Professional Documents

Culture Documents

David F. Mosteller v. Internal Revenue Service, 841 F.2d 1123, 4th Cir. (1988)

David F. Mosteller v. Internal Revenue Service, 841 F.2d 1123, 4th Cir. (1988)

Uploaded by

Scribd Government DocsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

David F. Mosteller v. Internal Revenue Service, 841 F.2d 1123, 4th Cir. (1988)

David F. Mosteller v. Internal Revenue Service, 841 F.2d 1123, 4th Cir. (1988)

Uploaded by

Scribd Government DocsCopyright:

Available Formats

841 F.

2d 1123

Unpublished Disposition

NOTICE: Fourth Circuit I.O.P. 36.6 states that citation of

unpublished dispositions is disfavored except for establishing

res judicata, estoppel, or the law of the case and requires

service of copies of cited unpublished dispositions of the Fourth

Circuit.

David F. MOSTELLER, Petitioner--Appellant,

v.

INTERNAL REVENUE SERVICE, Respondent-Appellee.

No. 87-3059.

United States Court of Appeals, Fourth Circuit.

Submitted: Jan. 29, 1988.

Decided: Feb. 24, 1988.

David F. Mosteller, appellant pro se.

Robert Allen Bernstein, Roger Milton Olsen, Michael Lee Paup, Janet A.

Bradley, United States Department of Justice, for appellee.

Before ERVIN and CHAPMAN, Circuit Judges, and BUTZNER, Senior

Circuit Judge.

PER CURIAM:

A review of the record, the opinion of the Tax Court and the informal briefs

submitted by the parties to this appeal reveals that the Tax Court's

determination that David F. Mosteller failed to rebut the presumption of

correctness that attaches to an IRS deficiency notice was proper. We

accordingly affirm the decision of the Tax Court based on its reasoning.

Mosteller v. Commissioner, No. 15361-81 (Tax Ct. Oct. 7, 1986).

Because the facts and legal contentions are adequately developed in the

materials before the Court and oral argument would not aid in the decisional

process, we dispense with argument in this case.

AFFIRMED.

You might also like

- Constitution of The Mexican Mafia in TexasDocument9 pagesConstitution of The Mexican Mafia in TexasJohn Tedesco33% (3)

- Javier V CA DigestDocument4 pagesJavier V CA DigestPetallar Princess LouryNo ratings yet

- Cherlyn Arrington LawsuitDocument130 pagesCherlyn Arrington LawsuitMichelle RindelsNo ratings yet

- Illinois Residential Lease AgreementDocument7 pagesIllinois Residential Lease Agreementcamel3781100% (1)

- Martin Sterenbuch, and Diane Sterenbuch v. Commissioner of The Internal Revenue Service, 12 F.3d 206, 4th Cir. (1993)Document2 pagesMartin Sterenbuch, and Diane Sterenbuch v. Commissioner of The Internal Revenue Service, 12 F.3d 206, 4th Cir. (1993)Scribd Government DocsNo ratings yet

- V. John G. Whittaker Cecilia B. Whittaker, Pe Titioners-Appellants, Commissioner of Internal Revenue, 993 F.2d 1541, 4th Cir. (1993)Document2 pagesV. John G. Whittaker Cecilia B. Whittaker, Pe Titioners-Appellants, Commissioner of Internal Revenue, 993 F.2d 1541, 4th Cir. (1993)Scribd Government DocsNo ratings yet

