Professional Documents

Culture Documents

The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2014

Uploaded by

John Paul Samuel ChuaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2014

Uploaded by

John Paul Samuel ChuaCopyright:

Available Formats

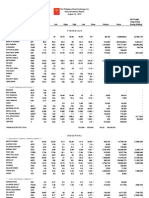

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 09 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

(2,614,294)

2,786,203

FINANCIALS

**** BANKS ****

ASIATRUST

ASIA UNITED

BDO UNIBANK

ASIA

AUB

BDO

68.6

70.55

68.8

70.65

68.7

72.5

68.9

72.5

68.6

70.5

68.8

70.55

230,280

1,642,760

15,832,642

117,171,025.5

BANK PH ISLANDS

CHINABANK

BPI

86.1

86.15

87.5

87.5

86.15

86.15

1,304,750

113,172,759.5

940,043

CHIB

60.2

60.3

60

60.2

59.9

60.2

82,550

4,960,301

(481,600)

CITYSTATE BANK

EXPORT BANK

EXPORT BANK B

EAST WEST BANK

CSB

EIBA

EIBB

EW

8

24.1

13.98

24.15

24.05

24.6

24.05

24.1

60,800

1,469,020

(706,110)

METROBANK

MBT

73.85

73.9

77.75

77.75

73.9

73.9

6,449,830

483,410,584

(148,165,912)

PB BANK

PBB

22.5

22.8

23.3

23.3

22.5

22.5

18,500

421,010

20,250

PBCOM

PHIL NATL BANK

PBC

PNB

61.6

83.45

68.2

83.5

86

86

83.5

83.5

343,070

29,077,045

(2,166,618.5)

PSBANK

PHILTRUST

RCBC

PSB

PTC

RCB

131.2

90

43.2

139

43.5

43.5

43.5

43.2

43.2

47,300

2,045,270

(1,707,310)

SECURITY BANK

SECB

116.8

116.9

117.9

118

116.5

116.8

264,680

30,951,718

14,755,612

UNION BANK

UBP

124.1

125.5

125.7

125.7

125.7

125.7

100

12,570

12,570

**** OTHER FINANCIAL INSTITUTIONS ****

AG FINANCE

AGF

2.96

3.04

2.96

2.96

2.96

2.96

40,000

118,400

BANKARD

BDO LEASING

BKD

BLFI

2.08

1.98

2.09

2.07

2.09

2

2.1

2

2.07

2

2.09

2

210,000

160,000

439,330

320,000

COL FINANCIAL

COL

15.94

16

16.04

16.8

16

16

113,100

1,813,732

(131,200)

FIRST ABACUS

FILIPINO FUND

FAF

FFI

0.78

15.2

0.84

16.5

16.5

16.6

16

16

2,500

40,380

IREMIT

MAYBANK ATR KE

MEDCO HLDG

I

MAKE

MED

2.66

0.236

2.79

0.246

0.255

0.255

0.236

0.236

690,000

166,220

MANULIFE

MFC

800

805

790

805

790

805

400

319,100

200,000

NTL REINSURANCE

NRCP

1.37

1.51

1.51

1.51

1.51

1.51

20,000

30,200

PHIL STOCK EXCH

SUN LIFE

PSE

SLF

305

1,350

306

1,375

306

1,350

306

1,375

305

1,350

305

1,375

2,000

105

611,960

141,875

(140,760)

-

VANTAGE

2.5

2.6

2.5

2.5

2.5

2.5

50,000

125,000

FINANCIALS SECTOR TOTAL

VOLUME :

11,732,725

VALUE :

802,650,142

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ALSONS CONS

ACR

1.34

1.36

1.34

1.34

1.33

1.33

193,000

257,820

ABOITIZ POWER

AP

34.8

34.9

35.2

35.2

34.65

34.9

1,169,800

40,927,020

21,875,325

ENERGY DEVT

FIRST GEN

EDC

FGEN

5.52

14.8

5.55

14.88

5.55

15.2

5.58

15.28

5.5

14.68

5.55

14.8

2,163,600

2,154,200

11,993,921

32,281,794

1,706,995

13,799,852

FIRST PHIL HLDG

FPH

60

60.05

61.4

61.45

59.8

60.05

445,020

26,963,394

15,022,806

CALAPAN VENTURE

H2O

6.53

7.19

7.2

7.2

7.2

7.2

2,000

14,400

14,400

MERALCO

MER

254

254.6

260

260.2

249.6

254.6

495,150

125,413,444

(64,060,602)

MANILA WATER

MWC

23.35

23.4

23.5

23.5

23.3

23.35

2,153,700

50,441,315

15,250,200

PETRON

PCOR

14.02

14.08

14.1

14.1

14

14.08

1,741,400

24,513,322

4,533,928

PHOENIX

PNX

4.81

4.86

4.9

4.9

4.81

4.81

26,000

125,730

SALCON POWER

TRANS ASIA

SPC

TA

4.32

1.53

4.6

1.54

1.55

1.56

1.54

1.54

5,180,000

7,986,500

421,940

VIVANT

VVT

9.01

12

12

12

12

12

1,000

12,000

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

ANI

5.35

5.5

5.06

5.08

5.05

5.05

9,900

50,100

BOGO MEDELLIN

CNTRL AZUCARERA

DEL MONTE

BMM

CAT

DMPL

37.7

22.7

58

22.85

22.75

22.85

22.75

22.85

289,100

6,577,115

(207,095)

