Professional Documents

Culture Documents

SCM MovieRental Gr15 Ver3

Uploaded by

Sanjeev RanjanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SCM MovieRental Gr15 Ver3

Uploaded by

Sanjeev RanjanCopyright:

Available Formats

MOVIE RENTAL BUSINESS: BLOCKBUSTER, NETFLIX

& REDBOX

SUBMITTED TO

SUBMITTED BY

Professor Jishnu Hazra

Indian

Institute

Bangalore

of

GROUP 15

Management,

ADITYA KUMAR GUPTA

1511377

CHINMAYA PANDA

1511388

MANISH PANDEY

M V SAI CHAITANYA

1511407

A CASE ANALYSIS OF MOVIE RENTAL BUSINESS: BLOCKBUSTER,

NETFLIX & REDBOX

Q1. What are the key success factors in the movie rental business?

How do the three players in the case compare on those

dimensions?

As per Industry analysis using Porter five forces:

Threat of new

entrants

Walmart,

Amazon,

Comcast, Netflix,

Redbox, BestBuy,

i-tunes, Time

warner cable etc.

HIG

Bargaining Power of

Buyers

Bargaining Power of

Suppliers

Suppliers are

Hollywood studios.

Switching cost is low

for them.

Recently introduced

VOD offers maximum

revenue to them.

rental

movies.

Switching cost is

low.

Customer

preferences &

behavior is changing

HIGH

HIG

HIG

Threat of

substitutes

VOD (Video on

demand), Kiosks,

Online streaming

are new

substitutes for instore rentals.

Theater

Experiences

2 | Page

Buyers are

Competition

customers

Rivalry

purchasing

HIG

A CASE ANALYSIS OF MOVIE RENTAL BUSINESS: BLOCKBUSTER,

NETFLIX & REDBOX

From the above analysis, it appears that the movie rental industry is a

tough battleground for new entrants but holds huge potentials for the

incumbents given the huge market potential and expansion opportunities in

different parts of the globe. Any new entrant or the existing players need to

come up with supply chain and technological innovations, a Critical Success

Factor.

This is the prime source of revenue for the Hollywood studios as 45% 1 of the

movie industry revenue of $24Bn comes from Home video in 2009 (DVD

sales & rentals). Hence Hollywood studios have quite a high bargaining

power over key players in the market. They are the key people who decide

after how many days of theatrical release the DVDs, VODs are going to be

in the market and what is going to be the type of contract between them

and Rental Service providers. This can vary from piece/rate to revenue

sharing contract. Hence, strategic partnership is required with the studios to

perform well in the market.

KEY SUCCESS FACTORS IN MOVIE RENTAL BUSINESS ARE:

1. Convenience: Customer convenience is the most important key success

factor in movie rental business. They are interested in getting what they

want when they want the product. Hence a flexibility is to be provided on

the customer side. While Blockbuster In-store rentals were about 3750 2 in

the US of which around 26% were on the verge of termination of the

lease. On other hand Red-box kiosks at the same time were around

230003. They were also located at the McDonalds restaurants, leading

grocery stores, Walmart, Walgreens & seven-eleven stores. Netflix was

getting further more convenient by pay per rental mail order & online

subscription based services.

2. Movie selection choice/ Variety: Customer is more focused on choice

availability. In Blockbuster in-store model the choice is limited by the

1

Exhibit 3, Movie Industry revenue distribution, Page 14, Movie Rental Business

case.

2

Page 4, Paragraph 6, Movie Rental Business Case

3

Page 8, Paragraph 2, Movie Rental Business Case

3 | Page

A CASE ANALYSIS OF MOVIE RENTAL BUSINESS: BLOCKBUSTER,

NETFLIX & REDBOX

number of titles generally around 3000 4. Netflix offered more than ten

times variety. Also, Redbox in its kiosks carried about 630 5 disks

comprising 200 of the newest movie titles. With the online model

disruption, clearly, Netflix offers the most choices as Netflix members

received any of more than 1000006 DVD titles delivered to their homes.

3. Cost/ Value: Cost/value is defined as the need gratification of the

customer. It is defined as per the value derived by the customers as per

their cost structure. Several customers who are frequent buyers will be

more inclined towards the monthly subscription-based service for $9 7

which costs while customers who watch comparatively fewer movies will

go for operated vending machines which are less than $1 per rental.

Customers who are fan following of a particular movie are more likely to

go for buying DVDs through in-stores or on mail delivery. Hence customer

preference which provides the cost per unit value addition will be the key

success factor in this regard.

