Professional Documents

Culture Documents

Alt - HR080815 Eeff 082T

Uploaded by

camarquezb0 ratings0% found this document useful (0 votes)

12 views15 pagesThis document provides financial statements for Alturas Minerals Corp. for the three and nine month periods ending June 30, 2008. It shows that as of June 30, 2008, Alturas had cash and cash equivalents of $3.5 million, total assets of $3.9 million, and total shareholders' equity of $3.4 million. For the nine month period ending June 30, 2008, Alturas had a net loss of $4.7 million and spent $3.7 million on exploration expenses. Cash used in operating activities for the nine month period was $4.3 million.

Original Description:

Original Title

ALT_HR080815 EEFF 082T

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides financial statements for Alturas Minerals Corp. for the three and nine month periods ending June 30, 2008. It shows that as of June 30, 2008, Alturas had cash and cash equivalents of $3.5 million, total assets of $3.9 million, and total shareholders' equity of $3.4 million. For the nine month period ending June 30, 2008, Alturas had a net loss of $4.7 million and spent $3.7 million on exploration expenses. Cash used in operating activities for the nine month period was $4.3 million.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views15 pagesAlt - HR080815 Eeff 082T

Uploaded by

camarquezbThis document provides financial statements for Alturas Minerals Corp. for the three and nine month periods ending June 30, 2008. It shows that as of June 30, 2008, Alturas had cash and cash equivalents of $3.5 million, total assets of $3.9 million, and total shareholders' equity of $3.4 million. For the nine month period ending June 30, 2008, Alturas had a net loss of $4.7 million and spent $3.7 million on exploration expenses. Cash used in operating activities for the nine month period was $4.3 million.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 15

ALTURAS MINERALS CORP.

(A development stage company)

Consolidated Interim Financial Statements

Three and nine months ended June 30, 2008

(Expressed in US dollars unless otherwise stated)

(Unaudited)

ALTURAS MINERALS CORP.

(A development stage company)

CONSOLIDATED INTERIM BALANCE SHEETS

(Expressed in US$ unless otherwise stated) (Unaudited)

As at June 30, As at September 30

2008 2007

ASSETS

Current assets

Cash and cash equivalents 3,542,422 $ 7,876,501 $

Accounts receivable 46,210 30,333

Prepayments 24,002 34,387

3,612,634 7,941,221

Mineral properties (Note 6) 240,000 240,000

Property, plant and equipment (Note 5) 65,937 60,687

3,918,571 $ 8,241,908 $

LIABILITIES

Current liabilities

Accounts payable and accrued liabilities 140,861 $ 138,734 $

Non current liabilities

Due to Equinox Minerals Limited (Note 7) 375,000 375,000

515,861 513,734

SHAREHOLDERS' EQUITY

Share capital (Note 8) 14,393,129 14,393,129

Warrants (Note 11) 1,135,454 1,451,234

Contributed surplus (Note 10) 3,533,303 2,890,972

Deficit (15,659,176) (11,007,161)

3,402,710 7,728,174

3,918,571 $ 8,241,908 $

See accompanying notes to interim consolidated financial statements.

Nature of operations and going concern (Note 1)

Commitments (Note 12)

- 1 -

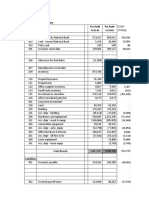

ALTURAS MINERALS CORP.

(A development stage company)

CONSOLIDATED INTERIM STATEMENTS OF LOSS AND COMPREHENSIVE LOSS

(Expressed in US$ unless otherwise stated) (Unaudited)

Three months Three months Nine months Nine months Cumulative from

ended ended ended ended inception on

June 30, 2008 June 30, 2007 June 30, 2008 June 30, 2007 Jan. 14, 2004

Expenses

Exploration 1,200,915 $ 1,258,223 $ 3,694,114 $ 3,633,076 $ 12,346,801 $

General and administration 235,882 153,430 735,319 595,736 2,761,032

Amortization of property, plant and equipment 2,906 2,471 9,301 7,012 37,456

Stock based compensation (Note 9) 102,545 138,092 326,551 349,463 1,163,302

Other expense (income) (Note 14) 13,936 (19,932) (113,270) 25,337 (649,415)

Net loss and comprehensive loss for the

period

1,556,184 $ 1,532,284 $ 4,652,015 $ 4,610,624 $ 15,659,176 $

Basic and diluted loss per share 0.03 $ 0.04 $ 0.09 $ 0.13 $

Weighted average number of shares 53,127,073 40,140,772 53,127,073 35,456,601

outstanding

See accompanying notes to interim consolidated financial statements.

- 2 -

ALTURAS MINERALS CORP.

(A development stage company)

CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

(Expressed in US$ unless otherwise stated) (Unaudited)

Three months Three months Nine months Nine months Cumulative from

ended ended ended ended inception on

June 30, 2008 June 30, 2007 June 30, 2008 June 30, 2007 Jan. 14, 2004

Cash Provided By (Used In) Operations

Net loss for the period (1,556,184) $ (1,532,284) $ (4,652,015) $ (4,610,624) $ (15,659,176) $

Items not involving cash: -

Stock based compensation (Note 9) 102,545 138,092 326,551 349,463 1,163,302

Amortization of property, plant and equipment 2,906 2,471 9,301 7,012 37,456

Foreign exchange loss (gain) 26,756 (5,881) 24,537 104,410 (261,367)

(1,423,977) (1,397,602) (4,291,626) (4,149,739) (14,719,785)

Changes in non cash working capital

Accounts receivable and prepayments (5,107) (67,210) (5,330) (9,197) 26,545

Accounts payable and accrued liabilities 9,535 (309,572) 27 (165,866) 50,546

(1,419,549) (1,774,384) (4,296,929) (4,324,802) (14,642,694)

