Professional Documents

Culture Documents

The EOQ Formula

The EOQ Formula

Uploaded by

Jithin SreenivasanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The EOQ Formula

The EOQ Formula

Uploaded by

Jithin SreenivasanCopyright:

Available Formats

The EOQ Inventory Formula

James M. Cargal

Mathematics Department

Troy University Montgomery Campus

A basic problem for businesses and manufacturers is, when ordering supplies, to determine

what quantity of a given item to order. A great deal of literature has dealt with this problem

(unfortunately many of the best books on the subject are out of print). Many formulas and

algorithms have been created. Of these the simplest formula is the most used: The EOQ (economic

order quantity) or Lot Size formula. The EOQ formula has been independently discovered many

times in the last eighty years. We will see that the EOQ formula is simplistic and uses several

unrealistic assumptions. This raises the question, which we will address: given that it is so

unrealistic, why does the formula work so well? Indeed, despite the many more sophisticated

formulas and algorithms available, even large corporations use the EOQ formula. In general, large

corporations that use the EOQ formula do not want the public or competitors to know they use

something so unsophisticated. Hence you might wonder how I can state that large corporations do

use the EOQ formula. Lets just say that I have good sources of information that I feel can be relied

upon.

The Variables of the EOQ Problem

Let us assume that we are interested in optimal inventory policies for widgets. The EOQ

formula uses four variables. They are:

D: The demand for widgets in quantity per unit time. Demand can be thought of as a

rate.

Q: The order quantity. This is the variable we want to optimize. All the other variables

are fixed quantities.

C: The order cost. This is the flat fee charged for making any order and is independent

of Q.

h: Holding costs per widget per unit time. If we store x widgets for one unit of time,

it costs us x@h.

The EOQ problem can be summarized as determining the order quantity Q, that balances the

order cost C and the holding costs h to minimize total costs. The greater Q is, the less we will spend

on orders, since we order less often. On the other hand, the greater Q is the more we spend on

inventory. Note that the price of widgets is a variables that does not interest us. This is because

we plan to meet the demand for widgets. Hence the value of Q has nothing to do with this quantity.

If we put the price of widgets into our problem formulation, when we finally have finally solved the

optimal value for Q, it will not involve this term.

The EOQ Inventory Formula by J. M. Cargal

Figure 1 The EOQ Process

T

P

C

Q

h

Q

D

C

Q h

D

= + = +

2 2

2

T

u

= +

CD

Q

Qh

2

The Assumptions of the EOQ Model

The underlying assumptions of the EOQ problem can be represented by Figure 1. The idea

is that orders for widgets arrive instantly and all at once. Secondly, the demand for widgets is

perfectly steady. Note that it is relatively easy to modify these assumptions; Hadley and Whitin

[1963] cover many such cases. Despite the fact that many more elaborate models have been

constructed for inventory problem the EOQ model is by far the most used.

An Incorrect Solution

Solving for the EOQ, that is the quantity that minimizes total costs, requires that we

formulate what the costs are. The order period is the block of time between two consecutive orders.

The length of the order period, which we will denote by P, is Q/D. For example, if the order

quantity is 20 widgets and the rate of demand is five widgets per day, then the order period is 20/5,

or four days. Let T

p

be the total costs per order period. By definition, the order cost per order period

will be C. During the order period the inventory will go steadily from Q, the order amount, to zero.

Hence the average inventory is Q/2 and the inventory costs per period is the average cost, Q/2, times

the length of the period, Q/D. Hence the total cost per period is:

If we take the derivative of T

p

with respect to Q and set it to zero, we get Q = 0. The problem is

solved by the device of not ordering anything. This indeed minimizes the inventory costs but at the

small inconvenience of not meeting demand and therefore going out of business. This is what many

people, perhaps most people do, when trying to solve for the EOQ the first time.

The Classic EOQ Derivation

The first step to solving the EOQ problem is to correctly state the inventory costs formula.

