Professional Documents

Culture Documents

Outlook 2014 Looking Forward

Uploaded by

sogo_yipCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Outlook 2014 Looking Forward

Uploaded by

sogo_yipCopyright:

Available Formats

Pri nt er-Fri endl y Page

Page 1 of16

P ri n ter-F ri en d l y P ag e

O u tl o o k 2014: L o o ki n g fo rw ard

Gl obaleconom i c and chem i calout put grow t h shoul d cont i nue t o accel erat ei n 2014. W i t hi m provi ng econom i c prospect s, headl i ne grow t hf or chem i cal s gl obal l ywi l li m prove t o 3. 8% i n 2014, says K evi n Sw i f t , A C C chi ef econom i st and m anagi ng di rect or. T hat num ber i s up f rom expect ed gl obalgrow t h of 2. 4% i n 2013. T he st rongest grow t h wi l lcont i nue t o be i nt he devel opi ng nat i ons of A si a, t he M i ddl e E ast , and Lat i n A m eri ca, S w i f t says. D ue t o com pet i t i ve advant ages f rom shal e gas, grow t h wi l lbe st rong i n N ort h A m eri ca as w el l . W est ern E urope and Japan w i l l l ag. W i t h st rengt heni ng product i on vol um es, gl obalcapaci t y ut i l i zat i on w i l li m prove i nt he years t o com e. T he overal lw orl d econom y i sl i kel yt o em erge f rom i t s ext ended sof t pat ch of t he l ast t w o years t hanks t ot he easi ng of t he t wi n headw i nds of pri vat e-sect or del everagi ng and publ i c-sect or aust eri t y, says I H S chi ef econom i st N ari m an B ehravesh. T hat sai d, t he gl obalgrow t h rebound i sl i kel yt o be qui t e m odest , he adds. I H S expect s 3. 3% grow t hi n 2014 com pared w i t h 2. 5% i n 2013. T he good new s i st hat t he upsi de surpri ses about grow t h m ay m ore t han bal ance out dow nsi de surpri ses, provi ded som e of t he m ore daunt i ng ri sks f aci ng t he w orl d econom y, such as an oi lshock, do not m at eri al i ze. U S chem i calm akers are f i rm l y back i nt he gam e t hanks t ot he cost advant age enabl ed by l ow -cost shal e f eedst ocks, accordi ng t o Sw i f t . U S chem i calproduct i on i s expect ed t o ri se 2. 5% i n 2014 and 3. 5% i n 2015, S w i f t says. F ol l ow i ng a decade of l ost com pet i t i veness, A m eri can chem i st ry i s reem ergi ng as a grow t hi ndust ry, Sw i f t says. U S chem i cal s product i on w i l lgrow st rongl yt hrough t he second hal f of t he decade, as t he nearl y $100 bi l l i on i n new chem i cali nvest m ent announced si nce 2010 com es onl i ne. D uri ng t he second hal f of t he decade, U S chem i st ry grow t hi s expect ed t o expand at a pace over 4% / year on average, a rat et hat exceeds t hat of t he overal lU S econom y, Sw i f t says. T he t ot alval ue of shi pm ent swi l ladvance at a sl i ght l y st ronger pace t han product i on, w i t h shi pm ent s val ues set t o exceed $1 t ri l l i on i n 2018, up f rom $789 bi l l i on i n 2013, A C C says. T he f orecast grow t h rat es are t he hi ghest f or i ndust ry i n m ore t han 20 years. E xcl udi ng pharm aceut i cal s, U S [ chem i cal ] grow t h has averaged l ess t han 1% / year si nce t he earl y 1990s, says M art ha G i l chri st M oore, A C C s seni or di rect or/ pol i cy anal ysi s and econom i cs. Thi si s goi ng t o be a realst ep-up f rom t hat l evel . U S chem i cal s product i on excl udi ng pharm aceut i cal s w as up 3. 2% i n 2013, and grow t hi s expect ed t o sl ow t o 2. 6% i n 2014. S peci al t i es and agri cul t uralchem i cal swi l ldrag dow n t he rat ei n 2014 af t er advanci ng st rongl yt he t w o years pri or. B asi c chem i cal s are expect ed t o grow 2. 4% i n 2014, up f rom 1. 2% i n 2013. C hem i cal s product i on grow t h excl udi ng pharm aceut i cal swi l lbe 3. 5% i n 2015, 3. 8% i n 2016, and 4. 0% i n 2019, accordi ng t o A C C est i m at es. U S export swi l lram p up sharpl y as product i on com es onl i ne. E xport s of chem i cal swi l lgrow 6. 6% i n 2014, t o $205 bi l l i on, and a f urt her 7. 6% i n 2015. E xcl udi ng pharm aceut i cal s, t he surpl us i n chem i cal st rade w i l lgrow t o $67. 5 bi l l i on by 2018, up f rom $42. 7 bi l l i on i n 2013, an average of 9. 6% / year. T he expansi on i s al so reversi ng t he i ndust ry sf al l i ng em pl oym ent t rend. E m pl oym ent i nt he chem i cali ndust ry w i l l have grow n by 1. 3% i n 2013 and cont i nue t o expand t hrough 2018, A C C says. T hi s grow t h cont rast swi t ht he cont i nuous decl i ne i ni ndust ry em pl oym ent bet w een 1999 and 2011. R O B E R T W E S T E R V E LT

C hi n a: S l o w er b u t so l i d g ro w th

T he C hi nese econom y i s set t o grow 8% i n 2014 com pared w i t h 7. 8% i n 2013, accordi ng t ot he I H S . O ur expect at i on i sf or C hi na s econom i c grow t ht o accel erat e sl i ght l yi n 2014, grow i ng by about 8% , on t he basi s of st eady i nvest m ent and consum pt i on grow t h and a m argi nali m provem ent i n ext ernaldem and, w hi ch has been a

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 2 of16

source of vol at i l i t y[ i n 2013] , says B ri an Jackson, econom i st / C hi na R egi onalS ervi ce at I H S . E xport grow t h wi l lpi ck up m oderat el y, but housi ng m arket swi l lrem ai n a drag on t he econom y, I H S says. O ur vi ew i st hat C hi na s econom i c grow t h wi l lexperi ence a secul ar dow nw ard t rend but , on average, w i l lrem ai n above 7% t hrough 2020, Jackson says. C hi na s chem i cali ndust ry i s m at uri ng and ent eri ng a phase of sl ow er but sol i d grow t h, anal yst s say. C hem i cal product i on i n C hi na w i l li ncrease 8. 5% i n 2015 com pared wi t h 8. 8% i n 2014 and 8. 5% i n 2013, A C C says. Fi gures rel eased by t he C hi na P et rol eum and C hem i cal I ndust ry Federat i on (C P C I F ; B ei j i ng) show t hat t ot al revenue f or t he chem i calsect or i n C hi na, w hi ch consi st s of over 25, 000 com pani es, i ncreased 12. 3% i nt he f i rst ni ne m ont hs of 2013 com pared w i t ht he year-ago peri od, t o 5. 81 t ri l l i on renm i nbi($957 bi l l i on), and t ot alprof i t sf or t he sect or i ncreased 11. 2% i nt he peri od, t o R m b267. 54 bi l l i on, says N orbert M eyri ng, part ner at K P M G C hi na (S hanghai ) and head/ chem i cal s, C hi na and A si a/ P aci f i c at K P M G . C hem i calsect or revenue w i l lbe about R m b8 t ri l l i on, a 12% i ncrease com pared w i t h 2012, and prof i t s w oul di ncrease 11% , t o R m b420 bi l l i on, M eyri ng says. I n 2014, cert ai n sect ors of C hi na s chem i cali ndust ry are l i kel yt o grow m ore st rongl yt han ot hers, M eyri ng says. S ect ors such as f i ne chem i cal s and speci al t y chem i cal s provi de pl ent y of grow t h opport uni t y, M eyri ng says. A grochem i cal s are ant i ci pat ed t o do w el lf ol l ow i ng a sl um p i n 2012, support ed by hi gher consum pt i on of chem i calf ert i l i zers. T he aut om ot i ve m arket i n C hi na i s expect ed t o cont i nue i t s grow t h at a rat e of about 5% / year unt i l2020, benef i t i ng sect ors such as l ubri cant s, synt het i c rubber, and engi neeri ng pl ast i cs, M eyri ng says. T he const ruct i on sect or s grow t hi sl i kel yt o drop because of reduced i nf rast ruct ure spendi ng, he adds. W hi l ei ncreasi ng consum er spendi ng w i l lhel p absorb som e of t he grow t hi n pol ym ers capaci t y, a si gni f i cant am ount of pol ym ers w i l lneed t o be export ed t oj ust i f yt he ext ended grow t hi n capaci t yi nt he segm ent , M eyri ng says. T he new l eadershi pi n C hi na has com m i t t ed t o ref orm s very cl earl y, and ref orm s w ere t he f ocalpoi nt of t he t hi rd pl enary sessi on, M eyri ng says. T he ref orm s encourage C hi nese ent erpri ses t o choose a new pat h of i ndust ri al i zat i on, enhance t hei r val ue chai ns, com pet ei nt ernat i onal l y, and creat e nat i onalcham pi ons t oi ncrease C hi na s sel f -suf f i ci ency i n chem i cal s and est abl i sh an envi ronm ent t hat prom ot es sust ai nabi l i t y. I ti s ai m ed t o i ncrease out bound and i nbound i nvest m ent [ s] by reduci ng t he l evelof governm ent i nvol vem ent i n deci si ons as w el l as adm i ni st rat i ve procedures, m easures w hi ch al so benef i tt he gl obalchem i cali ndust ry w i t ht hei ri nvest m ent si nt o C hi na by provi di ng enhanced m arket access, M eyri ng says. D E E P T I R A M E S H

G erm an y: E co n o m y accel erates

T he G erm an econom y w i l lst rengt hen i n 2014 despi t e rest rai nt s st em m i ng f rom l i ngeri ng w eakness el sew here i nt he E urozone, accordi ng t oI H S . G D P grow t hi s est i m at ed t o be 0. 6% i n 2013 but w i l lcl i mbt o 1. 8% i n 2014 and 2015. G erm an export s wi l lbenef i tf rom a st rengt heni ng gl obaleconom y and w ani ng recessi onary pressure i n sout hern E urope as t he need f or f i scalconsol i dat i on l et s up, says T i m o Kl ei n, seni or econom i st at I H S . G erm an dom est i c dem and shoul d pi ck up as w el lbased on bot h consum pt i on and i nvest m ent . P ri vat e consum pt i on has been underpi nned by ongoi ng em pl oym ent grow t h averagi ng 1% / year and sol i d w age i ncreases of roughl y 3% , even duri ng t he l ast t hree di f f i cul t years due t ot he escal at i ng eurozone debt cri si s, Kl ei n says. Hi st ori cal l yl ow i nt erest rat es t hat w i l lbroadl y persi st duri ng 2014 are di scouragi ng savi ng and t hus hel pi ng consum er dem and, Kl ei n adds. It hi nk t he gl obaleconom y has passed t he t rough, says K arl -Ludw i g Kl ey, presi dent of i ndust ry t rade associ at i on V C I (F rankf urt ) and chai rm an of M erck K G aA (D arm st adt , G erm any). T he G erm an chem i cali ndust ry i s caut i ousl y opt i mi st i c about t he st art of 2014, V C I says. M ost com pani es expect t he chem i calbusi ness t o pi ck up i nt he com i ng m ont hs. T here w i l lbe an upw ard devel opm ent next year f or t he G erm an chem i cali ndust ry, but a sl ow one, Kl ey

