Professional Documents

Culture Documents

Distribution Management of Hindustan Unilever LTD PDF

Distribution Management of Hindustan Unilever LTD PDF

Uploaded by

Anup BishnaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Distribution Management of Hindustan Unilever LTD PDF

Distribution Management of Hindustan Unilever LTD PDF

Uploaded by

Anup BishnaniCopyright:

Available Formats

A Study on Distribution

Management of

Hindustan Unilever Limited

SubmittedTo

Prof.SGovindrajan

By

PRADEEPNARAIN

g08075

SANJEEVKUMARJHA

g08086

SATADRUBAGCHI

g08088

SOUMITRADHALI

g08090

TARUNKUMARSAHA

g08095

Content

Page

1. IntroductionHindustanUnileverLimited

2. DistributionNetworkofHUL

2.1.EvolutionoverTime

2.2.DetailOverview

12

4. InitiativestakentoImprovetheDistributionNetwork

14

5. FieldForceManagement

16

6. AnalyticalFramework

18

7. FinancialAnalysis

26

8. References

33

3. ChannelDesign

1.IntroductionHindustanUnileverLimited

Hindustan UnileverLimited(HUL),formerlyHindustanLeverLimited (itwasrenamedin lateJune

2007asHUL),isIndia'slargestFastMovingConsumerGoodscompany,touchingthelivesoftwoout

of three Indians with over 20 distinct categories in Home & Personal Care Products and Foods &

Beverages.Theseproductsendowthecompanywithascaleofcombinedvolumesofabout4million

tonnesandsalesofnearlyRs.13718crores.

HUL is also one of the country's largest exporters; it has been recognised as a Golden Super Star

TradingHousebytheGovernmentofIndia.

The mission that inspires HUL's over 15,000 employees, including over 1,300 managers, is to "add

vitalitytolife."HULmeetseverydayneedsfornutrition,hygiene,andpersonalcarewithbrandsthat

helppeoplefeelgood,lookgoodandgetmoreoutoflife.ItisamissionHULshareswithitsparent

company, Unilever, which holds 52.10% of the equity. The rest of the shareholding is distributed

among360,675individualshareholdersandfinancialinstitutions.

HUL's brands like Lifebuoy, Lux, Surf Excel, Rin, Wheel, Fair & Lovely, Pond's, Sunsilk, Clinic,

Pepsodent,Closeup,Lakme,BrookeBond,Kissan,KnorrAnnapurna,KwalityWall'sarehousehold

names across the country and span many categories soaps, detergents, personal products, tea,

coffee,brandedstaples,icecreamandculinaryproducts.Theseproductsaremanufacturedover40

factoriesacrossIndia.Theoperationsinvolveover2,000suppliersandassociates.HUL'sdistribution

network comprisesabout 4,000redistributionstockists,covering 6.3millionretailoutletsreaching

theentireurbanpopulation,andabout250millionruralconsumers.

WehaveanalyzedthedistributionnetworkofHULfromthefollowingaspects:

1. EvolutionofHULsdistributionnetwork

2. Transportation&Logistics

3. ChannelDesign

4. Initiativestakenforchannelmembermanagement.

5. Fieldforcemanagement

6. AnalyticalFramework

7. FinancialAnalysis

2.DistributionNetworkofHUL

2.1.EvolutionoverTime

TheHULsdistributionnetworkhasevolvedwithtime.ThefirstphaseoftheHULdistribution

networkhadwholesalersplacingbulkordersdirectlywiththecompany.Largeretailersalsoplaced

directorders,whichcomprisedalmost30percentofthetotalorderscollected.Thecompany

salesmangroupedalltheseordersandplacedanindentwiththeHeadOffice.Goodsweresentto

thesemarkets,withthecompanysalesmanastheconsignee.Thesalesmanthencollectedand

distributedtheproductstotherespectivewholesalers,againstcashpayment,andthemoneywas

remittedtothecompany.

The focus of the second phase, which spanned the decades of the 40s, was to provide desired

productsandqualityservicetothecompany'scustomers.Inordertoachievethis,onewholesalerin

eachmarketwasappointedasa"RegisteredWholesaler,"astockpointforthecompany'sproducts

inthatmarket.Thecompanysalesmanstillcoveredthemarket,canvassingforordersfromtherest

ofthetrade.HethendistributedstocksfromtheRegisteredWholesalerthroughdistributionunits

maintained by the company. The Registered Wholesaler system, therefore, increased the

distributionreachofthecompanytoalargernumberofcustomers.

Thehighlightofthethirdphasewastheconceptof"RedistributionStockist"(RS)whoreplacedthe

RWs. The RS was required to provide the distribution units to the company salesman. The second

characteristic of this period was the establishment of the "Company Depots" system. This system

helpedintransshipment,bulkbreaking,andasastockpointtominimisestockoutsattheRSlevel.In

therecentpast,asignificantchangehasbeenthereplacementoftheCompanyDepotbyasystemof

thirdpartyCarryingandForwardingAgents(C&FAs).TheC&FAsactasbufferstockpointstoensure

that stockouts did not take place. The C&FA system has also resulted in cost savings in terms of

direct transportation and reduced time lag in delivery. The most important benefit has been

improvedcustomerservicetotheRS.

The role performed by the Redistribution Stockists includes: Financing stocks, providing

warehousing facilities, providing manpower, providing service to retailers, implementing

promotional activities, extending indirect coverage, reporting sales and stock data, demand

simulationandscreeningfortransitdamages.

2.2.DetailOverview

ThedistributionnetworkofHULisoneofthekeystrengthsthathelpittosupplymostproductsto

almostanyplaceinthecountryfromSrinagartoKanyakumari.Thisincludes,maintainingfavorable

trade relations, providing innovative incentives to retailers and organizing demand generation

activitiesamongahostofotherthings.EachbusinessofHULportfoliohascustomizedthenetwork

to meet its objectives. The most obvious function of providing the logistics support is to get the

companysproducttotheendcustomer.

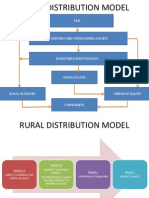

DistributionSystemofHUL

HUL's products, are distributed through a network of 4,000 redistribution stockists, covering 6.3

millionretailoutletsreachingtheentireurbanpopulation,andabout250millionruralconsumers.

There are 35 C&FAs in the country who feed these redistribution stockists regularly. The general

tradecomprisesgrocerystores,chemists,wholesale,kiosksandgeneralstores.HindustanUnilever

provides tailor made services to each of its channel partners. It has developed customer

management and supply chain capabilities for partnering emerging selfservice stores and

supermarkets.Around2,000suppliersandassociatesserveHULs40manufacturingplantswhichare

decentralizedacross2millionsquaremilesofterritory.

(Fig.1SchematicofHULsDistributionNetwork)

DistributionattheVillages:

The company has brought all markets with populations of below 50,000 under one rural sales

organisation.Theteamcomprisesanexclusivesalesforceandexclusiveredistributionstockists.The

teamfocusesonbuildingsuperioravailabilityofproducts.InruralIndia,thenetworkdirectlycovers

about50,000villages,reaching250millionconsumers,through6000substockists.

(Fig.2RuralDistributionModelofHUL)

HUL approached the rural market with two criteria the accessibility and viability. To service this

segment, HUL appointed a Redistribution stockist who was responsible for all outlets and all

businesswithinhisparticulartown.Inthe25%oftheaccessiblemarketswithlowbusinesspotential,

HULassignedasubstockistwhowasresponsibletoaccessallthevillagesatleastonceinafortnight

andsendstockstothosemarkets.Thissubstockistdistributesthecompany'sproductstooutletsin

adjacentsmallervillagesusingtransportationsuitabletointerconnectingroads,likecycles,scooters

ortheageoldbullockcart.Thus,HindustanUnileveristryingtocircumventthebarrierofmotorable

roads. The company simultaneously uses the wholesale channel, suitably incentivising them to

distributecompanyproducts.Themostcommonformoftradingremainsthegrassrootsbuyandsell

mode.ThisenablesHULtoinfluencetheretailersstocksandquantitiessoldthroughcreditextension

and trade discounts. HUL launched this Indirect Coverage (IDC) in 1960s.Under the Indirect

Coverage(IDC)method,companyvanswerereplacedbyvansbelongingtoRedistributionStockists,

whichservicedaselectgroupofneighbouringmarkets.

DistributionattheUrbancentres:

Distribution of goods from the manufacturing site to C & F agents take place through either the

trucksorrailroadsdependingonthetimefactorfordeliveryandcostoftransportation.Generally

the manufacturing site is located such that it covers a bigger geographical segment of India. From

theC&Fagents,thegoodsaretransportedtoRSsbymeansoftrucksandtheproductsfinallymake

thelastmilebasedonthelocalpopularandcheapmodeoftransport.

