Professional Documents

Culture Documents

Shoopman Eng 102 Problem Solution Final Draft

Uploaded by

api-236395206Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shoopman Eng 102 Problem Solution Final Draft

Uploaded by

api-236395206Copyright:

Available Formats

Shoopman 1 Amber Shoopman Meagan Newberry English 102 December 9, 2011 Proposal for a Solution How Much Does

Your Money Mean To You? There is a problem in Idaho, the Northwest, the United States, and the world. We are a people who have come to rely so heavily on technology that we are now finding our technology, specifically the fuel to operate our vehicles, is causing a strain on the family budget. So big of a strain that sometimes the choice isnt simply do we eat out or stay home. The choice is what to not pay so that we can buy food to put on the table. The need for money is a fact of life, though sometimes I wish it were not. I did a problem analysis, focusing on fuel prices and Idaho families, to determine just how bad the family budget is being strained. Though there are many solutions to this problem, some being long term and some short, the most feasible of these solutions lies within the family. In my problem analysis, I determined that high gas prices are not a problem that can be easily corrected as there are many factors that determine the price of fuel (EIA, 2011). In fact, my analysis showed that gas stations are not charging enough per gallon to cover the expense of transporting the fuel to Idaho (Halbouty, 2011). Furthermore, my research, based on the fuel price at that time, showed that there are on average two drivers per household in Idaho. I found that those households spend an average of $87.28 per week on fuel. (FHWA, 2010). I also determined that 1 in 4 households have an annual income of $25,000 or less, with the average

Shoopman 2 income actually being $18,655 per year (US Census Bureau, 2010). It is really hard to maintain a household on the amount of money left over after fuel has been deducted. In the course of my research, I discovered that the government, local or federal, has no control over the price of fuel (DeLange, 2008). They can simply ensure that gas stations do not conspire together to price fix or to take advantage of customers in an emergency situation (DeLange, 2008). The only way the government can help to possibly lower gas prices, would be to build storage tanks in Idaho, build oil refineries, or increase the size of the fuel transportation line. Unfortunately, all of these options will take time (which the family budget does not have), money (which the government does not have), and natural oil resources (which Idaho does not have a lot of). Another solution would be a better public transportation system. The Treasure Valley, consisting of Caldwell, Nampa, Meridian, Boise, Kuna, Star, Eagle, Garden City and Middleton, does not have a sufficient public transportation system. Based on the Valley Wide transit website, this is the information I found (Valley Ride, 2011). There are 29 bus routes in Ada County that run from 5:15 am until 6:45 pm. There are 5 bus routes in Canyon County that run from 6:20 am to 7:15 pm. There are 3 routes that run between the two counties. One of these routes is specifically between the Nampa CWI campus and BSU. The other two routes only operate during the peak hours (which is the average commuting hours) daily. The cost of an annual pass, $266, would be well worth the money as long as you are able to conduct all of your business within their time and route schedules. Given time and enough public feedback, I believe the city could devise a more efficient transportation service. However, this is, again, going to take money that is not available at the moment.

Shoopman 3 All of these solutions are based on someone else solving the problem so that the financial impact is not as hard on the family budget. Then, I thought about that statement. Why is the family looking for someone else to solve their financial struggles? The real solution lies within the family. If each household could find a way to save money on other things, besides fuel, then the struggle would not be so great. Until the government has the time and resources to solve the problem, the solution must lie within our own homes. I have comprised a few ideas, based on my research, which will help families save money now, if they will simply put forth the effort and sacrifice to do them. There were several small things I found that a family can do to save money on the things that they enjoy. Going on a trip? If you fly on Wednesday you will get the best prices (Kiplinger Finance Executives, 2011). Going on a trip over the holidays? Flying on the holiday can save you 40% or more (Kiplinger Finance Executives, 2011). Buy computers in December, furniture in January and July, and a new car in September for the best prices as this is when companies are clearing out inventory to make room for the new stuff (Kiplinger Finance Executives, 2011). Go to the movies a lot? Save money by renting one and watching it in the comfort of your own home. Have those must see television shows? Most of the broadcast networks post the most recent episodes online for viewers to watch. Connect your computer to your television and, voil, your show, just the way you want it. If you cant find it on their website, check www.netflix.com or www.hulu.com as they have television shows as well as movies for a low monthly streaming fee. Add the cost of the internet with the streaming fee, and you are still paying less money than you would on your television bill for services you probably already have anyway. While all of these solutions are easy ways to save money on the perks of life, what about the necessities? We dont need to go on vacation, buy a new couch, or watch television. We do