4. The quality of service/ No delivery Hassles: This metric is decided as

a key success factor in providing a customer experience in the movie

rental business. This experience should not detract him from the leisure

time. Since mostly in vending machine operated costs are less with

automation provided to deliver hassle free service. Also, Netflix spent

$600mn in 2010 for shipping expenses to facilitate one-day delivery

service to around 95% of customers. Even in the online streaming of

Netflix, the number of IT servers in different geographic locations were

increased to ensure zero buffering time. Netflix also focused on providing

supplements in the industry in the form of ratings. They partnered with

CineMatch that made recommendations based on customers rental

history. This rating system proved to be accurate with 60% of the Netflix

users selected their movies based on recommendations tailored to their

individual tastes8. Also, Blockbuster partnered with ATM manufacturer

NCR to begin installing Blockbuster express- branded DVD kiosks for video

4

Page 3, Paragraph 8, Movie Rental Business Case

5

Page 8, Paragraph 4, Movie Rental Business Case

6

Page 5, Paragraph 4, Movie Rental Business Case

7

Page 4, Paragraph 3, Movie Rental Business Case

8

4 | Page

A CASE ANALYSIS OF MOVIE RENTAL BUSINESS: BLOCKBUSTER,

NETFLIX & REDBOX

rentals to increase delivery service to customers. They also focused on

creating Blockbuster Direct Access that gave store customers access to

more than 95000 titles carried in the distribution centers. This made the

inventory searching for the staff and the customers easy and transparent.

5. Rental Holding Capacity: For customers, rental holding capacity is also

Key success factor. When Netflix targeted the Blockbuster customer base

they keep their offering as zero late fees. This helped in increasing the

customer base of the Netflix. Also, Redbox offering for the budget

conscious movie renter with less rate and more rental holding capacity.

6. Rental Transaction turns: This is an important factor for the physical

DVDs rental in the business. No. of transaction turns of DVDs increases

the revenue for the service provider thereby improving Profit Margins.

Redbox was able to achieve high transaction volumes for the rental DVDs

which was leveraged by keeping the pricing strategy low. Also, set up

costs was relatively inexpensive at $15000 and generated revenue on

average $30000 in the first year, rising to $40000 & $50000 in second

and third years. A Redbox kiosk rented its average DVD fifteen times at an

average of $2 per transaction 9. This metric was quite low for Blockbuster

as movie rental industry CAGR for in-store was declining at 9% from 200509 and was expected further decline at 5% from 2009-1410.

7. Supply Chain Innovation: As technological advancements have been

observed with change in process technology. Supply chain needed to be

responsive and flexible to keep in-line with the new industry shift. Cable

VOD (Video on demand) is having a CAGR of 144% from 2005-09 and is

estimated to rise to 29% from 2009-14 11. Traditional in-store is having

declining CAGR of 9% from 2005-09 which will continue with 5% from

2009-14. Also, industry is witnessing digitization of content rather than

physical DVDs. Netflix is able to provide a supply chain to customers with

technological advancements which Blockbuster failed to do so. Redbox

has kept the cost efficient supply chain with a focus on innovation to

deliver rental DVDs at low cost to customers.

Page 6, Paragraph 3, Movie Rental Business Case

9

Page 8, Paragraph 4, Movie Rental Business Case

10

Page 15, Exhibit 4, Movie Industry Rental Shift, 2005-14, Movie Rental Business

Case

11

Page 15, Exhibit 4, Movie Industry Rental Shift, 2005-14, Movie Rental Business

Case

5 | Page

A CASE ANALYSIS OF MOVIE RENTAL BUSINESS: BLOCKBUSTER,

NETFLIX & REDBOX

8. Low cost supply/ Cost efficient: Since price sensitivity of the

customers is also presence as one of the factors in customer buying

criteria. Netflix kept the strategy of purchasing an only limited number of

new release DVDs, preferring to wait a few weeks to buy the bulk of its

supply at lower cost. Redbox also offered an alternative that allowed last

minute rentals of new DVD releases at low cost. Blockbuster was suffering

massive losses as they failed due to change in customer buying

preferences, which resulted in the closing of stores.

9. First Mover Advantage: Netflix entered into the online streaming, mail

order video rental, subscription services in 1998 which helped them to

gain significant Market share as per customer preferences. Blockbuster

entered into the above segment but in 2004. Till then a lot of damage in

RMS (Revenue Market Share) has been done by the Netflix. Also,

Blockbuster entered into installing kiosks in partnership with ATM

manufacturer NCR. But till then, Redbox has gained a significant market

share of about 19% in this segment. Hence, tapping the technological

innovation is important in this industry. Currently, VOD (Video on Demand)

is gaining popularity with Comcast and Time Warner cable 12. Google/

Amazon/ Apple iTunes is also targeting these segments. Hence, First

mover advantage is a key success factor in this industry.

