Professional Documents

Culture Documents

APM Terminals Company Presentation

Uploaded by

chuongnino123Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

APM Terminals Company Presentation

Uploaded by

chuongnino123Copyright:

Available Formats

1

Companypresentation

April2010

2

Tradelanesarethearteriesofinternationalcommerce.

Containerports areattheheartoftheglobaleconomy.

Theglobalcontainertradelinkseconomies,marketsandpeople.

Portandtransportationinfrastructureareessentialfactorsofeconomicdevelopment.

Portsserveascommercialgatewaysandeconomicenginesnationally,regionallyandglobally.

Internationaltradewillalwaysseekthemostefficientmodesof transportationandservice.

Portsarethefundamentallinksinglobalsupplychainmanagement.

APMTerminals GlobalTerminalNetworksetsthestandardforthecontainerterminalindustry.

3

Presentationoverview

Companyintroduction

Examplesofimprovements

Thecontainershippingmarket

4

Companyintroduction

5

APMTerminalsispartoftheA.P.MollerMaerskGroup

A.P.MollerMaerskGroup

HQ:Copenhagen,Denmark

2009Revenue:USD$48.5b

inShipping,Energy,Retail

andBanking.

115,000employees,130

countries.

APMTerminals

HQ:TheHague,Netherlands

2009Revenue:USD$3.02b

Containervolume:31million

TEUs (weightedbyterminalequity

share)

19,000employees,34countries.

6

APMTerminalshasanindependentreportingstructure

April8,2010 GroupStrategyOffice PAGE6

Strategy

KlausRudSejling

CFO

TrondWestlie

GroupRelations

SteenReeslev

HumanResources

BillAllen

MaerskLine**

Eivind Kolding*

MaerskDrilling

Claus

Hemmingsen*

MaerskSupply

Service

CarstenAndersen

OdenseSteelShipyard

PeterJannNielsen

DanskSupermarked

Erling Jensen

Safmarine

TomasDyrbye

ContainerInlandServices

NigelSimonPusey

MaerskTankers

SrenSkou*

Damco

RolfHabbenJansen

MaerskShip

Management

LeifNielsen

MaerskOilTrading

NielsHenrikLindegaard

Accounting

JesperCramon

Finance&Risk

Management

JanKjrvik

Legal

ChristianKledal

InvestorRelations

AndersChristensen

IT

FlemmingSteen

MaerskFPSOs

PaulPedersen

*PartnerandmemberoftheExecutive

Board

**CorporateServices,delivering

administrativeandotherservicesin

Copenhagen,ismanagedbyMaerskLine

GlobalServiceCentre

CorporateCenter

ServiceFunction

SpecialProjects

FlemmingIpsen

Procurement

SteenKarstensen

Norfolkline

ThomasWoldbye

MaerskOil

JakobBoThomasen

Svitzer

JesperTeddyLok

MaerskLNG

PaulPedersen

APMTerminals

KimFejfer

NilsAndersen*

CEO

7

APMTerminals corebusinessiscontainerport

management

Thedesign,development,implementation,operationandmanagementoftheworldsonlytrue

geographicallybalancedGlobalContainerTerminalNetwork.

19,000professionalsdeliveroperationalexcellencetocustomers.

50terminalsin34countriesandonfivecontinents,withnewterminalprojectsunderway.

Customerbase:60shippinglinesandtheworldsleadingimportersandexporters.

Annualthroughputof31millionTEUsandglobalmarketshareof6.6%in2009.

8

History:50yearsofinnovation,growthandprogress

FirstdedicatedA.P.Mollerterminalfacilityopens,inthePort ofNewYork.

1958

Containerizationbeginstochangepatternsofglobaltradeandgrowth. 1970s

Ongoingevolutionofcontainerizationandeconomicefficienciesofinternationaltradingpatternsleadto

therapidestablishmentofglobalportloadcentersandtranshipmentnetworks,requiringhighly

coordinatedandspecializedcontainerterminaloperationsandequipmenttoaccommodateeverlarger

vesselsandcontainerflows.

1980s

MaerskLineacquisitionofSeaLandenlargesscopeofterminaloperationsglobally.

1999

EstablishedasindependentcontainerterminaloperatingcompanywithinMaerskLine.