Shoopman 4 need car insurance. By raising your deductible to $1000 you can decrease your monthly cost by 10% or more (Hunt, 2011). We all need to stay in touch with the world, and be reachable in an emergency. By cutting out your landline telephone service you can save over $300 a year (Hunt, 2011). And lets face it, water and electricity are two of the biggest utility bills a family has to pay each month. By installing all of your electronic devices on power strips and shutting them off at night, you can save about $4 per month per device. This may not seem like a lot, but when you count up your electronics that number definitely makes a difference. Also by installing a low flow shower or faucet head, which cost less than $20, you will not only conserve water, but can save as much as 50% per month on your water bill. One of the biggest necessities we have to pay for is food. Even if we are responsible and only eat out on special occasions, food is still expensive and the prices seem to keep rising. Fortunately there is a solution that can save the family budget hundreds of dollars a month! Couponing. I know what youre thinking, because it is the same thing I used to think. Couponing is for old ladies who have nothing better to do with their time than sit at home and clip them. While it is true that couponing can take a little time, todays technology makes it simple and quick. There are hundreds of websites and blogs online that have the coupons arranged so that all you have to do is click and print the ones you want. My favorite site, www.fabulesslyfrugal.com, even lists the sale ads from the paper and community flyers. Most coupon experts spend an hour or less each week finding coupons and deals they want to take advantage of (Simenc, 2011). If you could spend $160 a week on $1000 worth of groceries, would that hour be worth it to you? Another common hesitation to couponing is that the family budget just cant handle the extra money it would cost to get started on those savings. They cant afford to buy five cans of beans to be able to get them all $0.25 off. In an interview she did with the Idaho Press Tribune,

Shoopman 5 local coupon expert, Jessica Hacker, addressed this very concern. She advised beginning couponers, Dont spend lots to start with. Set a small budget and gradually buy things with coupons. As your stockpile grows, your regular grocery list will shrink, so you can slowly increase you coupon budget (Simenc, 2011). Basically, Hacker is advising beginners to start small; to set a budget, separate from the normal grocery budget, that will be specifically for coupon purchases. She further advises that the coupon budget is only spent on items you will normally eat. As you increase your stockpile of these items, you will not need to purchase them as often on regular grocery shopping trip. The money saved on your normal grocery bill can then be rolled over into your coupon budget. The more you stockpile, the more you can save, until, eventually, you achieve the same reward as Hacker. You will be spending less than $100 a month to care for a family of six! Lets face it, the family budget is in trouble, and no one has the power to save it except the family. By applying these money saving solutions to the budget crisis, making small changes, and some sacrifices, the family can put their finances back on track. They will then have the money to enjoy all the pleasures life has to offer.

Shoopman 6

Bibliography

DeLange, B. (2008, June). Idaho Gasoline Issues. Retrieved October 18, 2011, from Office of the Attorney General State of Idaho: http://www.ag.idaho.gov/comsumerProtection/gasolineIssues/gasolineIssuesIndex.html EIA, U. E. (2011, March 31). Energy Explained. Retrieved October 18, 2011, from http://www.eia.gov/energyexplained FHWA, U. D. (2010, November). Policy Information. Retrieved October 18, 2011, from http://www.fhwa.dot.gov/policyinformation/statistics/2009/mf21.cfm Halbouty, J. (2011, May 31). Pipeline Tariffs. Retrieved October 18, 2011, from Chevron Pipeline Company: http://www.chevron-pipeline.com Hunt, M. (2011, November 1). 16 easy ways to save big. Woman's Day, p. Accessed online. Kiplinger Finance Executives. (2011, August). The Best Bargains. Kiplinger Personal Finance Magazine, pp. 63-69. Simenc, T. (2011, May 16). Coupon Crazy: Intro to couponing for beginners. Idaho Press Tribune. US Census Bureau. (2010). Idaho Census Data 2010. Retrieved October 18, 2011, from http://www.uscensus2010data.com Valley Ride. (2011). Hop on Board. Retrieved December 1, 2011, from Valley Ride Transit Authority: http://valleyride.org