10. Supplier Relationship: With the increase in piracy content, there is

pressure on studios as they were wary of sharing revenue with pay-tv

providers. The contribution margin was higher for them in the physical

rental of DVDs which Blockbuster was following. Also, in Redbox model,

studios agreed to provide 28 days after DVD release. Hence strategic

partnership is also a key success factor in this industry.

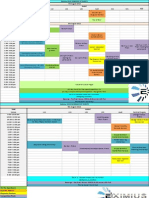

ANALYSIS OF KEY SUCCESS FACTORS FOR THREE

COMPANIES: BLOCKBUSTER, NETFLIX & REDBOX

S

No.

1

2

3

4

5

6

7

8

Dimension

Convenience

Movie selection choice/

variety

Cost/ Value

Quality of service/ No

delivery Hassles

Rental Holding Capacity

Rental Transaction turns

Supply Chain Innovation

Low-cost supply/ Cost

efficient

Blockbus

ter

Low

Medium

Netflix

Redbox

High

High

Medium

Low

Low

Low

Medium

High

High

Medium

Low

Low

Low

Low

High

Medium

High

Medium

Medium

High

Medium

High

12

Page 10, Paragraph 4, Movie Rental Business Case

6 | Page

A CASE ANALYSIS OF MOVIE RENTAL BUSINESS: BLOCKBUSTER,

NETFLIX & REDBOX

9

10

First Mover Advantage

Supplier Relationship

Low

High

High

Medium

Medium

Low

Value Ofered

High

Clearly, Blockbuster is on unsustainable operating costs while Netflix

(subscription services) & Redbox (Kiosks) is having lean operating

costs.

Q2. How would you advise these companies to modify their strategies and

structures going forward?

The frontiers of the battle of movie rental industry have seen disruptive

changes with the advent of mail delivery rental on online streaming services.

As discussed above, the three competitors: Blockbuster, Netflix, and Redbox

have created intense rivalry and need to excel on the value proposition, cost,

innovation, consumer-focus, and operations front. While Netflix and Redbox

have enjoyed success in recent times with $116mill and $54mill in profits in

Blockbuster

FY2009 respectively, the erstwhile industry behemoth Blockbuster has been

Netflix

facing huge losses and is under a debt

of nearly $1 billion13.

Channels of service

High

CURRENT POSITION (COVERAGE VS VALUES OFFERED):

Low

When we benchmark the three companies on the current market coverage i.e.

Channels of service such as retail stores, mail delivery, and online streaming,

Blockbuster is ahead of competition with high diversification

while when it

comes to value

Netflix has aced the market with its in-house

Lowoffered, Redbox

recommendation engine, movie ratings, queue system, suggestion system etc.

and huge library offered at a very high convenience. Redbox sits pretty in the

lower corner though it has captured the budget conscious movie watcher with

its accessible network of kiosks.

13

Page 11, Paragraph 3, Movie Rental Case

7 | Page

A CASE ANALYSIS OF MOVIE RENTAL BUSINESS: BLOCKBUSTER,

NETFLIX & REDBOX

Value Offered: movie rental + online rating, recommendations, suggestions, CRM etc.

Channels of service: Retail, mail order, online streaming/VOD.

Going forward, below are the recommendations on the strategic front for the

three companies:

BLOCKBUSTER

It is pretty evident that Blockbuster needs to update itself with the changing

consumption pattern of the customers. In this ready to go age, consumers

are watching films/TV shows while moving on their electronic devices such as

smartphone, tablets etc. and physical DVD consumption will see further

decline.

The primary issue in Blockbusters strategy is it being a laggard when it

came to adaptation and innovations. It has even tried to follow business

models of direct competitors without getting the operational part of it

correct. The price wars have hurt its bottom line.

Strengths: Hugh diversified network across the globe; huge range of titles;

support of Hollywood producers.

Weaknesses: High operating costs: high distribution costs; inefficient

distribution system

Here are some recommendations for Blockbusters.

1. Lower its operational costs: The high operational costs have been

hurting Blockbusters financials from past many years and Blockbuster

needs to take stock of the situation. It needs to close to its retail stores

in phased manner while the transition is made to mail delivery and

online mode.

2. Focus on online and mail delivery service: Its high time that

Blockbuster focuses on the online and mail mode of delivery of

services. It needs to build the web presence with tools of customer

relationship management such as loyalty benefits, recommendations,

and reviews which are now any important decision-making factor for

consumers for choosing a film which drives the consumption of the

medium itself. A recommendation and a prediction system will not only

help consumers find the movies they want, it will also help Blockbuster

on the operational fronts where it can predict demand and manage its

8 | Page

A CASE ANALYSIS OF MOVIE RENTAL BUSINESS: BLOCKBUSTER,

NETFLIX & REDBOX

inventory accordingly, reducing overage and underage costs. Also,

these features will complement the offline store experience with the

store managers having access to better information of choices of its

customers, helping them recommend content.

3. Transform its key retail stores to cater to niche movie lovers:

Given the presence of retail stores in key strategic locations,

Blockbuster can convert these few store into a movie experience

store by offering signed DVDs, merchandises, and rare prints for the

connoisseur of movies.

4. Build on relationships with studios to provide the latest

content: Blockbuster already enjoys the support of studios as per the

current revenue sharing agreements, where Studios make higher when

compared to other forms of distributions. It can leverage its

relationship to strike exclusive deals of not only recent movies but

prized films of yesteryear for the niche segment, film school students

etc.

5. One Stop Solution plans: As mentioned above, the key strength of

Blockbuster is its diversified network which it can optimize to provide

all access ecosystem of movie rental where consumers can utilize any

medium to rent, consume and return the DVDs with added offline and

online CRM based benefits. It can include subscription plans which

cater to needs of all different segments of movie rentals; even to ones

who do not have access to fast internet.

6. New product lines such as games: It's 2009 and the consoles such

as XBOX 360, PS3 and WII are staple platforms for playing games.

Game rentals is an exciting market given the steep prices of games

(~$60) and relatively small pocket size of target segments (14-35).

Blockbuster can leverage its industry contacts to enter into the game

disc rental market. The retail network in its arsenal can also be utilized

to offer its customers gaming accessories etc.

NETFLIX

Founded in 1997 as a pay per rental mail order video rental company,

Netflix grew to 13 million subscribers by 2010 for its subscription-based

model. With an intuitive web portal, no late fees, unlimited rentals for a fee,

Netflix was making huge strides into homes of average movie consumer via

devices such as laptops, PC, and even video game consoles and set-top

boxes.

9 | Page

A CASE ANALYSIS OF MOVIE RENTAL BUSINESS: BLOCKBUSTER,

NETFLIX & REDBOX

The technological backend and innovations have helped Netflix gain market

share very rapidly. However, in order to sustain and gain in its highly

competitive industry:

Strengths: Huge online subscription base; cutting age technology

delivering high quality of service; recommendation engine; low-cost

services.

Weakness: Low market coverage with only online and mail-delivery

services; lack of latest titles.

Some of the recommendations are:

1. Provide Original/Exclusive content: Netflix can bank on the

changing consumption behavior of users and provide them tailored,

conventional and relevant content to consumers, delivered onto his

mobile. Such content not only helps retain customers, increase their

willingness to pay but also unshackle itself from dependency on movie

studios for the content. The backward integration into content creation

can also help it supplement its brand value as a media consumption

platform.

Further, it needs to continue adding varieties of titles, its competitive

advantage, by collaborating with Movie Studios, TV serial studios and

independent filmmakers across industries.

2. Build technological capabilities to meet huge demand spikes:

Given online streaming can be accessed by many at the same time,

say a latest popular release, Netflix needs to build on its scale and

resilience factors of service to meet heavy access of its services and

products.

3. Capitalize on digital movie broadcasting: Given the advent of

competitors such as iTunes providing downloadable content, Netflix

shall venture into providing such option for the wide variety of content

it has on its platform.

4. Providing latest content: Though its Netflix Strategy to not source

latest movies in order to keep the costs low, it is advised to venture

into video on demand services for latest content such as latest movies,

maybe at a premium. This will help it tackle the new VOD services

offered by Cable operators.

5. Expansion into new territories: Given the technologically superior

backend using distributed systems which provide consistent streaming

services, Netflix can scale up and be open to other territories such as

Europe and East Asia where the internet speed and penetration are

good with the low amount of piracy.

10 | P a g e

A CASE ANALYSIS OF MOVIE RENTAL BUSINESS: BLOCKBUSTER,

NETFLIX & REDBOX

6. CRM: Netflix is already a pioneer in understanding the customer

preferences and it shall build up customer retention through loyalty

programs, referral programs, and bulk subscription discount offers.

REDBOX

Launched in 2002, REDBOX is DVD vending Kiosks installed at accessible

locations which dispense movie DVDs for a price as low as $1. Convenient

access, cheap price, and convenient return have made it a hot favorite

amongst the budget conscious movie watchers though it did face some

friction from studios as it was eating into their DVD sales business. In a

short amount of time, it captured a huge market share of 25% of DVD rental

volume with a network of 23000 kiosks.

