ApplicationsAishwarya Sunilkumar20% (5)

- Payment of Gratuity Act, 1972.Document15 pagesPayment of Gratuity Act, 1972.arpit0104100% (1)

- Minimum Wages ActDocument1 pageMinimum Wages ActAarthi PadmanabhanNo ratings yet

- Main Provisions of The Payment of Wages ActDocument7 pagesMain Provisions of The Payment of Wages ActPrashant Meena100% (1)

- Wage Policy of IndiaDocument26 pagesWage Policy of IndiaRahul ChandrasekharanNo ratings yet

- Payment of Bonus ActDocument48 pagesPayment of Bonus Actp1i2y3No ratings yet

- Fast Track Revision Notes of Labour LawsDocument11 pagesFast Track Revision Notes of Labour LawsanubhavdwivediNo ratings yet

- Projesct On Industrial RelationsDocument32 pagesProjesct On Industrial RelationsMahesh WaniNo ratings yet

- Laws Governing An Employer-Employee RelationshipDocument18 pagesLaws Governing An Employer-Employee RelationshipRitikaNo ratings yet

- P & A Compl - Induction MNGTDocument5 pagesP & A Compl - Induction MNGTAnimesh1981No ratings yet

- Department of Home ScienceDocument31 pagesDepartment of Home ScienceShreshtha RaoNo ratings yet

- Payment of Wages Act 1936Document18 pagesPayment of Wages Act 1936Linganagouda PatilNo ratings yet

- Lab PolDocument7 pagesLab PolsachinoilNo ratings yet

- Industrial Acts of IndiaDocument41 pagesIndustrial Acts of IndiaAllen Joy PazhukkatharaNo ratings yet

- Statutorycompliance 13031131101503 Phpapp01Document11 pagesStatutorycompliance 13031131101503 Phpapp01Pratibha ChopraNo ratings yet

- Labour Law Policy of IndiaDocument21 pagesLabour Law Policy of IndiaNav MatharuNo ratings yet

- 42 Annex-6 Labour Laws 1 191Document12 pages42 Annex-6 Labour Laws 1 191bhogbhogaNo ratings yet

- Labour Law-II Psda Presentation by Shivam JainDocument11 pagesLabour Law-II Psda Presentation by Shivam JainShivam JainNo ratings yet

- The Payment of Bonus Act, 1965Document9 pagesThe Payment of Bonus Act, 1965Priyanshi DaveNo ratings yet

- Payment of Wages ActDocument6 pagesPayment of Wages ActKirti YadavNo ratings yet

- Gratuity Act 1972Document6 pagesGratuity Act 1972Bhavdeepsinh JadejaNo ratings yet

- Recent Amendments in Labour LawDocument7 pagesRecent Amendments in Labour LawLovepreet KaurNo ratings yet

- Labour Legislation (1) (H.R.M)Document43 pagesLabour Legislation (1) (H.R.M)Karan Veer SinghNo ratings yet

- Provisions of Other Relevant Labour Laws in BriefDocument8 pagesProvisions of Other Relevant Labour Laws in BriefHarshit VermaNo ratings yet

- Constitutional Provisions of The Labour Law in PakistanDocument27 pagesConstitutional Provisions of The Labour Law in PakistankhalidsanaNo ratings yet

- Payment of Wages 9Document2 pagesPayment of Wages 9Alok SinghNo ratings yet

- PPLE, Module-4Document17 pagesPPLE, Module-4Urvi AaryikaNo ratings yet

- Labour Laws-Short NotesDocument31 pagesLabour Laws-Short NotesmrnaikNo ratings yet

- Laws Relating To WagesDocument16 pagesLaws Relating To Wagesnitin_chotuNo ratings yet

- Payment Wages Act 1936Document15 pagesPayment Wages Act 1936vipin jaiswalNo ratings yet

- Labour Legislations in INDIADocument43 pagesLabour Legislations in INDIAAbhinav RanaNo ratings yet

- Satutory ComplianceDocument12 pagesSatutory ComplianceAbdul Wahid Ibrahim MalkaniNo ratings yet

- Equal Remuneration Act 1976Document13 pagesEqual Remuneration Act 1976Beauty Of NatureNo ratings yet

- Act Person Responsible Penal ProvisionsDocument3 pagesAct Person Responsible Penal ProvisionsAarthi PadmanabhanNo ratings yet

- Payment of Wages 1936Document64 pagesPayment of Wages 1936santhosh prabhu mNo ratings yet

- Labour LawDocument4 pagesLabour LawAnonymous DxTrpzaNo ratings yet

- Lecture 12 - Payment of Wages Act, 1936Document12 pagesLecture 12 - Payment of Wages Act, 1936Gourav SharmaNo ratings yet

- Salient FeaturesDocument1 pageSalient FeaturessakethNo ratings yet

- Payment Wages Act 1936 - SelfDocument33 pagesPayment Wages Act 1936 - SelfEKTA AGARWALNo ratings yet

- Labor Rights in The ConstitutionDocument4 pagesLabor Rights in The ConstitutionAbdullah JadoonNo ratings yet

- Assignment 2 of IRLL Topic: Minimum Wages Act, 1948Document13 pagesAssignment 2 of IRLL Topic: Minimum Wages Act, 1948Satinder Kaur 753No ratings yet

- Provision in Constitution Related To Women, Slavery Etc in Labor LawDocument35 pagesProvision in Constitution Related To Women, Slavery Etc in Labor LawMomina NadeemNo ratings yet

- A Brief Check List of Labour LawsDocument54 pagesA Brief Check List of Labour Lawsjose_sebastian_2100% (1)

- Labour Laws 37Document37 pagesLabour Laws 37Tarun GoelNo ratings yet

- Minimum Wages ActDocument31 pagesMinimum Wages ActanithaNo ratings yet

- Three New Labour Codes: Country: IndiaDocument17 pagesThree New Labour Codes: Country: IndiaChanakya NitiNo ratings yet

- Labour Laws Individual Assignment - Code On Wages Subject Code: MHR4CCHR05Document5 pagesLabour Laws Individual Assignment - Code On Wages Subject Code: MHR4CCHR05Seher BhatiaNo ratings yet

- Payment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalDocument23 pagesPayment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal Agarwalangel.nishuNo ratings yet

- Payment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalDocument23 pagesPayment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalAdityaNo ratings yet

- The Minimum Wage Act, 1948: Definition of EmploymentDocument2 pagesThe Minimum Wage Act, 1948: Definition of EmploymentShraddha ChhapoliaNo ratings yet

- Minimum Wages Act, 1948Document10 pagesMinimum Wages Act, 1948Vinay SharmaNo ratings yet

- International HRM LawsDocument14 pagesInternational HRM Lawspranayprasad93No ratings yet

- Applicable Labour Laws in India: 1. Factories Act, 1948Document30 pagesApplicable Labour Laws in India: 1. Factories Act, 1948Dhanur GuptaNo ratings yet

- Statutory Compliances For HRDocument12 pagesStatutory Compliances For HRGaurav Narula83% (65)

- Law To Fix Minimum WagesDocument23 pagesLaw To Fix Minimum WagesSamuel NissyNo ratings yet

- Bar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3From EverandBar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3No ratings yet

- Labor Contract Law of the People's Republic of China (2007)From EverandLabor Contract Law of the People's Republic of China (2007)No ratings yet

- Employment Law: a Quickstudy Digital Law ReferenceFrom EverandEmployment Law: a Quickstudy Digital Law ReferenceRating: 1 out of 5 stars1/5 (1)