Professional Documents

Culture Documents

2015 AR Excel Financials For AR Web Site

Uploaded by

Juan Sebastián ChinomeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2015 AR Excel Financials For AR Web Site

Uploaded by

Juan Sebastián ChinomeCopyright:

Available Formats

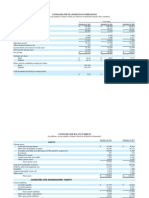

Dollars in Millions Except Per Share Amounts

Consolidated Statements of Income

For the years ended December 31,

2015

Net sales

Cost of sales

Gross profit

16,034

6,635

9,399

2014

$

17,277

7,168

10,109

2013

$

17,420

7,219

10,201

Selling, general and administrative expenses

Other (income) expense, net

Charge for Venezuela accounting change

Operating profit

5,464

62

1,084

2,789

5,982

570

570

3,557

6,223

422

422

3,556

Interest expense, net

Income before income taxes

26

2,763

24

3,533

(9)

3,565

Provision for income taxes

Net income including noncontrolling interests

1,215

1,548

1,194

2,339

1,155

2,410

Less: Net income attributable to noncontrolling interests

Net income attributable to Colgate-Palmolive Company

164

1,384

159

2,180

169

2,241

Earnings per common share, basic

1.53

2.38

2.41

Earnings per common share, diluted

1.52

2.36

2.38

See Notes to Consolidated Financial Statements.

Dollars in Millions

Consolidated Statements of Comprehensive Income

Colgate-Palmolive

Company

For the year ended December 31, 2013:

Net income

Other comprehensive income (loss), net of tax:

Cumulative translation adjustment

Retirement plan and other retiree benefit adjustments

Other

Total Other comprehensive income, net of tax

Total comprehensive income

For the year ended December 31, 2014:

Net income

Other comprehensive income (loss), net of tax:

Cumulative translation adjustment

Retirement Plan and other retiree benefit adjustments

Other

Total Other comprehensive income, net of tax

(163)

318

15

170

169

Total

(3)

(3)

2,410

(166)

318

15

167

2,411

166

2,577

2,180

159

2,339

For the year ended December 31, 2015:

Net income

Other comprehensive income (loss), net of tax:

Cumulative translation adjustment

Retirement Plan and other retiree benefit adjustments

Other

Total Other comprehensive income, net of tax

Total comprehensive income

2,241

Noncontrolling

Interests

(681)

(329)

(46)

(1,056)

(4)

(4)

(685)

(329)

(46)

(1,060)

1,384

164

1,548

(634)

196

(5)

(443)

(11)

(645)

196

(5)

(454)

(443)

See Notes to Consolidated Financial Statements.

(11)

(11)

(454)

Dollars in Millions Except Share and Per Share Amounts

Consolidated Balance Sheets

As of December 31,

2015

Assets

Current Assets

Cash and cash equivalents

Receivables (net of allowances of $59 and $54,

respectively)

Inventories

Other current assets

Total current assets

Property, plant and equipment, net

Goodwill

Other intangible assets, net

Deferred income taxes

Other assets

Total assets

Liabilities and Shareholders Equity

Current Liabilities

Notes and loans payable

Current portion of long-term debt

Accounts payable

Accrued income taxes

Other accruals

Total current liabilities

970

1,089

1,427

1,180

807

4,384

1,552

1,382

840

4,863

3,796

2,103

1,346

67

262

$ 11,958

4,080

2,307

1,413

76

720

13,459

Long-term debt

Deferred income taxes

Other liabilities

Total liabilities

4

298

1,110

277

1,845

3,534

16

488

1,231

294

1,917

3,946

6,269

233

1,966

12,002

5,644

261

2,223

12,074

1,466

1,466

1,438

18,861

(3,950)

(12)

(18,102)

(299)

255

(44)

$ 11,958

1,236

18,832

(3,507)

(20)

(16,862)

1,145

240

1,385

$ 13,459

Commitments and contingent liabilities

Shareholders Equity

Common stock, $1 par value

(2,000,000,000 shares authorized, 1,465,706,360 shares issued)

Additional paid-in capital

Retained earnings

Accumulated other comprehensive income (loss)

Unearned compensation

Treasury stock, at cost

Total Colgate-Palmolive Company shareholders

equityinterests

Noncontrolling

Total equity

Total liabilities and equity

2014

See Notes to Consolidated Financial Statements.

