Professional Documents

Culture Documents

E 9-8 General Journal: The Check Figure For Exercise 9-8 Should Read $314.79, Not $320.09

Uploaded by

Barry Mendoza0 ratings0% found this document useful (0 votes)

7 views3 pagesThe check figure for Exercise 9-8 should read $314.79, not $320.09. All corrections to original solutions in the Instructor's Solutions Manual are in blue type.

Original Description:

Original Title

Errata

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe check figure for Exercise 9-8 should read $314.79, not $320.09. All corrections to original solutions in the Instructor's Solutions Manual are in blue type.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesE 9-8 General Journal: The Check Figure For Exercise 9-8 Should Read $314.79, Not $320.09

Uploaded by

Barry MendozaThe check figure for Exercise 9-8 should read $314.79, not $320.09. All corrections to original solutions in the Instructor's Solutions Manual are in blue type.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

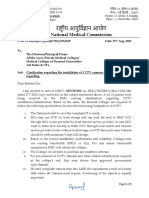

Errata Sheet for Horngren, Accounting, Canadian Seventh Edition

Please note this correction to page 465 of the textbook:

The check figure for Exercise 9-8 should read $314.79, not $320.09.

All corrections to original solutions in the Instructors Solutions Manual are in blue type.

(10-15 min.) E 9-8

General Journal

DATE

ACCOUNT TITLES AND

EXPLANATIONS

POST.

REF. DEBIT CREDIT

Oct. 1 Note ReceivableJ oe Lazarus

88,000

Cash 88,000

Nov. 3 Note ReceivableHighwater Inc. 6,325

Sales Revenue 6,325

16 Note ReceivableSTM Inc. 4,400

Account ReceivableSTM Inc. 4,400

30 Interest Receivable 314.79*

Interest Revenue 314.79

* ($88,000 0.02 60/365) +($6,325 0.04 27/365) +($4,400 0.04 14/365) =$314.79

$289.32 $18.72 $6.75

Req. 1 (maturity value of note) (30-40 min.) P 9-5A

Note Due Date Principal +Interest = Maturity Value

(a) Dec. 31, 2006 $18,000 +($18,000 0.04 92/365) = $18,181.48

(b) J an. 18, 2007 $24,000 +($24,000 0.03 60/365) = $24,118.36

(c) Dec. 1, 2007 $30,000 +($30,000 0.05 1) = $31,500.00

(d) Dec. 15, 2008 $40,000 +($40,000 0.06 2) = $44,800.00

Req. 2 (adjusting entries for interest at December 31, 2006)

General Journal

DATE

2006

ACCOUNT TITLES AND

EXPLANATIONS

POST.

REF. DEBIT CREDIT

Dec. 31 Interest Receivable

492.83

Interest Revenue 492.83

*Computation: Note (a) $18,000 0.04 92/365 = $ 181.48

Note (b) $24,000 0.03 42/365 = 82.85

Note (c) $30,000 0.05 30/365 = 123.29

Note (d) $40,000 0.06 16/365 = 105.21

Total interest $492.83

Req. 3 (to record collection of note b)

General Journal

DATE

2007

ACCOUNT TITLES AND

EXPLANATIONS

POST.

REF. DEBIT CREDIT

J an. 18 Cash

24,118.36

Note Receivable 24,000.00

Interest Receiv. ($24,000 0.03

42/365) 82.85

Interest Revenue

($24,000 0.03 18/365) 35.51

(15-20 min.) E 15-11

General Journal

DATE

ACCOUNT TITLES AND

EXPLANATIONS

POST.

REF. DEBIT CREDIT

2013

Oct. 1 Interest Expense

83,750

Discount on Bonds Payable 3,750

($60,000* x 1/8 x 6/12)

Cash ($2,000,000 x 0.08 x 6/12) 80,000

1 Bonds Payable 2,000,000

Loss on Retirement of Bonds Payable

42,500

Discount on Bonds Payable 22,500

($60,000 x 3/8) or ($60,000 - (10 x

$3,750))

Cash 2,020,000

* $2,000,000 x 0.97 =$60,000

The following corrections are for Chapter 4 of the Study Guide provided on CD with the textbook.

