Professional Documents

Culture Documents

Tema17ICARiesgos enProyectosdeIngenieria

Uploaded by

TpomaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tema17ICARiesgos enProyectosdeIngenieria

Uploaded by

TpomaCopyright:

Available Formats

International Journal of Project Management 19 (2001) 437443 www.elsevier.

com/locate/ijproman

Understanding and managing risks in large engineering projects

Roger Millera,*, Donald Lessardb

a b

Universite du Quebec a Montreal, Hydro-Quebec/CAF Chair, CP 8888, succ. A, Montreal, Quebec, Canada Sloan School of Management, Massachusets Institute of Technology, Cambridge, Massachusets 02139, USA Received 1 December 2000; received in revised form 30 January 2001; accepted 4 May 2001

Abstract Understanding and managing risks in projects especially large engineering initiatives are challenging tasks. Risks rst need to be dissected into categories such as (1) market-related: demand, nancial and supply; (2) completion: technical, construction and operational; (3) institutional: regulatory, social acceptibility and sovereign. Strategies for coping with foreseeable risks can be developed using management science approaches keeping in mind that costs of controlling risks must t with expected benets. Most risks and their control however need to be framed not as technical issues but as managerial problems. Some risks can be mastered by direct allocation and mitigation. Others are best controlled if shifted to co-specialized players with competencies, interest and knowledge. Still others need to be diversied through nancial instruments. Finally, a number of thorny risks can only be tackled by inuencing drivers and institutions which push risks upward. A process to cope with these varied risks is proposed. # 2001 Elsevier Science Ltd and IPMA. All rights reserved.

Keywords: Risks; strategies; institutions; decision theory

Large engineering projects are high-stakes games characterized by substantial irreversible commitments, skewed reward structures in case of success, and high probabilities of failure. Once built, projects have little use beyond the original intended purpose. Potential returns can be good but they are often truncated. The journey to the period of revenue generation takes 10 years on average. Substantial front-end expenditures prior to committing large capital costs have to be carried. During the ramp-up period, market estimates are tested and the true worth of the project appears; sponsors may nd that it is much lower than expected. Bankers can discover that covenants will not be respected. Restructuring of ownership and debt may be the only way to save prior investments. Managing risks is thus a real issue. The purpose of this article is to sketch-out the various components of risks, outline strategies for coping with risks and suggest a dynamic layering model for managing and shaping the risks of projects. The main argument developed in this article is that successful projects are not selected but shaped with risk resolution in mind. Rather than evaluating projects at the outset based on projections of the

* Corresponding author. Tel.: +1-514-987-3000.

full sets of benets, costs and risks over their lifetime, successful sponsors start with project ideas that have the possibility of becoming viable. Successful sponsors then embark on shaping eorts to inuence risk drivers. The seeds of success or failure are thus planted and nurtured as conscious choices are made. Successful rms cut their losses quickly when they recognize that a project has little possibility of becoming viable. Sponsors diculties stem largely from the fact that most of what we know about risks has been inherited from either Wall Street or Las Vegas. At the casino, the odds are public knowledge: success is strictly a matter of beating them. In nancial markets, price uctuations are not fully probabilistic, but indices make for decision situations that can be modeled with a sophisticated craft. By contrast, risks in real-life projects emerge over time, are indeterminate and often endogenous. External turbulence and surprise shocks can send a project into a degenerating crisis.

1. A risk-based taxonomy of large engineering projects Risks also dier according to types of projects. Fig. 1 positions various types of projects according to the intensity of the risks they pose to sponsors. For

0263-7863/01/$20.00 # 2001 Elsevier Science Ltd and IPMA. All rights reserved. PII: S0263-7863(01)00045-X

438

R. Miller, D. Lessard / International Journal of Project Management 19 (2001) 437443

Fig. 1. A risk-based taxonomy of large engineering projects.

instance, oil platforms are technically dicult, but they typically face few institutional risks because they are often built far from public attention and are socially desired because of the high revenues they bring to communities and countries. Hydroelectric-power projects tend to be moderately dicult insofar as engineering is concerned, but very dicult in terms of social acceptability. Nuclear-power projects pose high technical risks but still higher social and institutional risks. Road and tunnel systems present very high levels of risk. Rock formations usually hide surprises. Social acceptability diculties abound when user fees are applied. Market risks faced by roads, bridges, and tunnels are very high when they are built by private sponsors under concessionary schemes. Urban transport projects that meet real needs pose average market, social, and institutional risks. However, they still pose technical risks, as they regularly involve underground geological work. Research-and-development projects present scientic challenges but face fewer social acceptability and market diculties as they can be broken into smaller testable investments.

