Professional Documents

Culture Documents

Module 1 Problem 2

Module 1 Problem 2

Uploaded by

dawn0 ratings0% found this document useful (0 votes)

13 views1 pageNordstrom's financial metrics from 2012 to 2013 are presented. ROA increased from 8.6% in 2012 to 8.9% in 2013, while ROE increased from 8.6% to 8.9%. Profit margin decreased slightly from 6.5% to 6.2% while asset turnover increased from 1.32 to 1.42. The increasing ROA is likely due to Nordstrom using assets more efficiently to generate profits in 2013 compared to 2012, as total assets decreased while net income increased.

Original Description:

Financial Accounting for MBAs

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNordstrom's financial metrics from 2012 to 2013 are presented. ROA increased from 8.6% in 2012 to 8.9% in 2013, while ROE increased from 8.6% to 8.9%. Profit margin decreased slightly from 6.5% to 6.2% while asset turnover increased from 1.32 to 1.42. The increasing ROA is likely due to Nordstrom using assets more efficiently to generate profits in 2013 compared to 2012, as total assets decreased while net income increased.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageModule 1 Problem 2

Module 1 Problem 2

Uploaded by

dawnNordstrom's financial metrics from 2012 to 2013 are presented. ROA increased from 8.6% in 2012 to 8.9% in 2013, while ROE increased from 8.6% to 8.9%. Profit margin decreased slightly from 6.5% to 6.2% while asset turnover increased from 1.32 to 1.42. The increasing ROA is likely due to Nordstrom using assets more efficiently to generate profits in 2013 compared to 2012, as total assets decreased while net income increased.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

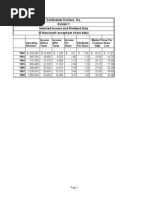

MODULE 1 Problem 2

Dawn Jones

($ millions)

Sales

Net Income

Total Assets

Equity

2013

11762

735

8089

1913

Answer

A.

ROA 2012

ROA 2013

Net Income/Average Equity

683/(7462+8491)/2

735/(8491+8089)/2

Net Income/Average Assets

683/(2021+1956)/2

735/(1956+1913)/2

ROE 2012

ROE 2013

B.

Profitability (Profit Margin)

Productivity (Asset turnover)

15953

16580

7976.50 0.085627

8290.00 0.088661

8.6

8.9

3977

3869

1988.50 0.343475

1934.50 0.379943

34.3

38.0

0.065066

0.062489

6.50%

6.20%

7976.5 1.315991

8290 1.418818

1.32

1.42

0.085627

0.088661

8.6

8.9

Net Income/Sales

2012 683/10497

2013 735/11762

Sales/Average assets

2012 10497/(7462+8491)/2

2013 11762/(8491+8089)/2

15953

16580

Net Margin*Profit Margin

2012 0.065066*1.315991

2013 0.062489*1.418818

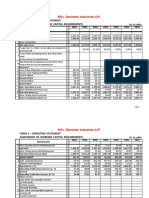

C.

For every dollar of average asset Nordstrom Inc.

earned $1.32 of sales 2012 and $1.42 in 2013.

ROA is higher now than last years, which could be

better efficiency in using assets to generate profit

during 2013 vs 2012. What appears to be driving

Nordstrom, Inc.'s change in ROA over time is total

assets.

2012

10497

683

8491

1956

2011

9310

613

7462

2021

You might also like

- IMT CeresDocument5 pagesIMT Ceresrithvik royNo ratings yet

- Southland Case StudyDocument7 pagesSouthland Case StudyRama Renspandy100% (2)

- IMT CeresDocument5 pagesIMT CeresKAJAL SHARMANo ratings yet

- GulahmedDocument8 pagesGulahmedOmer KhanNo ratings yet

- CongoleumDocument16 pagesCongoleumMilind Sarambale0% (1)

- Praktikum FinancialDocument22 pagesPraktikum Financiallisa amaliaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Zimplow FY 2012Document2 pagesZimplow FY 2012Kristi DuranNo ratings yet

- Ceres Gardening Company Submission TemplateDocument7 pagesCeres Gardening Company Submission TemplateKiran SinghNo ratings yet

- IMT CeresDocument5 pagesIMT CeresRithvik RoyNo ratings yet

- Financial Application: Portfolio SelectionDocument16 pagesFinancial Application: Portfolio SelectionTeree ZuNo ratings yet

- Balance Sheet AnalysisDocument8 pagesBalance Sheet Analysisramyashraddha18No ratings yet

- Standalone Financial Results, Auditors Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Continental CarriersDocument3 pagesContinental CarriersCharleneNo ratings yet

- Unitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Document4 pagesUnitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Bhuvan MalikNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document5 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Om - Monthly ReportDocument81 pagesOm - Monthly ReportRajeshbabhu Rajeshbabhu100% (1)

- Hanson Annual ReportDocument296 pagesHanson Annual ReportmohanesenNo ratings yet

- Heidelbergcement Annual Report 2016Document308 pagesHeidelbergcement Annual Report 2016someshNo ratings yet

- 2012 Geauga Park District BudgetDocument10 pages2012 Geauga Park District BudgetThe News-HeraldNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Tata Annual Report 2012Document6 pagesTata Annual Report 2012Vaibhav BindrooNo ratings yet

