Professional Documents

Culture Documents

Echo Entertainment Group: The Star-Sydney: Executive Summary

Uploaded by

RISHIOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Echo Entertainment Group: The Star-Sydney: Executive Summary

Uploaded by

RISHICopyright:

Available Formats

Echo Entertainment Group: The Star- Sydney

ASHISH SUNDERASHAN 1

Executive Summary

This report is analyses on the Sydneys dominating integrated resort owned by Echo

Entertainment Group-The Star that has rapidly adapted to the concept of Mixed-Use-

Development and its strategic position amidst the huge competitive integrated resort market in

the country as well as neighboring country. The key caption of this evaluation is to get a strong

understanding of mixed-use-development concept and the business roles in integrated resorts.

This report also presents the overview of gambling industry and evolution of the industry with

the change in trend, expectations and time.

This report also pivots a well placed analytical tools such as Kotlers PEST framework and

Porters competitive analysis, which evaluates the internal and external environment of The

Star. It also flows with the logical and practical arguments on the recent challenges and how

The Star manages its resources and control its immediate risk to stage itself as a unique

integrated resort with a robust competitive advantage.

For a deeper understanding the relevant datas and statistics has been drawn out form the

government websites and company published journals as well as the current news reports. This

report on overall will be rounding about the Echo Entertainment Groups turbulence, the start,

the run in financial track and forecasting the success facts that have a breakthrough in every

step to success for a sustainable business in future.

Echo Entertainment Group: The Star- Sydney

ASHISH SUNDERASHAN 2

1. Introduction

1.1 Concept of Mixed used Development

Mixed used developments are the blend of residential, commercial and culturally modified

concepts that consists of fully functional institutions and industries that are physically

integrated, providing a financial pedestrian to the businesses involved in this concept.

Promisingly, The Star of Echo Entertainment Group quickly adapted to the mixed used

development and evolved providing a modern accommodation variety and spacing, ease of

accessibility between the hotels, retails, workplaces and entertainments. The Development

of more compact facilities and gaming infrastructures are shaped and designed to serve

people of all ages and families of all sizes satisfying the expectations of wide population of both

leisure and business market in Sydney and other parts of Australia.

Echo Entertainment Group holder of The Star has completed a $870 million renovation to I

improvise and expand star into an premium blend Integrated resort with a modern New Life

theme and an architectural design which fails to be a traditional nature blend resort whilst

occupying a huge space amidst the busy city of Sydney, with an investment of approximately

$2 billion with 4 hectares of full fledged entertainment, casino, restaurants and

accommodation serving over 10 million visitors per year ahead of 2013 (Echo entertainment

Group, 2012)

1.2 Evolution and Expansion of Integrated resorts (IR)

The first Casino was established in Australia (Wrest Point Hotel) in the year of 1973. Since the

Opening of first authorized casino in Tasmania the gambling sector was established vastly with

a massive growth of 13 casinos nation wide. However, Australia has been formed as the first

destination to authorize American style casinos in urban locations after the

monopolization of casinos in Perth, Gold Coast and Brisbane at 1980s with a biggest gambling

state globally as per the statistics shown in [Appendix- Fig.1].

The Australian casino industry with the integrated entertainments have shaped the countries

economy since 1980s and reshaping the sector in the year 1990s with a tight government

regulated authority to run legalized gambling industry in the country. Australian gambling

sector have retained their position since 1999 as a protuberant integrated entertainment

destination dominated by 6 major organizations in New South Wales and Queensland such as,

Star City casino previously owned by Tabcorp Group in Sydney now owned by Echo

Entertainment group- The Star, Conrad Group of Casinos and entertainments, Crown Groups

In Melbourne and Burswood Entertainment Group In Perth. Since then, the Mixed used

developments; as well as integrated resorts have become one of the newest trends changing

the entertainment sectors to a fully used development (Queensland Treasury and Trade, 2012).

Echo Entertainment Group: The Star- Sydney

ASHISH SUNDERASHAN 3

1.3 Overview of Australian Gambling Industry And Development of The Star

The mainstream gambling disbursement in Australia was from the Casinos located inside the

hotels and IRs generating 62% of total gambling expenditure in the year June 2012, which has

declined from 76% of total gambling expenditure since December 2002. Casinos in Australia

push 21% of contribution to the total gambling expenditure. Echo entertainment Group: The

Star being a 1.2% contributor of the total casino expenditure to the local Australian economy

with a total revenue of $ 230 AUD million in the year June 2012 shown in [Appendix -Fig1.1].

Consistently adding up to the total of $19 billion AUD of Australian gambling expenditure. The 4

hectare spread integrated resort in Sydney has also won the increased share of about 27% in

VIP Gaming market in the year 2012 with 10 million visitors with 14% increase compared to

the 2009 visitor statistics of 8.8 million. The overall gambling market in Australian territories

however seem to face a declination of visitors and the lose of interest levels, The Star

Integrated resort has planned to renovate its casino and expand with the help of Echo

Entertainment Group and starts to build a keen interest level amidst the local and

international markets (Echo entertainment Group, 2012).