For Chapter 4, Demonstration Problem #1:

On page 21 - change b. Amortization expense from $1,650 to $650;

In the trial balance that follows f., change Accounts receivable $9,585 to $7,585;

change S. Star, Capital $103,140 to $101,140

On page 22 - change Total $236,740 to $234,740 for both the debit and credit totals

On page 23, in the Trial Balance columns of the worksheet, change Accounts receivable $9,585

to $7,585; change S. Star, Capital $103,140 to $101,140; change both the debit and credit totals

from $236,740 to $234,740

You might also like

- (Chapter 2) Sol Man of Intermediate Accounting 2 by Zeus MillanDocument17 pages(Chapter 2) Sol Man of Intermediate Accounting 2 by Zeus MillanJonathan Villazon RosalesNo ratings yet

- Exercise 14Document11 pagesExercise 14dwitaNo ratings yet

- PBPO008E FrontmatterDocument13 pagesPBPO008E FrontmatterParameswararao Billa67% (3)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Notes Receivable: Problem 1: True or FalseDocument11 pagesNotes Receivable: Problem 1: True or FalseJamie Rose Aragones50% (2)

- Sol. Man. - Chapter 5 - Notes Receivable - Ia Part 1aDocument11 pagesSol. Man. - Chapter 5 - Notes Receivable - Ia Part 1aKaisser Niel Mari FormentoNo ratings yet

- Useful Methods in CatiaDocument30 pagesUseful Methods in CatiaNastase Corina100% (2)

- Chapter - 14-Working Capital and Current Assets ManagementDocument8 pagesChapter - 14-Working Capital and Current Assets ManagementShota TsakashviliNo ratings yet

- F7 SolutionsDocument15 pagesF7 Solutionsnoor ul anumNo ratings yet

- Computer in Community Pharmacy by Adnan Sarwar ChaudharyDocument10 pagesComputer in Community Pharmacy by Adnan Sarwar ChaudharyDr-Adnan Sarwar Chaudhary100% (1)

- Chemical Safety ChecklistDocument3 pagesChemical Safety ChecklistPillai Sreejith100% (10)

- Harrison FA IFRS 11e CH09 SMDocument106 pagesHarrison FA IFRS 11e CH09 SMShako GrdzelidzeNo ratings yet

- Notes Receivable: Problem 1: True or FalseDocument21 pagesNotes Receivable: Problem 1: True or FalseAbegail Joy De GuzmanNo ratings yet

- Solution Manual For Accounting 9th Edition by Charles T Horngren Walter T Harrison JR M Suzanne OliverDocument39 pagesSolution Manual For Accounting 9th Edition by Charles T Horngren Walter T Harrison JR M Suzanne OliverPatriciaCooleyMDkrws100% (34)

- Practice Problems, CH 9 10 SolutionDocument6 pagesPractice Problems, CH 9 10 SolutionscridNo ratings yet

- FM FinalDocument7 pagesFM FinalStoryKingNo ratings yet

- Ias 32Document3 pagesIas 32Yến Hoàng HảiNo ratings yet

- Solutions Guide: This Is Meant As A Solutions GuideDocument4 pagesSolutions Guide: This Is Meant As A Solutions GuideVivienne Lei BolosNo ratings yet

- FIN 081 - P2 Quiz2Document55 pagesFIN 081 - P2 Quiz2Grazielle DiazNo ratings yet

- Final F09 SolutionDocument5 pagesFinal F09 SolutionWyatt Niblett-wilsonNo ratings yet

- Corporate Finance Week 5 Slide SolutionsDocument3 pagesCorporate Finance Week 5 Slide SolutionsKate BNo ratings yet

- Harrison Fa Ifrs 11e Ch09 SMDocument107 pagesHarrison Fa Ifrs 11e Ch09 SMAshleyNo ratings yet

- Fundamentals of Business Math Canadian 3rd Edition Jerome Solutions ManualDocument21 pagesFundamentals of Business Math Canadian 3rd Edition Jerome Solutions Manualnorianenclasphxnu100% (23)

- Working Capital Manageme NT: Weekend Assignment: 3Document10 pagesWorking Capital Manageme NT: Weekend Assignment: 3Ankit KhandelwalNo ratings yet

- Ch08 Harrison 8e GE SM (Revised)Document102 pagesCh08 Harrison 8e GE SM (Revised)Muh BilalNo ratings yet

- Notes Payable: Problem 1: True or FalseDocument16 pagesNotes Payable: Problem 1: True or FalseKim HanbinNo ratings yet

- Corporate Finance Week 4 Slide SolutionsDocument4 pagesCorporate Finance Week 4 Slide SolutionsKate BNo ratings yet

- Sol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aYamateNo ratings yet

- 4 - Notes Receivable Problems With Solutions: From The TextbookDocument23 pages4 - Notes Receivable Problems With Solutions: From The TextbookKate BNo ratings yet