Financing

Contributions from shareholders - - - - 2,032,799

Proceeds on issuance of securities,

net of share issue costs - 8,603,878 - 8,655,364 14,957,435

Acquisition costs net of cash acquired - - - - 161,907

Advances from (repayments to) Equinox

Minerals Limited (Note 7) - - - (375,000) 875,000

- 8,603,878 - 8,280,364 18,027,141

Investing

Purchase of property, plant and equipment (1,617) (12,803) (14,550) (32,351) (103,392)

Net change in cash and cash equivalents (1,421,166) 6,816,691 (4,311,479) 3,923,211 3,281,055

Cash and cash equivalents, beginning of period 4,990,344 2,167,735 7,876,501 5,171,506 -

Effect of exchange rate changes on cash held in foreign

currencies (26,756) 5,881 (22,600) (104,410) 261,367

Cash and cash equivalents, end of period 3,542,422 $ 8,990,307 $ 3,542,422 $ 8,990,307 $ 3,542,422 $

See accompanying notes to interim consolidated financial statements.

Interest paid - - - - -

Taxes paid - - - - -

See accompanying notes to interim consolidated financial statements.

- 3 -

ALTURAS MINERALS CORP.

(A development stage company)

CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

(Expressed in US$ unless otherwise stated) (Unaudited)

Three months Three months Nine months Nine months Cumulative from

ended ended ended ended inception on

Jun. 30, 2008 Jun. 30, 2007 Jun. 30, 2008 Jun. 30, 2007 Jan. 14, 2004

Share capital

Balance, beginning of period 14,393,129 $ 6,924,705 $ 14,393,129 $ 6,873,219 $ - $

Initial share allotment - - - - 1

Shares issued to acquire subsidiaries - - - - 240,001

Fair value warrant reallocation - - - - (30,140)

Shares issued to Equinox Minerals Limited - - - - 500,000

Share exchange to effect RTO, net of costs - - - - 168,351

Proceeds from private placements, net of issue costs - 7,468,424 - 7,468,424 14,267,418

Fair value of compensation options and broker warrants

issued, net of issue costs - - - - (224,858)

Fair value of warrants issued under private placements,

net of issue costs - - - - (1,226,376)

Exercise of stock options - - - - 13,217

Transfer from contributed surplus - - - - 8,718

Exercise of warrants - - - 51,486 676,797

Balance, end of period 14,393,129 14,393,129 14,393,129 14,393,129 14,393,129

Warrants

Balance, beginning of period 1,135,454 345,920 1,451,234 345,920 -

Transfer of warrants from share capital - - - - 30,140

Fair value of compensation options and broker warrants

issued, net of issue costs - - - - 224,858

Fair value of warrants issued under private placements,

net of issue costs - 1,135,454 - 1,135,454 1,226,376

Transfer to contributed surplus on expiry of warrants - - (315,780) - (345,920)

Balance, end of period 1,135,454 1,481,374 1,135,454 1,481,374 1,135,454

Contributed surplus

Balance, beginning of period 3,430,758 2,525,094 2,890,972 2,313,723 -

Shareholder contributions - - - - 2,032,799

Stock based compensation (Note 9) 102,545 138,092 326,551 349,463 1,163,302

Transfer to share capital on exercise of stock

options - - - - (8,718)

Transfer from warrants - - 315,780 - 345,920

Balance, end of period 3,533,303 2,663,186 3,533,303 2,663,186 3,533,303

Deficit

Balance, beginning of period (14,102,992) (8,043,934) (11,007,161) (4,965,594) -

Net loss for the period (1,556,184) (1,532,284) (4,652,015) (4,610,624) (15,659,176)

Balance, end of period (15,659,176) (9,576,218) (15,659,176) (9,576,218) (15,659,176)

Total 3,402,710 $ 8,961,471 $ 3,402,710 $ 8,961,471 $ 3,402,710 $

See accompanying notes to interim consolidated financial statements.

- 4 -

ALTURAS MINERALS CORP.

(A development stage company)

NOTES TO CONSOLIDATED INTERIM FINANCIALS STATEMENTS

(Expressed in US$ unless otherwise stated)

Three and nine months ended June 30, 2008 (unaudited)

- 5 -

1. NATURE OF OPERATIONS AND GOING CONCERN

Alturas Minerals Corp. ("Alturas" or the "Company") is a Canadian corporation that has been actively exploring

various mineral projects in Peru since J anuary 2004. The principal assets of the Company are four mineral

exploration projects located in southern Peru, being the Huilacollo Gold Project, the Baos del Indio Gold Project,

the Utupara Copper-Gold Project and the Huajoto Gold-Silver-Zinc Project. In addition, Alturas Peru has interests in

ten other exploration projects in Peru. The exploration strategy of the Company is to focus on the discovery of large

epithermal gold mineralized deposits and copper-gold porphyry/skarn deposits. To date, the Company has not

earned mining revenues and is considered to be in the development stage.

These consolidated financial statements have been prepared using Canadian generally accepted accounting

principles applicable to a going concern, which contemplate the realization of assets and settlement of liabilities in

the normal course of business as they come due. For the three and nine months ended J une 30, 2008, the

Company incurred a loss of approximately $1.6 million and $4.7 million respectively and as at J une 30, 2008 had

an accumulated deficit of approximately $15.7 million. In addition to its working capital requirements, the Company

must secure sufficient funding to meet its spending and purchase option obligations with respect to its mineral

properties in order to keep legal title and advance the projects. There are approximately $4.1 million in existing

commitments as at J une 30, 2008. In due course, the Company will have to secure additional financing to carry out

planned and future exploration and development activities. Such circumstances lend substantial doubt as to the

ability of the Company to meet its obligations as they come due and, accordingly, the appropriateness of the use of

accounting principles applicable to a going concern.