2. Societal Analysis (Kotler, 2013)

2.1 Political Analysis

Casino regulations in Australia are specific to the jurisdiction with each state having its own

rules and legislations. Australian Casinos are subjected to more stringent regulatory acts than

the other gambling sectors located in other countries. However in Australia, the generalized

regulations includes Trade Exercises Act (1974). In NSW (Sydney) consists of more than

11 regulatory acts such as Casino Controlling Act (1992), Casino, Gaming and Liquor Control

Authority Act (2007), shown in [Appendix -Fig1.2].

The Star a product of Echo Entertainment Group has generated approximately $691 million

Non-Rebate gaming revenue with $186 million of tax pay to the government with a marginal tax

rate of 34.5% Including GST. By the expansion of the new casino proposed business in The

Star by end of 2013 the Group has forecasted of about 15 % increase in the Non rebate on

gaming tax rate of 50% with $740 million Non rebate gaming revenue and more than $200

million tax to the government increasingly shown in [Appendix - Fig 1.3] (Smith, 2000).

2.2 Economical Analysis

In 2008- 2010, NSW (Sydney) accounted for 37.6% of Australias overall gambling expenditure.

NSW accounted the higher percentage of expenditure with a maximum household disposable

income of 2.7% increasingly shown in [Appendix-Fig 1.4]. The trend in real per capita

expenditure by the NSW jurisdiction over the period of IRs emergence till date has seen a

massive growth in the Gambling economy. The total expenditure on gambling in NSW has

forecasted a string growth from 1990 till date with an increase in $468 million positive growth

with a 132% increase on real expenditure over decades. Echo Entertainment Groups Proposal

for the development for The Star integrated resorts is a significant move, which creates and

Echo Entertainment Group: The Star- Sydney

ASHISH SUNDERASHAN 4

generate high revenue in gambling sector contributing to the local economy (Australasian

Casino Association, 2010) & (Australasian Casino Association, 2008).

Echo entertainment Group-The Star has orderly predicted to deliver an additional of 330,000

international visitors per annum with its substantial investment in shaping tourism infrastructure

of approximately $1.2billion and increased gaming and payroll tax of more than $63 million per

annum by the year 2025. With these high counts on tourism footfalls and gambling expenditure

NSW would have positive impacts on the Gross state product with a $350 million increase and

creating job opportunities of about 4000 on and offshore skilled workforce. This revolutionary

development of The Star has more positive impacts on the local Australian economy with an

increased value of Australian dollar and the economical boost breaking recession threshold.

2.3 Social Analysis

The total population of Sydney comprises of 107,271 people living in the urban lands with a

median age of 32 years old and 20,680 families. The median income level of families without

children is $2985 AUD and family with children is $3233 AUD with a 21.7% of employment

status of 100% in Australian employment status statistics (Australian Bureau of Statistics, 2012)

shown in [Appendix- Fig 1.5].

Echo promotes responsible gambling and deliberately eyes on the target segments which

experiences lower range of problem gambling without requiring and additional gaming licenses.

The Star with Echo Entertainment group set up responsible gaming initiatives to support

customers of both internal and external sources and the wider community by providing

counseling services through experts. Adding to that Echo also focuses on creating job

opportunities to the local families and commit support to a policy-oriented responsible gambling

research to facilitate the needs of the customers.

Ethical Gambling initiatives such as age restrictions of 21 years and above as well as

citizenship entry fee of 150 AUD has been implemented by The Star casino to minimize the

high gambling addiction in respective states of Australia. However, controlled measures of

compulsive gambling and illegal gambling is evident in the state of Sydney [Australia] it has

been difficult to regulate the control over it. Moral gambling initiatives of controlling theft, fraud

by Echo Entertainment Groups- The Star has taken preventive measures by counseling

people affected by household debts and addiction by joining hands with The Heroes-

Prevention and Detection Program (Gill, Luijerink and Bell 2013).

2.4 Environmental Analysis

The NSW (Sydney) Regulatory environment act is one of the most stringent acts like other

environmental acts followed by the integrated resorts in competitive countries. To Ensure the

NSW regulatory and framework, The Star creates and competitive edge with other integrated

resorts in Australia by modernizing the technology with minimal energy usage, state of art

Echo Entertainment Group: The Star- Sydney

ASHISH SUNDERASHAN 5

renewable resources. Ensuring apt risk based approach to the NSW regulations by adopting

markets best practices as well as changes in technology and consumer habits and

expectations. The Star being a trendsetter of the next generation integrated resort plans to

increase efficiencies for both Echo and ILGA (Independent Liquor and Gaming Authority) by

keeping the existing framework of environmental regulations and reform the practices that are

best suited for the stakeholders for implementation. (Echo Entertainment Group, 2012)