comes and causal forces are not fully understood: we refer to both as risks. Risks are multi-dimensional and thus need to be unbundled for clear understanding of causes, outcomes, and drivers. Nevertheless, since their impacts depend on how they combine and interact, reductionism must be avoided. In the IMEC study in which 60 large engineering projects were investigated across the world, managers were asked to identify and rank the risks they faced in the early front-end period of each project [1].1 Marketrelated risks dominated (41.7%), followed by technical risks (37.8%), and institutional/sovereign risks (20.5%). Fig. 2 gives the frequency of citations of the risks that managers ranked rst, second, and third in the early parts of projects. Market-related risks The ability to forecast demand varies widely, thus creating high levels of risks. The output of oil projects is a fungible commodity sold in highly integrated world markets: probabilistic forecasts are possible. In contrast, many road projects face a specic set of customers which often have many options. Users of highways, tunnels, bridges, airports, and ports often have alternatives: forecasting is extremely dicult.

The International Program in the Management of Engineering and Construction (IMEC) was sponsored by a dozen large rms as well as by government agencies and institutional investors. Sixty large engineering projects were investigated.

1

2. The nature of risks in projects Risk is the possibility that events, their resulting impacts and dynamic interactions may turn out dierently than anticipated. While risk is often viewed as something that can be described in statistical terms, uncertainty applies to situations in which potential out-

R. Miller, D. Lessard / International Journal of Project Management 19 (2001) 437443

439

Fig. 2. Major risks in large engineering projects.

The market for nancial inputs depends on prior risk management. Unless all risks have been addressed by sponsors, nancial markets are hard to reach. If a project oers an adequate prospective return, it is often unable to go forward because of the parties inability to work out acceptable risk-sharing arrangements. Supply risks are similar to market risks: both involve price and access uncertainties. Supply can be secured through contracts, open purchases or ownership. Completion risks Projects face technical risks that reect their engineering diculties and novelty: some of these risks are inherent in the designs or technologies employed. Construction risks refer to the diculties that sponsors, prime contractors, and contractors may face in the actual building of the project. Operational risks refer to the possibility future income ows will not materialize: such risks can be reduced substantially by the selection of an operator with an economic interest in enhancing revenues and controlling costs. Institutional risks The ability of projects to repay debts and investments depends on law and regulations that govern the appropriability of returns, property rights, and contracts. Some countries are governed under constitutional frameworks and the rule of law, while others are led by powerful political parties or clans. Institutional risks are typically seen as greatest in emerging economies in countries whose laws and regulation are incomplete and in a state of ux. Regulations concerning pricing, entry, unbundling, and other elements are presently undergoing major

changes in many countries, thus opening opportunities. Social-acceptability risks refer to the likelihood that sponsors will meet opposition from local groups, economic-development agencies, and inuential pressure groups. Sovereign risks in turn involve the likelihood that a government will decide to renegotiate contracts, concessions, or property rights. Many of these risks emerge over time. Projects that appeared sound at a point in time suddenly become ungovernable. Risks combine and interact to create turbulence. Many risks are linked to the life cycle of the project: regulatory risks, for instance, diminish very soon after permits are obtained: technical risks drop as engineering experiments are performed. Some risks, especially market-related ones continue as they are partly independent of project life cycle. Global market risks that are outside the control of virtually all players.

3. Approaches to managing risk in the large engineering project It is useful to distinguish between two broad categories of approaches to risk management: (1) decision theoretic approaches that by and large assume that risks are exogenous, probabilistic and partly endogenous, and (2) managerial approaches which focus on the front-end issues, turbulence, and the shaping of risk drivers. Decision theoretic approaches view projects as gambles in which sponsors attempt to identify options and probabilities. Strategists select a move with a high payo, make a bet, and wait for the probabilities to materialize. Groups of executives brainstorm to identify likely events and decision trees are built to identify the solution with the highest expected utility.