The Company raised capital by way of a private placement during the previous financial year and had

approximately $3.5 million in cash and cash equivalents at J une 30, 2008 to fund exploration and meet contractual

obligations. The Company's financing efforts to date, while substantial, are not sufficient in and of themselves to

enable the Company to fund all aspects of its operations. Management expects that the Company, based upon the

underlying value of its exploration projects, will be able to secure the necessary financing to meet the Companys

requirements on an ongoing basis. Nevertheless, there is no assurance that these initiatives will be successful.

The Company's ability to continue as a going concern is dependent upon its ability to fund its working capital and

exploration requirements and eventually to generate positive cash flows, either from operations or sale of

properties. These financial statements do not reflect the adjustments to the carrying values of assets and liabilities

and the reported expenses and balance sheet classifications that would be necessary were the going concern

assumption inappropriate, and these adjustments could be material.

2. BASIS OF PRESENTATION AND NEW ACCOUNTING POLICIES

Basis of Presentation

The unaudited interim consolidated financial statements have been presented in accordance with Canadian

generally accepted accounting principles ("GAAP"). The preparation of the financial statements is based upon

accounting policies and practices consistent with those used in preparing the annual, audited financial statements

as of September 30, 2007 (2007 statements). These unaudited interim consolidated statements should be read in

conjunction with the Notes to the 2007 statements, as they do not contain all the disclosures required under

Canadian GAAP for annual audited financial statements. These unaudited interim consolidated financial statements

reflect all normal and recurring adjustments, which are, in the opinion of management, necessary for fair

presentation of the interim periods presented.

ALTURAS MINERALS CORP.

(A development stage company)

NOTES TO CONSOLIDATED INTERIM FINANCIALS STATEMENTS

(Expressed in US$ unless otherwise stated)

Three and nine months ended June 30, 2008 (unaudited)

- 6 -

New Accounting Policies

(a) Capital Disclosures and Financial Instruments disclosures and presentation

On December 1, 2006, the CICA issued three new accounting standards: Capital Disclosures (Handbook

Section 1535), Financial Instruments Disclosures (Handbook Section 3862), and Financial Instruments

Presentation (Handbook Section 3863). These new standards became effective for the Company on

October 1, 2007.

(b) Capital Disclosures

Handbook Section 1535 specifies the disclosure of (i) an entitys objectives, policies and processes for

managing capital; (ii) quantitative data about what the entity regards as capital; (iii) whether the entity has

complied with any capital requirements; and (iv) if it has not complied, the consequences of such non-

compliance. The Company has included disclosures recommended by the new Handbook section in Note 3

to these interim financial statements.

(c) Financial Instruments

Handbook Sections 3862 and 3863 replace Handbook Section 3861, Financial Instruments Disclosure

and Presentation, revising and enhancing its disclosure requirements, and carrying forward unchanged its

presentation requirements. These new sections place increased emphasis on disclosures about the nature

and extent of risks arising from financial instruments and how the entity manages those risks. The Company

has included disclosures recommended by the new Handbook section in Note 4 to these interim financial

statements.

Future Accounting Changes

(a) Inventories

Handbook Section 3031, Inventories, relates to the accounting for inventories and revises and enhances

the requirements for assigning costs to inventories. The new standard applies to interim and annual

financial statements for fiscal years beginning on or after J anuary 1, 2008, and will be effective for the

Company's annual and interim financial statements for the periods beginning on and after October 1, 2008.

The Company does not expect that this standard will have a significant impact on its consolidated financial

statements.

(b) International Financial Reporting Standards (IFRS)

In J anuary 2006, the Accounting Standards Board ("AcSB") formally adopted the strategy of replacing

financial reporting under Canadian GAAP with financial reporting under IFRS, for Canadian enterprises with

public accountability. The current conversion timetable calls for financial reporting under IFRS for

accounting periods commencing on or after J anuary 1, 2011. On February 13, 2008, the AcSB confirmed

that the use of IFRS will be required in 2011 for publicly accountable for-profit enterprises. Financial

reporting under IFRS will be required for interim and annual financial statements relating to fiscal years

beginning on or after J anuary 1, 2011. The Company will be required to prepare comparative financial

statements in accordance with IFRS beginning with the three-month period ended December 31, 2010. The

Company is currently assessing the impact of IFRS on its consolidated financial statements.

(c) Goodwill and Intangible Assets

In October 2007, the CICA approved Handbook Section 3064, Goodwill and Intangible Assets which

replaces the existing Handbook Sections 3062, Goodwill and Other Intangible Assets and 3450 Research

and Development Costs. This standard is effective for interim and annual financial statements relating to

fiscal years beginning on or after October 1, 2008, with earlier application encouraged. The standard

ALTURAS MINERALS CORP.

(A development stage company)

NOTES TO CONSOLIDATED INTERIM FINANCIALS STATEMENTS

(Expressed in US$ unless otherwise stated)

Three and nine months ended June 30, 2008 (unaudited)

- 7 -

provides guidance on the recognition, measurement and disclosure requirements for goodwill and intangible

assets. The Company is currently assessing the impact of this new accounting standard on its consolidated

financial statements.

3. CAPITAL MANAGEMENT

The Companys objective when managing capital is to maintain adequate levels of funding to support its exploration

activities within Peru, to maintain corporate and administrative functions necessary to support organizational

functioning and obtain sufficient funding to further the identification and development of precious metals deposits

within Peru.

The Company manages its capital structure in a manner that provides sufficient funding for operational activities.

Funds are primarily secured through equity capital raised by way of private placements. There can be no

assurances that the Company will be able to continue raising equity capital in this manner.

The Company invests all capital that is surplus to its immediate operational needs in short-term, liquid and highly-

rated financial instruments, such as cash and other short-term guaranteed deposits, all held with major Canadian

financial institutions.