2.5 Competitor Analysis (Porter, 2013)

The Crown Hotels and Integrated Resorts are one of the major competitors for the Echo

Entertainment Group: The Star, which comprised of similar services and products before

Star expansion. The Star differentiated itself from The Crown by function of their scope and the

mass capability to offer the mainframe work of the tourism growth opportunities. The Crown

groups whereas targets only 1 out of 3 major market segments leaving them unable to

generate any revenue to the incremental economic growth as well as low involvement in

economic activities such as taxation and employment opportunities. As the Second casino

competitor in Sydney, it is not dependent on market growth to justify investment;

cannibalization of revenues from The Star provides a practical profit pool to underpin

investment. However, a proposal grounded on cannibalization delivers far inferior

economic outcomes for NSW than one based on market growth. Echo Entertainment Group is

the only IR that is dependent on growing the amusement and potential tourism market to justify

its revenue speculation in Sydney as shown in (Appendix Fig 1.6).

The buying powers are tolerated by The Star, by addressing the needs and requirements of

High Rollers and the MICE groups which has a supreme power to price modulation. The

suppliers who pull in target audiences globally, such as Viator, Topdecks, Sydney Tours and

government sites like Tourism Australia help The star in materialistically branding and

increased footfalls to The Star Integrated Resort (Echo Entertainment Group Profile, 2012) &

(Nicholls, 2013) shown in (Appendix Fig 1.7 & 1.8).

3. Challenges

3.1 Skilled labor force

Echo Entertainment Group-The Star integrated resort, has promised to create 5750

employment opportunity with 1460 permanent job scope for the Sydney people. The statistics

states about the global economic crisis and work force crunch in the companies has been

negated by the Australian economy and the hiring of skilled labor as been actively taking place

effectively. However, finding skilled labor in the Australian soil is yet a challenge for The Star,

which is located amidst the rich Australian natural resources and revolutionary renewable

energy hub. Foreign manpower tend to migrate into Australia opting for the job that

provides good pay and ease of finding job for the openings in The Star integrated resorts. In

order to provide jobs for foreign labors, the Sydney placed integrated resort tend to lose the

Echo Entertainment Group: The Star- Sydney

ASHISH SUNDERASHAN 6

local skilled manpower and leaving the industry with no choice to hire foreign labors to

compromise on the skilled work (Australian Bureau of Statistics, 2012).

3.2 Investment Opportunities

With a huge base of gaming revenue that is accessible to fund in non-gaming infrastructures

spread widely across numerous operators, each significant operator will have minimum

capacity to reinvest into a non-gaming tourism infrastructure. The consequences of this would

leave all the operators from having financial capability to build and integrated resort of that

standard to compete on a nation basis. There would be a reduced re-investment opportunity

into the future shaping of business and changes in competitive sector. The investment

opportunities would be crunched in such a way that the existing operator could only drive

returns on investment through the incremental tourism growth and revisiting foreign market

growth. However, the emergence of new integrated resort through foreign investment in NSW

with a increase in gambling products would have an adverse affect on the existing responsible

gaming market in the State (ONeil 2013).

4. The Star as Mixed Use Development

Casino Generated 48% of the total revenue in the year-end of 2012 leaving the net profit

of $229 million according to the Echos annual report. Its proposed that the revenue was

generated from the front money of both new and repeated guests of VIPs from Local and

International market mostly from Asian-Pacific region (Echo Entertainment Group Annual Report,

2012)

Restaurant / Hotels/ Clubs and PubsBeing a partial but important contributor stream, it

showed a relative growth of 70% revenue growth in the year 2013 June by accommodating and

serving guests and strong a tourism boosting product of Sydney. The Star states it to be

contributing about 33 % of revenue to the current approximate total revenue $ 280 million a

year. 11 restaurants and cuisines served by 6 celebrity chefs like Adriano Zumbo and David

Chang and 3- 5 Star graded hotels with 8 night clubs and pubs all together serve the guests to

create their own experience story and returning back year on year (Echo Entertainment Group

Annual Report, 2012).

The Spa- The traditionally designed day spa with a uniquely themed Moroccan Hammam ritual

which offers a wide range of beauty products and services from Massage services to couple

date spa treatments and exclusive aroma therapies. The Spa however is a minor contributor for

the revenue yet, acts as an added advantage of the package and shares its stream of revenue

to the total profit (The Star, 2012).

Events and Functions-The Uniquely Designed and renovated function room and ballroom

with a largest holding capacity of 4000 people quotes to be the most impressive infrastructural

epitome in Sydney. And the Events room of 2500 capacity named Marquee is the ideal spot for

Echo Entertainment Group: The Star- Sydney

ASHISH SUNDERASHAN 7

night events and music concerts that drives The Star to retain guests with surprise all year

round entertainment events as well as MICE, Business groups who choose to set up exhibitions

and stalls with sponsorship in their magnificent large event rooms. Events such as Blueman

Show, David Guetta shows, Ricky Martin concert, these international events not only draws the

crowd all over the world but also attracts the attention of mass medias and international news

medias and sponsorships which helps as the powerful branding for Echo Entertainment

Groups prestigious flagship The Star (Star, 2013).

