Professional Documents

Culture Documents

Consumer Lifestyles - Colombia (Mar 2012)

Uploaded by

tprojasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consumer Lifestyles - Colombia (Mar 2012)

Uploaded by

tprojasCopyright:

Available Formats

CONSUMER LIFESTYLES IN COLOMBIA

Euromonitor International March 2012

CONSUMER LIFESTYLES IN COLOMBIA

Passport

LIST OF CONTENTS AND TABLES

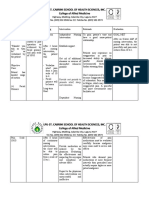

Consumer Habits in Context......................................................................................................... 1 Current Behaviour Within the Broader Economic Climate ........................................................ 1 Consumer Confidence .............................................................................................................. 2 Misery Index ............................................................................................................................. 2 Chart 1 Chart 2 Consumer Confidence Index 2006-2011 ...................................................... 2 Misery Index 2006-2011 ............................................................................... 3

Learning ....................................................................................................................................... 3 School Life ................................................................................................................................ 3 University Life ........................................................................................................................... 5 Adult Learning .......................................................................................................................... 7 Chart 3 Chart 4 Number of Students in Higher Education and Expenditure per Student in PPP Terms 2006-2011 ............................................................................. 7 Regional Ranking of Number of University Students 2011........................... 8

Working Habits ............................................................................................................................. 8 Working Conditions................................................................................................................... 9 Women in the Workplace........................................................................................................ 10 Commuting ............................................................................................................................. 11 Alternative Work Options ........................................................................................................ 12 Retirement .............................................................................................................................. 13 Chart 5 Chart 6 Chart 7 Employed and Unemployed Population and Labour Force Participation Rate 2006-2011 ..................................................................... 13 Regional Ranking of Female Employment Rate 2011 ................................ 14 Population Aged 15-64 Compared With Old-Age Dependency Ratio 2000-2020 .................................................................................................. 14

Eating Habits .............................................................................................................................. 15 Dining in.................................................................................................................................. 15 Dining Out ............................................................................................................................... 16 Caf Culture ........................................................................................................................... 17 Snacking Habits ...................................................................................................................... 17 Attitudes Towards Food .......................................................................................................... 18 Chart 8 Chart 9 Per Capita Expenditure on Consumer Foodservice by Chained and Independent 2011 ...................................................................................... 18 Regional Ranking of Average supply of food calories per day 2011 .......... 19

Drinking Habits ........................................................................................................................... 19 Attitudes Towards Drinking ..................................................................................................... 19 Drinking Inside the Home ....................................................................................................... 21 Drinking Outside the Home ..................................................................................................... 21 Chart 10 Chart 11 Per Capita Consumption of Alcoholic Drinks and Soft Drinks by Category 2011............................................................................................ 22 Regional Ranking of Alcoholic Drinks Consumption: Off-trade vs Ontrade 2011 .................................................................................................. 22

Grooming Habits ........................................................................................................................ 23 Attitudes Towards Personal Care ........................................................................................... 23 Attitudes Towards Beauty ....................................................................................................... 24

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

II

Male Grooming ....................................................................................................................... 25 Use of Hair Care Salons, Spas, Nail and Beauty Parlours ..................................................... 25 Chart 12 Chart 13 Value Sales of Beauty and Personal Care Key Categories 2006-2011 ...... 26 Regional Ranking of per capita Sales of Men's Grooming Products 2011 ........................................................................................................... 27

Fashion Habits ........................................................................................................................... 27 Attitudes Towards Clothing ..................................................................................................... 27 Attitudes Towards Footwear ................................................................................................... 28 Attitudes Towards Accessories/luxury Goods ......................................................................... 28 Chart 14 Chart 15 Consumer Expenditure on Clothing and Footwear 2006-2011................... 29 Regional Ranking of Consumer Expenditure on Clothing and Footwear as a Proportion of Total Consumer Expenditure 2011................ 29

Health and Wellness Habits ....................................................................................................... 30 Attitudes To Health and Well-being ........................................................................................ 30 Over-the-counter Versus Prescription-only Medicines ............................................................ 31 Sport and Fitness.................................................................................................................... 32 Obesity ................................................................................................................................... 32 Chart 16 Chart 17 Growth in Public and OTC Expenditure on Pharmaceuticals Compared With Healthy Life Expectancy at Birth 2006-2011 .................... 33 Regional Ranking of Obese and Overweight Population 2011 ................... 34

Smoking Habits .......................................................................................................................... 35 Smoking Prevalence ............................................................................................................... 35 Attitudes To Smoking.............................................................................................................. 35 Chart 18 Chart 19 Smoking Prevalence Amongst Men and Women 2006-2011 ..................... 36 Regional Ranking of Smoking Prevalence 2011 ........................................ 37

Shopping Habits ......................................................................................................................... 37 Attitudes To Shopping ............................................................................................................ 38 Main Household Food and Non-food Consumables Shop ...................................................... 38 Top-up Food Shopping ........................................................................................................... 39 Shopping for Big-ticket Items .................................................................................................. 40 Personal Shopping ................................................................................................................. 40 E-commerce and M-commerce .............................................................................................. 42 Chart 20 Chart 21 Importance of Hypermarkets, Supermarkets and Discounters within Grocery Retailing 2011 .............................................................................. 42 Regional Ranking of Sales through Internet Retailing 2011 ....................... 43

Leisure Habits ............................................................................................................................ 44 Staying in ................................................................................................................................ 44 Going Out ............................................................................................................................... 45 Public Holidays, Celebrations and Gift-giving ......................................................................... 45 Culture .................................................................................................................................... 46 Chart 22 Regional Ranking of Consumer Expenditure on Leisure and Recreation as a Proportion of Total Consumer Expenditure 2011 ............. 47

DIY and Gardening Habits.......................................................................................................... 48 Attitudes To DIY...................................................................................................................... 48 Attitudes To Gardening ........................................................................................................... 48 Chart 23 Number of Home Owners and New Dwellings Completed 2006-2011 ....... 49

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

III

Chart 24

Regional Ranking of Home Owners as a Proportion of Total Households 2011 ....................................................................................... 49

Pet Ownership Habits ................................................................................................................. 50 Attitudes To Pet Ownership .................................................................................................... 50 Chart 25 Chart 26 Pet Population and Sales of Pet Food 2006-2011 ..................................... 51 Regional Ranking of Pet Ownership 2011.................................................. 51