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 3 of16

says. W e are expect i ng an i ncrease i n chem i cal product i on of 2% f or 2014. C hem i calpri ces are l i kel yt o drop sl i ght l y, by about 0. 5% . V C I says i t expect s chem i calsal es t o ri se t o 191 bi l l i on ($263 bi l l i on), or 1. 5% , i n 2014. V C I bel i eves t here w i l lbe a f urt her i ncrease i n dom est i c dem and f or chem i cal s. V ery l i t t l ei s goi ng t o change i nt he f oreseeabl ef ut ure regardi ng t he G erm an chem i calexport surpl us, w hi ch i s good new s, Kl ey says. T he G erm an econom y rem ai ns hi ghl y com pet i t i ve i nt ernat i onal l y, enabl i ng i tt o prof i t rapi dl yf rom any i m provem ent i n gl obaldem and, as appears t o be f ort hcom i ng w i t ht he i m provi ng U S econom y. T he G D P grow t hf orecast of 1. 8% i n 2014 com pares w i t haf i gure of onl y 0. 8% i nt he eurozone as a w hol eroughl y 0. 4% excl udi ng G erm anyor 2. 5% f or t he U ni t ed S t at es, accordi ng t oI H S. T he expect ed pi ckup i n G erm an i m port s due t ot he robust ness of dom est i c dem and w i l li ncreasi ngl y del i ver grow t hi m pul ses t ot he rem ai nder of t he eurozone, i nt urn provi di ng bet t er condi t i ons f or G erm an export st ot hose count ri es, accordi ng t o Kl ei n. T he eurozone debt cri si si s not over, al t hough G erm any s robust st ruct urall abor m arket condi t i ons, beni gn i nf l at i on, and rock-bot t om i nt erest rat es, al ong w i t h a rel at i vel y w eak euro, are hel pi ng t o bri ng about a st rengt heni ng recovery, I H S says. I HS f orecast s consum er pri ce i nf l at i on t o be 1. 6% i n 2014. T he current account surpl us i sf orecast t o be 6. 5% of GDP i n 2014. T he surpl us w i l lnarrow i n 2014 15 gi ven i m provi ng near-t erm dom est i c dem and prospect s, accordi ng t oI H S . T he ref orm of energy pol i cy w i l lbe very i m port ant f or G erm any s m edi um -t erm grow t h pot ent i al , as f ai l ure t o cont ai n pow er cost s as t he energy m i x m oves m ore t ow ards renew abl es coul di ncreasi ngl y becom e an i m port ant burden f or t he i nt ernat i on com pet i t i veness of t he count ry si ndust ry, says K l ei n. M I C H A E L R A V E N S C R O FT

L ati n A m eri ca:P u rsu i n g en erg y secto r refo rm s

T he realG D P of Lat i n A m eri ca and t he C ari bbean w i l lexpand by 3. 4% i n 2014, w hi ch i s hi gher t han t he 3% f rom t he end of 2013, accordi ng t oI HS f orecast s. T he E conom i c C om m i ssi on on Lat i n A m eri can and t he C ari bbean (E cl ac; S ant i ago) expect s a m oderat el yf avorabl e gl obalenvi ronm ent w i l lhel p boost regi onalexport si n 2014. P ri vat e consum pt i on w i l lal so cont i nue t o grow , al t hough m ore sl ow l yt han recent peri ods. R egardi ng t he l argest econom y i nt he regi on, B razi l s realG D P i s expect ed t oi ncrease by 3. 1% i n 2014 com pared wi t ht he 2. 5% regi st ered l ast year. T he l ackl ust er grow t hby B razi l , R ussi a, I ndi a, and C hi na, i . e. B R I C, st andardsw as support ed nam el y by f i scalst i m ul us i n advance of next O ct ober s generalel ect i on and spendi ng rel at ed t ot he W orl d C up and t he 2016 S um m er O l ym pi cs, accordi ng t oI H S . T he [ t rade] def i ci ti nt he count ry s chem i calsect or has grow n qui t ei nt ensi vel yi n recent years, becom i ng a great concern f or bot h producers and f or t he governm ent , says F t i maGi ovanna C ovi el l o F errei ra, di rect or/ econom i cs and st at i st i cs at A bi qui m (S o P aul o), t he count ry s chem i cali ndust ry associ at i on. B razi l s pet rochem i calt rade def i ci t reached $32 bi l l i on i n 2013, accordi ng t o A bi qui m , and i s expect ed t o cont i nue grow i ng i n 2014. T he associ at i on says dem and f or pet rochem i calproduct swi l lgrow 4 5% , subj ect t o achi evi ng t he 3% G D P grow t h. The count ry sf eedst ock posi t i on based on napht ha i m pact st he com pet i t i veness of t he pet rochem i calsect or vi s--vi s N ort h A m eri can producers. The i m pact of t he f i scalm easures i nt roduced i n earl y 2013 w i l lbecom e m ore vi si bl et hi s year, as a seri es of unpl anned out ages of f set benef i t s duri ng t he second hal f of 2013, A bi qui m adds. [ K ey f ocus areas] i ncl ude cont i nui ng w ork on t he com pet i t i veness of dom est i ci ndust ryw i t hal ong t erm

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 4 of16

vi ew of at l east 10 years, a m ore def i ned pol i cy f or t he use of nat uralgas as f eedst ock, and t urni ng dem and grow t hi nt o i nvest m ent opport uni t i es, F errei ra says. A head of B razi l s and sl i ght l y behi nd t he rest of Lat i n A m eri ca s, M exi co s realG D P w i l lgrow by 3. 3% , accordi ng t oI H S . The f orecast i s si gni f i cant l y above of t he 1. 3% grow t hi n 2013. T he econom y sl ow ed abrupt l yi nt he f i rst hal f of l ast year, pri nci pal l y because of t he del ayed ef f ect s of w eak export dem and spi l l i ng over t ot he rest of t he econom y, accordi ng t o O EC D . H ow ever, f i scalpol i cy i s expect ed t o be support i ve i n 2014, wi t hat em porary i ncrease i nt he budget def i ci t envi si oned. A s gl obalcondi t i ons i m prove and governm ent expendi t ure expands, grow t h shoul d rebound over t he next 12 m ont hs and i nt o 2015, O E C D says. I nt erm s of i m proved energy and f eedst ock posi t i ons, P resi dent E nri que P ea N i et o w ant st o m oderni ze P et rl eos M exi canos (M exi co C i t y) and i ncrease i t s ef f i ci ency, al t hough t he possi bi l i t y of pri vat i zi ng i t has been rul ed out .I n addi t i on, t he governm ent i s at t em pt i ng t oi nt roduce great er pri vat ei nvest m ent i n areas t hat are not excl usi vel y reserved f or t he st at e, f or exam pl et hrough t he i nt roduct i on of a prof i t -shari ng cont ract ,I H S says. S uch changes t ot he count ry s energy sect or w oul d cont ri but et o access t ot radi t i onaland nont radi t i onal hydrocarbon product i on t echnol ogi es, i ncreasi ng access t o m ore com pet i t i vel y pri ced raw m at eri alf or t he pet rochem i cali ndust ry, says Jos Lui s U ri egas, C E O of I desa (M exi co C i t y). F R A N C I NI A P R O TT I -A LV A R E Z

C an ad a: C au ti o u s o p ti mi sm

C anada s chem i calproducers had a good 2013 but are caut i ous about t he year ahead. A recent survey by t he C hem i st ry I ndust ry A ssoci at i on of C anada (C I A C )f i nds m em ber com pani es i n aggregat e predi ct i ng l ow er sal es and prof i t s. T he com pani es st i l lexpect resul t st hat are hi st ori cal l y st rong, how ever, and t he cont i nued grow t h of capi t al i nvest m ent ref l ect sl ong-t erm opt i mi sm . R esul t sf or 2013 have set a hi gh st andard. S al es of i ndust ri alchem i cal si ncreased 6% year-on-year, t o m ore t han $27 bi l l i on, C I A C est i m at es, m at chi ng t he prerecessi on record hi gh of 2008. E xport si ncreased 8% , t o over $18 bi l l i on, and operat i ng prof i t s set an al l -t i m e record at $3. 5 bi l l i on. C api t alspendi ng grew by 20% . I nt he year ahead, by cont rast ,C I AC s m em bers expect overal lsal es t o drop 8% , w i t h m ost of t he decl i ne t o occur i n t he synt het i c resi ns and rubbers m arket . R educed product i on, i ncl udi ng out put l ost t o schedul ed pl ant t urnarounds, wi l laccount f or hal f of t he decl i ne, w hi l el ow er sel l i ng pri ces, t he resul t of l ow er com m odi t y pri ces and w eaker m arket condi t i ons, w i l lbe responsi bl ef or t he bal ance. T he com pani es predi ct t hat export swi l ldecl i ne by 5% . N ot surpri si ngl y, gi ven t hei r assum pt i ons, t hese com pani es expect operat i ng prof i t st o be 4% l ow er i n 2014. H ow ever, em pl oym ent l evel s wi l lrem ai n st abl e, perhaps decl i ni ng by 1% , t he survey respondent s say. M oreover, t hey expect capi t ali nvest m ent t oi ncrease 28% i n 2014, f ol l ow i ng a 20% j um p i n 2013. T hi s bul l i sh out l ook ref l ect s posi t i vel y on t he i nvest m ent cl i m at ei n C anada and rei nf orces t he not i on t hat com pani es are t aki ng advant age of at t ract i ve i nvest m ent opport uni t i es i n order t o st rengt hen t hei r com pet i t i ve readi ness[ es] f or t he aw ai t ed rebound i n gl obalm arket s, CI A C says. I n D ecem ber 2013, N ova C hem i cal s announced pl ans t o begi n a $300-m i l l i on proj ect t hat w i l li ncrease t he et hyl ene capaci t y of i t s C orunna, O N , cracker by 20% and i ncrease pol yet hyl ene capaci t y at i t s M oore, O N , f aci l i t y. I n June, N ova began a $980-m i l l i on proj ect t hat w i l ladd about 1 bi l l i on l bs/ year of pol yet hyl ene capaci t y at i t s Jof f re, A B , com pl ex. O t her m aj or proj ect si ncl ude an $850-m i l l i on propane dehydrogenat i on f aci l i t yt hat W i l l i am s i s bui l di ng near E dm ont on, A B . F eedst ock avai l abi l i t y has been an i ssue. C anada s suppl y of nat uralgas l i qui ds (N G Ls) i s cl osel yt i ed t o nat uralgas export s, w hi ch have been hi t hard by devel opm ent of shal e gas i nt he U ni t ed S t at es. C onsum ers have adapt ed by bui l di ng and adapt i ng pi pel i nes t o suppl y N G Ls f rom t hose sam e shal e deposi t st o C anada. N ova s C orunna cracker, revam ped t o run l i ght f eeds, began runni ng N G Ls f rom t he M arcel l us shal ei n P ennsyl vani a, del i vered t hrough t he new G enesi s Pi pel i ne ext ensi on, i n D ecem ber 2013. N ova says t hat t he V ant age pi pel i ne l i nki ng i t s Jof f re f aci l i t yt o

