Professional Documents

Culture Documents

Research and Analysis Project: Honda Atlas Cars (Pak) LTD

Research and Analysis Project: Honda Atlas Cars (Pak) LTD

Uploaded by

Nurul KabirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Research and Analysis Project: Honda Atlas Cars (Pak) LTD

Research and Analysis Project: Honda Atlas Cars (Pak) LTD

Uploaded by

Nurul KabirCopyright:

Available Formats

Research and Analysis Project

We're committed to providing 100% plagiarism free academic assignments i.e.

Course work, Homework assignments, thesis, dissertations, Oxford Brookes

(OBU) BSC Hons Applied Accounting ACCA Thesis (RAP, SLS,

PPT), Essays and Term/Research papers etc. Pay in instalments and that too

after you receive the first draft. Please visit and like our Facebook page

www.facebook.com/assignmentwritingservices/ and website

www.ghostwritingmania.com to avail our special discount packages. You can

also add me on Skype ghostwritingmania or email me

ghostwritingmania@yahoo.com for any further discussion...Looking forward to

working together on long term.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

2

Project Objectives and Research Approach:

The topic I selected for my BSc RAP is The Business and Financial

Performance of an Organization over a three year period.

Reasons for choosing the Topic:

For any organization to breath it is essential that it copes with

environment through its strengths and strategies and manages finance

effectively. An organizations Business & Financial performance plays a

leading role in deciding its position in the industry. Thats why I chose

this topic as it is even more important to know an organizations

performance during a Global Economic meltdown when markets have

been declining. Even more, this has been the major part of my studies

and I had a chance to enhance my knowledge and develop practical

skills in the area.

Reasons for choosing the Industry:

I chose automobile industry as it is a major sector of the country

having a major contribution to the economy.

Secondly, I wanted to know about challenges being faced by the auto

sector during the financial crisis.

Thirdly, I was curious to know about the key players of the industry and

to find out about ones performance.

Reason for choosing the Company:

Honda Atlas is a joint venture between Honda Motor Company Japan

and the Atlas Group of Companies Pakistan. The Company incorporated

about 20 years ago in 1992.

The reason I chose this Company is that it is one of the few leading

carmakers in Pakistan having a strong share in overall automobile

industry.

Another reason was my personal fascination with the brand.

As it is a listed Company at all the Stock Exchanges of the country,

easy access to the F/S was another reason to choose.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

3

Project

Aims and Objectives:

I aim to achieve the following objectives:

Carrying out the financial analysis ofHACPL in order to:

Know how successful it has been in generating earnings and

covering and controlling costs in the relevant periodby analysing

profitability of the Company.

Analyse the short-term liquidity of the Company during the

financial crunch.

Understand the impact of its capital structure on its long-term

solvency.

Analysing Companys activities impact on its working capital

management.

Understand the impact of its operations on the investor`s

confidence and share price volatility.

Carrying out business analysis of the Company to:

Obtain an understanding of the impact of the external pressures

on the internal operations and policies.

Examine the competitive pressures being faced by the Company.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

4

Research

Questions:

How will I utilize my time in order to complete my project within time?

What sources of information will I access to gain the necessary

information?

What models will be used in order to achieve objectives of my RAP?

Which ratios will be calculated and interpreted for the financial

analysis?

What models should be used to target my objective for the business

analysis?

What are the required IT skills?

What ethical problems I might face during the research?

Research Approach:

To initiate I will gather general information about the Automobile

industry to gain an understanding of current and future prospects of

the industry and the factors that are affecting it.

Then I will develop an understanding about the Company that I require

for the purpose of my analysis. After that I will calculate and then

interpret financial ratios using information that I gathered during my

initial research. Then, using appropriate business models and

techniques I will try to comprehend the effects of the macroenvironment on the policies and operations of the Company. I will also

try to verify and validate my assumptions through different information

sources. I intend to use both primary and secondary sources to gather

and validate information about the Company.

Then on the basis of my analysis I will draw conclusions and will give

recommendations accordingly.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

5

Information gathering and business models used

Sources of Information:

Two sources could be exploited for the purpose of information collection; The

Primary and the Secondary sources. Primary Information sources are those

that are closest to actual event, time period or individual in question. These

present original thinking and observations such as original research used to

write journal articles, reporting on original scientific studies, experiments or

observations (Solomon, Wilson and Taylor, 2011). Secondary sources of

information consist of descriptions and explanations that are created after a

historical event has already taken place (American BookWorks Corporation,

2010).

Information Gathering:

Primary Information:

Followed by telephonic calls I paid a visit to the Companys office seeking to

arrange a meeting with the management. I managed to obtain an

appointment for meeting with the Companys finance manager

MrAsadMurad, in which I interviewed him according to the questionnaire I

prepared beforehand to resolve my queries and to collect information about

the Company.

Secondary Information:

Wide range of secondary sources was used to corroborate the information

and to validate the interpretations made in the financial and business

analysis. The following sources were used:

Annual Audited Reports: These reports provided general information about

the Company and data to be used for purpose of ratios calculation.

Internet: Though relatively less reliable, internet provided vast knowledge &

information about the industry, Company and much about the macroenvironment surrounding such as Governments policies and economic

factors.

Newspapers, Journals & Articles: They were used to get the related

information about the automobile industry and the Company.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

Analysts Reports: I went through analysts reports and watched business

6

channels to get a walk through of the general status of the industry and the

Company and general state of countrys economy and political situation.

ACCA and other Textbooks: Text books form the college library was used to

refresh the Business and Financial models and techniques Ive applied for the

purpose of business & financial analysis.

ACCA Student Accountants Magazines: They were used to keep an eye on the

articles to keep updated with the latest developments in the profession.

Limitations of Data Gathering:

Seeking newspapers and searching over the internet used to bring a lot of

data and hunting the exact requirement absorbed a lot of energy and

occupied a lot of time.

Different analysts had conflicting views and generated confusion about

future prospects of the government, industry and the Company. It was often

strenuous to make judgment.

The library had just a few numbers of latest editions of books and they often

were not available being issued to other students and numerous visits to

library were need to made.

Ethical Issues:

Being Professional accountants we need to observe ACCAs code of ethics so

I remained prudent throughout preparation of this RAP.

Confidentiality was not an issue as all the information used was publicly

available.

During the preparation of thesis, I interacted with certain people of

undesirable attitudes but I

maintained professional behaviour.

Referring to latest editions of the books and student accountant magazines I

kept myself upgrade with professional updates.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

7

Business

and Financial Models used:

The techniques and models that I used for the purpose of Business and

Financial analysis are:

Ratio Analysis:

Its a tool for F/S analysis. It can be used to develop a set of statistics that

reveal key financial characteristics of a Company. (Droms and Wright, 2010)

Advantages:

Makes easy to grasp relationships between various items.

Provides comparative study of various businesses.

Highlights changes that took place between time periods.

Limitations:

Often future forecasting becomes difficult with ratios.