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shoopman Comm Midterm Essay GuidebookDocument18 pagesShoopman Comm Midterm Essay Guidebookapi-236395206No ratings yet

- Shoopman Comm Final Exam EssayDocument18 pagesShoopman Comm Final Exam Essayapi-236395206No ratings yet

- HX 220 Annotated BibliographyDocument3 pagesHX 220 Annotated Bibliographyapi-236395206No ratings yet

- Top Fifteen Assignment 5Document5 pagesTop Fifteen Assignment 5api-236395206No ratings yet

- Annotated Bibliography Eng 201-4001Document3 pagesAnnotated Bibliography Eng 201-4001api-236395206No ratings yet

- Top Fifteen Assignment 2Document6 pagesTop Fifteen Assignment 2api-236395206No ratings yet

- Top Fifteen Assignment 4Document9 pagesTop Fifteen Assignment 4api-236395206No ratings yet

- Social Work PresentationDocument41 pagesSocial Work Presentationapi-236395206No ratings yet

- Final Unknown ImagesDocument3 pagesFinal Unknown Imagesapi-236395206No ratings yet

- Top Fifteen Assignment 3Document8 pagesTop Fifteen Assignment 3api-236395206No ratings yet

- Amber Shoopman Geol 102 Fieldtrip AssignmentDocument10 pagesAmber Shoopman Geol 102 Fieldtrip Assignmentapi-236395206No ratings yet

- A Shoopman Literary Analysis 1Document5 pagesA Shoopman Literary Analysis 1api-236395206No ratings yet

- Amber Shoopman - Ancient AtheniansDocument15 pagesAmber Shoopman - Ancient Atheniansapi-236395206No ratings yet

- Top Fifteen Assignment 1Document9 pagesTop Fifteen Assignment 1api-236395206No ratings yet

- West Civ FP EssayDocument14 pagesWest Civ FP Essayapi-236395206No ratings yet

- Shoopman Eng 102 Problem Analysis Final DraftDocument14 pagesShoopman Eng 102 Problem Analysis Final Draftapi-236395206No ratings yet

- Amber Shoopman Us hx111 Research 1Document8 pagesAmber Shoopman Us hx111 Research 1api-236395206No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- STABILUS - Gas Springs and Dampers PDFDocument5 pagesSTABILUS - Gas Springs and Dampers PDFlesonionsNo ratings yet

- Mini Project On Suspension System Icf BogieDocument73 pagesMini Project On Suspension System Icf BogieKiran Kumar Topu100% (2)

- Analyse Stratégique Du Secteur de Transport Aérien Par Les Modèles Pestel Et Swot (Étude de Cas Portant Sur Un Échantillon Des Compagnies Aériennes)Document19 pagesAnalyse Stratégique Du Secteur de Transport Aérien Par Les Modèles Pestel Et Swot (Étude de Cas Portant Sur Un Échantillon Des Compagnies Aériennes)imane brahimiNo ratings yet

- Smart Traffic Management SystemDocument10 pagesSmart Traffic Management SystemGetachew BefekaduNo ratings yet

- The Chittagong Port Authority DATED: 22/03/2020Document4 pagesThe Chittagong Port Authority DATED: 22/03/2020S. M. Nazmul AlamNo ratings yet

- Parts Manual KX250F11Document78 pagesParts Manual KX250F11Tony RouillonNo ratings yet