Retail Shop- The matchlessly branded Stay & Shop theme of The Star Integrated resort is

seamlessly an ultimate shopping experience for the guests who stay at The Star parallel to the

physical shopping experience guests can also shop online retail store of The Star staying at the

hotel which would be delivered at the door step. Retail Therapy is a brand mascot created by

The Star retail departments that believes to enhance the shopping experience by offering

promotions and offers to the guests who spend more the $100 on any of their international multi

brands such as Calvin Klein Jeans, Bottega Veneta, Chanel Beauty Boutique, G-Star, Gucci,

famous Justine Rose and so on. This is an added advantage to the chain of revenue streams

amidst that high source of revenue generators of The Star as listed above (Star, 2013).

5. Sustainability and Sustainable Factors

5.1 Competitive Advantage

From world class gaming experience to the globally acclaimed chefs in its signature

restaurants, sets a new benchmark of a luxury lifestyle and modernized accommodation and

themed day spas. Delivering superior services all under one roof. Over a year of growth, The

Star attained revenue of $111.3 million, which was 53.2% lower than the previous financial

year. The Stars gross revenue escalated by 2.7% to $1,023.6 million. The uniquely designed

glass faade entrance embracing the Sydneys Harbour and Sky Scrapers with the VIP gaming

experience stay that includes private jet transportation and limousine services to the VIP suites.

This stands as the ultimate competitive advantage compared to Crown Hotel and Casino.

Another competitive lead of The Star Sydney is The Darling with a refurbished first 5 Start hotel

in Sydney that offers 171 stylish VIP rooms of own private gaming rooms and its uniquely

designed event rooms which has the largest floor space capacity of 4000 that attracts nearly

17% of MICE revenue of $100 million in 2013. Since these niche features as well as one-of-a-

kind Integrated resort creating an entertainment destination (The Star, 2013) shown in

(Appendix Fig 1.9).

5.2 All-Inclusive Strategy and its benefits

Echo entertainment Group-The Star has the niche ability to create several memories on the

same night of stay at the luxurious visit under one roof. One visit to entertainment destination

The Star, offers a unlimited experience to the guests from music performance, luxurious day

spa, super dining experience, night clubs, bar and ultimate gaming experience as well as

Echo Entertainment Group: The Star- Sydney

ASHISH SUNDERASHAN 8

private gaming rooms which is tailored according to the guest needs. This all-inclusive strategy

offers a superior blend of fun stay providing multiple reasons to visit and revisit of the targeted

VIP business and International tourist market. The chain linked to all revenue streams during

the stay in The Star creates a 3.8% revenue growth per average length of stay by up-scaling

the service standards and the upgrading facilities keeping on charts that the VIP market

segments are becoming competitive for Integrated Resorts in Asian-Pacific region (Echo

Entertainment Group Annual Report, 2012).

5.3 Risk Management

The Board of Risk and Compliance Echo Group Committee have responsibility for examining

health and safety issues and safeguarding keen focus on health and safety risks as well as the

prospects within the business. The flexibility of the Groups Health and Safety Management

Systems has provided a firm basis for unremitting improvement and audit results in managing

business and financial risks. Demand risks such as the expectations of target audience in order

to gamble has been handled in legally and ethical way by the Echo Group. In financial risks

such as interest rate risks and foreign currency risk the group has a policy of controlling

exposure to interest rate stipulations and hedging USD/AUD conversion maturity levels.

However natural disasters are unstoppable yet The Echo Groups have taken preventive

measures to maximize the security and safety levels to minimize occurrence of those threats to

their guests and internal guests. (AXS Corporate Governing Council 2013)

6. Conclusion

The change in lifestyle, change in trends, power of income and the cultural change has huge

impact in the development of the casinos and entertainment concepts. Casinos being the major

money generating entity occupying a minor space in the IR occupying huge space of natural

reserves and energy consumption compared to the city hotels. In order to sustain in this business

one the major IR player, Echo Entertainment Group: The Star continues to create key selling

entertainments and events to attract and retain the local as well as international markets

sustainably. However, The existing market players is small and its not seen to be growing rapidly

particularly in New South Wales while the International VIP segments has a massive growth in

recent years due to rapid economic growth in Asia-Pacific countries. This leaves The Star to have

a sustainable future ahead in generating profitable revenue offering exclusive services to the

guests by keeping the market of NSW for itself.

Echo Entertainment Group: The Star- Sydney

ASHISH SUNDERASHAN 9

7. References

ACA (Australasian Casino Association) 2008. The Australian Casino Industry: Economic Report 2006-

2007,pp.

ACA (Australasian Casino Association). 2010. Casino Industry Survey: Economic Reports 2009-

2010,pp.