Dollars in Millions

Consolidated Statements of Changes in Shareholders' Equity

Balance, January 1, 2013

Net income

Other comprehensive income (loss), net of tax

Dividends

Stock-based compensation expense

Shares issued for stock options

Shares issued for restricted stock awards

Treasury stock acquired

Other

Balance, December 31, 2013

Net income

Other comprehensive income (loss), net of tax

Dividends

Stock-based compensation expense

Shares issued for stock options

Shares issued for restricted stock awards

Treasury stock acquired

Other

Balance, December 31, 2014

Net income

Other comprehensive income (loss), net of tax

Dividends

Stock-based compensation expense

Shares issued for stock options

Shares issued for restricted stock awards

Treasury stock acquired

Other

Balance, December 31, 2015

Common

Stock

Colgate-Palmolive Company Shareholders' Equity

Additional

Accumulated Other

Treasury

Retained

Comprehensive

Paid-In

Unearned

Stock

Earnings

Income (Loss)

Capital

Compensation

Noncontrolling

Interests

$ 1,466

818

(41)

(14,386)

16,953

2,241

(2,621)

170

(1,242)

128

82

(75)

$ 1,466

51

1,004

8

(33)

201

75

(1,521)

(2)

(15,633)

17,952

2,180

(2,451)

(1,056)

(1,300)

131

100

(77)

$ 1,466

78

1,236

13

(20)

225

77

(1,530)

(1)

(16,862)

18,832

1,384

(3,507)

240

164

(11)

(138)

255

(443)

$ 1,466

See Notes to Consolidated Financial Statements.

56

1,438

8

(12)

243

69

(1,551)

(1)

(18,102)

18,861

(3,950)

4

231

159

(4)

(146)

(1,355)

125

90

(69)

201

169

(3)

(140)

Dollars in Millions

Consolidated Statements of Cash Flow

For the years ended December 31,

2015

Operating Activities

Net income including noncontrolling interests

Adjustments to reconcile net income including noncontrolling interests

to net cash provided by operations:

Depreciation and amortization

Restructuring and termination benefits, net of cash

Venezuela remeasurement charges

Voluntary benefit plan contributions

Charge for a foreign tax matter

Stock-based compensation expense

Gain on sale of South Pacific laundry detergent business

Charge for Venezuela accounting change

Deferred income taxes

Cash effects of changes in:

Receivables

Inventories

Accounts payable and other accruals

Other non-current assets and liabilities

Net cash provided by operations

1,548

2014

$

2,339

2013

$

2,410

449

69

34

0

0

125

(187)

1,084

(51)

442

64

327

(2)

66

131

18

439

182

172

(101)

128

71

(75)

(13)

(67)

33

2,949

(109)

(60)

57

25

3,298

(37)

(97)

24

13

3,204

(691)

9

(742)

599

(13)

221

(75)

7

(685)

(757)

24

(340)

283

(87)

18

(859)

(670)

15

(505)

267

(3)

6

(890)

(9,181)

9,602

(1,493)

(1,551)

347

(2,276)

(8,525)

8,960

(1,446)

(1,530)

371

(2,170)

(7,554)

7,976

(1,382)

(1,521)

339

(2,142)

Effect of exchange rate changes on Cash and cash equivalents

(107)

(142)

(94)

Net increase (decrease) in Cash and cash equivalents

(119)