- Was or Were PracticeDocument1 pageWas or Were PracticeenglishcolcomfeNo ratings yet

- WAREHOUSING DEEP DIVEDocument29 pagesWAREHOUSING DEEP DIVERadhika JaiswalNo ratings yet

- Q3 WK6 Simple MachinesDocument66 pagesQ3 WK6 Simple MachinesLorna Caronan CaylaluadNo ratings yet

- Results of Competition: Accelerating Innovation in Rail 5 - Disruption To Trains - 0-12 Months 1709 - INNV - RAIL5Document22 pagesResults of Competition: Accelerating Innovation in Rail 5 - Disruption To Trains - 0-12 Months 1709 - INNV - RAIL5Jack PadiNo ratings yet

- Report Wheel Chair Cum StretcherDocument44 pagesReport Wheel Chair Cum StretcherTanvi Khurana50% (2)

- RENEWABLE ENERGY POLICIESDocument1 pageRENEWABLE ENERGY POLICIESVincs KongNo ratings yet

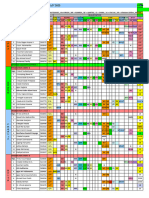

- Schedule MANPOWER TLD JAN. 2023Document21 pagesSchedule MANPOWER TLD JAN. 2023Putu RobedNo ratings yet

- Voyage Charter AgreementsDocument56 pagesVoyage Charter AgreementsMahdi Bordbar83% (12)

- Assess Eqpt Integrity PDFDocument85 pagesAssess Eqpt Integrity PDFswapan kumar hazraNo ratings yet

- Simulation of Five Bus SystemDocument29 pagesSimulation of Five Bus SystemakshaykarandeNo ratings yet

- City of Toronto Council Briefing Book 2010 To 2014Document514 pagesCity of Toronto Council Briefing Book 2010 To 2014Paisley RaeNo ratings yet

- Uadd Vol3 Road & Bridge WorksDocument124 pagesUadd Vol3 Road & Bridge WorksHaiderAliJoharNo ratings yet

- NC PSA 4.21-Rev2Document4 pagesNC PSA 4.21-Rev2Vaisal DarmawanNo ratings yet

- Business Traveller UK - December 2022Document94 pagesBusiness Traveller UK - December 2022Salim HaskariNo ratings yet

- Munich Augsburg PDFDocument37 pagesMunich Augsburg PDFVictor FlorinNo ratings yet

- Policy For Reimbursement of ExpensesDocument4 pagesPolicy For Reimbursement of ExpensesSuraj SinghNo ratings yet

- Nat Doc 008, Ed1 - Nat Asm (Nov2010)Document29 pagesNat Doc 008, Ed1 - Nat Asm (Nov2010)gurovalexNo ratings yet

- BS en Iso 3691-3 2016Document24 pagesBS en Iso 3691-3 2016yamen sayedNo ratings yet

- Ge700-2020-Gc16-Part1 Plot 26Document2 pagesGe700-2020-Gc16-Part1 Plot 26Daniel CryerNo ratings yet

- QC IN ROAD CONSTRUCTIONDocument27 pagesQC IN ROAD CONSTRUCTIONvinodshukla2573% (30)

- Nama: Siti Rahmawati Tuasamu Class: Acounting (C) NPM: 1413010105 English Language. Unit 15. My Home TownDocument2 pagesNama: Siti Rahmawati Tuasamu Class: Acounting (C) NPM: 1413010105 English Language. Unit 15. My Home TownRahma TuasamuNo ratings yet

- Presentation FileDocument10 pagesPresentation FileInnoVentureCommunityNo ratings yet

- Individual Assignment 1Document1 pageIndividual Assignment 1SweetNo ratings yet

- Transportation Injuries (Review of Forensic Medicine and Toxicology, 2nd Edition)Document14 pagesTransportation Injuries (Review of Forensic Medicine and Toxicology, 2nd Edition)Antonio jose Garrido carvajalinoNo ratings yet