Professional Documents

Culture Documents

Photo Published in The International Herald Tribune

Uploaded by

MaileCannonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Photo Published in The International Herald Tribune

Uploaded by

MaileCannonCopyright:

Available Formats

....

THE GLOBAL EDITION OF THE NEW YORK TIMES SATURDAY-SUNDAY, SEPTEMBER 26-27, 2009 | 15

Business

Imagining Europe takes

what Obama its turn in

could’ve said assessing

bank health

PARIS

After U.S. ‘stress tests,’

Joe regulators from E.U. try

Nocera to estimate credit losses

BY MATTHEW SALTMARSH

TALKING BUSINESS

Twenty-two large banks in Europe may

have accumulated credit losses of close

Good morning, Nicolas.* Did you sleep to ¤400 billion for this year and next, ac-

well, Angela? Wasn’t that a good din- cording to officials who have seen a

ner last night, Gordon? Pittsburgh is draft of conclusions of ‘‘stress tests’’

such a great city; I’m so glad we’re conducted by European regulators.

holding our G-20 meeting here. It was At a meeting next Thursday and Fri-

Michelle’s idea, you know. I think she day in Sweden, European Union finance

would have lobbied for Pittsburgh even ministers are planning to publish at

if the city hadn’t swung for me in the least one headline figure on banking

election. (Laughter.) O.K., maybe not. health based on the results of the tests,

So let’s get down to business. We the officials, who were not authorized to

made great progress on Thursday, speak publicly, said Friday.

didn’t we? Jintao, you agreed to push E.U. finance ministers are also plan-

for more domestic demand in your ning soon to initiate a stress test for

Chinese economy. My good friends in European insurance companies, with

Europe agreed to seek more invest- the results to be assessed in the spring,

ment from the rest of the world, and the officials said.

everybody agreed to be less dependent The bank tests in Europe were

on U.S. consumers. We even agreed to conducted by the Committee of Euro-

check up on each other to see if we’re pean Banking Supervisors, or C.E.B.S.,

all doing what we said we would do. ERIC PIERMONT/AGENCE FRANCE-PRESSE a pan-E.U. regulators’ panel based in

Wow. Are summits always this pro- London, which was assigned the matter

ductive? (More laughter.) I didn’t think by governments. The committee did not

so. Now we’ve got to tackle the subject reply Friday to requests for comment.

we’ve all been avoiding. What are we The figure of almost ¤400 billion, or

going to do about capital requirements $580 billion, covers assumed bank credit

for the banking system? losses rather than total bad assets, under

Please, Nicolas, don’t groan. Tim a ‘‘negative’’ scenario in which macro-

Geithner, my Treasury secretary, economic forecasts, like growth in gross

keeps telling me that strengthening domestic product for this year and next,

capital requirements for the banking are lower than the forecasts of the Euro-

system is the single pean Commission, the officials said.

I know you most important Other scenarios and elements of the

don’t all agree factor in ensuring testing process will not be released pub-

that we never have a licly, according to the officials.

with Tim’s repeat of last year’s Unlike a similar exercise carried out

proposals, but financial crisis. He’s in the United States this year, the re-

I think they got me convinced. lease of the European results will not in-

make a ton of When I was run- clude assessments of further action re-

sense. ning for president, I quired by individual banks to bolster

don’t think I even their balance sheets.

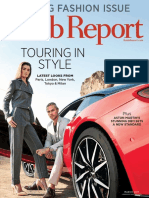

knew that banks had MAILE CANNON/INTERNATIONAL HERALD TRIBUNE TOSHIYUKI AIZAWA/REUTERS U.S. regulators released their stress

capital requirements. I certainly didn’t Fast Retailing is scheduled to open a 2,000-square-meter Uniqlo store Thursday in Paris, top and above left. Tadashi Yanai, above right, is founder and chief executive of the company. test results in May, saying that 9 of the

know the difference between Tier 1 and 19 largest U.S.-based banks were ad-

Tier 2 capital. I thought Basel was a equately protected, while the other 10

city in Switzerland, and not shorthand were ordered to raise a combined $75

A Japanese merchant in a hurry

for a complex international system to billion as a buffer against potential

regulate bank capital requirements. losses. The U.S. process added pressure

But I sure know about them now. on Europeans to disclose their results.