Inter-related. Single ratio cant convey any meaning.

Quantative measures. Ignores qualitative aspects.

(Murthy and Gurusamy, 2009)

SWOT Analysis:

SWOT Analysis is a careful evaluation of an organizations internal strengths

and weaknesses as well as its environmental opportunities and threats.

(Griffin, 2011)

Advantages:

Impetus to analyse a situation and develop suitable strategies.

Assesses core capabilities and competences.

Evidence for and cultural key to change.

Limitations:

Generate long lists.

Ignore prioritisation.

Descriptive rather than analytical.

(Mard, et al., 2004)

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

8

PEST Analysis:

Its a tool for analysing a business and, in particular understanding market

growth or decline. (Chapman, 2011)

Advantages:

Increase awareness of environmental change.

Facilitates risk management.

Acts as an early warning to anticipate opportunities and threats and

plan accordingly.

Limitations:

Contradicting changes may take place.

Pace of change may create unpredictability.

By the time one change is addressed another may have occurred.

(Evans, Campbell and Stonehouse, 2003)

Porters Five Forces:

Its a framework for industry analysis and business strategy development. It

defines competitive intensity and therefore the attractiveness of a market.

(Grunig and Kuhn, 2010)

Advantages:

Enables organisation to determine attractiveness of a particular

industry.

Enables organisation to assess its ability to compete effectively in

the industry.

Provide indication of the future profits in the industry. (Henry, 2008)

Limitations:

It implies suppliers, buyers and competitors are threats whereas

strategies could be made by collaboration.

It claims to assess industrys profitability while Company specific

factors are more important.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

9

It implies that five forces equally apply to all competitors in the

industry whereas forces may differ from business to business.

(Tiwari, 2009)

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

10

Results, Analysis, Conclusions and Recommendations:

Industry Information and Company Profile:

To the countrys manufacturing sector, auto sector contributes 16%

with Japanese companies dominating by producing and selling most of

the outputs. Majority of annual demand of auto parts of $0.96 billion is

manufactured locally and around 22% is imported. (Rohail, 2008)

Currently there is investment of PKR 98 billion (Pakistan Today, 2011)

in the auto sector and its contribution to the GDP is more than 12

billion rupees and to the national exchequer is PKR 40 billion (Toyota,

2011a). EDB is seeking to even increase this contribution. Moreover,

EDB is trying to enlarge the production capacity and to gain US $3

billion investment in the industry and attempting to grow exports to US

$650 billion. (Haq, 2009)

However, the local industry is facing pressures from the government as

sales tax raised from 16% to 17% and depreciation allowance on

imported cars increased from 50% to 60% (Honda Atlas Cars (Pakistan)

Limited, 2011a). Inflation and exchange rates variations have strained

costs. Another challenge for the local carmakers is the increase of age

limit of imported used cars from 3 to 5 years (Khan and Khan, 2010).

HACPL is one of the major car assemblers in Pakistani market (Khan,

2011). It is controlled by Honda Motor Company Japan which holds 51%

shares. It has its Sales, Services and Spare Parts dealership networks

spread around in all the major cities of the country. It offers four

brands: Honda CR-V, Honda Accord, Honda Civic and Honda City.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

11

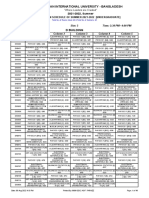

Profitability

Analysis

Profitability Ratios

2011

HACPL

2010

2009

2011

TOYOTA

2010

2009

%

Gross

Profit

Margi

n

Net

Profit

Margi

n

ROCE

0.90

-1.51

1.25

6.63

8.08

6.14

-1.35

-5.38

-2.84

4.45

5.73

3.66

-4.42

-16.10

-9.23

28.73

42.44

20.13

0

2009

-5

2010

2011

GP

NP

-10

ROCE

-15

-20

GP Margin:

FY 09:

The GP decreased by 71.87% led by the huge decrease in sales of

3.85% and relatively lower decrease in COS of merely 0.82%.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

12

Costs inflated uncontrollably following the recession which in-turn

negatively influenced the inflation and exchange rates fluctuations.

35% cash margin of imports of parts was also levied by the

government (Honda Atlas Cars (Pakistan) Limited, 2009a). HACPLs

management were unable to predict the economic recession and

enhanced production capacity to 50000 units from 30000 (Honda Atlas

Cars (Pakistan) Limited, 2010a) units which led to extreme

underutilization of capacity over these periods, thus further increasing

fixed costs and management remained unable to control the swell in

costs.

Due to the financial crisis and therefore, weakening purchasing power

parity, overall sales went down. The government raised sales tax by

1% and FED of 5% was imposed (Honda Atlas Cars (Pakistan) Limited,

2009b) and vehicles thus got expensive. Honda City, HACPLs main

product was at its decline along with intense competition from the

major assemblers subcompact cars decreased its sales by as much as

83% (Institute of Business Administration, 2010a). It was late this year

when the new 3rd Generation model of Honda City was launched

(Honda Atlas Cars (Pakistan) Limited, 2009c) and therefore it was not

much helpful in saving the reducing sales. To exacerbate, most banks

withdrew car financing facilities (Hallian, 2009). Thereby, Industry sales

went down by 50% and Honda Atlass by 28% (Institute of Business

Administration, 2010b).

GP therefore fell due to the worsening economy, lost sales and certain

future events that management could not have predicted beforehand.

FY 10:

There was further a larger decrease in GP of 235.72% despite 12.05%

increase in sales. With 15.18% increase in COS, the GP ratio was

-1.51%.

HACPL remained deficient in controlling costs due to economic upset.

PKR lost sustainability and severely depreciated against Yen (Figure 1,

Appendix) and US $ (Figure 2, Appendix) together with inflation

resulting in increasing prices of raw materials to which 77% rise in the

international steel price (IBA, 2010) added too. The underutilization of

the capacity kept pressure on the production costs (Interview,

Appendix).

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

13

However, following the introduction of new Honda City model and

reasonable prices, sales experienced rise. Later this period economic

condition improved and commercial banks restored their position in

consumer financing (Osama, 2010) encouraging the demand despite

rising costs. The government helped a little by withdrawing the FED on

locally assembled cars (Honda Atlas Cars (Pakistan) Limited, 2010b).

The Company therefore achieved growth in sales but due to large

increase in costs that could not be completely passed on to the

customers due to competitive prices (Interview, Appendix) the GP fell

significantly.

FY 11:

GP attained health increasing by 183.20% achieving GP ratio of 0.9%.

Sales considerably increased by 38.93% with lower increase in COS of

35.62%.

Such an increase in COS was due to immense increase in Raw

Materials costs bringing undue pressure on management to maintain

the costs. The price of steel sheets went high almost by 50% per ton

and price of aluminium primary ingot rose by 59% per pound (Jamal,

2010a). Similarly, the cost of rubber also expanded globally (Kumar,

2009). Further pressurising COS, Yen gained nearly 10% against PKR

making import of high tech parts, like CKDs which are almost 35% of a

products cost, even expensive (Jamal, 2010b). The introduction of new

accessories (Honda Atlas Cars (Pakistan) Limited, 2011b) also added to

costs. Fixed costs remained high due to capacity underutilization

(Interview, Appendix).