DNL INDUS

DNL

6.46

6.47

6.5

6.6

6.45

6.46

7,312,000

47,483,720

(1,456,095)

EMPERADOR

EMP

11.02

11.08

11.1

11.22

11

11.08

3,028,300

33,552,890

11,490,164

ALLIANCE SELECT

GINEBRA

FOOD

GSMI

1.01

21.6

1.02

21.9

1.02

22

1.03

22

1.02

22

1.02

22

410,000

5,600

419,300

123,200

(96,800)

JOLLIBEE

JFC

169

169.6

169.6

169.7

168.4

169

537,370

90,894,719

3,365,720

LIBERTY FLOUR

LT GROUP

LFM

LTG

50.05

15.22

15.32

14.98

15.32

14.98

15.22

6,526,700

99,072,982

(3,044,474)

PANCAKE

PUREFOODS

PCKH

PF

14.8

223.2

15.06

237.6

238

238

222.4

237.6

10,640

2,414,424

(2,271,864)

PEPSI COLA

PIP

4.5

4.51

4.48

4.52

4.48

4.5

8,072,000

36,313,880

3,919,460

ROXAS AND CO

RCI

3.21

3.8

3.3

3.3

3.2

3.2

7,000

22,710

RFM CORP

RFM

5.6

5.74

5.8

5.82

5.6

5.6

52,100

298,768

(32,230)

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 09 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

11,420

ROXAS HLDG

ROX

5.61

5.67

5.61

5.9

5.53

5.61

166,300

935,673

SWIFT FOODS

SFI

0.12

0.124

0.124

0.124

0.12

0.12

1,130,000

136,120

SAN MIGUEL CORP

SMC

60.55

60.85

61.05

61.2

60.5

60.55

183,430

11,158,892

(4,021,021.5)

UNIV ROBINA

URC

118.9

119.3

119

120.3

118.9

119.3

2,644,480

315,972,815

24,487,942

VITARICH

VICTORIAS

VITA

VMC

0.6

2

0.62

2.01

0.6

2.03

0.6

2.05

0.6

2

0.6

2

97,000

2,425,000

58,200

4,898,220

(121,700)

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

ASIABEST GROUP

ABG

10.8

11.2

11.3

11.3

11

11.2

1,700

18,750

CONCRETE A

CONCRETE B

SEACEM

DAVINCI CAPITAL

EEI CORP

CA

CAB

CMT

DAVIN

EEI

38.6

15

0.97

0.87

9.99

55

1.03

0.9

10

0.9

10.1

0.9

10.14

0.9

9.99

0.9

10

54,000

283,700

48,600

2,840,496

(2,316,646)

FEDERAL RES. INV

FED

9.35

9.01

9.3

9.01

9.01

400

3,652

HOLCIM

LAFARGE REP

HLCM

LRI

15

8.79

15.5

8.8

15.52

8.86

15.52

8.86

15.5

8.75

15.5

8.79

13,000

3,611,000

201,516

31,695,203

173,600

-

MEGAWIDE

MWIDE

12.3

12.58

12.22

12.58

12.2

12.58

148,800

1,819,294

(1,130,906)

PHINMA

PNCC

SUPERCITY

TKC STEEL

VULCAN INDL

PHN

PNC

SRDC

T

VUL

12

0.81

1.82

1.38

12.48

1.87

1.43

1.87

1.4

1.87

1.4

1.87

1.38

1.87

1.38

1,000

102,000

1,870

140,800

CHEMPHIL

CHEMREZ

EUROMED

LMG CHEMICALS

CIP

COAT

EURO

LMG

107.5

2.93

1.31

3.05

209

3.04

1.6

3.14

2.95

3.1

2.95

3.1

2.95

3.05

2.95

3.05

30,000

34,000

88,500

104,030

METROALLIANCE A

METROALLIANCE B

MELCO CROWN

MAH

MAHB

MCP

13.2

13.3

13.6

13.7

13.16

13.2

1,931,800

25,778,436

(7,485,046)

MABUHAY VINYL

PRYCE CORP

MVC

PPC

2.21

-

2.6

-

**** CHEMICALS ****

**** ELECTRICAL COMPONENTS & EQUIPMENT ****

CIRTEK HLDG

CONCEPCION

CHIPS

CIC

14.18

23

14.4

23.3

14.4

23.5

14.4

23.55

14.4

21.5

14.4

23

4,800

100,800

69,120

2,335,540

(2,241,040)

GREENERGY

INTEGRATED MICR

IONICS

PANASONIC

GREEN

IMI

ION

PMPC

0.011

2.52

0.37

5.6

0.012

2.69

0.42

6.39

0.011

-

0.012

-

0.011

-

0.012

-

13,000,000

-

150,000

-

1.82

1.88

1.85

1.85

1.82

1.82

11,000

20,200

11,100

31,000

246,430

58,770

130,244,370

57,339,940

**** OTHER INDUSTRIALS ****

FILSYN A

FILSYN B

PICOP RES

SPLASH CORP

FYN

FYNB

PCP

SPH

STENIEL

STN

INDUSTRIAL SECTOR TOTAL

VOLUME :

68,371,110

VALUE :

