Professional Documents

Culture Documents

12A Real Option Examples

12A Real Option Examples

Uploaded by

XY Chan0 ratings0% found this document useful (0 votes)

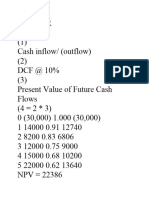

2 views3 pages1) This document analyzes the net present value (NPV) of different investment options over multiple time periods and scenarios.

2) The first option considers postponing an investment with an expected NPV of $107 if postponed to year 1 and $117 if invested in year 1.

3) The second option considers a growth option with an expected stage 1 NPV of -$166 if not exercised, and an overall expected NPV of $142 if the growth option is exercised over two stages.

Original Description:

Real options FIN 3300

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) This document analyzes the net present value (NPV) of different investment options over multiple time periods and scenarios.

2) The first option considers postponing an investment with an expected NPV of $107 if postponed to year 1 and $117 if invested in year 1.

3) The second option considers a growth option with an expected stage 1 NPV of -$166 if not exercised, and an overall expected NPV of $142 if the growth option is exercised over two stages.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views3 pages12A Real Option Examples

12A Real Option Examples

Uploaded by

XY Chan1) This document analyzes the net present value (NPV) of different investment options over multiple time periods and scenarios.

2) The first option considers postponing an investment with an expected NPV of $107 if postponed to year 1 and $117 if invested in year 1.

3) The second option considers a growth option with an expected stage 1 NPV of -$166 if not exercised, and an overall expected NPV of $142 if the growth option is exercised over two stages.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

1) POSTPONEMENT OPTION

i) Without Postponement

NPV

Prob

388.4297521

41.32231405

-132.231405

yr 0

0.25

0.5

0.25

-1000

-1000

-1000

Expected NPV (at year 0) =

84.7107438017

2) GROWTH OPTION

i) Stage 1

NPV

Prob

666,666.67

###

yr 0

0.50

(1,000,000.00)

0.50

(1,000,000.00)

Expected NPV (stage 1, no growth option) =

(166,666.67)

ii) Overall

NPV

Prob

2,827,160.49

(259,259.26)

(1,000,000.00)

Expected NPV =

141,975.31

yr 0

yr1

0.25

(1,000,000.00)

0.25

(1,000,000.00)

0.50

(1,000,000.00)

800,000.00

800,000.00

-

yr 1

yr 2

800

600

500

800

600

500

ii) Postponed

NPV

Prob

$388.43

$41.32

$0.00

0.25

0.5

0.25

Expected NPV (at year 1) =

$117.77

Expected NPV (at year 0) =

$107.06

yr1

1,800,000.00

-

ii) Stage 2

NPV (yr0)

Prob

2,160,493.83

(925,925.93)

-

0.25

0.25

0.50

Expected NPV (stage 2, yr 0) =

308,641.98

yr2

3,600,000.00

-

Expected NPV (stage 1, no growth option) + Ex

-166666.666667 +

yr 0

yr 1

yr 2

-1000

-1000

0

yr1

yr 3

800

600

0

yr2

(1,000,000.00)

(1,000,000.00)

-

3,600,000.00

###

, no growth option) + Expected NPV (stage 2, yr 0) =

308,641.98 =

141,975.31

800

600

0

You might also like

- NPV and IRRDocument19 pagesNPV and IRRGukan VenkatNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Cash Flow Brigham SolutionDocument14 pagesCash Flow Brigham SolutionShahid Mehmood100% (4)

- BUS 5110 - Written Assignment - Unit 6Document5 pagesBUS 5110 - Written Assignment - Unit 6Aliyazahra KamilaNo ratings yet

- Digital Electronics For Engineering and Diploma CoursesFrom EverandDigital Electronics For Engineering and Diploma CoursesNo ratings yet

- GDV: TDC:: Per PeriodDocument9 pagesGDV: TDC:: Per PeriodM. HfizzNo ratings yet

- Tugas Mankeu Khairu AndikaDocument3 pagesTugas Mankeu Khairu AndikaKhairu AndikaNo ratings yet

- SamigroupDocument9 pagesSamigroupsamidan tubeNo ratings yet

- Adjusted Mock Final Exam PM 19.8.2021 With Answer 1Document13 pagesAdjusted Mock Final Exam PM 19.8.2021 With Answer 1Phương PhạmNo ratings yet

- Housing Price in UkDocument3 pagesHousing Price in UkenginiboeerNo ratings yet

- Caledonia AnswersDocument4 pagesCaledonia AnswersjaredrollinsNo ratings yet

- FFM 9 Im 12Document31 pagesFFM 9 Im 12Mariel CorderoNo ratings yet

- Module 2 Additional ActivitiesDocument3 pagesModule 2 Additional ActivitiesYell AsiaNo ratings yet

- Chapter 2 AssignmentDocument9 pagesChapter 2 AssignmentDhapaDanNo ratings yet

- Chapter 12Document14 pagesChapter 12Naimmul FahimNo ratings yet

- Pine Valley Funiture Economic Feasibility Analysis Customer Tracking System ProjectDocument5 pagesPine Valley Funiture Economic Feasibility Analysis Customer Tracking System ProjectliorklaNo ratings yet

- (A) WACC W XK +K K +G +0.07 0.09304+0.07 0.16304 16.30% K K (1-t) 0.095 (1-0.35) 0.06175 6.175% WACC 0.4x16.30%+0.6x6.175% 6.52+3.705 10.225% (B)Document10 pages(A) WACC W XK +K K +G +0.07 0.09304+0.07 0.16304 16.30% K K (1-t) 0.095 (1-0.35) 0.06175 6.175% WACC 0.4x16.30%+0.6x6.175% 6.52+3.705 10.225% (B)Aditya RathiNo ratings yet