4. FINANCIAL RISK FACTORS

A summary of the Companys risk exposures as it relates to financial instruments are reflected below:

(a) Credit risk

The Company is not exposed to major credit risks attributable to customers and does not engage in any sales

activities. Additionally, the majority of the Companys cash and cash equivalents are held with a highly rated

Canadian financial institution in Canada; the remainder being held with a Peruvian branch of another major

Canadian financial institution.

(b) Market risk

Interest rate risk

The Company had approximately $3.5 million in cash and cash equivalents at the end of J une 30, 2008 and

does not have any interest-bearing debt. The Company invests cash surplus to its operational needs in

investment-grade short-term deposit certificates issued by the bank where it keeps its Canadian bank

accounts. The Company periodically assesses the quality of its investments with this bank and is satisfied

with the credit rating of the bank and the investment grade of its short-term deposit certificates.

Foreign currency risk

The Companys exploration and evaluation activities are substantially denominated in US dollars. The

Companys funds are predominantly kept in US dollars with major Canadian financial institutions. The

majority of the funds are held in Canada and the Company periodically sends wires of US dollar funds to its

Peruvian operations, sufficient to sustain one financial quarter of operational expenditure.

A minor amount of Canadian dollar funds are held to maintain head office operational requirements.

Sensitivity analysis

The Company has designated its cash and cash equivalents as held-for-trading, which is measured at fair

value. As at J une 30, 2008, the carrying amount of the financial instruments equals fair market value.

Management believes that, based on their knowledge and experience of financial markets, the following

sensitivity analysis is appropriate for its cash and cash equivalents and its exposure to foreign exchange

risk:

ALTURAS MINERALS CORP.

(A development stage company)

NOTES TO CONSOLIDATED INTERIM FINANCIALS STATEMENTS

(Expressed in US$ unless otherwise stated)

Three and nine months ended June 30, 2008 (unaudited)

- 8 -

The Companys funds are held primarily in short-term investment-grade deposits, the rates of which are

fixed for a period not exceeding three months. A one-percent change in the interest rate for these

instruments would affect the Company by an annualized amount of interest equal to approximately $0.03

million.

The Company accounts for temporal movements in the US dollar exchange rate for all items measured at

historical cost on its balance sheet, by including such changes as a charge or gain to its income statement.

5. PROPERTY, PLANT AND EQUIPMENT

June 30, September 30,

2008 2007

Property, plant and equipment - at cost $ 103,392 $ 88,842

Less: accumulated amortization (37,455) (28,155)

$ 65,937 $ 60,687

6. MINERAL PROPERTIES

June 30, September 30,

2008 2007

Utupara

(i)

$ 190,000 $ 190,000

Huilacollo

(ii)

20,000 20,000

Baos del Indio

(iii)

30,000 30,000

$ 240,000 $ 240,000

Notes:

(i) Utupara copper-gold project 100% owned by Alturas.

(ii) Huilacollo gold project Alturas holds an option on this advanced exploration project in the department of Tacna in the

Peru-Chile border region.

(iii) Baos del Indio gold project 100% owned by Alturas

7. DUE TO EQUINOX MINERALS LIMITED

On March 31, 2006, Alturas issued a $750,000 promissory note to Equinox Minerals in order to recognize the over

contribution Equinox Minerals had made with respect to shareholdings in Alturas Peru. This promissory note is

non-interest bearing and due on March 31, 2010. Alturas has the right to repay Equinox Minerals the owed amount

in whole at any time, and the promissory note is non-assignable. To date, half of the amount has been repaid,

leaving a balance of $375,000 at J une 30, 2008.

The fair value of the promissory note has been estimated by management to be approximately $354,828.

ALTURAS MINERALS CORP.

(A development stage company)

NOTES TO CONSOLIDATED INTERIM FINANCIALS STATEMENTS

(Expressed in US$ unless otherwise stated)

Three and nine months ended June 30, 2008 (unaudited)

- 9 -

8. SHARE CAPITAL

(a) Authorized capital

The number of authorized common shares and preferred shares is unlimited.

(b) Issued capital

Number of

Shares Amount

Balance, J une 30, 2008 and September 30, 2007 53,127,073 $ 14,393,129

9. STOCK OPTIONS

The Company has a Stock Option Plan (the "Plan") to provide incentive for the directors, officers, employees,

consultants and service providers of the Company (and its subsidiary). The maximum number of shares which may

be set aside for issuance under the Plan is 10% of the outstanding common shares (1,312,707 maximum common

shares in addition to options in issue as at March 31, 2008) (September 30, 2007 - 1,682,707 maximum common

shares in addition to options in issue at September 30,2007).

The following table reflects the continuity of stock options for the nine months ended J une 30, 2008:

Number of Stock

Options

Weighted average

exercise price

($ CAD)

Balance, September 30, 2007 3,630,000 0.63

Expired during the period (75,000) 0.70

Granted 445,000 0.22

Balance, J une 30, 2008 4,000,000 0.59

The following table reflects the actual stock options issued and outstanding at J une 30, 2008:

Expiry Date

Exercise

Price

($ CAD)

Number of

Options

Outstanding

Number of

Options

Vested

Number of

Options

Unvested

September 10, 2010 0.30 50,000 50,000 -

J une 14, 2011 0.65 1,635,000 1,635,000 -

J anuary 19, 2012 0.65 300,000 200,000 100,000

J une 30, 2012 0.50 500,000 333,333 166,667

September 7, 2012 0.68 920,000 306,667 613,333

September 29, 2012 0.68 150,000 50,000 100,000

March 2, 2013 0.22 445,000 148,334 296,666

4,000,000 2,723,334 1,276,666

ALTURAS MINERALS CORP.