440

R. Miller, D. Lessard / International Journal of Project Management 19 (2001) 437443

The gamble metaphor is however not always applicable to real-life projects. First, it is simply impossible to predict the future of projects over the 1015-year period of shaping, building, ramping up, and early operation not to mention the entire life of the project. Second, the intellectual exercise in which the complete set of relevant futures can be laid out is dicult to achieve under conditions of turbulence. Decisioneering approaches also view LEPs as ventures that can be planned and specied in advance. The future of projects is said not to be dictated by circumstances but by management [2,3]. Careful analyses of trade-os between costs and risks, it is claimed, can yield good approximations for the appropriate timing of investment in projects. Accelerating a project will increase development costs to the point that there is a danger of sinking it. Proceeding with prudence increases the danger of missing the opportunity that the project aims for. Managerial approaches by contrast view projects as complex adaptive systems facing endogenous risks as well as exogenous surprises that cannot always be anticipated in advance. Diligent sponsors do not sit idle, waiting for the probabilities to yield a win or a loss, but work hard to inuence outcomes and turn

the selected initial option into a success. They shepherd their choice in light of changing conditions and often succeed against odds. Dynamic complexity, because of its turbulent and unpredictable nature, has to be met by versatile managerial approaches. The front-end decision processes observed by IMEC were messy, often chaotic: the untidiness reected the various moves made by managers.

4. Managerial strategies to cope with risks Sponsors strategize to inuence outcomes by using four main risk-management techniques: (1) shape and mitigate; (2) shift and allocate; (3) inuence and transform institutions; and (4) diversify through portfolios. Fig. 3 illustrates these techniques along two axes: the extent to which risks are controllable and the degree to which risks are specic to a project or systematically aect large numbers of actors. When risks are endogenous that is, specic and controllable the prescription is to mitigate with traditional risk management approaches. In contrast, when risks are specic but outside the control of any of the potential parties,

Fig. 3. Strategies to cope with risks.

R. Miller, D. Lessard / International Journal of Project Management 19 (2001) 437443

441

shifting or allocating them using contracts or nancial markets is the appropriate solution. When risks are poorly dened and under the control of aected parties, governments, or regulators, transforming them through inuence is the way for sponsors to gain control. When risks are broad, systematic, but controllable, the approach is to diversify exposure through portfolios or projects. Residual, systematic, and uncontrollable risks have to be embraced by sponsors. The process of strategizing to understand and manage risks prior to embracing residual uncertainties is best described as an interactive layering of choices. The reasoned assignment of knowable risks starts by discovering and assigning them to a coping strategy. Some risks will be dealt with by using nancial markets, others by institutional shaping, still others by project coalitions. Many can be assigned to partnership members in accordance with these parties knowledge, inuence, and ability to shape, exploit, and bear them. Tracing risk management in 60 large engineering projects, we identied six primary layers of mechanisms

used by managers for coping with risks (Fig. 4). First, risks are understood by hiring experts or undertaking analysis and simulations. Second, risks that are signicant but transferable, especially if they are closely matched by market instruments, can be shifted to parties that can best bear them. Third, project risks are pooled through the constitution of large portfolios. Fourth, options are designed to allow a greater range of responses in line with future outcomes. Fifth, remaining risks are shaped or transformed through inuences on drivers as they are the result of behaviors by other social agents. Finally, residual risks are embraced by sponsors. This layering process is repeated in many iterative episodes until nal commitments are made. Potential participants do not have equal comparative advantages in risk bearing. Participants to be selected for membership in a project structure should display complementary comparative advantages in taking the lead with a particular risk. Relative superiority in risk bearing may arise for any one of three reasons: some

Fig. 4. The layering process.

442

R. Miller, D. Lessard / International Journal of Project Management 19 (2001) 437443

Fig. 5. Comparative advantage in risk taking.

parties may have more information about particular risks and their impacts than others; some parties or stakeholders may have dierent degrees of inuence over outcomes; or some investors dier in their ability to diversify risks. Fig. 5 illustrates how potential partners dier in their ability to control risks and enjoy a comparative advantage. For instance, local partners can inuence outcomes but have little ability to diversify risks and little knowledge about commercial prospects worldwide. World portfolio investors certainly diversify risks, but their ability to know about local commercial prospects or to inuence outcomes is low [4]. Strategizing about risks is almost always benecial, but at some point diminishing returns set in and the costs of acquiring additional information or gaining control over risks fall short of their value. The design of responses to risks must be judged on a cost-benet basis. Aligning performance incentives is critical when particular parties to the project have a signicant degree of control over the economic value created by the project but do not have an incentive to maximize this overall value.