This can be done by taking the cost per period T

p

and dividing by the length of the period, Q/D, to

get the total cost per unit time, T

u

:

2

The EOQ Inventory Formula by J. M. Cargal

Q h

QT CD

u

2

2

0 + =

Q

T

h

CD

h

T

h

u u

|

\

|

.

| + =

2

2

2

2

0

T

h

Q

T

h

k

u u

2

2

2

=

|

\

|

.

| +

T

u

*

= 2CDh

Q

*

=

2CD

h

In this formula the order cost per unit time is CD/Q and Qh/2 is the average inventory cost per unit

time. If we take the derivative of T

u

with respect to Q and set that equal to 0, we can solve for the

economic order quantity (where the exponent * implies that this is the optimal order quantity):

If we plug Q

*

into the formula for T

u

, we get the optimal cost, per unit time:

The Algebraic Solution

It never hurts to solve a problem in two different ways. Usually each solution technique will

yield its own insights. In any case, getting the same answer by two different methods, is a great way

to verify the result. If we multiply the formula for T

u

on both sides by Q, we get, after a little

rearranging, a quadratic equation in Q:

Next we divide through by h/2 to change our leading coefficient to 1. Completing the square, we

get:

Note that this equation has two variables. T

u

is a function of Q (and could well be written as T

u

(Q)).

Hence we have a curve in the Cartesian plane with axes labeled Q and T

u

. We want the value of Q

that minimizes T

u

. Notice that the term is a constant. Writing that constant as k, and

2CD

h

rearranging the equation, we get:

3

The EOQ Inventory Formula by J. M. Cargal

0

200

400

600

800

1000

1200

1400

1600

T

o

t

a

l

C

o

s

t

1 6 11 16 21 26 31 36 41 46 51 56 61 66 71 76

Order Quantity

Min

Figure 2 Total Cost as a Function of Order Quantity

Q .

*

=

=

2 30 50

6

22 36

If we set the quadratic term to zero, then . Any change in the quadratic term from zero T h k

u

=

increases the size of T

u

. Hence the optimal size of T

u

is which just happens to be

h k

which is the value we found earlier. The quadratic term is zero if and only if .

2CDh

Q

T

h

u

=

This gives us the identity . Q h T

u

* *

=

An Example

It is useful at this point to consider a numerical example. The demand for klabitzs is 50 per

week. The order cost is $30 (regardless of the size of the order), and the holding cost is $6 per

klabitz per week. Plugging these figures into the EOQ formula we get:

This brings up a little mentioned drawback of the EOQ formula. The EOQ formula is not an integer

formula. It would be more appropriate if we ordered klabitzs by the gallon. Most of the time, the

nearest integer will be the optimal integer amount. In this case, the total inventory cost T

u

is $134.18

per week when we order 22 klabitzs. If instead, we order 23 klabitzs the cost is $134.22.

4

The EOQ Inventory Formula by J. M. Cargal

0

200

400

600

800

1000

1200

1400

1600

O

r

d

e

r

C

o

s

t

H

o

l

d

i

n

g

C

o

s

t

1 6 1116212631364146515661667176

Order Quantity

Min

Figure 3 Order and Holding Costs

d T

dQ

CD

Q

2

2 3

2

=

d T

dQ

hCD

h CD

2

2 2

2

4

*

=

A graph of this problem is illuminating: Figure 2. Because the graph is so flat at the optimal

point, there is very little penalty if we order a slightly sub-optimal quantity. We can better

understand the graph if we view the combined graphs of the order costs and the holding costs given

in Figure 3. The basic shapes of all three graphs (total costs, order costs, holding costs) are always

the same. The graph of order costs is a hyperbola; the graph of holding costs is linear; and as a

result the graph of the total costs (T

u

) is convex. This can also be seen in that the function is

dT

dQ

u

increasing and the function

is positive every where. If we plug the optimal quantity, Q

*

, into this last formula we get:

5

The EOQ Inventory Formula by J. M. Cargal

Ordinarily this last quantity is very small, which indicates that the total cost of inventory T

u

changes

very slowly with Q (in the optimal region). Hence the assumptions of the EOQ model do not have

to be accurate because the problem usually is tolerant of errors.

If you study closely the graphs in Figure 3, it may seem clear to you that their sum, T

u

,

reaches a minimum precisely where the two graphs intersect; that is at the point where order costs

and holding costs are equal. The gives us the equality . Solving that equality is the easiest

Qh

CD

Q 2

=

way to derive the EOQ formula.

Why Use the EOQ Formula At All?

A problem that occurs in applied mathematics more than pure is that we hang onto formulas

and techniques that have been made (mostly) obsolete by technology. Try to think what it was like

to solve a problem like the one here forty years ago. The simple operation of division was either

done by hand, or by use of logarithms out of a table, or less exactly by using a slide rule. It was not

practical to simply calculate the total cost of inventory for a large set of order quantities and to

compare answers. The EOQ formula simplified the problem to a minimal number of calculations.