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 5 of16

t he B akken S hal ei n N ort h D akot ai s essent i al l y com pl et e and w i l lbegi n suppl yi ng et hane i nt he f i rst quart er of 2014. C LA Y B O S W E LL

E u ro p e: C h em i cal s exi t recessi on

E uropean recovery i s expect ed t o cont i nue, but at a very sl uggi sh pace. D espi t e som e si gns of w eakness, t he nascent eurozone recovery w i l lhave st ayi ng pow er, says I H S chi ef econom i st N ari m an B ehravesh. I HS nevert hel ess predi ct st hat t he eurozone w i l lnot regai nt he G D P peak i t achi eved i nt he f i rst quart er of 2008, j ust bef ore t he onset of t he f i nanci alcri si s, unt i learl y 2016. I HS f orecast st hat t he eurozone econom y w i l lgrow overal lby 0. 8% i n 2014. A w i de range of f act ors w i l lsupport t hat grow t h, B ehravesh says. T hey i ncl ude m onet ary pol i cy t hat ease credi t condi t i ons, st abi l i zi ng l abor m arket s, l ess em phasi s on aust eri t y by E U and nat i onalpol i cym akers, i m proved spendi ng pow er because of ul t ral ow i nf l at i on, st ruct uralref orm s t hat boost product i vi t yi nt he peri pheralcount ri es, and m ore conf i dence i nt he abi l i t y of eurozone pol i t i ci ans t o m anage t he soverei gn debt cri si s. F al l out f rom t he cri si swi l lcont i nue t o dent grow t hi n sout hern E urope duri ng 2014. E ven w i t ht hese posi t i ve t rends, som e count ri es, such as G reece, I t al y, and S pai n, w i l lst ruggl et o achi eve posi t i ve grow t h, B ehravesh says. I HS f orecast st hat I t al y s econom y wi l lcont ract by 0. 3% i n 2014. F rance s econom y w i l lgrow by 0. 5% i n 2014, I H S says. E uropean econom i es out si de t he eurozone are l i kel yt of are bet t er. I HS f orecast st hat t he U K econom y w i l lgrow 2. 8% i n 2014, benef i t i ng f rom di mi ni shi ng consum er pri ce i nf l at i on, easi ng credi t condi t i ons, and st rengt heni ng export m arket si n E urope and N ort h A m eri ca. T he em ergi ng count ri es of E ast ern E urope and t he B al kans w i l lgenerat e overal lG D P grow t h of 2. 9% , I H S says. T he chem i cali ndust ry i nt he E uropean U ni on t urned a corner i n S ept em ber 2013, w hen i t achi eved m ont hl y out put grow t h of 0. 7% . T he S ept em ber readi ng conf i rm ed grow t hf or t he O ct ober quart ert he second successi ve quart er of ri si ng chem i calproduct i on i nt he regi on. T hi s event m arked t he i ndust ry s exi tf rom a l ong, pai nf ulrecessi on, C ef i c says. C ef i c expect st he E U chem i cali ndust ry s recovery t o cont i nue i n 2014 but ,l i ke t he overal leconom y, at a m odest pace. C ef i c predi ct s a ret urn t o annualout put grow t h wi t ht he sect or s product i on of chem i cal sl i kel yt oi ncrease 1. 5% i n 2014. E U chem i cal s out put cont ract ed by 1% i n 2013 despi t et he exi tf rom recessi on i nt he t hi rd quart er, C ef i c says. T he gradualrecovery w i l lbe f ounded on st abi l i zat i on of i ndust ri alproduct i on i n E urope af t er t w o years of w eakness and a m odest ri se i n export s, C ef i c chi ef econom i st M oncef H adhrisays. I n 2014, E urope s chem i calproducers w i l lf ace i ncreasi ng com pet i t i on f rom i m port s ori gi nat i ng i nt he U ni t ed S t at es. T he E uropean chem i cal s sect or w i l lf ace t ough com pet i t i on f rom U S producers benef i t i ng f rom cheap energy and f eedst ock, H adhrisays. C om pet i t i on w i l lbe m ost i nt ense i nt he pet rochem i calsect or, and t he f ut ure of som e of E urope s pet rochem i cal product i on pl ant s, based on rel at i vel y expensi ve napht ha f eedst ock, i s under t hreat , anal yst s say. T he cl osure of severalnapht ha crackers w as announced i nt he E uropean U ni on duri ng 2013. C ef i c nevert hel ess predi ct s a 2% ri se i n out put by t he E U pet rochem i calsect or i n 2014. C ef i c al so says t hat product i on of speci al t y chem i cal swi l lgrow 2% t hi s year i nt he E uropean U ni on and t hat em pl oym ent across t he ent i re E U chem i cali ndust ry w i l lbe st agnant . I AN YO U N G

Mi d east: A sh i ft i n strateg y

T he G D P grow t h of t he G ul f C ooperat i on C ounci l(G C C ) st at esB ahrai n, K uw ai t , O m an, Q at ar, S audiA rabi a, and t he U ni t ed A rab E m i rat esas w el las t he w i der M i deast regi on, w i l ldecl i ne sl i ght l yi n 2014, accordi ng t oI H S . T he G C C st at es w i l lgrow 4. 2% i n 2014 com pared w i t h 4. 4% l ast year because of reduced gai ns i n oi lG D P , but nonoi l G D P grow t hi nt he G C C rem ai ns robust , says B ryan P l am ondon, seni or econom i st / Mi deast and N ort h Af ri ca (M E N A ) at I H S .M E N A w i l lgrow by 3. 6% and t he M i deast by 3. 4% . C hem i calvol um es i n M EN A w i l lgrow by 4. 8% i n 2014 com pared w i t h grow t h of 3. 6% i n 2013, A C C says.

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 6 of16

T he G C C s pet rochem i cal s out put l ast year reached $97. 3 bi l l i on, grow i ng at 19% / year over t he l ast f i ve years, accordi ng t ot he G ul f P et rochem i cal s and C hem i cal s A ssoci at i on (G P C A ; D ubai ). Thi s grow t hi st he hi ghest post ed by any pet rochem i cal s-produci ng regi on i nt he w orl d, G P C A says. The G C C l ast year earned $52. 7 bi l l i on i n export revenues. Hi st ori cal l y, t he M i deast has been t he w orl dw i de cost -l eader pri m ari l y because of i t s access t of avorabl y pri ced f eedst ock. T hi s si t uat i on i s changi ng, how ever. M i deast producers are pl aci ng m ore em phasi s on addi ng val ue t o basi c pet rochem i cal s because of a short age of advant aged f eedst ocks. C ert ai n m aj or pl ayers, not abl y S abi c, are consi deri ng i nvest i ng i n N ort h A m eri ca t ot ake advant age of i nexpensi ve shal e gas and t o secure grow t h. T hey are al so cont i nui ng t oi nvest i n C hi na, w hi ch, t oget her w i t ht he w i der A si a regi on, i st he l ogi calm arket f or M i deast producers. F eedst ock short ages have al so l ed M i deast governm ent st o i ncreasi ngl yf avor subsi di ari es or j oi nt vent ures of nat i onalenergy groups f or f eedst ock al l ocat i ons, l eavi ng i ndependent chem i calcom pani es scram bl i ng f or raw m at eri al s. C onsol i dat i on t hrough M & A i s one w ay of addressi ng f eedst ock chal l enges and securi ng grow t h. S i pchem (A lK hubar, S audiA rabi a) and S ahara P et rochem i cal s (A l Jubai l ) are i n m erger t al ks, and anal yst s expect ot her M i deast producers t of ol l ow t he M & A rout e. T he Z am i lG roup i s a sharehol der i n Si pchem as w el las S ahara, w hi ch are l i st ed on t he S audiS t ock E xchange. T he regi on i s devel opi ng new f eedst ock resources, i ncl udi ng shal e gas, but t hese devel opm ent s are i nt hei r i nf anci es. O m an recent l y announced a m aj or t i e-up w i t h BP i n gas and acet i c aci d proj ect s. T he K hazzan f i el di s expect ed t o produce 1 bi l l i on cubi cf eet / day of gas and 25, 000 bbl / day of gas condensat e, equi val ent t o about onet hi rd of O m an st ot aldai l y dom est i c gas suppl y. B P and O m an O i lC o. have si gned a m em orandum of underst andi ng t o devel op t he w orl d sf i rst acet i c aci d pl ant usi ng B P s new synt hesi s gas t o acet i c aci d process. T he 1-m i l l i on m. t . / year pl ant i s expect ed t o be bui l t at D uqm , O m an, w i t h st art -up i n 2019. M aj or i nvest m ent s underw ay i nt he regi on i ncl ude t he $20-bi l l i on S adara j v bet w een S audiA ram co and D ow C hem i cal , now m ore t han 25% com pl et e; a doubl i ng of capaci t y by P et ro R abi gh, a j v bet w een A ram co and S um i t om o C hem i cal , at R abi gh, S audiA rabi a; S abi c and E xxonM obi lC hem i cal s rubber and el ast om ers proj ect at t hei r K em ya j v at A lJubai l ; and an i nvest m ent i n pol yuret hanes by S abi c, w hi ch i s m aki ng an ent ry i nt ot hi s m arket . Q at ar i s pl anni ng t o spend about $25 bi l l i on by 2020 t o expand i t s chem i caland pet rochem i cali ndust ri es. P roj ect s i ncl ude t wo i nvest m ent st o bui l d ol ef i ns and dow nst ream com pl exes at R as Laf f an. N A T A S H A A LP E R O W I CZ

Jap an : S ti mi l u s b o o st

Japan s econom y and chem i cali ndust ry, ai ded by t he aggressi ve st i m ul us and f i scalpol i cy encouraged by Japanese pri memi ni st er S hi nzo A be, shoul d grow i n 2014. I ndust ri alproduct i on and chem i calout put are l i kel yt o exceed G D P grow t h as a w eaker yen reduces i m port s and boost s export s. Japan s GDP i s expect ed t o grow 1. 8% i n 2014, w hi l ei ndust ri alproduct i on w i l lgrow 4. 8% , accordi ng t oI H S . Japan s chem i calproduct i on w i l li ncrease 4% i n 2014, accordi ng t o AC C . Japan econom i c spi ri t s have l i f t ed as A be, w ho ret urned t o of f i ce i n D ecem ber 2012, has l aunched aggressi ve f i scal and m onet ary st i m ul it o reverse nearl y 20 years of def l at i on and f l at econom i ct rends. Japan s cent ralbank, at t he urgi ng of A be, has announced t hat i tw i l lt arget a 2% i nf l at i on rat e wi t hi nt w o years. Y en depreci at i on i s rai si ng i m port pri ces, i m provi ng i nt ernat i onalcom pet i t i veness, and boost i ng prof i t s of m ul t i nat i onalcom pani es, says D an R yan, I H S di rect or/ research, A si a/ P aci f i c. F ut ure grow t h wi l ldepend on how ef f ect i vel yt he new A be adm i ni st rat i on i m pl em ent s st i m ul us program s and ref orm s i nl abor and product m arket s. R O B E R T W E S T E R V E LT

I ndi a: S p eci al ty secto r b o o sts g ro w th

E conom i c grow t hi s expect ed t o pi ck up i nI ndi a duri ng 2014. The count ry s G D P grow t h rat e wi l li ncrease f rom 4. 6% i nt he f i scalyear endi ng 31 M arch 2014 t o 5. 6% i nt he f i scalyear endi ng 31 M arch 2015 and 6. 5% i nt he f ol l ow i ng f i scalyear, I H S says.

