Professional Documents

Culture Documents

Traditional Return Measure

Uploaded by

ajaykashvi0 ratings0% found this document useful (0 votes)

16 views9 pagesXcel in Fixed Income Analysis - Workbook Series Fixed Income Analysis Traditional Return Measure From this sheet you will learn: the computations needed to find the Reinvestment Income of a bond. Understand when and how to use the table function.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentXcel in Fixed Income Analysis - Workbook Series Fixed Income Analysis Traditional Return Measure From this sheet you will learn: the computations needed to find the Reinvestment Income of a bond. Understand when and how to use the table function.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views9 pagesTraditional Return Measure

Uploaded by

ajaykashviXcel in Fixed Income Analysis - Workbook Series Fixed Income Analysis Traditional Return Measure From this sheet you will learn: the computations needed to find the Reinvestment Income of a bond. Understand when and how to use the table function.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 9

Contact Us:

+1 347 647 9001

www.edupristine.com

Pristine pristinecareers@eneev.com

Visit www.edupristine.com to download more spreadsheets from our Xcel in

Fixed Income Analysis Workbook Series

Fixed Income Analysis

Traditional Return Measure

From this sheet you will learn:

The computations needed to find the reinvestment income of a bond.

Understand when and how to use the table function

Visit www.edupristine.com to download more spreadsheets from our Xcel in

Fixed Income Analysis Workbook Series

Fixed Income Analysis

Traditional Return Measure

From this sheet you will learn:

The computations needed to find the reinvestment income of a bond.

Understand when and how to use the table function

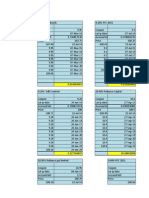

Question

Consider a Bond with the following characteristics:

If the market rate for this bond is 6%, find:

i. The price of the bond

ii. All possible realized yield based on reinvestment income.

Bond Valuation Process

Notional amount $ 100

Coupon % 5%

Coupon $ 5

Tenure Years 10

1-Jan-10 31-Jan-11

Year 0 Year 01

Interest Rate 6.00% 6.00%

Discount Factor 1.00 0.94

Future Factor 1.79 1.69

Cash Flow from the Bond

Coupon Payments $ 5

Face Value of the Bond $ -

Total Cashflow during the Year $ 5

Present Value of the Cash Flows

Present Value of the Cashflow $ 5

Price of the Fixed Rate Bond $ 92.64

Reinvestment Income

Reinvested Amount $ 8

Future Value $ 166

Reinvestment Income $ 16

Cummulative Annual Growth Rate 6.00%

Bond Equivalent Yield 5.91%

Effective Annual Yield 6.00%

Relationships between Parameters

Reinvestment

Income

16

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

40

50

60

70

I

n

t

e

r

e

s

t

R

a

t

e

-

10

20

30

40

0%

31-Jan-12 31-Jan-13 31-Jan-14 31-Jan-15 31-Jan-16 31-Jan-17 31-Jan-18

Year 02 Year 03 Year 04 Year 05 Year 06 Year 07 Year 08

6.00% 6.00% 6.00% 6.00% 6.00% 6.00% 6.00%

0.89 0.84 0.79 0.75 0.70 0.67 0.63

1.59 1.50 1.42 1.34 1.26 1.19 1.12

5 5 5 5 5 5 5

- - - - - - -

5 5 5 5 5 5 5

4 4 4 4 4 3 3

8 8 7 7 6 6 6

1% 2% 3% 4% 5% 6% 7%

0 1 1 2 2 3 3

1 2 3 4 5 6 7

1 3 4 6 7 9 10

2 4 6 8 10 12 14

3 5 8 10 13 15 18

3 6 10 13 16 19 22

4 8 11 15 19 23 27

4 9 13 18 22 27 31

5 10 16 21 26 31 36

6 12 18 24 30 36 42

Reinvestment Income vs. YTM and Coupon

Coupon

2% 4% 6% 8% 10%

Reinvestment vs Coupon Reinvestment vs YTM

156 255 - 168

- 199 97 239

6 205 - 206

31-Jan-19 31-Jan-20

Year 09 Year 10

6.00% 6.00%

0.59 0.56

1.06 1.00

5 5

- 100

5 105

3 59

5 105

8% 9% 10%

4 4 5

8 9 9

12 13 15

16 18 20

21 23 26

25 29 32

31 34 38

36 40 45

42 47 52

47 53 59

12%

You might also like

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Tower Crane Raft Design ReportDocument22 pagesTower Crane Raft Design ReportFranklyn Genove100% (4)

- Simple Discounted Cash Flow Model & Relative ValuationDocument14 pagesSimple Discounted Cash Flow Model & Relative ValuationlearnNo ratings yet

- Business Finance Assignment 2Document8 pagesBusiness Finance Assignment 2Akshat100% (1)

- Analyze Capital Projects Using NPV, IRR, Payback for Highest ReturnDocument10 pagesAnalyze Capital Projects Using NPV, IRR, Payback for Highest Returnwiwoaprilia100% (1)

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- The Dividend Discount Model Explained: Home About Books Value Investing Screeners Value Investors Links Timeless ReadingDocument12 pagesThe Dividend Discount Model Explained: Home About Books Value Investing Screeners Value Investors Links Timeless ReadingBatul KudratiNo ratings yet

- Dividend Growth ModelDocument4 pagesDividend Growth ModelRichardDanielNo ratings yet

- Making Investment Decisions With The Net Present Value Rule: Principles of Corporate FinanceDocument25 pagesMaking Investment Decisions With The Net Present Value Rule: Principles of Corporate FinanceSalehEdelbiNo ratings yet

- Analysis and Modification of Bogie Suspension SystemDocument76 pagesAnalysis and Modification of Bogie Suspension SystemKrishnaSingh0% (2)

- Vocational Training at PGCIL SubstationDocument22 pagesVocational Training at PGCIL SubstationSanitha Michail100% (1)

- Analyze Financial RatiosDocument33 pagesAnalyze Financial RatiosSiva UdNo ratings yet

- Forex robot Leprechaun v 2.2 manualDocument25 pagesForex robot Leprechaun v 2.2 manualSimamkele Ntwanambi100% (1)

- Fixed Income Analysis: Traditional Return MeasureDocument9 pagesFixed Income Analysis: Traditional Return MeasureajaykashviNo ratings yet

- Stock Research Report For ACN As of 7/27/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For ACN As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Coca Cola - With Notes On Discount Factor CalculationDocument20 pagesCoca Cola - With Notes On Discount Factor CalculationJared HerberNo ratings yet

- Chapter 1 - Overview - 2022 - SDocument100 pagesChapter 1 - Overview - 2022 - SĐức Nam TrầnNo ratings yet

- Fixed Income Analysis: Duration-ConvexityDocument8 pagesFixed Income Analysis: Duration-Convexitynaveen.ibsNo ratings yet

- CHS Investment AnalysisDocument8 pagesCHS Investment Analysismclennan68_13No ratings yet

- Dividend Discount Model: AssumptionsDocument15 pagesDividend Discount Model: Assumptionsminhthuc203No ratings yet

- Chapter 6 Valuating StocksDocument46 pagesChapter 6 Valuating StocksCezarene FernandoNo ratings yet

- Momentum Investing: Mi25 An Alternate Investing StrategyDocument18 pagesMomentum Investing: Mi25 An Alternate Investing Strategysantosh MaliNo ratings yet

- Quick Reference Guide For Financial Planning July 2012Document7 pagesQuick Reference Guide For Financial Planning July 2012imygoalsNo ratings yet

- Stock Research Report For MA As of 7/8/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For MA As of 7/8/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Quick Reference Guide For Financial Planning Aug 2012Document7 pagesQuick Reference Guide For Financial Planning Aug 2012imygoalsNo ratings yet

- Chapter08 KGWDocument24 pagesChapter08 KGWMir Zain Ul HassanNo ratings yet

- Stock Scorecard: Overall ScoreDocument30 pagesStock Scorecard: Overall ScorejoNo ratings yet

- Measuring Yield Curve RiskDocument6 pagesMeasuring Yield Curve Risknaveen.ibsNo ratings yet

- MacrodurDocument41 pagesMacrodurnoel_manroeNo ratings yet

- CTRN (Citi Trends) Investment AnalysisDocument7 pagesCTRN (Citi Trends) Investment Analysismclennan68_13No ratings yet

- Analyzing Turnover Reports to Reduce Employee TurnoverDocument8 pagesAnalyzing Turnover Reports to Reduce Employee TurnoverrahulsukhijaNo ratings yet

- Stock and Its Valuation: The Application of The Present Value ConceptDocument37 pagesStock and Its Valuation: The Application of The Present Value Concepter_aritraNo ratings yet

- Damodaran Estimating Growth PDFDocument11 pagesDamodaran Estimating Growth PDFdeeps0705No ratings yet

- Sample TestDocument11 pagesSample Testgloworm44No ratings yet

- Pensford Rate Sheet - 06.09.14Document1 pagePensford Rate Sheet - 06.09.14Pensford FinancialNo ratings yet

- Decent Overview of The Workings of A DCF Model Click HereDocument5 pagesDecent Overview of The Workings of A DCF Model Click HererajsalgyanNo ratings yet

- Estimating Spot Rates and FWD Rates (Using Bootstrapping Method)Document3 pagesEstimating Spot Rates and FWD Rates (Using Bootstrapping Method)9210490991No ratings yet

- FIN 571 Week 2 Individual HomeworkDocument5 pagesFIN 571 Week 2 Individual HomeworkadammadsenNo ratings yet

- Axial 5 Minute DCF ToolDocument18 pagesAxial 5 Minute DCF ToolDefriNo ratings yet

- Stock Research Report For TW As of 7/27/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For TW As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- UntitledDocument5 pagesUntitledPhương Hiền NguyễnNo ratings yet

- NewcrestDocument10 pagesNewcrestJosh LimNo ratings yet

- FIN 371 TUTOR Begins EducationDocument26 pagesFIN 371 TUTOR Begins EducationFrankLStoddartNo ratings yet

- Edgestone Capital Equity FundDocument2 pagesEdgestone Capital Equity Fund/jncjdncjdnNo ratings yet

- Pavise Equity Partners LP Performance Summary and Commentary for July 2022Document4 pagesPavise Equity Partners LP Performance Summary and Commentary for July 2022Kan ZhouNo ratings yet

- Dividend PolicyDocument74 pagesDividend PolicyNithin KsNo ratings yet

- Discounted Cash Flow Valuation: Rights Reserved Mcgraw-Hill/IrwinDocument48 pagesDiscounted Cash Flow Valuation: Rights Reserved Mcgraw-Hill/IrwinEnna rajpootNo ratings yet

- Coca Cola CaseDocument3 pagesCoca Cola CaseJared HerberNo ratings yet

- Audit Final TutorialDocument19 pagesAudit Final TutorialNurfairuz Diyanah RahzaliNo ratings yet

- Lecture 5Document4 pagesLecture 5TinNo ratings yet

- 4.6 Model Assumptions GuidebookDocument6 pages4.6 Model Assumptions GuidebookAlfred DurontNo ratings yet

- India's Structural and Secular Bull StoryDocument21 pagesIndia's Structural and Secular Bull StorydddNo ratings yet

- Fin 455 SP 2017 CumulativeDocument10 pagesFin 455 SP 2017 CumulativedasfNo ratings yet

- 2Document13 pages2Ashish BhallaNo ratings yet

- Safal Niveshaks Stock Analysis ExcelDocument26 pagesSafal Niveshaks Stock Analysis ExcelUmesh KamathNo ratings yet

- Test 2 Review QuestionsDocument11 pagesTest 2 Review QuestionsMae Justine Joy TajoneraNo ratings yet

- Chapter 7Document5 pagesChapter 7Trí Bùi HữuNo ratings yet

- Discounted Cash Flow (DCF) Model Tutorial and Dell Inc. Case StudyDocument18 pagesDiscounted Cash Flow (DCF) Model Tutorial and Dell Inc. Case StudySanket AdvilkarNo ratings yet

- Analysis of SFP - SPLOCIDocument26 pagesAnalysis of SFP - SPLOCIAkib Mahbub KhanNo ratings yet

- PE Ratios PDFDocument40 pagesPE Ratios PDFRoyLadiasanNo ratings yet

- Financial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesFrom EverandFinancial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesNo ratings yet

- National Aluminium Company LTD Agro LTD: Retail ResearchDocument10 pagesNational Aluminium Company LTD Agro LTD: Retail ResearchajaykashviNo ratings yet

- Avenue Supermart AnalysisDocument394 pagesAvenue Supermart Analysisashish.forgetmenotNo ratings yet

- Xirr SheetDocument6 pagesXirr SheetajaykashviNo ratings yet

- Xirr SheetDocument6 pagesXirr SheetajaykashviNo ratings yet

- Traditional Return MeasureDocument9 pagesTraditional Return MeasureajaykashviNo ratings yet