Newdistributionchannels

ProjectShakti

This model creates a symbiotic partnership between HUL and its consumers. Started in the late

2000,ProjectShaktihadenabledHindustanLevertoaccess80,000ofIndia's638,000villages.HUL's

partnership with Self Help Groups(SHGs) of rural women, is becoming an extended arm of the

company's operation in rural hinterlands. Project Shakti has already been extended to about 12

states Andhra Pradesh, Karnataka, Gujarat, Madhya Pradesh, Tamil Nadu, Chattisgarh, Uttar

Pradesh, Orissa, Punjab, Rajasthan, Maharashtra and West Bengal. The respective state

governments and several NGOs are actively involved in the initiative. The SHGs have chosen to

partner with HUL as a business venture, armed with training from HUL and support from

government agencies concerned and NGOs. Armed with microcredit, women from SHGs become

directtohomedistributorsinruralmarkets.

Themodelconsistsofgroupsof(1520)villagersbelowthepovertyline(Rs.750permonth)taking

microcredit from banks, and using that to buy our products, which they will then directly sell to

consumers.Ingeneral,amemberfromaSHGselectedasaShaktientrepreneur,commonlyreferred

as'ShaktiAmma'receivesstocksfromtheHULruraldistributor.Afterbeingtrainedbythecompany,

the Shakti entrepreneur then sells those goods directly to consumers and retailers in the village.

Each Shakti entrepreneur usually service 610 villages in the population strata of 1,0002,000. The

ShaktientrepreneursaregivenHULproductsona`cashandcarrybasis.'

ThefollowingtwodiagramsshowtheProjectShaktimodelasinitiatedbyHUL.

ProjectStreamline

To cater to the needs of the inaccessible market with high business potential HUL initiated a

Streamlineinitiativein1997.ProjectStreamlineisaninnovativeandeffectivedistributionnetwork

forruralareasthatfocusesonextendingdistributiontovillageswithlessthan2000peoplewiththe

help of rural substockists/Star Sellers who are based in these very villages. As a result, the

distributionnetworkdirectlycoversasofnowabout40percentoftheruralpopulation.

Under Project Streamline, the goods are distributed from C & F Agents to Rural Distributors (RD),

whohas1520ruralsubstockistsattachedtohim.Eachofthesesubstockists/starsellersislocated

in a rural market. The substockists then perform the role of driving distribution in neighboring

villages using unconventional means of transport such as tractor and bullock carts. Project

Streamline being a cross functional initiative, the Star Seller sells everything from detergents to

personalproducts.

Higherqualityservicing,intermsoffrequency, creditandfulllineavailability,istobeprovidedto

ruraltradeaspartofthenewdistributionstrategy.

ThediagraminthenextpageshowsthemodelofProjectStreamline.

HindustanLeverNetwork(HLN)

It is the company's arm in the Direct Selling channel, one of the fastest growing in India today. It

alreadyhasaboutseverallakhconsultantsallindependententrepreneurs,trainedandguidedby

HLN'sexpertmanagers.HLNhasalreadyspreadtoover1500townsandcities,covering80%ofthe

urban population, backed by 42 offices and 240 service centres across the country. It presents a

rangeofcustomisedofferingsinHome&PersonalCareandFoods.

The New Compensation plan for HLN partners provides new exciting ways of earning substantial

income in addition to offering rewards like revenue sharing through the innovative concept of

pools

MotherDepotandJustinTimeSystem

Inordertorationalisethelogisticsandplanningtask,aninnovativestephasbeentheformationof

theMotherDepotandJustinTimeSystem(MDJIT).CertainC&FAswereselectedacrossthecountry

to act as mother depots. Each of them has a minimum number of JIT depots attached for stock

requirements.AllbrandsandpacksrequiredforthesetofmarketswhichtheMDandJITsservicein

a given area are sent to the mother depot by all manufacturing units. The JITs draw their

requirementsfromtheMDonaweeklyorbiweeklybasis.

LeveragingInformationtechnology

HULcustomersareservicedoncontinuousreplenishment.ThisispossiblebecauseofITconnectivity

across the extended supply chain of about 2,000 suppliers, 80 factories and 7,000 stockists. This

sophisticated network with its voice and data communication facilities has linked more than 200

locationsalloverthecountry,includingtheheadoffice,branchoffices,factories,depotsandthekey

redistributionstockists.TheyhavealsocombinedbackendprocessesintoacommonSharedService

infrastructure, which supports the units across the country. All these initiatives together have

10

enhanced operational efficiencies, improved the service to the customers and have brought us

closertothemarketplace.

RSNetInitiative:

TheRSNetinitiative,launchedin2001,aimsatconnectingRedistributionStockists(RSs)throughan

internetbasedsystem.ItnowcoversstockistsoftheHome&PersonalCarebusinessandFoods&

Beveragesincloseto1200townsandcities.Togethertheyaccountforabout80%ofthecompany's

turnover. RS Net is one of the largest B2B ecommerce initiatives ever undertaken in India. It

provides linkages with the RSs own transaction systems, enables monitoring of stocks and

secondarysalesandoptimisesRSsordersandinventoriesonadailybasisthroughonlineinteraction

on orders, despatches, information sharing and monitoring. The ITpowered system has been

implemented to supply stocks to redistribution stockists on a continuous replenishment basis.

Today, the sales system gets to know every day what HUL stockists have sold to almost a million

outletsacrossthecountry.InformationonsecondarysalesisnowavailableonRSNeteveryday.

RSNetispartofProjectLeap.ProjectLeapbeginswiththesupplierrunsthroughthefactoriesand

depotsandreachesuptotheRSs.ThisensuresHULsgrowthbyensuringthattherightproductis

available at the right place in the right quantities and at the right time in the most costeffective

manner. Leap also aims at reducing inventories and improving efficiencies right through the

extendedsupplychain.

RSNethascomeasaforcemultiplierforHULWay,thecompany'sactionplantonotonlymaximise

the number of outlets reached but also to achieve leadership in every outlet. RS Net has enabled

stockists to place orders on a Continuous Replenishment System. This in turn has unshackled the

fieldforcetosolelyfocusonsecondarysalesfromthestockiststoretailersandmarketactivation.It

hasalsoenabledRSstoprovideimprovedservicetoretailoutlets.Simultaneously,HULisservicing

theruralmarket,keyurbanoutlets,andthemoderntradeasasingleconcern.

AdexaiCollaborationsuite

In 2000, HUL identified improved supply chain management as a critical business priority and

launched a comprehensive initiative, Project Leap, tasked with increasing supplier/distributor

responsiveness,reducinginventorybuffers,andoptimizingplanningandscheduling.HULchosethe

AdexaiCollaborationsuiteforfacilitatingcentralizedmonitoringoftheSCM,livecustomer/supplier

collaboration, and integrating demand and distribution planning with production scheduling. With

theaggregatedviewofdataprovidedbytheiCollaborationsuite,HULwasabletocombinesalesand

11

distributioneffortsonthediverseproductlines,whichresultedinsignificantsavingsonthecostside

for inventories and distribution. HUL updates inventory positions, shipments and customer orders

onadailybasiswiththesesoftwarepackagesandcangetapulseonthemarketrealtime.

(Fig.3HULsTurnoverComparedwithCompetitors,2006)

(Fig.4HULsMarketLeadershipacrossvariousFMCGCategories)

12

3.ChannelDesign

HindustanLeverLimited(HUL)hastwotypesofchannelselling

i.

Regular(traditional)retailchannel,

ii. DirectSellingChannelinthenameofHindustanLeverNetwork(HLN).

HUL has a well entrenched high distribution model which comprises of C&FAs, Redistribution

Stockists,wholesalersandretailers(asshownearlier).HindustanUnilever'sdistributionnetworkis

recognizedasoneofitskeystrengths.ItsfocusesonProductavailability,Brandcommunication,and

higherlevelsofbrandexperience.

HULsSalesBreakupthroughdifferentchannels:

Sales Break-up Through Different Channels

7%

33%

60%

Modern Retail

Urban General Trade

Rural Areas

ChannelStructure(SpecialFocusisonJamshedpur)

Typically,thegoodsproducedineachoftheHUL's40factoriesaresenttoadepotwiththehelpofa

carryingandforwardingagent(C&FA).Thecompanyhasitsdepotineverystateofthecountry.The

C&FA is a third party and gets servicing fee for stock and delivery of the products. In each town,

thereisatleastaredistributionstockist(RS)whotakesthegoodsfromtheC&FAandsellsthemto

retail outlets. In Jharkhand the C&FA is in Ranchi and Jamshedpur is serviced by 3 Redistribution

StockistsatSakchi(M/sOmPrakashAgarwal),BistupurandParsudih.