Travel Habits .............................................................................................................................. 52 Getting Around ....................................................................................................................... 52 Use of Public Transport .......................................................................................................... 53 Air Travel ................................................................................................................................ 54 Chart 27 Kilometres Travelled by Road, Rail and Air Compared With Motorway Intensity, Petrol Prices and Number of Scheduled Airline Passengers Carried 2006-2011 ..................................................................................... 55 Regional Ranking of New Car Registrations 2010 ..................................... 56

Chart 28

Vacation Habits .......................................................................................................................... 57 Attitudes To Taking Holidays .................................................................................................. 57 Main Holiday-taking Trends .................................................................................................... 57 Domestic Versus Foreign Holidays ......................................................................................... 58 Preferred Travel Methods ....................................................................................................... 59 Popularity of Different Types of Holiday Activities .................................................................. 60 Chart 29 Chart 30 Domestic and Outgoing Tourist Expenditure by Sector 2006-2011 ............ 60 Regional Ranking of Holiday Takers 2011 ................................................. 61

Financial Habits .......................................................................................................................... 62 Attitudes Toward Payment Methods ....................................................................................... 62 Savings ................................................................................................................................... 63 Loans and Mortgages ............................................................................................................. 64 Chart 31 Chart 32 Consumer Lending Compared with Savings and Savings Ratio 20062011 ........................................................................................................... 64 Regional Ranking of Financial Cards in Circulation 2011 ........................... 65

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

CONSUMER LIFESTYLES IN COLOMBIA

CONSUMER HABITS IN CONTEXT Current Behaviour Within the Broader Economic Climate

According to the National Administrative Department of Statistics (DANE), between 2010 and 2011 Colombias real gross domestic product (GDP) grew at a rate of 5.6%. This significant growth was based on several factors, including the progress made by the National Armed Forces in the fight against terrorist groups such as FARC (Fuerzas Armadas Revolucionarias de Colombia) and ELN (Ejercito de Liberacin Nacional), am effort which has attracted more foreign direct investment into the country. Colombias international trade also increased significantly. Between 2005 and 2010, the value of Colombian exports grew by more than 87% to reach US$87 billion in 2010. Growth was based in part on improved relations with neighbours Venezuela and Ecuador. At the same time, Colombia has taken advantage of its strong trade links with the United States. Indeed, according to the US government website export.g ov, The United States is Colombias largest trading partner and Colombia improved its ranking to the 20th largest market for US exports in 2010 from 23rd in 2009. US exports to Colombia in 2010 reached US$12 billion, 29% higher than 2009. US imports from Colombia in 2010 reached US$15.6 billion, 37% higher than 2009. In the future, trade between the two countries will be facilitated by the bilateral United States-Colombia Trade Promotion Agreement (Tratado de Libre Comercio entre Colombia y Estados Unidos) which was finally passed by the US Congress in 2011. Among other benefits, duty on 80% of consumer and industrial imports will be eliminated with remaining tariffs phased out over 10 years. Generally, this is expected to lead to lower prices for US products for Colombian consumers. As its institutional lending habits are far more conservative than those of many of its neighbours, Colombia was less affected by the recent global economic crisis than other South American nations. Nevertheless, the downturn did have a negative impact on disposable income and, in turn, consumer spending. Among other factors, declining demand for Colombian exports by recession-wracked countries such as the US rippled through the Colombian economy. In 2009, both annual disposable income per capita and consumer expenditure per household fell. But both rebounded positively in 2010 and 2011 as the economic picture brightened. Indeed, Colombias annual disposable income per capita increased to Col$8.3 million in 2010 and then to Col$8.7 million in 2011. Over the same period, annual consumer expenditure rose to Col$7.7 million in 2010 and then to Col$8.1 million in 2011. Colombian consumers are not as heavily taxed as consumers in other Latin American countries and this, of course, has had an impact on levels of disposable income. In 2010, taxes and social security contributions were estimated to be 14.5% of Colombian consumers gross income, while in Latin America as a whole they were estimated to be 17.3%. This translated into tax contributions per capita in Colombia of US$718 in 2010 compared to US$1,087 for Latin America as a whole. According to advocacy project ABColombia, in terms of income inequality Colombia is the third most unequal country in the Americas after Bolivia and Haiti. The poverty gap is most evident between rural and urban areas where 62% of the rural population are poor compared to 39% in urban areas, they note. The is also true in the case of extreme poverty, in rural areas 22% live in extreme poverty compared to 9% in the urban sector. Rural poverty is of particular

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

concern given that poverty and exclusion in rural areas has traditionally been one of the root causes of socio-political violence in the country and continues to be an important conflict accelerator. Obviously, these low levels of income have a significant impact on the behaviour and purchasing power of many Colombian consumers. Colombia believes it can be the third-largest economy in Latin America by 2015. At a recent trade conference in Madrid, Trade, Industry and Tourism Minister Sergio Diazgranados said Today Colombia is the fourth largest economy in Latin America; it was the fifth four years ago. We are in the process of transforming the country so that we can say (...) we are the largest economy in Latin America after Brazil and Mexico. He added that the goal was to be able to join the Organisation for Economic Co-operation and Development (OECD).

Consumer Confidence

According to the Fundacin para la Educacin Superior y el Desarrollo (Fedesarrollo), in December 2011 consumer confidence in the outlook for the countrys economic situation registered a value of 21.8, down from a high of 30.6 in 2006 but far significant increase from the 3.1 registered in 2009 a the height of the economic downturn. Not surprisingly, overall consumer confidence dramatically improved as the Colombian economy showed signs of recovery. However, confidence slipped in 2011, particularly among consumers in the middle classes and lower classes. Interestingly, confidence declined in 2011 amongst consumers in Bogot and Cali but increased amongst consumers in Medellin. A recent article in the newspaper Elespectador analysing the general rising consumer confidence noted that an increasing number of consumers said that their more optimistic outlook meant that they were now more likely to purchase durable goods, furniture and appliances than they were in the past. On the other hand, many consumers remain sceptical about the slowerthan-anticipated economic recovery of the United States, the countrys most important trading partner. As well, Venezuelas exit from the Andean C ommunity of Nations in 2011 was seen by many as having a negative effect on Colombias exporting companies, which employ a great number of workers.