They helped create the mess we got in- In a brief statement in May, the com-

to last year. And now, because our mittee confirmed that it was ‘‘carrying

banks and most of your banks use dif- out an E.U.-wide forward-looking stress

ferent capital standards, it is going to be TOKYO niers and Princesse Tam-Tam. will come Oct. 1 in Paris, with the open- said Fast Retailing would have a fair testing exercise on the aggregate bank-

really tough to get us on the same page. From its founding in 1963 as a family- ing of a Uniqlo flagship store on Rue shot at selling well in Europe. ing system’’ based on common

But we have to try. run clothing shop, and despite a few set- Scribe — 2,000 square meters, or more ‘‘Uniqlo’s pricing structure is low guidelines and scenarios. It said it

I’m sure you all saw the proposal for Founder of Fast Retailing backs along the way, Fast Retailing has than 21,000 square feet, of retail space enough to enable it to compete well with

tougher capital requirements that Tim

and his folks at Treasury issued a few

aims to be the king of generally lived up to its name. The com-

pany has forecast that sales for the year

just around the corner from the land-

mark department stores Galeries Lafa-

H&M and Zara,’’ Mr. Wright said. ‘‘It has

a wider range of prices, which should

‘‘We know that the problem

weeks ago. I know you don’t all agree cheap chic in 10 years through Aug. 31 rose 16 percent, to ¥680 yette and Printemps. make it better able to attract consumers

is with certain banks,

with his proposals, but I think they billion, or about $7.4 billion, while profits Even though cheap chic is thriving as who are trading down from higher-priced and a global figure doesn’t

make a ton of sense. And I am very re- BY MIKI TANIKAWA rose 20 percent, to ¥52 billion. Many consumers cut back, opening a flagship brands into the midmarket segment, not help us with that.’’

luctant to compromise on Tim’s plan, analysts expect that the final numbers, store in the world’s fashion capital could just people looking for bargains.’’

because I think it offers the best chance For someone whose stated aim is to lead to be announced Oct. 8, will beat the be the definition of chutzpah. Mr. Yanai Building its business globally will be

to make sure that the banking system the global market for his product, Ta- forecast. sees it as a natural extension of the crucial if Fast Retailing is to achieve its would not identify individual banks that

survives the next big financial crisis. dashi Yanai cuts an unassuming figure. In a depressed market for retailers’ brand — and of his business style. ambitious goals. Like every big Japa- might need recapitalization, and that it

For instance, Tim says that the qual- He speaks softly about his passion for stocks, Fast Retailing shares have been ‘‘We have grown to this from a ¥1 bil- nese consumer products company, it was the responsibility of national gov-

ity of Tier 1 capital has to be vastly im- business but also about his firm belief buoyant, trading at a price-to-earnings lion company in 1984, when we estab- faces a deadline: Japan’s population is ernments to name such banks.

proved. Who knew that not all capital is that successful people will inevitably ratio of 21.35. That performance has pro- lished our first Uniqlo shop,’’ Mr. Yanai aging, and its youth population is shrink- ‘‘In terms of the better visibility of the

the same? (Tier 2 capital isn’t worth make mistakes, and then learn from pelled Mr. Yanai, the company’s biggest said in a recent interview in his office in ing. At the same time, the forces of glob- fiscal costs of the bailouts, it will be pos-

talking about. ‘‘It’s the bank equivalent them. His autobiography, published in shareholder, to the top of the current Tokyo. ‘‘That is no less preposterous alization are bringing multinational itive to publish the results,’’ said Hans-

of your brother-in-law saying he’ll lend 2003, is titled ‘‘One Win and Nine than what we aim to achieve’’ in the competitors into the Japanese market. Joachim Dübel, a banking expert at Fin-

you $5 if you get in trouble,’’ somebody Losses.’’ ‘‘Corporations have to go next 10 years. ‘‘Companies that sell only in Japan will polconsult in Berlin. ‘‘But we know that

told me the other day.) Mr. Yanai, 60, the founder and chief Most Uniqlo items go for just tens of eventually not be able to sell even in Ja- the problem is with certain banks, and a