5. Conclusion: creation and exercise of options The front-end process to cope with risks is consistent with the real-options framework that is currently revolutionizing academic treatments of project evaluation. The real-options framework is based on the same logic

as that of nancial options as developed by Black and Scholes [5]. Dixit and Pindyck [6] and Trigeorgis [7] extend it to real options, while Laughton and Jacoby [8] provide operational specication for options valuation. Kulatilaka and Lessard [9] have demonstrated how the real-options approach can be combined with a decisiontree framework. However, while the emphasis of the real options literature is how to price the risks involved, ours is on the managerial process of recognizing, shaping, and realizing these options. In fact, as is often the case with cuttingedge practice, managers have been successful at creating value through the development and exercise of sequential options without explicitly framing the process in options terms. Academics have simply codied this practice in the form of a new conceptual framework. The real-options approach recognizes that decisions that determine project cash ows are made sequentially over many episodes. The key insight of this approach is that uncertainty or volatility can actually increase the value of a project, as long as exibility is preserved and resources are not irreversibly committed. As a result, the economic value of a project when it is still relatively unformed is often greater than the discounted present value of the expected future cash ows. Value is increased by creating options for subsequent sequential choices and exercising these options in a timely fashion. Thus, sponsors seek projects that have the potential for large payos under particular institutional and technical circumstances.

R. Miller, D. Lessard / International Journal of Project Management 19 (2001) 437443

443

References

[1] Miller R, Lessard D. The strategic management of large engineering projects: shaping risks, institutions and governance. Cambridge, MA: MIT Press, 2001. [2] Urban GL, Hauser JR. Design and marketing of new products. Englewood Clis, NJ: Prentice-Hall, 1980. [3] Cooper RG. Winning at new products: accelerating the process from idea to launch. Reading, MA: Addison-Wesley, 1997. [4] Lessard DR. Country risk and the structure of international nancial intermediation. In: Stone C, editor. Financial risk: the[5] [6] [7] [8] [9]

ory, evidence, and implications. Boston, MA: Kluwer Academic Publishers, 1989. Black F, Scholes M. From theory to a new nancial product. Journal of Finance 1974;29(2):399412. Dixit AK, Pindyck RS. The options approach to capital investment. Harvard Business Review 1995;73(3):10516. Trigeorgis L. Real options: managerial exibility and strategy in resource allocation. Cambridge: MIT Press, 1996. Laughton DG, Jacoby HD. Reversion, timing options, and longterm decision-making. Financial Management 1993;22(3):2245. Kulatilaka N, Lessard D. Total risk management. Working paper. Sloan School, Massachusetts Institute of Technology, 1998.

You might also like

- Introduction to Project Finance in Renewable Energy Infrastructure: Including Public-Private Investments and Non-Mature MarketsFrom EverandIntroduction to Project Finance in Renewable Energy Infrastructure: Including Public-Private Investments and Non-Mature MarketsNo ratings yet

- Risk Management in Construction Industry: Mr. Satish K. Kamane, Mr. Sandip A. MahadikDocument7 pagesRisk Management in Construction Industry: Mr. Satish K. Kamane, Mr. Sandip A. MahadikAnusha AshokNo ratings yet

- What is Project FinanceDocument29 pagesWhat is Project FinanceGeorgeNo ratings yet

- Unlocking Capital: The Power of Bonds in Project FinanceFrom EverandUnlocking Capital: The Power of Bonds in Project FinanceNo ratings yet

- PGP IDM-31 - Project Risk Mgmt.Document33 pagesPGP IDM-31 - Project Risk Mgmt.suhas vermaNo ratings yet

- Qualitative Risk Assessment and Mitigation Measures For Real Estate Projects in MaharashtraDocument9 pagesQualitative Risk Assessment and Mitigation Measures For Real Estate Projects in MaharashtraInternational Jpurnal Of Technical Research And ApplicationsNo ratings yet

- Society of Construction Law (UAE)Document11 pagesSociety of Construction Law (UAE)Ahmed AbdulShafiNo ratings yet

- Risk Assessment in Construction ProjectsDocument5 pagesRisk Assessment in Construction ProjectsIJRASETPublicationsNo ratings yet

- Providing Mitigation Startegies Arising in Infrastructure ProjectsDocument20 pagesProviding Mitigation Startegies Arising in Infrastructure ProjectsAritra KeshNo ratings yet

- Transferring Construction RisksDocument18 pagesTransferring Construction RiskswhyoNo ratings yet

- International Project Finance: Chiemezie EjinimmaDocument15 pagesInternational Project Finance: Chiemezie EjinimmaAlihayderNo ratings yet

- Journal of Structured Finance AcuLeadDocument24 pagesJournal of Structured Finance AcuLeadAtanu MukherjeeNo ratings yet

- Risk ManagementDocument18 pagesRisk ManagementAnusha KishoreNo ratings yet

- Ijtra1505236 PDFDocument9 pagesIjtra1505236 PDFRushi NaikNo ratings yet

- Risk AssignmentDocument53 pagesRisk AssignmentNafiz ImtiazNo ratings yet

- Risk Analysis & Assessment in Nigerian Banks IIDocument16 pagesRisk Analysis & Assessment in Nigerian Banks IIShowman4100% (1)