- Frankie McCoy v. Howard N. Lyles, Warden, Lt. Brown, Correctional Officer, Sgt. Sinkler, Correctional Officer, 838 F.2d 1210, 4th Cir. (1988)Document1 pageFrankie McCoy v. Howard N. Lyles, Warden, Lt. Brown, Correctional Officer, Sgt. Sinkler, Correctional Officer, 838 F.2d 1210, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- Timothy Carness Autry v. Mark Dalton J. W. Morris Ray Powell Cranford Fann, 829 F.2d 34, 4th Cir. (1987)Document2 pagesTimothy Carness Autry v. Mark Dalton J. W. Morris Ray Powell Cranford Fann, 829 F.2d 34, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- Johnell Porter v. John R. Justice, Mr. Michael D. Williams County of Chester, 829 F.2d 1120, 4th Cir. (1987)Document2 pagesJohnell Porter v. John R. Justice, Mr. Michael D. Williams County of Chester, 829 F.2d 1120, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- Michael O. Egger v. Commissioner of Internal Revenue, 849 F.2d 604, 4th Cir. (1988)Document2 pagesMichael O. Egger v. Commissioner of Internal Revenue, 849 F.2d 604, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument3 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Nathan A. Thorne v. R.K. Bynum, Robert R. Kelly, James Smith, 838 F.2d 1210, 4th Cir. (1988)Document2 pagesNathan A. Thorne v. R.K. Bynum, Robert R. Kelly, James Smith, 838 F.2d 1210, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument2 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Larry William Caple v. Edward W. Murray, Attorney General of The State of Virginia, Respondents, 838 F.2d 1209, 4th Cir. (1988)Document2 pagesLarry William Caple v. Edward W. Murray, Attorney General of The State of Virginia, Respondents, 838 F.2d 1209, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- Willie H. Mitchell v. State of North Carolina, Child Support Enforcement Section, 819 F.2d 1138, 4th Cir. (1987)Document1 pageWillie H. Mitchell v. State of North Carolina, Child Support Enforcement Section, 819 F.2d 1138, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- Stedson A. Linkous v. Kenneth Devore John B. Myers, JR., Clerk, 843 F.2d 1387, 4th Cir. (1988)Document1 pageStedson A. Linkous v. Kenneth Devore John B. Myers, JR., Clerk, 843 F.2d 1387, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument2 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Sidney Faison v. Northampton County Department of Social Services James P. Clark Harriet Beasley, 850 F.2d 689, 4th Cir. (1988)Document2 pagesSidney Faison v. Northampton County Department of Social Services James P. Clark Harriet Beasley, 850 F.2d 689, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- Marion Leroy Pressley v. Commonwealth of Virginia Fred C. Dalton, M.D. Powhatan Correctional Center, 861 F.2d 265, 4th Cir. (1988)Document2 pagesMarion Leroy Pressley v. Commonwealth of Virginia Fred C. Dalton, M.D. Powhatan Correctional Center, 861 F.2d 265, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- Victor Huntley v. Warden Lyles, 846 F.2d 71, 4th Cir. (1988)Document1 pageVictor Huntley v. Warden Lyles, 846 F.2d 71, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- Dennis Lee Fleek v. Warden, Federal Correctional Institute, Lewisburg, Pennsylvania, Respondent, 838 F.2d 466, 4th Cir. (1988)Document2 pagesDennis Lee Fleek v. Warden, Federal Correctional Institute, Lewisburg, Pennsylvania, Respondent, 838 F.2d 466, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- United States v. Robert B. MacHen, 862 F.2d 315, 4th Cir. (1988)Document2 pagesUnited States v. Robert B. MacHen, 862 F.2d 315, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- Claude L. Mathis v. Jerry Moore, Superintendent, Lacy Thornburg, Attorney General of North Carolina, 811 F.2d 1505, 4th Cir. (1987)Document1 pageClaude L. Mathis v. Jerry Moore, Superintendent, Lacy Thornburg, Attorney General of North Carolina, 811 F.2d 1505, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- William Henry Thomas v. Veterans Administration Medical Center, 841 F.2d 1123, 4th Cir. (1988)Document1 pageWilliam Henry Thomas v. Veterans Administration Medical Center, 841 F.2d 1123, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- John Wayne Lunsford Edward D. Bennett v. First National Bank of Randolph County, 808 F.2d 835, 1st Cir. (1986)Document2 pagesJohn Wayne Lunsford Edward D. Bennett v. First National Bank of Randolph County, 808 F.2d 835, 1st Cir. (1986)Scribd Government DocsNo ratings yet

- Terry Lee Newman v. Toni v. Bair Attorney General of Virginia, 819 F.2d 1138, 4th Cir. (1987)Document1 pageTerry Lee Newman v. Toni v. Bair Attorney General of Virginia, 819 F.2d 1138, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- David A. Nuttle Karen M. Nuttle v. Commissioner of The Internal Revenue Service, 40 F.3d 1244, 4th Cir. (1994)Document2 pagesDavid A. Nuttle Karen M. Nuttle v. Commissioner of The Internal Revenue Service, 40 F.3d 1244, 4th Cir. (1994)Scribd Government DocsNo ratings yet