Hence, Selling Prices increased, also incorporating the rise in sales tax

of 1% (Honda Atlas Cars (Pakistan) Limited, 2011c). Surprisingly,

customers behaviour remained positive despite political and economic

tensions. Sales increased incredibly (KHan, 2011). It was deduced that

the growth in the agricultural sector particularly Rabi season crops

(Khan, 2010) increased the spending of the country and the

introduction of new accessories in the Honda cars captured the interest

of customers. The growth in car financing facilities also backed up the

increase (Honda Atlas Cars (Pakistan) Limited, 2011c).

Therefore, despite raised costs Company performed excellent in sales

thus improving GP.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

14

10

6

HACPL

TOYOTA

0

2009

2010

2011

-2

Competitor Comparison

Toyota has been the foremost competitor of HACPL and has been

performing way better than HACPL in GP over the years due to its

higher market share and costs management. Toyotas management

has been controlling costs through application of Kaizen costing

methodology (Toyota, 2011b) which include the elimination of waste in

the production, assembly and distribution process as well as

elimination of work steps in any of these areas (M. Bragg, 2009).

Higher sales resulted in better capacity utilization and lower fixed costs

than HACPL.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

15

NP Margin:

FY 09:

The NP ratio reduced dramatically to -2.84% as compared to the last

years 0.5%.

Subsequent to fall in GP, Company reduced advertisement expenses

despite launch of new models keeping costs under control. Achieved

257% rise in profits on deposits owing to high deposit rates (Figure 3,

Appendix) was advantageous; however fuel & power prices went up

during the year increasing operating costs. Up to 31% increase in

electricity prices (The Nation, 2008) and 127.43% in Gas prices (Daily

Times, 2010) occurred. Company faced huge exchange losses during

the period as currency miserably weakened against Japanese Yen and

US $ (Figure 1 and 2, Appendix). PPE and old Honda Citys parts

written-off further contracted profitability. FC remained unchanged as

borrowing costs of raised long-term loans were capitalized to PPE.

(Honda Atlas Cars (Pakistan) Limited, 2009d) Effective tax rate was

-35.43% as compared to 17.90% last year to due to 83.37% reduction

in current tax because of Company making loss (under section 113 of

income tax ordinance, 2001 a Company is charged minimum tax on

turnover in case of losses) and 69% increase in deferred tax assets

mainly comprising unused tax losses aided profitability slightly.

FY 10:

NP declined to -5.38%.

Following huge fall in GP, management extensively reduced

advertisement expenses keeping costs under check. Profit on bank

deposits sharply decreased shrinking profitability as after huge

investments last year, Company commenced year with a heavy

overdraft (Interview, Appendix). Despite rise in costs of electricity

(Business News, 2010) and gas (Aqeel, 2010) fuel & power expenses

lowered slightly sinking costs as the production level decreased. Since

last year exchange losses lessen as currency became relatively stable

(Figure 1 and 2, Appendix) and Companys overall exposure to

currency risk reduced. Narrowing profitability, FC increased by 104%

due to newly availed loans by Company to finance investment for new

car models. Enlarged sales raised current tax by 654.14% with lesser

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

16

deferred tax assets rise of 40.56% upraised effective tax rate to

-13.74% dipping NP.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

17

FY 11:

NP rose by 65% to -1.35%.

As GP attained health, Company enhanced spending on advertisement

of new car models with new accessories, burdening costs. With

healthier cash-flow status, Company gained enormous rise in profit on

deposits enjoying high deposit rates (Figure 3, Appendix) improving NP.

Production rose and electricity and gas prices went up by 15% (Umeed,

2010) and 8% (Zeeshan, 2010) respectively, fuel & power expenses

ascended raising costs. The currency further depreciated and increase

in Companys currency risk exposure increased exchange losses. Aided

by liquidity support on CKD supplies by the Holding Company, HACPL

repaid short-term & long-term borrowings achieving reduction in FC.

Effective tax rate reached 21.90%. 103.77% rise in current tax was the

upshot of increased sales with increase of 15.42% in deferred tax

assets available to net off.

8

6

4

2

HACPL

TOYOTA

0

2009

2010

2011

-2

-4

-6

Competitor Comparison

Toyotas strong performance in GPs cushioned it from inflated prices

and preserved the NP ratios. Toyotas profits on bank deposits were

grander than HACPLs due to stronger cash position. Unlike HACPL,

Toyota kept its currency risk low by entering foreign exchange

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

18

contracts (Toyota, 2011c) and so lower exchange losses. Toyota has not

been using borrowings and so had much lesser FC than HACPL

consisting only of mark-up on advances from customers and the bank

charges.

ROCE:

FY 09:

ROCE was -9.23% compared to the last years 8.81%.

OP fell by 234% and the Company went to loss, unable to generate

return on Capital invested. Equity decreased due to increased

accumulated losses yet CE increased due to raised long-term finance

for the investment in Capital expenditure (Honda Atlas Cars (Pakistan)

Limited, 2009e) of the new model of Honda City.

Company thus appeared to be underutilizing resources.

FY 10:

ROCE even deteriorated to -16.10%.

OP even worsened by 33% and despite decreased CE due to reduction

in renewed long-term finance with part of it becoming current and

decrease in equity on account of increased accumulated losses and

transfer of reserves to P/L, ROCE further shrunk representing further

underutilization.

FY 11:

ROCE improved to -4.42%.

Companys improved performance achieved a reduction in operating

loss of 83% but Company still failed to produce return. The year added

lesser to accumulated losses but due to large transfer from reserves to

P/L, equity reduced. Company reduced its long-term finance (Honda

Atlas Cars (Pakistan) Limited, 2011d) by 69% as well and therefore

overall CE reduced.

Consequently, ROCE became better but the persisted negative figure

still presented poor utilization of resources.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

19

50

40

30

20

TOYOTA

HACPL

10

0

2009

2010

2011

-10

-20

Competitor Comparison

Toyota remained profitable and ungeared and has been earning much

higher returns on CE than HACPL thus, much better ROCE.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

20

LIQUIDITY

ANALYSIS

Liquidity Ratios

2011

HACPL

2010

2009

2011

times

TOYOTA

2010

2009

Curren

t Ratio

0.67

0.62

0.70

1.84

1.67

1.69

Quick

Ratio

0.26

0.21

0.17

1.38

1.31

1.28

0.8

0.7

0.6

0.5

Current Ratio

0.4

Quick Ratio

0.3

0.2

0.1

0

2009

2010

2011

Current & Quick Ratio:

FY 09:

CR was 0.70 times, even riskier compared to last years 0.80 times.