2001

Spunoffasindependentcorporateentity,withheadquartersinTheHague,Netherlands. 2004

RevenueofUSD$2.5billion,USD$111millioninprofit;APMTreportsearningsseparately. 2007

OnlytrueGlobalTerminalNetworkinportindustry;Focusonemergingmarketterminalinvestment.

2008

Named"PortOperatoroftheYear"byLloyd'sList.;RevenueofUSD$3billion;Globalmarketshareof6.6%.

2009

9

Establishedin2004asaseparateandindependentbusiness

unit,APMTerminalsconsistentlyoutperformsthemarket.

Revenue

SegmentCashFlowfromOperations

SegmentResult

APMTerminals FinancialResults20042009(USDmillion)

53

92

142

160

302

442

103

1,313

230

299

275

679

657

1,504

2,068

2,520

3,126

3,021

10

T

E

U

s

(

M

i

l

l

i

o

n

s

)

(

E

q

u

i

t

y

S

h

a

r

e

W

e

i

g

h

t

e

d

)

APMTerminals containervolumegrowth20042009

20.6

24.1

28.4

31.4

34

31

11

Regionalorganizationofexistingterminalbusiness

Americas

Portsmouth,VirginiaUSA

AsiaPacific

Shanghai,China

Europe

Rotterdam,Netherlands

Africa,MiddleEastand

IndianSubcontinent

Dubai,UnitedArab

Emirates

Closeraccesstocustomersandmarkets.

Accelerateddecisionmakingandexecution.

CorporateHeadoffice

TheHague,Netherlands

12

AtrulyGlobalTerminalNetworkservingallmajormarkets

13

AmericasRegion

14

EuropeRegion

15

Africa,MiddleEastandIndianSubcontinentRegion

16

AsiaPacificRegion

17

DemonstratedPerformanceandProgress

Portproductivity

Portsafety

18

Apapa,Nigeria:Significantimprovement

inservice&safetylevels

Beforetakeover Aftertakeover

Whatdidwedo?

Eliminatedvesselwaitingtime.

ImprovedSafetyandSecurity.

Increasedcapacityandthroughput.

InvestedUSD$200millionin

improvements.

Takeover

19

Aqaba,Jordan:Successfulprivatization

Whatchanged?

InvestmentinCranes(Phase1).

YardProceduresandITSystems.

ImprovedProductivity.

SignedManagementAgreement(2004).

JointDevelopmentAgreement 25Years(2006).

ACTBeforeAPMTerminals

Terminalcongestion.

Extremedelaysofvesselandcontainerdelivery.

NosafetytrainingorITsysteminplace.

ACTPresent

15%containerthroughputgrowthin2009.

Annualcapacityof750,000TEUs.

Sustainedprofitabilityandcompetitiveness.

Employinglocalstaffinseniorpositions.

ACTFuture

Installationofnew,largercranes.

Doublingofwharfto1000meters.

Annualcapacityof2.4millionTEUsby2013.

ThepreferredPortintheRedSea.

20

Benchmarkingsafetyperformance

Safetyhighlightsfor2009

SafetyperformanceresultsplacedAPM

Terminalsintheleadoftheportsand

terminalindustryfortheyear.

TheLostTimeInjuryFrequency(LTIF)rate

wasreducedby43%to4.1permillionman

hoursfor2009overthepreviousyear.

Afourhoursafetycultureprogram

(availablein12languages)wascompleted

by17,000ofour19,000employees.

EmployeeresponsetoSafetyCulture

trainingwasreflectedina400%increasein

reportedNearMissincidents,to10,151.

ProgressinaMustWin Battle:Terminal

fatalitieshavecontinuetodecline,from10

in2007,toninein2008,andfourin2009.

Injuriesper1,000,000manhours

LTIFjourney(APMT)

21

Thecurrentcontainershippingmarket

22

TodaysglobalfleetrequiresaGlobalTerminalNetwork

Atpresent,nearly5,900vesselsservelinertraderoutes;ofwhich4,721arepure

containerships.

Thereare538containervesselsonorder,representinganadditional3.87million

TEUsofcapacity(30%oftheexistingfleetcapacity).

Thethreelargestcontainershipoperatorsaccountfor35%ofworldstotal

containershipcapacity.

Thetopsevenshippinglinesrepresent50%ofthetotalglobalfleetscurrent

containercapacity.