- Wilford Andrew Matherly, Jr. v. Attorney General of The State of Virginia, W.D. Blankenship, Respondents, 835 F.2d 875, 4th Cir. (1987)Document1 pageWilford Andrew Matherly, Jr. v. Attorney General of The State of Virginia, W.D. Blankenship, Respondents, 835 F.2d 875, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- United States v. James Henry Fuller, 842 F.2d 1293, 4th Cir. (1988)Document1 pageUnited States v. James Henry Fuller, 842 F.2d 1293, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- Don Cornell Wilson v. B. Norris Vassar Virginia Parole Board, 829 F.2d 1121, 4th Cir. (1987)Document2 pagesDon Cornell Wilson v. B. Norris Vassar Virginia Parole Board, 829 F.2d 1121, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- Billie Jean C. Barlow v. Esselte Pendaflex Corporation, Meto Division, 838 F.2d 1209, 4th Cir. (1988)Document1 pageBillie Jean C. Barlow v. Esselte Pendaflex Corporation, Meto Division, 838 F.2d 1209, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- Vernon Martin v. William D. Leeke, Commissioner Attorney General of The State of South Carolina, 822 F.2d 55, 4th Cir. (1987)Document1 pageVernon Martin v. William D. Leeke, Commissioner Attorney General of The State of South Carolina, 822 F.2d 55, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- Robert Scott Dunning v. Commissioner of Internal Revenue, 861 F.2d 263, 4th Cir. (1988)Document2 pagesRobert Scott Dunning v. Commissioner of Internal Revenue, 861 F.2d 263, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- United States v. James Anthony Faison, 888 F.2d 1387, 4th Cir. (1989)Document2 pagesUnited States v. James Anthony Faison, 888 F.2d 1387, 4th Cir. (1989)Scribd Government DocsNo ratings yet

- Katrina G. Molake v. Commissioner of Internal Revenue, 914 F.2d 248, 4th Cir. (1990)Document2 pagesKatrina G. Molake v. Commissioner of Internal Revenue, 914 F.2d 248, 4th Cir. (1990)Scribd Government DocsNo ratings yet

- Frizell Stephens v. R.M. Muncy, Mary Sue Terry, Attorney General of Virginia, 888 F.2d 1387, 4th Cir. (1989)Document2 pagesFrizell Stephens v. R.M. Muncy, Mary Sue Terry, Attorney General of Virginia, 888 F.2d 1387, 4th Cir. (1989)Scribd Government DocsNo ratings yet

- Harrison E. Livingstone v. Little, Brown & Company and John Taylor Williams, 838 F.2d 1210, 4th Cir. (1988)Document2 pagesHarrison E. Livingstone v. Little, Brown & Company and John Taylor Williams, 838 F.2d 1210, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- Monroe Patterson, Jr. v. The Memorial Hospital, 825 F.2d 408, 4th Cir. (1987)Document1 pageMonroe Patterson, Jr. v. The Memorial Hospital, 825 F.2d 408, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- Marion Leroy Pressley v. Toni v. Bair, 873 F.2d 1440, 4th Cir. (1989)Document2 pagesMarion Leroy Pressley v. Toni v. Bair, 873 F.2d 1440, 4th Cir. (1989)Scribd Government DocsNo ratings yet

- James Milton de Vone, Sr. v. Fannie Batchelor, 978 F.2d 1254, 4th Cir. (1992)Document2 pagesJames Milton de Vone, Sr. v. Fannie Batchelor, 978 F.2d 1254, 4th Cir. (1992)Scribd Government DocsNo ratings yet

- Carlton Jerome Pope v. Walter M. Edmonds, Clerk Leslie T. Jolly, Court Reporter, 829 F.2d 36, 4th Cir. (1987)Document1 pageCarlton Jerome Pope v. Walter M. Edmonds, Clerk Leslie T. Jolly, Court Reporter, 829 F.2d 36, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- John T. Roberts, and Louise S. Roberts v. United States, 846 F.2d 73, 4th Cir. (1988)Document2 pagesJohn T. Roberts, and Louise S. Roberts v. United States, 846 F.2d 73, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument2 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Edwin David Henry v. W. Holt Trotman, Assistant District Attorney, New Hanover County, NC, 818 F.2d 28, 4th Cir. (1987)Document2 pagesEdwin David Henry v. W. Holt Trotman, Assistant District Attorney, New Hanover County, NC, 818 F.2d 28, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument2 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Leon D. Tyler v. O. Ivan White, Warden United States Parole Commission Federal Bureau of Prisons, 825 F.2d 408, 4th Cir. (1987)Document1 pageLeon D. Tyler v. O. Ivan White, Warden United States Parole Commission Federal Bureau of Prisons, 825 F.2d 408, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument1 pageUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Milton Nelson-Rodriguez v. United States, 979 F.2d 844, 1st Cir. (1992)Document3 pagesMilton Nelson-Rodriguez v. United States, 979 F.2d 844, 1st Cir. (1992)Scribd Government DocsNo ratings yet