Strengths: Huge network presence; low costs and convenience for

customers; quick ROI for installers;

Weakness: Only kiosks vending presence, no online or mail delivery

option.

Though REDBOX had seen success faster than Netflix, but in order to

sustain it needs to implement below strategic steps:

1. Have an Online presence: It is no denying fact the Kiosks model has

been highly successful but given the new industry trends and

consumption pattern changes (physical DVD players to tablets), REDBOX

needs to build capabilities to deliver online streaming content. There is

already a very stiff and strong competition from Netflix and VOD services,

but building an ecosystem of online + Kiosks will be beneficial in the next

decade. People can browse and book DVD for nearest kiosk and pick it up

as per their convenience and time. Also, the online portal will provide an

avenue for rating titles, recommending titles and also payment options

using a subscription feature. Since the capacity of a box is limited, online

bookings will help REDBOX to predict and accommodate demand

changes such as sudden interest in a movie. The movies in demand can

be replenished to accommodate user interests. The streaming

capabilities shall be built over time in a phased manner.

2. Improve network using collaborations: With 23000 kiosks

nationwide, REDBOX already as a strong presence in the mainland USA. It

can still build up on the network by targeting specific strategic locations

such as outside IT parks, Office parks and Hostels where there is a high

density of budget-conscious movie enthusiast who wishes to relax over

the weekend at his/her house. REDBOX can also collaborate with fast

food/pizza joints and offer weekend chill packages for movie + food at

the house at affordable bundle prices.

11 | P a g e

A CASE ANALYSIS OF MOVIE RENTAL BUSINESS: BLOCKBUSTER,

NETFLIX & REDBOX

3. Improve demand responsiveness: It also needs to strengthen its

operational backend to meet uncertain demands such as a spike in a

certain movie of a deceased actor etc. Stock-outs can be painful

customer experience and REDBOX needs a very responsive system to

update its catalogs as per the demand. Further, titles low in demand

must be turned over using discounts and bundle offers say a popular title

+ non-popular title at $1.59 etc.

4. Better variety of movies including latest titles:

Though the

economic factors and the competitive advantage of cost do not

showroom for latest movie titles from major studios, REDBOX can come

up with premium pricing for latest content in order to serve customers

who are REDBOX loyal/find kiosk vending comfortable. It needs to

negotiate waiting period times with the remaining studios for reducing

the interval between availability at REDBOX and availability at retail

stores. It may come up with a revenue/rent sharing models per a given

window.

5. Venture into other media content such as video games: As stated

above, there is a huge market for video game rentals and REDBOX can

provide video game rentals after striking a balance between studio,

customers and its own expectations on the pricing and service front.

12 | P a g e

A CASE ANALYSIS OF MOVIE RENTAL BUSINESS: BLOCKBUSTER,

NETFLIX & REDBOX

APPENDIX

Movie Rental Industry Shift CAGR 2005-14

Cable VOD

Online Subscription

Vending

Instore

160.00

140.00

120.00

100.00

80.00

60.00

40.00

20.00

0.00

2005-09

-20.00

2009-14

FIGURE 1: MOVIE RENTAL INDUSTRY SHIFT CAGR 2005-14

13 | P a g e

You might also like

- Bergerac Case AnalysisDocument12 pagesBergerac Case Analysissiddhartha tulsyan100% (1)

- Movie Rental Business PDFDocument6 pagesMovie Rental Business PDFAmir khanNo ratings yet

- Was Konka's Internationalization Success Attributable To The Export Mode of Internationalization? Our Position - YesDocument3 pagesWas Konka's Internationalization Success Attributable To The Export Mode of Internationalization? Our Position - YesMUDIT YAGNIK 23No ratings yet

- Deepanshu Singh D WAC1 2Document9 pagesDeepanshu Singh D WAC1 2Deepanshu SinghNo ratings yet

- WAC-P16052 Dhruvkumar-West Lake Case AnalysisDocument7 pagesWAC-P16052 Dhruvkumar-West Lake Case AnalysisDHRUV SONAGARANo ratings yet

- Rachit SubmissionDocument8 pagesRachit Submissionharshita ramrakhyaniNo ratings yet

- Zipcar AnalysisDocument13 pagesZipcar Analysis15pgp086.manishNo ratings yet

- ECO7 WorksheetDocument9 pagesECO7 WorksheetSaswat Kumar DeyNo ratings yet

- Case Analysis On Color Kinetics Incorporated' UpdatedDocument19 pagesCase Analysis On Color Kinetics Incorporated' UpdatedNamit Baser100% (1)