Containershipscarryonethirdofallglobaltradebyvalue.

Source:AXSAlphaliner,9/09

(Sources:WorldShippingCouncil;

Alphaliner,February2010)

23

Longtermattractivenessoftheportindustryisdrivenby

ongoingglobalization,containerizationandprivatization

Worldcontainerporthandlingdemand(TEUmillion)

10%CAGRfrom1990 2008

13%for2009/3%in2010?

5%CAGRnext5years?

1990 2009 - 10 2015

Fundamentaldriversofportdemand

Economicglobalization.

Increasedregionaltrade(e.g.

IntraSoutheastAsia).

Increasedcontainerizationof

commodities(e.g.reefer).

Necessitytoupgradeexisting

capacity(e.g.Westernmarket,

deepdraft).

Privatizationopportunities.

Growingconsumerdemandin

developingcountries.

24

2009Rankings:WorldsLargestContainerports

(APMTerminalsGlobalTerminalNetworklocationslistedinbolditalic)

Source:ContainerisationInternational,March2010

Port Volume (MillionTEUs)

Singapore 25.8

Shanghai(China) 25.0

HongKong 20.9

Shenzhen (China) 18.2

Busan(Korea) 11.9

Guangzhou(China) 11.2

Dubai(UAE) 11.1

Ningbo(China) 10.5

Qingdao(China) 10.2

Rotterdam(Netherlands) 9.7

Tianjin(China) 8.7

Kaohsiung(Taiwan) 8.5

Antwerp(Belgium) 7.3

PortKlang (Malaysia) 7.3

Hamburg(Germany) 7.0

LosAngeles(USA) 6.7

TanjungPelepas(Malaysia) 6.0

LongBeach(USA) 5.0

Xiamen(China) 4.6

LaemChabang(Thailand) 4.6

25

Portoperatormarketshares:APMTerminalsranks3

rd

,

goalisnottobethebiggest,butthebest.

Source:DrewryShippingConsultants,August

2009

2006 2007 2008 TEUmillion

Equityweighted

Volumes MarketShare Volumes MarketShare Volumes MarketShare

PSA 42.4 9.6% 50.5 10.3% 50.8 9.8%

Hutchison 30.9 7.0% 35.1 7.2% 34.9 6.8%

APMTerminals 28.4 6.4% 31.4 6.4% 34 6.6%

DPWorld 25.9 5.9% 30.5 6.2% 32.1 6.2%

TotalTop4Operators 127.6 28.9% 147.5 30.1% 151.8 29.4%

Otheroperators 314.4 71.1% 342.5 69.9% 364.2 70.6%

Total 442.0 100.0% 490.0 100.0% 516.0 100.0%

26

Top20ContainershipLinesrankedbyfleetcapacity

(Source:AXSAlphaliner,March2010)

TEUS

27

APMTerminalsisredefiningtheindustryithelpedcreate

Mostgeographicallybalancedportfolioofanyterminaloperator.

Named2009PortOperatoroftheYear byLloydsList.

StrongfinancialstabilityoftheparentA.P.MollerMaerskGroup.

Industryleading,customerdrivenefficiencyandinnovation.

Asanindependentoperator,APMTerminalscanserveallcustomers.

Comprehensivenewterminaldevelopmentandexistingfacilityexpansionworldwide.

Equippedtoservelargervesselsenteringtheglobalfleet.

Corporatecommitmenttoimprovementin:

HealthandSafety

Security

Environmentalsustainability

Localcommunities

28

Forfurtherinformation

APMTerminals.com

You might also like

- APM Terminals Fact SheetDocument2 pagesAPM Terminals Fact SheetFelipe MarquesNo ratings yet

- Apm Terminals Corporate BrochureDocument19 pagesApm Terminals Corporate BrochureSky MarshallNo ratings yet

- A Mathematical Model for Handling in a Warehouse: The Commonwealth and International Library: Social Administration, Training, Economics and Production DivisionFrom EverandA Mathematical Model for Handling in a Warehouse: The Commonwealth and International Library: Social Administration, Training, Economics and Production DivisionNo ratings yet

- Determinants_of_Port_Performance_-_Case_Study_of_FDocument9 pagesDeterminants_of_Port_Performance_-_Case_Study_of_FWai PhyopaingNo ratings yet