127

78

Investing Activities

Capital expenditures

Sale of property and non-core product lines

Purchases of marketable securities and investments

Proceeds from sale of marketable securities and investments

Payment for acquisitions, net of cash acquired

Proceeds from sale of South Pacific laundry detergent business

Reduction in cash due to Venezuela accounting change

Other

Net cash used in investing activities

Financing Activities

Principal payments on debt

Proceeds from issuance of debt

Dividends paid

Purchases of treasury shares

Proceeds from exercise of stock options and excess tax benefits

Net cash used in financing activities

Cash and cash equivalents at beginning of year

Cash and cash equivalents at end of year

1,089

970

962

1,089

884

962

$

$

1,259

131

$

$

1,009

133

$

$

1,087

118

Supplemental Cash Flow Information

Income taxes paid

Interest paid

See Notes to Consolidated Financial Statements.

Dollars in Millions Except Per Share Amounts

Historical Financial Summary

For the years ended December 31,

(Unaudited)

Continuing Operations

Net sales

Results of operations:

Net income attributable to Colgate-Palmolive Company

Per share, basic

Per share, diluted

Depreciation and amortization expense

2015

2014

2013

$ 16,034

$ 17,277

$ 17,420

1,384 (1)

1.53 (1)

1.52 (1)

449

2,180 (2)

2.38 (2)

2.36 (2)

442

2,241 (3)

2.41 (3)

2.38 (3)

439

2012

$

17,085

2,472 (4)

2.60 (4)

2.57 (4)

425

2011

$

16,734

2,431 (5)

2.49 (5)

2.47 (5)

421

2010

$

15,564

2,203 (6)

2.22 (6)

2.16 (6)

376

2009

$

15,327

2,291

2.26

2.18

351

2008

$

15,330

1,957 (7)

1.91 (7)

1.83 (7)

348

2007

$

13,790

2006

$

12,238

1,737 (8)

1.67 (8)

1.60 (8)

334

1,353 (9)

1.29 (9)

1.23 (9)

329

Financial Position

Current ratio

Property, plant and equipment, net

Capital expenditures

Total assets

Long-term debt

Colgate-Palmolive Company shareholders' equity

1.2

3,796

691

11,958

6,269

(299)

1.2

4,080

757

13,459

5,644

1,145

1.1

4,083

670

13,985

4,749

2,305

1.2

3,842

565

13,394

4,926

2,189

1.2

3,668

537

12,724

4,430

2,375

1.0

3,693

550

11,172

2,815

2,675

1.1

3,516

575

11,134

2,821

3,116

1.3

3,119

684

9,979

3,585

1,923

1.1

3,015

583

10,112

3,222

2,286

1.0

2,696

476

9,138

2,720

1,411

Share and Other

Book value per common share

Cash dividends declared and paid per common share

Closing price

Number of common shares outstanding (in millions)

Number of common shareholders of record

Number of employees

(0.04)

1.50

66.62

892.7

24,400

37,900

1.55

1.42

69.19

906.7

25,400

37,700

2.79

1.33

65.21

919.9

26,900

37,400

2.60

1.22

52.27

935.8

27,600

37,700

2.71

1.14

46.20

960.0

28,900

38,600

2.95

1.02

40.19

989.8

29,900

39,200

3.26

0.86

41.08

988.4

30,600

38,100

2.04

0.78

34.27

1,002.8

31,400

36,600

2.37

0.70

38.98

1,018.0

32,200

36,000

1.51

0.63

32.62

1,025.4

33,400

34,700

Note: All per share amounts and numbers of shares outstanding were adjusted for the two-for-one stock split of the Company's stock in 2013.

1

Net income including noncontrolling interests, Net income attributable to Colgate-Palmolive Company and earnings per common share for the full year of 2015 include a $1,058 aftertax charge related to the change in accounting for the

Companys Venezuelan operations, $183 of aftertax charges related to the 2012 Restructuring Program, $22 of aftertax charges related to the remeasurement of CP Venezuelas local currency-denominated net monetary assets as a

result of effective devaluations, $120 aftertax gain on the sale of the South Pacific laundry detergent business, a $14 charge related to a foreign competition law matter and a $15 charge for a foreign tax matter.