However, now it is quite simple to calculate total costs of inventory for hundreds of order quantities,

and this can be done from scratch in less time than it use to take to employ the EOQ formula. We

can do it with a spreadsheet.

The spreadsheet in Figure 4, takes the problem from the previous example, and computes

for a large variety of quantities the order costs, holding costs, and total costs. It took about 15

minutes to set this spreadsheet up, and most of that time was spent on formatting (for example

putting in lines). The formulas for order costs and holding costs were inserted to calculate the

respective entries for the order quantity of one. The total cost entry is defined to be the sum of the

first two entries (although its column comes first). Then the formulas are copied down the length

of the order quantity column. The only trick is that you must remember to use absolute addresses

for the fixed parameters. Once the spreadsheet is set up, the values for C, D, and h can be changed

and the entire spreadsheet will recalculate in less than a second. Note also, that the EOQ formula

itself is calculated at the top of the spreadsheet: its result can be compared with the columns. The

spreadsheet also provided the graphs in Figure 2 and Figure 3.

Spreadsheets are superb for many problems in discrete mathematics. Knowing this, software

companies have endowed current spreadsheets with hundreds of scientific functions. Just like

formulas, the spreadsheet can be made to incorporate assumptions more realistic than those in the

EOQ model. In many cases it is easier to do this with spreadsheets and more illuminating.

6

The EOQ Inventory Formula by J. M. Cargal

Demand/unit time order cost holding cost item /unit time

50 30 6

EOQ = 22.3606797749979

Order Quantity Total Cost Order Cost Holding Cost

1 1503.00 1500.00 3

2 756.00 750.00 6

3 509.00 500.00 9

4 387.00 375.00 12

5 315.00 300.00 15

6 268.00 250.00 18

7 235.29 214.29 21

8 211.50 187.50 24

9 193.67 166.67 27

10 180.00 150.00 30

11 169.36 136.36 33

12 161.00 125.00 36

13 154.38 115.38 39

14 149.14 107.14 42

15 145.00 100.00 45

16 141.75 93.75 48

17 139.24 88.24 51

18 137.33 83.33 54

19 135.95 78.95 57

20 135.00 75.00 60

21 134.43 71.43 63

22 134.18 68.18 66

23 134.22 65.22 69

24 134.50 62.50 72

25 135.00 60.00 75

26 135.69 57.69 78

27 136.56 55.56 81

28 137.57 53.57 84

29 138.72 51.72 87

30 140.00 50.00 90

31 141.39 48.39 93

32 142.88 46.88 96

33 144.45 45.45 99

34 146.12 44.12 102

35 147.86 42.86 105

36 149.67 41.67 108

37 151.54 40.54 111

38 153.47 39.47 114

39 155.46 38.46 117

40 157.50 37.50 120

Figure 4 A Spreadsheet Analysis of the Inventory Problem

7

The EOQ Inventory Formula by J. M. Cargal

Hadley, G. and T. M. Whitin. Analysis of Inventory Systems. 1963. Englewood Cliffs, New Jersey:

Prentice-Hall.

8

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Applied Mathematics 10 (Zambak) - Zambak Publishing (2008) PDFDocument200 pagesApplied Mathematics 10 (Zambak) - Zambak Publishing (2008) PDFdata100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Activity Design ScoutingDocument3 pagesActivity Design ScoutingMary Ann Marasigan Cruiz94% (18)

- Inclusive Education in The Philippines: Study Guide For Module No. 1 (Las 2)Document9 pagesInclusive Education in The Philippines: Study Guide For Module No. 1 (Las 2)Maia GabrielaNo ratings yet

- On Line Company MumbaiDocument2 pagesOn Line Company Mumbaisharadggg8309No ratings yet

- CAIIB-Financial Management-Module B Study of Financial Statements C.S.Balakrishnan Faculty Member SPBT CollegeDocument39 pagesCAIIB-Financial Management-Module B Study of Financial Statements C.S.Balakrishnan Faculty Member SPBT Collegesharadggg8309No ratings yet

- Success Quotes - IIIDocument2 pagesSuccess Quotes - IIIsharadggg8309No ratings yet

