Professional Documents

Culture Documents

(Compulsory Assignment) : Lovely Professional University Academic Task No.1

(Compulsory Assignment) : Lovely Professional University Academic Task No.1

Uploaded by

M Zuber AyeshiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Compulsory Assignment) : Lovely Professional University Academic Task No.1

(Compulsory Assignment) : Lovely Professional University Academic Task No.1

Uploaded by

M Zuber AyeshiCopyright:

Available Formats

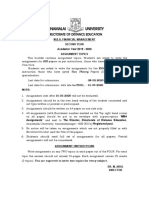

LOVELY PROFESSIONAL UNIVERSITY

ACADEMIC TASK NO.1

(COMPULSORY ASSIGNMENT)

Course Code: BSL352

Course Title: Legal Aspects of Banking and Insurance

Section: Q4E03

Batch: 2016-2017

Max. Marks: 30

Date of Allotment: September 08, 2016

Date of Written Report submission: September 22, 2016

S.

No

1

Roll

No

Objectives of

Academic

Activity

ALL

STUD

ENTS

To make the

students

understand,

One,

the

function of

banks in the

light

of

Reserve

Bank

of

India

Act,

1934

and

Banking

Regulation

Act,

1949.

Two,

the

KYC

requirement

s/norm

s

involved in

the

loan

appli cation.

Topic

You have to work in a

team of 3 students.

Details:

As a part of loan

team/department of the bank,

perform your role in the light of

given task.

Study the loan application of

the

company/organization/individua

l (allocated by the course

instructor).

Comprehend the financial

position of a potential

borrower (for the

company/individual

allocated by the course

instructor).

Write a report ( 27 marks)

which considers and include the

following points.

1. Assess the repayment ability

of the borrower. (9 marks)

2. Assess and evaluate the

collateral security/

mortgage/pledge to manage

risk. (9 marks)

3. Draw out the existing and

Evaluation

Parameters

1.Write up (20

marks)

- Content

- Coherence

with the topic

2.Presentation

(10 marks)

- Content (5)

- Communication

(5)

Expecte

d

outcom

es

Applic

ation

of

conce

pt

probable risks associated with

the borrower and to what extent

they are being covered by the

bank while approving the loan

application. (9 marks)

4. Any other peculiar aspect

emerged while studying the

position of the potential

borrower. Chalk out a clear and

a coherent report (3 marks),

which discusses the broad

issues involved in the credit risk

associated with the loan

approvals and disbursements.

If you feel the need to visit the

bank premises, for completing

this task, you can do that as

well but, in that case, list out

the details of the visit in your

report.

NOTE:

- To be submitted on

September 22, 2016

by 5pm)

- Report should be

hand written.

You might also like

- Syllabus FIN408 2020Document5 pagesSyllabus FIN408 2020seanNo ratings yet

- Mba 1st Yeat Old Batches 2018-19 AyDocument15 pagesMba 1st Yeat Old Batches 2018-19 AyRaghuNo ratings yet

- Law of Banking and FinanceDocument3 pagesLaw of Banking and FinanceTanna SenapatiNo ratings yet

- 9f 1 Sample of Exam Paper UAS Introduction - Into - Islamic - FinanceDocument2 pages9f 1 Sample of Exam Paper UAS Introduction - Into - Islamic - Financefaisal17950No ratings yet

- Course Plan: BBA N-106: Indian Banking System by Ms. Karamveer SinghDocument19 pagesCourse Plan: BBA N-106: Indian Banking System by Ms. Karamveer SinghVipin RawatNo ratings yet

- MFM Project Guidelines From Christ University FFFFFDocument6 pagesMFM Project Guidelines From Christ University FFFFFakash08agarwal_18589No ratings yet

- S346MBADocument22 pagesS346MBAabiram1622001No ratings yet

- Abhishek.g (Fa1b)Document5 pagesAbhishek.g (Fa1b)fathimabanu1084No ratings yet

- Exim BankDocument89 pagesExim BankAjmir Hossain ApurboNo ratings yet

- Fin 325 Fa 22-23 Assignment 1 CL Copy-1Document8 pagesFin 325 Fa 22-23 Assignment 1 CL Copy-1Muhammad SaqlainNo ratings yet

- Spring 2016 - BNK619 - 4 - MC140401473Document13 pagesSpring 2016 - BNK619 - 4 - MC140401473Khalid MahmoodNo ratings yet

- Course Out Line MBFI 12-14Document3 pagesCourse Out Line MBFI 12-14chitu1992No ratings yet

- HW2 MGT 515 R1001Document1 pageHW2 MGT 515 R1001Sharad SharmaNo ratings yet

- S346 - Mba (E.m)Document12 pagesS346 - Mba (E.m)SUNDAR PNo ratings yet

- Babu Banarasi Das University Lucknow: Course CurriculumDocument88 pagesBabu Banarasi Das University Lucknow: Course CurriculumKrishna EelaNo ratings yet

- WBS Handbook 6FNCE003WDocument13 pagesWBS Handbook 6FNCE003WThomas HaddadNo ratings yet

- B SchoolDocument4 pagesB SchoolRajan MittalNo ratings yet

- Mba Final Year ProjectDocument72 pagesMba Final Year ProjectAniket Yadav100% (1)

- T3 FIM Course OutlineDocument4 pagesT3 FIM Course OutlineVAKUL SINGHNo ratings yet