- F2 - Mock A - Answers-2-11 143Document10 pagesF2 - Mock A - Answers-2-11 143MD KaifNo ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Learning Materials - Chapters 4, 5, and 7Document12 pagesLearning Materials - Chapters 4, 5, and 7Kyla Joy T. SanchezNo ratings yet

- Sol. Man. - Chapter 5 - Notes Receivable - Ia Part 1a - 2020 EditionDocument20 pagesSol. Man. - Chapter 5 - Notes Receivable - Ia Part 1a - 2020 EditionJapon, Jenn RossNo ratings yet

- Quiz 3solutionDocument5 pagesQuiz 3solutionAhsan IqbalNo ratings yet

- Review Questions For Final Exam ACC210Document13 pagesReview Questions For Final Exam ACC210AaaNo ratings yet

- D E+ D X RD+ E D+ E X : Return Richard ExpectDocument5 pagesD E+ D X RD+ E D+ E X : Return Richard ExpectSu Suan TanNo ratings yet

- Assessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Document7 pagesAssessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Jaydeep KushwahaNo ratings yet

- Sol. Man. - Chapter 15 EpsDocument12 pagesSol. Man. - Chapter 15 Epsfinn mertensNo ratings yet

- Tamisha McQuilkin Final ExamDocument8 pagesTamisha McQuilkin Final ExamTamisha McQuilkinNo ratings yet

- Chapter 7 - Teacher's Manual - Ifa Part 1aDocument7 pagesChapter 7 - Teacher's Manual - Ifa Part 1aCharmae Agan CaroroNo ratings yet

- Introduction To Managerial Accounting Canadian 5th Edition Brewer Solutions Manual 1Document36 pagesIntroduction To Managerial Accounting Canadian 5th Edition Brewer Solutions Manual 1warrenbakerrofjngwkia100% (27)

- Chapter 3 Fundamental Interpretations Made From Financial Statement Data 1) D 2) B 3) C 4) B 5) B 6) A 7) BDocument4 pagesChapter 3 Fundamental Interpretations Made From Financial Statement Data 1) D 2) B 3) C 4) B 5) B 6) A 7) BJue WernNo ratings yet

- ACC3100 Fall 2017 Mid Term 1 Exam Practice Question From Test BankDocument100 pagesACC3100 Fall 2017 Mid Term 1 Exam Practice Question From Test BankGuinevereNo ratings yet

- Class+8+ Chapter+8 +Practice+Questions+ ANSWERSDocument4 pagesClass+8+ Chapter+8 +Practice+Questions+ ANSWERSMar JoNo ratings yet

- 2011 Gray Stone Lawson TotalsDocument3 pages2011 Gray Stone Lawson TotalsAndrea RobinsonNo ratings yet

- F2 - MOCK A - ANSWERS NowDocument11 pagesF2 - MOCK A - ANSWERS NowRoronoa ZoroNo ratings yet

- F9 Mock Exam June 2020 - Answers PDFDocument9 pagesF9 Mock Exam June 2020 - Answers PDFNguyễn Quốc TuấnNo ratings yet

- Chapter 8Document6 pagesChapter 8swaroopcharmiNo ratings yet

- Chapter 6 - Teacher's Manual - Ifa Part 1aDocument12 pagesChapter 6 - Teacher's Manual - Ifa Part 1aCharmae Agan CaroroNo ratings yet

- Assignment 1 - SolutionsDocument3 pagesAssignment 1 - SolutionsEsther LiuNo ratings yet

- Chapter 15Document6 pagesChapter 15Rayhan Atunu100% (1)

- Financial Ratios of Keppel Corp 2008-1Document3 pagesFinancial Ratios of Keppel Corp 2008-1Kon Yikun KellyNo ratings yet

- Chap11 ConnectDocument5 pagesChap11 ConnectThanh PhuongNo ratings yet

- Corporate Finance Week 3 Slide SolutionsDocument6 pagesCorporate Finance Week 3 Slide SolutionsKate BNo ratings yet

- Case Answer (8068)Document3 pagesCase Answer (8068)Ali Al AjamiNo ratings yet

- CF Final 2020 Preparation Answers: B. Payback PeriodDocument5 pagesCF Final 2020 Preparation Answers: B. Payback PeriodXatia SirginavaNo ratings yet

- Economics: Ordinary and Exact Simple InterestDocument5 pagesEconomics: Ordinary and Exact Simple InterestLoiza Joi MulanoNo ratings yet