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 7 of16

T he w orst m ay be over f or I ndi a s econom y, but persi st ent i nf l at i on, a w eak i nvest m ent cl i m at e, and pol i t i cal uncert ai nt y ahead of t he 2014 el ect i on w i l ll ead t o sl ow and uneven progress, says N ari m an B ehravesh, chi ef econom i st at I H S . P ost el ect i on econom i c ref orm s and an upt urn i n capi t ali nvest m ent w i l lbe essent i alt o rest ori ng I ndi a s grow t h m om ent um , B ehravesh says. T he I ndi an C hem i calC ounci l(I C C ; M um bai ) and anal yst s say t hat dem and f or chem i calproduct s cont i nues t o ri se i n I ndi a. Di sposabl e surpl us i ncom e i s ri si ng i nI ndi a, and t he i ncreasi ng st andard of l i vi ng l eads t o grow t hi n consum pt i on of consum er goods, w hi ch resul t si n great er dem and f or chem i calproduct s, says H . S . K arangl e, di rect or generalat I CC. P er capi t a consum pt i on i nI ndi af or product s such as pl ast i cs and pai nt si s st i l lw el lbel ow t he gl obalaverage. D espi t et hat ,t he overal ldem and f or chem i cal si nI ndi a wi l lcont i nue t o rem ai n st rong i n 2014, says C hai t ra N arayan, associ at e di rect or/ chem i cal s, m at eri al s, and f oods pract i ce at F rost & S ul l i van (B angal ore). T he I ndi an chem i cali ndust ry has al w ays grow n 1 2% above t he overal lG D P grow t h rat ei nt he count ry. T hi st rend wi l lcont i nue, and t he chem i cali ndust ry i nI ndi a wi l lgrow about 2% above t he G D P grow t h rat ei n 2014, K arangl e says. I ndi a s chem i cali ndust ry sal es are est i m at ed t o reach $115 120 bi l l i on i n 2014, I C C says. E xport s of chem i calproduct sf rom I ndi a grew at a com pound annualgrow t h rat e of 8 9% duri ng 2008 13, a rat et hat wi l lcont i nue i nt he m edi um t erm , N arayan says. C ert ai n sect ors of I ndi a s chem i cali ndust ry are l i kel yt o grow st rongl yi n 2014, I C C and anal yst s say. S ect ors such as agri cul t uralchem i cal s, speci al t y chem i cal s, [ and] const ruct i on chem i cal s. . . are expect ed t o perf orm w el li n 2014, K arangl e says. G row t h rat es i nI ndi af or basi c organi c chem i cal s, such as acet i c aci d and f orm al dehyde, are expect ed t of ol l ow G D P and grow at a rat e of 5 6% . M eanw hi l e, t he speci al t y chem i cal s segm ent i s expect ed t o grow at a rat e of 11 12% , N arayan says. S peci al t y chem i cal s and ag chem s are l i kel yt o grow f ast er t han basi c and com m odi t y chem i cal s. C ert ai n speci al t y chem i cal s, such as personal -care i ngredi ent s, addi t i ves, act i ve pharm aceut i cali ngredi ent s, pai nt s and coat i ngs, const ruct i on chem i cal s, and w at er chem i cal s, are l i kel yt o grow st rongl y. Al so, t here has been an i ncrease i n act i vi t i es by I ndi an pl ayers i nt hese segm ent swi t h respect t o expansi onsbot h organi c and i norgani c. C om m odi t y and bul k chem i cal s are expect ed t o sl ow i n 2014 because of l ow er grow t hi n end-user segm ent s, N arayan says. D E E P T I R A M E S H

A si a: I n creasi ng i n terest i n' O th er A si a'

T he G D P grow t h rat ef or A si a/ P aci f i cwi l li ncrease f rom 4. 8% i n 2013 t o 5. 4% i n 2014, says N ari m an B ehravesh, chi ef econom i st at I H S . T he gl obalenvi ronm ent f aci ng em ergi ng m arket swi l lbe m ore grow t hf ri endl yt han i t has been i nt he l ast t hree years. U S and C hi nese grow t h[ s] w i l lbe a l i t t l e st ronger, and t he eurozone w i l lno l onger be a drag on t he w orl d econom y. T hi s m eans t hat em ergi ng-m arket export swi l lagai n becom e a source of grow t h, B ehravesh says. A ret urn t ot he very rapi d grow t h rat es enj oyed i nt he boom years of t he 2000s i s unl i kel y unl ess t he governm ent si nt hese count ri es enact m ore st ruct uralref orm s t hat rai se product i vi t y, al l ocat e capi t alm ore ef f i ci ent l y, and, t hereby, boost pot ent i algrow t h, B ehravesh says. T he out l ook f or t he chem i cali ndust ry i n A si aexcl udi ng C hi na, I ndi a, and Japani s posi t i ve f or 2014, anal yst s say. M any of t he f undam ent al st hat support chem i cali ndust ry dem andi ncl udi ng G D P grow t h, urbani zat i on, grow i ng mi ddl e cl assescont i nue t o m ove i n a posi t i ve di rect i on, w hi ch can onl y be benef i ci alt o grow t h of t he chem i cal i ndust ry, says P aulH arni ck, gl obalC O O / chem i cal s and perf orm ance t echnol ogi es at K P M G (P hi l adel phi a). T here has al so been a f undam ent alshi f ti nt he w ay A sean count ri es are vi ew ed over t he l ast 18 m ont hs. W hen w e t al kt o seni or execut i ves of t he w orl d s bi ggest chem i calcom pani es, t here i si ncreasi ng i nt erest i nOt her A si a. N o l onger i s an A si an grow t h st rat egy j ust about C hi na or I ndi a. T he chal l enge f or governm ent si nt he regi on i st o cont i nue t o adopt pol i ci es t hat w i l lengender i nvest m ent and grow t h, cont i nue t oi nvest i n basi ci nf rast ruct ure, and encourage t ransparent busi ness pract i ces, H arni ck says. St rong year-on-year gai ns i n chem i cal s out put grow t h are expect ed i n A si a/ P aci f i c, A C C says. O veral lchem i cal product i on i n A si a/ P aci f i c wi l li ncrease 6. 5% i n 2014, A C C says. C hem i calproduct i on i nOt her A si a/ P aci f i cwi l l i ncrease 6. 7% i n 2014, accordi ng t o AC C . S everalcount ri es i n A si a wi l lbe at t he f oref ront of t he next w ave of em ergi ng-m arket , chem i cali ndust ry grow t h, H arni ck says. T hey i ncl ude I ndonesi a, M al aysi a, Thai l and, t he P hi l i ppi nes, and V i et nam count ri es w i t h di f f erent speci f i c st rengt hs. I ndonesi a s popul at i on gi ves i t a m assi ve pot ent i alconsum er base, w hi l e Vi et nam i s becom i ng a

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 8 of16

f avored dest i nat i on f or l ow -cost m anuf act uri ng. T he one t hi ng t hey al lhave i n com m on i s st rong f undam ent al sf or grow t h, H arni ck says. C om m odi t y chem i cal s are l i kel yt o at t ract m ore i nvest m ent i nt hese count ri es, H arni ck says. T he chem i cali ndust ry i nt hese count ri es has t ol earn t o w al k bef ore i t can run, so i nvest m ent i sl i kel yt o be f ocused on t he com m odi t y end of t he sect or and est abl i shi ng t he basi c bui l di ng bl ocks of t he i ndust ry, H arni ck says. H ow ever, w i t hi ncreased urbani zat i on and cont i nued m i ddl e-cl ass grow t h, t here are al so l i kel yt o be opport uni t i es i n segm ent s such as const ruct i on chem i cal s, consum er chem i cal s, and personalcare. The chal l enge f or t he count ri es i n quest i on i st o have al lof t he f undam ent al si n pl ace, bot hi nt erm s of t he chem i cali ndust ry suppl y chai n, as w el las l egalst ruct ures and busi ness pract i ces, such t hat t hese hi gher-val ue chem i cal s can be m anuf act ured i n-count ry rat her t han i m port ed f rom abroad, H arni ck says. D E E P T I R A M E S H

P etro ch em i cal s: R eg i o n al i ssu es are key

T he out l ooks f or ol ef i ns and arom at i cs show t hat regi onalconcerns w i l lshape pet rochem i calm arket si n 2014. T he i nf l uence of shal e gas and oi lw i l lcont i nue t o dom i nat e N ort h A m eri ca. E uropean producers w i l lcont i nue adapt i ng t o a subdued econom i c envi ronm ent and t o cost pressures. A si an m arket swi l ll engt hen w i t h C hi na s grow i ng dom est i c product i on. A sl i ght i ncrease i nt he cost of nat uralgas l i qui ds (N G Ls) w i l lreduce U S et hyl ene m argi ns bel ow t he record l evelof 2013, but t hey w i l lrem ai n at l east 20 ct s/ l bt hrough 2015, I H S C hem i calproj ect s. C ash cost s are expect ed t o m ove sl i ght l y hi gher i nt he com i ng m ont hs but w i l lrem ai nt oo l ow t o exert pressure on pri ces. I H S expect s propyl ene t o cont i nue t i ght eni ng i n N ort h A m eri ca. S uppl yf rom st eam crackers has been reduced by about 30% si nce 2007, and N G Ls wi l lcont i nue t o di spl ace napht ha f rom t he f eedsl at e t hi s year. R ef i nery-propyl ene product i on by f l ui d cat al yt i c crackers (F C C s) w i l lnot m ake up t he di f f erence. F al l i ng U S gasol i ne consum pt i on shoul d keep F C C uni t grow t h at a m i ni m um , and grow i ng hydrocracki ng capaci t ywi l lcom pet ef or FC C f eedst ocks. P ropyl ene suppl ywi l lnot i m prove si gni f i cant l y unt i l l at e 2015, w hen new propane dehydrogenat i on uni t s st art up. I H S nevert hel ess expect st he average m ont hl y U S cont ract pri ce of pol ym ergrade propyl ene f or 2014 t o be about 2 ct s/ l bl ow er t han i n 2013, ow i ng t o a sl i ght l yl ow er crude oi l pri ce f orecast . A rom at i cs product i on i n N ort h A m eri ca has l i kew i se been undercut by t he shi f tt o N G L cracki ng, and suppl y has been const rai ned by grow i ng dem and f or t ol uene and xyl enes t o boost oct ane cont ent . O perat i ng m argi ns f or ref orm ers have been ext rem el yl ow of l at e, m aki ng t ol uene and xyl ene pri ces very sensi t i ve t o ref orm er napht ha pri ces, w hi ch are expect ed t o cont i nue st rengt heni ng, pushi ng t ol uene and xyl ene pri ces upw ard i n January and February, I H S C hem i calsays. I H S does not expect et hyl ene dem and i n E urope t o i m prove m uch i n 2014, gi ven w eak dow nst ream m arket s. C ont i nued rest rai nt on t he part of cracker operat ors w i l lkeep t he m arket i n bal ance, and m argi ns w i l lbe si mi l ar t ot hose of 2013. O i lpri ces