TheHULmanagementrealizedcertainproblemswiththeexistingsalesmodel.First,themodelwas

not viable for small towns with small population and small business. HUL found it expensive to

appoint one stockist exclusively for each town. Secondly, the retail revolution in the country has

changedthepatternthecustomersshop.Largeretailselfserviceshopsarebecomingcommonplace.

13

In response of these problems, HUL redesigned its sales and distribution channel and the new

systemisknownas'diamondmodel'inthecompany.Atthetopendofthediamond,therearethe

selfserviceretailstoreswhichconstitute10%ofthetotalFMCGmarket.Themiddle,fatterpartof

thediamondrepresentstheprofitcenterbasedsalesteam.Inthebottomofthepyramidistherural

marketing and distribution which accounts for 20% of the business. As a result of the new

distributionplanthecompanyhasplannedtoreducethenumberofRSinsmalltowns.

RedistributionStockists:

TotalnumberofRSinJamshedpur=3(atSakchi,Bistupur,Parsudih).Thisisgoingtobereducedto

onlyonewitheffectfromnextmonthofthisyear.

Sales Margin: 4.76% which includes cash discount, unloading expenses from depot,

distributionexpensestoretailers,incentiveschemes&otherincidentalexpenses.

Modesoftransportused:Rickshaw,tempo.

Incentiveschemes:Before2000holidaypackagesandtoursbutafter2000nononmonetary

incentiveforRS.

Software systems and Information System: UNIFY 8.3 (Developed by IBM & CMC). This

softwareneedstobesynchronizeddailyandthesystemupdatesanyinformation/incentive

schemes/salesfiguresetctoandfromthecommonsharedplatform.

AreasofOperations:MarkedforeachoftheRS.

SellingOperations:RSssellsthegoodsto

o

Wholesaler(gets1.5%max.discountfromRS)

Retailers(gets1.0%max.discountfromRS)

Wholesaler:

GetscashdiscountsandotherschemespromotedbyHUL(getspointsunderVijetaScheme).

Retailers:

TotalretailerbaseinJamshedpur:Approximately1070.

SalesMargin:Dependsontheproduct

o

Soap,detergents

8%onMRP

Cosmetics

10%onMRP

Fooditems

8%onMRP

14

Incentiveschemes:

Companyprograms(SchemeDiscounts+CashDiscounts)

TPRschemesbasedonSales(1%to4%)

Vijetaschemeisnotforretailers.

FieldSalesForce:

To meet the everchanging needs of the consumer, HUL has set up a distribution network that

ensures availability of all their products, in all outlets, at all times. This includes, maintaining

favourable trade relations, providing innovative incentives to retailers and organizing demand

generationactivitiesamongahostofotherthings.

TheimportantactivitiesthatHULfieldsalesforcedoesare(i)targetchasingand(ii)reportingona

dailybasis.AccountinformationismaintainedonpalmtopsgivenbyHUL.Duringourresearchand

informalsurveyofHULfieldsalesforce,wecametoknowthatforthelasttwoyears,trainingisnot

beinggivenatalltothesalesforce.

HULhaslimitedthenetworkchannelsellingtocategoriesofHome&PersonalCare(HPC)andFood

products with exclusive brands for this channel. That is, these particular brands (products) are all

exclusivetoHLN,specificallydevelopedfortheDirectSellingchannel,andnotavailableintheretail

channel. The general trade comprises grocery stores, chemists, wholesaler, kiosks and general

stores.HindustanUnileverserviceseachwithatailormademixofservices.

4.InitiativestakentoImprovetheDistributionNetwork

HULhastakenthefollowinginitiativestoimproveitsdistributionnetwork:

Setting up of a fullscale sales organisation comprising key account management and

activationtoimpact,fullyengageandservicemodernretailersastheyemerge.

ServicingChannelpartnersandcustomerswithcontinuousdailyreplenishment.

LeveragingscaleandbuildingexpertisetoserviceModernTradeandRuralMarkets.

Delayeringofsalesforcetoimproveresponsetimesandservicelevels.

Revamping of its sales organisation in the rural markets to fully meet the emerging needs

andincreasedpurchasingpoweroftheruralpopulation.HULsdistributionnetworkinrural

India already directly covers about 50,000 villages, reaching about 250 million consumers

throughabout6,000substockists.

15

Implementationofsupplychainsystemthatconnectsstockistsacrossthecountry,andalso

includesabackendsystemconnectingsuppliers,allcompanysitesandstretchingrightupto

stockists. IT tools have been deployed for connectivity across the extended supply chains.

BackendprocesseshavebeencombinedintoacommonSharedServiceinfrastructure.

LaunchingofProjectShaktithroughwhichthe companyisable toextenditsoperationsin

villages. HUL has also included several NGOs and state governments as the initiative helps

ruralwomentoimprovetheirfinancialposition.

LaunchingofHULNetworktoleveragethechannelofdirectsellingbypresentingcustomised

offeringsin11homeandpersonalcareandfoodcategories.Startedin2003,italreadyhasa

baseof300,000consultantsacrossthecountry.

StartingoffranchisedLakmeBeautySalonsandAyushTherapycentrestoofferstandardised

services, in line with the strategy to leverage the equity of its brands through relevant

services.

Finding out Innovative ways to reach out to its consumers, particularly in rural areas by

leveragingnonconventionalmedialikewallpaintings,cinemavans,weeklymarkets(haats),

fairsandfestivals.

InitiatingtheconceptofSuperValueStores(SVS)inurbanareastopartnertraditionalstores

to provide a range of services ranging from managing their inventory to setting up POS

(pointofsale)banners.Inadditiontothis,toboostuptraditionalretailinthefaceincreasing

inroads made by large, modern retailing chains like Spencers, Reliance Fresh etc (where

HULissqueezedharderfordiscounts),HULstartedrestructuringsomeoftheselectedSVSs

intotheformofselfserviceretailshopsalamodernretails.Thisistoprotect&maintainthe

competitiveadvantagethatHULhasoveritsbiggestcompetitorsintheothermarkets(e.g.,

P&G),withitsverydeepdistributionreachthroughtraditionalretail.

LaunchingtheUnicareschemewithupmarketpharmaciesandretailerstosaleitspremium

brands.

Undertakingseveralinitiativesfortraditionalchannelsinordertoimproveitscapabilitiesat

thefrontendbydevelopingskillsforstockists'salesforce.Under'ProjectDronacharya',the

FMCGmajorcontinuouslyimpartedtrainingtoover10,000stockistsalesmen.

Launching of several promotional schemes for existing wholesalers and distributors. For

instance,ithasstartedtheVijetaRishtaJeetKaschemelastyeartoprovideaplatformfor

thewholesalerandHULtogrowthebusinessbyearningpointsandredeemingthem.

16

5.FieldForceManagement

TheworkingcycleofatypicalHULfieldforcememberisfrom21stofeverymonthtothe20thofthe

nextmonth.Duringthisperiodheisgivenvarioustargetsthathelpstoachievecompanyobjectives

andgiveshimachancetoprovehisperformancerelativetoother.

Tostartwiththefieldforcememberisgivenaparticularareaandhisresponsibilityistocatertoall

theretailersinthatarea.Whiledecidingtheareaforeachmemberofthefieldforce,thecompany

makessurethattheoperatingareaofeachfieldmemberdoesn'toverlapwithhisothercolleagues.

TherearevariousmethodsusedbythecompanytoincentivizethefieldforceMonetaryandNon

Monetary.

InHUL,thefieldforceisevaluatedusingQOC(QualityofContribution).Itconsistsof4components

1.SecondarySale(Maxpoints=2.5)

2.Eco(Maxpoints=0.5)

3.Focus(Maxpoints=0.5)

4.FCS(MaxPoints=0.5)

SECONDARY

ECO

QOC

FOCUS

FCS

17

Secondary Sale Based on the operating area, each member is given a specific target in terms of

value(e.g.,Rs.15lacs)fortheoperatingmonth(21st20thofnextmonth).Ifheachieves100%of

thetargethegets2.5points,ifheachieves95%targethegets1.5points.Thesepointsareusedto

addtothetotalQOCscoreaswellaslinkedtomonetaryincentive.

ECO/WidthpackTargetThisisusedforthepenetration/reachofcertainproductsintheexisting

market.ThefollowingisatypicalECOtargetassignedtoafieldforceagent:

LuxInternational

105outletsx1SKU

PearsSoap

135outletsx1SKU

Rin

104outletsx1SKU

BreezeSoap

100outletsx1SKU

Theoutletsmentionedarewithintheoperatingareaofthepersonand1SKU=Rs.27/.Basedon

thistheFieldpersoncalculatesnumberofpacksheshouldselltotheretailers.Theconcernedagent

receivesthistargetaround25thofeachmonthandhastocompletethistargetwithinthe5thdayof

next month. Upon completion he gets additional 0.5 points added to his QOC score along with

monetary incentive associated with it. However if this is not met within 5th, he looses the

opportunity.