(A development stage company)

NOTES TO CONSOLIDATED INTERIM FINANCIALS STATEMENTS

(Expressed in US$ unless otherwise stated)

Three and nine months ended June 30, 2008 (unaudited)

- 10 -

The following table reflects the actual stock options issued and outstanding at September 30, 2007:

Expiry Date

Exercise

Price

($ CAD)

Number of

Options

Outstanding

Number of

Options

Vested

Number of

Options

Unvested

September 10, 2010 0.30 50,000 50,000 -

J une 14, 2011 0.65 1,635,000 1,090,000 545,000

October 29, 2007 0.70 75,000 75,000 -

J anuary 19, 2012 0.65 300,000 100,000 200,000

J une 30, 2012 0.50 500,000 166,667 333,333

September 7, 2012 0.68 920,000 306,667 613,333

September 29, 2012 0.68 150,000 50,000 100,000

3,630,000 1,838,334 1,791,666

The amount remaining to be expensed of the stock options issued and outstanding as at J une 30, 2008 is

$178,485.

On March 2, 2008, Alturas granted an aggregate of 445,000 incentive stock options to officers and directors of the

Company, pursuant to the Companys Stock Option Plan, at an exercise price of $0.22 (Canadian) per share. The

options are exercisable over a period of five years. The fair value of each option was estimated on the date of the

grant using the Black-Scholes option pricing model, with the following assumptions: dividend yield of 0%, expected

volatility of 90%; risk-free interest rate of 4.19%; and an expected average life of 5 years. The estimated fair value

of $78,929 will be classified as stock-based compensation and credited to contributed surplus as the options vest.

The options vest over two years as to one-third immediately and one-third per year thereafter. For the three and

nine months ended J une 30, 2008, $9,866 and $36,176 respectively was charged to expenses relating to these

options.

10. CONTRIBUTED SURPLUS

Activity for the nine months ended J une 30, 2008 is as follows:

$

Balance, September 30, 2007 2,890,972

Stock-based compensation 326,551

Expiry of warrants (Note 11) 315,780

Balance, J une 30, 2008 3,533,303

ALTURAS MINERALS CORP.

(A development stage company)

NOTES TO CONSOLIDATED INTERIM FINANCIALS STATEMENTS

(Expressed in US$ unless otherwise stated)

Three and nine months ended June 30, 2008 (unaudited)

- 11 -

11. WARRANTS

The following table reflects the continuity of warrants for the nine months ended J une 30, 2008:

Number of

Warrants

Weighted

average

exercise

price

($ CAD) $

Balance, September 30, 2007 18,358,019 0.67 1,451,234

Warrants expired (6,958,019) 0.72 (315,780)

Balance, J une 30, 2008 12,177,778 0.63 1,135,454

The following table reflects the actual warrants outstanding as of J une 30, 2008:

Expiry Date

Number of

Warrants

Exercise

price

($ CAD) Fair Value

November 29, 2008 10,000,000 0.65 949,376

November 29, 2008 1,400,000 0.50 186,078

11,400,000 0.63 1,135,454

The following table reflects the actual warrants outstanding as of September 30, 2007:

Expiry Date

Number of

Warrants

Exercise

price

($ CAD) Fair Value

March 31, 2008 5,421,264 0.75 277,000

March 31, 2008 758,977 0.65 38,780

April 10, 2008 777,778 0.60 -

November 29, 2008 10,000,000 0.65 949,376

November 29, 2008 1,400,000 0.50 186,078

18,358,019 0.67 1,451,234

ALTURAS MINERALS CORP.

(A development stage company)

NOTES TO CONSOLIDATED INTERIM FINANCIALS STATEMENTS

(Expressed in US$ unless otherwise stated)

Three and nine months ended June 30, 2008 (unaudited)

- 12 -

12. COMMITMENTS

The Company's contractual obligations to maintain its mineral property interests over the next five calendar years

are as follows:

December 31

Commitment 2008 2009 2010 2011 2012 Total

Utupara-

Chapi Chapi

Property fees $ - $ 53,074 $ 103,681 $ 113,223 $ 113,223 $ 383,201

Huilacollo

Mining rights 1,200,000 1,500,000 - - - 2,700,000

Property fees 40,000 46,000 46,000 46,000 46,000 224,000

1,240,000 1,546,000 46,000 46,000 46,000 2,930,000

Baos del

Indio

Property fees 113,766 133,375 138,465 138,465 138,465 662,536

Huajoto

Property fees 5,968 20,859 32,250 32,250 32,250 123,577

Totals

Mining rights 1,200,000 1,500,000 - - - 2,700,000

Property fees 159,734 253,308 320,396 329,938 329,938 1,393,314

$ 1,359,734 $ 1,753,308 $ 320,396 $ 329,938 $ 329,938 $ 4,093,314

13. RELATED PARTY TRANSACTIONS

Related party transactions reflected below are in the normal course of operations and are measured in US dollars

at the exchange amount of consideration established and agreed to by the parties.

(i) Exploandes SRL, a company in which a director of the Company is the principal, has provided certain

technical, managerial and exploration services to the Company. The cost of such services for the three

months ended J une 30, 2008 was $136,468, compared with $192,846 for the three months ended J une

30, 2007. The cost of such services for the nine months ended J une 30, 2008 was $470,649 compared

with $683,553 for the nine months ended J une 30, 2007. As of J une 30, 2008, $20,817 was owed to

Exploandes SRL.

(ii) Oreforming Solutions SRL, a company in which a director of the Company is the principal, has provided

certain technical services to the Company. The cost of such services for the three months ended J une

30, 2008 was $132,162, compared with $115,851 for the three months ended J une 30, 2007. The cost

of such services for the nine months ended J une 30, 2008 was $394,648, compared with $298,964 for

the nine months ended J une 30, 2007. As of J une 30, 2008, $Nil was owed to Oreforming Solutions

SRL.

(iii) Gestora de Negocios e Inversiones SA, a company in which a director of the Company is the principal,

has provided certain technical services to the Company. The cost of such services for the three months

ALTURAS MINERALS CORP.