1,072,531,327

HOLDING FIRMS

**** HOLDING FIRMS ****

ASIA AMLGMATED

ABACORE CAPITAL

AYALA CORP

AAA

ABA

AC

1.88

0.49

525

1.96

0.51

528.5

1.9

535

1.96

535

1.88

525

ABOITIZ EQUITY

AEV

ALLIANCE GLOBAL

AGI

53.65

54.2

26

26.05

ANSCOR

ANS

6.64

ANGLO PHIL HLDG

APO

ATN HLDG A

1.96

525

54.15

54.2

53.3

54.2

285,420

15,338,567

(3,261,167.5)

26

26.15

26

26.05

3,787,800

98,754,965

24,599,315

6.7

6.7

6.7

6.7

6.7

6,300

42,210

1.71

1.75

1.79

1.79

1.71

1.71

26,000

44,720

ATN

1.15

1.31

1.2

1.2

1.16

1.16

75,000

88,200

ATN HLDG B

ATNB

1.18

1.27

1.2

1.2

1.18

1.18

119,000

140,820

59,000

BHI HLDG

COSCO CAPITAL

BH

COSCO

282.2

8.9

825

8.91

8.8

8.8

8.91

4,364,700

38,912,741

10,316,160

DMCI HLDG

DMC

56.5

56.8

56.1

56.65

56.1

56.5

1,089,380

61,517,635.5

1,181,410

FIL ESTATE CORP

FILINVEST DEV

FC

FDC

4.3

4.4

4.4

4.4

4.25

4.25

20,000

86,250

FJ PRINCE A

FJ PRINCE B

FORUM PACIFIC

GT CAPITAL

FJP

FJPB

FPI

GTCAP

2.93

2.36

0.173

757.5

3.2

3.97

0.195

759.5

761

766.5

757.5

759.5

105,570

80,364,640

2,258,405

HOUSE OF INV

HI

JG SUMMIT

JGS

JOLLIVILLE HLDG

KEPPEL HLDG A

KEPPEL HLDG B

JOH

KPH

KPHB

6.34

6.58

6.41

6.41

6.3

6.34

10,400

66,207

38.65

39

39.1

39.1

38.5

39

177,600

6,893,955

(610,255)

4.5

3.01

3.2

5.74

4.95

5

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 09 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

LODESTAR

LIHC

0.6

0.63

0.6

0.62

0.6

0.6

218,000

131,320

LOPEZ HLDG

LPZ

4.32

4.34

4.29

4.35

4.29

4.34

1,457,000

6,295,040

(2,963,100)

MARCVENTURES

MARC

3.16

3.19

3.3

3.35

3.15

3.16

2,270,000

7,472,840

(32,500)

MABUHAY HLDG

MHC

0.59

0.62

0.59

0.61

0.59

0.61

150,000

89,500

MINERALES IND

MIC

4.91

5.25

5.05

5.25

4.95

5.25

28,500

141,900

MJC INVESTMENTS

METRO PAC INV

MJIC

MPI

3.25

4.27

4.04

4.28

3.25

4.34

3.25

4.36

3.25

4.28

3.25

4.28

5,000

16,250

8,881,000

38,199,290

(12,957,740)

PACIFICA

PA

0.038

0.041

0.033

0.045

0.033

0.038

39,900,000

1,525,500

22,900

PRIME ORION

PRIME MEDIA

POPI

PRIM

0.44

1.42

0.485

1.5

1.45

1.45

1.42

1.42

107,000

153,810

REPUBLIC GLASS

SOLID GROUP

REG

SGI

2.48

1.23

2.62

1.25

1.26

1.26

1.23

1.23

84,000

105,370

SYNERGY GRID

SINOPHIL

SM INVESTMENTS

SGP

SINO

SM

240

0.27

701.5

390

0.305

702

0.27

718

0.27

718

0.27

702

0.27

702

80,000

219,740

21,600

155,406,550

5,541,420

SOUTH CHINA

SOC

1.07

1.01

1.01

1.01

1.01

100,000

101,000

(101,000)

SEAFRONT RES

UNIOIL HLDG

WELLEX INDUS

ZEUS HLDG

SPM

UNI

WIN

ZHI

1.51

0.161

0.175

0.3

1.65

0.194

0.192

0.33

1.51

0.33

1.51

0.33

1.51

0.33

1.51

0.33

7,000

10,000

10,570

3,300

HOLDING FIRMS SECTOR TOTAL

VOLUME :

63,870,920

VALUE :

647,004,140.5

PROPERTY

**** PROPERTY ****

ARTHALAND CORP

ANCHOR LAND

ALCO

ALHI

0.189

13.02

0.192

13.76

0.19

13.06

0.19

13.8

0.19

13.02

0.19

13.02

50,000

5,300

9,500

69,266

AYALA LAND

ALI

ALPHALAND

ALPHA

25.8

17

25.85

26.1

26.15

17.86

17.98

17.98

25.6

25.8

11,073,000

285,596,700

58,539,520

17

17.86

4,000

70,232

ARANETA PROP

ARA

1.43

1.48

1.46

(10,660)

1.46

1.46

1.46

20,000

29,200

BELLE CORP

BEL

4.92

4.96

5.02

5.02

4.9

4.96

497,100

2,458,539

(494,997)