Despite 91% decrease in cash & bank due to huge cash used in

operations and heavy investments, CA increased by 61% mainly

because of 83% rise in stock level as sales lessened. The CL raised by

82% when Company obtained short-term loan to finance working

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

21

capital requirements of the new car model. (Honda Atlas Cars

(Pakistan) Limited, 2009f)

Matching just the liquid CA with CL gives QR of 0.17 times which was

dangerously low as stock has been the major part of CA.

The destabilized liquidity concerned investors as it could lead to goingconcern issue in future.

FY 10:

CR worsened to 0.62 times.

Despite improved cash & bank balances due to high cash from

operations and lower investments than last year the CA decreased by

11% due to immense decrease in finished goods stock as sales

increased. Company paying off short-term loan did not lessen CL as

other payables, particularly bills payable (1054% rise) increased

considerably. (Honda Atlas Cars (Pakistan) Limited, 2010c)

QR improved just a little to 0.21 times as all current liquid assets,

mainly cash & bank increased.

For Investors, even poorer liquidity meant trouble for the Company in

the future.

FY 11:

CR increased insignificantly to 0.67 times still being treacherous.

CA raised by 61% by virtue of increased CKDs stock as Company was

trying to stock as much as possible due to future uncertainty about

supply chain as Japan was hit by natural disaster. Moreover, advanced

cash-flow position raised cash & bank by 959%. CL increased by 50%

due to increase in current portion of long-term loan and increased

trade & other payables including 94% rise in bills payables. (Honda

Atlas Cars (Pakistan) Limited, 2011e)

The increase in cash & bank balances raised CA improving QR to 0.26

times.

The Companys liquidity throughout these years has been risky

indicating cash-flow difficulties. However, credit payment support

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

22

from holding Company on CKD supplies to some extent was a comfort.

(Honda Atlas Cars (Pakistan) Limited, 2011f)

2

1.8

1.6

1.4

1.2

HACPL Current Ratio

HACPL Quick Ratio

TOYOTA Current Ratio

0.8

TOYOTA Quick ratio

0.6

0.4

0.2

0

2009

2010

2011

Competitor Comparison

Toyota maintained almost twice the CA than CL by having high cash & bank

and stock levels due to high market share than HACPL. Whereas HACPLs CA

have been lesser than CL due to much lower cash and bank and stock levels

than Toyotas. Unlike HACPL, Toyota did not rely on short-term borrowings.

Therefore Toyotas current and quick ratios have been much superior to

HACPLs.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

23

SOLVENCY

ANALYSIS

Solvency Ratios

2011

Gearin

g

Ratio

(%)

Intere

st

Cover

(times

)

HACPL

2010

2009

2011

TOYOTA

2010

2009

19.90

40.29

34.66

0.00

0.00

0.00

-0.61

-1.17

-1.79

88.77

53.50

78.02

45

40

35

30

25

Gearing

20

Interest Cover

15

10

5

0

-5

2009

2010

2011

Gearing:

FY 09:

Gearing Ratio of the Company rose to 34.66% led not only by

decreased equity but also by huge increase in long-term liabilities.

Besides reduction in equity due to huge rise in accumulated losses the

large increment in long-term debt as Company obtained new loans for

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

24

purpose of capital investments abruptly increased the gearing and

discomforted the shareholders by increasing the financial risk.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

FY 10:

25

Gearing ratio rose to 40.29% due to further decrease in equity and

sustained reliance on long-term borrowings.

There was a further fall in equity on account of huge increase in

accumulated losses further elevating the gearing. Company renewed

its Long-term loans.The minor decrease in long-term loans figure was

due to part of it becoming current.

Raised gearing was of concern to investors as already negative

profitability had to bear further FC.

FY 11:

Gearing ratio dropped to 19.90% owing to reduction in loans.

After major portion of reserves were transferred to P/L, equity further

decreased. Long-term debt fell with larger percentage as Company

fully repaid one of its loans and half of remaining loan became current.

Hence, Gearing relaxed decreasing the degree of risk of equity holders

providing them ease.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

26

45

40

35

30

25

HACPL

20

TOYOTA

15

10

5

0

2009

2010

2011

Competitor Comparison

Toyotas Capital Structure only consisted of equity and so it was not

geared whereas HACPL`s gearing kept fluctuating by the use of

borrowings to finance their capital & working capital requirements

keeping the gearing high.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

27

Interest Cover:

FY 09:

Interest Cover turned -1.79 times from 1.3 times last year due to

Company making loss.

Although, substantial loans obtained did not affect FC as the borrowing

costs were capitalized to PPE,(Honda Atlas Cars (Pakistan) Limited,

2009g) OP since last year decreased by 234% turning into loss which

turned interest cover negative reducing investors confidence and

raised questions about management of the Company.

FY 10:

Interest Cover was -1.17 times.

Although Companys FC raised owing to long-term and short-term

loans obtained for the Capital and Working capital requirements of the

new Honda City model but as operating loss increased by lesser

percentage of 33% than 234% last year resulting in lesser difference

between FC and Operating loss, interest cover demonstrated a minor

improvement. Company couldnt cover its FC indicating profitability

was too low given the gearing of the Company.

FY 11:

Interest Cover improved to -0.61 times with decreased FC and reduced

loss.

As Company reduced its loans helped by credit payment facility by the

Holding Company, there was a large decrease in FC. Operating loss too

achieved 83% reduction improving ratio, but improvement was yet not

enough for the Company to cover its FC.

Shareholders thus remained disappointed.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

28

100

80

60

HACPL

40

TOYOTA

20

0

2009

2010

2011

-20

Competitor Comparison

As Toyota remained un-geared its FC has been much lesser than

HACPLs consisting only of mark up on advances from the customers

and the bank charges. Earning delightful OP, Toyotas Interest Cover

has been exceptionally well than HACPLs over these periods.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

29

EFFICIENCY

ANALYSIS

Efficiency Ratios

2011

HACPL

2010

2009

2011

Days

TOYOTA

2010

2009

Payabl

e Days

10

Invento

ry Days

58

53

77

36

34

42

90

80

70

60

50

Payable Days

40

Inventory Days

30

20

10

0

2009

2010

2011

Payable Days:

FY 09:

Payable days were 10 rose from 3 days last year as creditors raised.

Trade Creditors rose by 204.35% from last year. Due to the economic

recession Companys sales fell together with colossal cash used in

operations. Furthermore, Company heavily invested during the year in

NCA. Therefore, due to feeble cash position, Company faced difficulty

in payments increasing creditors affecting WC management adversely.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

30

FY 10:

Payable days halved to 5 owing to reduced creditors.

Despite 15% rise in COS, Trade creditors reduced by 40.02% reflecting

tightening credit facilities after HACPLs deteriorated financial

performance and cash position last year. However, with sales rising,

cash position grew stable and Company timely paid back its creditors

and improved its WC management.

FY 11:

Payable days became 7 as creditors rose.

There was an increase of 36% in COS and 67.19% in creditors. Due to

future doubt over CKDs supply chain being affected due to tsunami in

Japan, Company was increasing stock of CKDs (Interview, Appendix) in

attempt to avoid future stock outs, and thus raised trade payables.