- A Firm Foundation For Project FinanceDocument6 pagesA Firm Foundation For Project FinanceMarc BernardNo ratings yet

- Chapter 04Document13 pagesChapter 04sanjaymits2No ratings yet

- Contract DocumentDocument78 pagesContract DocumentEngineeri TadiyosNo ratings yet

- Group 1 RMFD SynopsisDocument7 pagesGroup 1 RMFD SynopsisguptadivyeNo ratings yet

- PRM Chapter 1Document9 pagesPRM Chapter 1Kan Fock-KuiNo ratings yet

- SEBI Project Finance GuidelinesDocument21 pagesSEBI Project Finance GuidelinesSachin ShintreNo ratings yet

- Project Finance Assignment: Student Name Institutional Affiliation Course Number and Name Professor's Name DateDocument12 pagesProject Finance Assignment: Student Name Institutional Affiliation Course Number and Name Professor's Name DateFREDRICKNo ratings yet

- 41 - KTS-CM-13Document8 pages41 - KTS-CM-13IrenataNo ratings yet

- The Nature of Credit Risk in Project FinanceDocument4 pagesThe Nature of Credit Risk in Project FinanceSayon DasNo ratings yet

- Risk Analysis Project FinanceDocument181 pagesRisk Analysis Project Financeshah_harshit25100% (1)

- Infrastructure Risk ManagementDocument16 pagesInfrastructure Risk ManagementNihar NanyamNo ratings yet

- Tianjin PlasticsDocument9 pagesTianjin PlasticsmalikatjuhNo ratings yet

- Lecture 2 - Risk ManagementDocument41 pagesLecture 2 - Risk ManagementchristopherNo ratings yet

- Energy Industry - Evolving Risk - MarshDocument28 pagesEnergy Industry - Evolving Risk - MarshbxbeautyNo ratings yet

- Adekoya, Adebanji - Managing Non-Technical Risk in E and P ProjectsDocument6 pagesAdekoya, Adebanji - Managing Non-Technical Risk in E and P ProjectsU4rayNo ratings yet

- Rating Methodology For Project Finance TransactionsDocument6 pagesRating Methodology For Project Finance TransactionsAlka KakkarNo ratings yet

- Risks Associated With International Project Financing: Submitted By: Sajal Nahar G-44 Akshay Arora G-48Document13 pagesRisks Associated With International Project Financing: Submitted By: Sajal Nahar G-44 Akshay Arora G-48sajalNo ratings yet

- BSCE4-E Manibog Mart-Lliam Activity 5 Research-ManuscriptDocument20 pagesBSCE4-E Manibog Mart-Lliam Activity 5 Research-ManuscriptMiNT MatiasNo ratings yet

- Examining Risk Tolerance in Project-Driven OrganizationDocument5 pagesExamining Risk Tolerance in Project-Driven Organizationapi-3707091No ratings yet

- Risks in Project and Risk Mitigation Measures - An OverviewDocument42 pagesRisks in Project and Risk Mitigation Measures - An OverviewashishNo ratings yet

- A Review of Risk Management Techniques For Construction ProjectsDocument6 pagesA Review of Risk Management Techniques For Construction ProjectsIJRASETPublicationsNo ratings yet

- 1 s2.0 S2405844022030146 MainDocument11 pages1 s2.0 S2405844022030146 MainglifemeashoNo ratings yet

- Giao trinh riskDocument3 pagesGiao trinh riskNguyễn Ngọc QuỳnhNo ratings yet

- Analysis of The Dulles GreenwayDocument21 pagesAnalysis of The Dulles GreenwayRakesh JainNo ratings yet

- Ar2006-0553-0561 Laryea and HughesDocument9 pagesAr2006-0553-0561 Laryea and HughessweetyNo ratings yet

- Chapter Three: Looing at ProjectDocument7 pagesChapter Three: Looing at ProjectMikias EphremNo ratings yet

- Contractorsrisk Paras 0003 File PDFDocument57 pagesContractorsrisk Paras 0003 File PDFRiyasNo ratings yet

- Preliminary Risk Assessment in Project FinanceDocument18 pagesPreliminary Risk Assessment in Project FinanceflichuchaNo ratings yet

- Financial Risks in Construction ProjectsDocument5 pagesFinancial Risks in Construction Projectsalaa jalladNo ratings yet

- Risk ManagementDocument22 pagesRisk Managementاحمد مفرجNo ratings yet

- Managing Healthcare PF Investments.j.jim.20130201.12Document13 pagesManaging Healthcare PF Investments.j.jim.20130201.12Sky walkingNo ratings yet