A BROWN

BRN

1.05

CITYLAND DEVT

CDC

1.04

1.08

1.05

1.05

1.05

1.05

1,000

1,050

1.1

1.05

1.05

1.05

1.05

3,000

3,150

CROWN EQUITIES

CEI

0.073

0.077

CEBU HLDG

CENTURY PROP

CHI

CPG

5.61

1.39

5.65

1.41

5.65

1.43

5.75

1.44

5.65

1.4

5.65

1.41

292,000

5,624,000

1,649,830

7,899,990

(1,649,830)

(534,610)

CEBU PROP A

CEBU PROP B

CYBER BAY

CPV

CPVB

CYBR

4.3

5

0.51

5.5

5.35

0.55

0.51

0.51

0.51

0.51

24,000

12,240

EMPIRE EAST

EVER GOTESCO

FILINVEST LAND

ELI

EVER

FLI

0.92

0.177

1.37

0.93

0.203

1.38

0.92

1.39

0.92

1.39

0.92

1.34

0.92

1.38

502,000

26,056,000

461,840

35,477,350

2,494,570

GLOBAL ESTATE

GOTESCO LAND A

GOTESCO LAND B

8990 HLDG

IRC PROP

GERI

GO

GOB

HOUSE

IRC

1.35

6.1

1.37

1.36

6.75

1.42

1.36

1.39

1.37

1.42

1.36

1.39

1.36

1.42

395,000

43,000

537,800

59,920

KEPPEL PROP

CITY AND LAND

MARSTEEL A

MARSTEEL B

MEGAWORLD

KEP

LAND

MC

MCB

MEG

2.8

1.62

3.3

3.1

1.65

3.32

1.7

3.4

1.7

3.4

1.7

3.3

1.7

3.3

1,000

47,956,000

1,700

159,494,900

(33,546,600)

MRC ALLIED

PHIL ESTATES

PRIMETOWN PROP

PRIMEX CORP

MRC

PHES

PMT

PRMX

0.072

0.375

3.11

0.079

0.39

3.2

3.05

3.53

3.05

3.21

211,000

687,690

ROBINSONS LAND

RLC

20.5

20.6

20.65

20.85

20.6

20.6

5,791,000

119,655,975

(18,858,135)

PHIL REALTY

RLT

0.45

0.46

0.445

0.445

0.445

0.445

100,000

44,500

ROCKWELL

ROCK

1.56

1.59

1.59

1.59

1.56

1.56

70,000

109,670

SHANG PROP

STA LUCIA LAND

SM PRIME HLDG

SHNG

SLI

SMPH

3.15

0.62

14.48

3.25

0.64

14.5

0.62

14.64

0.64

14.7

0.62

14.42

0.64

14.5

297,000

24,969,400

185,160

363,161,452

42,193,454

STARMALLS

STR

3.45

3.57

3.53

3.55

3.53

3.55

50,000

177,320

SUNTRUST HOME

SUN

0.95

0.97

0.93

0.98

0.92

0.95

448,000

416,860

PHIL TOBACCO

UNIWIDE HLDG

VISTA LAND

TFC

UW

VLL

15.1

5.17

27

5.3

5.3

5.3

5.13

5.3

5,468,000

28,619,984

(8,895,532)

PROPERTY SECTOR TOTAL

VOLUME :

129,950,800

VALUE :

1,006,891,818

SERVICES

**** MEDIA ****

ABS CBN

ABS

30.6

31.45

31.5

31.5

30.6

30.6

9,300

285,830

GMA NETWORK

GMA7

8.09

8.1

8.13

8.15

8.1

8.1

345,900

2,811,505

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 09 , 2014

Name

MANILA BULLETIN

MLA BRDCASTING

Symbol

MB

MBC

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

0.68

2

0.72

-

**** TELECOMMUNICATIONS ****

GLOBE TELECOM

GLO

1,637

1,638

1,609

1,660

1,609

1,638

50,510

82,697,145

(2,713,020)

LIBERTY TELECOM

PTT CORP

PLDT

LIB

PTT

TEL

1.64

2,692

1.98

2,694

2,668

2,694

2,668

2,694

143,955

387,145,700

143,702,670

**** INFORMATION TECHNOLOGY ****

DFNN INC

IMPERIAL A

IMPERIAL B

ISLAND INFO

ISM COMM

DFNN

IMP

IMPB

IS

ISM

5.1

4.5

0.035

1.93

5.2

6.5

52.9

0.039

1.99

5.18

1.93

5.2

1.98

5.08

1.93

5.1

1.93

30,000

36,000

153,372

69,580

MG HLDG

NEXTSTAGE

TRANSPACIFIC BR

MG

NXT

TBGI

0.35

1.92

0.375

2

2.09

2.09

6,000

12,090

PHILWEB

WEB

YEHEY CORP

YEHEY

8.6

8.78

8.75

8.8

8.75

8.78

75,200

659,829

202,279

1.08

1.2

**** TRANSPORTATION SERVICES ****

2GO GROUP

2GO

1.7

1.83

1.84

1.84

1.84

1.84

1,000

1,840

ASIAN TERMINALS

CEBU AIR

ATI

CEB

10.7

50.95

11

51

51

51.2

51

51

598,770

30,538,411

(2,039,399)

INTL CONTAINER

ICT

97

99.35

99.7

99.8

97

97

3,951,340

392,193,891.5

(93,246,049.5)

LORENZO SHIPPNG

MACROASIA

LSC

MAC

1.24

3.37

1.44

3.4

3.56

3.6

3.37

3.4

1,191,000

4,118,020

(44,850)