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 9 of16

are expect ed t o decl i ne, resul t i ng i n a sl i ght decl i ne i nt he pri ce of et hyl ene. T he si t uat i on i s si mi l ar f or propyl ene i n E urope, al t hough t he m arket bal ance i s m ore pri cesensi t i ve. D uri ng 2013, t he E uropean m arket has been abl et o m ai nt ai n a degree of bal ance t hat had been severel yl acki ng i n 2012, and i t m ay be possi bl et o see t he sam e dynam i ci n 2014, I HS C hem i calsays. T he i m pendi ng overbui l d of propyl ene capaci t yi n C hi na w i l lm ake t he t ask m ore di f f i cul t , how ever. B enzene w as i n pl ent i f ulsuppl yi n E urope bef ore recent hi ccups i n product i on, and t hat si t uat i on shoul d soon ret urn, I H S says. There are no new si gni f i cant cracker out ages expect ed i nt he next coupl e of m ont hs, and pyrol ysi s gas avai l abi l i t y shoul d rem ai n good. T he suppl y of t ol uene di i socyanat e (T D I ) grade t ol uene i n E urope shoul d i ncrease, hel pi ng m eet i ncreased dem and w i t ht he st art -up of B ayer s new T D I uni t at D orm agen, G erm any, i nt he second hal f of 2014. T he m arket i s expect ed t o rem ai nf ai rl y bal anced. C hi na s dri ve f or sel f -suf f i ci ency cont i nues t o reshape A si a s ol ef i nt rade. The count ry s et hyl ene i m port vol um es i ncreased by 40% i n 2012, but I HS est i m at es t hat t hey i ncreased by onl y 15 20% i n 2013 and w i l lsoon begi nt o decl i ne. S out h K orea suppl i es m ost of t hi s m at eri al , but t hat si t uat i on i s l i kel yt o change dram at i cal l yt hi s year, w hen several S out h K orean export ers st art up deri vat i ve uni t s wi t hout i ncreasi ng et hyl ene product i on. P ropyl ene suppl yi s m eanw hi l e expect ed t o l engt hen i n A si a as new product i on uni t si n C hi na begi nt o com e onl i ne earl yt hi s year, I H S says. C hi na s propyl ene i m port s have grow n m ore sl ow l y i n recent years and m ay decl i ne i n 2014. N ew export vol um es f rom T ai w an w i l ladd t ot he excess, al t hough a cracker cl osure i n Japan t hi s year and anot her i n T ai w an i nmi d-2015 w i l lease t he si t uat i on. I H S expect s regi onalol ef i n m argi ns t o rem ai n posi t i ve, how ever, w i t h nort heast A si an napht ha pri ces proj ect ed at about $40/ m. t .l ow er i n 2014 t han i n 2013, reduci ng cash cost sf or i nt egrat ed crackers by as m uch as $50/ m. t . W i t ht urnarounds com pl et e, hi gh run-rat es at i nt egrat ed para-xyl ene (p-xyl ene) pl ant s, and hi gh napht ha cracker operat i ons, benzene product i on has been robust i n A si a, I H S says. T he pri ce of benzene i sf orecast t o decl i ne f rom D ecem ber s hi gh i nl i ne w i t h a sof t U S pri ce f orecast . T he pri ce w i l lrem ai n by f ar t he l ow est f or benzene i nt he w orl d, but t he di f f erence w i t ht he U S pri ce m ay not be l arge enough f or arbi t rage. H ow ever, t he t ol uene pri ce i n A si ai sf orecast t o rem ai nt he hi ghest i nt he w orl df or severalm ont hs. I H S proj ect st hat t ol uene dem and w i l lbe seasonal l y sl uggi sh f or gasol i ne and sol vent use but const ant l y hi gh f or t ransal kyl at i on i nt egrat ed w i t h p-xyl ene pl ant s. T he m arket coul d change dram at i cal l y at t he end of t he second quart er, w hen a 1-m i l l i on m . t . / year p-xyl ene pl ant com es onl i ne at U l san, S out h K orea. C LA Y B O S W E LL

Pl asti cs: M i xed fo rtu n es

Gl obalcapaci t yf or pol yet hyl ene (P E ) w i l lreach 101. 7mi l l i on m . t . / year i n 2014an i ncrease of j ust over 4% f rom 2013, accordi ng t oI H S C hem i caldat a. W orl dw i de product i on, m eanw hi l e, i s expect ed t o go up by al m ost 5% i nt he com i ng 12 m ont hs, and average gl obaloperat i ng rat es are f orecast t o ri se t o 84. 2% , 1 percent age poi nt hi gher t han

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 10 of16

l ast year. D em and f or P E i n N ort h A m eri ca w i l lm ai nt ai ni t s m oderat e grow t h duri ng 2014 bef ore m aj or new product i on capaci t y begi ns t o com e onl i ne i n 2015 17, I H S C hem i calsays. A verage regi onaloperat i ng rat es w i l l rem ai ni nt he l ow 90% range duri ng 2014, I H S C hem i calsays. N ort h A m eri can dem and grow t hi n 2014 w i l lboost t ot alP E vol um es above t he previ ous peak l evel s at t ai ned i n 2007, I H S C hem i calsays. S eparat el y, i nt he M i deast , I ran pl ans t o com m i ssi on up t of i ve P E pl ant swi t hi nt he next year, al t hough U N sanct i ons on I ran have del ayed t he st art -ups of new f aci l i t i es. I nt he U ni t ed A rab E m i rat es, t he B orouge 3 proj ect ,i ncl udi ng m aj or P E capaci t y, shoul d be com pl et ed i n 2014, I H S C hem i calsays. I n 2014, W orl dw i de capaci t yf or pol ypropyl ene (P P ) wi l li ncrease by m ore t han 6. 5% , f rom 67. 9mi l l i on m. t . / year t o 72. 4mi l l i on m . t . / year, accordi ng t oI HS C hem i caldat a. Tot alproduct i on w i l lal so go up, al bei t at a sl i ght l yl ow er pace of 4. 9% , I HS C hem i calsays. A verage gl obaloperat i ng rat es w i l l decl i ne by 0. 8 percent age poi nt ,t o 81. 1% , because of a recent w ave of capaci t y addi t i ons, m ost l yi n C hi na, I H S C hem i calsays. N ew l y added and pl anned C hi nese capaci t i es are m ost l yf or coal based P P because of l ow er cost s and t he vast avai l abi l i t y of coali n C hi na, I H S C hem i calsays. A s C hi na sl ow l y becom es sel f -suf f i ci ent i n PP, export ers t radi t i onal l y suppl yi ng t he count ry w i l l need t o seek al t ernat i ve m arket s, I H S C hem i cal says. C ondi t i ons i nt he w orl dw i de pol yvi nylchl ori de (P V C ) m arket , m eanw hi l e, are expect ed t o rem ai n chal l engi ng t hroughout 2014. S uspensi on-grade P V C (S -P V C ) capaci t ywi l li ncrease by 6% duri ng 2014, t o 59 m i l l i on m . t . / year, I H S C hem i calsays. A s producers t ri m product i on t o m at ch st i l l -sl uggi sh dem and, t he average operat i ng rat ei n 2014 w i l lbe about 64. 8% gl obal l y1. 1 percent age poi nt sl ow er t han i n 2013, I H S C hem i caldat a show . W orl dw i de P V C dem and i s ant i ci pat ed t o reach 40. 15 m i l l i on m . t .i n 2014, w i t h an annual grow t h rat e of 4. 15% , of f set by persi st ent oversuppl y. W est ern E urope s PVC i ndust ry rem ai ns f ragm ent ed, but t here are si gns of consol i dat i on. T he regi on sl argest producers, I neos and S ol Vi na j oi nt vent ure bet w een S ol vay and B A S Fai m t o com pl et e pl ans t o m erge t hei rP V C busi nesses t hi s year. T he S -P V C capaci t i es of I neos and S ol Vi n are about 1. 8mi l l i on m . t . / year and 1. 2mi l l i on m. t . / year, respect i vel y, accordi ng t oI H S C hem i caldat a. W het her K em O ne, t he regi on st hi rd-l argest producerf orm erl y part of A rkem aem erges f rom i t sf i nanci aldi f f i cul t i es i s one of t he key unansw ered quest i ons f or PVC i n E urope goi ng i nt o 2014. E l sew here, N ort h A m eri ca s P V C export swi l lgrow on t he back of t he regi on s i m proved cost posi t i on, and t he M i deast w i l lrem ai n a si gni f i cant export er i n 2014, I H S C hem i calsays. P ol yst yrene (P S ) w i l lal so f ace di f f i cul tt i m es t hi s year caused by t he ext rem e pri ce vol at i l i t y of f eedst ocks benzene and et hyl ene, I H S C hem i calsays. W orl dw i de operat i ng rat es f or P S w i l ldecrease by 2 percent age poi nt st hi s year, si nce gl obalproduct i on w i l lgrow 1. 9% , t o about 10. 6mi l l i on m . t . , and dem and w i l lgrow 1. 7% , t o about 10. 6mi l l i on m. t . , accordi ng t oI H S C hem i caldat a. F R A N C I NI A P R O T TI -A LV A R E Z

S p eci al ti es: G ro w th g ai n s m o m en tu m

M ost f orecast s cal lf or cont i nued sol i d grow t hi n speci al t i es vol um es as t he econom i c recovery gat hers f orce i nt he U ni t ed S t at es and t he new em ergi ng-m arket m i ddl e cl ass dri ves f urt her grow t h. A C C expect s U S speci al t i es vol um e grow t ht ot ot al3. 2% i n 2014, af t er 4. 8% grow t hi n 2013, w hen t he recovery f rom t he dow nt urn gai ned a f oot hol d. I HS C hem i calf orecast st he val ue of t he gl obalspeci al t y chem i cal s m arket t o grow by 3. 7% / year t hrough 2017, w hen i t wi l lt ot al$586. 7 bi l l i on. W hi l e grow t h rat es m ay decel erat e, at l east i nt he U ni t ed S t at es, t hey w i l lbe underpi nned a st ronger econom y and end m arket s. M uch of t he grow t hi n speci al t i es f rom 2008 t o 2013 w as si m pl y m aki ng up ground l ost i nt he recessi on, si nce U S speci al t i es m arket vol um es di d not hi t 2007 s peak agai n unt i ll ast year.