Focus/DepthPacktargetThisismainlyusedtoincreasethesalesvolumeofcertainproducts.A

typicalFocustargetisgivenbelow:

LuxInternational

Rs20,640/@Rs6/perunit

LifeBuoy

Rs70,220/@Rs10/perunit

Wheel

Rs99,000/@Rs10/perunit

BreezeSoap

Rs27,000/@Rs10/perunit

This target needs to be achieved within 20th of next month. Upon achieving the target the field

personisawarded0.5pointswhichisthenaddedtohisoverallQOCscore.

FieldCapabilityScore(FCS)Inthiscomponent,thefieldforcepersonsarerequiredtoensurethat

the scheduled visit/outlet billing is such that at least 15 items are demanded per order. If this is

achieved the retailer gets a discount of 1% on the billed amount and on the other hand the field

person gets an additional score of 0.5 which is added to his QOC score. Each scheduled visit per

outlet is one per week. For example if there are 100 outlets within the operating area of a field

personthenthenumberofvisitperweekis100andtotalnumberofvisitpermonth=100x4=400.

18

Thesalespersonisrequiredtoachieve90%successratetoget0.5pointsforhisQOCscoreandat

least65%forasatisfactoryperformance.

NonMonetaryMethods

TheotherpurposeoftheQOCscoresistohighlighttheperformanceofthefieldpersonamonghis

peers. Based on the QOC various awards are distributed to the field persons at the end of every

month. These awards are also known as MOC Star awards. MOC stands for Monthly operating

Cycle.

IfQOCscore>4.5Thepersoniseligiblefor7staraward

IfQOCscore>4Thepersoniseligiblefor5staraward

IfQOCscore>3.5Thepersoniseligiblefor3staraward

In the event of exceptional performance, management representatives from the regional office

cometothezonalofficetodistributetheawards.Thephotographoftheawardwinnersisdisplayed

intheofficeasasourceofinspirationforothersalesperson.

TargetSettingMechanismandmonitoring

Theregional officemonitorstheperformanceofvariouszones.Athoroughanalysisisdoneatthe

end of each month and based on that the weak products are identified or those for which the

demandhasweakened.ThisisthebasisofsettingECOandFOCUStargetsforthefieldpersons.Each

fieldpersonisgivenapalmtopwhereinhecanfeedtheentriesonthespotwherethetransactionis

done.Thissolvesbasicallythetwopurposes

a)Thefieldpersonisfreedfromthetedioustaskofmaintainingcumbersomerecordsandcanthen

concentrateonthejob(thusITisreplacingsomeofthefieldforceorotherchannelmembers),

b)Thesolditemisimmediatelyupdatedinthecompanyinformationsystem.

6.AnalyticalFramework

WetriedtoanalyzeHULsdistributionnetworkinthelightof20mostsignificantvariablesthataffect

the distribution part of channel management for any organization in the business of marketing &

sellingofgoods.Thevariables,theirexplanationsandtheirimpactontheHULsdistributionnetwork

aregivenbelow

1. NumberofConsumers

In retail business dominated by traditional stores like Kirana Stores etc (Indian retail business

falls in this category), higher the no. of consumers, higher will be the no. of channel

intermediaries.Theimplicationofthisisthattherewillbemanylayersinthechannelinsucha

19

situationandmanagingsuchacomplexdistributionnetworkbykeepingtabsoneveryplayerwill

be a huge task. Moreover, Transport & Logistics (T&L) support provided by the organization

needstobewellorganized.

ImplicationforHUL

HULskeystrengthliesinmanagingitsdistributionnetworkinIndia.HULisIndiaslargestFMCG

company with unmatched distribution network, which is built over a century focusing on

traditional retail. HUL's distribution network comprises about 4,000 redistribution stockists,

covering about 6.3 million retail outlets reaching the entire urban population, and about 250

million rural consumers in India. Its said that HUL is able to touch the lives of about 2 out of

every 3 Indian consumers. This achievement is due to the sheer strength of its distribution

network(productsshouldbegoodasalways,otherwisetheywillfindnobuyersinthelongrun).

Foracomparison,P&G,worldslargestFMCGmajor,doesnotfinditsnameinthelistoftop5

FMCGmajorsinIndiaasitsstrengthliesinmanagingmodernretail(biggestexample,WalMart),

butnottraditionalretail.

2. GeographicDispersionofConsumers

Again,thisiscloselyrelatedwiththepreviousvariable,moresoinalarge,geographicallydiverse

country like in India. With the increase in this dispersion level, more intermediaries and more

layersarerequiredinthedistributionnetworksoastoeffectivelyreachthelength&breadthof

the country. Obviously the T&L management for such an organization would be critical to

accomplishthis.

ImplicationforHUL

For a country as geographically diverse as India, panIndian presence & market leadership can

only be possible when products reach even the remotest parts of the country. HUL is very

successfulinachievingandmaintainingthisreachduetoitsdistributionnetwork.

3. FrequencyofPurchase

If the frequency of purchase is high, then transport intensity in the last mile (i.e., from

distributortoretailers)increasesmanifold.ForFMCGproducts,asathumbrulewecantakethat

themeantimebetweentwopurchasesis~90days.Withtheintroductionofsmallerformfactor

packagingforFMCGgoods(Re.1/shampoosachetsbeingaverygoodexample),thetransport

intensityincreasedfurther.

20

ImplicationforHUL

HUL has about 4000 redistribution stockists, who supply to approx. 6.3 million outlets across

India.Sincemanufacturingisdoneat40plantsaroundthecountry,rationalizingthelogisticsand

planningisahugetask.AninnovativestepinthatregardhasbeentheformationoftheMother

DepotandJustinTimeSystem(MDJIT).CertainC&FAswereselectedacrossthecountrytoact

as mother depots. Each of them has a minimum number of JIT depots attached for stock

requirements. All brands and packs required for the set of markets which the MD and JITs

serviceinagivenareaaresenttothemotherdepotbyallmanufacturingunits.TheJITsdraw

theirrequirementsfromtheMDonaweeklyorbiweeklybasisandsupplytostockistsinthat

area,who,inturn,supplytoretailers.

4. TendencytoPostponePurchase

Ifthetendencytopostponepurchaseislesser,thentheproductwillbeeasiertodistribute.For

example,products/serviceslikeFireExtinguishers,LifeInsuranceetc.aresuchthatthoughthese

are needed, the overall tendency for the consumers is to postpone the purchases these

products/services can be termed as necessary evil. For this kind of products, regular

reinforcementinthemindsofconsumersbecomesnecessary,salesfieldforcebecomescritical

anduseofexpertfieldforceiscommonplace.

ImplicationforHUL

Since FMCG products are used regularly and these products are not necessary evils,

distributionnetworkofHULdoesnotrequireanyexpertfieldforcetosellitsproducts.Onlythe

recent diversification of HUL into Home Water Purification business (Pure It brand) needs

dedicatedfieldsalesforce.

5. LevelofFamiliarity/Knowledge(ofconsumer)abouttheProduct

Iftheleveloffamiliarityofconsumerwiththeproductishigher,lowerwillbetheimportanceof

fieldsalesforceandhigherwillbetheimportanceofchannel.

ImplicationforHUL

SinceFMCGgoodsareverymuchfamiliartoconsumers,channelanditsdifferentmembersare

very much important to HUL and field sales forces function is mostly limited to channel

managementandensuringavailabilityofproducts.

21

6. DegreeofBrandLoyalty

If the consumers are more brand loyal, then less push will be required from the channel

memberstoselltheproductsastherewillbesufficientpullordemandfromtheconsumers.

Thisimpliesthatforproductswithloyalcustomerbase,effortsfromthechannelmemberscan

bemuchlesserforfinalofftaketohappenwhichinturnleadstolessermarginstothechannel

members for those products. For faster moving products (mostly due to brand pull), retailers

maynotbeaversetoslightlylessermarginsasrotationoftheproductsishighandthushis/her

ROIisprotected.

RetailersROI=

M arg in Rotation

Investment

ForaFMCGplayerwithanonestablishedbrand,marginstochannelmembersandpointofsale

(POS)advertisingarebothimportant.

ImplicationforHUL

AsHULenjoysleadershippositioninmanyFMCGsegmentslikeSoaps,Detergents,PersonalCare

productsetcwithstrongbrandswithcontinuouspull,HULhaslesstoworryaboutmarginsto

channelmembersorPOSadvertising.Butthissituationcanchangeconsiderablyinthefaceof

riseofasignificantcompetitorhavingalmostthesamereachasHULhas(e.g.,ITCasitseating

intoHULsmarketsharecontinuouslysinceitenteredFMCGsegment).