- Risk Analysis and Management in ConstructionDocument16 pagesRisk Analysis and Management in ConstructionwahyuNo ratings yet

- Day 4 - Operations - Risk ManagementDocument37 pagesDay 4 - Operations - Risk ManagementPhilip CabuhatNo ratings yet

- Jurnal EnglishDocument8 pagesJurnal EnglishAnnurramadhani OciNo ratings yet

- 153 155ncice 078Document4 pages153 155ncice 078Dewa Gede Soja PrabawaNo ratings yet

- Azerbaijan State University of EconomicsDocument15 pagesAzerbaijan State University of EconomicsAnar hummatovNo ratings yet

- FP BaydounDocument16 pagesFP Baydounanon_902477153No ratings yet

- Project Apprisal and FinanceDocument56 pagesProject Apprisal and Financeroypronoy354No ratings yet

- Construction ManagementDocument11 pagesConstruction ManagementSumit PriyamNo ratings yet

- Risk ManagementDocument6 pagesRisk ManagementLaprick MwangiNo ratings yet

- Contractorsrisk Paras 0003 File PDFDocument57 pagesContractorsrisk Paras 0003 File PDFMauro MLRNo ratings yet

- Lecture 5 - Project Finance and Risk ManagementDocument55 pagesLecture 5 - Project Finance and Risk ManagementLewisNo ratings yet

- PRM Chapter 3Document20 pagesPRM Chapter 3Kan Fock-KuiNo ratings yet

- CookiesDocument1 pageCookiesTpomaNo ratings yet

- A Fast Algorithm For The Minimum Covariance Determinant Estimator PDFDocument31 pagesA Fast Algorithm For The Minimum Covariance Determinant Estimator PDFAlvaro MamaniNo ratings yet

- DISCRIMINANT DIAGRAMS For IRON OXIDE Fingerprinting of Mineral Deposit TypesDocument17 pagesDISCRIMINANT DIAGRAMS For IRON OXIDE Fingerprinting of Mineral Deposit Typesjunior.geologiaNo ratings yet

- 10 1002@gj 3693Document18 pages10 1002@gj 3693TpomaNo ratings yet

- Asus 1Document1 pageAsus 1TpomaNo ratings yet

- IoGAS Quick Start Tutorial1Document42 pagesIoGAS Quick Start Tutorial1Pia Lois100% (2)

- Lithos 2001 15Document1 pageLithos 2001 15TpomaNo ratings yet

- AsusDocument1 pageAsusTpomaNo ratings yet

- One (1) Year (U.S. and Latin America) Standard Limited Warranty ("Limited Warranty") For Toshiba Branded Accessories and ElectronicsDocument6 pagesOne (1) Year (U.S. and Latin America) Standard Limited Warranty ("Limited Warranty") For Toshiba Branded Accessories and ElectronicsJosé SayraNo ratings yet

- CHAP4 - Magmatic Sulfide DepositsDocument11 pagesCHAP4 - Magmatic Sulfide DepositsJaime CuyaNo ratings yet

- IoGAS Quick Start Tutorial1Document42 pagesIoGAS Quick Start Tutorial1Pia Lois100% (2)

- 2306 8286 1 PBDocument16 pages2306 8286 1 PBTpomaNo ratings yet

- Jansen 2017Document30 pagesJansen 2017TpomaNo ratings yet

- Rosasetal 2018 SGPCongresoDocument5 pagesRosasetal 2018 SGPCongresoTpomaNo ratings yet

- Arndt 2013Document18 pagesArndt 2013TpomaNo ratings yet

- The Abundance of Seafl Oor Massive Sulfi de DepositsDocument4 pagesThe Abundance of Seafl Oor Massive Sulfi de DepositsTpomaNo ratings yet

- Arndt 2013Document18 pagesArndt 2013TpomaNo ratings yet

- New Software For Faster and Better 3d Geological ModellingDocument9 pagesNew Software For Faster and Better 3d Geological Modellingbeku_ggs_bekuNo ratings yet

- Permian-Early Mesozoic Rifts in Peru and Bolivia, and Their Bearing On Andean-Age TectonicsDocument6 pagesPermian-Early Mesozoic Rifts in Peru and Bolivia, and Their Bearing On Andean-Age TectonicsTpomaNo ratings yet

- 10 1016@j Chemgeo 2016 10 032Document67 pages10 1016@j Chemgeo 2016 10 032TpomaNo ratings yet

- Hollister 1978Document10 pagesHollister 1978TpomaNo ratings yet

- Chapter 4 Perello Et AlDocument26 pagesChapter 4 Perello Et AlTpoma100% (1)

