Professional Documents

Culture Documents

Formula Sheet: Managerial Finance FRL 300

Formula Sheet: Managerial Finance FRL 300

Uploaded by

raja_ali1005082Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Formula Sheet: Managerial Finance FRL 300

Formula Sheet: Managerial Finance FRL 300

Uploaded by

raja_ali1005082Copyright:

Available Formats

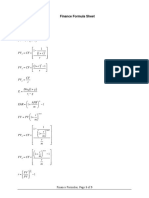

Managerial Finance

FRL 300

Formula Sheet

Prepared by P. Sarmas

Income Taxable

Liability Tax

Rate Tax Average =

Cash Flow from Assets = Cash Flow to Creditors + Cash Flow to Stockholders

Operating Cash Flow Interest Paid Dividend Paid

- ANet Working Capital - Net New Borrowing - Net New Equity

- Net Capital Spending Cash Flow to Creditors Cash Flow to Stockholders

Cash Flow from Assets

EBIT Ending Net Fixed Assets

+ Depreciation - Beginning Net Fixed Assets

- Taxes + Depreciation .

Operating Cash Flow Net Capital Spending

Ending Net Working Capital (CA CL)

- Beginning Net Working Capital (CA-CL)

Change in Net Working Capital

Ending L.T. Debt Ending Equity

- Beginning L.T. Debt - Beginning Equity

Net New Borrowing - Addition to Retained Earnings

Net New Equity

b = 1 Dividend Payout Ratio

Earnings Retention Ratio =

b) * (ROA - 1

b * ROA

Rate Growth = Internal

b) * (ROE - 1

b * ROE

Rate Growth e Sustainabl =

t r

t

FVIF PV r PV

,

* ) 1 ( = + = FV

t r

t

PVIF FV

r

PV

,

*

) 1 (

=

+

=

FV

mt

m

,

r

t m

FVIF PV

m

r

PV FV

*

* ) 1 ( = + =

mt

r

t m

PVIF FV

r

FV

PV

,

*

* =

+

=

m

m

) 1 (

1

m

1 ( EAR + =

t r

e PV FV

*

* =

t r

e FV PV

*

*

=

)

r

m

t r

t

FVIFA C

r

r

C FVA

,

*

1 ) 1 (

* =

(

+

=

t r

t

PVIFA C

r r

,

*

) 1 ( *

* =

(

+

=

r

C PVA

1 1

(

r

C

PV

Perpetuity

=

) 1 ( * * ) 1 ( *

1 ) 1 (

*

,

r FVIFA C r

r

r

C FVA

t r due

t

due

+ = +

(

+

=

) 1 ( * * ) 1 ( *

) 1 ( *

1

*

,

r PVIFA C r

r r

r

C

t r due

t

due

+ = +

(

1

(

= PVA

Reminder: In the case of frequent compounding or discounting,

divide the nominal rate (APR) by m and multiply period by m.

m is number of times interest is compounded/discounted in one

period. Also, annuity interval must match the frequency (m) of

compounding or discounting.

t t

r

FV

r r

r

C Value Bond

) 1 ( ) 1 ( *

1 1

*

+

+

(

+

=

(1+R) = (1+r)*(1+h)

t t

B

B

YTM

FV

YTM YTM

YTM

C V

V

Coupon

Yield Current

FV

Coupon

Rate Coupon

) 1 ( ) 1 ( *

1 1

*

+

+

(

+

=

=

=

(

+

+

+ +

+

+

+

+

+

=

+

+

+

+

+

+

=

+

n

c

n

n

n

t

r

g r

D

r

D

r

D

r

D

r

D

P

r

D

r

D

r

D

P

) 1 (

1

*

) 1 (

.....

) 1 ( ) 1 ( ) 1 (

........

) 1 ( ) 1 ( ) 1 (

1 3

2

2

1

1

0

3

3

2

2

1

1

0

n

n

g D D

g

P

D

r

g r

D

P

r

D

P

) 1 ( *

0

0

1

1

0

0

+ =

+ =

=

=

=

+

+

=

n

t

t

t

CF

r

CF

NPV

1

0

) (

) 1 (

0 ) (

) 1 (

0

1

= +

+

=

CF

IRR

CF

n

t

t

t

0

1

) 1 (

CF

r

CF

PI

n

t

t

t

=

+

=

1 +

+ =

t

t

CF

CF Cum

t PBP

2

1

Ivestment Value Ending Investment Value Beginning

n

Income Net

ARR

n

t

t

+

=

=

n

n

t

t n

I t

n

o t

t

F

t

MIRR

r CIF

r

COF

) 1 (

) 1 ( *

) 1 (

1

+

+

=

+

=

Operating Cash Flow = (SalesVariable CostFixed CostDepreciation)(1-T) + Depreciation