7. PurchasedonImpulse

Theimpulsepurchaseproductslikechocolates,toffees,colas,icecreamsetc.followSaysLaw

whichstatesthatSupplyCreatesDemand,implyingavailabilityoftheseproductsarethemost

critical aspect for these to be sold and consumed. This stresses on the fact that T&L for these

productsbecomesveryimportant.

ImplicationforHUL

HULhasonlyoneproductinthisimpulsepurchasecategoryKwalityWalls(icecream).HULis

#2afterAmulinthisFMCGsegment.Toincreasethisbrandssale&marketshare,availability,

visibilityandconsumermindsharehastobeincreasedandimprovedaswell.

8. LevelofInvolvement(LOI)

Level of involvement (i.e., time & effort spent by the consumer) generally depends on the

product cost. If LOI is higher, lower is the importance of availability and more critical is the

22

supply of information as consumer decision process depends more on elaborate information

search.

ImplicationforHUL

AsFMCGproductsaregenerallyLowInvolvementProducts,HULhastobothermoreonensuring

availabilityoftheproducts,ratherthansupplyofinformation.

9. PurchasedasaBasketofGoods

Theproductswhicharegenerallyboughttogetherbyconsumersasabasketofgoods(e.g.,Rice,

Flourpowder,Cookingoiletcatthebeginningofthemonth)aretobemadeavailabletogether

forfinalofftake.

ImplicationforHUL

ThisaspectpartlyappliestoHULsproductsassomeproductslikeshampoos,soaps,detergents

mayfallinabasket.EfficientdistributionnetworkofHULensuresavailabilityofallsuchproducts

ateachsellingpoint(individualretailer).

10. Speed&ComplexityofDecisionMakingProcess

Ifthespeedislow,thenthecomplexityofthedecisionmakingprocessishigherandgreateris

theimportanceoffieldsalesforceandthesalespersonsskill,knowledgeandquality.

ImplicationforHUL

ForFMCGproducts,complexityofdecisionmakingprocessisnotthereandso,speedofdecision

makingishigh.ThismeansthatforHUL,fieldsalesforceisoflimitedfunctionalusage.

11. PresentofExpertInfluencerintheDecisionMakingProcess

Roles of sales field force vary depending upon whether expert influencer (e.g., doctors) is

present in the process or not. If present, then consumer buying behavior may become

subcontractedandtheexpertinfluencerbecomesanothercustomerofthenetwork,apartfrom

the enduser. In that situation two groups of sales force are needed to cater to both the

segments.

ImplicationforHUL

ForFMCGgoods,roleofexpertinfluencerislimited.Butcompaniestrytoassociatebrandswith

regulatory bodies/authorities and show advertising with experts commenting upon superior

virtues of a product in an attempt to make the buying behaviour shift from picking/variety

23

seekingtosubcontractedandmakeconsumersmoreloyaltothebrand.ThesearetrueforHUL

also(e.g.,PondsIntitute).

12. ElementofCrisisPurchaseExists

If element of crisis purchase exists in the buying decision of a product (for example, bulbs &

tubes),thenitsavailabilitybecomescritical.

ImplicationforHUL

None of the products of HUL fall under this category. Nevertheless, availability of products of

HULisnecessaryforotherreasons.

13. ElementofRiskAversionExists

If the level of involvement of the consumer in buying decision process is higher, risk taking

tendency of the consumer will be lower or consumer will be more risk averse. In such a

situation,channelmemberscanunsellabrandbygivingexplicitorimplicitsuggestions. This

implies that in such a case, selling depends on many cases how the company is taking care of

channelmembers(keepingthemhappy)suchthattheyarenotluredbyothercompetitorsor

directedbygrievancessoastounsellthebrand.ThissituationisprevalentmostlyinConsumer

Durables(likeTV,Refrigeratorsetc.).InFMCGgoods,thesituationdoesnotexistperse.

ImplicationforHUL

HULisnotaffectedforitsFMCGproductsbythisvariable.ForwaterpurifierPureIt,thiscan

haveconsiderableimpactifitssalestartstohappenthroughchannelmembersratherthanby

fieldsalesforceasishappeningnow.

14. PerishabilityoftheProduct

Iftheproductisperishable(havingsmallshelflife;examplesnewspaper,milk,fruitsetc),then

thedimensionofspeedinreachingtheendconsumersbecomescritical&T&Lassumesgreat

significanceforthecompany.

ImplicationforHUL

The FMCG products that HUL sells are not perishable by nature, but have limited life. So this

aspectisnotcriticalforHUL.

15. TimeBandAssociatedwiththePurchaseoftheProduct

If there is seasonality/cyclicity for the demand or purchase of the product (examples

newspaper, milk are most on demand in the 1st three hours of the day; cooking oil, rice etc

24

grocery items are most on demand in the 1st week of the month), then high T&L and

infrastructuralrequirementsareneededforthelastmileforthetimebandwhendemandis

maximum. It is possible to have idle capacity in the areas mentioned above outside the peak

requiredtimeband.

ImplicationforHUL

ForsomeoftheproductsofHUL,theabovestatedvariableissignificant.Forexample,inFood

segment,BrandedAttaAnnapurna;insegmentslikeLaundryDetergents,Shampoo&HairOil

etc. this element of demand time band exist to a certain extent. This underscores the

importance of T&L for HUL as the transport intensity between distributors and retailers

increasesinthe1st&4thweekofamonthfortheproductsmentionedabove.Thisisoverand

abovetheregularreplenishmentofstocksatretailersdonebydistributors.FestivalslikeHolietc.

may also increase the demand for personal care items like soaps, shampoos etc for a short

periodanddistributionnetworkshouldbegearedupnottomissanysuchopportunity.

16. Fungibility

Fungibility is the property of a good or a commodity whose individual units are capable of

mutualsubstitution.Examplesofhighlyfungiblecommoditiesarecrudeoil,wheat,orangejuice,

preciousmetals,andcurrencies.Fungibility hasnothing todowith theabilitytoexchangeone

commodityforanotherdifferentcommodity.Itrefersonlytotheeaseofsubstitutionofoneunit

ofacommoditywithanotherunitofthesamecommodityforallintentsandpurposes.

Fungibilityisdifferentfromliquidity.Agoodisliquidandtradableifitcanbeeasilyexchanged

for money or for another different good. A good is fungible if one unit of the good is

substantiallyequivalenttoanotherunitofthesamegoodofthesamequalityatthesametime

and place. It is said that commodities are fungible, goods tangible, services intangible,

experiencesmemorable&transformationsareeffectual1.

As an example, one Rs. 100/ bank note is interchangeable with another. Cash is fungible. A

barrelofWestTexasIntermediatecrudeoilisfungible(directexchange)withanotherbarrelof

thesamecrudeoil.Oil(ofthesametype)isfungible.

Fungibilitydoesnotimplyliquidity,andliquiditydoesnotimplyfungibility.Jewelscanbereadily

bought and sold (the trade is liquid), but individual diamonds, being unique, are not

interchangeable (diamonds are not fungible). Indian rupee bank notes are interchangeable in

London (they are fungible there), but they are not easily traded there (they are not liquid in

London).Incontrasttodiamonds,goldcoinsarefungible.Theyarealsoliquid,especiallyundera

25

gold standard. The combination of fungibility and liquidity is one of the reasons why gold has

successfullyservedasmoneyforthousandsofyears.

Further,afungiblethingcanbecomenonfungibleundersomecircumstances.Forexample,an

old coin or a currency note may assume a value which is way above its face value due to

historical reasons or due to some defects in it which makes it unique from others from a

viewpointwhichseesitdifferentlythanitsintendedpurpose.

Theoutcomeofproductfungibilityisthatthemorefungibleaproduct becomes,higher isthe

chancethatpartsofthedistributionchannelitcanbereplacedbyIT.Agoodexampleofthisis

dematerialization(Demat) routeforsharetrading nowwherethereisnophysicalexistenceof

shares.

ImplicationforHUL

As branded FMCG goods are not fungible per se (branding is done to decommoditize &

differentiatetheproduct),theimportanceofchannelmemberswillcontinue.

17. DegreeofCustomizationPossible

Degreeofcustomizationdirectlyaffectseconomiesofscale;higherthecustomization,lesserthe

economiesofscale.Also,criticalityofsalesfieldforceincreaseswithcustomizationlevelsofthe

offering.

ImplicationforHUL

ForFMCGproductsofHUL,whicharemassproduced,suchcustomizationsarenotpossibleand

thus with higher economies of scale, lower criticality of field forces from the standpoint of

customizationofproductofferings,costsarelowerintheserespectswithHUL.