PAL HLDG

HARBOR STAR

PAL

TUGS

5.68

1.25

5.9

1.28

1.28

1.28

1.25

1.28

89,000

111,710

**** HOTEL & LEISURE ****

ACESITE HOTEL

BOULEVARD HLDG

ACE

BHI

1

0.145

1.02

0.146

1.03

0.144

1.03

0.147

1

0.144

1.02

0.146

5,000

29,130,000

5,050

4,264,930

DISCOVERY WORLD

GRAND PLAZA

WATERFRONT

DWC

GPH

WPI

2.1

25.15

0.335

2.2

50

0.365

2.18

-

2.18

-

2.18

-

2.18

-

2,000

-

4,360

-

CEU

FEU

IPO

STI

10.6

1,110

11.26

0.66

11.28

1,150

12

0.67

0.67

0.67

0.66

0.67

875,000

578,570

198,000

18

9

27.45

9.01

9.03

8.96

9.01

8,512,100

76,619,730

(27,515,499)

-

**** EDUCATION ****

CENTRO ESCOLAR

FAR EASTERN U

IPEOPLE

STI HLDG

**** CASINOS & GAMING ****

BERJAYA

BLOOMBERRY

BCOR

BLOOM

IP EGAME

EG

0.012

0.013

0.012

0.013

0.012

0.013

5,400,000

64,900

PACIFIC ONLINE

LOTO

15.58

16

15.02

16

15

16

721,900

10,831,464

LEISURE AND RES

LR

6.45

6.48

6.45

6.49

6.45

6.48

458,000

2,954,191

2,841,225

MANILA JOCKEY

PRMIERE HORIZON

PHIL RACING

TRAVELLERS

MJC

PHA

PRC

RWM

1.94

0.29

8.97

10.36

2

0.31

9.4

10.4

2

0.295

10.46

2

0.295

10.46

1.92

0.295

10.36

2

0.295

10.4

587,000

500,000

1,168,300

1,143,260

147,500

12,192,262

6,335,224

**** RETAIL ****

CALATA CORP

CAL

PUREGOLD

PGOLD

3.3

3.38

3.32

3.42

3.3

3.3

230,000

762,900

16,550

39.1

39.15

39.5

39.5

39

39.15

975,100

38,157,520

(1,831,550)

ROBINSONS RTL

PHIL SEVEN CORP

RRHI

58

58.1

58.1

58.1

57.95

58

982,770

57,083,984

563,570

SEVN

96

99

94

95.5

94

95.5

4,900

465,700

465,700

APC GROUP

EASYCALL

NOW CORP

PAXYS

APC

ECP

NOW

PAX

0.63

2.17

0.38

2.18

0.64

2.82

0.395

2.2

0.64

2.16

0.64

2.2

0.63

2.16

0.64

2.2

335,000

116,000

211,300

252,310

PHILCOMSAT

GLOBALPORT

PHC

PORT

5.01

8.15

2,000

16,000

781,010

(644,560)

**** OTHER SERVICES ****

SERVICES SECTOR TOTAL

VOLUME :

58,445,045

VALUE :

1,151,869,964.5

MINING & OIL

**** MINING ****

ATOK

APEX MINING

AB

APX

12.12

1.77

17.9

1.8

1.79

1.79

1.77

1.77

439,000

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 09 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

0.003

14.5

0.0031

14.68

0.0031

14.82

0.0031

14.9

0.0031

14.5

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

0.0031

14.68

2,000,000

1,746,400

6,200

25,659,278

(6,648,048)

Close

ABRA MINING

ATLAS MINING

AR

AT

BENGUET A

BENGUET B

COAL ASIA HLDG

CENTURY PEAK

BC

BCB

COAL

CPM

6.45

6.32

0.83

0.55

6.75

6.7

0.85

0.6

0.83

0.6

0.83

0.6

0.83

0.6

0.83

0.6

2,000

1,000

1,660

600

600

DIZON MINES

GEOGRACE

LEPANTO A

DIZ

GEO

LC

5.17

0.395

0.375

5.21

0.405

0.38

5.4

0.4

0.375

5.4

0.405

0.38

5.15

0.4

0.375

5.21

0.4

0.375

60,300

890,000

17,180,000

314,743

358,600

6,459,500

LEPANTO B

LCB

0.375

0.38

0.38

0.38

0.375

0.38

4,340,000

1,635,750

(225,000)

MANILA MINING A

MA

0.014

0.015

0.016

0.016

0.014

0.015

638,700,000

9,586,800

MANILA MINING B

MAB

0.017

0.018

0.018

0.018

0.018

0.018

8,000,000

144,000

NIHAO

NI

2.11

2.12

2.07

2.23

2.05

2.11

1,248,000

2,674,910

(112,320)

NICKEL ASIA

NIKL

16.06

16.08

15.36

16.2

15.36

16.06

1,649,500

26,320,736

(693,870)

OMICO CORP

ORNTL PENINSULA

PHILEX

OM

ORE

PX

0.35

1.58

8.35

0.4

1.6

8.37

1.57

8.54

1.64

8.55

1.57

8.38

1.58

8.38

7,182,000

11,503,610

(4,808,550)