- A Study On Success Factors of Development Strategi PDFDocument12 pagesA Study On Success Factors of Development Strategi PDFHafida FahmiasariNo ratings yet

- Panama Canal Expansion Impact On Logistic and Supply Chains - June 2012Document42 pagesPanama Canal Expansion Impact On Logistic and Supply Chains - June 2012CJ SchexnayderNo ratings yet

- Executive Radar 2011: European Rail IndustryDocument30 pagesExecutive Radar 2011: European Rail IndustryBrazil offshore jobsNo ratings yet

- TQM Success at Shipping Company EurasiaDocument4 pagesTQM Success at Shipping Company Eurasiapriyaa03100% (3)

- OoclDocument42 pagesOoclDeepti GuptaNo ratings yet

- APM Terminals 2016 Company Brochure: Lifting Global Trade Through Infrastructure LeadershipDocument19 pagesAPM Terminals 2016 Company Brochure: Lifting Global Trade Through Infrastructure LeadershipNayumi Flora QNo ratings yet

- Significance of World Shipping and Sea-Borne TradeDocument26 pagesSignificance of World Shipping and Sea-Borne TradeIqtiran KhanNo ratings yet

- Competition, Market Concentration, and Relative Efficiency of Major Container Ports in Southeast AsiaDocument30 pagesCompetition, Market Concentration, and Relative Efficiency of Major Container Ports in Southeast AsiaPhạm Phương ThảoNo ratings yet

- Company Visit Q1 11 ThaiDocument49 pagesCompany Visit Q1 11 ThaiMeghna GuptaNo ratings yet

- Wiegmans Et Al, Port and Terminal Selection, Martime P & M, 2008Document20 pagesWiegmans Et Al, Port and Terminal Selection, Martime P & M, 2008Evert SmitNo ratings yet

- Organisation For Economic Co-Operation, Development, European Integration of Rail Freight Transport (2004)Document121 pagesOrganisation For Economic Co-Operation, Development, European Integration of Rail Freight Transport (2004)dedalos777No ratings yet

- Logistics and Global Commodity Chains: Jean-Paul RodrigueDocument43 pagesLogistics and Global Commodity Chains: Jean-Paul Rodrigueanujhanda29No ratings yet

- Maritime Centres of 2025Document14 pagesMaritime Centres of 2025yoville898No ratings yet

- Scenario AnalisysDocument40 pagesScenario Analisysmarco_chin846871100% (1)

- Inland Waterways and the Global Supply ChainDocument24 pagesInland Waterways and the Global Supply ChainMAMuhammadFikriAkbarNo ratings yet

- Port Competition in MalaysiaDocument22 pagesPort Competition in MalaysiaBaie Sams100% (3)

- GAC Logistics Supply Chain Report 2010-11Document24 pagesGAC Logistics Supply Chain Report 2010-11World Economic ForumNo ratings yet

- Green Growth Shipbuildingfinal Report enDocument152 pagesGreen Growth Shipbuildingfinal Report envika_caranfilNo ratings yet

- Logistics Practices in EthiopiaDocument85 pagesLogistics Practices in Ethiopiaanteneh tesfawNo ratings yet

- Maritime Logistics A Guide To Contemporary Shipping and Port Management (201-250)Document50 pagesMaritime Logistics A Guide To Contemporary Shipping and Port Management (201-250)ZaNo ratings yet

- A New Approach To Port Choice Modelling: Mateusmagala &adriansammonsDocument26 pagesA New Approach To Port Choice Modelling: Mateusmagala &adriansammonsRipta RaskaNo ratings yet

- E Ciency Measurement of Selected Australian and Other International Ports Using Data Envelopment AnalysisDocument16 pagesE Ciency Measurement of Selected Australian and Other International Ports Using Data Envelopment AnalysisHarish SrinivasanNo ratings yet

- Autos MalaysiaDocument45 pagesAutos MalaysiaNicholas AngNo ratings yet

- International Journal of Operations & Production ManagementDocument17 pagesInternational Journal of Operations & Production Managementdr_hsn57No ratings yet

- Handbook of Ocean Container Transport Logistics - Making Global Supply Chains Effective PDFDriveDocument556 pagesHandbook of Ocean Container Transport Logistics - Making Global Supply Chains Effective PDFDriveMigle Bloom100% (1)