18. NegativeorPositiveReinforcingProduct

Negative reinforcing products are those which are bought to avoid/reduce the problem (ex.

insurance, washing machine, car battery etc). Positive reinforcing products are those which

gratify the senses (ex. Perfumes, Chocolates, Vacation etc). Shopping experience becomes a

criticalaspectforpositivereinforcingproductstoreaffirmthepositivefeelings.

ImplicationforHUL

Axe & Rexona deodorants are distinctly positive reinforcing products from HUL, including

others like Lux, Lakme etc. So these are seen in most shopping malls etc. with high visibility

displaystoreaffirmthefeelings.Consumersarewillingtopayhigherforthesebrands.

26

19. Value/VolumeRatio(ValueDensity)oftheProduct

Thisratioisveryimportantforboththecompanyandtheretailerforitstwocriticalaspects

T&L cost and retailer ROI/sq. cm (retailers are actually in real estate business in true sense).

Highertheratio,betteritisforbothcompanyandtheretailerashigherratiosignifieslesserT&L

costperunitvolumetransportedforthecompanyandgreaterROIperunitofshelfspaceforthe

retailer.

ImplicationforHUL

IngeneralforFMCGgoodsandforHULaswell,valuedensityisrelativelylower.Inadditionto

this fact, increasing trend towards using smaller pack sizes increases the packaging density

(increased packaging density increase cost to some extent, but favours mechanized handling

greatly,reducinghandlingcosts).Sincevaluedensityisless,transportationcostswillbehigher

andthusitisofeconomicsensetohavemanufacturingplantslocatedclosuretomajormarkets.

ThisisthereasonHULhasvariousmanufacturingplants(40intotality)locatedacrossIndia.This

is a pointer to the fact most of the major FMCG players (including HUL) use contracted

manufacturing dispersed across the geographic spread so as to lower transportation cost

component.

7.FinancialAnalysis

We have taken data from CMIE database while analyzing the performance of marketing & sales

(including distribution) functions of HUL and comparable companies. By comparable, we mean

those companies whose main economic activity, as defined in the CMIE database, is the same as

HULs.Forexample,maineconomicactivityofHULasdefinedinthatdatabaseisCosmetics,toilet

preparations, soap & washing prep. Obviously, one major FMCG company in India, ITC, does not

comeunderthispurviewasitsmajoreconomicactivityisTobaccobusinesswhichisnearly85%ofits

totalrevenue.Butforthesakeofcomparison,wehaveincludedITCalsoasitsnontobaccoFMCG

businessrevenueinFY08wasRs.2511Cr.,nearlyashighasNirma,thesecondlargestplayerafter

HULinHULschosencategory.Butthefiguresforadvertising,marketing&distributionexpensesof

ITC as percentages to its total sales may not be directly comparable to those figures of HUL as

product categories are different and the impact of above mentioned variables on these two

companyssales&distributionfunctionisdissimilar.OthermajorFMCGplayersnotincludedinthe

analysis are Nestle, Amul, Britannia & Tata Tea, which are mostly into the Food & Beverages

27

segmentwhereHULhasrelativelylesserpresence(ProcessedFoods&Icecreamsegmentstogether

constituteonlyapproximately5%ofHULstotalsales).InTea,HULispresentsignificantly,though.

Inthefollowingpagesadvertising,marketing&distributionexpensesofmajorFMCGgoods(inHULs

categorymostly)arebeingshown.Itistobeunderstoodherethatmarketingexpenseshereinclude

commissions, rebates, discounts, sales promotional, expenses on direct selling agents &

entertainmentexpenseswhereasdistributionexpensesincludeoutwardfreight.

Exhibit1:AnnualSpendinAdvertising,Marketing&DistributionfunctionsinFY08

Sl.

Company Name

No.

1

2

3

4

5

6

7

8

9

10

11

12

Annual

Rs. Crore

Mar-08

Annual

Rs. Crore

Mar-08

Sales

Advertising

expenses

HUL

14937.88

1422.9

Nirma

Dabur

Colgate-Palmolive

Reckitt Benckiser

P&G Home

Godrej

Emami

P&G Hygiene & Health

Henkel

Henkel Marketing

ITC

2651.15

2128.17

1597.3

1334.76

1079.57

922.78

586.42

556.02

430.33

417.79

21467.38

40.96

248.1

256.51

207.85

119.45

61.4

102.92

57.95

0

0

427.83

Advert. Exp.

As % of

Sales

9.53

1.54

11.66

16.06

15.57

11.06

6.65

17.55

10.42

0.00

0.00

1.99

Annual

Rs. Crore

Mar-08

Marketing

expenses

6.07

71.87

21.4

0

9.34

44.31

42.37

27.46

40.85

40.94

65.64

68.17

Annual

Rs. Crore

Mar-08

Marketing

Distribution

Exp. As %

expenses

of Sales

0.04

731.41

2.71

1.01

0.00

0.70

4.10

4.59

4.68

7.35

9.51

15.71

0.32

136.91

66.84

35.36

55.88

70.54

32.27

14.86

37.24

16.4

17.63

548.4

Dist. Exp.

As % of

Sales

4.90

5.16

3.14

2.21

4.19

6.53

3.50

2.53

6.70

3.81

4.22

2.55

Exhibit2:AdvertisingExpensesaspercentageofSales

Advertising Expenses as % of Sales

20.00

17.55

18.00

16.06

Advertising Exp. as % to Sales

16.00

15.57

14.00

11.66

12.00

11.06

10.42

10.00

9.53

8.00

6.65

6.00

4.00

1.99

1.54

2.00

0.00

0.00

Henkel

Henkel

Marketing

0.00

HUL

Nirma

Dabur

ColgateReckitt

Palmolive Benckiser

P&G

Home

Godrej

Emami

P&G

Hygiene &

Health

ITC

28

We can see here that Nirma, Godrej & Henkel (ITC also) have less advertising expenses (as % to

sales)thanHUL.Importantly,Henkelhaszeroadvertisingexpensesin2008,whichmayexplainthe

factthatawarenesslevelinconsumersforHenkelbrandsislow.HULadvertisingisdonemainlyin

case of soaps (for example Dove; done mainly to reaffirm that its not a soap!), shampoos,

deodorants (Axe), laundry detergents (Surf Excel, Rin) etc. With the introduction of home

waterpurifier(PureIt),considerableadvertising&promotionalexpenseshavegoneintoit.

Oflate,weseeverylittleofNirmaadvertisements.Thisisapparentfromitsadvertisingexpenseas

% to sales, which is very low (only 1.54%). ITC is altogether a different story. Cigarettes & other

tobacco related products which constitute approx. 85% of its sales, all relate to intoxication or

habitual consumption patterns having intensely brand loyal consumers and thus almost no

advertising(surrogateadvertisingisdone)isneededeithertoreaffirmthebrandsorintroducenew

consumers to the brands (there is regulatory angle as well). Current consumers of these tobacco

products are the biggest advertising agents that ITC has and of course, they do it voluntarily and

without knowing what theyre doing. But while moving faster into nontobacco FMCG business

ridinghighonitsstrengthofdistributionnetworkmatchingorsurpassinginsomecasesthatofHUL,

ITC has started aggressive advertising campaigns (Fiama Di Wills shampoo, Vivel soap,

Sunfeastbiscuits,Bingosnacksetc),directlyfocusingonmarqueebrandsofHULlikeSunsilk&

Lux,increasingtheheatonBritanniaforbiscuitsandtakingonKurkure&othersnacksandchips

fromPepsi,Cokeandothers.

Advertising expenses as percentage to sales is highest for Emami, which owns brands such as

Navratnahairoil&talc,Boropluscream&talc,HimaniFastRelief,Fair&Handsome,SonaChandi

Chawanprash,Menthoplusetc,eachofwhichisadvertisedheavilyinthemassmedia(e.g.,TV)with

famous & expensive celebrity endorsers like Amitabh Bachchan, Kareena Kapoor, Govinda etc. On

the other hand, we see regular advertising streams for Colgate toothpastes and other oral care

products, in which category ColgatePalmolive is the market leader. ReckittBenckiser advertises

considerablyforitsbrandslikeHerpic,Mortein,Vanish,Clearasil,Dettol,Strepsilsetc,whichisthe

reasonforitshighadvertisingcostaspercentageofsales.

MarketingExpenses

Asstatedearlieralso,marketingexpenseshereincludethefollowing

commissions

rebates

29

discounts

salespromotional

expensesondirectsellingagents

entertainmentexpensesetc.