Companys revived financial performance and Cash position earned it

extended credit period.

12

10

8

HACPL

TOYOTA

4

2

0

2009

2010

2011

Competitor Comparison

Toyotas Payable days were not much different from HACPLs.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

31

Inventory Days:

FY 09:

Inventory days were 77 compared to 42 days last year as stock rose.

There was a huge increase in finished goods stock due to steep fall in

Honda City sales representing slowdown in trading due to the models

decline stage and economic fall down.

The inventory days hence increased, undermining WC.

FY 10:

Inventory days fell to 53 with decreased stock.

There was a vast decrease in finished goods stock indicating of re

growth of sales following introduction of new car model and re-entry of

consumer financing services with slight improvement in economy. The

working capital thus improved.

FY 11:

Inventory days rose to 58 with increased stock.

Immense increase in raw material described this rising. Major supplier,

Japan struck by natural disaster was going to affect future CKD

supplies and so Company was acquiring as much as it could to avoid

stock outs (Interview, Appendix).

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

32

90

80

70

60

50

HACPL

40

TOYOTA

30

20

10

0

2009

2010

2011

Competitor Comparison

Due to higher sales and thus higher inventory turnover than HACPL,

Toyotas inventory days remained better than HACPLs over these

years displaying better WC performance by Toyota than HACPL.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

33

INVESTORS

ANALYSIS

Investor's Ratios

2011

HACPL

2010

2009

Earning

per

Share

(PKR)

-2.09

-5.97

-2.81

34.90

43.81

17.62

Share

Price

(PKR/Sha

re)

10.00

16.00

12.00

220.00

262.38

107.72

Price

Earning

Ratio

(times)

-4.78

-2.68

-4.26

6.30

5.99

6.11

2011

TOYOTA

2010

2009

20

15

10

EPS

5

Share Price

P/E

0

2009

2010

2011

-5

-10

EPS:

Number of shares did not change during the three years therefore the

change in EPS has been solely because of the earnings. HACPL being in

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

34

losses generated negative EPS for all three years of -2.81/share,

-5.97/share and -2.09/share in 2009, 2010 and 2011 respectively.

50

40

30

HACPL

20

TOYOTA

10

0

2009

2010

2011

-10

Competitor Comparison

Toyota with healthy profits generated attractive EPS in all three years

of 17.62, 43.81 and 34.90/share respectively while HACPLs losses

produced negative EPS.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

35

P/E Ratio:

FY 09:

MP of HACPLs shares fell to PKR 12 from PKR 44 last year. The P/E ratio

became -4.27 times compared to last years 83.02 times.

Reduction in earnings played havoc on performance of the Company

along with difficulties in management of liquidity and recession in the

country reduced investors confidence leading to sudden slump in MP.

Together with negative EPS, P/E fell exceedingly.

FY 10:

Share price rose to PKR 16. The P/E ratio became -2.68 times.

Though Company made further loss increasing loss per share together

with continued delicate liquidity, investors confidence rose after huge

investment by Company in new Honda City that resulted in increased

sales (Interview, Appendix). MP of shares hence rose in expectancy of

future success and P/E became better.

FY 11

Share price fell to PKR 10 and P/E ratio to -4.78 times.

Despite notable rise in sales HACPL yet remained lossmaking as even

costs rose significantly along with continuous poor liquidity. Company

also not declaring dividends for a longer period reduced investors trust

and share price and P/E ratio thus fell.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

36

8

6

4

2

HACPL

TOYOTA

0

2009

2010

2011

-2

-4

-6

Competitor Comparison

Toyotas profits over these years and payment of dividends kept

investors trust and thus MP high. Together with Toyotas attractive

EPS, its P/E has been much better than HACPLs.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

37

SWOT

ANALYSIS

STRENGHTS:

Strong brand loyalty and smart

marketshare.

ISO 9001(QMS) and EMS

certified and therefore

maximum quality focused and

environmental friendly.

Providing greatest passenger

safety through ABS, SRS & GCON technology and fuel

efficient cars via i-VTEC

technology.

Countrywide sales, services

and spare parts dealership

networks and therefore

presence and sales in all the

major cities.

Credit support from the Holding

Company on CKD supplies

comforting cash position.

WEAKNESSES:

Higher car pricesacting

adversely on market share.

(Daily Times, 2011)

Capacity underutilization

creating high fixed costs.

Inefficient costs management.

Not providing smaller cars that

have the maximum demand.

(Pak Top 10, 2011a)

Reliance on borrowings and

therefore high FC.

(Honda Atlas Cars (Pakistan) Limited,

2011d)

OPPURTUNITIES:

THREATS:

Global demand for more fuel

Rising fuel prices making

efficient cars such as hybrid

use of cars uneconomical for

cars and applying latest

consumer. (Tirmizi, 2012)

Power shortage distressing

technology to target this

production. (APP, 2012)

demand can capture more

Swelling raw material prices

market share. (Deloitte,

increasing input costs which

2012)

Higher demand for smaller

may make production

uneconomical.

cars and diversification

Government supporting new

therein can achieve

competitors raising rivalry.

enhanced market share and

Uncertainty over future

better capacity utilization.

supply of CKDs may lead to

(Pak Top 10, 2011b)

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

38

Escalating sales due to

growth in agriculture sector

can grab healthier suppliers

relations by negotiating

improved credit policies.

(PAKISTAN Today, 2011)

stock outs.

Cheap imitates and

smuggled auto-parts

harming Companys autoparts business. (The Dawn,

2012)

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

39

PEST

ANALYSIS

POLITICAL:

Political factors are connected with government and its policies relating

business.

Government is attempting to knot-up long-term automobile policies with

Japan (KHAN, 2011). Government is also providing free of cost seeds to boost

up agriculture to advance economy and spending (Asif, 2011). However,

continued changing government policies are unpleasant for the auto sector

(Interview, Appendix) and government is not trusted by foreign investors.

Government raised sales tax and age and depreciation limit of imported used

cars to inspire competition. AIDP which was set to take the auto sector up is

expiring in near future and needs to be redeveloped (Rind,2012). Power

shortage has not for long been resolved by government keeping industry

under operational constraints.

ECONOMICAL:

Economic factors relates to general state of countrys economy.

Economy has gone down. In recent years inflation has run very high. This

means expensive inputs, increased selling price and affected sales. Interest

rates have gone up generating higher return on deposits but resulting in

higher borrowing costs. Regularly rising fuel prices are making use and

manufacturing of cars uneconomical. Recent floods left devastating effects

on agriculture sector massively declining farm income though government is

promoting the sector that will rise future spending. Although car financing

facilities are growing (Sabir, 2011), economy has touched the worst

extensively weakening purchasing power with worst effects on imports.

SOCIAL:

Social factors are related to the culture and trends of the countrys

population.