- Atlantic Computer - A Bundle of Pricing OptionsDocument6 pagesAtlantic Computer - A Bundle of Pricing OptionsAashi JainNo ratings yet

- Cottle-Taylor: Expanding The Oral Care Group in India: Submitted By: Group B32Document7 pagesCottle-Taylor: Expanding The Oral Care Group in India: Submitted By: Group B32Janani Ramanathan0% (1)

- Group 2 - Sattve E TechDocument12 pagesGroup 2 - Sattve E TechMohanapriya JayakumarNo ratings yet

- Harvard-Sup Chain SylDocument23 pagesHarvard-Sup Chain SylPrashanth CecilNo ratings yet

- Analysis For TruEarthDocument1 pageAnalysis For TruEarthUtkristSrivastava0% (1)

- SnapTV BrochureDocument24 pagesSnapTV BrochureShyamnath Chambakassery Veetil100% (1)

- Assignment 2: Sands Corporation A Report Submitted To Prof. Girija Shankar SemuwalDocument8 pagesAssignment 2: Sands Corporation A Report Submitted To Prof. Girija Shankar SemuwalSubhajit RoyNo ratings yet

- Cinepolis India: Indian Institute of Management, BangaloreDocument13 pagesCinepolis India: Indian Institute of Management, BangaloreSambit Rath0% (1)

- Flexcon 1Document2 pagesFlexcon 1api-534398799100% (1)

- Dosa KingDocument15 pagesDosa KingAshwani Shastri100% (1)

- Assignment: Individual Assignment 5 - Infosys: Growing Share of A Customer's BusinessDocument4 pagesAssignment: Individual Assignment 5 - Infosys: Growing Share of A Customer's BusinessVinayNo ratings yet

- Corporatization of BollywoodDocument4 pagesCorporatization of BollywoodRhythm JainNo ratings yet

- Sands SampleDocument13 pagesSands SampleNiraj BauaNo ratings yet

- Group 10 - Sec BDocument10 pagesGroup 10 - Sec BAshishKushwahaNo ratings yet

- Piyush Sevaldasani C WAC1 1Document5 pagesPiyush Sevaldasani C WAC1 1Piyush SevaldasaniNo ratings yet

- Section D - OSD - Group 5Document6 pagesSection D - OSD - Group 5Chidananda PuriNo ratings yet

- Kunst 3500Document3 pagesKunst 3500Ashish GondaneNo ratings yet

- Acquisition and Merger of Kia Motors by Hundai Motors Rev 1.0Document13 pagesAcquisition and Merger of Kia Motors by Hundai Motors Rev 1.0Tejaswi Monangi100% (1)

- CMR Enterprises: B2B Marketing - Case PresentationDocument17 pagesCMR Enterprises: B2B Marketing - Case PresentationdevilmiraNo ratings yet

- Classic Knitwear CaseDocument4 pagesClassic Knitwear CaseSwapnil JoardarNo ratings yet

- Netflix: Pricing Decision 2011Document5 pagesNetflix: Pricing Decision 2011Harsh YadavNo ratings yet

- Metro Cash & CarryDocument9 pagesMetro Cash & CarrySaurav SanganeriaNo ratings yet

- Case Analysis: Netflix: Pricing Decision 2011: Group 3Document7 pagesCase Analysis: Netflix: Pricing Decision 2011: Group 3vedant thakreNo ratings yet

- Quiz Management Accounting - VIDocument31 pagesQuiz Management Accounting - VILav SharmaNo ratings yet

- Savemart Wareshousing: Group 10Document3 pagesSavemart Wareshousing: Group 10arjavsNo ratings yet

- QMDocument87 pagesQMjyotisagar talukdarNo ratings yet

- K-Pop Fans' Identity and The Meaning of Being A Fan: June 2020Document50 pagesK-Pop Fans' Identity and The Meaning of Being A Fan: June 2020T TQNo ratings yet

- DMB2B Assignment Shreya 2018PGP355Document5 pagesDMB2B Assignment Shreya 2018PGP355SHREYA PGP 2018-20 BatchNo ratings yet

- MIS BuckingThe Trend GRP5 SecBDocument2 pagesMIS BuckingThe Trend GRP5 SecBPratik GaokarNo ratings yet

- Newell's Corporate StrategyDocument1 pageNewell's Corporate StrategyAmogh Suman0% (1)

- Sands Corporation: Written Managerial CommunicationDocument9 pagesSands Corporation: Written Managerial CommunicationSonu GuptaNo ratings yet

- Sales & Wilkins, A Zurn Company Demand Forecasting: Group 7Document8 pagesSales & Wilkins, A Zurn Company Demand Forecasting: Group 7HEM BANSALNo ratings yet