The way Tim explained it to me, the executive of the Japanese company

global in order to survive.’’ dollars and rarely carry a retail price of pan,’’ Mr. Yanai, who sprinkles the word global figure doesn’t help us with that.’’

best kind of capital is the kind that is Fast Retailing, has big ambitions: to be more than $60, even for jackets and ‘‘globalization’’ liberally into his conver- Peer Steinbrück, the German finance

tangible and never has to be paid back the world’s largest purveyor of cheap Forbes list of the richest people in Ja- coats. In warehouselike stores, Uniqlo’s sation and public remarks, said recently minister, had previously signaled his re-

— the kind that comes from either issu- yet chic clothing in the next 10 years. pan, with a net worth of $6.1 billion. simply dressed salespeople stack up in a news conference. ‘‘Corporations luctance to release findings of stress

ing stock, or from putting aside re- Fast Retailing owns Uniqlo, the so- Yet despite its best efforts to expand sweat shirts, turtlenecks and sweaters have to go global in order to survive.’’ tests. One reason, according to Mr Dübel,

tained earnings. That is the kind of cap- called fast fashion chain whose square globally, Fast Retailing still generates in vivid colors of all gradations, as if Like most companies that sell to the is that German politicians are worried

ital bankers can use to plug holes when red logo with white characters now flies about 90 percent of its sales in Japan. they were displaying crayons. youth market, Uniqlo gets the word out about the extent of the troubles at the

their banks report losses, or they have above 777 stores in Japan and 90 stores Mr. Yanai wants to change that. His 10- To keep costs low and quality high, about a new store or a new collection via German Landesbanken, or state lenders.

to write down assets. But one of the in China, Hong Kong, South Korea, year goal is to achieve annual sales of Uniqlo manufactures in China under the a variety of media, including distribut- One E.U. regulator, who had a central

things I’ve learned is that the rules al- Singapore, Britain, France and the more than ¥5 trillion — more than the watchful eye of Japanese executives ing leaflets in newspapers. But its role, said Friday that the exercise of

low other vehicles to be classified as United States. combined sales of competitors like Gap who are handpicked by Mr. Yanai and strongest sell usually is word of mouth. conducting the stress tests — a first on

Tier 1 ‘‘capital.’’ Preferred stock, for in- It also owns the Theory clothing Stores, H&M and Inditex, which owns have experience in textiles and design. ‘‘We have been around for three this scale in Europe — had been very

stance. Or hybrid forms of debt. Or brand in the United States and two the Zara brand. Jon Wright, retail industry analyst at years, and customers throughout New positive.

even — and I hear you do this a lot in French brands, Comptoir des Coton- Fast Retailing’s latest overseas salvo Euromonitor International in London, UNIQLO, PAGE 16 ‘‘It was a big learning process,’’ said

Europe — certain deferred taxes. the official, who was unauthorized to

But when you run into trouble, you speak publicly. ‘‘But we now know bet-

can’t use deferred taxes to replace as- ter how to do this in future. There is a

Australian oil spill renews development debate

sets that have just been written down. centralized command.’’

And you can’t use preferred stock The International Monetary Fund will

either, because ultimately, that money publish its own forecast of bank health

you’ve raised by issuing preferred Wednesday as part of its Financial Sta-

stock has to be paid back. SYDNEY about three more weeks to plug the leak. comes at a price. They say the Montara and flood the area with heavy mud to bility Review. The fund estimated in

In other words, it’s not the kind of The platform is located above the oil spill is merely a sign of things to stanch the flow. April that European banks still required

capital that will act as a safeguard in Montara oil field, about 250 kilometers, come unless greater protections are ex- But such highly specialized equip- $375 billion in capital to cover losses,

times of trouble. And that’s the whole Fragile marine systems or 155 miles, northwest of the Truscott tended to vast stretches of tropical reefs ment is not easy to come by. It took three compared with $275 billion for U.S.

point of capital.

The second thing Tim’s been telling

need better protection, Air Base in the remote Kimberley re-

gion of the country.

off northwestern Australia.