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 11 of16

A m ong speci al t i es sect ors, t he coat i ngs, const ruct i on, f ood, oi l f i el d, and pharm aceut i calm arket s have som e of t he m ost prom i si ng prospect sf or 2014, producers and anal yst s say. I n coat i ngs and const ruct i on, t he U S housi ng m arket appears t o have def i ni t i vel yt urned a corner. I don t w ant t o decl are vi ct ory yet , but [ const ruct i on] i s becom i ng a t ai l wi nd, especi al l yi n N ort h A m eri ca, says H ow ard U ngerl ei der, execut i ve v. p. / advanced m at eri al s at D ow C hem i cal . U S housi ng st art swi l lnot t ake of f anyt i m e soon, but t he t rend i s general l y posi t i ve af t er t he dol drum s of t he past f ew years, accordi ng t o A C C . E ven com m erci aland i nst i t ut i onal const ruct i on, w hi ch t ends t ol ag resi dent i alconst ruct i on, i s experi enci ng gl i m m ers of grow t h, U ngerl ei der says. T rends i nf ood and pharm a, m eanw hi l e, are heavi l yt i ed t o agi ng popul at i ons i nt he devel oped w orl d and ri si ng m i ddl e cl asses i n em ergi ng m arket s. F M C sees a l ot of robust dem and f or nut raceut i cali ngredi ent s, such as om ega-3s, across t he w orl d as a resul t of t hese t rends, says M i ke S m i t h, v. p/ heal t h and nut ri t i on at F M C . T he com pany al so sees opport uni t i es f or f ood i ngredi ent si n devel oped m arket s as new consum ers seek novelw ays of get t i ng prot ei n, w hi ch can be expensi ve i n pl aces l i ke C hi na and I ndi a, S m i t h adds. S om e end m arket s, how ever, are i nt he process of rearrangi ng t hem sel ves. A s t he sem i conduct or m arket has had basi cal l y zero grow t h f or t hree years runni ng, el ect roni c chem i cal s m akers are shi f t i ng t o hi gher-grow t h, areas such l i ght -em i t t i ng di ode (LE D ) di spl ays, U ngerl ei der says. D ow A dvanced M at eri al s expect s year-on-year grow t hi n 2013 f or i t s el ect roni cs busi ness al m ost ent i rel y because of grow t hi n LE D s, organi c LE D s, and advanced packagi ng m at eri al sf or sem i conduct ors, he adds. N ext year, t hose segm ent s are expect ed t o dri ve grow t hi n el ect roni c chem i cal s agai n, al t hough U ngerl ei der ant i ci pat es som e rebound i nt he sem i conduct or space. D ow expect s 3% grow t hi n sem i conduct or i ndust ry revenues i n 2014 and 4 5% grow t hi n subsequent years. I tw i l lgrow , j ust not as f ast as t he past coupl e of decades, U ngerl ei der says. B ack i n N ort h A m eri ca, t he hydraul i cf ract uri ng boom i s dri vi ng rapi d grow t hi nt he oi l f i el d chem i cal s space. T hat grow t h, how ever, i s hi ghl y di spersed am ong di f f erent producers, accordi ng t o R ay W i l l , di rect or at I H S C hem i cal . H ydraul i cf ract uri ng i s gi vi ng bi g dem and boost st o bi oci des, w at er-sol ubl e pol ym ers, addi t i ves f or dri l l i ng, suspendi ng part i cl es, and ot her m at eri al s, he adds. B ut , w e are t al ki ng about dozens of product s across m any di f f erent ki nds of product l i nes, W i l lsays. A l ot of com pani es are exposed t ot hi si n a sm al lw ay, so i t gi ves t hem al l a m oderat e boost . St i l l , a m oderat e boost i s bet t er t han no boost at al l . V I N C E N T V A LK

R en ew ab l e: N ew o p p o rtu n i ti es em erg e

M om ent um i n renew abl e chem i cal si s expect ed t o cont i nue grow i ng i n 2014 as l arge-scal e proj ect s are com m i ssi oned and bi obased processes becom e part of st rat egi c pl ans at l arge chem i calcom pani es. P roduct st hat are not cost -com pet i t i ve and f ai lt o of f er equi val ent or superi or perf orm ance at t ri but es w i l lst ruggl et of i nd a f oot hol d i nt he gl obalchem i cali ndust ry, how ever. M ark M organ, gl obalm anagi ng di rect or/ renew abl es at I H S C hem i cal , expect s green chem i cal s devel opm ent t o cont i nue, al t hough t he f ocus needs t o be on perf orm ance and com pet i t i veness. T he cont i nued em phasi s on shal e gas has l ed t o a reduced em phasi s on bi obased com m odi t i es, w here t here i s di rect com pet i t i on i n shal e gas rel at ed deri vat i ves, he adds. T he f l ood of cheap et hane i n N ort h A m eri ca has al ready pushed t w o hi gh-prof i l e proj ect st ot he back burner. B raskem , t he l argest producer of bi opl ast i cs, sai di n earl y 2013 t hat i t w oul d hol d of f on a previ ousl y announced i nvest m ent si n pol yet hyl ene (P E ) and pol ypropyl ene capaci t i es based on sugarcane et hanoli n order t of ree up capi t alf or gas-based pet rochem i calproj ect s. D ow C hem i calhas al so post poned pl ans f or a green P E com pl ex i n B razi l .I H S C hem i calest i m at es t hat P E based on sugarcane et hanoli s 15 20% m ore expensi ve t han pet rol eum based et hanol . M organ expect st he devel opm ent of bi obased bui l di ng bl ocks f or pol yam i des t o cont i nue i n 2014. Bi obased adi pi c aci d has a f ut ure based on i t st heoret i calcom pet i t i veness and arom at i c deri vat i ves not f avored by shal e devel opm ent , al t hough at t ent i on m ust be pai dt o adi pi c aci d qual i t y and t he l evelof t race i m puri t i es, he adds. A det ai l ed I H S C hem i calP rocess E conom i cs P rogram report f i nds t hat t he econom i cs of bi obased adi pi c aci d product i on l ook encouragi ng.

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 12 of16

H ow ever, M organ rem ai ns caut i ous on bi obased hexam et hyl enedi am i ne (H M D A ), t he ot her com ponent needed f or nyl on-6, 6. I ti s possi bl et o convert adi pi c aci di nt o H M D A ;I C I used t o do t hi si nt he 1970s at W i l t on i nt he U K , and P ri ngdi ngshan i n C hi na al so ran t hi s ki nd of process, he says. B ot ht hese uni t s no l onger operat e, as t here i sa m arket f or adi pi c aci d and t he overal lconversi on i s uneconom i c. H ow ever, i t com es dow n t o a deci si on regardi ng w here and how you t ake your m argi n and w here you m ake your ret urn; cl earl y, i nt he past ,I C I consi dered H M D A f rom adi pi c aci d unw orkabl e, but m aybe ci rcum st ances f or t hi s conversi on need revi si t i ng as w el las possi bl e al t ernat i ve bi o-rout es. N ew appl i cat i ons f or bi obased succi ni c aci d wi l lcom e about i n 2014, gi ven t hat t he di carboxyl i c aci di s now bei ng produced i n quant i t y, says M ari f ai t h H acket t , seni or consul t ant at I H S C hem i cal .B i obased succi ni c aci di sa f eedst ock f or pol ybut yl ene succi nat e, a bi odegradabl e pol ym er, and a pot ent i alst art i ng m at eri alf or pol yest er pol yol s and novelpl ast i ci zers. I n addi t i on, bi obased succi ni c aci d can serve as a st art i ng m at eri alf or 1, 4-but anedi oland t et rahydrof uran. M yri ant C orp. (C am bri dge, M A ) st art ed l arge-scal e product i on i nmi d-2013, w hi l e S ucci ni t y, a j oi nt vent ure of B A S F and C orbi on P urac, pl ans t o st art product i on i n earl y 2014. R everdi a, a j v of D S M and R oquet t e, i ni t i at ed product i on i n D ecem ber 2012. B i oA m ber cont i nues t o produce bi obased succi nc aci d on a sm al l er scal e but says i t rem ai ns on t rack f or m echani calcom pl et i on of i t s bi obased succi ni c aci d pl ant i nt he f ourt h quart er of 2014. T he devel opm ent of speci al t i es deri ved f rom bi obased m at eri al swi l lal so cont i nue i n 2014, M organ says. B i obased m et hi oni ne proj ect s announced by R oquet t e and a C J/ A rkem a i ndi cat e an i nt erest i n com pl et i ng t he am i no aci d port f ol i of rom a bi obased perspect i ve. P ri m ary am i no aci ds l ysi ne, t hreoni ne, and t rypt ophan are m ade vi a bi ot echnol ogy t oday, w hereas f or m any years D L-m et hi oni ne and i t s anal ogue have been m ade f rom acrol ei n, hydrogen cyani de, and m et hylm ercapt an, he adds. A bi ot ech process f or m et hi oni ne m ay be greener and cost -ef f ect i ve, M organ says. O ne f act or t o consi der i n addi t i on i st hat a bi orout e generat es 100% L-f orm w i t h m axi m um act i vi t y, w hereas chem i calrout es generat e D Lm et hi oni ne. T he cost per act i ve w ei ght of m et hi oni ne coul d prove a pow erf ulsel l . H ow ever, t here w oul d st i l lbe a need f or caref ulref orm ul at i on of ani m alf eed nut ri t i on syst em s t o accom m odat et hi s very act i ve m at eri al , and, hence, t here i s once m ore a need possi bl yf or m ul t i pl e suppl i ers f or m arket upt ake. Fl avor and f ragrance product s and rel at ed i ndust ri es, l i ke personalcare, al so have an opport uni t yt ot ake f urt her advant age of bi obased t erpenoi ds, M organ says. F arnesene and deri vat i ves l i ke squal ane, produced by A m yri s (E m eryvi l l e, C A ), i l l ust rat et hat one can ent er t he f l avor and f ragrance m arket at di f f erent poi nt si nt he product i on cycl e. A ccessi ng som e of t he sm al l er-vol um e, hi gher-val ue-added product s vi a bi ot echnol ogy coul d provi de new opport uni t i es, M organ adds. C hri st ophe S chi l l i ng, C E O and f ounder of G enom at i ca (S an D i ego), expect st he recent st art -up of l arge-scal e cel l ul osi c et hanolpl ant st o hel p accel erat e bi ochem i caldevel opm ent . It hi nk t hi swi l lhel p peopl et o real l y see t he opport uni t yt hese at t ract i ve f eedst ocks and suppl y chai ns of f er and how t o put al lt he pi eces i n pl ace t o be abl et o l everage i t . H e al so not es t hat t he i ndust ry has m at ured and w i l lcont i nue t o advance i n 2014. W e re get t i ng i nt ot he realsubst ant i ve em ergence of t he f i el d, S chi l l i ng says. C om m erci alpl ant s are bei ng bui l t ; product s are bei ng sol d com m erci al l y. F or m any years, i t w as real l y about a t echnol ogy vi si on, and t hat s now t ransl at ed i nt o com m erci al real i t y. I t hi nk you w i l lsee m ore of t hat i n 2014realsubst ant i ve advancem ent st hat show t hat t hi si ndust ry i s st art i ng t o get i t sf eet and have a realcom m erci ali m pact . R E B E C C A C O O N S