(A development stage company)

NOTES TO CONSOLIDATED INTERIM FINANCIALS STATEMENTS

(Expressed in US$ unless otherwise stated)

Three and nine months ended June 30, 2008 (unaudited)

- 13 -

ended J une 30, 2008 was $8,568, compared with $8,658 for the three months ended J une 30, 2007.

The cost of such services for the nine months ended J une 30, 2008 was $25,704, compared with

$25,704 for the nine months ended J une 30, 2007. As of J une 30, 2008, $Nil was owed to Gestora de

Negocios e Inversiones SA.

(iv) The Company paid $21,146 during the three months ended J une 30, 2008 to a legal firm in which a

director of the Company is a partner, compared with $64,651 for the three months ended J une 30, 2007.

The Company paid $82,078 for the nine months ended J une 30, 2008 to this firm, compared with

$111,955 for the nine months ended J une 30, 2007. As of J une 30, 2008, $15,250 was owed to this

legal firm.

(v) The Company also paid $18,150 during the three months ended J une 30, 2008 to a consulting firm in

which an officer of the Company is a principal, compared with $Nil for the three months ended J une 30,

2007. The Company paid $62,000 for the nine months ended J une 30, 2008 to this firm, compared with

$Nil for the nine months ended J une 30, 2007. As of J une 30, 2008, $6,230 was owed to this firm.

14. OTHER EXPENSE (INCOME)

Three months

ended June

30, 2008

Three months

ended J une

30, 2007

Nine months

ended June

30, 2008

Nine months

ended J une

30, 2007

Cumulative

from

inception on

Jan 14, 2004

Interest income $ (13,038) $ (14,051) $ (105,051) $ (79,073) $ (371,876)

Foreign exchange

(gain) / loss 26,759 (5,881) (8,628) 104,410 (277,948)

Other 215 - 409 - 409

$ 13,936 $ (19,932) $ (113,270) $ 25,337 $ (649,415)

ALTURAS MINERALS CORP.

(A development stage company)

NOTES TO CONSOLIDATED INTERIM FINANCIALS STATEMENTS

(Expressed in US$ unless otherwise stated)

Three and nine months ended June 30, 2008 (unaudited)

- 14 -

15. SEGMENTED INFORMATION

The Company operates in one reportable operating segment, being the exploration and development of mineral

properties in Peru. The Company has administrative offices in Toronto, Canada. Geographical information is as

follows:

Cash and

cash

equivalents

Other

assets

Capital

assets Total assets

June 30, 2008

Canada $ 2,603,944 $ 48,814 $ 2,910 $ 2,655,668

Peru 938,478 21,398 303,027 1,262,903

$ 3,542,422 $ 70,212 $ 305,937 $ 3,918,571

September 30, 2007

Canada $ 7,151,605 $ 60,902 $ 2,910 $ 7,215,417

Peru 724,896 243,818 57,777 1,026,491

$ 7,876,501 $ 304,720 $ 60,687 $ 8,241,908

You might also like

- Teikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016Document1 pageTeikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016LymeParkNo ratings yet

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDocument2 pagesInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesMike TruongNo ratings yet

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDocument2 pagesInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDaniyal NawazNo ratings yet

- Cashflow 2007Document1 pageCashflow 2007Zeeshan SiddiqueNo ratings yet

- Niocorp Developments LTD.: (Formerly Quantum Rare Earth Developments Corp.)Document18 pagesNiocorp Developments LTD.: (Formerly Quantum Rare Earth Developments Corp.)niobfNo ratings yet

- Cashflow StatementDocument1 pageCashflow Statementarslan.ahmed8179No ratings yet

- Yahoo Annual Report 2006Document2 pagesYahoo Annual Report 2006domini809No ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsKartik SharmaNo ratings yet

- Samsung Electronics Co., Ltd. interim cash flow statementDocument2 pagesSamsung Electronics Co., Ltd. interim cash flow statementMohammadNo ratings yet

- Dandot Mar 09Document6 pagesDandot Mar 09studioad324No ratings yet

- Samsung Cash Flow and Fund Flow2Document14 pagesSamsung Cash Flow and Fund Flow2Suhas ChowdharyNo ratings yet

- Beng Kuang Marine Limited: Page 1 of 10Document10 pagesBeng Kuang Marine Limited: Page 1 of 10pathanfor786No ratings yet

- NICOL Financial Statement For The Period Ended 30 Sept 2023Document4 pagesNICOL Financial Statement For The Period Ended 30 Sept 2023Uk UkNo ratings yet

- American International Ventures Inc /de/: FORM 10-QDocument18 pagesAmerican International Ventures Inc /de/: FORM 10-QChapter 11 DocketsNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementNaeem Uddin100% (1)

- 133399-A 2018 2018 Annual CFDocument1 page133399-A 2018 2018 Annual CFVijay KumarNo ratings yet

- 133399-AA 2018 2018 Annual CFDocument1 page133399-AA 2018 2018 Annual CFVijay KumarNo ratings yet

- Unaudited Consolidated Financial Statements: For The Nine Months Ended 30 September 2021Document10 pagesUnaudited Consolidated Financial Statements: For The Nine Months Ended 30 September 2021Fuaad DodooNo ratings yet

- Unconsolidated Statement of Cash Flows: For The Year Ended December 31, 2010Document1 pageUnconsolidated Statement of Cash Flows: For The Year Ended December 31, 2010maqsoom471No ratings yet

- 2021 Con Quarter04 CFDocument2 pages2021 Con Quarter04 CFMohammadNo ratings yet

- Trabajo de Contabilidad en InglesDocument5 pagesTrabajo de Contabilidad en Inglescarmen viquezNo ratings yet