Australian Bureau of Statistics, 2012. Australian Demographic Statistics. Population by Age and Sex,

Regions of Australia, 1, 1-10.

AXS Corporate Governance Council. 2013. Echo Corporate Governance Statement. Queensland: Echo

Entertainment Group Limited

Echo Entertainment Group Profile. 2012. Asia Investor Road Show 2012. Queensland: Echo

Entertainment Group Limited

Echo entertainment Group. 2012. Annual report 2012. Queensland: Echo Entertainment Group Limited

E Porter, M. 2013. Competitive Strategy. 1st ed. New York: The Free Press. England: Prentice Hall.

Gill, G., Luijerink, D., Bell, S. 2013. Forensic Survey of Fraud. A survey of fraud, bribery and corruption

in Australia & New Zealand 2012, 5, 1-41.

Kotler, P. 2013. Principles of Marketing (15th Edition). 15. Prentice Hall.

Nicholls, S. 2013. A battle royale for the very, very profitable VIPs. Sydney Morning Herald, 29 June. 3.

ONeil, J. 2013. Half-Year Results Announcements and Accounts. Echo Entertainment Group Directors

Report, 2,1-13.

Queensland Treasury And Trade. 2012. Australian Gambling Report. Australian Gambling Statistics

2009 - 2010, 28, 1-37.

Smith, J. 2000. Gambling Taxation: Public Equity in the Gambling Business. The Australian Economic

Review, 33.120144.

Star. 2013. Sydney Hotels, Restaurants, Casino and Entertainment. [Online] Available at: http://

www.star.com.au [Accessed 16 September 2013].

The Editor. 2013. Sydney's Star Casino offers $250 million for exclusive license. ABC News, 23 June.

2.

The Star. 2012. The Spa Brochure. Queensland: Echo Entertainment Group Limited

The Star. 2013. Unsolicited Proposal to NSW Government To Further Develop the Star as Sydneys

Only Integrated Resort. Queensland: Echo Entertainment Group Limited

You might also like

- Promotional Version of Crown's Submission in Support of Its Unsolicited ProposalDocument33 pagesPromotional Version of Crown's Submission in Support of Its Unsolicited ProposalBetel AbeNo ratings yet

- Crown Resorts ReportDocument16 pagesCrown Resorts ReportcharlesNo ratings yet

- MGM Osaka PresentationDocument34 pagesMGM Osaka PresentationMassLiveNo ratings yet

- Course Notes Handbook RSGDocument26 pagesCourse Notes Handbook RSGjaeNo ratings yet

- RUTGERS The Contribution of The Casino Hotel Industry To New Jerseys EconomyFinal May 26 2010 Revision3Document71 pagesRUTGERS The Contribution of The Casino Hotel Industry To New Jerseys EconomyFinal May 26 2010 Revision3Cfk DonNo ratings yet

- 5star Hotel Business Plan - MG321 Major AssignmentDocument35 pages5star Hotel Business Plan - MG321 Major AssignmentGrace Versoni90% (21)

- 4-Star Hotel SouthDocument41 pages4-Star Hotel SouthRamon ColonNo ratings yet

- Business Events News For Mon 24 Feb 2014 - Dubai/'s Record Growth, GCCEC 10 Years, Accor and AFL Partner, Getting To Know The Central Coast and MoreDocument3 pagesBusiness Events News For Mon 24 Feb 2014 - Dubai/'s Record Growth, GCCEC 10 Years, Accor and AFL Partner, Getting To Know The Central Coast and MoreBusiness Events NewsNo ratings yet

- Business Events News For Mon 30 May 2016 - MCEC Expansion, MEETINGS, Luxperience, Tourism Portfolio, Business Events Tasmania and Much MoreDocument2 pagesBusiness Events News For Mon 30 May 2016 - MCEC Expansion, MEETINGS, Luxperience, Tourism Portfolio, Business Events Tasmania and Much MoreBusiness Events NewsNo ratings yet

- Outer Hebrides Creative Industries Strategy 2006-2009Document10 pagesOuter Hebrides Creative Industries Strategy 2006-2009Nimrah RanaNo ratings yet

- Private Investment in Culture: Executive SummaryDocument20 pagesPrivate Investment in Culture: Executive SummarygokderNo ratings yet

- ScreenCurrency SA ReportDocument12 pagesScreenCurrency SA ReportSyeda MahvishNo ratings yet

- Analysis of Australian Financial SystemDocument20 pagesAnalysis of Australian Financial SystemSUMAN BERANo ratings yet

- JKH - WPL Rights Issue Update - 20131021Document10 pagesJKH - WPL Rights Issue Update - 20131021Randora LkNo ratings yet

- News Release - Ascott Expands Global Presence With 26 New PropertiesDocument9 pagesNews Release - Ascott Expands Global Presence With 26 New PropertiesVirak ThitNo ratings yet