- Assignment Data UsagesDocument2 pagesAssignment Data UsagesjgukykNo ratings yet

- Half-Year 2013 Results: Belek - TurquieDocument28 pagesHalf-Year 2013 Results: Belek - TurquieEugen IonescuNo ratings yet

- Audited Financial Results For The Quarter and Financial Year Ended 31st March 2021Document12 pagesAudited Financial Results For The Quarter and Financial Year Ended 31st March 2021Abhilash ABNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Name Annapoorneshwari .S. UDocument4 pagesName Annapoorneshwari .S. Uannapoorneshwari suNo ratings yet

- Devmeta Project Report CmaDocument9 pagesDevmeta Project Report CmaharshNo ratings yet

- Lecture 6 Excel Integrated ExercisesDocument9 pagesLecture 6 Excel Integrated Exercisesasdsad dsadsaNo ratings yet

- Standalone Financial Results For The Quarter / Year Ended On 31st March 2012Document9 pagesStandalone Financial Results For The Quarter / Year Ended On 31st March 2012smartashok88No ratings yet

- Uflex Audited Consolidated Results 31st March 2019Document4 pagesUflex Audited Consolidated Results 31st March 2019markelonnNo ratings yet

- Pinto Ch03 PptsDocument14 pagesPinto Ch03 PptsArthur HoNo ratings yet

- ISE307 153 Final SolvedDocument10 pagesISE307 153 Final SolvedMmNo ratings yet

- Statement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Document11 pagesStatement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Narsingh Das AgarwalNo ratings yet

- Consolidated Statement of Comprehensive Income For Years 2012 and 2013Document5 pagesConsolidated Statement of Comprehensive Income For Years 2012 and 2013Kunal GudhkaNo ratings yet

- Coca Cola Financial AnalysisDocument4 pagesCoca Cola Financial AnalysisMohammad AliNo ratings yet

- Particulars 31-3-2011 31-3-2012 Increase Decrease Current AssetsDocument25 pagesParticulars 31-3-2011 31-3-2012 Increase Decrease Current AssetsJithendar ReddyNo ratings yet

- Standalone & Consolidated Financial Results For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Alcoa: 5.7 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDocument1 pageAlcoa: 5.7 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDekidenNo ratings yet

- Financial+Statements-Ceres+Gardening+Company 1Document5 pagesFinancial+Statements-Ceres+Gardening+Company 1AG InteriorNo ratings yet

- Taller 3 - Sistemas NumericosDocument15 pagesTaller 3 - Sistemas NumericosJulian CamargoNo ratings yet

- Strategic Valuation IssuesDocument29 pagesStrategic Valuation IssuesMohd Faiz67% (3)

- Albay Electric Cooperative, Inc. (Aleco) : 2017 Budget Utilization ReportDocument12 pagesAlbay Electric Cooperative, Inc. (Aleco) : 2017 Budget Utilization ReportEdsel Alfred OtaoNo ratings yet

- Chapter 1. Exhibits y AnexosDocument15 pagesChapter 1. Exhibits y AnexoswcornierNo ratings yet

- Biblio & AnnexureDocument4 pagesBiblio & AnnexureJoy CharlesNo ratings yet

- Earth: Current Previous Close 2013 TP Exp Return Support Resistance CGR 2012 N/RDocument4 pagesEarth: Current Previous Close 2013 TP Exp Return Support Resistance CGR 2012 N/RCamarada RojoNo ratings yet

- Annual Report-2018 PDFDocument226 pagesAnnual Report-2018 PDFjagadeeshyogiNo ratings yet

- RM 2-1Document2 pagesRM 2-1Ali Irfan GhumroNo ratings yet

- LVB Audited Financials 31032019Document9 pagesLVB Audited Financials 31032019Maran VeeraNo ratings yet

- Capital Budget TemplateDocument1 pageCapital Budget TemplaterajvakNo ratings yet

- Assigment # 2aDocument28 pagesAssigment # 2aomeryounosNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- MeharVerma IMT Ceres 240110 163643Document9 pagesMeharVerma IMT Ceres 240110 163643Mehar VermaNo ratings yet

- Exchequer Final Statement March 2012Document5 pagesExchequer Final Statement March 2012Politics.ieNo ratings yet

- Girish Telage - Ceres Gardening CompanyDocument7 pagesGirish Telage - Ceres Gardening Companygirishtelage565No ratings yet

- MSSL Results Quarter Ended 31st December 2011Document4 pagesMSSL Results Quarter Ended 31st December 2011kpatil.kp3750No ratings yet

- AcasestudyonkodakdownfallDocument8 pagesAcasestudyonkodakdownfallJonnaline AlfonNo ratings yet

- Financial AnalysisDocument12 pagesFinancial AnalysisjoeNo ratings yet

- Appendix Table 3: Gross Domestic Saving and Investment Item Per Cent of GDP at Current Market Prices Amount in ' BillionDocument2 pagesAppendix Table 3: Gross Domestic Saving and Investment Item Per Cent of GDP at Current Market Prices Amount in ' BillionSaumya SinghNo ratings yet

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet