Professional Documents

Culture Documents

Rent 1: - Claim For Rent Relief For Private Rented Accommodation

Uploaded by

vkabatchOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rent 1: - Claim For Rent Relief For Private Rented Accommodation

Uploaded by

vkabatchCopyright:

Available Formats

Rent 1 - Claim for Rent Relief for Private Rented Accommodation

Important: Please read notes overleaf before completing this form

Separate forms should be completed for each property that you have rented

Claimants Details

First Name:

Last Name:

PPS Number:

Address:

Single Married or in a Civil Partnership Widowed or Surviving Civil Partner

In a Marriage or Civil Partnership (but living apart)

Divorced or in a dissolved Civil Partnership

Personal Status: (please select one of the following)

Date of Birth:

(Revenue will use

this address for

correspondence)

Address of Rented Property:

(if different from above)

Is the owner of the property related to you? (please tick box)

Date tenancy

commenced:

Date tenancy

ceased: (if ceased)

Amount of Rent Payable by you each month:

See overleaf for Declaration

which MUST be signed

D D M M Y Y Y Y

D D M M Y Y Y Y D D M M Y Y Y Y

Rented Property Details

Yes No

RPC003850_EN_WB_L_1

, .

Note:

The credit for the years 2011 onwards applies to individuals who were renting a property on

7 December 2010. No credit is due to individuals who began renting after 7 December 2010.

If yes, state relationship:

D D M M Y Y Y Y

Declaration which MUST be signed

I declare that all the particulars on this form are correct to the best of my knowledge and belief.

Signature:

E-mail Address: Phone No:

Date:

Refunds

If you wish to have any refund paid directly to your bank account, please supply your bank account

details.

Single Euro Payments Area (SEPA)

From 1 February 2014, account numbers and sort codes have been replaced by International Bank

Account Numbers (IBAN) and Bank Identifer Codes (BIC). These numbers are generally available on

your bank account statements. Further information on SEPA can be found on www.revenue.ie.

It is not possible to make a refund directly to a foreign bank account that is not a member of SEPA.

International Bank Account Number (IBAN) (Maximum 34 characters)

Bank Identifer Code (BIC) (Maximum 11 characters)

Note: Any subsequent Revenue refunds will be made to this bank account unless otherwise

notifed.

Who do you pay the rent to? (please tick box)

Does the Landlord live outside the State? (please tick box)

Landlord or Agent Name:

PPS or Tax Registration Number of Landlord or Agent (see overleaf):

Landlord or Agent Address:

Landlord Agent

Unknown No Yes

Please read notes on Landlord details overleaf Landlords Details

Who can Claim

An individual, paying for private rented accommodation used as a sole or main residence. This

includes rent paid for fats, apartments or houses. It does not include rent paid to Local Authorities or

State Agencies or under a lease agreement for 50 years or more.

Relevant limits

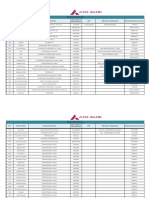

Tax years 2010 to 2017

The amount of the relevant limits are set out in the table below.

Tax Year Single

Under 55

Single

Over 55

Widowed or Surviving Civil

Partner or Married or in a

Civil Partnership

Under 55

Widowed or Surviving Civil

Partner or Married or in a Civil

Partnership

Over 55

2010 2,000 4,000 4,000 8,000

2011 1,600 3,200 3,200 6,400

2012 1,200 2,400 2,400 4,800

2013 1,000 2,000 2,000 4,000

2014 800 1,600 1,600 3,200

2015 600 1,200 1,200 2,400

2016 400 800 800 1,600

2017 200 400 400 800

Credit for rent paid will be withdrawn on a phased basis, ending in 2017.

4-year time limit

A claim for tax relief must be made within 4 years after the end of the tax year to which the claim

relates.

Premises outside the State

Rent payable for premises outside the State is also allowable.

Receipt from Landlord

You should obtain a receipt from your landlord as Revenue may ask for this to verify your claim. This

receipt should be retained for six years.

PPS or Tax Registration Number of Landlord or Agent

If this number is known or available to you please insert in the box overleaf. If unknown, please leave

blank.

Mortgage Interest Relief (TRS)

If at any point you have a mortgage and are in receipt of Tax Relief at Source you should advise

your Revenue offce immediately as you may no longer be entitled to Rent Relief and your Tax Credit

Certifcate might need to be adjusted.