- Business Events News For Wed 07 Mar 2012 - TAA, NCC, Business Tourism, Ipswich, Coffs, Movie Tickets and Much MoreDocument4 pagesBusiness Events News For Wed 07 Mar 2012 - TAA, NCC, Business Tourism, Ipswich, Coffs, Movie Tickets and Much MoreBusiness Events NewsNo ratings yet

- Business Events News: Upgrade Cessnock Airport'Document5 pagesBusiness Events News: Upgrade Cessnock Airport'Business Events NewsNo ratings yet

- Firm War Slot IIDocument11 pagesFirm War Slot IIjnrrejkeNo ratings yet

- Project Feasibility Study: For Establishing Five Star Hotel in Mekelle CityDocument25 pagesProject Feasibility Study: For Establishing Five Star Hotel in Mekelle Citysolomon atsbeha100% (2)

- 04 CasinoDocument6 pages04 CasinoJinendra Aherkar0% (1)

- Big Gambling The Rise of The Global Industry State Gambling ComplexDocument5 pagesBig Gambling The Rise of The Global Industry State Gambling ComplexAjmarel Mizarelly AjazihNo ratings yet

- Business Events News For Fri 29 Aug 2014 - TEQ Turns It Up, Shangri-La's $11m Refurb, Eternity Is Here, The Jen On Traders and Much MoreDocument2 pagesBusiness Events News For Fri 29 Aug 2014 - TEQ Turns It Up, Shangri-La's $11m Refurb, Eternity Is Here, The Jen On Traders and Much MoreBusiness Events NewsNo ratings yet

- Oriental DisneylandDocument15 pagesOriental DisneylandDhiangga JauharyNo ratings yet

- Business Events News For Wed 08 Aug 2012 - SCEC/'s Centre Stories, TA/'s Prospectus, Queenstown Makeover, IHG and Much MoreDocument3 pagesBusiness Events News For Wed 08 Aug 2012 - SCEC/'s Centre Stories, TA/'s Prospectus, Queenstown Makeover, IHG and Much MoreBusiness Events NewsNo ratings yet

- Business Events News: EEAA Partners With Tourism AusDocument4 pagesBusiness Events News: EEAA Partners With Tourism AusBusiness Events NewsNo ratings yet

- Business Events News For Wed 09 May 2012 - EEAA On MCEC Growth, Tassie Development, Skyrail, Nautica Cruises and Much MoreDocument3 pagesBusiness Events News For Wed 09 May 2012 - EEAA On MCEC Growth, Tassie Development, Skyrail, Nautica Cruises and Much MoreBusiness Events NewsNo ratings yet

- Business Events News: MEA Calls For ApplicationsDocument2 pagesBusiness Events News: MEA Calls For ApplicationsBusiness Events NewsNo ratings yet

- Trying For The Past 3 Years Having Issues With India's Rules Entering India in A JV With Tata CoffeeDocument9 pagesTrying For The Past 3 Years Having Issues With India's Rules Entering India in A JV With Tata CoffeeMansi JoshiNo ratings yet

- Business Events News: BECA Confirms HingertyDocument3 pagesBusiness Events News: BECA Confirms HingertyBusiness Events NewsNo ratings yet

- Business Events News For Fri 01 Jun 2012 - Club Med, Grant, Hyatt, Getting To Know and Much MoreDocument3 pagesBusiness Events News For Fri 01 Jun 2012 - Club Med, Grant, Hyatt, Getting To Know and Much MoreBusiness Events NewsNo ratings yet

- Economic Structure of Park Hyatt SydneyDocument6 pagesEconomic Structure of Park Hyatt SydneyAnjali DudarajNo ratings yet

- Aristocrat Leisure: Jump To Navigationjump To SearchDocument3 pagesAristocrat Leisure: Jump To Navigationjump To SearchReovolut1onNo ratings yet

- Business Events News: No MCEC Expansion FundingDocument6 pagesBusiness Events News: No MCEC Expansion FundingBusiness Events NewsNo ratings yet

- Heritage Tourism Benefits Report 2013Document26 pagesHeritage Tourism Benefits Report 2013Lay MankadNo ratings yet

- Business Events News: BET's Best Months in 10 YearsDocument2 pagesBusiness Events News: BET's Best Months in 10 YearsBusiness Events NewsNo ratings yet

- Oderid56301 Lhihbp3sDocument11 pagesOderid56301 Lhihbp3sTanmoy NaskarNo ratings yet

- Oderid56301 Lhihbp3sDocument11 pagesOderid56301 Lhihbp3sTanmoy NaskarNo ratings yet

- Business Events News For Fri 19 Jul 2013 - Starwood Hawaii, MCI, Club Med, Macau and Much MoreDocument3 pagesBusiness Events News For Fri 19 Jul 2013 - Starwood Hawaii, MCI, Club Med, Macau and Much MoreBusiness Events NewsNo ratings yet

- Business Events News: Uluru To Host Biz Chicks ConfDocument2 pagesBusiness Events News: Uluru To Host Biz Chicks ConfBusiness Events NewsNo ratings yet