Operating Cash Flow = EBIT + Depreciation Taxes

Operating Cash Flow = (Sales OC Depreciation)*(1-T) + Depreciation

Operating Cash Flow = Net Income + Depreciation

Operating Cash Flow = (Sales OC)*(1 T) + T*Depreciation

Book Value of Asset = Original Cost Accumulated Depreciation

n

Value Salvage Cost Original

on Depreciati Line Straight

=

2

365

Turnover Receivable

365

Period Receivable

Receivable Accounts Average

Sales Credit

Turnover Receivable

Turnover Inventory

365

Inventory Average

Sold Goods of Cost

End Beginning

Average

Turnover Payable

Period Payable

Payable Average

Sold Goods of Cost

Turnover Payable

Period Inventory

Turnover Inventory

+

=

=

=

=

=

=

=

You might also like

- Equations From DamodaranDocument6 pagesEquations From DamodaranhimaggNo ratings yet

- Formula Sheet Foundations of FinanceDocument5 pagesFormula Sheet Foundations of Financeyukti100% (1)

- Robbins Fom8 TB 01aDocument40 pagesRobbins Fom8 TB 01adavidsaucedaiii100% (2)

- Exam Formula SheetDocument2 pagesExam Formula SheetYeji KimNo ratings yet

- FNCE 623 Formulae For Mid Term ExamDocument3 pagesFNCE 623 Formulae For Mid Term Examleili fallahNo ratings yet

- RSM 333 Fall 2019 Formula SheetDocument2 pagesRSM 333 Fall 2019 Formula SheetJoe BobNo ratings yet

- Finance Final Cheat SheetDocument1 pageFinance Final Cheat SheetAnonymous OEdl6l28QANo ratings yet

- Sustainable Architecture: One Central ParkDocument10 pagesSustainable Architecture: One Central ParkVAISHNAVINo ratings yet

- The Aspectual System of Soviet DunganDocument18 pagesThe Aspectual System of Soviet DunganSergey BychkoNo ratings yet

- Formula Sheet: Evaluation of Financial Policy GBA 546Document9 pagesFormula Sheet: Evaluation of Financial Policy GBA 546Sameer SayyedNo ratings yet

- Selection of Useful FormulasDocument3 pagesSelection of Useful FormulasМаша СкрипченкоNo ratings yet

- Useful Formulas: C C C R C CDocument4 pagesUseful Formulas: C C C R C CSebine MemmedliNo ratings yet

- Bff2140 Corporate Finance I: Formula Sheet Financial MathematicsDocument2 pagesBff2140 Corporate Finance I: Formula Sheet Financial MathematicsFira SyawaliaNo ratings yet

- FRL 300 Formula Sheet Common FinalDocument3 pagesFRL 300 Formula Sheet Common FinalAnonymous WimU99ilUNo ratings yet

- Adms3530f18 Final Exam Formula Sheet PDFDocument6 pagesAdms3530f18 Final Exam Formula Sheet PDFSandy SandNo ratings yet

- FIN10670 - Formula Sheet - Final TestDocument2 pagesFIN10670 - Formula Sheet - Final TestSean ZhangNo ratings yet

- Formula Sheet Exam 1 PDFDocument2 pagesFormula Sheet Exam 1 PDFBlue DragonNo ratings yet

- Formula Sheet: Short-Term Solvency RatiosDocument2 pagesFormula Sheet: Short-Term Solvency RatiosNgô Hoàng Bích Kha100% (1)

- Formula Sheet Short-Term Solvency RatiosDocument2 pagesFormula Sheet Short-Term Solvency RatiosNguyễn Ngọc Phương LinhNo ratings yet

- Corporate Finance Theory: Formula SheetDocument5 pagesCorporate Finance Theory: Formula SheeticeslothNo ratings yet

- FIN10670 Formula Sheet Mid Term TestDocument2 pagesFIN10670 Formula Sheet Mid Term TestSean ZhangNo ratings yet

- Formula Sheet BF FMDocument2 pagesFormula Sheet BF FMZara MoosaNo ratings yet

- 2016CFA一级强化班 数量Document313 pages2016CFA一级强化班 数量Mario XieNo ratings yet

- Selected Formulas - 4thedition - Jul2018Document5 pagesSelected Formulas - 4thedition - Jul2018yantong0505No ratings yet