‘‘It’s a classic conflict between devel-

weeks to tow the rig from Singapore,

and PTT has said it will take at least an-

lenders. That forecast caused some con-

sternation among European officials,

me is that banks need to have more conservationists say The leaking well head is owned by the opment and the ecological values of the other three weeks to plug the leak. who had not been informed of its release

capital. Last year, as banks wrote down national petroleum company of Thailand, region,’’ said John Carey, manager of The company has declined to esti- and were unclear on the methodology.

their bad loans, they became so low on BY MERAIAH FOLEY PTT Exploration and Production, one of the Kimberley Conservation Program mate how much oil has spilled into the The stress tests for European insurers

capital that some of there were techni- the many energy firms that have set up with the Pew Environment Group. ‘‘We sea, saying it is too dangerous to take will be conducted by the Frankfurt-

cally insolvent. Gordon, isn’t that why Visitors hoping to peek at the exotic operations in western Australia to feed need to get the balance right. But the accurate measurements from the dam- based committee of European insurance

you now own the Royal Bank of Scot- marine life in Australia usually make a Asia’s growing appetite for oil and gas. aged rig. Both PTT and Australian and occupational pensions supervisors,

land? It’s why we had to shore up our beeline for the Great Barrier Reef. But In the first half of this year, more than ‘‘The Timor Sea is literally a maritime officials, who are helping to according to E.U. officials.

banks with taxpayer money — they conservationists say that an equally re- 50 wells were drilled in the tropical wa- clean up the spill, say that the slick is With their more conservative invest-

hadn’t put enough capital aside to cover markable, but lesser known, marine en- ters off western Australia, adding to

rich soup of marine life, and around 40 kilometers wide and 140 kilo- ment strategies, insurers — with the

all the losses from their toxic securities. vironment is under threat from the hundreds of other recent projects. Last now we have a massive oil meters long, but that the rate of leakage notable exception of the U.S. giant

Right now the rules say banks must booming oil and gas exploration taking month, the government gave Chevron slick sitting on the surface.’’ appears to be slowing. American International Group — gener-

have, at a minimum, Tier 1 capital that place among the reefs and atolls off the the green light to expand its exploration Earlier this month, the federal envir- ally steered clear of the most toxic struc-

amounts to 4 percent of their assets. Australian northwest coast. of the massive Gorgon gas field, a $40 onment minister, Peter Garrett, said the tured products that brought a number of

Tim hasn’t unveiled a new number yet, A damaged oil well in the region has billion project that was opposed by con- balance at the moment is that less than 1 government believed that around 300 Western banks to their knees last year.

NOCERA, PAGE 16 been spewing thousands of liters of servationists because of its potential en- percent of this globally significant area barrels to 400 barrels of oil were leaking But unlike banks, many insurers are

crude, gas and condensate into the vironmental impacts. is under any form of protection.’’ into the sea each day. That amounts to now suffering from the record-low level

* I’m not saying this is what President Timor Sea since Aug. 21, when a blowout Economists credit the booming trade PTT Exploration and Production said more than 1.7 million liters, or 450,000 of interest rates in the major economies.

Barack Obama said Friday morning forced the evacuation of all 69 workers in petroleum and other mineral re- it was still investigating what caused gallons, of oil (and unknown quantities This had dented their returns from in-

when he met with his fellow world lead- on board the platform. Emergency crews sources with helping Australia escape the blowout. To stop the spill, the com- of gas and condensate) since the blow- vestments like bonds, while they have

ers at the Group of 20 summit meeting in have been working overtime to contain the brunt of the Great Recession, but en- pany has hired a specialist rig to drill out began. fixed obligations in the form of policy

Pittsburgh. But he should have. the spill, but officials say it could take vironmentalists say this prosperity down 2.4 kilometers below the seabed AUSTRALIA, PAGE 17 payouts.

You might also like

- DroneAcharya Financial Statements 2022 2023Document8 pagesDroneAcharya Financial Statements 2022 2023pradeep kumar pradeep kumarNo ratings yet

- Maple Ridge Pitt Meadows News - March 2, 2011 Online EditionDocument36 pagesMaple Ridge Pitt Meadows News - March 2, 2011 Online EditionmapleridgenewsNo ratings yet

- Live Mint - Wall Street Journal PartnerDocument31 pagesLive Mint - Wall Street Journal Partnerresearch@infoguanxi.com88% (8)

- Sports Hub: Vivian Asks For Patience, 22 Nov 2009, Straits TimesDocument1 pageSports Hub: Vivian Asks For Patience, 22 Nov 2009, Straits TimesdbmcysNo ratings yet