Net income including noncontrolling interests, Net income attributable to Colgate-Palmolive Company and earnings per common share in 2014 include $208 of aftertax charges related to the 2012 Restructuring Program, $214 of

aftertax charges related to the remeasurement of CP Venezuelas local currency-denominated net monetary assets as a result of effective devaluations, $41 of charges for foreign competition law matters, $3 of aftertax costs related to

the sale of land in Mexico and a $66 charge for a foreign tax matter.

Net income attributable to Colgate-Palmolive Company and earnings per common share in 2013 include $278 of aftertax charges related to the 2012 Restructuring Program, a $111 aftertax charge related to the remeasurement of CP

Venezuelas local currency-denominated net monetary assets as a result of a devaluation, a $23 charge for a foreign competition law matter and $12 of aftertax costs related to the sale of land in Mexico.

income attributable to Colgate-Palmolive Company and earnings per common share in 2012 include $70 of aftertax charges related to the 2012 Restructuring Program, $18 of aftertax costs related to the sale of land in Mexico and

$14 of aftertax costs associated with various business realignment and other cost-saving initiatives.

4 Net

5 Net

income attributable to Colgate-Palmolive Company and earnings per common share in 2011 include an aftertax gain of $135 on the sale of the non-core laundry detergent business in Colombia, offset by $147 of aftertax costs

associated with various business realignment and other cost-saving initiatives, $9 of aftertax costs related to the sale of land in Mexico and a $21 charge for a foreign competition law matter.

6 Net

income attributable to Colgate-Palmolive Company and earnings per common share in 2010 include a $271 one-time charge related to the transition to hyperinflationary accounting in Venezuela, $61 of aftertax charges for

termination benefits related to overhead reduction initiatives, a $30 aftertax gain on sales of non-core product lines and a $31 benefit related to the reorganization of an overseas subsidiary.

7 Net

income attributable to Colgate-Palmolive Company and earnings per common share in 2008 include $113 of aftertax charges associated with the 2004 Restructuring Program.

income attributable to Colgate-Palmolive Company and earnings per common share in 2007 include a $29 aftertax gain for the sale of the Companys household bleach business in Latin America and an income tax benefit of $74

related to the reduction of a tax loss carryforward valuation allowance in Brazil, partially offset by tax provisions for the recapitalization of certain overseas subsidiaries. These gains were more than offset by $184 of aftertax charges

associated with the 2004 Restructuring Program, $10 of pension settlement charges and $8 of charges related to the limited voluntary recall of certain Hills Pet Nutrition feline products.

8 Net

9 Net

income attributable to Colgate-Palmolive Company and earnings per common share in 2006 include a gain for the sale of the Companys household bleach business in Canada of $38 aftertax. This gain was more than offset by

$287 of aftertax charges associated with the 2004 Restructuring Program and $48 of aftertax charges related to the adoption of the update to the Stock Compensation Topic of the FASB Codification.

You might also like

- Anwal Gas-TnDocument35 pagesAnwal Gas-TnMaysam Kh67% (3)

- Colgate-Financial-Model-unsolved-wallstreetmojo.com_.xlsxDocument33 pagesColgate-Financial-Model-unsolved-wallstreetmojo.com_.xlsxFarin KaziNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Colgate Palmolive Edos. Financieros 2009 A 2011Document11 pagesColgate Palmolive Edos. Financieros 2009 A 2011manzanita_2412No ratings yet

- Mary Washington Case Study DCF ValuationDocument6 pagesMary Washington Case Study DCF ValuationKatrinaNo ratings yet

- Checkpoint Exam 3 (Study Sessions 16-19, 1)Document11 pagesCheckpoint Exam 3 (Study Sessions 16-19, 1)Bảo TrâmNo ratings yet

- Amalgamation Summary NotesDocument10 pagesAmalgamation Summary NotesAvinash RoyNo ratings yet