109,100

926,213

93,940

SEMIRARA MINING

SCC

303.2

303.4

305

307.8

303

303.4

116,390

35,361,102

3,078,406

UNITED PARAGON

UPM

0.01

0.011

0.011

0.011

0.011

0.011

17,000,000

187,000

0.25

0.017

0.019

0.035

5.49

7.99

0.255

0.018

0.021

0.036

5.53

8

0.25

0.018

0.019

0.036

7.99

0.25

0.018

0.019

0.036

8.02

0.25

0.017

0.019

0.036

7.99

0.25

0.017

0.019

0.036

8

100,000

9,400,000

200,000

19,300,000

239,300

25,000

160,100

3,800

694,800

1,914,720

(3,204)

**** OIL ****

BASIC PETROLEUM

ORIENTAL A

ORIENTAL B

PHILODRILL

PETROENERGY

PX PETROLEUM

BSC

OPM

OPMB

OV

PERC

PXP

MINING & OIL SECTOR TOTAL

VOLUME :

729,902,990

VALUE :

124,720,132

PREFERRED

ABC PREF

ABS HLDG PDR

ABC

ABSP

30.5

30.6

30.6

31.5

30.5

30.6

1,449,000

44,396,390

14,932,760

AC PREF A

AC PREF B

ACPA

ACPB

525

528

526.5

526.5

525

525

9,080

4,776,250

5,260

BC PREF A

DMC PREF

FGEN PREF F

FGEN PREF G

BCP

DMCP

FGENF

FGENG

11.36

112.5

108.6

109

112.5

110.1

112.5

110.1

112.5

108

112.5

109

410

19,140

46,125

2,101,104

FPH PREF

GLO PREF A

GMA HLDG PDR

FPHP

GLOPA

GMAP

5

8.1

8.18

8.2

8.2

8.1

8.1

67,000

546,040

(358,500)

LR PREF

LRP

1.01

1.03

1.03

1.03

1.01

1.01

356,000

361,080

PF PREF

PCOR PREF

PFP

PPREF

1,051

108.3

1,060

108.5

109

109

108.3

108.5

127,250

13,788,609

7,588

SFI PREF

SMC PREF 2A

SMC PREF 2B

SFIP

SMC2A

SMC2B

1.22

76.2

76.5

76.25

77.6

1.22

76.15

77.6

1.22

76.25

77.6

1.22

76.1

77.6

1.22

76.2

77.6

3,000

244,240

6,000

3,660

18,606,252

465,600

(9,276,473)

-

SMC PREF 2C

SMC2C

78.8

78.85

78.8

78.9

78.8

78.9

11,280

889,582

(516,795)

SMC PREF 1

TEL PREF HH

SMCP1

TLHH

PREFERRED TOTAL

VOLUME :

2,292,400

VALUE :

85,980,692

PHIL. DEPOSITARY RECEIPTS

PHIL. DEPOSIT RECEIPTS TOTAL

VOLUME :

VALUE :

WARRANTS

LR WARRANT

LRW

0.28

0.32

0.28

0.32

0.28

0.32

40,000

11,600

MEG WARRANT

MEG WARRANT 2

MEGW1

MEGW2

2.01

1.9

2.4

2.65

11,680

WARRANTS TOTAL

VOLUME :

40,000

VALUE :

11,600

SMALL & MEDIUM ENTERPRISES

MAKATI FINANCE

IRIPPLE

MFIN

RPL

SMALL & MEDIUM ENTERPRISES TOTAL

2.32

9.62

5

11.68

11.68

11.68

VOLUME :

11.68

1,000

11.68

1,000

VALUE :

11,680

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 09 , 2014

Name

FIRST METRO ETF

Symbol

FMETF

EXCHANGE TRADED FUNDS TOTAL

TOTAL MAIN BOARD

Bid

95.65

Ask

95.7

Open

96.3

High

96.3

VOLUME :

VOLUME :

Low

95.65

2,550

1,062,277,140

Close

95.65

Volume

2,550

VALUE :

VALUE :

244,490.5

4,805,923,694.5

Value, Php

244,490.5

Net Foreign

Buying/(Selling),

Php

1,913.5

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 09 , 2014

Name

Symbol

Bid

NO. OF ADVANCES:

NO. OF DECLINES:

NO. OF UNCHANGED:

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

48

93

49

NO. OF TRADED ISSUES:

NO. OF TRADES:

190

22,072

ODDLOT VOLUME:

ODDLOT VALUE:

271,804

103,584.97

BLOCK SALE VOLUME:

BLOCK SALE VALUE:

8,913,990

258,728,220.97

BLOCK SALES

SECURITY

PRICE

JFC

170.2217

EDC

5.5652

BPI

87.3000

PNB

86.0000

TEL

2,668.0000

EMP

11.1348

SM

715.0000

VOLUME

312,760

4,525,400

321,000

837,800

7,500

2,870,000

39,530

VALUE

53,238,538.89

25,184,756.08

28,023,300.00

72,050,800.00

20,010,000.00

31,956,876.00

28,263,950.00

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining & Oil

SME

ETF

PSEi

All Shares

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

1,470.29

8,916.22

5,479.61

2,267.88

1,864.64

12,870.47

1,470.29

8,931.26

5,484.25

2,272.07

1,877.29

12,939.46

1,438.45

8,865.7

5,422.44

2,237.62

1,864.61

12,813.36

1,438.45

8,878.7

5,427.56

2,247.26

1,867.79

12,827.4

(2.07)

(0.28)

(0.78)

(1.11)

0.21

(0.42)

(30.33)

(25.06)

(42.85)

(25.17)

3.89

(53.79)

12,891,752

76,081,225

64,032,048

129,951,250

58,453,654

730,049,455

1,000

2,550

902,733,837.68

1,182,933,755.80

675,312,953.76

1,006,897,459.00

1,171,891,754.50

124,729,569.20

11,680.00

244,490.50

5,990.32

3,669.94

5,994.45

3,672.22

5,937.51

3,641.22

5,937.51

3,643.05

(0.82)

(0.67)

(48.97)

(24.54)

1,071,462,934

5,064,755,500.44

GRAND TOTAL

Note: Sectoral and Grand Total include Main Board, Oddlot, and Block Sale transactions.