- BMG6a-G4W KrigeDocument24 pagesBMG6a-G4W KrigeTpomaNo ratings yet

- Chapter 4 Perello Et AlDocument26 pagesChapter 4 Perello Et AlTpoma100% (1)

- Rel Notes Update 2007Document35 pagesRel Notes Update 2007Julio SantosNo ratings yet

- Implicit Book - Digital.fv1Document57 pagesImplicit Book - Digital.fv1TpomaNo ratings yet

- Tinka Presentation 23 March 2017Document30 pagesTinka Presentation 23 March 2017TpomaNo ratings yet

- SCZn2 - G3-B4 Alter ENGL Short Lima2012rDocument20 pagesSCZn2 - G3-B4 Alter ENGL Short Lima2012rTpomaNo ratings yet

- SCZn2 - G3-B4 Alter ENGL Short Lima2012rDocument20 pagesSCZn2 - G3-B4 Alter ENGL Short Lima2012rTpomaNo ratings yet

- Skarn Short Course 1 IntroDocument12 pagesSkarn Short Course 1 IntroTpomaNo ratings yet

- Jurnal PajakDocument43 pagesJurnal PajakIndahNo ratings yet

- Financial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDocument79 pagesFinancial Statement Analysis: Presenter's Name Presenter's Title DD Month Yyyyjohny BraveNo ratings yet

- Improving Social Cohesion in Ethiopia's Babile DistrictDocument9 pagesImproving Social Cohesion in Ethiopia's Babile DistrictsimbiroNo ratings yet

- BS Wira SartikaDocument1 pageBS Wira SartikaJGL MOTORNo ratings yet

- IPSFDocument7 pagesIPSFmanikandan BalasubramaniyanNo ratings yet

- National Shelter ProgramDocument43 pagesNational Shelter ProgramLara CayagoNo ratings yet

- SEC-MC No. 24 (s.2019)Document42 pagesSEC-MC No. 24 (s.2019)Zihr EllerycNo ratings yet

- Natco Medicine CompanyDocument12 pagesNatco Medicine CompanyPawan SoniNo ratings yet

- Recognizing and Measuring Government GrantsDocument12 pagesRecognizing and Measuring Government GrantsGraciasNo ratings yet

- Forex Indicators GuideDocument3 pagesForex Indicators Guideenghoss77No ratings yet

- ADM 3351-Final With SolutionsDocument14 pagesADM 3351-Final With SolutionsGraeme RalphNo ratings yet

- Contract of Lease With Option To PurchaseDocument3 pagesContract of Lease With Option To PurchaseNeilJuan JuanNo ratings yet

- Management of Banks and Financial Institutions Ass - 2Document5 pagesManagement of Banks and Financial Institutions Ass - 2Agnet TomyNo ratings yet

- NOCIL Investor PresentationDocument28 pagesNOCIL Investor PresentationSaurabh JainNo ratings yet

- MPC 2002 Financial ReportDocument25 pagesMPC 2002 Financial ReportMelbourne Press ClubNo ratings yet

- Inclusive Growth With Disruptive Innovations: Gearing Up For Digital DisruptionDocument48 pagesInclusive Growth With Disruptive Innovations: Gearing Up For Digital DisruptionShashank YadavNo ratings yet

- Eugene Fama ThesisDocument7 pagesEugene Fama Thesiskriscundiffevansville100% (1)

- Corporate Finace 1 PDFDocument4 pagesCorporate Finace 1 PDFwafflesNo ratings yet

- Loan Application FormDocument17 pagesLoan Application FormBodhiratan BartheNo ratings yet

- Comprehensive Accounting Case StudyDocument11 pagesComprehensive Accounting Case StudyMike StevenNo ratings yet

- Soal LatihanDocument1 pageSoal Latihanflypop13No ratings yet

- Unit 1 Portfolio Activity Review of Key Financial StatementsDocument4 pagesUnit 1 Portfolio Activity Review of Key Financial StatementsSimran PannuNo ratings yet

- 2024 Financial Report SanFranciscoDocument1 page2024 Financial Report SanFranciscoWiljohn ComendadorNo ratings yet

- LEI Bulk - 1000 ItemsDocument542 pagesLEI Bulk - 1000 ItemsVyacheslavNo ratings yet

- Dusty R BouthilletteDocument16 pagesDusty R Bouthillettedanw5646No ratings yet

- Iasb Employee BenDocument3 pagesIasb Employee BenRommel CruzNo ratings yet

- A Study On The Impact of Project Management Strategy On Real EstateDocument72 pagesA Study On The Impact of Project Management Strategy On Real EstateTasmay Enterprises100% (1)