- CRM EnterprisesDocument2 pagesCRM EnterprisesDivya YerramNo ratings yet

- Summary and AnswersDocument9 pagesSummary and Answersarpit_nNo ratings yet

- CMA Individual Assignment Manu M EPGPKC06054Document6 pagesCMA Individual Assignment Manu M EPGPKC06054CH NAIRNo ratings yet

- Iim KDocument6 pagesIim KSajid KhanNo ratings yet

- Bergerac Systems: The Challenge of Backward IntegrationDocument13 pagesBergerac Systems: The Challenge of Backward Integration111845arvindNo ratings yet

- Benefice Limited - Team 5Document16 pagesBenefice Limited - Team 5DEMINo ratings yet

- CMR Enterprises: Presented by - Division B - Group 10Document9 pagesCMR Enterprises: Presented by - Division B - Group 10Apoorva SomaniNo ratings yet

- CP 5Document1 pageCP 5Mohammad Sameed Zaheer100% (1)

- Case Analysis Pleasant Ridge Habitat For Humanity Second Chance Home SupplyDocument10 pagesCase Analysis Pleasant Ridge Habitat For Humanity Second Chance Home SupplyEina GuptaNo ratings yet

- Group30 Assignment 1Document7 pagesGroup30 Assignment 1Rajat GargNo ratings yet

- The Coop CaseDocument3 pagesThe Coop CaseKuthe Prashant GajananNo ratings yet

- Gawade Mayur Sunil B WACI 2Document11 pagesGawade Mayur Sunil B WACI 2Mayur GawadeNo ratings yet

- The Accellion Service GuaranteeDocument4 pagesThe Accellion Service GuaranteeRaviteja Chinta0% (1)

- Metro Cash and CarryDocument4 pagesMetro Cash and CarryNageeta BaiNo ratings yet

- Exercise 1 SolnDocument2 pagesExercise 1 Solndarinjohson0% (2)

- BA AssignmentDocument2 pagesBA AssignmentkeshavNo ratings yet

- Movie Rental Business PDFDocument6 pagesMovie Rental Business PDFRajendra Talele100% (1)

- Netflix CaseDocument9 pagesNetflix CaseXI MIPA 2No ratings yet

- Netflix Case PaperDocument8 pagesNetflix Case PaperM Sul100% (1)

- Netflix Case AnalysisDocument13 pagesNetflix Case AnalysisFaraz Haq100% (4)

- ch11tn ApplichemDocument3 pagesch11tn Applichemashs22No ratings yet

- PGP New Admission ProcessDocument6 pagesPGP New Admission ProcessSanjeev RanjanNo ratings yet

- Practice ProblemsDocument3 pagesPractice ProblemsSanjeev Ranjan25% (4)

- WP 15136Document44 pagesWP 15136Sanjeev RanjanNo ratings yet

- Movie Rental Business: BY: #TechdummiesDocument13 pagesMovie Rental Business: BY: #TechdummiesSanjeev RanjanNo ratings yet

- NMC CaseDocument2 pagesNMC CaseSanjeev RanjanNo ratings yet

- Aggregate PlanningDocument57 pagesAggregate PlanningSanjeev RanjanNo ratings yet

- Jiamblavo Problem 3-10 - SolutionDocument6 pagesJiamblavo Problem 3-10 - SolutionSanjeev RanjanNo ratings yet

- SCMDocument4 pagesSCMSanjeev RanjanNo ratings yet

- Student Registration Information: CourseDocument1 pageStudent Registration Information: CourseSanjeev RanjanNo ratings yet

- Kaplan 1988 - One Cost System Isn't EnoughDocument13 pagesKaplan 1988 - One Cost System Isn't EnoughSanjeev RanjanNo ratings yet

- Crack DownloadDocument13 pagesCrack DownloadSanjeev RanjanNo ratings yet

- Tutorial-1: Haritha SarangaDocument9 pagesTutorial-1: Haritha SarangaSanjeev RanjanNo ratings yet

- Proportion of Goods and Services in Purchase Bundle: Service QualifierDocument5 pagesProportion of Goods and Services in Purchase Bundle: Service QualifierSanjeev RanjanNo ratings yet

- 5 Les S Ons A S A N Entrepreneur - Mr. Ankur Wa Ri Koo, GrouponDocument2 pages5 Les S Ons A S A N Entrepreneur - Mr. Ankur Wa Ri Koo, GrouponSanjeev RanjanNo ratings yet

- 1 IIMB Webmail-O365 Login ProcedureDocument1 page1 IIMB Webmail-O365 Login ProcedureSanjeev RanjanNo ratings yet

