Professional Documents

Culture Documents

Formula Sheet Not Provided at The Exam: Discounted Cash Flow Model and All Its Variations: + +

Uploaded by

if.antunes4724Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Formula Sheet Not Provided at The Exam: Discounted Cash Flow Model and All Its Variations: + +

Uploaded by

if.antunes4724Copyright:

Available Formats

Formula sheet not provided at the exam

1. C I = d + F = OI NOA1

2. C I = NFA NFI + d 2

3. C I = NFE NFO + d 3

4. CSEt = CSEt-1 + Total Comprehensive Incomet Net payout to shareholderst 4

5. Discounted cash flow model and all its variations: 0 =

+1 +1

( )(1+ )

1 1

(1+ )

+ +

0 5

6. REt = Earningst re * CSEt-1 = (ROCEt re) * CSEt-16

7. Residual income model and all its variations: 0 = 0 +

+1

( )(1+ )

1

(1+ )

+ +

8. ROCE = RNOA + NFO/CSE * (RNOA NBC) = RNOA NFA/CSE * (RNOA

RNFA) 8

See, for example, pp. 238 and 244 in Financial Statement Analysis and Securities Valuation, Penman,

McGraw-Hill 5th Edition (i.e., textbook)

2

See, for example, p. 244 in the textbook

3

See, for example, p. 244 in the textbook

4

See, for example, p. 40 in the textbook

5

See, for example, p. 116 in the textbook

6

See, for example, pp. 145 and 147 in the textbook

7

See, for example, p. 154 in the textbook. Variations of the Residual Income model that you must learn

by heart include the Residual Operating Income model of chapter 14.

8

See, for example, pp. 366 and 368

You might also like

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet

- Financial EconometricsDocument21 pagesFinancial Econometricsandrewchen336No ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- List of 63 Useful Exam Formulas For Paper F9Document4 pagesList of 63 Useful Exam Formulas For Paper F9Muhammad Imran UmerNo ratings yet

- Bachelor'S Degree Programme 0 Term-End Examination December, 2012 Elective Course: Commerce Eco-1: Business OrganisationDocument4 pagesBachelor'S Degree Programme 0 Term-End Examination December, 2012 Elective Course: Commerce Eco-1: Business OrganisationRohit GhuseNo ratings yet

- Tutorial 8, Multifactor Experiments Partialy Replicated SolDocument5 pagesTutorial 8, Multifactor Experiments Partialy Replicated SoligeNo ratings yet

- Notice - Final ExamDocument13 pagesNotice - Final ExamNicoleNo ratings yet

- Financial Economic Theory and Engineering Formula Sheet 2011Document22 pagesFinancial Economic Theory and Engineering Formula Sheet 2011cass700No ratings yet

- t1 2020 Tfin202 Sample Final ExamDocument4 pagest1 2020 Tfin202 Sample Final ExamSravya MagantiNo ratings yet

- Sarah Scaife Foundation 251113452 2005 02496419searchableDocument47 pagesSarah Scaife Foundation 251113452 2005 02496419searchablecmf8926No ratings yet

- MCO-3 June13Document6 pagesMCO-3 June13BinayKPNo ratings yet

- FormulasDocument7 pagesFormulaskasimgenelNo ratings yet

- Bachelor'S Degree ProgrammeDocument6 pagesBachelor'S Degree ProgrammeSougata ChattopadhyayNo ratings yet

- IandF CT8 201609 ExaminersReportDocument17 pagesIandF CT8 201609 ExaminersReportAnonymous k7TK4e4No ratings yet

- MCR3U - Mr. Santowski: SS.02.1 - Simple Interest, Arithmetic Sequences and Linear GrowthDocument8 pagesMCR3U - Mr. Santowski: SS.02.1 - Simple Interest, Arithmetic Sequences and Linear GrowthlaubrantleyNo ratings yet