Exhibit3:MarketingExpensesaspercentageofSales

Marketing Expenses as % to Sales

18.00

15.71

16.00

Marketing Exp. as % to Sales

14.00

12.00

9.51

10.00

8.00

7.35

6.00

4.59

4.68

4.10

4.00

2.71

2.00

1.01

0.04

0.70

0.32

0.00

0.00

HUL

Nirma

Dabur

ColgateReckitt

Palmolive Benckiser

P&G

Home

Godrej

Emami

P&G

Hygiene &

Health

Henkel

Henkel

Marketing

ITC

Here we see that the marketing expenses of HUL are among the lowest in the market (only the

second lowest after Colgate Palmolive which has very good brand pull for its Colgate

toothpastes).ThisprovesthatHULisabletomaintainconsiderablebrandpullthroughadvertising.

ITCagaincomesamongthelowestitstobaccoproductsrequireverylittlepushandhaveveryhigh

rotations.Also,ITCmostlydealswithsmallretailersanddistributors(paancigaretteshopsowners)

whohavemarginalbargainingpower.

AnotherrevelationisthatHenkel,whichhaszeroadvertisingexpenditure,hasthehighestmarketing

expenses among all others. But this strategy to push the products through the channel partners

may not be a good one for Henkel as it might be losing out for the lack of visibility and thus

consumer mind share and brands such as Margo, Fa, Neem toothpaste etc are losing out in the

market. Further, it is also a pointer to the fact that Henkels largest business share is in industrial

30

chemicals (adhesives, sealants e.g., popular brand Loctite; this segment constitute ~44% of

worldwide sales of Henkel) and for B2B, advertising per se is not that much important. For B2B ,

important is directselling approach, which generally requires negotiations, volume discounts etc,

whicharereflectedinhighestmarketingexpenses(aspercentagetosales)comparedtoothers.

P&G is in between the extremes and with considerable advertising expenses also, it is unable to

createsufficientpullforitsproductsinIndia(asevidencedbythefactthatmarketingexpensesare

also relatively higher) or its getting stuck for the lack of sufficient distribution muscle a la HUL in

traditionalretailinIndiaandsuffersfromlackofreachandavailabilityattheendconsumerlevel.

As mentioned earlier, both ColgatePalmolive and ReckittBenckiser both enjoys very good brand

loyalties and market leadership for their key brands like Colgate toothpastes and Dettol (#1 in

antiseptics),Herpic,Morteinetc.Thisiscorroboratedbythefactthatthesecompanieshavesomeof

thelowestmarketingexpenses(aspercentagetosales)inthegroup,asshowninthechart.

DistributionExpenses

Distributionexpensesincludetheoutwardfreightcosttothecompany.

Exhibit4:DistributionExpensesaspercentageofSales

Distribution Expenses as % to Sales

8.00

7.00

6.70

6.53

Distribution Exp. as % to Sales

6.00

5.16

5.00

4.90

4.22

4.19

3.81

4.00

3.50

3.14

3.00

2.55

2.53

2.21

2.00

1.00

0.00

HUL

Nirma

Dabur

ColgateReckitt

Palmolive Benckiser

P&G

Home

Godrej

Emami

P&G

Hygiene &

Health

Henkel

Henkel

Marketing

ITC

31

WehaveseenthatT&LplaysaveryimportantroleforHUL&otherswhohavepanIndianpresence

inFMCGbusiness.ColgatePalmolive,Emami&ITChassomeofthelowestdistributionexpenses(as

%tosalesfigures)&P&Ghasthehighest.HULislowerinthisrespectthanNirma&P&G,buthigher

than Henkel. This can be explained somewhat from the impact of the variable, Time Band of

purchase,ontheincreasedtransportintensityforHULinthelastmileforsomeoftheproductslike

householdpersonalcare,laundrydetergent,brandedattaetcinthefirst&lastweekofthemoth.

ITC(tobacco),Henkel(largelyB2B)aremostlyprotectedfromthisimplicationofthevariable.

AnotherimportantthingtorememberthatvaluedensityofFMCGgoodsisrelativelylower,causing

share of transportation costs in the overall cost structure to be relatively higher. This implies

dispersed manufacturing, locating manufacturing plants nearer to major markets. So one location

manufacturing to get higher economies of scale and on the other hand, trying to serve

geographically diverse markets may not be economically attractive for FMCG sector. Compared to

HULs 40 manufacturing plants across India, Nirma, the 2nd largest FMCG major in soaps and

detergents category, has 6 manufacturing plants, all located in and around Gujarat. So,

transportationcostofNirma,ifittriestocatertopanIndianmarketwillbehigher.Thisissupported

bythefactthatNirmas higherdistributioncost percentagethanHUL.ForP&G,thesamereasons

significantlyaffectitsdistributioncostwhichishighestforthegroupanalyzed.

32

8.References

1. B.JosephPine,JamesH.Gilmore(1999),TheExperienceEconomy:WorkisTheatre&

EveryBusinessaStage,PublishedbyHarvardBusinessPress,254pages.

2. HULWebsite(http://www.hul.co.in/)

3. HULCLSAConference,InvestorPresentation(24thSept.,2008).

4. ReckittBenckiserWebsite

(http://www.reckittbenckiser.com/site/RKBR/Templates/Home.aspx?pageid=1)

5. ColgatePalmoliveWebsite

(http://www.colgate.co.in/app/Colgate/IN/HomePage.cvsp)

6. EmamiGroupWebsite(http://www.emamigroup.com/Brands)

7. CMIE

8. Wikipedia

You might also like

- HUL Distribution ModelDocument19 pagesHUL Distribution ModelArpan Mehra93% (70)

- HUL Supply Chain ReportDocument56 pagesHUL Supply Chain ReportWHO IS ITNo ratings yet

- Hindustan Unilever Marketing Strategies and PoliciesDocument46 pagesHindustan Unilever Marketing Strategies and Policiesroma4321No ratings yet

- Air Waybill Form - Printable TemplateDocument1 pageAir Waybill Form - Printable Templateวชิรวิชญ์ ศรีทองกุลNo ratings yet

- HUL S&D ManagementDocument21 pagesHUL S&D ManagementKuldipak KheradiyaNo ratings yet

- Hul Distribution ModelDocument5 pagesHul Distribution ModelBhavik LodhaNo ratings yet

- HINDUSTAN UNILEVER Limited Final ProjectDocument78 pagesHINDUSTAN UNILEVER Limited Final ProjectNeeta MohanNo ratings yet

- HUL Supply ChainDocument20 pagesHUL Supply ChainAbhishesh Suman77% (13)

- Difference BW HUL and P&G Distribution Structure PDFDocument14 pagesDifference BW HUL and P&G Distribution Structure PDFRahul Mehay100% (1)

- Distribution Channel of Kohinoor CondomsDocument11 pagesDistribution Channel of Kohinoor CondomsPravah Shukla100% (1)

- IKEA's Strategic ManagementDocument38 pagesIKEA's Strategic ManagementJobeer Dahman93% (45)

- Backgrounder: 1. SchlumbergerDocument5 pagesBackgrounder: 1. Schlumbergervikri rahmatNo ratings yet

- Distribution Channels HULDocument12 pagesDistribution Channels HULnavdeep98480% (10)

- Sales and Distribution of HULDocument17 pagesSales and Distribution of HULAnkit Patodia100% (1)

- Sales and Distribution Manaagement in HULDocument18 pagesSales and Distribution Manaagement in HUL'Gitesh ⎝⏠⏝⏠⎠ Patil'No ratings yet

- Hindustan Unilever Limited (HUL)Document17 pagesHindustan Unilever Limited (HUL)priyankasinghal100% (20)

- SCM Synopsis HulDocument17 pagesSCM Synopsis HulSanjib BiswasNo ratings yet

- HUL Distribution Network (Final Presentation)Document22 pagesHUL Distribution Network (Final Presentation)angihpNo ratings yet

- VijetaDocument2 pagesVijetaPandharinath Rameshrao Chidrawar100% (1)

- Supply Chain Nanagement of HULDocument11 pagesSupply Chain Nanagement of HULsalil1235650% (4)

- Sales and Distribution - Hindustan Uni LeverDocument25 pagesSales and Distribution - Hindustan Uni LeverAthirapai75% (4)

- HUL (Supply Chain)Document19 pagesHUL (Supply Chain)rohan_jangid8100% (4)

- Competitive Strategies of HULDocument13 pagesCompetitive Strategies of HULankitpnani100% (1)

- Hindustan Unilever Pricing PolicyDocument2 pagesHindustan Unilever Pricing PolicyALLEN MATHEW JOHN100% (1)

- HUL Case With QuestionsDocument20 pagesHUL Case With QuestionsPrakash KcNo ratings yet

- Study of The Promotional Strategies of HUL LTDDocument73 pagesStudy of The Promotional Strategies of HUL LTDPawan Saini80% (5)