Misery Index

In 2011, Colombias Misery Index reading (calculated by adding the inflation rate to the unemployment rate) stood at 14.2, up slightly from the 14 registered in 2010 but down significantly from the 18.3 registered in 2008. The relatively insignificant variations in the overall Misery Index readings can be attributed to high unemployment rates in 2008 declining to reach 10.8% in 2011 with inflation also declining over the same period. On the other hand, it must be noted that inflation increased from 2.3% in 2010 to 3.4% in 2011. Colombias Misery Index is one of the highest in South America, and is only surpassed by Venezuela, Argentina and Suriname. Peru, Chile and Brazil have seen their Misery Index readings decline. Neighbour Venezuela, in contrast, had the highest Misery Index in Latin America in 2011 with a reading of 35, consisting of an unemployment rate of approximately 8% and an inflation rate of approximately 27%. Over the next decade, Colombias Misery Index readings are projected to remain below 15%. Inflation rates are not expected to rise above 3% as a result of the new monetary policies implemented by the Colombian government. Over the same period, unemployment rates are expected to decline as the countrys economic performance improves and as the economy in the US, Colombias most important trading partner, rebounds. Chart 1 Consumer Confidence Index 2006-2011

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

Source: Note:

Fedesarrollo Consumer Confidence Index measures consumers' levels of optimism regarding current economic conditions and the direction of the economy.

Chart 2

Misery Index 2006-2011

Source: Note:

Euromonitor International calculated by adding the countrys unemployment rate to its inflation rate.

LEARNING School Life

Colombias educational system is made up of four main stages: pre -primary education, elementary or primary education, secondary education and higher education. While the first nine years of education are compulsory, a typical Colombian student attends school for an average 14 years in order to complete secondary educations. The Ministry of National Education sets the national standards and has control over all levels of education. Education in Colombia may be publicly or privately funded. Children begin to attend pre-primary school generally between the ages of one and two years and they leave at the age of age of five or six years. According to the Ministry of National Education, in 2010 there were 43,000 pre-primary schools in Colombia serving almost 1.4 million students. Depending levels of household income, parents can send their children to private or public pre-primary schools. Children from more affluent households tend to go to private kindergartens and pre-primary schools, which are often referred to as Jardines Infantiles. Unlike students at public schools, many private school students are required to wear uniforms. As well, most private schools provide snacks to their students, which generally consist of fresh fruit juice, milk and bread. Working parents often hire a private transportation service for

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

their children, taking them from home to school and back. Children are usually transported in small vans or minibuses suitable for this purpose. Children from low-income families attend public pre-primary schools. These public schools, known as Hogares Comunitarios or Community Homes, are sponsored by the Instituto Colombiano de Bienestar Familiar (ICBF or National Institute for Family Welfare). For the most part, these are day care centres located in poor neighbourhoods in urban areas. The unique characteristic of Community Homes is that mothers from the community take care of their own children as well as children from the immediate neighbourhood. ICBF provides daily portions of bienestarina which is used by community mothers to feed students. Bienestarina is a flour-like mixture made of wheat flour, soy flour and whole milk, enriched with vitamins and minerals. According to the National Institute for Family Welfare, more than 28,000 tonnes of bienestarina are produced each year and distributed across the country. The elementary school segment contains over 54,000 schools. According to the Ministry of National Education, in 2010 there were 5.3 million students in all elementary schools in Colombia. Children are admitted to primary school at the age of five. Elementary education lasts for five years and covers from the first to the fifth grade, In addition, some public and private schools include a preparatory year before first grade, which is referred to as Transition or Grade 0, and during which children are usually taught how to read and write. School day schedules vary depending on the region and the weather; however a typical school day starts between 6.30am and 8am and finishes around lunchtime. Children usually receive 30 hours of classes per week in subjects such as natural science, mathematics, physical education, social studies, Spanish, religious training and art education. Depending on the school, some children are taught a second language, usually English, French or German. Public schools start classes at the end of January and finish in November, with a three-week break in June. According to the Ministry of National Education, Colombias secondary school system consisted of more than 32,000 schools and 5.1 million students in 2010. The first phase, basic secondary education, includes grades six through nine and is compulsory for all students. The second phase, mid-secondary education, covers grades 10 and 11 and it is not compulsory. Academic programmes for these last two years are specially designed to prepare students for higher education. One of three streams may be selected: science, humanities or academic. Schedules involve at least 35 hours of classes per week in such subjects as mathematics, philosophy, history, physics, general chemistry, Spanish and literature and foreign languages. Other subjects taken vary depending on the stream chosen by the student. Colombias government finances approximately 85% of all elementa ry education and 60% of all secondary education. According to the Ministry of National Education, almost 9.3 million students attended public elementary and secondary schools in 2011 while almost 1.7 million students attended private schools. Seventy-five percent of all students attended educational institutions located in urban areas while the remainder attended schools in rural areas. Many public schools are underequipped and they are unable to provide a high quality of education. Private education tends to be of better quality but, of course, private schools charge fees. Costs for a private school in an intermediate city can range from between US$50 to US$450 a month. In bigger cities, tuition costs are typically above US$300 per month. Unlike public schools, private schools have the liberty to choose between two options for their school calendar: Calendar A starts in January and finishes in November, with a three week vacation in June (like public schools) while Calendar B starts in August and finishes in June. Additionally, starting in 2011 it will compulsory for all schools to incorporate into their academic calendars a five-day break for students in the week prior to the 12th of October to commemorate the discovery of the Americas by Columbus. Most schools provide catering and restaurant services for students, sometimes funded by the state. Lunch always consists of a portion of rice, potatoes and salad, as well as beans and

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

lentils. Meat, chicken and tuna may also be provided to students. It is not common for students to bring their lunches to school from home. However, as a school day lasts between six and seven hours, students are allowed to eat snacks during a short recess at 10am. Students bring snacks from home or buy them at school. Traditional snacks include potato chips, plantain chips, cookies, chocolate bars, fresh fruit, fruit juice and ice cream. Most Colombian school children wear uniforms, even in public schools. Students have uniforms to wear during school, usually a jacket, shirt and pants for boys and skirt, shirt and jacket for girls. Boys and girls wear white socks and dark shoes with the official uniform. Uniforms may vary depending on the school, the region and the weather. As well, students wear uniforms for physical education classes. This generally consists of a sweatshirt, a shirt, and sport shoes. Uniforms are usually purchased by parents at the beginning of the school year in specialised shops designated by the schools. Before the beginning of the academic year, schools provide parents with a list of supplies that will be required by the student throughout the whole year. Schools supplies for elementary school students include notebooks, books, pencils, glue, scissors, crayons and rulers. Secondary school students usually require pens, notebooks, books and calculators. In the case of elementary school students, supplies are purchased by parents before the academic year commences in stationery departments in large retail stores as they usually offer the most competitive prices. Many secondary school students are more independent and prefer to do their school shopping on their own.