- Ratio Analysis of Colgate-Palmolive Company Financial Statements (2007-2015Document18 pagesRatio Analysis of Colgate-Palmolive Company Financial Statements (2007-2015Zohaib AhmedNo ratings yet

- Alphabet 2014 Financial ReportDocument6 pagesAlphabet 2014 Financial ReportsharatjuturNo ratings yet

- Colgate Financial Model SolvedDocument33 pagesColgate Financial Model SolvedVvb SatyanarayanaNo ratings yet

- Pre q12013fsDocument27 pagesPre q12013fsKatie SanchezNo ratings yet

- Vertical Analysis For Att and VerizonDocument4 pagesVertical Analysis For Att and Verizonapi-299644289No ratings yet

- USD $ in MillionsDocument8 pagesUSD $ in MillionsAnkita ShettyNo ratings yet

- Consolidated Statement of Earnings (Usd $)Document68 pagesConsolidated Statement of Earnings (Usd $)fivehoursNo ratings yet

- Financial Model OverviewDocument20 pagesFinancial Model OverviewShawn PantophletNo ratings yet

- Laporan Keuangan - Mki IchaDocument6 pagesLaporan Keuangan - Mki IchaSempaks KoyakNo ratings yet

- Sadlier WH 2009 Annual ReportDocument17 pagesSadlier WH 2009 Annual ReportteriksenNo ratings yet

- 2015 Financial Highlights: Year-End 2015 2014 % B/ (W) ChangeDocument1 page2015 Financial Highlights: Year-End 2015 2014 % B/ (W) Changeimran shaikhNo ratings yet

- Basic Accounting Concepts: Financial AccountingDocument16 pagesBasic Accounting Concepts: Financial AccountinggusneriNo ratings yet

- Fiscal Year Is January-December. All Values ZAR MillionsDocument14 pagesFiscal Year Is January-December. All Values ZAR MillionsRavi JainNo ratings yet

- Apple 10QDocument57 pagesApple 10QadsadasMNo ratings yet

- Hannans Half Year Financial Report 2012Document19 pagesHannans Half Year Financial Report 2012Hannans Reward LtdNo ratings yet

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Document5 pagesConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNo ratings yet

- TSL Audited Results For FY Ended 31 Oct 13Document2 pagesTSL Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweNo ratings yet

- Factset Data Sheet Financial Statements and AnalysisDocument22 pagesFactset Data Sheet Financial Statements and Analysischandan.hegdeNo ratings yet

- Net Sales: January 28, 2012 January 29, 2011Document9 pagesNet Sales: January 28, 2012 January 29, 2011장대헌No ratings yet

- HKSE Announcement of 2011 ResultsDocument29 pagesHKSE Announcement of 2011 ResultsHenry KwongNo ratings yet

- Document Research: MorningstarDocument52 pagesDocument Research: Morningstaraaa_13No ratings yet

- Yahoo, Microsoft and Google Financial AnalysisDocument62 pagesYahoo, Microsoft and Google Financial AnalysisAnjana GummadivalliNo ratings yet

- Comperative BALANCE SHEETS-Horizontal ANALIYIS: (Expressed in Thousands of United States Dollars)Document9 pagesComperative BALANCE SHEETS-Horizontal ANALIYIS: (Expressed in Thousands of United States Dollars)jopa77No ratings yet

- 70 XTO Financial StatementsDocument5 pages70 XTO Financial Statementsredraider4404No ratings yet

- Colcom Press Results Dec2011Document1 pageColcom Press Results Dec2011Kristi DuranNo ratings yet

- Verizon Communications Inc. Condensed Consolidated Statements of Income Before Special ItemsDocument9 pagesVerizon Communications Inc. Condensed Consolidated Statements of Income Before Special ItemsvenkeeeeeNo ratings yet

- Microsoft FY14 Q3 Financial DataDocument46 pagesMicrosoft FY14 Q3 Financial Datacrtc2688No ratings yet