- Robb Report - March 2017Document204 pagesRobb Report - March 2017oo100% (2)

- BGM 01.26.18Document28 pagesBGM 01.26.18cnymediaNo ratings yet

- Newspaper BoosthDocument37 pagesNewspaper BoosthLarMhNo ratings yet

- Megaworld Annual Report 2010Document76 pagesMegaworld Annual Report 2010Novelyn PlanNo ratings yet

- Usatoday 20151221 USA TodayDocument28 pagesUsatoday 20151221 USA TodaystefanoNo ratings yet

- Thesun 2009-07-01 Page01 Freer EconomyDocument1 pageThesun 2009-07-01 Page01 Freer EconomyImpulsive collectorNo ratings yet

- The Wall Street Journal - 03.03.2023Document46 pagesThe Wall Street Journal - 03.03.2023MARIO M TORRESANo ratings yet

- Fromlackofbeds Toriseinpoverty, Housepanelflags CovidconcernsDocument16 pagesFromlackofbeds Toriseinpoverty, Housepanelflags Covidconcernsshivam srivastavaNo ratings yet

- Wall Street Journal June 3 2016Document54 pagesWall Street Journal June 3 2016Shubham RankaNo ratings yet

- Eskan Tower 6: Muscat CapitalDocument46 pagesEskan Tower 6: Muscat Capitalalim shaikhNo ratings yet

- Multibagger Stocks and The Million-Dollar Question: Income Tax Dept Detects Under-Invoicing of ImportsDocument12 pagesMultibagger Stocks and The Million-Dollar Question: Income Tax Dept Detects Under-Invoicing of Importsrajat guptaNo ratings yet

- Sea Risk Basel III To Basel Iv2Document1 pageSea Risk Basel III To Basel Iv2abcNo ratings yet

- Tax Sleuths Search Offices of Newsclick, Newslaundry: Vax Coverage Up, Serious Cases Decline, State Eases Curbs AgainDocument16 pagesTax Sleuths Search Offices of Newsclick, Newslaundry: Vax Coverage Up, Serious Cases Decline, State Eases Curbs AgainabeymechNo ratings yet

- Poem 1 - The City Planners - AtwoodDocument1 pagePoem 1 - The City Planners - AtwoodAlyssa Wong Yi ReiNo ratings yet

- New Book Reveals Who Is Really in Charge of The White HouseDocument1 pageNew Book Reveals Who Is Really in Charge of The White HouseRamonita GarciaNo ratings yet

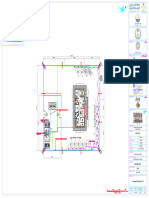

- 11001-TPE-3671911219-Z1-GF-3321312131-028016 - DWG - C02 - LV CABLE ROUTING LAYOUT-Layout1Document1 page11001-TPE-3671911219-Z1-GF-3321312131-028016 - DWG - C02 - LV CABLE ROUTING LAYOUT-Layout1Muhammad IrfanNo ratings yet

- 02-06-18 EditionDocument28 pages02-06-18 EditionSan Mateo Daily JournalNo ratings yet

- Kjaer Global Trends 2020Document11 pagesKjaer Global Trends 2020João JönkNo ratings yet

- Companies - Dealroom - Co - 02Document1 pageCompanies - Dealroom - Co - 02Tyler JohnsonNo ratings yet

- PreliminaryDocument13 pagesPreliminarydineshkmr373No ratings yet

- 11001-TPE-3671911219-Z1-GF-3321312131-028013 - DWG - C02 - SITE LIGHTING LAYOUT-Layout1Document1 page11001-TPE-3671911219-Z1-GF-3321312131-028013 - DWG - C02 - SITE LIGHTING LAYOUT-Layout1Muhammad IrfanNo ratings yet

- Adweek - October 10, 2022Document46 pagesAdweek - October 10, 2022ganis supriadiNo ratings yet

- Cityam 2011-01-05bookDocument28 pagesCityam 2011-01-05bookCity A.M.No ratings yet

- Amateur Radio 73Document148 pagesAmateur Radio 73Guillermo LariosNo ratings yet