- Priority List JEEDocument3 pagesPriority List JEE6r5x5znb8bNo ratings yet

- Deep Learning For Sentiment Analysis of Tunisian DDocument21 pagesDeep Learning For Sentiment Analysis of Tunisian DJamila HamdiNo ratings yet

- LAN-1 Lan Cable TesterDocument2 pagesLAN-1 Lan Cable TesterDan DanNo ratings yet

- Chapter 5Document37 pagesChapter 5Yasser ElshaerNo ratings yet

- Casio AT 1 Service ManualDocument28 pagesCasio AT 1 Service ManualMario Gabriel MoralliNo ratings yet

- Ai Lab13Document5 pagesAi Lab13Hamna AmirNo ratings yet

- El Niño Modoki Dan Pengaruhnya Terhadap Perilaku Curah Hujan Monsunal Di IndonesiaDocument62 pagesEl Niño Modoki Dan Pengaruhnya Terhadap Perilaku Curah Hujan Monsunal Di IndonesiaSarNo ratings yet

- 3064 A CG Assignment-2Document57 pages3064 A CG Assignment-2nokexo6067No ratings yet

- Chemistry Paper (12 TH New Pattern)Document2 pagesChemistry Paper (12 TH New Pattern)Suyog TekamNo ratings yet

- Final Thesis On CNCDocument55 pagesFinal Thesis On CNCFranco100% (1)

- SBPM Testing in Bothkennar Clay Structure EffectsDocument8 pagesSBPM Testing in Bothkennar Clay Structure Effectssgaluf5No ratings yet

- Manual Testing - Common Interview QuestionsDocument31 pagesManual Testing - Common Interview QuestionsSravanthi AylaNo ratings yet

- Analysis On Spatial Variation of Rainfall and Groundwater Fluctuation in Hebballa Watershed, Mysore District, Karnataka, IndiaDocument7 pagesAnalysis On Spatial Variation of Rainfall and Groundwater Fluctuation in Hebballa Watershed, Mysore District, Karnataka, IndiaEditor IJTSRDNo ratings yet

- Heart Failure Prediction Using ANNDocument13 pagesHeart Failure Prediction Using ANNSHIVANSH KASHYAP (RA2011003010988)No ratings yet

- Design Codes and StandardsDocument22 pagesDesign Codes and StandardsFederico.IoriNo ratings yet

- CH 14Document34 pagesCH 14Tarun NeerajNo ratings yet

- Manual Swan Quad CrowDocument2 pagesManual Swan Quad CrowApex PredatorNo ratings yet

- Step by Step To Building A Computer LabDocument7 pagesStep by Step To Building A Computer LabRaiyan RahmanNo ratings yet

- Percentage Biased Differential Relay For 3-Winding TransformersDocument2 pagesPercentage Biased Differential Relay For 3-Winding TransformersshekooferiahiNo ratings yet

- Johan Sundberg. Intonation in Singing.Document15 pagesJohan Sundberg. Intonation in Singing.Юрий СемёновNo ratings yet

- 3.1. Optical Sources - LED - FOC - PNP - February 2022 - NewDocument49 pages3.1. Optical Sources - LED - FOC - PNP - February 2022 - NewyashNo ratings yet

- BSc Computer Science Degree Exam Papers and Sample QuestionsDocument5 pagesBSc Computer Science Degree Exam Papers and Sample Questionslalithkumar100% (1)

- Besam PowerSwing (Cua Mo)Document2 pagesBesam PowerSwing (Cua Mo)phuc_tuanNo ratings yet

- Lecture Exercise No. 3 Cell Structures and Their Functions Name:Luis Miguel W. Bautista Section:7 Date SubmittedDocument3 pagesLecture Exercise No. 3 Cell Structures and Their Functions Name:Luis Miguel W. Bautista Section:7 Date Submittedessketit ruruNo ratings yet

- Euromart Stores: 2.3M 283.2K 30.4K 8.0K 12.1% 792Document1 pageEuromart Stores: 2.3M 283.2K 30.4K 8.0K 12.1% 792Ashutosh Chauhan100% (1)

- Conzerv EM6400 Series Power Meters: User ManualDocument81 pagesConzerv EM6400 Series Power Meters: User ManualJayakanthan SangeeNo ratings yet