- Success Quotes - IIIDocument2 pagesSuccess Quotes - IIIsharadggg8309No ratings yet

- OMS NaturopatiaDocument33 pagesOMS NaturopatiaJoão Augusto Félix100% (1)

- Jarrett Graff - PD Reference Letter Spring 2021Document1 pageJarrett Graff - PD Reference Letter Spring 2021api-453380215No ratings yet

- TCSDocument17 pagesTCSFahad MaqsoodNo ratings yet

- Paediatrics ProformaDocument34 pagesPaediatrics ProformaPranita BhatNo ratings yet

- ComDocument294 pagesComAMAN SAXENANo ratings yet

- Key Account ManagementDocument27 pagesKey Account ManagementMahmood SadiqNo ratings yet

- Assgnmnt Equity 2Document17 pagesAssgnmnt Equity 2Khazatul NaimaNo ratings yet

- LBP - Dr. Dessy Sp.sDocument77 pagesLBP - Dr. Dessy Sp.srahmadsyahNo ratings yet

- Stanislavakian Acting As PhenomenologyDocument21 pagesStanislavakian Acting As Phenomenologybenshenhar768250% (2)

- Checklist of Land Birds in Tenkasi and Ambasamudram Taluk, Tirunelveli District: at The Foot Hills of Southern Western GhatsDocument12 pagesChecklist of Land Birds in Tenkasi and Ambasamudram Taluk, Tirunelveli District: at The Foot Hills of Southern Western GhatsresearchinbiologyNo ratings yet

- The Surrealist Roots of Video EssaysDocument5 pagesThe Surrealist Roots of Video EssayspsicorticoNo ratings yet

- TT4 Tests Unit 9BDocument2 pagesTT4 Tests Unit 9BSonia AdevaNo ratings yet

- Case Presentation: Muhammad Ali Bin Abdul Razak Wan Ahmad Syazani Bin Mohamed Nadiah Mohd NasirDocument63 pagesCase Presentation: Muhammad Ali Bin Abdul Razak Wan Ahmad Syazani Bin Mohamed Nadiah Mohd NasirarbyjamesNo ratings yet

- Content Analysis: Objective, Systematic, and Quantitative Description of ContentDocument30 pagesContent Analysis: Objective, Systematic, and Quantitative Description of ContentpratolectusNo ratings yet

- Module NoDocument2 pagesModule NoCristia FayeNo ratings yet

- Stylus StudyDocument2 pagesStylus Studyapi-549307910No ratings yet

- English in Use - Verbs - Wikibooks, Open Books For An Open World PDFDocument86 pagesEnglish in Use - Verbs - Wikibooks, Open Books For An Open World PDFRamedanNo ratings yet

- Nahjul Balagha - Selected Letters and AdmonishmentsDocument93 pagesNahjul Balagha - Selected Letters and AdmonishmentsYasin T. al-Jibouri100% (1)

- Bsim3v3 3.3 Manual PDFDocument200 pagesBsim3v3 3.3 Manual PDFfabbNo ratings yet

- Japanese - Verb - Conjugation (From Wikipedia) PDFDocument16 pagesJapanese - Verb - Conjugation (From Wikipedia) PDFYuki MarcelinNo ratings yet

- Datig & Schlurmann - Performance and Limitations of The Hilbert-Huang Transformation (HHT) With An Application To Irregular Water WavesDocument52 pagesDatig & Schlurmann - Performance and Limitations of The Hilbert-Huang Transformation (HHT) With An Application To Irregular Water Wavesnkoreisha7752No ratings yet

- English Communication 2Document25 pagesEnglish Communication 2Tilak MishraNo ratings yet

- Chandi Homam: Laghu Paddhati (Short Procedure)Document33 pagesChandi Homam: Laghu Paddhati (Short Procedure)Maximiliano Baratelli100% (1)

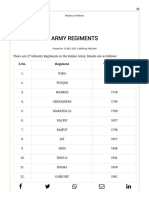

- Army Regiments: S.No. Regiment Year of RaisingDocument3 pagesArmy Regiments: S.No. Regiment Year of RaisingAsc47No ratings yet

- Assignment 3 English Unit PlanDocument8 pagesAssignment 3 English Unit Planapi-626567329No ratings yet

- Theories of Language Acquisition (Table ( (R)Document14 pagesTheories of Language Acquisition (Table ( (R)Vali Rahaman100% (2)