- FM Shot NotesDocument25 pagesFM Shot NotesragefolioNo ratings yet

- I. Formula SheetDocument6 pagesI. Formula SheetHuyền ĐoànNo ratings yet

- Valuation and Risk ModelsDocument28 pagesValuation and Risk ModelsChaitanya JadhavNo ratings yet

- Cover Page & Formulae Sheet For Fnce10002 MST ExamDocument2 pagesCover Page & Formulae Sheet For Fnce10002 MST ExamTaeeeNo ratings yet

- Profit Margin Total Assets Turnover Equity Multiplier: Formula AFDocument4 pagesProfit Margin Total Assets Turnover Equity Multiplier: Formula AFDiva Tertia AlmiraNo ratings yet

- BFC2140 Final Exam List of FormulaeDocument2 pagesBFC2140 Final Exam List of FormulaeLisa KangNo ratings yet

- Valuation and Risk ModelsDocument28 pagesValuation and Risk ModelsmohamedNo ratings yet

- Ross Formula - Card SheetDocument3 pagesRoss Formula - Card SheetkazadiratiNo ratings yet

- Financial Markets and ProductsDocument54 pagesFinancial Markets and ProductsNg Win WwaNo ratings yet

- FINA 1310 - Lecture 3 NotesDocument6 pagesFINA 1310 - Lecture 3 NotesAayushi ReddyNo ratings yet

- Exam Cheat Sheet VSJDocument3 pagesExam Cheat Sheet VSJMinh ANhNo ratings yet

- 395 Midterm 1 Cheat SheetDocument2 pages395 Midterm 1 Cheat Sheetchrisjames20036No ratings yet

- Managerial Fin 2Document5 pagesManagerial Fin 2api-3698549No ratings yet

- CRMA 4 FreeCashFlowDocument12 pagesCRMA 4 FreeCashFlowSiddharth MehtaNo ratings yet

- 01 V1 - 2016CFA一级强化班 - 数量组合经济学固收3Document105 pages01 V1 - 2016CFA一级强化班 - 数量组合经济学固收3Mario XieNo ratings yet

- FORMULASDocument5 pagesFORMULASNurul AsyiqinNo ratings yet

- Fomula Spreadsheet (WACC and NPV)Document7 pagesFomula Spreadsheet (WACC and NPV)vaishusonu90No ratings yet

- Công TH CDocument12 pagesCông TH Chvu65291No ratings yet

- Interest Rates That Vary With Time: I A I CWDocument3 pagesInterest Rates That Vary With Time: I A I CWTepe HolmNo ratings yet

- Corporate Finance: Week 1 - Introductory TutorialDocument14 pagesCorporate Finance: Week 1 - Introductory TutorialIshmeet SinghNo ratings yet

- Finance NoteDocument19 pagesFinance NoteHui YiNo ratings yet

- Formulae SheetDocument1 pageFormulae Sheetsolid_foxNo ratings yet

- Formula Sheet Corporate FinanceDocument19 pagesFormula Sheet Corporate FinancePatricia TekgültekinNo ratings yet

- MBA32-Corporate Finance SharingDocument23 pagesMBA32-Corporate Finance SharingPhươngAnhNo ratings yet

- Ba2802 FormulaSheet2Document1 pageBa2802 FormulaSheet2eee “eezzyy” zzzNo ratings yet

- Session 2-The Time Value of Money-Reminder SM 2022-23Document42 pagesSession 2-The Time Value of Money-Reminder SM 2022-23Deborah KpeyeNo ratings yet

- Microsoft Word - Formula Sheet N1560 and N1560edo - 221124 - 182738Document3 pagesMicrosoft Word - Formula Sheet N1560 and N1560edo - 221124 - 182738Dawid HamerNo ratings yet

- Crib SheetDocument3 pagesCrib SheetabboussyNo ratings yet

- Formula SheetDocument4 pagesFormula Sheetinspiredbysims4No ratings yet

- FV PV R: Finance Formula SheetDocument3 pagesFV PV R: Finance Formula Sheetkfir goldburdNo ratings yet

- 04 Investasi Lanjutan Deni JaenudinDocument12 pages04 Investasi Lanjutan Deni JaenudinDENI JAENUDINNo ratings yet

- Executive Summary of Finance 430Document31 pagesExecutive Summary of Finance 430Ein LuckyNo ratings yet

- 4 - 9 Valuation Model Dino Polska SADocument111 pages4 - 9 Valuation Model Dino Polska SAyms122874No ratings yet