- Chapter+2 3Document14 pagesChapter+2 3kanasanNo ratings yet

- Topic 3 Extra Questions Suggested AnswersDocument4 pagesTopic 3 Extra Questions Suggested AnswersThirusha balamuraliNo ratings yet

- Mathematics of Finance Canadian 8th Edition Brown Kopp Solution ManualDocument41 pagesMathematics of Finance Canadian 8th Edition Brown Kopp Solution Manualflorence100% (30)

- ULCR Investment Consultants Investor’s Course “The Ultimate Investor’s Educational Learning Experience on Earth...”From EverandULCR Investment Consultants Investor’s Course “The Ultimate Investor’s Educational Learning Experience on Earth...”No ratings yet

- The Dust Bunnies COL FKBDocument36 pagesThe Dust Bunnies COL FKBPradeep ManralNo ratings yet

- ERP22006Document1 pageERP22006Ady Surya LesmanaNo ratings yet

- Line Integrals in The Plane: 4. 4A. Plane Vector FieldsDocument7 pagesLine Integrals in The Plane: 4. 4A. Plane Vector FieldsShaip DautiNo ratings yet

- Game ApiDocument16 pagesGame ApiIsidora Núñez PavezNo ratings yet

- PDF Synopsis PDFDocument9 pagesPDF Synopsis PDFAllan D GrtNo ratings yet

- Conjunctions in SentencesDocument8 pagesConjunctions in SentencesPunitha PoppyNo ratings yet

- Exploded Views and Parts List: 6-1 Indoor UnitDocument11 pagesExploded Views and Parts List: 6-1 Indoor UnitandreiionNo ratings yet

- CBSE Class 10 Science Sample Paper SA 2 Set 1Document5 pagesCBSE Class 10 Science Sample Paper SA 2 Set 1Sidharth SabharwalNo ratings yet

- Planning Effective Advertising and Promotion Strategies For A Target AudienceDocument16 pagesPlanning Effective Advertising and Promotion Strategies For A Target Audiencebakhoo12No ratings yet

- Indian Traditional Musical InstrumentsDocument3 pagesIndian Traditional Musical InstrumentsPiriya94No ratings yet

- NSTP SlabDocument2 pagesNSTP SlabCherine Fates MangulabnanNo ratings yet

- Ultrasonic Based Distance Measurement SystemDocument18 pagesUltrasonic Based Distance Measurement SystemAman100% (2)

- T Rex PumpDocument4 pagesT Rex PumpWong DaNo ratings yet

- Acronyms and AbbreviationsDocument875 pagesAcronyms and AbbreviationsLacky KrishnanNo ratings yet

- Advanced Statistical Approaches To Quality: INSE 6220 - Week 4Document44 pagesAdvanced Statistical Approaches To Quality: INSE 6220 - Week 4picalaNo ratings yet

- CCTV Guidelines - Commission Letter Dated 27.08.2022Document2 pagesCCTV Guidelines - Commission Letter Dated 27.08.2022Sumeet TripathiNo ratings yet

- Lyka Kendall B. Adres: Personal Na ImpormasyonDocument2 pagesLyka Kendall B. Adres: Personal Na ImpormasyonKendall BarbietoNo ratings yet

- Encapsulation of Objects and Methods in C++Document46 pagesEncapsulation of Objects and Methods in C++Scott StanleyNo ratings yet

- Maintenance Performance ToolboxDocument6 pagesMaintenance Performance ToolboxMagda ScrobotaNo ratings yet

- Prediction of Mechanical Properties of Steel Using Artificial Neural NetworkDocument7 pagesPrediction of Mechanical Properties of Steel Using Artificial Neural NetworkInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- MSDS Charcoal Powder PDFDocument3 pagesMSDS Charcoal Powder PDFSelina VdexNo ratings yet

- BBO2020Document41 pagesBBO2020qiuNo ratings yet

- Ladies Code I'm Fine Thank YouDocument2 pagesLadies Code I'm Fine Thank YoubobbybiswaggerNo ratings yet

- Sco 8th Class Paper - B Jee-Main Wtm-15 Key&Solutions Exam DT 17-12-2022Document4 pagesSco 8th Class Paper - B Jee-Main Wtm-15 Key&Solutions Exam DT 17-12-2022Udaya PrathimaNo ratings yet

- Travelstart Ticket (ZA10477979) PDFDocument2 pagesTravelstart Ticket (ZA10477979) PDFMatthew PretoriusNo ratings yet

- ENG 102 Essay PromptDocument2 pagesENG 102 Essay Promptarshia winNo ratings yet