- TSL Quals July 2012Document17 pagesTSL Quals July 2012Yannis KoliousisNo ratings yet

- Veldman&Rachman (2008) Transhipment Port Choice IAME DalianDocument23 pagesVeldman&Rachman (2008) Transhipment Port Choice IAME DalianIves Barrientos ArteagaNo ratings yet

- Container Industry Value ChainDocument14 pagesContainer Industry Value ChainRasmus ArentsenNo ratings yet

- Book Review of Port EconomicsDocument4 pagesBook Review of Port Economicsbabu0202No ratings yet

- 3PL PresentationDocument32 pages3PL Presentationspyros_peiraias100% (2)

- Manning Strategies & Role of Outsourcing, Papademetriou 2005Document21 pagesManning Strategies & Role of Outsourcing, Papademetriou 2005sdrakopoulos323No ratings yet

- Inland Waterways and The Global Supply ChainDocument24 pagesInland Waterways and The Global Supply ChainBambang Setiawan MNo ratings yet

- 16.terminal Selection Unit IIDocument30 pages16.terminal Selection Unit IIrobin shajiNo ratings yet

- Emirates Customer ServiceDocument20 pagesEmirates Customer ServiceAjay Padinjaredathu AppukuttanNo ratings yet

- Competetion in Harbour TowageDocument16 pagesCompetetion in Harbour TowageDeanna BarrettNo ratings yet

- TradeLens Adds Hapag-Lloyd and ONE Carriers to Blockchain Shipping PlatformDocument3 pagesTradeLens Adds Hapag-Lloyd and ONE Carriers to Blockchain Shipping PlatformRazvan OracelNo ratings yet

- 3 PLDocument26 pages3 PLNigam MohapatraNo ratings yet

- Brambles FY13 Results - Investor Information PackDocument88 pagesBrambles FY13 Results - Investor Information Packsanjeev7777No ratings yet

- 05 - UAS Industry and Market Issues - BAE Systems - UKDocument10 pages05 - UAS Industry and Market Issues - BAE Systems - UKdiana_veronicaNo ratings yet

- Growth of Air Cargo and Issues in Southeast AsiaDocument44 pagesGrowth of Air Cargo and Issues in Southeast AsiavivekimdrNo ratings yet

- Shipping Industry GlencoreDocument100 pagesShipping Industry GlencoreAnna Kruglova100% (2)

- Transportation Management Systems and Intermodal RailDocument23 pagesTransportation Management Systems and Intermodal RailtbmiqbalNo ratings yet

- Shipping Company Strategies PDFDocument211 pagesShipping Company Strategies PDFMohamed Salah El DinNo ratings yet

- Informacion Ed 2013Document9 pagesInformacion Ed 2013chithirai10No ratings yet

- Comparing Efficiency of East and West African Ports Using DEADocument6 pagesComparing Efficiency of East and West African Ports Using DEAMuhammad AliNo ratings yet

- Service Quality Evaluation of International Freight Forwarders AnDocument16 pagesService Quality Evaluation of International Freight Forwarders AnAminadab TewhiboNo ratings yet

- Transport Operations in Container Terminals Literature Overview Trends Research Directions and Classification SchemeDocument36 pagesTransport Operations in Container Terminals Literature Overview Trends Research Directions and Classification SchemeJorge Prado Vieira LeiteNo ratings yet

- MaxDocument205 pagesMaxKanpicha ChanngamNo ratings yet

- UAE - JAFZA - Dubai Economic Outlook 2011Document18 pagesUAE - JAFZA - Dubai Economic Outlook 2011humbertopinto32No ratings yet

- Case Study (Airline Startup / AirAustralsia) - Submission Summative 1Document20 pagesCase Study (Airline Startup / AirAustralsia) - Submission Summative 1Eman Mohy0% (1)

- Chapter 8 Textbook QuestionsDocument3 pagesChapter 8 Textbook QuestionsArvin SolNo ratings yet

- Intro to Menzies AviationDocument17 pagesIntro to Menzies AviationAlex MartayanNo ratings yet

- Top 100 de Líneas Navieras. 2015Document1 pageTop 100 de Líneas Navieras. 2015Ana Belén Herencia UrquizoNo ratings yet