- Ronnie Andrew Mabry v. Raymond M. Muncy Attorney General of The State of Virginia, Respondents, 852 F.2d 566, 4th Cir. (1988)Document2 pagesRonnie Andrew Mabry v. Raymond M. Muncy Attorney General of The State of Virginia, Respondents, 852 F.2d 566, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- William Brown, Jr. v. St. Brides Correctional Center Alton Baskerville Mohammed Yunas, DR., 813 F.2d 1227, 4th Cir. (1987)Document1 pageWilliam Brown, Jr. v. St. Brides Correctional Center Alton Baskerville Mohammed Yunas, DR., 813 F.2d 1227, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- Ronnie Lee Simmons, Sr. v. R.M. Muncy B.W. Soles Patrick J. Gurney, 843 F.2d 1388, 4th Cir. (1988)Document1 pageRonnie Lee Simmons, Sr. v. R.M. Muncy B.W. Soles Patrick J. Gurney, 843 F.2d 1388, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument2 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- John J. Berlin v. Edward W. Murray, Director of Virginia Department of Correction, Respondent, 841 F.2d 1122, 4th Cir. (1988)Document1 pageJohn J. Berlin v. Edward W. Murray, Director of Virginia Department of Correction, Respondent, 841 F.2d 1122, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- James Bennett v. Lieutenant Baldwin K. M. Mottern, Officer, 28 F.3d 1208, 4th Cir. (1994)Document2 pagesJames Bennett v. Lieutenant Baldwin K. M. Mottern, Officer, 28 F.3d 1208, 4th Cir. (1994)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument2 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument2 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Milton Ray Denton v. John G. Patseavouras C.M. Creecy, JR., 857 F.2d 1468, 4th Cir. (1988)Document1 pageMilton Ray Denton v. John G. Patseavouras C.M. Creecy, JR., 857 F.2d 1468, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- Herman David Stevenson, Jr. v. Commissioner of Internal Revenue, 912 F.2d 464, 4th Cir. (1990)Document2 pagesHerman David Stevenson, Jr. v. Commissioner of Internal Revenue, 912 F.2d 464, 4th Cir. (1990)Scribd Government DocsNo ratings yet

- Norris Leo Dangler v. Catterton, Kemp & Mason, Attorneys at Law Judith Catterton Paul Kemp, 843 F.2d 1386, 4th Cir. (1988)Document1 pageNorris Leo Dangler v. Catterton, Kemp & Mason, Attorneys at Law Judith Catterton Paul Kemp, 843 F.2d 1386, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- Stephen R. Austin v. Anthony M. Franks, Postmaster General, 948 F.2d 1280, 4th Cir. (1991)Document2 pagesStephen R. Austin v. Anthony M. Franks, Postmaster General, 948 F.2d 1280, 4th Cir. (1991)Scribd Government DocsNo ratings yet

- Timothy Dexter Walton v. W. Q. Overton Vicki Meadors, and Franklin County Jail Franklin County Jail Staff, 28 F.3d 1212, 4th Cir. (1994)Document2 pagesTimothy Dexter Walton v. W. Q. Overton Vicki Meadors, and Franklin County Jail Franklin County Jail Staff, 28 F.3d 1212, 4th Cir. (1994)Scribd Government DocsNo ratings yet

- United States of America, and Floyd A. Bell, Jr. v. Webb W. Turner, 9 F.3d 1545, 4th Cir. (1993)Document3 pagesUnited States of America, and Floyd A. Bell, Jr. v. Webb W. Turner, 9 F.3d 1545, 4th Cir. (1993)Scribd Government DocsNo ratings yet

- Steven Eugene Smith v. John Brown, Warden, PHP Corporation, Ms. Sword, Arnold Hopkins, Commissioner of Corrections, 884 F.2d 1389, 4th Cir. (1989)Document2 pagesSteven Eugene Smith v. John Brown, Warden, PHP Corporation, Ms. Sword, Arnold Hopkins, Commissioner of Corrections, 884 F.2d 1389, 4th Cir. (1989)Scribd Government DocsNo ratings yet

