Professional Documents

Culture Documents

Format For Financial The Statements Analysis

Uploaded by

Abhishek Singh0 ratings0% found this document useful (0 votes)

13 views1 pageThe document outlines a 14-point format for conducting a financial statement analysis of a company, including providing the company background, industry outlook, 3 years of financial statements, interpretation of statements highlighting cash flows, additional financial details, ratio analyses, trend analysis comparing the company to its closest competitor across key metrics, and an overall assessment of financial health.

Original Description:

Format for Financial the Statements Analysis

Original Title

Format for Financial the Statements Analysis

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines a 14-point format for conducting a financial statement analysis of a company, including providing the company background, industry outlook, 3 years of financial statements, interpretation of statements highlighting cash flows, additional financial details, ratio analyses, trend analysis comparing the company to its closest competitor across key metrics, and an overall assessment of financial health.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageFormat For Financial The Statements Analysis

Uploaded by

Abhishek SinghThe document outlines a 14-point format for conducting a financial statement analysis of a company, including providing the company background, industry outlook, 3 years of financial statements, interpretation of statements highlighting cash flows, additional financial details, ratio analyses, trend analysis comparing the company to its closest competitor across key metrics, and an overall assessment of financial health.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

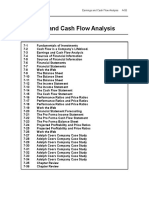

Format for Financial Statements Analysis

1.

2.

3.

4.

5.

6.

7.

Name of the Company

Name of the Chairman/MD/CEO

Listed in: (stock exchange(s))

Brief company background (not more than one page)

Brief industry outlook (not more than one page)

Balance Sheet, P&L and Cash flows (Rs. Million) for last three years

Overall interpretation of each financial statement (Balance Sheet, P&L, and Cash

flows) - broad highlights on absolute numbers- without using any ratio. Spend

more space for analyzing cash flow statement.

8. Additional financial details (only those which are required to calculate various

ratios)

9. Generic Ratio Analyses

10. Trend analysis (using three year data)

11. Comparative Analysis: Compare the performance of the company with one of its

closest competitors.

12. Map the performance of the company with the competitors on (a) profitability vs.

sales growth, (b) efficiency vs. profitability, (c) liquidity vs. profitability, (d) sales

growth vs. market valuation (book/market), and (e) div pay out vs. capex.

13. Highlight any one or more indicator(s) which capture the industry characteristics.

14. Overall comments on the financial health.

You might also like

- Report Format - FFMDocument6 pagesReport Format - FFMMuhammad MansoorNo ratings yet

- Case Study FaDocument5 pagesCase Study Faabhishek ladhaniNo ratings yet

- Globus AnnualReport InstructionsDocument2 pagesGlobus AnnualReport InstructionsAneesha ZNo ratings yet

- User's Manual CapitalineonlineDocument74 pagesUser's Manual CapitalineonlineGurjeevAnandNo ratings yet

- Accounting For Business Decisions Assignment T1 2015Document3 pagesAccounting For Business Decisions Assignment T1 2015shoaiba1No ratings yet

- Manifold Business Forms World Summary: Market Sector Values & Financials by CountryFrom EverandManifold Business Forms World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Financial Research Project T Mobile Valuation and AnalysisDocument24 pagesFinancial Research Project T Mobile Valuation and Analysisalka murarka100% (1)

- Guidelines: Financial Statements Analysis (Group Project)Document1 pageGuidelines: Financial Statements Analysis (Group Project)Sahil GargNo ratings yet

- Developing A Business PlanDocument20 pagesDeveloping A Business PlanVikas AgrawalNo ratings yet

- Car Aftermarket Components - OES -v- Generic Suppliers World Summary: Market Values & Financials by CountryFrom EverandCar Aftermarket Components - OES -v- Generic Suppliers World Summary: Market Values & Financials by CountryNo ratings yet

- Modifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryFrom EverandModifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Teamwork Project - Valuation K18404CADocument2 pagesTeamwork Project - Valuation K18404CANgọc Dương Thị BảoNo ratings yet

- Flight Training Revenues World Summary: Market Values & Financials by CountryFrom EverandFlight Training Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryFrom EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Company AssignmentDocument2 pagesCompany AssignmentHarsh NaharNo ratings yet

- Aircraft Engines & Parts World Summary: Market Sector Values & Financials by CountryFrom EverandAircraft Engines & Parts World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Financial Planning & Analysis and Performance ManagementFrom EverandFinancial Planning & Analysis and Performance ManagementRating: 3 out of 5 stars3/5 (1)

- Format of Project On Enterprise AnalysisDocument13 pagesFormat of Project On Enterprise AnalysisHatim Ezzi100% (1)

- Aircraft Rental & Leasing Revenues World Summary: Market Values & Financials by CountryFrom EverandAircraft Rental & Leasing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Financial Statements Analysis-ProjectDocument1 pageFinancial Statements Analysis-ProjectSiddharth Shankar BebartaNo ratings yet

- Business Plan Checklist: Plan your way to business successFrom EverandBusiness Plan Checklist: Plan your way to business successRating: 5 out of 5 stars5/5 (1)

- Outboard Engines World Summary: Market Sector Values & Financials by CountryFrom EverandOutboard Engines World Summary: Market Sector Values & Financials by CountryNo ratings yet

- SAPMDocument7 pagesSAPMRanjith SNo ratings yet

- P3 - Dec 2013 IRC PresentationDocument248 pagesP3 - Dec 2013 IRC Presentationjayraj90No ratings yet