Rent Relief for Private Rented Accommodation

Rent-a-Room Relief Restriction

Where Rent Relief is being claimed in respect of rent paid by a child to their parent, the parent will

not qualify for the Rent-a-Room exemption and will be required to declare their Rental Income to

Revenue at the end of the year.

Rents payable to Landlords living outside the State

If your landlord resides outside the country and you pay the rent directly to him or her or into his

or her bank account either in the State or abroad, you must deduct tax at the standard rate of tax

(currently 20%) from the gross rent payable. A form R185 should be completed and given to the

landlord. This form is available from any Revenue offce, or from Forms & Leafets Service,

LoCall 1890 306706 (Republic of Ireland only) or on www.revenue.ie.

Example

Gross rent per month 1,000

Deduct standard rate tax (1,000 x 20%) 200

Pay to Landlord (1,000 - 200) 800

Pay to Revenue 200

If you pay tax under the PAYE system an arrangement can be put in place at your request that your

tax credits and standard rate band will be adjusted to collect the amount due. This method will spread

the tax evenly over the year. You should contact your Revenue offce to arrange this.

Failure to deduct tax leaves you liable for the tax that should have been deducted

If you are a person with a disability and require this leafet in an alternative format the Revenue

Access Offcer can be contacted at accessoffcer@revenue.ie.

You might also like

- NatWest Current Account Application Form Non UK EU ResDocument17 pagesNatWest Current Account Application Form Non UK EU ResL mNo ratings yet

- Household Charge Form - An PostDocument5 pagesHousehold Charge Form - An PostIrl_tax_expertNo ratings yet

- Bond Refund FormDocument2 pagesBond Refund FormJofamu100% (1)

- Residents Discount Registration FormDocument9 pagesResidents Discount Registration FormtuyreNo ratings yet

- Bond Lodgement Form NZDocument2 pagesBond Lodgement Form NZJordyCarterNo ratings yet

- Current Account ApplicationDocument4 pagesCurrent Account ApplicationSourabh TiwariNo ratings yet

- Form12 PDFDocument16 pagesForm12 PDFAsder DareNo ratings yet

- Form 15G & 15H: Save Tds On Interest On FdsDocument6 pagesForm 15G & 15H: Save Tds On Interest On FdsShreekumarNo ratings yet

- Taxes On Commercial LeaseDocument8 pagesTaxes On Commercial Leasebelbel08No ratings yet

- BIR Form 1701 Filing GuideDocument4 pagesBIR Form 1701 Filing GuideJazz techNo ratings yet

- Prospective Tenant Information SheetDocument2 pagesProspective Tenant Information SheetCamille Louise Ferrer ContrerasNo ratings yet

- Minnesota Property Tax Refund: Forms and InstructionsDocument28 pagesMinnesota Property Tax Refund: Forms and InstructionsJeffery MeyerNo ratings yet

- Claim For Repayment of Tax Deducted From Savings and InvestmentsDocument4 pagesClaim For Repayment of Tax Deducted From Savings and InvestmentsxzmangeshNo ratings yet

- One Account Application DocumentsDocument7 pagesOne Account Application DocumentsjsinnNo ratings yet

- Philippines Taxation GuideDocument8 pagesPhilippines Taxation GuideCindy-chan DelfinNo ratings yet

- How To File Your Income Tax Return in The Philippines-COMPENSATIONDocument10 pagesHow To File Your Income Tax Return in The Philippines-COMPENSATIONmiles1280No ratings yet

- BIR Form 1700 filing guideDocument72 pagesBIR Form 1700 filing guidemiles1280No ratings yet

- SBI UK account openingDocument4 pagesSBI UK account openingTeja VaitlaNo ratings yet

- Eligible Exemption FAQ FY 23-24- Reference File for Income TaxDocument19 pagesEligible Exemption FAQ FY 23-24- Reference File for Income Taxdabawa5345No ratings yet

- Geokinetics international retirement plan termination formDocument2 pagesGeokinetics international retirement plan termination formmobla007No ratings yet

- Fatca Declaration Active Trade Channel IslandsDocument6 pagesFatca Declaration Active Trade Channel IslandsLosaNo ratings yet

- HMRC Charities variations formDocument7 pagesHMRC Charities variations formHabib Ur-RehmanNo ratings yet

- Tax return for 2013 tax yearDocument16 pagesTax return for 2013 tax yearmwf1806No ratings yet

- Installment Agreement RequestDocument1 pageInstallment Agreement Requestkyiwayphy03681No ratings yet