Most Pakistani population are middle class families (Jafri, 2011) mostly being

able to afford small economical compact cars. HACPL only offers subcompact

luxurious cars with high maintenance and prices. Japan tsunami has

disrupted the supply chain raising car and spare parts prices which will

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

further discourage demand for expensive cars. High illiteracy (Javed, 2010)

40

means shortages of educated and capable workforce resulting in high

training costs but cheap labour availability.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

TECHNOLOGICAL:

41

Technological factors relate to the availability and reliability of the

technology in the country required by a business.

HACPL use imported Japanese technology and provides auto-parts locally as

technology has been transferred to Pakistans OEM (Mirza, 2010). Public has

alternative sources too such as smuggled parts at low prices and cheap

imitates. Government has spent heavily on roads infrastructure (Business

recorder, 2012). HACPL provides countrywide auto-parts and services.

PORTERS FIVE FORCES ANALYSIS

THREAT OF NEW ENTRANTS:

These are the threats that potential new entrants will enter market.

Existing carmakers including HACPL have gathered a vast know how of

customers and have created brand loyalty building barriers to entry. Capital

requirements are high. However HACPL has not been able to achieve

economies of scale working far under capacity. Switching costs are low.

Government is providing relief to newcomers by reducing levies on imports

for primary years (Rind, 2011) and encouraging Indian (Ali, 2012), South

Korean and Chinese manufacturers (Hussain, 2011). Therefore, threat is high.

THREAT OF SUBSTITUTE PRODUCTS:

These are the threats that customers will move to some

alternative/replaceable product or technology with comparable price,

performance and Capital expenditure by similar or another industry that

satisfies the same needs.

There are alternative sources people can use to travel by like motorbikes and

public transports including busses, vans and three wheelers but these are in

no comparison with a personal own car. Therefore only substitute for HACPL

cars would be competitors and used imported cars. With regular increase in

fuel prices such as petrol, diesel and CNG, the customers are turning to lower

maintenance, lower fuel consumption cars i.e. 800 and 1000 CC cars.

Nevertheless, by maintaining quality at affordable prices HACPL has created

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

strong brand loyalty and Honda users would prefer not to move to lower

42

quality products. Therefore threat is low.

BARGAINING POWER OF SUPPLIERS:

These are the factors that indicate position of suppliers of the industry.

For auto sector there are technological and other auto-parts required. For

technological parts HACPL depends on Holding Company and the group to

supply parts. Bargaining power here would be high. As for suppliers of other

parts such as steel, aluminium, rubber etc. the bargaining power is low

because there are many such suppliers, low switching costs and there are

only a few leading car makers in the country and if Company decides to shift

to another supplier there would be a drastic effect on the supplier. Hence,

the overall threat is moderate.

BARGAINING POWER OF CUSTOMERS:

These are the factors that indicate the position of the customers of the

industry.

Bargaining power of customers is high as there are many options available to

them including competing carmakers and lower price imported cars.

Switching costs are low. However, HACPL has maintained the customers

loyalty by providing high quality at reasonable prices and use of latest

technology to make products fuel efficient and safe for customers. It has

developed dealership networks all around the country providing sales and

after sales services. The government however, is putting pressure on

automakers to reduce their prices (Jamal, 2010). The power is high.

COMPETITION AND RIVALRY:

These describe the nature of local market competition.

The local market has become saturated, main rivals being the leading

carmakers. Plus government has raised competition by providing relief to

used imported cars. There are price wars going on between rivals and costs

to exit the business are high. Government is still trying to bring in new

competitors which mean that already under capacity working companies

would face more trouble. The competition therefore, is very high.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

43

Conclusion and Recommendations

HACPL holds a major share in Pakistans automotive sector. However, its

performance in recent years remained lacklustre.

Companys profitability has been frail for the recent years as the recession

attacked economy. Devastating floods further eroded the situation.

Companys production capacity enhancement prior to these events led to

underutilization and therefore higher fixed costs. Companys one of the

mainstream product Honda City reached decline in FY09 and withdrawn car

financing facilities by banks deteriorated sales. Minor improvement in

economy and Companys introducing new model helped in achieving rise in

sales in succeeding years but continued currency devaluation and inflation

kept exchange losses high and profitability unstable. Interest rates kept

raising FC but brought in high profits on deposits too. Government remained

unkind by raising sales tax and encouraging competition. The competitor,

Toyotas high market share achieved better capacity utilization and cost

management through Kaizen costing kept its profitability well. The foreign

exchange contracts safeguarded it from exchange losses. Being ungeared, it

kept its FC minimal.

Short-term liquidity of Company too remained ominous. In FY09 huge

investments by Company placed it in weak cash position. Company obtained

short-term loan for working capital purposes which endangered its shortterm liquidity. Lately, though Company improved the cash status and paid off

short-term borrowings but high other payables kept short-term liquidity risky.

However, credit help by Holding Company to some extent comforted HACPL.

Toyota did not rely on short-term borrowings because of high cash levels

maintained and so had much better short-term liquidity.

Long-term solvency too has not been very satisfactory. Company has been

relying on long-term loans aiming to finance capital investments hence

raising gearing. Though lately gearing relaxed, the negative interest cover

during these years was of concern. This was on account of financial losses

and raised FC. Toyota remained independent of long-term borrowings and

had durable solvency.

The working capital remained questionable as well. Companys tensed

financial performance kept its credit period tight. Adequate level of inventory

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

has not been maintained as well. Toyotas inventory management has been

44

fine due to high sales.

Investors confidence in Company subsided as Company has been in losses

and have not been declaring dividends. EPS and P/E ratio went down. This

resulted in decreased share price. Toyota enjoyed profits and kept paying

dividends keeping investors confidence high.

HACPL has certain strengths such as strong brand loyalty created by

providing luxury at reasonable prices and strong market share but it needs to

cope with weaknesses like capacity underutilization and high production

costs. It has ability to cease opportunities like capturing the small cars

segment and to deal with threat of losing customers to competitors

substitute products and imported used cars.

The External environment has to be looked upon too. Governments

perpetually changing and unfriendly policies are harmful for the industry.

Deteriorated economic factors of inflation, interest rates, taxes, depreciated

currency, raw material and fuel prices had unfavourable impacts. There is

high demand for smaller cars, illiteracy and cheap labour availability. Original

auto-parts should be made available at reasonable prices to prevent losing

customers to cheap parts.

Barriers to entry by existing players and capital requirements are high but

government is supporting new entrants. Although there are no other

substitutes but competitors lower maintenance cars and imported used cars.

The overall suppliers power is moderate. Numerous providers, imported

used cars and low switching costs create high customer power. The saturated

market has created rivalry in the sector leading to price wars.

Although the country is emerging market for automobiles, political

uncertainty and terrorist activities are creating challenges. Economy has yet

not recovered. Inflation and depreciating currency are expected to keep

necessities high. Raw materials like steel are rising and future availability of

CKDs is a question. Rising fuel prices will create smaller cars demand.