A g ri cu l tu re: O p ti mi sm tu rn s to cau ti on

T he 2014 out l ook f or seeds and agri cul t uralchem i cal s dem and i nt he U ni t ed S t at es i s caut i ous, si nce depressed com m odi t y pri ces are expect ed t o dri ve corn acreages dow n 3 5% year-on-year, and bot h seeds and ag chem i cal s wi l lst ruggl et o achi eve pri ces i ncreases, says Ji m Loar, seni or v. p. / sal es and m arket i ng, agri busi ness at W i l bur-E l l i s (S an F ranci sco), an i nt ernat i onalm arket er and di st ri but or of agri cul t uralproduct s. U S D A expect s 2013 net f arm i ncom e t o be $131 bi l l i on, up 15. 1% f rom 2012, but says l ow er crop pri ces w i l ll i kel y l ead t o sof t er net i ncom e i n 2014. U S D A says t he 2013 14 season average f arm pri ce f or corn w i l lbe $4. 05 4. 75/ bushel , dow n f rom a record of $6. 89/ busheli n 2012 13a harvest dram at i cal l yi m pact ed by drought and expect st hat 2014 15 pri ces w i l lret reat even f urt her. T he opt i mi sm experi enced goi ng i nt o 2013 has been repl aced by caut i on goi ng i nt o 2014, Loar says. D epressed com m odi t y pri ces have caused a reset of f ert i l i zer pri ces and ag chem i cal swi l lst ruggl et o achi eve i nf l at i onary-dri ven pri ce i ncreases. S eed suppl i ers have announced pri ce i ncreases averagi ng approxi m at el y 4% goi ng i nt o 2014. H ow ever, w e are l i kel yt o see l ocaldi scount i ng as grow ers push back agai nst t oday s com m odi t y crop pri ces.

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 13 of16

T ot alcrop acreage shoul d not appreci abl y change, and t hus crop m i x, envi ronm ent alcondi t i ons, and pest pressure wi l ldet erm i ne ul t i m at e dem and, Loar adds. T oday s com m odi t y pri ces and i nput cost real i t i es shoul d dri ve corn acreage t o beans, unl ess w e see a si gni f i cant decl i ne i n soy bean pri ces bef ore M arch. G rai n sorghum m ay al so benef i t at t he expense of corn i ft he drought persi st si nt he S out hw est and l ow er pl ai ns st at es. S m al lgrai ns, ri ce, and cot t on acres coul d al so see sl i ght acreage i ncreases goi ng i nt o 2014, Loar says. U S D A not es t hat export s have benef i t t ed f rom l ow er corn pri ces and i ncreased gl obalconsum pt i on. C om pet i t i ve pri ces have rest ored t he U ni t ed S t at es t ot op pl ace i nt he gl obalcorn m arket w i t ht he U S share of t rade proj ect ed at 33% com pared w i t h 18% i n 2012 13. G eneral l y hi gher corn t rade w orl dw i de has al so enhanced dem and f or U S corn, i t says. A l so, a sharp drop i n O ct ober N ovem ber 2013 soybean export sf rom B razi land A rgent i na has l ef tU S shi pm ent st ol argel y accom m odat et he w orl d s current i m port needs. A ccordi ng t o U SD A s export i nspect i ons dat a, N ovem ber 2013 soybean export sat 317 m i l l i on bushel sw ere l i kel y t he l argest of any m ont h ever. R obust export s of soybeans and soybean m ealhave bol st ered t hei r cash pri ces; U S D A recent l y rai sed i t sf orecast range f or t he soybean season-average f arm pri ce by 35 cent s, t o $11. 50 13. 50/ bushel . M eanw hi l e, i ncreasi ng herbi ci de and i nsect i ci de resi st ances are dri vi ng dem and f or ef f ect i ve ag chem i st ry com bi nat i ons, Loar says. A dequat e, proven chem i st ri es i nat ank m i x, f or prepl ant or post -pl ant s spray program s, of f er grow ers t he w eapons needed t o com bat resi st ance. Bi opest i ci de R & D and i nvest m ent s are al so i ncreasi ng, but t he w i nners t hus f ar have been t he new cl asses of greener i nsect i ci des, Loar adds. W e are def i ni t el y seei ng a shi f t , at l east i nt he i nsect i ci de arena, t ot hese new and ef f ect i ve sol ut i ons. T rue bi opest i ci des m ust prove t hat t hey can st and al one agai nst pest st o gai n wi despread use. T oday, m any are used i n com bi nat i on w i t hl ong-proven chem i calt echnol ogi es. R egul at ory pressures are i ncreasi ng, and, i n com bi nat i on w i t h econom i c consi derat i ons, are hel pi ng dri ve i nnovat i on, he adds. B A S F ,t he t hi rd-l argest producer of agri cul t uralchem i cal s, behi nd S yngent a and B ayer C ropS ci ence, est i m at es t hat t he gl obalcrop prot ect i on m arket val ued at approxi m at el y $53. 7 bi l l i on i n 2012w i l lgrow at 2 3% / year i nt he next f i ve years. R ebecca C oons

F erti l i zers: P ro d u cers fo recast 2014 reb o u n d

F ert i l i zer m akers are opt i mi st i c af t er a vol at i l e 2013. U ncert ai nt y has cast a shadow i n pot ash m arket s, si nce t he sum m er breakup of t he B el arusi an P ot ash C o. one of t wo l arge pot ash export congl om erat esdel ayed cont ract s and st agnant f arm out put i nI ndi a w eakened earni ngs i nt he second hal f of t he year. W e are guardedl y opt i mi st i c about t he pot ash dem and out l ook, says M i ke R ahm , v. p. / m arket and st rat egi c anal ysi s at M osai c. Gl obalshi pm ent s of pot ash and phosphat e wi l li ncrease and dem and w i l lrebound: F undam ent al s are good. S everalot her f act ors underpi n our dem and f orecast s, w i t h one bei ng f arm econom i cs. Farm prof i t abi l i t y and net cash f arm i ncom e are expect ed t o rem ai n el evat ed i n 2014 but not as hi gh as t he l ast f ew years, w hen agri cul t uralcom m odi t y pri ces spi ked t o record l evel si n 2008 and agai ni n 2011. I nvent ory w as kept l ow si nce pri ces t rended dow n i n 2013, R ahm says. N i t rogen pri ces w i l lrebound $30 40/ m. t . on average f or 2014 f rom t he l ow s of f al l2013, he says. N i t rogen pri ces bot t om ed i nl at e O ct ober 2013 and have rebounded $50 75/ m . t . si nce. F or exam pl e, t he pri ce of urea on a barge i n N ew O rl eans j um ped t o about $350/ m. t . as of 6 January 2014 com pared w i t h around $275/ m. t .i nl at e O ct ober 2013, he says. P hosphat e pri ces bot t om ed about a m ont hl at er and have rebounded by about t he sam e am ount . The pri ce of di am m oni um phosphat e on a barge i n N ew O rl eans has i ncreased f rom about $315/ m. t .i nl at e N ovem ber 2013 t o around $375/ m . t . as of 6 January 2014. Di st ri but ors are not goi ng t o be abl et ol i ve of ft he pi pel i ne t ot he sam e ext ent as t hey di di n 2013, R ahm says. T he post er chi l df or l ean di st ri but i on i sI ndi a because t he si t uat i on t here has been com pl i cat ed by ot her f act ors such as subsi dy cut backs and i ncreases i n ret ai lpri cesexport st here have dropped i n hal f . R ahm bel i eves pri ces w i l lrebound i n 2014part i cul arl ywi t h urea and phosphat e. There are si gns of pri ci ng reachi ng a pri ci ng bot t om part i al l y because of l arge cont ract cust om ers i n C hi na and I ndi a. T he m arket i s w ai t i ng on how set t l em ent s shake out , and, once t hose cont ract s are set t l ed i n January, a f ai r am ount of dem and w i l lcom e t o t he m arket , R ahm says. W e have a f ai rl y hi gh degree of conf i dence of a ni ce rebound and i ncrease i n dem and. F ert i l i zer pri ces sof t ened duri ng 2013, si nce each nut ri ent f aced uni que suppl y and dem and chal l enges, accordi ng t o P ot ashC orp sf ourt h-quart er m arket anal ysi s report . T he l arge crops produced t hi s year w i l lhave rem oved record am ount s of nut ri ent sf rom t he soi l , w hi ch shoul d support f ert i l i zer consum pt i on i n 2014, P ot ashC orp says. D espi t e

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 14 of16

t he pot ent i alf or l ow er f arm i ncom e i n 2014, w e ant i ci pat e a heal t hy econom i c envi ronm ent rel at i ve t o hi st ori cal st andards, t he com pany says. W hen i t com es t o product i on, t hough, R ahm says t hat he i sl ess cert ai n about t he out l ook and t hat i tw i l lbe an i m port ant dri ver f or t he di rect i on of pri ci ng. G l obalpot ash and phosphat e shi pm ent swi l li ncrease t o 64 66 m i l l i on m. t . , up f rom t he 63 64 m i l l i on i n 2013, R ahm says. P ot ash dem and w i l lrebound t o 57 59 m i l l i on m . t . , up f rom 53 54 m i l l i on m . t . P ot ashC orp expect s gl obalpot ash dem and t oi ncrease t o 53 54 m i l l i on m . t . as w el l , and shi pm ent s coul d reach 55 58 m i l l i on m . t . next year. S hi pm ent s at t he l ow end of our range coul d occur i f m arket uncert ai nt y persi st si nt ot he f i rst hal f of 2014, i m pact i ng buyi ng pat t erns i n m aj or of f shore m arket s, P ot ashC orp says. D em and at t he hi gher end of t he range w oul d requi re great er m arket engagem ent earl yi nt he year, i ncl udi ng a si gni f i cant i m provem ent i n dem and f rom I ndi a. R ahm i s encouraged t hat gl obalm arket swi l lcom e back. Up t ot hi s poi nt ,i t has been a t al e of t w o hem i spheres: T he A m eri cas w ere st rong i nt erm s of dem and, but t he east ern hem i sphere w as l ess robust but I ndi a m ay com e back, R ahm says. T hey are a l arge i m port er of product s dri ven by good f arm econom i cs, as t hey are cont i nui ng t o appl y t echnol ogy t o crops. M ore hect ares are bei ng produced. B razi lhas al so been a good m arket , and w e expect t hat t o cont i nue. LI N D S A Y FR O S T