- Tourism Vision 2020 Northern Territorys Strategy For GrowthDocument52 pagesTourism Vision 2020 Northern Territorys Strategy For Growthunu doiNo ratings yet

- Tourism Department - 0Document20 pagesTourism Department - 0Mahesh GopalakrishnanNo ratings yet

- Ruane Cunniff Sequoia Fund Annual LetterDocument29 pagesRuane Cunniff Sequoia Fund Annual Letterrwmortell3580No ratings yet

- Destination Management AustraliaDocument14 pagesDestination Management AustraliaMriganga BarmanNo ratings yet

- Business Events News: MEA Winners AnnouncedDocument3 pagesBusiness Events News: MEA Winners AnnouncedBusiness Events NewsNo ratings yet

- R9113 Sports and Recreation Facilities Operation in Australia Industry Report - at A GlanceDocument13 pagesR9113 Sports and Recreation Facilities Operation in Australia Industry Report - at A Glancedecheny7No ratings yet

- Crisis, What Crisis The EffecDocument15 pagesCrisis, What Crisis The EffecNajya AzzahraNo ratings yet

- Dereje AsnakeDocument50 pagesDereje AsnakeRamon ColonNo ratings yet

- VV3 Press-Release PlacementDocument4 pagesVV3 Press-Release PlacementJoeKaviNo ratings yet

- BSBMKG605 - Assessment Number 2 - Laven Basne - pr3229Document7 pagesBSBMKG605 - Assessment Number 2 - Laven Basne - pr3229lavenbasnetNo ratings yet

- Business Events News For Fri 31 Aug 2012 - Venue NSW, Silversea, EEAA, Getting To Know and Much MoreDocument3 pagesBusiness Events News For Fri 31 Aug 2012 - Venue NSW, Silversea, EEAA, Getting To Know and Much MoreBusiness Events NewsNo ratings yet

- Entain PLC Acquisition of BetCityDocument5 pagesEntain PLC Acquisition of BetCityIan GardinerNo ratings yet

- Business Events News For Wed 24 Sep 2014 - New Panel For SA Tourism, M&E Oz Spend Lift, Jet Park Conf Centre, Getting To Know: Ladakh, and Much MoreDocument3 pagesBusiness Events News For Wed 24 Sep 2014 - New Panel For SA Tourism, M&E Oz Spend Lift, Jet Park Conf Centre, Getting To Know: Ladakh, and Much MoreBusiness Events NewsNo ratings yet

- Family Entertainment Centre Tourism OpportunityDocument21 pagesFamily Entertainment Centre Tourism OpportunityAlif Rizky BaihaqiNo ratings yet

- Business Events News For Fri 03 Feb 2012 - Diethelm, Carnival Australia, Starwood, MEA, Pullman and Much MoreDocument5 pagesBusiness Events News For Fri 03 Feb 2012 - Diethelm, Carnival Australia, Starwood, MEA, Pullman and Much MoreBusiness Events NewsNo ratings yet

- Business Events News For Wed 25 Jun 2014 - Brisbane Show Success, ICE Launch, Aquis, Star Ratings, EEAA and Much MoreDocument3 pagesBusiness Events News For Wed 25 Jun 2014 - Brisbane Show Success, ICE Launch, Aquis, Star Ratings, EEAA and Much MoreBusiness Events NewsNo ratings yet

- 20020307-08 Denis HewDocument25 pages20020307-08 Denis HewJack CalvenNo ratings yet

- Business Events News Business Events News: Eeaa Reveals Growth AspirationsDocument4 pagesBusiness Events News Business Events News: Eeaa Reveals Growth AspirationsBusiness Events NewsNo ratings yet

- Business Events News For Wed 23 Jul 2014 - Mantra's Biz Ev Engine, CWT Meetings Leader, NZ To Host Ministers, Face To Face and Much MoreDocument3 pagesBusiness Events News For Wed 23 Jul 2014 - Mantra's Biz Ev Engine, CWT Meetings Leader, NZ To Host Ministers, Face To Face and Much MoreBusiness Events NewsNo ratings yet

- Addis Ababa Science and Technology UniversityDocument15 pagesAddis Ababa Science and Technology UniversityYabsra kasahunNo ratings yet

- Energy And Environmental Hedge Funds: The New Investment ParadigmFrom EverandEnergy And Environmental Hedge Funds: The New Investment ParadigmRating: 3.5 out of 5 stars3.5/5 (2)

- Finding Roots of Equations Bracketing MethodsDocument11 pagesFinding Roots of Equations Bracketing MethodsmebrahtenNo ratings yet

- Mus Culo SkeletalDocument447 pagesMus Culo SkeletalKristine NicoleNo ratings yet

- Theology and Pipe Smoking - 7pDocument7 pagesTheology and Pipe Smoking - 7pNeimar HahmeierNo ratings yet