FOREIGN BUYING:

FOREIGN SELLING:

NET FOREIGN BUYING/(SELLING):

TOTAL FOREIGN:

Php 2,892,074,889.97

Php 2,774,289,957.68

Php 117,784,932.29

Php 5,666,364,847.65

Securities Under Suspension by the Exchange as of January 09 , 2014

ABC PREF

AC PREF A

ASIATRUST

CNTRL AZUCARERA

EXPORT BANK

EXPORT BANK B

FIL ESTATE CORP

FPH PREF

FILSYN A

FILSYN B

GOTESCO LAND A

GOTESCO LAND B

METROALLIANCE A

METROALLIANCE B

MAYBANK ATR KE

MARSTEEL A

MARSTEEL B

NEXTSTAGE

PICOP RES

PHILCOMSAT

PRIMETOWN PROP

ABC

ACPA

ASIA

CAT

EIBA

EIBB

FC

FPHP

FYN

FYNB

GO

GOB

MAH

MAHB

MAKE

MC

MCB

NXT

PCP

PHC

PMT

The Philippine Stock Exchange, Inc

Daily Quotations Report

January 09 , 2014

Name

PNCC

PRYCE CORP

PTT CORP

SMC PREF 1

STENIEL

TEL PREF HH

UNIWIDE HLDG

Symbol

Bid

PNC

PPC

PTT

SMCP1

STN

TLHH

UW

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

You might also like

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 06, 2015Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 06, 2015Melissa BaileyNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 24, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 24, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 02, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 02, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 14, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 14, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2014Chris DeNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 04, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 04, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 12, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 12, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 13, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 13, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2014Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014John Paul Samuel ChuaNo ratings yet

- Stockquotes 02042015 PDFDocument8 pagesStockquotes 02042015 PDFsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Ryan Samuel C. CervasNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2016J CervNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report July 26, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report July 26, 2016Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 27, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 27, 2015Art JamesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015RafaelAndreiLaMadridNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 07, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 07, 2016craftersxNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 08, 2013Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 08, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 06, 2013Document6 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 06, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report July 22, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report July 22, 2016Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report November 03, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report November 03, 2014nadonecNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNo ratings yet

- Stockquotes 08132013Document7 pagesStockquotes 08132013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report July 12, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report July 12, 2016Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 10, 2015Paul JonesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 20, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 20, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012srichardequipNo ratings yet

- Stockquotes 08122013Document7 pagesStockquotes 08122013srichardequipNo ratings yet

- Stockquotes 05202016Document8 pagesStockquotes 05202016Radney BallentosNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013srichardequipNo ratings yet

- Aid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentFrom EverandAid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Pse Anrpt2004Document55 pagesPse Anrpt2004John Paul Samuel ChuaNo ratings yet

- Conquering Frontiers Formidable: The Philippine Stock Exchange, IncDocument112 pagesConquering Frontiers Formidable: The Philippine Stock Exchange, IncJohn Paul Samuel ChuaNo ratings yet

- Pse Anrpt2010Document59 pagesPse Anrpt2010John Paul Samuel ChuaNo ratings yet

- Pse Anrpt2005Document66 pagesPse Anrpt2005John Paul Samuel ChuaNo ratings yet

- Pse Anrpt2006Document88 pagesPse Anrpt2006John Paul Samuel ChuaNo ratings yet

- PSE Annual Report 2009Document118 pagesPSE Annual Report 2009sarsijNo ratings yet

- Pse Anrpt2008Document89 pagesPse Anrpt2008John Paul Samuel ChuaNo ratings yet

- Pse Anrpt2012Document60 pagesPse Anrpt2012John Paul Samuel ChuaNo ratings yet

- Pse Anrpt2003Document51 pagesPse Anrpt2003John Paul Samuel ChuaNo ratings yet

- Pse Anrpt2007Document94 pagesPse Anrpt2007John Paul Samuel ChuaNo ratings yet

- Philippine Stock Ex: ChangeDocument36 pagesPhilippine Stock Ex: ChangeJohn Paul Samuel ChuaNo ratings yet

- Stockquotes 02112014 PDFDocument8 pagesStockquotes 02112014 PDFJohn Paul Samuel ChuaNo ratings yet

- Pse Anrpt2002Document47 pagesPse Anrpt2002John Paul Samuel ChuaNo ratings yet

- Pse Anrpt2000Document48 pagesPse Anrpt2000John Paul Samuel ChuaNo ratings yet

- Stockquotes 02042014 PDFDocument8 pagesStockquotes 02042014 PDFJohn Paul Samuel ChuaNo ratings yet