- MEL 756 (SCM) : ZARA-Competitive and Innovative Supply ChainDocument1 pageMEL 756 (SCM) : ZARA-Competitive and Innovative Supply ChainSanjeev RanjanNo ratings yet

- Engaging With Music 2022 - Full Report 1Document17 pagesEngaging With Music 2022 - Full Report 1MarcoNo ratings yet

- Creating Value From IPTV: Co-Sponsored Feature: Sun MicrosystemsDocument5 pagesCreating Value From IPTV: Co-Sponsored Feature: Sun MicrosystemsDominic JumaNo ratings yet

- Mobile IptvDocument29 pagesMobile IptvManish PushkarNo ratings yet

- Project ReportDocument12 pagesProject ReportPrem chauhanNo ratings yet

- Ekta Kkatiyar - Mba123Document71 pagesEkta Kkatiyar - Mba123Harshit KashyapNo ratings yet

- PROD-300 VCAS Operator Management InterfaceDocument307 pagesPROD-300 VCAS Operator Management InterfaceJean Carlos Alexander Cruz Herradez - JhonyCertzNo ratings yet

- Swisscom BluewinTV Using Most Important Fucntions EngDocument13 pagesSwisscom BluewinTV Using Most Important Fucntions EngbmmanualsNo ratings yet

- Netflix - International Expansion: Nasir Butt Zoya Farooq M Talha MalikDocument11 pagesNetflix - International Expansion: Nasir Butt Zoya Farooq M Talha MalikZoya FarooqNo ratings yet

- Unit 1 Novel Drug Delivery SystemDocument47 pagesUnit 1 Novel Drug Delivery SystemRxanurag PatelNo ratings yet

- The End of Ownership 2020Document37 pagesThe End of Ownership 2020Hugo Cocoletzi A100% (1)

- A&E v. Big FishDocument48 pagesA&E v. Big FishTHROnline100% (1)

- Test Bank For Information Technology For Management On Demand 11th by TurbanDocument36 pagesTest Bank For Information Technology For Management On Demand 11th by Turbanboson.clombj2eck100% (44)

- Verasity Whitepaper EngDocument40 pagesVerasity Whitepaper Engandreiraducanu4No ratings yet

- OnDemand App - PPTDocument21 pagesOnDemand App - PPTBoomesh WaranNo ratings yet

- DD - CABLEVISION.Insert. Z39.15-41-2012.M.1Document2 pagesDD - CABLEVISION.Insert. Z39.15-41-2012.M.1Stuart RosenthalNo ratings yet

- Htz-101dvd Manual AuDocument44 pagesHtz-101dvd Manual AuKrlos Edú JacomeNo ratings yet

- 2022 Year End Music Industry Revenue ReportDocument3 pages2022 Year End Music Industry Revenue ReportPeter BurkeNo ratings yet

- 5G in ASEAN Reigniting Growth in Enterprise and Consumer MarketsDocument33 pages5G in ASEAN Reigniting Growth in Enterprise and Consumer MarketsphuockhNo ratings yet

- KDL 55ex725 PDFDocument36 pagesKDL 55ex725 PDFRogério TorquatoNo ratings yet

- Digital Media Trends: The Future of MoviesDocument20 pagesDigital Media Trends: The Future of MoviesYandhi SuryaNo ratings yet

- Video On Demand On Aws PDFDocument21 pagesVideo On Demand On Aws PDFshreyasNo ratings yet

- MVH-8250BT MVH-8250: Media Center Receiver Receptor Y Centro de Comunicaciones Media Center ReceiverDocument148 pagesMVH-8250BT MVH-8250: Media Center Receiver Receptor Y Centro de Comunicaciones Media Center ReceiverKeimoNo ratings yet

- PortalDocument5 pagesPortalSorin GlavanNo ratings yet

- Lineto Licence 22050562587Document6 pagesLineto Licence 22050562587Rongyi TangNo ratings yet

- Iptvgreat Vs Falcon TVDocument6 pagesIptvgreat Vs Falcon TVAparajita LamiaNo ratings yet

- Business Model For NetflixDocument8 pagesBusiness Model For NetflixJacques OwokelNo ratings yet

- 3000 Wrong Number SeriesDocument37 pages3000 Wrong Number SeriesSaurabh SinghNo ratings yet

- Gearbox II Anytime T+T2 PDFDocument4 pagesGearbox II Anytime T+T2 PDFLaszlo ZoltanNo ratings yet

- 39pfl3208h 12 Fhi ItaDocument4 pages39pfl3208h 12 Fhi ItaXhanina MicaNo ratings yet