- Sim Business-Month 1928-03-31 36 1801Document17 pagesSim Business-Month 1928-03-31 36 1801john08sanNo ratings yet

- CondensadorDocument120 pagesCondensadorMacarena Paz Gonzalez SáezNo ratings yet

- Success by NumbersDocument2 pagesSuccess by NumberstinaeminiNo ratings yet

- Financial Accounting SummaryDocument23 pagesFinancial Accounting SummaryKapeLatte (카페라떼)No ratings yet

- Min Residence: 29 Witherbee Avenue Pelham Manor, New YorkDocument7 pagesMin Residence: 29 Witherbee Avenue Pelham Manor, New Yorkapi-27426552No ratings yet

- rc0913 AlliedDocument4 pagesrc0913 AlliedsymonpatenNo ratings yet

- 4619-C-D3-03 - Details Engineering - AFU - Road Construction Details Sheet 3 - ADocument1 page4619-C-D3-03 - Details Engineering - AFU - Road Construction Details Sheet 3 - ARoy MarechaNo ratings yet

- Architect: Customer: Washington Metro Clark Const. Group: Dulles Airport StationDocument12 pagesArchitect: Customer: Washington Metro Clark Const. Group: Dulles Airport StationmirfanjpcgmailcomNo ratings yet

- Studio Sound 1988 08Document66 pagesStudio Sound 1988 08Hifi ShareNo ratings yet

- Express 021908Document8 pagesExpress 021908aptureincNo ratings yet

- Bandages and Dressings 1908 LancetDocument1 pageBandages and Dressings 1908 LancetbeirutjenNo ratings yet

- INYT Frontpage Global.20220818Document1 pageINYT Frontpage Global.20220818Goutam KumarNo ratings yet

- Global Order Book 2022Document5 pagesGlobal Order Book 2022dzobaksashaNo ratings yet

- P, I, Controller T2 Switch Gear (North) - 1Document1 pageP, I, Controller T2 Switch Gear (North) - 1Cindz BananiaNo ratings yet

- A20 NorthbaybusinessjournalDocument1 pageA20 NorthbaybusinessjournalA. GibsonNo ratings yet

- CD05R13 - Sparepart StoreDocument1 pageCD05R13 - Sparepart StoreDhiraj BeechooNo ratings yet

- Wallstreetjournal 20171111 TheWallStreetJournalDocument52 pagesWallstreetjournal 20171111 TheWallStreetJournalsadaq84No ratings yet

- NYC Blues - The Number of Potential NYPD Cops PlummetsDocument1 pageNYC Blues - The Number of Potential NYPD Cops PlummetsRamonita GarciaNo ratings yet

- Seq 4Document1 pageSeq 4oscarzabala1311No ratings yet

- Practical Wireless Index Volume 1Document12 pagesPractical Wireless Index Volume 1Lajos NagyNo ratings yet

- 2021-03-27 WSJ PDFDocument51 pages2021-03-27 WSJ PDFMike GlaswellNo ratings yet

- STDB 2 BDocument1 pageSTDB 2 BgarpheetNo ratings yet

- Report WritingDocument8 pagesReport WritingPrince RathoreNo ratings yet

- 02 - (MAT) MATERIAL SUBMITTAL LOGDocument3 pages02 - (MAT) MATERIAL SUBMITTAL LOGjovindhaNo ratings yet

- All S-Curve B, C & EtcDocument1 pageAll S-Curve B, C & EtcstatikaNo ratings yet

- TheSun 2008-12-05 Page01 Najib ValueCap Not For BailoutsDocument1 pageTheSun 2008-12-05 Page01 Najib ValueCap Not For BailoutsImpulsive collectorNo ratings yet

- Site PlanDocument1 pageSite PlanKanak YadavNo ratings yet

- Sunday Times Good University Guide 2021Document57 pagesSunday Times Good University Guide 2021So Ho HanNo ratings yet

- Howard Davies AFDocument1 pageHoward Davies AFAarzoo SuriNo ratings yet

- Esd 19130616Document8 pagesEsd 19130616Abimanyu OrnNo ratings yet

- Proceedings of Spie: "Fast" Is Not "Real-Time": Designing Effective Real-Time AI SystemsDocument10 pagesProceedings of Spie: "Fast" Is Not "Real-Time": Designing Effective Real-Time AI SystemsbassbngNo ratings yet