- Stockquotes 01222014Document8 pagesStockquotes 01222014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014John Paul Samuel ChuaNo ratings yet

- Stockquotes 02112014 PDFDocument8 pagesStockquotes 02112014 PDFJohn Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2014John Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014John Paul Samuel ChuaNo ratings yet

- Stockquotes 02112014 PDFDocument8 pagesStockquotes 02112014 PDFJohn Paul Samuel ChuaNo ratings yet

- Stockquotes 02112014 PDFDocument8 pagesStockquotes 02112014 PDFJohn Paul Samuel ChuaNo ratings yet

- PSEistockQuotes 01082014Document8 pagesPSEistockQuotes 01082014John Paul Samuel ChuaNo ratings yet

- Stockquotes 02112014 PDFDocument8 pagesStockquotes 02112014 PDFJohn Paul Samuel ChuaNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014John Paul Samuel ChuaNo ratings yet

- Stockquotes 02112014 PDFDocument8 pagesStockquotes 02112014 PDFJohn Paul Samuel ChuaNo ratings yet

- PSEistockQuotes 01082014Document8 pagesPSEistockQuotes 01082014John Paul Samuel ChuaNo ratings yet

- PSEistockQuotes 01082014Document8 pagesPSEistockQuotes 01082014John Paul Samuel ChuaNo ratings yet

- 3946 Mohamed Alameri ResumeDocument2 pages3946 Mohamed Alameri Resumeapi-413425549No ratings yet

- Capital Budgeting AssignmentDocument3 pagesCapital Budgeting AssignmentRobert JohnsonNo ratings yet

- Market Creation For Clean Energy Access: INSIGHTS FROM JEEVIKA-TERI PARTNERSHIP IN BIHARDocument13 pagesMarket Creation For Clean Energy Access: INSIGHTS FROM JEEVIKA-TERI PARTNERSHIP IN BIHARAnonymous WlNTUT2sVsNo ratings yet

- Century BankDocument11 pagesCentury BankBimalNo ratings yet

- HyundaiDocument6 pagesHyundaiRahul KumarNo ratings yet

- 4 Salomon V A Salomon & Co LTDDocument13 pages4 Salomon V A Salomon & Co LTDBilal RasoolNo ratings yet

- CFO VP Finance COO in New York City Resume Lilach SteinbockDocument2 pagesCFO VP Finance COO in New York City Resume Lilach SteinbockLilachSteinbockNo ratings yet

- Afs FinalDocument21 pagesAfs FinalAjit ShindeNo ratings yet

- The Case of The Unidentified Industries 2006Document4 pagesThe Case of The Unidentified Industries 2006sherry1317967% (3)

- VIETTEL Operation in Foreign CountriesDocument14 pagesVIETTEL Operation in Foreign CountriespokerfishNo ratings yet

- Ratio Analysis and Equity ValuationDocument68 pagesRatio Analysis and Equity ValuationDui Diner MusafirNo ratings yet

- Firststrike 1 PDFDocument8 pagesFirststrike 1 PDFgrigoreceliluminatNo ratings yet

- Dot Com BubbleDocument8 pagesDot Com BubbleplokijNo ratings yet

- AQA As Business Unit 2 Course CompanionDocument130 pagesAQA As Business Unit 2 Course CompanionCiaraHyndsNo ratings yet

- ICSE Mathematics Formulae Booklet 2016-2017Document23 pagesICSE Mathematics Formulae Booklet 2016-2017rakesh kushwaha50% (2)

- EY Business Plan GuideDocument24 pagesEY Business Plan GuideRakesh100% (3)

- The Securitzation of Commodities - RitterDocument6 pagesThe Securitzation of Commodities - RitterCervino InstituteNo ratings yet

- Sample Contemporary Accounting A Strategic Approach For Users 9th 9E-2 PDFDocument38 pagesSample Contemporary Accounting A Strategic Approach For Users 9th 9E-2 PDFWilliam Pinto0% (1)

- CeatdraftDocument164 pagesCeatdraftvishwanathmurkalNo ratings yet

- Coco Life Audited Financial Statement 2014Document95 pagesCoco Life Audited Financial Statement 2014Angel PortosaNo ratings yet

- The Good Life Lab - Sneak PeekDocument13 pagesThe Good Life Lab - Sneak PeekStorey PublishingNo ratings yet

- BusinessStrategyPolicy - Estee Lauder Inc Case Study (Draft 1)Document10 pagesBusinessStrategyPolicy - Estee Lauder Inc Case Study (Draft 1)Alison Morris100% (1)

- Financial Engineering ISB-UCLADocument8 pagesFinancial Engineering ISB-UCLASathiaram RamNo ratings yet

- Economic Fluctuations: The Business CycleDocument31 pagesEconomic Fluctuations: The Business Cyclegenildindi11No ratings yet

- Strama 2015Document72 pagesStrama 2015Millicent Matienzo100% (5)

- Acca F2Document3 pagesAcca F2Diana AldanovaNo ratings yet

- Investopedia ExplainsDocument28 pagesInvestopedia ExplainsPankaj JoshiNo ratings yet

- Du Pont AnalysisDocument5 pagesDu Pont AnalysisBindal HeenaNo ratings yet

- SWOT Analysis 4PDocument3 pagesSWOT Analysis 4PHaranSundaramNo ratings yet

- Ias 36Document8 pagesIas 36Muhammad MoizNo ratings yet