- Form 46G: Return of Third Party Information For The Year 2010Document4 pagesForm 46G: Return of Third Party Information For The Year 2010billyhorganNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormYaacov KotlickiNo ratings yet

- Withdrawal Great American Life FormsDocument13 pagesWithdrawal Great American Life FormsMax PowerNo ratings yet

- BIR FORM 1701 GUIDE FOR SELF-EMPLOYEDDocument22 pagesBIR FORM 1701 GUIDE FOR SELF-EMPLOYEDAlexander Cooley0% (1)

- Form 11: Tax Return and Self-Assessment For The Year 2014Document32 pagesForm 11: Tax Return and Self-Assessment For The Year 2014garyjenkins82No ratings yet

- Self Certifications PDFDocument2 pagesSelf Certifications PDFAhmed Issah100% (1)

- Change To Customer AddressDocument2 pagesChange To Customer Addressgio477No ratings yet

- BIR Form 0605 UsesDocument4 pagesBIR Form 0605 UsesCykee Hanna Quizo LumongsodNo ratings yet

- Petunjuk DGT Per 25 PJ 2018Document2 pagesPetunjuk DGT Per 25 PJ 2018RJF HsbnNo ratings yet

- Ca5403 Static PDFDocument3 pagesCa5403 Static PDFKamilaWolskaNo ratings yet

- Formr185 PDFDocument2 pagesFormr185 PDFAnayat Ur RehmanNo ratings yet

- Check tax-free interest eligibility formDocument1 pageCheck tax-free interest eligibility formjonyelyNo ratings yet

- Document Pack 9ST99MJR PDFDocument6 pagesDocument Pack 9ST99MJR PDFMohamed Diaa Mortada100% (1)

- It Declaration Year 2011 12Document1 pageIt Declaration Year 2011 12Vijay BokadeNo ratings yet

- Circular Ay 2010 11Document4 pagesCircular Ay 2010 11shaitankhopriNo ratings yet

- Notes For Completing Form R40Document12 pagesNotes For Completing Form R40hrpwmv83No ratings yet

- Form N4 - Checklist: Notice To End A Tenancy Early For Non-Payment of RentDocument3 pagesForm N4 - Checklist: Notice To End A Tenancy Early For Non-Payment of RentAppleNo ratings yet

- CSC Saln Base FormDocument3 pagesCSC Saln Base Formjocansino4496No ratings yet

- File Income Tax Returns in PakistanDocument5 pagesFile Income Tax Returns in PakistanadilNo ratings yet

- Federal 2016 :DDocument15 pagesFederal 2016 :DAnguila Angel Anguila AngelNo ratings yet

- 2 Employee Proof Submission (EPS) Form-TemplateDocument13 pages2 Employee Proof Submission (EPS) Form-TemplateAnil GanduriNo ratings yet

- BIR Form 1600Document39 pagesBIR Form 1600maeshach60% (5)

- LK DNN ModulesDocument1 pageLK DNN ModulesLatiful KhanNo ratings yet

- Tax Credit Claim Form 2018: For Donation Claims OnlyDocument2 pagesTax Credit Claim Form 2018: For Donation Claims OnlyasdfNo ratings yet

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- Tax Return 2012 Guide EnclosedDocument16 pagesTax Return 2012 Guide EnclosedNatalia Ciocirlan100% (1)

- Spain IndividualDocument22 pagesSpain IndividualhajolNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Form12 PDFDocument20 pagesForm12 PDFwattersed1711No ratings yet

- SET (O) Application For Indefinite Leave To Remain in The UK in One of The Categories Listed in This Form and A Biometric Immigration DocumentDocument84 pagesSET (O) Application For Indefinite Leave To Remain in The UK in One of The Categories Listed in This Form and A Biometric Immigration DocumentArsalanNo ratings yet

- Petunjuk_DGT1_PER_10_PJ_2017Document3 pagesPetunjuk_DGT1_PER_10_PJ_2017Fauzi AffanNo ratings yet

- NSW Claim For Refund of Bond MoniesDocument2 pagesNSW Claim For Refund of Bond MoniesM J RichmondNo ratings yet

- Account Holder: AEOI Self-Certification For An Individual/Controlling PersonDocument3 pagesAccount Holder: AEOI Self-Certification For An Individual/Controlling PersonNigil josephNo ratings yet

- Rent Application FormDocument4 pagesRent Application Formrickn9982No ratings yet