- Petition for Certiorari Denied Without Opinion: Patent Case 96-1178From EverandPetition for Certiorari Denied Without Opinion: Patent Case 96-1178No ratings yet

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- Coyle v. Jackson, 10th Cir. (2017)Document7 pagesCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Lopez, 10th Cir. (2017)Document4 pagesUnited States v. Lopez, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Marjorie Tocao and William T. Belo, Petitioners, vs. Court of APPEALS and NENITA A. ANAY, RespondentsDocument12 pagesMarjorie Tocao and William T. Belo, Petitioners, vs. Court of APPEALS and NENITA A. ANAY, Respondentsjodelle11No ratings yet

- United States v. Lateef Akande, 4th Cir. (2015)Document5 pagesUnited States v. Lateef Akande, 4th Cir. (2015)Scribd Government DocsNo ratings yet

- Robert Jordan in Hemingways For Whom The Bell Tolls Is For Freedom and Authenticity An Existential AnalysisDocument5 pagesRobert Jordan in Hemingways For Whom The Bell Tolls Is For Freedom and Authenticity An Existential AnalysisIJRASETPublicationsNo ratings yet

- Additional VacanciesDocument8 pagesAdditional VacanciesKeleeNo ratings yet

- Purchase Order Financing AgreementDocument6 pagesPurchase Order Financing AgreementMoffat Nyamadzawo100% (1)

- Department of Environment and Natural Resources Community Environment and Natural Resources OfficeDocument5 pagesDepartment of Environment and Natural Resources Community Environment and Natural Resources OfficeleahtabsNo ratings yet

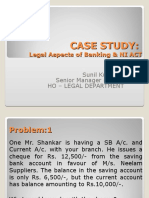

- Case Study Legal Aspects & NI ActDocument23 pagesCase Study Legal Aspects & NI Actvarun_bathula100% (1)

- Lab 2-1 Trip To GermanyDocument5 pagesLab 2-1 Trip To Germanyapi-276736137No ratings yet

- History of HighlandersDocument14 pagesHistory of HighlandersSiranjana RodrigoNo ratings yet

- PCGG V CojuangcoDocument24 pagesPCGG V CojuangcoJan Igor GalinatoNo ratings yet

- Marquez Vs Desierto DigestDocument2 pagesMarquez Vs Desierto DigestKathleen CruzNo ratings yet

- 21st Literature ReviewerDocument5 pages21st Literature ReviewerLorie joy AlojipanNo ratings yet

- GRHS FlygirlDocument2 pagesGRHS FlygirlHirenkumar ShahNo ratings yet

- 2011Vol36No1 PDFDocument84 pages2011Vol36No1 PDFcofs.ranger5788No ratings yet

- Oral Reasons For Judgment (Short Leave Application Seeking Stay of Injection Passport)Document2 pagesOral Reasons For Judgment (Short Leave Application Seeking Stay of Injection Passport)Canadian Society for the Advancement of Science in Public PolicyNo ratings yet

- All Quiet On The Western FrontDocument6 pagesAll Quiet On The Western Frontapi-405719582No ratings yet

- The Democratic Republic of The Congo Vs Uganda ICGJ 31Document11 pagesThe Democratic Republic of The Congo Vs Uganda ICGJ 31inderpreetNo ratings yet

- Affidavit of Loss - Driver's LicenseDocument1 pageAffidavit of Loss - Driver's Licensejc cayananNo ratings yet

- Police AccountabilityDocument71 pagesPolice Accountabilityapi-529643598100% (1)

- Англи хэлний түвшин тогтоох тест B2 C1 PDFDocument7 pagesАнгли хэлний түвшин тогтоох тест B2 C1 PDFMunkhjin BatturNo ratings yet

- AML Refresher COCDocument3 pagesAML Refresher COCakshay kasanaNo ratings yet

- Complaint Salcedo - PMADocument3 pagesComplaint Salcedo - PMAAnonymous 5k7iGyNo ratings yet

- Group C PresentationDocument15 pagesGroup C PresentationSTEPHEN GWATSWAIRANo ratings yet

- Enabling ClauseDocument3 pagesEnabling ClausehimanshuNo ratings yet

- Datu Macalawan Badio/ Bae Marigay A So ParamataDocument6 pagesDatu Macalawan Badio/ Bae Marigay A So ParamataSumayyah Mautante MuslimenNo ratings yet

- Qumran and The Old Testament (PDFDrive)Document15 pagesQumran and The Old Testament (PDFDrive)Dariusz JNo ratings yet