I n d u stri al g ases: C rackers to i n crease g as b u si n ess

T he U S shal e revol ut i on resul t ed i n a num ber of proj ect sf or i ndust ri algas producers i n 2013and t hey expect st rengt ht o cont i nue i nt o 2014. C rackers i nt he G ul f creat ed gas opport uni t i es w i t h ai r separat i on uni t s; ext ended pi pel i nes; and rel at ed nongas busi ness, such as t echnol ogy and equi pm ent f or new l i quef i ed nat uralgas (LN G ) t rai ns. W hen w e t al k speci f i cal l y about cracker i nvest m ent s, a key area f or t hi s grow t hi s al ong t he G ul f C oast , says Mi chaelG raf f , chai rm an and C E O of A m eri can A i r Li qui de. I n 2014 and beyond, w e are l ooki ng t of urt her expand our busi ness i nt hi s area, bui l di ng on our exi st i ng pi pel i ne i nf rast ruct ure al ong t he G ul f C oast . I ndust ri algas com pani es are al so grow i ng i n ref i ni ng, st eel , heal t h care, oi land gas, and el ect roni cs. N ew t echnol ogi es and t he use of l i qui d ni t rogen and carbon di oxi de i n enhanced oi lrecovery and hydraul i cf ract uri ng f or nat uralgas are f urt her advanci ng t he abi l i t yt o devel op w el l s m ore ef f i ci ent l y, product i vel y, and sust ai nabl y, usi ng subst ant i al l yl ess w at er, G raf f says. As f ar as overal lgrow t hi s concerned, A i r P roduct s expect s m odest G D P grow t h, 2 4% , t he com pany says i ni t s 2014 out l ook. W e expect t hat t he U S w i l lgrow 2 4% , as i t cont i nues t of ace unresol ved f i scalchal l enges, w eak j ob grow t h, l ow consum er conf i dence, and l ow er gl obaldem and. H ow ever, t he com pany says i ti s hopef ul t hat an econom i c recovery w el lbegi ni n E urope w i t h 0 2% grow t h. C hi na w i l lgrow 5 7% , and S out h A m eri ca, w hi ch i s l argel y dependent on gl obaldem and dri vi ng export s, w i l lgrow 1 3% , t he com pany says. R egi onal l y, t he U ni t ed S t at es w i l lbe t he st rongest spot f or i ndust ri algas producers as ext ensi ve pi pel i nes grow i n t he U S G ul f .F i el d operat i ons i n key regi ons, such as B akken i n N ort h D akot a and t he E agl e F ord, B arnet t , and P erm i an basi n regi on i n T exas and N ew M exi co, are cont ri but i ng t o st rengt h as w el l . T here i s a renai ssance of m anuf act uri ng and grow t h due i n great part t ot he abundance of energy at rel at i vel yl ow pri ces, G raf f says. Looki ng out si de t he U ni t ed S t at es, A i r Li qui de says i t sees cont i nued prom i se i n S out h A m eri capart i cul arl yi n B razi l . C hi na, t he M i ddl e E ast , and E ast ern E urope. B y segm ent , el ect roni cs w as one of t he w eakest i n 2012 and 2013, A i r P roduct s says, t hough i t expect s a rebound i n 2014. O veral l , w e expect si l i con grow t h of 3 5% i n 2014, t he com pany says. A ddi t i onal l y, w e expect busi ness t o benef i tf rom t he 2013 cost -reduct i on act i ons and product -l i ne rest ruct uri ng. Ti ght er areas, as f ar as suppl y goes, has been hel i um t hough A i r Li qui de says suppl yi s now st abi l i zi ng and grow i ng because of a com bi nat i on of new gl obalsources com i ng onl i ne and recent l egi sl at i on enact ed t o reaut hori ze dom est i c product i on i nt he U ni t ed S t at es. T he com pany al so recent l y brought onl i ne a new hel i um source i n Q at ar. A rgon has al so seen recent suppl y chal l enges, but as m ore ai r separat i on uni t s are com m i ssi oned due t o ri si ng dem ands of i ndust ry f or oxygen and ni t rogen, argon product i on i s al so i nt he i ncrease, G raf f says. Ai r P roduct s says i t expect s hi gher earni ngs i n 2014 f rom new pl ant onst ream s, hi gher LN G act i vi t y, and vol um e l oadi ng on exi st i ng asset srecogni zi ng t hat t he l ast f act or w i l lbe m ost i nf l uenced by t he econom y. H ow ever, t he com pany expect sl ow er earni ngs f rom t he shut dow n of i t s pol yuret hane i nt erm edi at es busi ness. I n m erchant gases, vol um e grow t h wi l l cont i nue t o be i nf l uenced by t he econom y, t he com pany says.

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 15 of16

Ai r Li qui de says t hat f or 2011 15, i t expect s average annualrevenue grow t h gl obal l y of 5 7% , dri ven by t hree m aj or t rendsi ndust ry gl obal i zat i on and resource const rai nt s, evol vi ng consum pt i on pat t erns, and dem ographi cs. W e are opt i mi st i c about t he year ahead, G raf f says. Low -cost nat uralgas cont i nues t o dri ve a renai ssance i na broad array of m anuf act uri ng i ncl udi ng chem i cal s, ref i ni ng, and st eel . Thi s grow t h wi l lcont i nue t o be i nf l uenced by gl obaleconom i c condi t i ons and dom est i c regul at ory pol i ci es and w i l lrel y on our abi l i t yt o navi gat et hese chal l enges w hi l e cont i nui ng t oi nnovat e, serve m arket s, and m eet cust om er needs. LI N D S A Y FR O S T

Fi n an ce: B i g d eal si n th e p i p el i ne

C hem i cal s M & A act i vi t yl ooks set f or a robust year i n 2014. S everalchem i calm akers have put up asset sf or sal ei n recent m ont hs. A sset si ncl ude A shl and s w at er t reat m ent busi ness and m any of D ow C hem i cal s com m odi t y chem i cal s asset s. D ow s di vest i t ures are w ort h $5 bi l l i on/ year i n revenues, and sources say A shl and s w at er busi ness coul d at t ract a $1-bi l l l i on-pl us of f er f rom pri vat e equi t y. D uP ont , m eanw hi l e, i s spi nni ng of f m any of i t s com m odi t i es asset s. Lot s of com pani es are put t i ng noncore busi nesses on t he m arket because t hey f i gure i ti s a good t i met o be exi t i ng and t he m arket condi t i ons w e have t oday w i l lnot l ast f orever, says T el l y Z achari ades, part ner w i t h T he V al ence G roup (N ew Y ork). F avorabl e credi t and f i nanci ngw hi ch has been avai l abl ef or som e t i m e now underpi ns t he current spat e of bi g announcem ent s. Fi nanci ng i swi de open, and t he l arger deal s are m ore i m pact ed by t he f i nanci ng m arket s, says M ari o T oukan, m anagi ng di rect or and head/ chem i cal s at K eyB anc C api t alM arket s (C l evel and, O H ). B ankers expect f i nanci ng t o cont i nue t o be rel at i vel y cheap i n 2014, t hough t hey al so agree t hat current condi t i ons are not perm anent . I don tt hi nk i tw i l lbe anot her year or t w o w here peopl ef i nance deal s at 5. 5t i m es (x) or 6x debt , T oukan says. As t hat cool s, i tw i l li m pact act i vi t y and val uat i on. H ow ever, bankers do not f oresee any part i cul ar event t hat w i l lhi tf i nanci ng m arket s; rat her, w hat goes up m ost go dow n. T he cost of debt t oday, w hi ch i s an i m port ant f act or dri vi ng M & A act i vi t y, i s hi st ori cal l y w el lbel ow average, Z achari ades says. T he st rong f i nanci ng m arket s are, obvi ousl y, a boon t o pri vat e equi t y, w hi ch st i l lhas l ot s of cash t o depl oy, bankers say. T hi s si t uat i on m eans pri vat e equi t yf i rm s are abl et o subm i t bi g bi ds f or bi g asset s. W hi l e com pani es are al so si t t i ng on l arge cash pi l es, pri vat e equi t yi s general l y com pet i t i ve i n si t uat i ons i nvol vi ng orphan asset sbusi nesses, of t en l arge, w hi ch have f ew , i f any, l ogi calbuyers and ni che spaces w i t h rol l -up opport uni t i es. C om pani es, m eanw hi l e, cont i nue t o be conservat i ve about acqui si t i ons. I don tt hi nk t he adj acent acqui si t i ons t hem e has run i t s course yet , says P aulG raves, C F O of F M C . E qui t y m arket s, m eanw hi l e, are unusual l yf avorabl ef or chem i cal s. For t he f i rst t i m e si nce probabl y 2006, w e are seei ng publ i c m arket val uat i ons t hat ri valor exceed M & A val uat i ons, says D avi d B radl ey, gl obalhead/ chem i cal s i nvest m ent banki ng at Jef f eri es (N ew Y ork). It hi nk w e m ay see a good year f or i ni t i alpubl i c of f eri ngs. I nt erm s of subsect ors, anyt hi ng t o do w i t h oi land gas chem i cal s, f ood i ngredi ent s, personalcare, next -generat i on el ect roni cs or bat t ery t echnol ogy, advanced m at eri al s, w at er t reat m ent , and agrochem i cal s i s generat i ng a l ot of M &A i nt erest , Z achari ades says. S om e sect ors, such as const ruct i on m at eri al s, are generat i ng i nt erest because t hey are at an at t ract i ve poi nt i nt he busi ness cycl e. T he cycl el ooks t o be goi ng up i n const ruct i on, and so t he pl ay i nvol ves ri di ng t he rebound, part i cul arl yi n N ort h A m eri ca, Z achari ades says. V I N C E N T V A LK

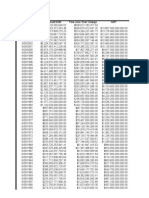

U S chem i calout l ook at a gl ance (i n bi l l i ons unl ess ot herw i se not ed) 2014 V al ue of chem i calshi pm ent s O perat i ng rat e (i n percent ) C hem i calexport s C hem i cali m port s % C hange

812. 0 3. 1% 75. 2 1. 7

190. 7 4. 7 189. 5 4. 1 4. 8 2. 5

T rade bal ance excl udi ng pharm a 43. 4 R & D spendi ng 58. 3

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

Pri nt er-Fri endl y Page

Page 16 of16

C api t alspendi ng E m pl oym ent (i nt housands) H ourl y w ages (i n dol l ars) S ource: A C C (W ashi ngt on)

46. 2

9. 0

794. 8 0. 1 21. 7 1. 1

P ri ntThi sW i ndow

Cl o se W i ndow

ht t p: / / www. chem w eek. com / pri nt / l ab/ O ut l ook-2014-L ooki ng-forw ard_57898. ht ml

3/ 25/ 2014

You might also like

- ISO 14971-2019 医疗器械 风险管理对医疗器械的应用(第三版)-中文版Document76 pagesISO 14971-2019 医疗器械 风险管理对医疗器械的应用(第三版)-中文版yd l75% (4)

- Finance Assignment Case AnalysisDocument6 pagesFinance Assignment Case AnalysisBinayak GhimireNo ratings yet

- Yesus Nam Budhdha ShrawakayanoDocument107 pagesYesus Nam Budhdha ShrawakayanoRandzzz1100% (23)