- 2010 Ibm StatementsDocument6 pages2010 Ibm StatementsElsa MersiniNo ratings yet

- Ratio Analysis: Coca ColaDocument21 pagesRatio Analysis: Coca ColaAadil KakarNo ratings yet

- Fsap Template in EnglishDocument34 pagesFsap Template in EnglishDo Hoang HungNo ratings yet

- Apple Inc.: Form 10-QDocument53 pagesApple Inc.: Form 10-QSeiha ChhengNo ratings yet

- Introduction To Corporate Finance: Mcgraw-Hill/IrwinDocument105 pagesIntroduction To Corporate Finance: Mcgraw-Hill/IrwinVKrishna Kilaru100% (2)

- Coca-Cola Financial Statements AnalysisDocument4 pagesCoca-Cola Financial Statements AnalysisJossy AndrinaNo ratings yet

- Fortune Brands Inc: FORM 10-QDocument49 pagesFortune Brands Inc: FORM 10-Qtomking84No ratings yet

- Boeing: I. Market InformationDocument20 pagesBoeing: I. Market InformationJames ParkNo ratings yet

- Lecture 1 CHP 1 No SolutionsDocument20 pagesLecture 1 CHP 1 No SolutionsHarry2140No ratings yet

- 155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportDocument14 pages155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportASX:ILH (ILH Group)No ratings yet

- Comprehensive Income Statement AnalysisDocument29 pagesComprehensive Income Statement AnalysisAlphan SofyanNo ratings yet

- Statement of Profit or Loss 2014Document8 pagesStatement of Profit or Loss 2014LouiseNo ratings yet

- IfrsDocument272 pagesIfrsKisu ShuteNo ratings yet

- Income Statement VADocument2 pagesIncome Statement VAErikaNo ratings yet

- Chapter 03 PenDocument27 pagesChapter 03 PenJeffreyDavidNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Coca Cola Financial Statements 2008Document75 pagesCoca Cola Financial Statements 2008James KentNo ratings yet

- Appropriations Dividend To Shareholders of Parent CompanyDocument30 pagesAppropriations Dividend To Shareholders of Parent Companyavinashtiwari201745No ratings yet

- Teavana Holdings Inc: Quarterly Report Pursuant To Sections 13 or 15 (D) Filed On 06/12/2012 Filed Period 04/29/2012Document38 pagesTeavana Holdings Inc: Quarterly Report Pursuant To Sections 13 or 15 (D) Filed On 06/12/2012 Filed Period 04/29/2012Michael LurchNo ratings yet

- Eicher Motors LTDDocument6 pagesEicher Motors LTDshivam mehraNo ratings yet

- 6.3.1 EditedDocument47 pages6.3.1 EditedPia Angela ElemosNo ratings yet

- Particulars: Gross ProfitDocument2 pagesParticulars: Gross ProfitpreetilakhotiaNo ratings yet

- Leucadia 2012 Q3 ReportDocument43 pagesLeucadia 2012 Q3 Reportofb1No ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineFrom EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineNo ratings yet

- Presentation and Proposed Action Plan 2017Document22 pagesPresentation and Proposed Action Plan 2017Juan Sebastián ChinomeNo ratings yet

- Developing an Optimized CBM System through Data Fusion and RCMDocument11 pagesDeveloping an Optimized CBM System through Data Fusion and RCMJuan Sebastián ChinomeNo ratings yet

- CKE6126 Lathe Technical SpecificationsDocument8 pagesCKE6126 Lathe Technical SpecificationsJuan Sebastián ChinomeNo ratings yet

- Chapter SevenDocument18 pagesChapter SevenJuan Sebastián ChinomeNo ratings yet

- CKE6126 Lathe Technical SpecificationsDocument8 pagesCKE6126 Lathe Technical SpecificationsJuan Sebastián ChinomeNo ratings yet