- Burkenroad GuiaDocument24 pagesBurkenroad GuiacoricorpNo ratings yet

- Project 2Document4 pagesProject 2kipkemei ezekielNo ratings yet

- Tyres (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandTyres (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- LBO Due Diligence Standard Data RequestDocument9 pagesLBO Due Diligence Standard Data RequestAndrew LeeNo ratings yet

- 12 - MWS96KEE127BAS - 1research Project - WalmartDocument7 pages12 - MWS96KEE127BAS - 1research Project - WalmartashibhallauNo ratings yet

- Equity Analyst ReportDocument3 pagesEquity Analyst Reportমেহের আব তমালNo ratings yet

- Mercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryFrom EverandMercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Instruments, Indicating Devices & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandInstruments, Indicating Devices & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Portfolio Element 2Document10 pagesPortfolio Element 2Mahendra paudel PaudelNo ratings yet

- Group Presentation - Sector Analysis 2017Document8 pagesGroup Presentation - Sector Analysis 2017Abhishek NegiNo ratings yet

- Template-FinStatement Analysis v8 1Document14 pagesTemplate-FinStatement Analysis v8 1maahi7No ratings yet

- Ratio AnaylsisDocument92 pagesRatio AnaylsisRamesh Chand100% (1)

- Financial Analysis GuideDocument6 pagesFinancial Analysis GuideRomelyn Joy JangaoNo ratings yet

- Fuel & Feedstock Gases World Summary: Market Values & Financials by CountryFrom EverandFuel & Feedstock Gases World Summary: Market Values & Financials by CountryNo ratings yet

- Financial Analysis AssignmentDocument5 pagesFinancial Analysis AssignmentSaifiNo ratings yet

- Group Assignment - Financial Statement Analysis: Good Luck!Document4 pagesGroup Assignment - Financial Statement Analysis: Good Luck!Quỳnh GiangNo ratings yet

- Ratio Analysis: Related ArticlesDocument4 pagesRatio Analysis: Related ArticlesdibopodderNo ratings yet

- Flowmeters World Summary: Market Values & Financials by CountryFrom EverandFlowmeters World Summary: Market Values & Financials by CountryNo ratings yet

- Financials RatiosDocument25 pagesFinancials RatiosSayan DattaNo ratings yet

- Ratios Tell A Story F16Document3 pagesRatios Tell A Story F16Zihan ZhuangNo ratings yet

- A Balance Sheet Differs From An Income Statement in Terms of What It Describes. An Income StatementDocument2 pagesA Balance Sheet Differs From An Income Statement in Terms of What It Describes. An Income StatementnehapurawatNo ratings yet

- FUNDAMENTAL ANALYSIS NotesDocument8 pagesFUNDAMENTAL ANALYSIS NotesBalaji GaneshNo ratings yet

- Starter Motors & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandStarter Motors & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Fuel Pumps & Fuel Tanks (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandFuel Pumps & Fuel Tanks (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Motor Vehicle Towing Revenues World Summary: Market Values & Financials by CountryFrom EverandMotor Vehicle Towing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Vertical Common Size Balance SheetDocument23 pagesVertical Common Size Balance SheetStewart SerraoNo ratings yet

- ContentsDocument2 pagesContentsgunjanbihaniNo ratings yet

- Wheels & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandWheels & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Things To DoDocument3 pagesThings To DoEpic GamerNo ratings yet

- A Suggested Format For The Company Analysis ReportDocument4 pagesA Suggested Format For The Company Analysis ReportPrasanth VngNo ratings yet

- SamarthDocument2 pagesSamarthSamarth JainNo ratings yet

- P5 RM March 2016 Questions PDFDocument12 pagesP5 RM March 2016 Questions PDFavinesh13No ratings yet

- Crushing, Pulverizing & Screening Machinery World Summary: Market Sector Values & Financials by CountryFrom EverandCrushing, Pulverizing & Screening Machinery World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Case Analysis-Recognize The Industry - Part - IDocument2 pagesCase Analysis-Recognize The Industry - Part - Ijatinag990No ratings yet

- Stock Report InstructionsDocument2 pagesStock Report InstructionsMike AmukhumbaNo ratings yet

- Earnings and Cash Flow Analysis: SlidesDocument6 pagesEarnings and Cash Flow Analysis: Slidestahera aqeelNo ratings yet

- BrochureDocument1 pageBrochureAbhishek SinghNo ratings yet

- MV Exp5Document6 pagesMV Exp5Abhishek SinghNo ratings yet

- Lecture 7 - Building A Balanced Team and Legal Forms of Business 21.01.2015Document43 pagesLecture 7 - Building A Balanced Team and Legal Forms of Business 21.01.2015Abhishek SinghNo ratings yet

- Aptitude Logical ReasoningDocument43 pagesAptitude Logical ReasoningChandramauli MishraNo ratings yet

- Plant Physiology Taiz Zeiger 4th Edition PDFDocument2 pagesPlant Physiology Taiz Zeiger 4th Edition PDFAbhishek Singh26% (19)

- MCM Online Application For RenewalDocument1 pageMCM Online Application For RenewalAbhishek SinghNo ratings yet

- MM Exp - 5Document2 pagesMM Exp - 5Abhishek SinghNo ratings yet

- Reference Guide & Formula Sheet For PhysicsDocument16 pagesReference Guide & Formula Sheet For PhysicsAbhishek SinghNo ratings yet