- Annual financial report of company operationsDocument2 pagesAnnual financial report of company operationsusama siddiquiNo ratings yet

- Capital Alliance PLC Interim Financial StatementsDocument10 pagesCapital Alliance PLC Interim Financial Statementskasun witharanaNo ratings yet

- 6 MIS January 2013Document143 pages6 MIS January 2013kr__santoshNo ratings yet

- Nigeria German Chemicals Final Results 2012Document4 pagesNigeria German Chemicals Final Results 2012vatimetro2012No ratings yet

- Hong Fok Corporation Limited: Revenue (Note 1)Document10 pagesHong Fok Corporation Limited: Revenue (Note 1)Theng RogerNo ratings yet

- Financial MStatements Ceres MGardening MCompanyDocument11 pagesFinancial MStatements Ceres MGardening MCompanyRodnix MablungNo ratings yet

- Balance Sheet of HDFC STANDARD LIFE As at March 31 For Five YearsDocument7 pagesBalance Sheet of HDFC STANDARD LIFE As at March 31 For Five YearsNagendra PrasadNo ratings yet

- "Finacial Statement": TugasDocument7 pages"Finacial Statement": TugasSekar Arum OctavanyNo ratings yet

- First Cobalt Q3 2018 Financial StatementsDocument22 pagesFirst Cobalt Q3 2018 Financial StatementscristamaarNo ratings yet

- Statements of Dunkin DonutsDocument4 pagesStatements of Dunkin DonutsMariamiNo ratings yet

- H1 Consolidated FS 2023 FinalDocument21 pagesH1 Consolidated FS 2023 FinalHussein BoffuNo ratings yet

- Misc Accounts FilesDocument229 pagesMisc Accounts Filesapi-19622983No ratings yet

- TeslaDocument5 pagesTeslaRajib ChatterjeeNo ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- Financial Statements ofDocument11 pagesFinancial Statements ofConversionApiTestNo ratings yet

- Integrated Micro-Electronics: Q2 Results (Press Release)Document17 pagesIntegrated Micro-Electronics: Q2 Results (Press Release)BusinessWorldNo ratings yet

- UntitledDocument69 pagesUntitledJonathan OngNo ratings yet

- Osisko Mining Corporation: (A Development Stage Company)Document21 pagesOsisko Mining Corporation: (A Development Stage Company)Blog de MalarticNo ratings yet

- Change Analysis Balance Sheet AccountsDocument10 pagesChange Analysis Balance Sheet AccountsIndra HadiNo ratings yet

- Intermediate AccountingDocument5 pagesIntermediate AccountingWindelyn ButraNo ratings yet

- Burshane Petroleum Income Statement AnalysisDocument25 pagesBurshane Petroleum Income Statement AnalysisCorolla GrandeNo ratings yet

- Statements of Changes in Equity PDFDocument2 pagesStatements of Changes in Equity PDFJanine padronesNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- RFL Bond Report q1 Fy 2015Document6 pagesRFL Bond Report q1 Fy 2015husnuozyegiinNo ratings yet

- Financial Statement Analysis UnsolvedDocument3 pagesFinancial Statement Analysis Unsolvedavani singhNo ratings yet

- Annual-Report-FML-30-June-2020 Vol 1Document1 pageAnnual-Report-FML-30-June-2020 Vol 1Bluish FlameNo ratings yet

- 4019 XLS EngDocument13 pages4019 XLS EngRish JayNo ratings yet

- S H D I: Untrust OME Evelopers, NCDocument25 pagesS H D I: Untrust OME Evelopers, NCfjl300No ratings yet

- Sterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Document1 pageSterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Sterling Bank PLCNo ratings yet

- Rak Properties 1Document9 pagesRak Properties 1Govind Kumar VermaNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsUkaaaNo ratings yet

- Tesla, Inc. (TSLA) : Cash FlowDocument239 pagesTesla, Inc. (TSLA) : Cash FlowAngelllaNo ratings yet

- Colgate Cash FlowsDocument2 pagesColgate Cash FlowsChetan DhuriNo ratings yet

- Appendix 5 Consolidated Cash Flow Statement: For The Year Ended 31 December 2008Document15 pagesAppendix 5 Consolidated Cash Flow Statement: For The Year Ended 31 December 2008Architecture ArtNo ratings yet

- Income Statement: Year Ended 31 December 2005Document19 pagesIncome Statement: Year Ended 31 December 2005phckuwaitNo ratings yet

- Ambc 7sec-Amda-1tkrmb-1193125-13-334909 PDFDocument135 pagesAmbc 7sec-Amda-1tkrmb-1193125-13-334909 PDFpeterlee100No ratings yet

- Acc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291Document201 pagesAcc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291290acc100% (2)

- Mirl - hr100525 Results of EgmDocument2 pagesMirl - hr100525 Results of EgmcamarquezbNo ratings yet

- MIRL - HR101018 Filing Preliminary Short Form ProspectusDocument2 pagesMIRL - HR101018 Filing Preliminary Short Form ProspectuscamarquezbNo ratings yet

- ALT - HR081216 Defines Gold Target at Chapi Chapi PDFDocument2 pagesALT - HR081216 Defines Gold Target at Chapi Chapi PDFcamarquezbNo ratings yet

- GF - R&R 2009 Presentation 091005Document64 pagesGF - R&R 2009 Presentation 091005camarquezbNo ratings yet

- FERREYC1 - HR110110 Operaciones Con ADR's 1Document2 pagesFERREYC1 - HR110110 Operaciones Con ADR's 1camarquezbNo ratings yet

- MILPOC1 - 09Q4 Earnings Review Celfin On Milpo 100216Document4 pagesMILPOC1 - 09Q4 Earnings Review Celfin On Milpo 100216camarquezbNo ratings yet