- Lecture 2 - How Time and Interest Affect MoneyDocument50 pagesLecture 2 - How Time and Interest Affect MoneyDanar AdityaNo ratings yet

- Bachelor'S Degree Programme: Term-End Examination December, 2011 Elective Course: Commerce Eco-13: Business EnvironmentDocument4 pagesBachelor'S Degree Programme: Term-End Examination December, 2011 Elective Course: Commerce Eco-13: Business Environmentstruggling survivorNo ratings yet

- ECO-9 (Dec-2019)Document6 pagesECO-9 (Dec-2019)Sudarshan BhatNo ratings yet

- Bachelor'S Degree Programme Term-End Examination December, 2015 Elective Course: CommerceDocument4 pagesBachelor'S Degree Programme Term-End Examination December, 2015 Elective Course: CommerceManoj PandayNo ratings yet

- Chapter 11 - Test BankDocument86 pagesChapter 11 - Test Bankمحمد عقابنةNo ratings yet

- Bachelot (S Degree PR Ogt (Amme: Leco-G IDocument8 pagesBachelot (S Degree PR Ogt (Amme: Leco-G Ibiresh321No ratings yet

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocument6 pagesFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNo ratings yet

- Pages: 11 Bachelor'S Degree Programme Term-End Examination December, 2012 Elective Course: Commerce Eco-7: Elements of StatisticsDocument10 pagesPages: 11 Bachelor'S Degree Programme Term-End Examination December, 2012 Elective Course: Commerce Eco-7: Elements of StatisticsRohit GhuseNo ratings yet

- Time: 2 Hours Maximum Marks: 50 Note: The Paper Contains THREE Sections A, B, C. Instructions Are Given in Each Section Alongwith MarksDocument6 pagesTime: 2 Hours Maximum Marks: 50 Note: The Paper Contains THREE Sections A, B, C. Instructions Are Given in Each Section Alongwith MarksRohit GhuseNo ratings yet

- Time: 2 Hours Maximum Marks: 50 Note: The Paper Contains THREE Sections A, B, C. Instructions Are Given in Each Section Alongwith MarksDocument6 pagesTime: 2 Hours Maximum Marks: 50 Note: The Paper Contains THREE Sections A, B, C. Instructions Are Given in Each Section Alongwith MarksRohit GhuseNo ratings yet

- Economic Equivalence Involving InterestDocument3 pagesEconomic Equivalence Involving Interestmiang.gabriel0928No ratings yet

- Chapter 4 Risk and ReturnDocument25 pagesChapter 4 Risk and Returnsharktale2828No ratings yet

- CSC 1101 Assignment 1Document16 pagesCSC 1101 Assignment 1cl8810No ratings yet

- ECO-13 I Bachelor'S Degree Programme Term-End Examination, December 2019 Elective Course: COMMERCE Eco-13: Business EnvironmentDocument4 pagesECO-13 I Bachelor'S Degree Programme Term-End Examination, December 2019 Elective Course: COMMERCE Eco-13: Business EnvironmentashishNo ratings yet

- Term-End Examination C/1 CD December, 2012 Elective Course: Commerce Eco-10: Elements of CostingDocument8 pagesTerm-End Examination C/1 CD December, 2012 Elective Course: Commerce Eco-10: Elements of CostingRohit GhuseNo ratings yet

- Factored Loads: Longitudinal SectionDocument2 pagesFactored Loads: Longitudinal SectionStephen Harold RayosoNo ratings yet

- Honors Algebra 2-Logs and Exponents Review Guide KEYDocument4 pagesHonors Algebra 2-Logs and Exponents Review Guide KEYb100% (1)

- ECO-2-D11 - Compressed PDFDocument6 pagesECO-2-D11 - Compressed PDFAkshay kumarNo ratings yet