- JaletaDocument8 pagesJaletaአረጋዊ ሐይለማርያምNo ratings yet

- SolutionCH9 CH11Document9 pagesSolutionCH9 CH11qwerty1234qwer100% (1)

- SBA Topic 1-Taylor Corporation-SolutionsDocument2 pagesSBA Topic 1-Taylor Corporation-SolutionsAli BasyaNo ratings yet

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- Simulasi Penggajihan Dan Bonus CleanerDocument5 pagesSimulasi Penggajihan Dan Bonus Cleanerfahmiwahono.bsc03No ratings yet

- 4.01% Is The 1-Year Spot RateDocument6 pages4.01% Is The 1-Year Spot RatePaulo TorresNo ratings yet

- Evaluation of Project Alternatives Using Simulation: Table 1: Discrete Distribution of Initial Outlay of The ProjectDocument5 pagesEvaluation of Project Alternatives Using Simulation: Table 1: Discrete Distribution of Initial Outlay of The ProjectSamar PratapNo ratings yet

- Project Selection SimulationDocument5 pagesProject Selection SimulationSamar PratapNo ratings yet

- Case 05 FinalDocument11 pagesCase 05 FinallittlemissjaceyNo ratings yet

- Project Selection-SimulationDocument5 pagesProject Selection-SimulationShreyansh GargNo ratings yet

- Capital BudgetingDocument38 pagesCapital Budgetingvini2710No ratings yet

- Fin Strategy Ass 1Document3 pagesFin Strategy Ass 1mqondisi nkabindeNo ratings yet

- Which Project Should You Accept and Why?: Chart TitleDocument7 pagesWhich Project Should You Accept and Why?: Chart Titlesohinidas91No ratings yet

- Ref NSCP 2015 EditionDocument45 pagesRef NSCP 2015 EditionVanessa AggabaoNo ratings yet

- A. Generate The Cumulative (Non-Discounted) After-Tax Cash Flow DiagramDocument13 pagesA. Generate The Cumulative (Non-Discounted) After-Tax Cash Flow DiagramHaziq Hakimi100% (1)

- 7-28 7-29 The Direct MethodDocument5 pages7-28 7-29 The Direct MethodJohn Carlo AquinoNo ratings yet

- Assignment 4 - Cost of Capital and Capital BudgetiDocument5 pagesAssignment 4 - Cost of Capital and Capital BudgetiBrian AlalaNo ratings yet

- ln3 NumericalsDocument86 pagesln3 NumericalssangeeiyerNo ratings yet

- Corporate FinanceDocument3 pagesCorporate FinanceRitesh BangNo ratings yet

- FM Assaignment Second SemisterDocument9 pagesFM Assaignment Second SemisterMotuma Abebe100% (1)

- Case 1 - TaylorDocument5 pagesCase 1 - TaylorEdwin EspirituNo ratings yet

- Financial Statement Activity W AnswersDocument4 pagesFinancial Statement Activity W AnswersLizlee LaluanNo ratings yet

- Cumulative Cumulative Total Discount Year Costs Cost Benefits Benefits Benefits FactorDocument2 pagesCumulative Cumulative Total Discount Year Costs Cost Benefits Benefits Benefits FactorAlden ArmenterosNo ratings yet

- Corporate Finance (FIN722) Assignment No. 1: Requirement 1Document4 pagesCorporate Finance (FIN722) Assignment No. 1: Requirement 1mudassar saeedNo ratings yet

- Operations Management. Assignment1Document3 pagesOperations Management. Assignment1Isaac GumboNo ratings yet

- Tugas Ke 5 Ade Hidayat Kelas 1a MMDocument4 pagesTugas Ke 5 Ade Hidayat Kelas 1a MMadeNo ratings yet

- Question 2BDocument6 pagesQuestion 2BtawandaNo ratings yet

- Project ManagementDocument10 pagesProject ManagementcleousNo ratings yet

- Cost Acct Capital BudgetingDocument4 pagesCost Acct Capital BudgetingKerrice RobinsonNo ratings yet

- Risk Free Rate + Beta× (Expected Market Return Risk Free Rate)Document4 pagesRisk Free Rate + Beta× (Expected Market Return Risk Free Rate)Sadiya Sweeto0% (1)

- Chapter 36Document2 pagesChapter 36kai68No ratings yet

- Case 6Document3 pagesCase 6Farhanie Nordin0% (1)

- Investment Decision TheoryDocument71 pagesInvestment Decision TheorykaranvishweshsharmaNo ratings yet

- Buscom (Quiz)Document10 pagesBuscom (Quiz)Maria Raven Joy Espartinez ValmadridNo ratings yet

- Solution To Problems From HW Set # 6Document4 pagesSolution To Problems From HW Set # 6Nasr CheaibNo ratings yet

- TA112.BQAF - .L Solution CMA January 2022 Examination PDFDocument8 pagesTA112.BQAF - .L Solution CMA January 2022 Examination PDFMohammed Javed UddinNo ratings yet

- Corporate FDocument8 pagesCorporate Fjainvj100No ratings yet

- Evaluating Income Producing InvestingDocument12 pagesEvaluating Income Producing InvestingSanthosh VarmaNo ratings yet

- Project Management NotesDocument2 pagesProject Management NotesAtiqullah sherzadNo ratings yet

- Exercises - 4 (Solutions) Chapter 10, Practice QuestionsDocument7 pagesExercises - 4 (Solutions) Chapter 10, Practice QuestionsFoititika.netNo ratings yet

- HMW 2 - AnswersDocument2 pagesHMW 2 - Answersbrahim.safa2018No ratings yet

- Corporate Finance - Exercises Session 1 - SolutionsDocument5 pagesCorporate Finance - Exercises Session 1 - SolutionsLouisRemNo ratings yet