- Simplified Cost Accounting Part Ii: Solutions ManualDocument58 pagesSimplified Cost Accounting Part Ii: Solutions ManualAnthony Koko CarlobosNo ratings yet

- Reflection SogieDocument11 pagesReflection SogieCHRISTIAN ALLEN S. LOPENANo ratings yet

- WatsuDocument5 pagesWatsuTIME-TREVELER100% (1)

- Chapter 10: Third Party Non-Signatories in English Arbitration LawDocument13 pagesChapter 10: Third Party Non-Signatories in English Arbitration LawBugMyNutsNo ratings yet

- MATH 7S eIIaDocument8 pagesMATH 7S eIIaELLA MAE DUBLASNo ratings yet

- Financial Vs Health and Safety Vs Reputation Vs Opportunity CostsDocument11 pagesFinancial Vs Health and Safety Vs Reputation Vs Opportunity Costschanlego123No ratings yet

- Pemphigus Subtypes Clinical Features Diagnosis andDocument23 pagesPemphigus Subtypes Clinical Features Diagnosis andAnonymous bdFllrgorzNo ratings yet

- Gianna Pomata (Editor), Nancy G. Siraisi (Editor) - Historia - Empiricism and Erudition in Early Modern Europe (Transformations - Studies in The History of Science and Technology) (2006)Document493 pagesGianna Pomata (Editor), Nancy G. Siraisi (Editor) - Historia - Empiricism and Erudition in Early Modern Europe (Transformations - Studies in The History of Science and Technology) (2006)Marcelo Rizzo100% (1)

- ch09 (POM)Document35 pagesch09 (POM)jayvee cahambingNo ratings yet

- Department of Education Division of Cebu ProvinceDocument5 pagesDepartment of Education Division of Cebu ProvinceNelsie FernanNo ratings yet

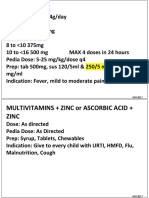

- Common RHU DrugsDocument56 pagesCommon RHU DrugsAlna Shelah IbañezNo ratings yet

- LabDocument11 pagesLableonora KrasniqiNo ratings yet

- Group Process in The Philippine SettingDocument3 pagesGroup Process in The Philippine Settingthelark50% (2)

- IOSH Managing Safely Leaflet For Training ProvidersDocument6 pagesIOSH Managing Safely Leaflet For Training ProvidersShakil Ahmad AligNo ratings yet

- Effect of Employee Loyalty On Customer S PDFDocument37 pagesEffect of Employee Loyalty On Customer S PDFShailendra DasariNo ratings yet

- (Applied Logic Series 15) Didier Dubois, Henri Prade, Erich Peter Klement (Auth.), Didier Dubois, Henri Prade, Erich Peter Klement (Eds.) - Fuzzy Sets, Logics and Reasoning About Knowledge-Springer NeDocument420 pages(Applied Logic Series 15) Didier Dubois, Henri Prade, Erich Peter Klement (Auth.), Didier Dubois, Henri Prade, Erich Peter Klement (Eds.) - Fuzzy Sets, Logics and Reasoning About Knowledge-Springer NeAdrian HagiuNo ratings yet

- Automated Long-Distance HADR ConfigurationsDocument73 pagesAutomated Long-Distance HADR ConfigurationsKan DuNo ratings yet

- Geographical Milieu of Ancient KashiDocument14 pagesGeographical Milieu of Ancient Kashismk11No ratings yet

- 4.dynamic Analysis of Earth Quake Resistante Steel FrameDocument28 pages4.dynamic Analysis of Earth Quake Resistante Steel FrameRusdiwal JundullahNo ratings yet

- SEO Roadmap - Bayut & DubizzleDocument17 pagesSEO Roadmap - Bayut & Dubizzlebasel kotbNo ratings yet

- Đại Từ Quan Hệ Trong Tiếng AnhDocument5 pagesĐại Từ Quan Hệ Trong Tiếng AnhNcTungNo ratings yet

- Pengaruh Kompetensi Spiritual Guru Pendidikan Agama Kristen Terhadap Pertumbuhan Iman SiswaDocument13 pagesPengaruh Kompetensi Spiritual Guru Pendidikan Agama Kristen Terhadap Pertumbuhan Iman SiswaK'lala GrianNo ratings yet

- Gaulish DictionaryDocument4 pagesGaulish DictionarywoodwyseNo ratings yet

- Exposicion Verbos y AdverbiosDocument37 pagesExposicion Verbos y AdverbiosmonicaNo ratings yet

- The Students Ovid Selections From The Metamorphoses by Ovid, Margaret Worsham MusgroveDocument425 pagesThe Students Ovid Selections From The Metamorphoses by Ovid, Margaret Worsham MusgroveMiriaam AguirreNo ratings yet

- 3658 - Implement Load BalancingDocument6 pages3658 - Implement Load BalancingDavid Hung NguyenNo ratings yet