- Click To Edit Master Title StyleDocument4 pagesClick To Edit Master Title StyleJuan Sebastián ChinomeNo ratings yet

- Plastic MoneyDocument76 pagesPlastic MoneyMukesh ManwaniNo ratings yet

- Unit 3.2modes of Creating Charge FR LoanDocument8 pagesUnit 3.2modes of Creating Charge FR LoanVelankani100% (1)

- Ameritrade History of Transactions From 2002 To April 3, 2010Document16 pagesAmeritrade History of Transactions From 2002 To April 3, 2010Stan J. CaterboneNo ratings yet

- Dec 2021. VattamDocument11 pagesDec 2021. VattamsadaSivaNo ratings yet

- Ad Account Question PaperDocument3 pagesAd Account Question PaperAbdul Lathif0% (1)

- Commercial Transactions and Finance ExplainedDocument5 pagesCommercial Transactions and Finance ExplainedKaran UpadhyayNo ratings yet

- HO4Document2 pagesHO4Emily Dela CruzNo ratings yet

- 2022 02 20 - Kryptview Pitch Deck WebsiteDocument23 pages2022 02 20 - Kryptview Pitch Deck Websiteindian democracyNo ratings yet

- Cambridge, 2nd Ed. Irrecoverable Debt and Provision For Doubtful DebtDocument4 pagesCambridge, 2nd Ed. Irrecoverable Debt and Provision For Doubtful DebtShannen LyeNo ratings yet

- Orford Creditor's ReportDocument29 pagesOrford Creditor's Reportdyacono5452No ratings yet

- Breakfasting Mr. Ifan 31 Maret 2023Document2 pagesBreakfasting Mr. Ifan 31 Maret 2023Ifan FadilahNo ratings yet

- CMA Data For Bank Loan ProposalDocument29 pagesCMA Data For Bank Loan Proposalshardaashish0055% (11)

- Managerial Finance - Ch. 1 - May 2022Document11 pagesManagerial Finance - Ch. 1 - May 2022thomasNo ratings yet

- Case Study On Custard Apple Beneficiary (Srijan)Document38 pagesCase Study On Custard Apple Beneficiary (Srijan)Narendra ShandilyaNo ratings yet

- Introduction To Macroeconomics: Prepared By: Fernando Quijano and Yvonn QuijanoDocument46 pagesIntroduction To Macroeconomics: Prepared By: Fernando Quijano and Yvonn Quijanohasan jabrNo ratings yet

- Jurnal Financial Developing PDFDocument12 pagesJurnal Financial Developing PDFMichael ComunityNo ratings yet

- Chapter 005 PMDocument5 pagesChapter 005 PMHayelom Tadesse GebreNo ratings yet

- Bank GK Raw FileDocument7 pagesBank GK Raw FileThomas HarveyNo ratings yet

- Finance - Self Study Guide For Staff of Micro Finance InstitutionsDocument7 pagesFinance - Self Study Guide For Staff of Micro Finance InstitutionsmhussainNo ratings yet

- How Are Exchange Rates DeterminedDocument2 pagesHow Are Exchange Rates Determinedsapfico2k8No ratings yet

- Intermediate Accounting 2 (Notes Payable) - Problem 2Document3 pagesIntermediate Accounting 2 (Notes Payable) - Problem 2DM MontefalcoNo ratings yet

- InvoiceDocument1 pageInvoiceAbhishek VyasNo ratings yet

- Still Searching For Optimal Capital StructureDocument26 pagesStill Searching For Optimal Capital Structureserpent222No ratings yet

- P.O.A. TrustDocument2 pagesP.O.A. Trustjoe100% (1)

- Retail BankingDocument10 pagesRetail BankingDr.I.SelvamaniNo ratings yet

- Preqin Insight Alternative Assets in Australia and New Zealand September 2017 PDFDocument78 pagesPreqin Insight Alternative Assets in Australia and New Zealand September 2017 PDFPaulo MottaNo ratings yet