- Direct payments of LHA to landlordsDocument6 pagesDirect payments of LHA to landlordsaymanNo ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- Virtual Accounts Virtual Account ManagementDocument20 pagesVirtual Accounts Virtual Account ManagementIrfanListiawanNo ratings yet

- Open Call Letter v1Document43 pagesOpen Call Letter v1EdgarNo ratings yet

- X3 WhatsNew U9 FinanceCompliancy NFRDocument175 pagesX3 WhatsNew U9 FinanceCompliancy NFRAriel SpallettiNo ratings yet

- Mt940 Format DetailsDocument12 pagesMt940 Format DetailsrajiwaniNo ratings yet

- 18,500 New Update Mp2112 Turkey Gpi 103 Cash TTDocument6 pages18,500 New Update Mp2112 Turkey Gpi 103 Cash TTpezhmanbayat924No ratings yet

- XtensionLinkDocument5 pagesXtensionLinkuesli.selfoNo ratings yet

- Iban enDocument2 pagesIban enPeter ChristopherNo ratings yet

- BRD Bank statement analysis 01/09/14 - 24/08/15Document23 pagesBRD Bank statement analysis 01/09/14 - 24/08/15korfosNo ratings yet

- ERH-Payment Import Format Description BEC-November-2018 - UkDocument15 pagesERH-Payment Import Format Description BEC-November-2018 - UkCine WorldNo ratings yet

- IBAN Guide for Correspondent BanksDocument7 pagesIBAN Guide for Correspondent BanksNe VadimNo ratings yet

- Loading Payroll Interface Inbound Records Using HCM Data LoaderDocument18 pagesLoading Payroll Interface Inbound Records Using HCM Data LoaderyurijapNo ratings yet

- TestDocument1 pageTestAlex ȘerbanNo ratings yet

- Mt940e Extended Account StatementDocument55 pagesMt940e Extended Account StatementSaikat Babin BiswasNo ratings yet

- Account ConfirmationDocument2 pagesAccount ConfirmationEsia StachurskaNo ratings yet

- Fellowship Application Form - EuropeDocument4 pagesFellowship Application Form - EuropexingobuilderNo ratings yet

- OracleApps88 - Credit Card Payments Setups and Process in Oracle R12Document65 pagesOracleApps88 - Credit Card Payments Setups and Process in Oracle R12kottamramreddyNo ratings yet

- People Soft Bundle Release Note 9 Bundle21Document21 pagesPeople Soft Bundle Release Note 9 Bundle21rajiv_xguysNo ratings yet

- Nostro Account DetailsDocument3 pagesNostro Account Detailsanoop nandananNo ratings yet

- Cash Back Agreement via DTCDocument17 pagesCash Back Agreement via DTC17 ChnSad50% (2)

- BarclaysDocument1 pageBarclaysVera DedkovskaNo ratings yet

- New TT ApplicationDocument3 pagesNew TT ApplicationEdu DharmasenaNo ratings yet

- Sepa GuideDocument5 pagesSepa GuideSantosh Poojari0% (1)

- Charges Applied To The Main Banking Operations Carried Out by Legal EntitiesDocument11 pagesCharges Applied To The Main Banking Operations Carried Out by Legal EntitiesBenedict Wong Cheng WaiNo ratings yet

- Cigna ME Reimbursement Claim FormDocument2 pagesCigna ME Reimbursement Claim FormLimitless PritamNo ratings yet

- Jazzcash App Phython CodeDocument20 pagesJazzcash App Phython CodeMuhammad AliNo ratings yet

- BANDO DIRITTO ALLO STUDIO 2023 - 2024 en 2Document47 pagesBANDO DIRITTO ALLO STUDIO 2023 - 2024 en 2Elif Sultan KuzucularNo ratings yet

- View Bank Transactions ReportDocument12 pagesView Bank Transactions ReportAlina SinfulSweetNo ratings yet

- MT940 SpecificationsDocument14 pagesMT940 SpecificationsRajendran SureshNo ratings yet

- For Payments Other Than Imports and Remittances Covering Intermediary TradeDocument3 pagesFor Payments Other Than Imports and Remittances Covering Intermediary TradeBgrj AjitNo ratings yet

- His Hands International of Guatemaa O.N.G. PGL - L2L de Fecha 13032024 1Document11 pagesHis Hands International of Guatemaa O.N.G. PGL - L2L de Fecha 13032024 1albertjoe202No ratings yet