- Hul Distribution NetworkDocument33 pagesHul Distribution Networksalmanjimmy100% (6)

- HulDocument30 pagesHulkunal joijode100% (1)

- A Brief Study On Market Sructure and Demand Analysis of Hindustan Unilever LimitedDocument65 pagesA Brief Study On Market Sructure and Demand Analysis of Hindustan Unilever LimitedShivangi AgrawalNo ratings yet

- HUL Final ProjectDocument60 pagesHUL Final Projectsharmanmanu67% (3)

- Project On HULDocument25 pagesProject On HULArchit KhandelwalNo ratings yet

- Pantaloons RetailDocument18 pagesPantaloons RetailSumit RathiNo ratings yet

- SCM DaburDocument21 pagesSCM Daburanshvaidhya0% (1)

- HUL Strategic MarketingDocument60 pagesHUL Strategic MarketingDebangan DasNo ratings yet

- Marketing Strategies of HulDocument57 pagesMarketing Strategies of HulHarshit JainNo ratings yet

- HUL-branding StrategyDocument59 pagesHUL-branding Strategypriyanka-telang-210876% (17)

- Hindustan Unilever Limited (HUL) IntroductionDocument3 pagesHindustan Unilever Limited (HUL) Introductionravi thapar40% (5)

- Hul Sip Report 12Document76 pagesHul Sip Report 12Nishtha Zutshi100% (1)

- Hindustan UnileverDocument24 pagesHindustan Unileverspenzik100% (5)

- A Power Point Presentation On HUL's Marketing Strategy in Rural India - FinalDocument26 pagesA Power Point Presentation On HUL's Marketing Strategy in Rural India - FinalGuddu Kumar100% (2)

- Amul StrategyDocument18 pagesAmul StrategyAkram Ul Hoque100% (12)

- Hul ReportDocument28 pagesHul ReportB.C.ChoudharyNo ratings yet

- DR Umesh SolankiDocument29 pagesDR Umesh Solankivivek guptaNo ratings yet

- Introduction To HULDocument7 pagesIntroduction To HULvaibhhav1234567890100% (1)

- Strategies of HulDocument48 pagesStrategies of Hulbins157% (7)

- Indian Institute of Planning and Management: New DelhiDocument33 pagesIndian Institute of Planning and Management: New DelhiDip RanjanNo ratings yet

- A Study On Distribution Management of Hindustan Unilever Limited by Ashish AgarwalDocument32 pagesA Study On Distribution Management of Hindustan Unilever Limited by Ashish AgarwalAshish AgarwalNo ratings yet

- Distribution Management of Hindustan Unilever LTD NewDocument31 pagesDistribution Management of Hindustan Unilever LTD NewNachiket JaniNo ratings yet

- A Study On Distribution Strategies of Hindustan Unilever Limited by Rajnikant GharatDocument31 pagesA Study On Distribution Strategies of Hindustan Unilever Limited by Rajnikant GharatRajnikant GharatNo ratings yet

- A Study On DistributionDocument5 pagesA Study On Distributionpranav2411No ratings yet

- Distribution Channel ReportDocument20 pagesDistribution Channel ReportVijay SharmaNo ratings yet

- HUL S&D StrategyDocument16 pagesHUL S&D Strategyakshay_abs100% (1)

- "A Study On Marketing Strategies of HLL in South India": Project ProposalDocument8 pages"A Study On Marketing Strategies of HLL in South India": Project ProposalAishwarya RajNo ratings yet

- Marketing PlanDocument59 pagesMarketing PlanSharath Shyamasunder75% (4)

- Submitted By: Hiren Gadhvi Neeraj Trivedi Shikha Agrawal Rahul Mehta Sachin PatelDocument23 pagesSubmitted By: Hiren Gadhvi Neeraj Trivedi Shikha Agrawal Rahul Mehta Sachin PatelShikha AgrawalNo ratings yet

- A Study On Sale and Distribution Management of Hindustan Unilever LimitedDocument35 pagesA Study On Sale and Distribution Management of Hindustan Unilever LimitedJakir HussainNo ratings yet

- UntitledDocument10 pagesUntitledkranthiNo ratings yet

- Hindustan Unilever LimitedDocument63 pagesHindustan Unilever LimitedPrashant Chaudhary100% (1)

- CA2 Marketing, Discuss Any Two Questions. Marks: 25 Case Study: Rural Distribution For The FMCG Sector - A Case Study of HLLDocument8 pagesCA2 Marketing, Discuss Any Two Questions. Marks: 25 Case Study: Rural Distribution For The FMCG Sector - A Case Study of HLLPrashant RazdanNo ratings yet

- MarketingChannel Group6Document31 pagesMarketingChannel Group6Anx19No ratings yet

- Project LuxDocument48 pagesProject LuxKing Nitin Agnihotri33% (3)

- SandeepDocument56 pagesSandeepAli AhmadNo ratings yet

- Hindustan Unilever Limited: Distribution System of HULDocument3 pagesHindustan Unilever Limited: Distribution System of HULRushabh JadavNo ratings yet

- Ai - PPT 7 (Internal Control)Document30 pagesAi - PPT 7 (Internal Control)diana_busrizalti100% (1)

- Salina YeungDocument10 pagesSalina Yeungabdullah basemNo ratings yet

- Organization and Management QuizDocument3 pagesOrganization and Management QuizJisbert Pablo AmpoNo ratings yet

- The Cultural Context of EntrepreneurshipDocument8 pagesThe Cultural Context of Entrepreneurshipfansuri80No ratings yet

- Case 1Document19 pagesCase 1Ragini RangaramuNo ratings yet

- Reebok Project WorkDocument56 pagesReebok Project WorkdipanshuNo ratings yet

- Tds Party NamesDocument24 pagesTds Party NamesSunil MishraNo ratings yet

- SMCSL Reviewed Bye-Laws 11 May 2021Document23 pagesSMCSL Reviewed Bye-Laws 11 May 2021Adeyeye EniolaNo ratings yet

- Occupational Health and Safety AgentDocument2 pagesOccupational Health and Safety AgentmphatuseniNo ratings yet

- 3D Printing Trends 2020: Industry Highlights and Market TrendsDocument38 pages3D Printing Trends 2020: Industry Highlights and Market TrendsAlex BurdeNo ratings yet

- Internal Audit Scheduling Tool3Document1 pageInternal Audit Scheduling Tool3BharathNo ratings yet

- Cost Accounting - ABC Vs Variable CostingDocument3 pagesCost Accounting - ABC Vs Variable CostingJaycel Yam-Yam VerancesNo ratings yet

- Oracle Hrms IndiaDocument318 pagesOracle Hrms Indiavinay_narula_4No ratings yet

- Rera BookDocument80 pagesRera BookRahul O Agrawal100% (1)

- Commercial Banks Behavior and Effect On Profitability in UaeDocument16 pagesCommercial Banks Behavior and Effect On Profitability in UaeAbdelghani RemramNo ratings yet

- (Module 10 - Module 18) MGT 101 FinalDocument453 pages(Module 10 - Module 18) MGT 101 FinalUsama KJ100% (1)

- DCCI Membership Application Form - Angel ProjectsDocument2 pagesDCCI Membership Application Form - Angel ProjectsDurban Chamber of Commerce and IndustryNo ratings yet

- Me Market-StructureDocument3 pagesMe Market-Structurebenedick marcialNo ratings yet

- Liabilities of Independent Director Under Company LawDocument19 pagesLiabilities of Independent Director Under Company LawVIPIN PANDEYNo ratings yet

- Rusame33492Document1 pageRusame33492jinalpatel004No ratings yet

- The Driver Business Plan2Document16 pagesThe Driver Business Plan2AhmedHassanSharkasNo ratings yet

- Pharmaceutical Industry of BangladeshDocument32 pagesPharmaceutical Industry of BangladeshPratikBhowmick100% (1)

- BBTX4203 Taxation II - Eaug20Document296 pagesBBTX4203 Taxation II - Eaug20MUHAMMAD ZAKI BIN BASERI STUDENTNo ratings yet

- Consultancy Procurement Document (CPD) - TPS Zemun - Procurement Support and SupervisionDocument120 pagesConsultancy Procurement Document (CPD) - TPS Zemun - Procurement Support and SupervisionSheila MaNo ratings yet

- Rate Analysis FormatDocument1 pageRate Analysis FormatShashika Sameera77% (13)

- National Highways Authority of IndiaDocument239 pagesNational Highways Authority of IndiaAnonymous eKt1FCDNo ratings yet

- Mid-Term % Midtrem Exam 20 % Result Course IdentificationDocument6 pagesMid-Term % Midtrem Exam 20 % Result Course IdentificationSukhmani KambojNo ratings yet