University Life

University students can attend public or private institutions. Only 40% of the higher education institutions in Colombia are funded by the state, making it difficult for students from low- and middle-income families to have the opportunity to attain access to higher education. Tuition fees for private universities are estimated to be US$2,000 per semester in the intermediate cities and US $3,500 in bigger cities such as Bogota, Cali and Medellin. Tuition fees in public institutions are calculated according to the students household income. In 2010, 1.6 million students were enrolled in Colombias higher education institutions, reflecting an increase of 60% over the previous five years. In the same year, 54% of students attended public institutions of higher education. Higher education in Colombia consists of four types of institutions: universities, university institutions, technological institutions and technical institutions. Technological institutions offer undergraduate programmes in technologyrelated fields. These programmes generally are three years in length. Technical institutions provide short term vocational education in operational and instrumental fields and programmes typically last for two years. University institutions provide undergraduate programmes as well as postgraduate studies in highly specialised academic disciplines. In addition to teaching, universities undertake research at the graduate and postgraduate levels and offer programmes consisting of between seven and 12 semesters. According to the Ministry of National Education, in 2010 there were 50 technical institutions, 59 technological institutions, 95 university institutions and 76 universities. The majority of tertiary students (69% in 2010) pursue higher education in universities while about 28% attend technological and technical training institutions. Although there are an increasing number of students who enrol in post-graduate programmes once their undergraduate studies are over, the proportion of students who pursue post-graduate degrees is still low. The Ministry of National Education stated that in 2005 only 6% of students enrolled in a post-graduate study after finishing their undergraduate studies. By 2010, that had increased to 9%. Colombian students have a tendency to select undergraduate programmes that are related with economic and administrative sciences. According to the Ministry of National Education, the

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

most popular undergraduate programmes are business administration, law and law-related programmes, systems engineering, accounting and industrial engineering. Approximately 1.2 million students graduated from these five programmes in 2010. The Ministry of National Education estimated that 31% of all Colombian graduates are concentrated within the fields of economics, management and accounting whilst 25% of all graduates are in the fields of engineering, architecture and urban planning. Undergraduate programmes related to social sciences and humanities rank third followed by arts, mathematics and natural sciences. Students attending institutions located in the same towns or cities as their families usually live at home while they undertake their studies. Students only leave home when the university they attend is located in a different city. Student halls are not very common in Colombian institutions; students usually rent rooms or apartments with financial aid from their families. Some public universities do provide very cheap living halls for low-income students who show display excellent academic performance. Public universities may also provide low-income students with food subsidies, particularly if they exhibit continued good academic performance. On the other hand, it is not common for Colombian students to eat their lunches at the university. Most go home during lunch or eat in restaurants close to the university. A recent study from Universidad Javeriana revealed that 43% of university students eat three meals per day, 12% eat two meals per day and 5% eat more than five meals per day. The study also revealed that 53% of students take at least 30 minutes to eat their meals, 19% spends at least one hour and 28% only spend 15 minutes. According to the same study, 6% of university students eat fruit every day, with oranges and tangerines the most preferred. Consumption of vegetables was low, with only 17% of students saying that they eat vegetables daily (29% said they eat them three or four times per week). Beef or chicken were preferred over pork and tuna. Fifty-three percent of students said they milk daily while 22% said they drink it three or four times per week. Eighteen percent of students said they consume soft drinks daily while 26% said they drink them three or four times per week. Most Colombian university students, even those from low-income households, have their own laptops with internet access. A recent study published by the Marketing Department of Universidad Sergio Arboleda revealed that university students spend between three and 4.5 hours per day on the internet, undertaking academic research, downloading music and video games and chatting with friends. Many spend a great deal of time on social networking sites such as Facebook. Many Colombian students must work in order to help finance their living and university costs. Some students work as waiters or waitresses in restaurants or cafes, allowing them to earn the legal minimum wage per hour. However, due to the fact that university and working schedules are often not compatible, many students work in formal jobs for full eight-hour days and study in the night programmes offered by many of the universities. In these programmes, students generally attend daily classes from 6pm to 10pm on weekdays and from 7am to 12 noon Saturdays. During the last ten years, there has been an increased number of Programas de Educacin Abierta a Distancia long-distance learning programmes. According to Colombias National University, Colombia is one of the pioneer countries in this concept of education where the physical presence of students is not required. Lessons are given to students via the internet or other technology resources. The Ministry of National Education recently estimated that 4% of all undergraduate programmes in Colombia are conducted online. Students for these programmes are mostly women living in remote regions of the country who typically have children and, thus, cannot attend university away from home. The hobbies of university students in Colombia are varied. According to Universidad Javeriana, 30% of university students participate in some kind of physical or sports activity at least three times per week. The same study revealed, on the other hand, that almost 28% of

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

university students consume alcoholic beverages during the weekends and 62% consume them at least every other weekend. Most drink beer (54%) followed by aguardiente (16%), a colourless drink with a strong anise flavour. These are the cheapest alcoholic beverages available and, thus, they appeal to cash-strapped students. University students also enjoy going to the cinema, particularly on weekdays as most cinemas offer a 50% student discount on Tuesdays or Wednesdays.

Adult Learning

Institutions such as the National Learning Service (SENA) and the National Training Academy offer a wide range of courses in health, design, art, management, mechanics and equipment operation, sports, languages, culture, culinary techniques, among others. The National Learning Service has over 117 training centres across the country and has at least one training centre in each of the 32 departments of the country. Courses offered by these institutions are free as they are funded by the Colombian government and are available to any Colombian citizen who has a Bachelors degree and is over 18 years-old. These institutions also offer long-distance learning programmes. The number of students enrolled in Colombias national learning centres has increased during the last five years. According to the Ministry of National Education, more than 393,000 students were enrolled in 2005 and the number increased to 541,000 in 2010. The age of students ranges from between 18 and 55 years-old. The most popular programmes include health administration, agricultural management, culinary techniques, accounting, industrial and mechanical maintenance and software and programming. Students enrol in adult education programmes for several reasons. For most students, institutions like SENA are the only way of accessing e ducation after they obtain their Bachelors degree. Unlike public universities, where the tuition is calculated as a percentage of the students income, adult training courses in Colombia are free. The Ministry of Education states that 80% of the students that are enrolled in adult training centres are from low-income households. Many courses are taken by women who are the head of their households and need to attain new skills in order to be able to support their families. There is also an increasing trend of small farmers enrolling as they find they must be more productive and more efficient in the management and use of their land. Younger students between the ages of 20 and 30 years also take courses that might allow them to become secretaries, medical office assistants, factory workers, etc. Although students do not have to pay tuition fees once they join the programme, they nevertheless are responsible for the rest of their expenses. These include transportation to the centres facilities, food and basic school supplies. Students are required to buy notebooks, pens and pencils before the programme commences. At the same time, special supplies are often provided by the institutions. Chart 3 Number of Students in Higher Education and Expenditure per Student in PPP Terms 2006-2011

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

Source:

Euromonitor International

Chart 4

Regional Ranking of Number of University Students 2011

Source:

Euromonitor International

WORKING HABITS

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

Working Conditions

Colombias Labour Code states that employees are expected to work a maximum of 48 hours per week. This is the longest working week in Latin America. Exceptions to this law include working teenagers between the ages of 15 and 17 years-old who can work up to a maximum of 30 hours per week with a maximum work load of six hours per day. As well, working teenagers over 17 years-old may work up to 40 hours per week with a maximum work load of eight hours per day. In 2010, the minimum wage in Colombia was Col$515,000. The amount is agreed to every year by the government and the various working associations in the country. All employers are obliged to provide their employees with a paid holiday period of 15 working days per year. The days and hours under which employees normally work vary according to the nature of the job performed. According to Colombias Labour Code, the 48-hour week may be distributed from Mondays to Fridays or Mondays to Saturdays. A typical working day will commence at 7:30am and end around 5:30pm with a 1.5 hour lunch break. Factory workers often work in shifts. A typical night shift will start at 10pm and finish at 6am. However, employees working night shifts get paid a night surcharge of an additional 35% of day wages. In Colombia, hours worked over the number of the regular working hours are considered overtime, which may not exceed two hours per day and 12 hours per week. Overtime hours are always compensated with an additional 25% surcharge. Overtime charges do not apply to management or administrative staff or other salaried workers. According to a recent study published by Regus, 84% of employers in Colombia offer flexible working hours to their employees. According to the Labour Code, employees and employers may agree that the 48-hour work week may be completed in more than six days and the number of working hours may be distributed within the week with a minimum of four hours per day and a maximum of ten. Employees with kids often take advantage of flexible working hours as they are able to spend more time with their families. Workers are entitled to have contracts of employm ent. According to Colombias Labour Code, working contracts may be either written or oral. However, nearly all organisations use written contracts. Contracts are classified into indefinite term contracts, definite term contracts and contracts with limited duration (usually for performing specific tasks). According to Colombias Ministry of Social Protection, indefinite working contracts are most often used by companies and they are preferred most employees as they tend to provide workers with higher levels of security and stability. The Labour Code also states that all organisations must provide their employees with a complete social security system. For example, workers are entitled to healthcare and pension benefits. The pension contribution is equal to 1 5% of the employees salary, 75% of which is paid by the employer and 25% by the employee. The healthcare benefit covers any medical issues that may affect the health of the employee or his family. The healthcare contribution is 12% of the employees salary, with 8% paid by the employer and 4% deducted from the employees salary. Other benefits include two premium payments per year, unemployment aid, provision of clothing for work and transportation allowance (these last two depending on the employees salary level). Although not compulsory, Colombian workers can join a syndicate union or an association of collective bargaining. Workers receive two premium payments per year, the first on June 30th and the second on December 20th. These correspond to 15 days of salary worked during the semester. Workers are also entitled to membership in Cajas de Compensacin or Compensation Funds which offer employees such benefits as discounts for gym and recreation centres memberships, holiday resorts and amusement parks, theatres and art exhibitions and cinemas. According to the National Association of Family Compensation in Colombia, 6.3 million employees were members of the 43 Compensation Funds in 2010. Membership also allows employees from low-

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

10

and middle-income households to receive subsidies to help them acquire new homes. In 2010, more than 44,000 house subsidies worth Col$474 billion were provided to members of Compensation Funds. Colombians consider lunch to be the most important meal of their day. Office workers typically have between one hour and an hour and a half for a lunch break daily. Most manufacturing organisations are located in large industrial parks in city suburbs. These companies usually provide employees with canteens. In other cases, they provide dining facilities where workers can heat and eat their own lunches. Most industrial parks also provide a restaurant where office workers can buy meals at very reasonable prices (meals are often partly subsidised by the employers). Employees who work in shifts inside factories usually bring their meals to work, as it is often cheaper than to buy it. Employees working in companies such as banks or insurance companies (which are usually located in trade centres, malls or city centres) usually bring their lunch to work or eat in nearby restaurants which sell almuerzos ejecutivos (executive lunches) at very reasonable prices. The workplace dress codes vary. Employees working for banks or insurance companies are required to wear more formal business clothing, although some companies allow their employees to dress down and wear jeans and casual clothing on Fridays. Managers in industrial organisations are not required to dress formally, and they often wear casual pants and shirts to work. Factory workers and cleaners are usually provided with uniforms that allow them to perform their jobs in a secure and comfortable manner. However, there has been a recent trend of companies providing their employees with uniforms at all hierarchical levels. This trend has been seen most often in the banking and financial sector as well as in the travel and accommodation sectors. Arturo Calle, a major apparel company, has estimated that the use of uniforms in the workplace has grown by 12% per year since 2008. Many employees wear uniforms because they are subsidised by the employers, allowing them to spend less for clothing.

Women in the Workplace

There were 6.7 million working women in Colombia in 2010. Women are found more often working in some sectors rather than others. For example, more often than not women work as nurses, kindergarten and elementary school teachers, domestic workers inside family homes, executive secretaries, physician assistants and receptionists. As well, factory workers in apparel companies are usually women. In contrast, it is not common for women to work as bus or taxi drivers, electricians or factory workers in metalworking industries. According to DANE, 65% of the working women in Colombia are concentrated in two main sectors: tourism (most employees in hotels and restaurants are women) and social and community services. According to the International Labour Organisation (ILO), there are strong patterns of gender discrimination in the Colombian labour market. DANE recently revealed that working men earned salaries 26% higher than those of women in 2010. Unemployment rates for women are also higher than those for men. In 2010, according to DANE, the unemployment rate for men was 9.2% while the unemployment rate for women was nearly 16%. Traditionally, Colombian companies have preferred to hire women for entry-level positions and men for executive positions. However, this has changed somewhat as more women have attained higher education qualifications. Indeed, there are many more women working at various levels in the banking and finance and tourism sectors. Within manufacturing environments, however, there are fewer women managers (with the exception of clothing manufacturing) as many male factory employees would find it difficult to be supervised by women. All working women are entitled to 14 weeks of maternity leave. Women may start to make use of this time two weeks before their due date. The Labour Code states that maternity leave is also applicable to any woman adopting a child below the age of seven years-old. In these

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

11

cases, the due date will be replaced by the date of the official reception of the child. Once they have completed their maternity leave and returned to their normal work duties, new mothers are entitled to two breaks of thirty minutes per day to breastfeed their children.

Commuting

The most common ways that Colombians get to work are via passenger cars, motorcycles and public transport. Executives tend to drive their own vehicles to work and it is not common for them to use public transportation. Some organisations even provide company cars for the use of general managers. It is also common for mid-level employees to have their own cars and drive them to work. Less affluent employees often use public transport or their own motorcycles. Motorcycles have become very popular among commuters as the costs related to their use and maintenance are lower than the costs related to passenger cars. While the number of passenger cars in Colombia increased by 26% since 2005 (reaching a total of two million in 2010) the number of motorcycles increased by 108% (reaching a total of 2.7 million in 2010). Only a few Colombian cities have modern urban transport systems. Medellin, Colombias second-largest city, is the only city with a modern railway system for urban transport, the Metro de Medellin. According to Metro de Medellin, the system served more than 159 million passengers in 2010. Other cities, such as Bogot, Cali, Pereira, Barranquilla, Cucuta and Bucaramanga, maintain rapid bus systems. These usually consist of several lines and numerous elevated stations in the centre of main avenues. Typically, two or four lanes down the centre of the street are dedicated exclusively to bus traffic. In the case of Bogota, Colombias capital and largest city, 1.6 million passengers per day use the Transmilenio bus system. Manizales and Medellin also have systems known as Metrocable. In the remainder of the cities, there are no organised transportation networks and urban transport is limited to just a number of buses and transport companies. Buses are the most common public urban transport vehicles, followed by busetas. Busetas are buses of a smaller size and lower passenger capacity. According to DANE, 34% of the passengers that use public urban transport travel by bus while almost 30% use busetas. The rest of the commuters use minibuses, also referred to as colectivos and, in the cities where they are available, urban transport systems. Taxis are considered by commuters to be expensive and they are usually used only in cases of emergency, such as when workers are late or if their usual mode of transport is not available. The average length of a commute to work in Colombia depends on the city. Commutes in large metropolitan areas, such as Bogota, Medellin and Cali, tend to average of 38.5 minutes. According to the World Bank, this average would be 32% higher if these cities did not have modern urban transport systems such as the Metro de Medellin or rapid bus systems. Commutes in smaller cities such as Pereira, Cartagena and Bucaramanga average about 25 minutes. The average cost of commuting also varies depending on the city and of the means of transport used. In Bogota and Cali, the average cost of commuting in 2010 was Col$$1.70 while in Medellin it was Col$1.75. In other cities, the average cost of a commute by bus was Col$1.10, Col$1.40 for those commuting in busetas and Col$1.50 for those commuting in minibuses or colectivos. Travel by bus in urban areas is mostly informal and operates on a cash basis, meaning that commuters pay for the service at the time of use. Only in cities with modern urban transport systems may commuters buy travel permits. Travel permits are not popular amongst Colombian commuters as they are not discounted. It is often difficult to find parking spaces in urban areas and this affects the commuting decisions of many Colombian workers. Parking in main streets in city centres is mostly forbidden and unsecure. Some cities have buildings dedicated to providing parking spaces. Fees may be paid monthly (at an estimated cost of Col$60) or by the hour, with an estimated value of Col$2.

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

12

Some cities have implemented a programme known as Pico y Placa (Peak and License Plate). This programme restricts private and public vehicles with license plate numbers ending in specified digits from travelling on city streets between certain times. These policies are intended to encourage commuters to use public transport. Additionally, Bogota holds the worlds largest car-free weekday event, encouraging motorists to give up their car for one day and use an alternative means of transport. Cycling is becoming an increasingly popular commuting option in the largest metropolitan cities of Colombia. Cycling routes can be found in many large metropolitan cities but smaller cities and towns lack an adequate infrastructure to promote cycling as a commuting alternative. Bogota offers the most extensive network of cycling routes, also referred to as ciclorrutas. The network comprises over 300 kilometres of paths dedicated exclusively to the use of bicycles. Some Transmilenio Stations (the citys Bus Rapid Transport System) are integrated with the cycling network through bicycle parking facilities. Medellin has a shorter cycling network of 33 kilometres, in which 45,000 people commute every day.

Alternative Work Options

For the most part, Colombian workers tend to want to work in traditional full-time jobs and alternative work options are not eagerly sought after. According to Banco de la Repblica, the monthly income of full-time employees is double the income of part-time or informal employees. In 2010, the average monthly income of an informal employee was estimated to be Col$550 while for a full-time employee it was estimated to be Col$1, 050. As well, most of the alternative work options tend to be informal jobs without access to healthcare and pension benefits. According to the economic journal Portafolio, by the end of 2011 there were more than 12.5 million informal workers in the Colombian labour market, with 8.3 million earning less than the minimal wage. Between 2005 and 2010, the number of part-time workers increased by just over 5% to reach 25,300 in 2010. According to DANE, 57% of part-time employees in Colombia are women. The reason behind this is that men are still considered to be the main providers of household income in the Colombian society. Hence, men will accept part-time jobs only on a temporarily basis; they tend to quit as soon as they find a full-time work that provides more security and stability. Women, on the other hand, seek out part-time jobs in order to help increase household income. Many women work as domestic and housekeeping employees. As well, there are many female part-time workers in restaurants and hotels and in the public sector. The number of self-employed Colombians increased by 22% between 2005 and 2010, reaching 8.2 million in 2010. This trend reflects the positive attitude many Colombians have towards being your own boss. Women often prefer to be self-employed as it allows them to combine their work with household chores and looking after their children. Self-employed women often work with catalogue sales (Ventas por Catlogo) in which they advertise, sell and distribute a wide range of products, such as cosmetics, diet foods and clothing. Women get paid on commission based on the volume of their sales. Some professional men prefer to be selfemployed as do younger entrepreneurs who often decide to take advantage of the subsidies provided by the Colombian government to start up new businesses. These include bank loans at low interest rates as well as free advisory services. Working at home is common only for those who are self-employed. Employers do not typically encourage full-time employees to work from home. On the other hand, this is expected to change in coming years and it is projected that the number of workers working from home will increase by 30% between 2010 and 2020.