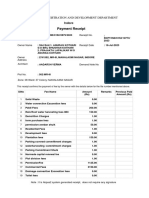

- Payment Receipt: Urban Administration and Development DepartmentDocument2 pagesPayment Receipt: Urban Administration and Development Departmentaadarsh vermaNo ratings yet

- Instructor's Manual Chapter 4 Time Value of MoneyDocument21 pagesInstructor's Manual Chapter 4 Time Value of MoneyReginoSaynoValenzuelaNo ratings yet

- CFP - SuggestedSolutions - RPEBDocument6 pagesCFP - SuggestedSolutions - RPEBSODDEYNo ratings yet

- Packing for Mars: The Curious Science of Life in the VoidFrom EverandPacking for Mars: The Curious Science of Life in the VoidRating: 4 out of 5 stars4/5 (1395)

- Sully: The Untold Story Behind the Miracle on the HudsonFrom EverandSully: The Untold Story Behind the Miracle on the HudsonRating: 4 out of 5 stars4/5 (103)

- Hero Found: The Greatest POW Escape of the Vietnam WarFrom EverandHero Found: The Greatest POW Escape of the Vietnam WarRating: 4 out of 5 stars4/5 (19)

- The Fabric of Civilization: How Textiles Made the WorldFrom EverandThe Fabric of Civilization: How Textiles Made the WorldRating: 4.5 out of 5 stars4.5/5 (57)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- The Beekeeper's Lament: How One Man and Half a Billion Honey Bees Help Feed AmericaFrom EverandThe Beekeeper's Lament: How One Man and Half a Billion Honey Bees Help Feed AmericaNo ratings yet

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Faster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestFrom EverandFaster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestRating: 4 out of 5 stars4/5 (28)

- The Weather Machine: A Journey Inside the ForecastFrom EverandThe Weather Machine: A Journey Inside the ForecastRating: 3.5 out of 5 stars3.5/5 (31)

- Einstein's Fridge: How the Difference Between Hot and Cold Explains the UniverseFrom EverandEinstein's Fridge: How the Difference Between Hot and Cold Explains the UniverseRating: 4.5 out of 5 stars4.5/5 (50)

- The Quiet Zone: Unraveling the Mystery of a Town Suspended in SilenceFrom EverandThe Quiet Zone: Unraveling the Mystery of a Town Suspended in SilenceRating: 3.5 out of 5 stars3.5/5 (23)

- The End of Craving: Recovering the Lost Wisdom of Eating WellFrom EverandThe End of Craving: Recovering the Lost Wisdom of Eating WellRating: 4.5 out of 5 stars4.5/5 (80)

- 35 Miles From Shore: The Ditching and Rescue of ALM Flight 980From Everand35 Miles From Shore: The Ditching and Rescue of ALM Flight 980Rating: 4 out of 5 stars4/5 (21)

- Recording Unhinged: Creative and Unconventional Music Recording TechniquesFrom EverandRecording Unhinged: Creative and Unconventional Music Recording TechniquesNo ratings yet

- Pale Blue Dot: A Vision of the Human Future in SpaceFrom EverandPale Blue Dot: A Vision of the Human Future in SpaceRating: 4.5 out of 5 stars4.5/5 (586)

- The Path Between the Seas: The Creation of the Panama Canal, 1870-1914From EverandThe Path Between the Seas: The Creation of the Panama Canal, 1870-1914Rating: 4.5 out of 5 stars4.5/5 (124)

- A Place of My Own: The Architecture of DaydreamsFrom EverandA Place of My Own: The Architecture of DaydreamsRating: 4 out of 5 stars4/5 (241)

- Reality+: Virtual Worlds and the Problems of PhilosophyFrom EverandReality+: Virtual Worlds and the Problems of PhilosophyRating: 4 out of 5 stars4/5 (24)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- The Future of Geography: How the Competition in Space Will Change Our WorldFrom EverandThe Future of Geography: How the Competition in Space Will Change Our WorldRating: 4.5 out of 5 stars4.5/5 (4)

- Permaculture for the Rest of Us: Abundant Living on Less than an AcreFrom EverandPermaculture for the Rest of Us: Abundant Living on Less than an AcreRating: 4.5 out of 5 stars4.5/5 (33)

- Dirt to Soil: One Family’s Journey into Regenerative AgricultureFrom EverandDirt to Soil: One Family’s Journey into Regenerative AgricultureRating: 5 out of 5 stars5/5 (125)