- AQM - HR100521 Intersects 66 M of 1.03% Cu at ZafranalDocument2 pagesAQM - HR100521 Intersects 66 M of 1.03% Cu at ZafranalcamarquezbNo ratings yet

- GF - Q4F2010 Presentation Transcript 110218Document65 pagesGF - Q4F2010 Presentation Transcript 110218camarquezbNo ratings yet

- GF - Q4F2010 Results Presentation 100805Document47 pagesGF - Q4F2010 Results Presentation 100805camarquezbNo ratings yet

- RIO - HR100901 Annual General MeetingDocument36 pagesRIO - HR100901 Annual General MeetingcamarquezbNo ratings yet

- DNT - HR091231 Closing Financing MM$9.0 - Listing DNT GoldDocument2 pagesDNT - HR091231 Closing Financing MM$9.0 - Listing DNT GoldcamarquezbNo ratings yet

- AQM - HR090601 Private Placement MM$ 5.0Document1 pageAQM - HR090601 Private Placement MM$ 5.0camarquezbNo ratings yet

- DNT - HR110406 Cañariaco NI 43-101 BDocument15 pagesDNT - HR110406 Cañariaco NI 43-101 BcamarquezbNo ratings yet

- Nom - HR100212 Eeff 09T4Document25 pagesNom - HR100212 Eeff 09T4camarquezbNo ratings yet

- GF - C090811 Diggers DealersDocument21 pagesGF - C090811 Diggers DealerscamarquezbNo ratings yet

- GF - Q4F2009 Presentation Transcript 090812Document57 pagesGF - Q4F2009 Presentation Transcript 090812camarquezbNo ratings yet

- ALT - HR100305 Announces Closing of First Tranche of FinancingDocument2 pagesALT - HR100305 Announces Closing of First Tranche of FinancingcaamarquezbNo ratings yet

- Ch4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Document45 pagesCh4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Wenhui TuNo ratings yet

- SD HHML FinalDocument139 pagesSD HHML FinalParas BarbhayaNo ratings yet

- ECONOMIC APPLICATIONS HANDS-ON EXPERIENCEDocument6 pagesECONOMIC APPLICATIONS HANDS-ON EXPERIENCEPankaj KumarNo ratings yet

- Currency Convertor: 1.abstractDocument6 pagesCurrency Convertor: 1.abstractUSHASI BANERJEE100% (1)

- W Gs Position DescriptionDocument5 pagesW Gs Position DescriptionJonniNo ratings yet

- Chap 6 ProblemsDocument5 pagesChap 6 ProblemsCecilia Ooi Shu QingNo ratings yet

- Exploring Microeconomics Canadian 4th Edition Sexton Test BankDocument55 pagesExploring Microeconomics Canadian 4th Edition Sexton Test BankAnnGregoryDDSmewqn100% (15)

- Franchising: Bruce R. Barringer R. Duane IrelandDocument18 pagesFranchising: Bruce R. Barringer R. Duane IrelandWazeeer AhmadNo ratings yet

- Class XI QPDocument100 pagesClass XI QPDevansh DwivediNo ratings yet

- Rolta Wins 13 Million Dollar Contract For Engineering Systems (Company Update)Document1 pageRolta Wins 13 Million Dollar Contract For Engineering Systems (Company Update)Shyam SunderNo ratings yet

- ENGG650 Assignment 1Document1 pageENGG650 Assignment 1Jihan BerroNo ratings yet

- Major Benefits For IndiaDocument3 pagesMajor Benefits For IndiaamitNo ratings yet

- Qualitative ResearchDocument3 pagesQualitative ResearchEumy JL JeonNo ratings yet

- Inventory Control Models EOQDocument59 pagesInventory Control Models EOQNguyen NinhNo ratings yet

- Term Paper (Business Mathematics)Document34 pagesTerm Paper (Business Mathematics)Omar Faruk100% (1)

- Accounting Problem B Abeleda (AutoRecovered)Document14 pagesAccounting Problem B Abeleda (AutoRecovered)xjammer100% (2)

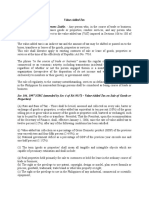

- VAT Codal and RegulationsDocument6 pagesVAT Codal and RegulationsVictor LimNo ratings yet

- AIS Reviewer PDFDocument20 pagesAIS Reviewer PDFMayNo ratings yet

- Sivagnanam PDFDocument213 pagesSivagnanam PDFjohn100% (1)

- Revenue Regulations on Compromise SettlementDocument6 pagesRevenue Regulations on Compromise SettlementMilane Anne CunananNo ratings yet

- Calculate LTV ratio and monthly amortizationDocument4 pagesCalculate LTV ratio and monthly amortizationMichelle GozonNo ratings yet

- Affidavit - SampleDocument3 pagesAffidavit - Sampleqandaadvisory2No ratings yet

- Directives Unified Directives 2073 Revised NewDocument402 pagesDirectives Unified Directives 2073 Revised Newits4krishna37760% (1)

- Intro To Tax ManagementDocument55 pagesIntro To Tax ManagementJam HailNo ratings yet

- Communication Strategies For The Asia PacificDocument25 pagesCommunication Strategies For The Asia PacificfahadaijazNo ratings yet

- The Billabong CaseDocument14 pagesThe Billabong CaseRati Sinha100% (1)

- An Introduction To Marxism - Its Origins, Key Ideas, and Contemporary RelevanceDocument2 pagesAn Introduction To Marxism - Its Origins, Key Ideas, and Contemporary RelevancemikeNo ratings yet

- Step: 1Document24 pagesStep: 1LajukNo ratings yet

- Marketing Project On SuzukiDocument96 pagesMarketing Project On SuzukiAsh LayNo ratings yet

- GAAP: Generally Accepted Accounting PrinciplesDocument7 pagesGAAP: Generally Accepted Accounting PrinciplesTAI LONGNo ratings yet