Though government is to reduce 3.5% in duties & taxes () but is further

encouraging competition now by approving Indian auto imports () increasing

customers power. Therefore I think the sector has challenging future.

However, much is dependent on successor government that follows after

2013 elections.

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

45

Honda Atlas Cars [Pak] Ltd

Research and Analysis Project

46

Recommendations:

I would recommend that HACPL should:

Try to reduce production costs through effective management.

Hedge against currency risk.

Try to increase credit period by building healthy relations with

suppliers.

Think about diversifying in smaller cars segment as this opportunity

will incredibly raise market share leading to better capacity utilization.

Maintain investors confidence by deriving a better dividend policy as

this is an important factor for long-term stability of the Company.

Honda Atlas Cars [Pak] Ltd

You might also like

- Obu Rap Topic 20Document1 pageObu Rap Topic 20Mbecha BenedictNo ratings yet

- RAP 8 DGKHAN Cement PDFDocument37 pagesRAP 8 DGKHAN Cement PDFSusan Gomez100% (2)

- Final SLSDocument6 pagesFinal SLSHasanNo ratings yet

- Techniques - ST Patrick's CollegeDocument2 pagesTechniques - ST Patrick's Collegealrac_noseimaj70550% (2)

- RAPDocument42 pagesRAPJozua Oshea PungNo ratings yet

- RAPDocument48 pagesRAPRohail Amjad100% (1)

- SLS GuideDocument4 pagesSLS GuideYuvraj VermaNo ratings yet

- An Analysis of Financial and Business Performance of Gul Ahmed Textile Mills Limited Between FY2009 To FY2011Document32 pagesAn Analysis of Financial and Business Performance of Gul Ahmed Textile Mills Limited Between FY2009 To FY2011techyaccountantNo ratings yet

- Esearch Roject: A. Files To Be UploadedDocument4 pagesEsearch Roject: A. Files To Be Uploadedasfandkamal12345No ratings yet

- RAP MARYAM - R02 (Old)Document34 pagesRAP MARYAM - R02 (Old)Asad MuhammadNo ratings yet

- Skills and Learning StatementDocument7 pagesSkills and Learning StatementBlessing UmorenNo ratings yet

- C CC C CC C C C CC CC CCC C: CCCC C CCC C C C C C C C C C C C C C C C C C CCDocument26 pagesC CC C CC C C C CC CC CCC C: CCCC C CCC C C C C C C C C C C C C C C C C C CCAhmed FarazNo ratings yet

- SLSDocument8 pagesSLSJehanzeb KhanNo ratings yet

- An Analysis and Evaluation of Financial and Business Performance of Apollo Tyres LimitedDocument26 pagesAn Analysis and Evaluation of Financial and Business Performance of Apollo Tyres LimitedAditya KanabarNo ratings yet

- RAP StyleDocument1 pageRAP StyleThansal Abdul BasheerNo ratings yet

- Sls Ukessays - Com-Skills - and - Learning - Statement - Education - Essay PDFDocument4 pagesSls Ukessays - Com-Skills - and - Learning - Statement - Education - Essay PDFKit YuenNo ratings yet

- SLS Lucky Cement - RAPDocument6 pagesSLS Lucky Cement - RAPAbdulHameedAdamNo ratings yet

- SampleDocument8 pagesSampleTahir SirtajNo ratings yet

- Skills and Learning Statement Sample OneDocument9 pagesSkills and Learning Statement Sample OneAsad MahmoodNo ratings yet

- Acca Thesis For BSC Applied AccountancyDocument32 pagesAcca Thesis For BSC Applied AccountancyJehanzeb KhanNo ratings yet

- OBU Topic 8 Lucky CementDocument25 pagesOBU Topic 8 Lucky CementHassanNo ratings yet

- Skill and Learning StatementDocument5 pagesSkill and Learning StatementYibel GebregziabiherNo ratings yet

- RAP PresentationDocument16 pagesRAP PresentationHammad SaeedNo ratings yet

- Sls Ukessays - Com-Personal - Skills - and - Learning - Statement - Personal - Development - Essay PDFDocument4 pagesSls Ukessays - Com-Personal - Skills - and - Learning - Statement - Personal - Development - Essay PDFKit YuenNo ratings yet

- Sls Ukessays - Com-Skills - and - Learning - Statement - On - RAP PDFDocument4 pagesSls Ukessays - Com-Skills - and - Learning - Statement - On - RAP PDFKit YuenNo ratings yet

- RAP Checklist 2018 19Document2 pagesRAP Checklist 2018 19IkennaNo ratings yet

- Skills and Learning StatementDocument6 pagesSkills and Learning StatementLin AungNo ratings yet

- Obu - Rap IntroDocument21 pagesObu - Rap IntroLavyciaNo ratings yet

- OBU Essay SampleDocument46 pagesOBU Essay SampleAsif SajibNo ratings yet

- Oxford Brookes University: Research and Analysis ProjectDocument46 pagesOxford Brookes University: Research and Analysis ProjectjawadNo ratings yet

- OBUDocument30 pagesOBUYanhong Zhao0% (1)

- OBU BSC RAP-Business ModelsDocument4 pagesOBU BSC RAP-Business ModelsTanim Misbahul MNo ratings yet

- Lidl SR Report 2017 PDFDocument68 pagesLidl SR Report 2017 PDFUrsu DanielaNo ratings yet

- BSC Thesis 02Document21 pagesBSC Thesis 02Shuhaib MukkolyNo ratings yet

- Topic 8 How To Tackle EvaluationDocument5 pagesTopic 8 How To Tackle EvaluationMbecha BenedictNo ratings yet

- Rap Checklist 1Document1 pageRap Checklist 1Asim SaleemNo ratings yet

- SLS (Period 36 - Draft)Document5 pagesSLS (Period 36 - Draft)M.KazimSadiqNo ratings yet

- RAP 20 Nestle PDFDocument46 pagesRAP 20 Nestle PDFSusan Gomez100% (2)

- Skills and Learning Statement Oxford Brookes University Nishat Mills Limited (NML)Document6 pagesSkills and Learning Statement Oxford Brookes University Nishat Mills Limited (NML)Flutter BugNo ratings yet

- Use of Business / Accountancy Models: Annotated Examples of Research and Analysis - Topic 8Document2 pagesUse of Business / Accountancy Models: Annotated Examples of Research and Analysis - Topic 8Reznov KovacicNo ratings yet

- The Cadbury ReportDocument4 pagesThe Cadbury Reportlife15No ratings yet

- Obu Tata Motors Final DraftDocument48 pagesObu Tata Motors Final DraftNayeem SazzadNo ratings yet

- ACCA RAP OBU - How To PassDocument2 pagesACCA RAP OBU - How To PassTop Grade Papers100% (1)

- Skill and Learning Statement An Evaluation of Business and Financial Analysis of British Airways PLCDocument7 pagesSkill and Learning Statement An Evaluation of Business and Financial Analysis of British Airways PLCHammad SaeedNo ratings yet