- Eco 6Document4 pagesEco 6Rohit GhuseNo ratings yet

- Extra StuffDocument34 pagesExtra StuffNikita MohiteNo ratings yet

- MATH104 Midterm 2013W1Document9 pagesMATH104 Midterm 2013W1examkillerNo ratings yet

- Mco 05Document8 pagesMco 05rammar147No ratings yet

- Solución de La Segunda Práctica de Econometria Ii: Universidad Nacional de Piura Facultad de EconomiaDocument3 pagesSolución de La Segunda Práctica de Econometria Ii: Universidad Nacional de Piura Facultad de EconomiaSergio SaavedraNo ratings yet

- Semmler 2005Document16 pagesSemmler 2005Anonymous sGLwiwMA4No ratings yet

- David Bares LakevilleDocument5 pagesDavid Bares LakevilleLocalTransparencyNo ratings yet

- M459 Unit-01 SampleDocument32 pagesM459 Unit-01 SamplepedroNo ratings yet

- Manipulating Present Value FormulasDocument2 pagesManipulating Present Value FormulasMaricarmen FloresNo ratings yet

- Financial Analysis, Planning and Forecasting Theory and ApplicationDocument43 pagesFinancial Analysis, Planning and Forecasting Theory and ApplicationErnestaUlytėNo ratings yet

- MAT ReportDocument25 pagesMAT ReportZunaeid Mahmud LamNo ratings yet

- Bachelor'S Degree Programme: Time: 2 Hours Maximum Marks: 50 (Weightage 70 %) Note: Attempt Both Part - A and PartDocument4 pagesBachelor'S Degree Programme: Time: 2 Hours Maximum Marks: 50 (Weightage 70 %) Note: Attempt Both Part - A and PartSougata ChattopadhyayNo ratings yet

- Principles of Engineering EconomicsDocument17 pagesPrinciples of Engineering EconomicsbestnazirNo ratings yet

- Eco 12Document4 pagesEco 12Joel PowerNo ratings yet

- Formula SheetDocument3 pagesFormula SheetjainswapnilNo ratings yet

- Bachelor'S Degree ProgrammeDocument4 pagesBachelor'S Degree ProgrammeSougata ChattopadhyayNo ratings yet

- Bachelor'S Degree Programme: Time: 2 Hours Maximum Marks: 50 (Weightage 70 %)Document4 pagesBachelor'S Degree Programme: Time: 2 Hours Maximum Marks: 50 (Weightage 70 %)Sougata ChattopadhyayNo ratings yet

- ECO 1 Dec 2014 PDFDocument4 pagesECO 1 Dec 2014 PDFAnukrati JainNo ratings yet

- Damodaran On Valuation Lect5Document7 pagesDamodaran On Valuation Lect5Keshav KhannaNo ratings yet

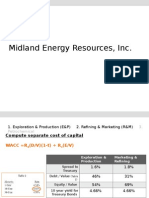

- Midland Energy Resources, IncDocument10 pagesMidland Energy Resources, IncAnshulSharmaNo ratings yet

- Compulsory.: Bachelor'S Degree Programme Term-End Examination June, 2010 Cni C) (Application Oriented Course)Document4 pagesCompulsory.: Bachelor'S Degree Programme Term-End Examination June, 2010 Cni C) (Application Oriented Course)riyaNo ratings yet

- Formulas To LearnDocument3 pagesFormulas To LearnHuệ LêNo ratings yet

- Engineering Economics - The PrinciplesDocument31 pagesEngineering Economics - The Principlesking.jabamanNo ratings yet

- Mass Transfer OperationDocument11 pagesMass Transfer OperationFebryan CaesarNo ratings yet

- Engineering Economy 1 (MNG 151) ديزوبأ سابع ىنسح / دDocument45 pagesEngineering Economy 1 (MNG 151) ديزوبأ سابع ىنسح / دRommelBaldagoNo ratings yet

- Britannia - Production FunctionDocument9 pagesBritannia - Production FunctionAnkitMehan100% (1)