- Unit 2Document170 pagesUnit 2anmolpahawabsrNo ratings yet

- BankingDocument7 pagesBankingPiyush RewatkarNo ratings yet

- Strategies of Policy of Credit Card SbiDocument60 pagesStrategies of Policy of Credit Card Sbivipul tandonNo ratings yet

- MGT728Document1 pageMGT728Tappin SoodNo ratings yet

- Presentation1 1Document9 pagesPresentation1 1vikas thakurNo ratings yet

- Guidelines For Summer Training Report - Mba 3rd SemDocument21 pagesGuidelines For Summer Training Report - Mba 3rd SemJasmine KaurNo ratings yet

- Coursework On Economics of Monetary and BankingDocument2 pagesCoursework On Economics of Monetary and BankingChannel HNSNo ratings yet

- UIL Project GuidelinesDocument11 pagesUIL Project GuidelinesAnonymous 5quBUnmvm1No ratings yet

- T3 Financial Institutions and MarketsDocument5 pagesT3 Financial Institutions and MarketsHarshit AgarwalNo ratings yet

- Syllabus FINA210 Business Finance FALL 2013Document6 pagesSyllabus FINA210 Business Finance FALL 2013Mahmoud KambrisNo ratings yet

- Assingment of MbaDocument4 pagesAssingment of MbaSenthil KumarNo ratings yet

- N.R. Institute of Business Management Gujarat Technological UniversityDocument4 pagesN.R. Institute of Business Management Gujarat Technological UniversityjyotindrasinhNo ratings yet

- Foreign Exchange Report ShankarDocument85 pagesForeign Exchange Report ShankarTipu khanNo ratings yet

- Course Outline Economics-IIDocument3 pagesCourse Outline Economics-IIsheetal rajputNo ratings yet

- Internship Report On: "Loan Disbursement" A Case Study On First Security Islami Bank LimitedDocument38 pagesInternship Report On: "Loan Disbursement" A Case Study On First Security Islami Bank LimitedBishnu Sutra DharNo ratings yet

- Project Work Synopsis Preparation Date:-26/07/2019Document10 pagesProject Work Synopsis Preparation Date:-26/07/2019varsha satheNo ratings yet

- Retail Sector LoansDocument45 pagesRetail Sector LoanseloeanNo ratings yet

- Labour Law I Course Manual 2015Document14 pagesLabour Law I Course Manual 2015Priya SinghNo ratings yet

- Law 201Document19 pagesLaw 201Tan Tzi Xin0% (1)

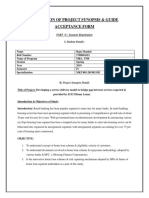

- Submission of Project Synopsis & Guide Acceptance Form: PART A': Synopsis RegistrationDocument3 pagesSubmission of Project Synopsis & Guide Acceptance Form: PART A': Synopsis Registrationsunny eventechNo ratings yet

- Karthi.m (Fa1c)Document5 pagesKarthi.m (Fa1c)fathimabanu1084No ratings yet

- Internship Report On Generel Banking Activities of Exim BankDocument57 pagesInternship Report On Generel Banking Activities of Exim BankMorshedul HasanNo ratings yet

- Notice For Internal Assessment 2020Document5 pagesNotice For Internal Assessment 2020Megha RajakNo ratings yet

- Assignment 2Document1 pageAssignment 2mashoodahmed23No ratings yet

- New MBA Detailed Syllabus For Sem IV GTU-2013Document86 pagesNew MBA Detailed Syllabus For Sem IV GTU-2013Nigam Contractorr100% (1)

- Good Luck!Document1 pageGood Luck!Aqash AliNo ratings yet

- Lovely Professional University Academic Task No. 1 School of Business Faculty of Accounting & Business Laws-IIDocument2 pagesLovely Professional University Academic Task No. 1 School of Business Faculty of Accounting & Business Laws-IIVishal VisNo ratings yet

- Internship Report On Generel Banking Activities of Exim BankDocument57 pagesInternship Report On Generel Banking Activities of Exim BankMorshedul Hasan100% (2)

- Asign Quest MS 03 2010Document2 pagesAsign Quest MS 03 2010ravidixit70No ratings yet

- Chapter-1: Introduction: An Analysis of Loans & Advances Activities of Pubali Bank LTDDocument41 pagesChapter-1: Introduction: An Analysis of Loans & Advances Activities of Pubali Bank LTDJehan MahmudNo ratings yet

- II Year-Banking and InsuranceDocument1 pageII Year-Banking and InsuranceSiddharth ShuklaNo ratings yet

- Qdoc - Tips Project Work B Com Part3Document6 pagesQdoc - Tips Project Work B Com Part3Chinmaya Prasad Sahu ChinuNo ratings yet

- FinalDocument5 pagesFinalBrian ClaytonNo ratings yet

- Advertisement For Recruitment of Faculty On Contract Basis and Retainer BasisDocument3 pagesAdvertisement For Recruitment of Faculty On Contract Basis and Retainer BasisIshan KakkarNo ratings yet

- GC University Lahore: Department of Commerce & FinanceDocument3 pagesGC University Lahore: Department of Commerce & Financewarda rashidNo ratings yet

- Assignment Business Resources ND Unit 2 by Masuma BegumDocument19 pagesAssignment Business Resources ND Unit 2 by Masuma BegumSakeef Mahbub50% (2)

- Skills Development in Uzbekistan: A Sector AssessmentFrom EverandSkills Development in Uzbekistan: A Sector AssessmentNo ratings yet