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

13

Retirement

The number of pensioners in Colombia increased by 24.5% between 2005 and 2010, reaching 4.9 million in 2010. Women accounted for 64% of the total retired population in 2010. It was estimated that at the end of 2010, 11% of the Colombian population were pensioners. By 2020, that percentage is expected to reach 15%. Before 2010, men could retire at the age of 55 years and women could retire at the age of 50 years, after proving they had worked for a minimum of twenty years. In 2010, the Ministry of Social Protection increased the retirement age to 62 years for men and 60 years for women. Pensions in Colombia correspond to 75% of the average wages earned by the employee during the last year of work. Although retirement in Colombia is not compulsory, most employees look forward to this stage of their lives. A high number of Colombians see their retirement as an opportunity to change their lifestyles without having to worry about work. This perception is not likely to change in the future, as most employees tend to retire from work once they have met the age and working time requirements. As Colombias healthcare system is seen as inefficient and often providing poor attention to all patients, pensioners and older adults tend to buy private health care services through insurance companies or prepaid medicine companies (Compaas de Medicina Prepagada). Services offered by these companies are considered to be expensive and can only be afforded by more affluent consumers. Regardless, as the number of pensioners increases in coming years it is expected that demand for these services will grow. Traditionally, the lives of Colombian pensioners have centred on their homes. However, there is an increasing trend among those that can afford it to join healthcare centres and gyms, not only as a way to monitor and enhance their health but also as a way to socialise and spend their free time. There has also been increased demand (again among those that can afford it) for leisure products and services such as package holidays. It is also common for retired people to join associations whose memberships are based on shared interests. Examples of these associations include the Colombian Garden Club and the Colombian Orchid Association, which allow retired people to specialise on their hobbies and assist specialised exhibitions on these matters. Going to church is also an important part of daily life for many older people, as older Colombians are still strong believers in the Catholic religion. The range of housing options for older consumers ultimately depends on their level of income. Older people from the affluent segments tend to live in their own houses or apartments. Those with low incomes often live with extended family. It is not common for older people in Colombia to live in retirement communities. Despite the fact that nursing homes are common, these are often inhabited by elderly homeless people. The average Colombian associates nursing and retirement homes with abandonment; hence, they would rather live with their older family members than to intern them in retirement communities. Chart 5 Employed and Unemployed Population and Labour Force Participation Rate 2006-2011

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

14

Source:

Euromonitor International

Chart 6

Regional Ranking of Female Employment Rate 2011

Source:

Euromonitor International

Chart 7

Population Aged 15-64 Compared With Old-Age Dependency Ratio 20002020

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

15

Source:

Euromonitor International

EATING HABITS Dining in

Colombians usually eat three main meals per day, breakfast, lunch and dinner. They also often eat smaller mid-morning and mid-afternoon snacks. A traditional Colombian breakfast includes fried or scrambled eggs with an arepa, a bread made of corn with the shape of a tortilla. Breakfast drinks usually include orange juice with hot coffee or hot chocolate. Typical Colombian lunches and dinners often have three courses, including soup, seco, the main dish with rice, plantains, meat and salad and a traditional dessert. Although patterns are similar all over the country, Colombians specific eating habits and preferences vary depending on region. For instance, in the coastal region it is common to serve breakfast with an arepa de huevo, a deep-fried arepa with an egg filling together with suero, a sour cream. In Bogot, it is common to start the day with a tamal which consists of pieces of pork and beef and rice and potatoes, wrapped in plantain leaves and usually boiled. In Antioquia and the Coffee Region, fried eggs and arepas are usually served with beans and sausages. However, many Colombians often eat lighter breakfasts, with juice, bread and coffee or cereal with milk, as they are quicker and more convenient. For most Colombians, lunch is the most important meal of the day. It can start with soup or fruit as an appetiser. The main course, el seco, may consist of a portion of protein (meat or chicken), at least two portions of carbohydrates (the most widely consumed is rice, followed by potatoes and plantains) and salad. Fruit juice is usually consumed with lunch. Desserts are also eaten, with the most traditional being arequipe and bocadillo. Colombians frequently consume soups as main courses during lunch. In Bogot, the traditional soup is ajiaco, which contains chicken, three kinds of potatoes, avocado and a Colombian spice called guascas. On the Caribbean coast, seafood soups are very popular. Sancocho, a soup that might contain chicken, meat or fish depending on the region, and frijoles (red beans) with rice are also very common

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

16

dishes in most territories. In large cities, consumers often to not have time to eat lunch at home as they do in rural areas and smaller towns and they turn instead to lighter types of food, such as salads, pizzas and sandwiches, available at foodservice outlets. Indeed, the number of fast food restaurants has increased significantly in the largest cities. Colombians usually eat their dinner at home, especially during the week. Dinner typically consists of either a lighter version of lunch or, frequently, bread rolls or arepas served with coffee or hot chocolate. Eating habits tend to vary significantly depending on consumers income and economic condition. Low-income consumers tend to prepare meals with more starches, lower quality fats and meat. They also tend to eat fewer fruits and vegetables. Consumers from this segment tend to eat more beans and lentils. More affluent Colombians often have healthier diets as they can afford to buy more nutritious and healthier food, such as cereals, better quality oils, beef and pork of better quality and more fruits and vegetables. Affluent consumers also tend to enjoy nontraditional foods. Indeed, Asian and European dishes and dishes from countries such as Mexico and Argentina have become increasingly popular and these are often prepared at home. It is not uncommon for households to have Mexican burritos or Chinese noodles and rice for lunch at home. However, international foods are cooked at home mostly during weekends when family members have more time to prepare them. Looking for convenience and time savings, an increasing number of Colombian consumers are buy ready-meals in supermarkets and heating them up at home. This is particularly the case during the week when many people simply do not have time to cook. Fewer consumers still buy fresh ingredients and prepare meals from scratch every day. On the other hand, many Colombian families get together during weekends to enjoy freshly prepared meals. These family get-togethers usually take place at the home of grandparents and traditional dishes are prepared and served. The typical cooking appliances in Colombian households include freezers, refrigerators, electric ovens, microwave ovens and gas stoves. Many Colombians have pressure cookers and they use them to cook such dishes as frijoles, ajiaco and sancocho. It is also common to own rice cookers, frying pots and pans, blenders and grills that are specially designed to heat arepas. Barbecues have also become popular amongst Colombian consumers looking to dine at home.

Dining Out

Dining out is reserved for more affluent consumers as it is far more expensive to eat at a restaurant than it is to eat at home. Many consumers, particularly those in urban areas, enjoy dining in food malls in shopping centres where it is common to find outlets selling typical Colombian dishes at reasonable prices. Chicken grills are also very popular amongst consumers. These usually serve roasted chicken with boiled potatoes and arepas at very low prices. The most popular consumer foodservice establishments tend to be fast food restaurants as well as restaurants where consumers may find all types of international food at a reasonable price and good quality. Restaurant chains such as Crepes & Waffles, El Corral Gourmet and Il Forno offer consumers a wide range of food options, an adequate atmosphere and rapid service together with reasonable prices. In the last decade, there has been an increase in the number of restaurants serving international cuisine. Colombia now hosts a large variety of restaurants offering European, Mediterranean, Asian and Latin American food. In addition, fusion cuisine, in which traditional Colombian and Latin flavours are mixed with international recipes and ingredients, has become widely popular. Italian cuisine is amongst the most popular and preferred by Colombian consumers from nearly all income levels. Italian restaurants serving pizza and pasta are common in all cities. There is also an increasing number of consumers who prefer dining in

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

17

Asian restaurants. Fast food outlets are popular among younger consumers who enjoy hamburgers and fried chicken. It is not common among Colombian consumers to eat breakfast out. Most workers eat breakfast at home before going to work. At the same time, however, many workers in urban areas cannot get home to eat lunch and they often dine out. It is common for workers to eat at restaurants that sell corrientazos, which tend to be homemade lunches. Many other workers eat their lunch in food malls at large shopping centres.

Caf Culture

Coffee is an important part of Colombian consumers lives and the tradition of growing coffee in the country has led to high consumption levels. According to the National Coffee Federation (Federacin Nacional de Cafeteros) 70% of Colombians drink coffee 21 days of the month. Typically, people living in urban areas tend to have their first coffee in the morning during breakfast, together with hot milk and sugar. Farmers also tend to drink coffee for breakfast, sweetened with panela, a brown sugar-like powder extracted from sugar cane. Office workers often have black coffee before starting their day as well as one after lunch. During the last decade, there has been a significant increase in the number of cafs operating in urban areas. It is now common for consumers of all generations to have coffee at cafs after work or school or even over the weekend. Among the popular varieties are caf Americano, cappuccino, macchiato and iced coffee. Espresso is not as popular in Colombia as it is in other countries as most consumers consider it too strong. Coffee is usually drunk inside cafs as there is no strong tradition for take-away coffee. As Colombians like to have their coffee with a snack in the afternoon, most establishments sell a wide range of snacks and other food, such as fruit cake, brownies, cinnamon rolls and croissants. Pan de bono and buuelos are also typical bakery snacks and these are popular accompaniments for coffee. Cafs are considered to be both social and working venues in Colombia. They are frequented not only by consumers who want to spend time with friends and family but also by students and workers during the day. It is common for cafs to offer customers free access to Wi-Fi services that they can use to work or study while they enjoy their coffee. Tiendas Juan Valdez and Caf Oma are amongst the most popular caf chains in Colombia. Tiendas Juan Valdez is owned by the Federacin Nacional de Cafeteros. It opened its first coffee establishment in 2002 and today the chain has 126 outlets in Colombia, 17 in Ecuador, nine in Chile, six in Spain and six in the US. Caf Oma is a popular gourmet chain which has more than 158 establishments in the principal Colombian cities. Smaller and more traditional cafs serving various types of coffee and dessert are also common in most urban areas. Usually smaller cafs offer many of the same products as the biggest coffee chains but they offer better service, as well. These smaller types of establishments are mostly frequented by older consumers; younger consumers tend to prefer larger chained outlets where they can study or search the web.

Snacking Habits

Traditionally, Colombians have two snack breaks per day. The first takes places between 10am and 10:30am and the second one between 4pm and 5pm. Potato chips, plantain chips and biscuits have always been the most popular snacks amongst the Colombian consumers, but the type of snacks consumed tends to vary depending on the age of the consumer. School children and teenagers enjoy potato chips and confectionery in the morning and heavier snacks like sandwiches, empanadas (a pastry made out of corn dough with potato and meat stuffing) or arepas in the afternoon once they arrive home from school. Older consumers traditionally prefer

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

18

to eat Colombian biscuits for snacks, such as buuelos or pan de bono. These are usually accompanied by coffee, soda or fruit juice. The snacking habits of the Colombian population have changed in recent years, a reflection in part of new international brands entering the market. For instance, flavoured corn chips are now a very popular snack amongst consumers while the consumption of traditional plantain chips has fallen significantly. Indeed, plantain chips are not sold in most supermarkets anymore. Demand for homemade potato crisps has significantly declined while demand for branded crisps such as those from Frito-Lay has increased, particularly among younger consumers. Chocolate bars such as Milky Way, Snickers and Mars are also very popular despite these brands not being available in Colombia until recent years. In contrast, demand for traditional snacks such as empanadas, buuelos and pan de bonos has declined. Younger and more affluent consumers tend to prefer pizza, hamburgers and hot dogs as snacks in the afternoon. Of course, some health-conscious consumers prefer to eat healthier snacks. Hence, fruit, cereal bars and fresh fruit salads have become popular for the morning or afternoon snacks.

Attitudes Towards Food

Colombian consumers have become much more aware of the benefits of healthy eating habits. However, the extent to which they can act on that growing awareness is based, in large part, on income levels. Organic food and other healthy options are simply more expensive than many less healthy options. In fact, demand for organic food is low among consumers in all income segments and it is not common to see organic products on the shelves of most supermarkets and grocery stores. All organic food produced in Colombia, such as tropical fruit, organic coffee and vegetables, are exported to North American or European markets. On the other hand, there has been increased demand among Colombian consumers for socalled ethical foods. This demand is coming mostly from younger consumers who have become aware and concerned of ethical issues as they pertain to food production. For instance, an increasing number of consumers, particularly in urban areas, only buy chicken, beef or pork that has been processed in licensed slaughter plants using methods that guarantee the lowest levels of animal suffering. In terms of corporate responsibility, it is worth noting that an important part of the success achieved by the foodservice chain Crepes & Waffles was based on it employing divorced women from the lowest socio-economic levels who had often been abused and abandoned by their partners and who remained the head of their households. The Fairtrade concept has also become well-known among younger consumers. The campaign hosted by Tiendas Juan Valdez and the Federacin Nacional Cafeteros has contributed to the great success of these stores. Despite the growing awareness of healthy eating, many consumers simply seek convenience and time savings and, as a result, many turn to processed foods. Colombians often buy processed foods at their supermarkets or grocery stores. Frozen processed poultry and frozen crispy products are amongst the most popular processed frozen foods among consumers in Colombia. These generally come in various figures, sizes and presentations, such as cheesefilled nuggets, chips with the shape of smiling faces or animal-shaped chicken nuggets. Most of these products can be prepared in the oven, offering high levels of convenience for busy mothers. Dried processed foods such as rice, pasta and soup are also very popular as they are affordable for consumers from all socio-economic levels. Chart 8 Per Capita Expenditure on Consumer Foodservice by Chained and Independent 2011

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

19

Source:

Euromonitor International

Chart 9

Regional Ranking of Average supply of food calories per day 2011

Source:

Euromonitor International

DRINKING HABITS Attitudes Towards Drinking

The consumption of alcoholic beverages is deeply embedded in Colombian culture. Consumers drink alcohol during social celebrations, parties and holiday vacations, among other occasions. Alcohol is used to celebrate important life events such as weddings, birthdays and

Euromonitor International

CONSUMER LIFESTYLES IN COLOMBIA

Passport

20