- An Analysis On Containerized Cargo Services at Coimbatore CityDocument15 pagesAn Analysis On Containerized Cargo Services at Coimbatore CityUlsasiNo ratings yet

- Types of Vessels AssignmentDocument8 pagesTypes of Vessels AssignmentHtoo Nay AungNo ratings yet

- Nigel Gee - Izar Pentamaran ConceptDocument14 pagesNigel Gee - Izar Pentamaran ConceptrmdowlandNo ratings yet

- Seam 4Document2 pagesSeam 4Dom ClutarioNo ratings yet

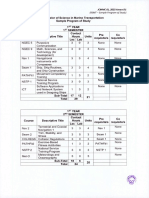

- ANNEX D1 BSMT Sample Program of StudyDocument4 pagesANNEX D1 BSMT Sample Program of StudyJeynard Moler J. TanNo ratings yet

- Dream - Cruise - Rules EN - enDocument8 pagesDream - Cruise - Rules EN - enSicaNo ratings yet

- Wiki ShippingDocument3 pagesWiki ShippingmrmdnadimNo ratings yet

- Checklist 12217-3 - 2015 Stability Power Under 6m En161206Document17 pagesChecklist 12217-3 - 2015 Stability Power Under 6m En161206Yudi DarmawanNo ratings yet

- Grade 11 Term 1 Week 9 Memo- Cruise LinerDocument3 pagesGrade 11 Term 1 Week 9 Memo- Cruise LinerntlatsengkagishoNo ratings yet

- Bismarck: Instructions Read FirstDocument6 pagesBismarck: Instructions Read Firstrkalscheur12No ratings yet

- Cargo Handling Exam for First MateDocument56 pagesCargo Handling Exam for First Matesamar jeetNo ratings yet

- Abandonship Drill FORMATDocument1 pageAbandonship Drill FORMATNyelle Jhon C. IlustrisimoNo ratings yet

- Boaters HandbookDocument37 pagesBoaters HandbookgaryNo ratings yet

- The Neptune Declaration On Seafarer Wellbeing and Crew ChangeDocument8 pagesThe Neptune Declaration On Seafarer Wellbeing and Crew ChangeNeil DewaraNo ratings yet

- Ship Particular Citra 03 - 23.5 M Twin Screw TugDocument4 pagesShip Particular Citra 03 - 23.5 M Twin Screw TugniaNo ratings yet

- PERSONAL CV FOR ENGINEER OFFICER POSITIONDocument1 pagePERSONAL CV FOR ENGINEER OFFICER POSITIONAzuan SyahrilNo ratings yet

- Roro Ships and CargoesDocument25 pagesRoro Ships and CargoesKyle Steven Cayme100% (1)

- Naval ShipDocument3 pagesNaval Shipmldc2011No ratings yet

- PomorstvoDocument5 pagesPomorstvoNatasa KidisevicNo ratings yet

- SC & NA Objective Type Questions Mar 2013Document28 pagesSC & NA Objective Type Questions Mar 2013lazyreaderr100% (3)

- Chapter 3 - ContainerizationDocument25 pagesChapter 3 - ContainerizationDipankar NimkarNo ratings yet

- Atlantic London Accommodation Jack-UpDocument3 pagesAtlantic London Accommodation Jack-UpRiccoNo ratings yet

- Implementing Regulations of CLLDocument17 pagesImplementing Regulations of CLLAbdullah AlfalehNo ratings yet

- Ship specs: length, breadth, draft, speedDocument2 pagesShip specs: length, breadth, draft, speedKyaw Win TunNo ratings yet

- Accidental Oil Outflow PerformanceDocument8 pagesAccidental Oil Outflow Performanceksangeeth2000No ratings yet

- Surveys & HSSCDocument14 pagesSurveys & HSSCsidadams2No ratings yet

- CV FormetDocument2 pagesCV FormetJ CNo ratings yet

- Ivaylo Georgiev: Master & Chief OfficerDocument2 pagesIvaylo Georgiev: Master & Chief OfficerMcaMcaNo ratings yet

- 2008 (B) - Iqbal Et AlDocument9 pages2008 (B) - Iqbal Et AlZobair Ibn AwalNo ratings yet

- Seamanship WPGLCatalogue2014Document92 pagesSeamanship WPGLCatalogue2014Joao Hecker100% (2)