- Công thức IM tự luận- cho finalDocument6 pagesCông thức IM tự luận- cho finalTuấn NguyễnNo ratings yet

- Time Value of Money: CFA Level 1 2006 - Formula SheetDocument18 pagesTime Value of Money: CFA Level 1 2006 - Formula SheetGautam MehtaNo ratings yet

- ADMS3530 - Midterm 1 Formula Sheet - W24Document2 pagesADMS3530 - Midterm 1 Formula Sheet - W24anthonymalizia1234No ratings yet

- Principles of Finance Formulae SheetDocument4 pagesPrinciples of Finance Formulae SheetAmina SultangaliyevaNo ratings yet

- FM 03 Time Value of MoneyDocument14 pagesFM 03 Time Value of MoneyPrathmesh JoshiNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Nbme Medicine Shelf Review Session 2Document142 pagesNbme Medicine Shelf Review Session 2Swisskelly1100% (1)

- EHEF 2013 Book CatalogueDocument71 pagesEHEF 2013 Book CatalogueAlfianti ElixirNo ratings yet

- Thesis For MD Community MedicineDocument7 pagesThesis For MD Community Medicinedianaturnerspringfield100% (2)

- Analytical Skills 15 McqsDocument4 pagesAnalytical Skills 15 Mcqsmuhammad usmanNo ratings yet

- Lecture04 AnnotatedDocument25 pagesLecture04 AnnotatedLevi HackermanNo ratings yet

- The Third LevelDocument2 pagesThe Third LevelHari PrakashNo ratings yet

- Congestion Pricing Now TMRB Recommendations Letter 7.14.23Document4 pagesCongestion Pricing Now TMRB Recommendations Letter 7.14.23City & State New YorkNo ratings yet

- Manual HT001Document13 pagesManual HT001andrija_ganzbergerNo ratings yet

- Disintegration TestDocument19 pagesDisintegration TestUsman Najeeb Cheema100% (1)

- Electronic Fuel Viscosity ControllerDocument44 pagesElectronic Fuel Viscosity ControllerPhan Cao An Truong100% (1)

- LRT200C Parts 79578 PDFDocument198 pagesLRT200C Parts 79578 PDFAlejandro Alberto Robalino Mendez100% (1)

- Laundry Business PlanDocument58 pagesLaundry Business PlanJennifer Beatriz Mena RenderosNo ratings yet

- Script FinalDocument7 pagesScript FinalGEENE CASTRONo ratings yet

- Lab Report Water Potential FinalDocument6 pagesLab Report Water Potential Finalade2001fr3113No ratings yet

- Language Learning As A Factor of Women Empowerment As Perceived by The Ab Els StudentsDocument10 pagesLanguage Learning As A Factor of Women Empowerment As Perceived by The Ab Els StudentsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Ah Xiang - History of China To 1912 PDFDocument558 pagesAh Xiang - History of China To 1912 PDFKarthikeya MulaNo ratings yet

- Alloy Casting Institute - Big Chemical EncyclopediaDocument3 pagesAlloy Casting Institute - Big Chemical EncyclopediaJohn BoranNo ratings yet

- Call For Book Chapter (Springer)Document3 pagesCall For Book Chapter (Springer)Puneet Bansal100% (1)

- Michelle - Chemical Equilibrium WS PDFDocument2 pagesMichelle - Chemical Equilibrium WS PDFLin Xian XingNo ratings yet

- Unit 3 Economic Geography: WG.7a-b, 8, 9a-DDocument39 pagesUnit 3 Economic Geography: WG.7a-b, 8, 9a-DLeoncio LumabanNo ratings yet

- 3rd QUARTER B&P 9 Week 1Document42 pages3rd QUARTER B&P 9 Week 1Odessa MarohomsalicNo ratings yet

- Guillain-Barre Syndrome Student HandoutDocument2 pagesGuillain-Barre Syndrome Student HandoutMiss LindiweNo ratings yet

- Art Appreciation ActivityDocument8 pagesArt Appreciation ActivityArman DomingoNo ratings yet

- Handbook of PhysicsDocument73 pagesHandbook of PhysicsAnonymous D3CSwOPCzNo ratings yet

- Innovation in Food IndustryDocument10 pagesInnovation in Food IndustryKrishma GuptaNo ratings yet

- Budget NotesDocument17 pagesBudget NotesHeer SirwaniNo ratings yet

- 500W 24V Off Grid Solar Power System Quotation (1kw Inverter) ModelDocument2 pages500W 24V Off Grid Solar Power System Quotation (1kw Inverter) ModelRaed Al-HajNo ratings yet