- Pediatrics Alaa Notes PDFDocument54 pagesPediatrics Alaa Notes PDFmaimoona sulemanNo ratings yet

- Unit Test: Año de La Diversificación Productiva y Del Fortalecimiento de La EducaciónDocument5 pagesUnit Test: Año de La Diversificación Productiva y Del Fortalecimiento de La EducaciónClaudia Ortiz VicenteNo ratings yet

- 'Tis So Sweet To Trust in JesusADocument1 page'Tis So Sweet To Trust in JesusAEsterlyn BumanlagNo ratings yet

- Bible Study MethodsDocument60 pagesBible Study MethodsMonique HendersonNo ratings yet

- Amul ProjectDocument52 pagesAmul ProjectPrabuddha BhaleraoNo ratings yet

- Vice President Human Resources in Louisville KY Resume Christopher LitrasDocument3 pagesVice President Human Resources in Louisville KY Resume Christopher LitrasChristopher LitrasNo ratings yet

- Introduction To Wastewater ManagementDocument18 pagesIntroduction To Wastewater ManagementMuhammad IqmalNo ratings yet

- Luxury Customer ProfilingDocument16 pagesLuxury Customer ProfilingIndrani Pan100% (1)

- Generacion de Modelos de NegocioDocument285 pagesGeneracion de Modelos de NegocioMilca Aguirre100% (2)

- Accounting 121Document2 pagesAccounting 121Now OnwooNo ratings yet

- Cultural Transmission in SchoolsDocument5 pagesCultural Transmission in SchoolsNurhashimah Za'ba50% (2)

- Dokumen - Tips Copy of Internship Report 5584606d564cbDocument55 pagesDokumen - Tips Copy of Internship Report 5584606d564cbRao SohailNo ratings yet

- Ester An IntroductionDocument22 pagesEster An IntroductionAnandNo ratings yet

- 100 + 1 Big Lies of MacedonismDocument158 pages100 + 1 Big Lies of MacedonismJames PetersonNo ratings yet

- Heidenhain EXE 602 E Datasheet 2015617105231Document6 pagesHeidenhain EXE 602 E Datasheet 2015617105231Citi MelonoNo ratings yet

- Comments On Manual Dexterity-NYTDocument78 pagesComments On Manual Dexterity-NYTSao LaoNo ratings yet

- Haldex ViscosoDocument6 pagesHaldex Viscosotoro123404No ratings yet

- Sociology 08Document10 pagesSociology 08Lata SinghNo ratings yet

- Qw-482 Welding Procedure SpecificationDocument2 pagesQw-482 Welding Procedure SpecificationAmanSharmaNo ratings yet

- TuteDocument3 pagesTuteSatyam SinghNo ratings yet

- The Official Shopping Guide To SeoulDocument51 pagesThe Official Shopping Guide To Seoulkozaza: book homes in Korea100% (1)

- COMM294 SyllabusDocument4 pagesCOMM294 SyllabuswdorfmannNo ratings yet

- Commercial Liens - A Most Potent WeaponDocument89 pagesCommercial Liens - A Most Potent Weaponjeff100% (1)

- Blackpink Interview in Rolling StoneDocument8 pagesBlackpink Interview in Rolling StoneNisa Adina RNo ratings yet

- Arvind Medicare v. Neeru MehraDocument21 pagesArvind Medicare v. Neeru MehraSparsh GoelNo ratings yet

- 9 Budgets - Budgetary ControlDocument10 pages9 Budgets - Budgetary ControlLakshay SharmaNo ratings yet

- William Reich HAbla de Freud PDFDocument32 pagesWilliam Reich HAbla de Freud PDFxtreme1981xNo ratings yet

- High Court of KeralaDocument4 pagesHigh Court of KeralaNidheesh TpNo ratings yet

- Burns: Sept 2015 East of England CT3 DaysDocument29 pagesBurns: Sept 2015 East of England CT3 DaysThanujaa UvarajNo ratings yet

- Flushing of An Indwelling Catheter and Bladder Washouts KnowbotsDocument5 pagesFlushing of An Indwelling Catheter and Bladder Washouts KnowbotsTanaman PeternakanNo ratings yet