- Sls Ukessays - Com-Research - and - Analysis - Project PDFDocument4 pagesSls Ukessays - Com-Research - and - Analysis - Project PDFKit YuenNo ratings yet

- Research DocumentDocument24 pagesResearch DocumentZiaBilalNo ratings yet

- Pfizer Skills and Learning Statement - December 2015Document10 pagesPfizer Skills and Learning Statement - December 2015Nadeen PujaNo ratings yet

- Skills and Learning Statement: Oxford Brookes University BSC (Honours)Document7 pagesSkills and Learning Statement: Oxford Brookes University BSC (Honours)HasanNo ratings yet

- Skills and Learning Statement Nov-21Document5 pagesSkills and Learning Statement Nov-21zeeshan saleem100% (1)

- 1-AAA MockDocument10 pages1-AAA MockSafa Aziz100% (1)

- BSC Degree Oxford Brookes - How To Get StartedDocument7 pagesBSC Degree Oxford Brookes - How To Get StartedMamunur Rashid RedoyNo ratings yet

- OBU RAP TipsssDocument1 pageOBU RAP Tipsssjafar ul hassanNo ratings yet

- OBU Project Pass NotesDocument2 pagesOBU Project Pass NotesWaqas Siddique SammaNo ratings yet

- Acca - BSC Hons Degree - Rap Topics - Top Grade PapersDocument4 pagesAcca - BSC Hons Degree - Rap Topics - Top Grade PapersTop Grade Papers100% (1)

- Financial Statements Analysis of Attock Petroleum Company LimitedDocument36 pagesFinancial Statements Analysis of Attock Petroleum Company LimitedHumayun82% (11)

- Ayodele Olatiregun ObuDocument32 pagesAyodele Olatiregun ObuAyodele Samuel OlatiregunNo ratings yet

- Recruitment Process Outsourcing A Complete Guide - 2020 EditionFrom EverandRecruitment Process Outsourcing A Complete Guide - 2020 EditionNo ratings yet

- Green Products A Complete Guide - 2020 EditionFrom EverandGreen Products A Complete Guide - 2020 EditionRating: 5 out of 5 stars5/5 (1)

- ECI - Limitations (Doc ID 652117.1)Document3 pagesECI - Limitations (Doc ID 652117.1)RabiaasadNo ratings yet

- Obu ExamplerDocument11 pagesObu Examplerahsan1379No ratings yet

- Nestle 2013 StatsDocument7 pagesNestle 2013 StatsRabiaasadNo ratings yet

- OBU - Rap Checklist 2013 2014Document1 pageOBU - Rap Checklist 2013 2014RabiaasadNo ratings yet

- Final - Day 2 Slot 3Document48 pagesFinal - Day 2 Slot 3MH SyamNo ratings yet

- Real Estate OverviewDocument14 pagesReal Estate OverviewRavi Chaurasia100% (3)

- Ultra HNI 15Document2 pagesUltra HNI 15Rafi AzamNo ratings yet

- GEPC Module 3 Varieties and Registers of Language 1Document7 pagesGEPC Module 3 Varieties and Registers of Language 1Kurt Russell BalaniNo ratings yet

- Accountability Structures:: A Comparative AnalysisDocument26 pagesAccountability Structures:: A Comparative AnalysisAbrar AhmedNo ratings yet

- Technological Institute of The Philippines: Name ID NoDocument2 pagesTechnological Institute of The Philippines: Name ID NoJohn Cabrera PlacenteNo ratings yet

- Equitrac - Installation GuideDocument97 pagesEquitrac - Installation GuideEduNo ratings yet

- RA-030745 - PROFESSIONAL TEACHER - Secondary (Mathematics) - Tuguegarao - 9-2019 PDFDocument31 pagesRA-030745 - PROFESSIONAL TEACHER - Secondary (Mathematics) - Tuguegarao - 9-2019 PDFPhilBoardResultsNo ratings yet

- Prayer A Warrior's WeaponDocument2 pagesPrayer A Warrior's WeaponEduardo ReyesNo ratings yet

- TCRP RPT 114Document86 pagesTCRP RPT 114steeven77No ratings yet

- International Standard: Norme InternationaleDocument19 pagesInternational Standard: Norme InternationaleZEBOUANo ratings yet

- Fisher Fieldvue DVC6200 SIS Digital Valve Controller: Lower Cost of Ownership Testing FlexibilityDocument2 pagesFisher Fieldvue DVC6200 SIS Digital Valve Controller: Lower Cost of Ownership Testing FlexibilityZts MksNo ratings yet

- Capili vs. Sps. Cardana, Et Al. - EvidenceDocument7 pagesCapili vs. Sps. Cardana, Et Al. - EvidenceFenina ReyesNo ratings yet

- Odisha DV List1Document66 pagesOdisha DV List1Chottu MondalNo ratings yet

- MesopotamiaDocument4 pagesMesopotamiaMinh HoangNo ratings yet

- BQMS Template Procedure 8.2.1 Internal Audit v3.0Document4 pagesBQMS Template Procedure 8.2.1 Internal Audit v3.0Tria Meildha GustinNo ratings yet

- Five Ethical Principles in Student LifeDocument7 pagesFive Ethical Principles in Student LifeLorenaNo ratings yet

- 31 Secret Restaurant RecipesDocument53 pages31 Secret Restaurant Recipeslotsofspam123100% (4)

- Connecting The BSC6900 To The M2000Document2 pagesConnecting The BSC6900 To The M2000AbDalla YabarowNo ratings yet

- Prof Abed Onn-Equity and Efficiency in Private Occupational Health SettingsDocument27 pagesProf Abed Onn-Equity and Efficiency in Private Occupational Health SettingsNavaganesh KannappenNo ratings yet

- Information Security Literature ReviewDocument7 pagesInformation Security Literature Reviewfahynavakel2100% (1)

- Walk A Mile 1st Edition by Joey Paul - Test BankDocument19 pagesWalk A Mile 1st Edition by Joey Paul - Test Bankroseyoung0No ratings yet

- Yoruba Religion and Medicine in Ibadan PDFDocument237 pagesYoruba Religion and Medicine in Ibadan PDFEnriqueHernandez100% (2)

- Tutorial 5 & 6 (1) 3441Document22 pagesTutorial 5 & 6 (1) 3441lunarsaleNo ratings yet

- Guide Questions - DPA, ECA and EASEDocument19 pagesGuide Questions - DPA, ECA and EASEAnjilla RubiaNo ratings yet

- Stayzilla Contract - B2BDocument4 pagesStayzilla Contract - B2BAnonymous gmw92zsNo ratings yet

- Assignment 4Document4 pagesAssignment 4api-615679676No ratings yet

- Double Passive VoiceDocument6 pagesDouble Passive Voiceminhdang021225No ratings yet

- 3-Listado Defin. Puntuacion T. LaboratorioDocument52 pages3-Listado Defin. Puntuacion T. LaboratoriofNo ratings yet