Professional Documents

Culture Documents

Income Tax Return: Annex 2 Calculation of Tax For Entities

Uploaded by

Artha SarokarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Return: Annex 2 Calculation of Tax For Entities

Uploaded by

Artha SarokarCopyright:

Available Formats

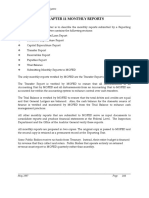

Form Income Tax-D-11-03-0162

INCOME TAX RETURN

ANNEX 2

CALCULATION OF TAX FOR ENTITIES

Fiscal Year: ______________________________________

Estimate Return

Revised Estimate Return

IRO Name __________________________________________________

Jeopardy Assessment Return as per Income Tax Act 2002, Section 96.5

Tax Assessment Return

Review/Appeal

Instalment Revision, Jeopardy Assessment, Amended Assessment

TAXPAYER DETAILS

PAN

Name

TAX CALCULATION TABLE

Type of Income

Inclusions

Income (or Loss)

Assessable Income

Donations to

Exempt Organisations

Taxable Income

Columns D-E

Tax Rate

(in %)

Concession

(in %)

Tax Liability

Columns F*G*H

Foreign Taxes paid

current FY

Foreign Tax Credits

from previous FYs

Foreign Tax Credits

used

Net Tax Liability

NEPAL SOURCE INCOME

2

Income from Business

Income from Investment

SUBTOTAL OF COLUMNS B-D

Rows 2+3

Income from Business

of different Tax Rate

Income from Business

of different Tax Rate

Loss from the Disposal of Business Assets

4

5

6

7

8

25%

Exempt Income

SUBTOTAL

Rows 4+5+6+7+8

FOREIGN SOURCE INCOME OF RESIDENTS

Income from Business

10

st

1 Country:

Income from Investment

11

st

1 Country:

SUBTOTAL OF COLUMNS B-D

12

Rows 10+12

Income from Banking & Insurance

13

st

1 Country

Loss from the Disposal of Business As14

sets

SUBTOTAL

15

Rows 13+14

Income from Business

16

nd

2 Country:

Income from Investment

17

nd

2 Country:

SUBTOTAL OF COLUMNS B-D

18

Rows 16-17

Income from Banking & Insurance

19

nd

2 Country

Loss from the Disposal of Business As20

sets

SUBTOTAL

21

Rows 18+19 +20

9

22

Repatriated Income

23

TOTAL

Rows 9+15+21+22

25%

30%

25%

30%

10%

TAXPAYER CERTIFICATION

Signature Taxpayer/Representative

Signature Auditor

Date

Date

***For Instructions, read Brochure Income Tax Forms Instructions***

Page 1 of 1

You might also like

- Income Tax Return: Annex 1 Calculation of Tax For IndividualsDocument1 pageIncome Tax Return: Annex 1 Calculation of Tax For IndividualsknmodiNo ratings yet

- Annex6 IncomefromEmployment (IncomeTax D 16-02-0860) English1172014100110AMDocument1 pageAnnex6 IncomefromEmployment (IncomeTax D 16-02-0860) English1172014100110AMArtha SarokarNo ratings yet

- Tax - Guides For IndividualDocument85 pagesTax - Guides For IndividualViki VaishaviNo ratings yet

- Philippine Economic Zone Authority: Republic of The PhilippinesDocument2 pagesPhilippine Economic Zone Authority: Republic of The PhilippinesPaul GeorgeNo ratings yet

- IRS Fiduciary Income Tax Returns - 12fd02Document12 pagesIRS Fiduciary Income Tax Returns - 12fd02bdlimmNo ratings yet

- Individual Income Tax ReturnDocument2 pagesIndividual Income Tax ReturnMNCOOhioNo ratings yet

- Annex7 IncomefromInvestment (IncomeTax D 17-02-0860) English1172014100110AMDocument1 pageAnnex7 IncomefromInvestment (IncomeTax D 17-02-0860) English1172014100110AMArtha SarokarNo ratings yet

- B2011 Guidebook 2 PDFDocument175 pagesB2011 Guidebook 2 PDFRkakie KlaimNo ratings yet

- Annex5 IncomefromBusiness (IncomeTax D 15-02-0860) English1172014100110AMDocument1 pageAnnex5 IncomefromBusiness (IncomeTax D 15-02-0860) English1172014100110AMArtha SarokarNo ratings yet

- Business Tax and Tax Planning Very RelevantDocument106 pagesBusiness Tax and Tax Planning Very RelevantGracie KiarieNo ratings yet

- Manual 3 Federal Accounting System Chapter 11. Monthly ReportsDocument32 pagesManual 3 Federal Accounting System Chapter 11. Monthly ReportsKumera Dinkisa ToleraNo ratings yet

- EFG Chapter 4Document13 pagesEFG Chapter 4Kal KalNo ratings yet

- Manual 3 Federal Accounting System Chapter 11. Monthly ReportsDocument38 pagesManual 3 Federal Accounting System Chapter 11. Monthly ReportsalemayehuNo ratings yet

- Securities and Exchange Commission (SEC) - Formx-17a-5 3Document2 pagesSecurities and Exchange Commission (SEC) - Formx-17a-5 3highfinanceNo ratings yet

- 05 System ViewDocument142 pages05 System ViewutkarshNo ratings yet

- Chapter 4 Prepating Financial ReportsDocument18 pagesChapter 4 Prepating Financial ReportsGedion100% (1)

- Chapter 3/unit 4 Review Sheet 4/preparing The Income StatementDocument2 pagesChapter 3/unit 4 Review Sheet 4/preparing The Income Statementkamaljeet kaurNo ratings yet

- Acct 557Document5 pagesAcct 557kihumbae100% (4)

- LBP Form 9Document1 pageLBP Form 9Jerald MirandaNo ratings yet

- Letter of Acceptance - 2015 (Form C - F - D v1.03)Document1 pageLetter of Acceptance - 2015 (Form C - F - D v1.03)Andy Cheng YCNo ratings yet

- Acc 109 - P3 Quiz Cash Flows and Accounting For Errors StudentsDocument6 pagesAcc 109 - P3 Quiz Cash Flows and Accounting For Errors StudentsJonela VintayenNo ratings yet

- FOIIDocument1 pageFOIINadra DanwerNo ratings yet

- Test Bank Ques - 4Document6 pagesTest Bank Ques - 4MahfuzulNo ratings yet

- Form12 ADocument2 pagesForm12 AMohan RajkumarNo ratings yet

- Petty Cash Paid-Out FormDocument1 pagePetty Cash Paid-Out FormMayo de la PazNo ratings yet

- 2012 Building Intl Bridges (03!28!2013)Document17 pages2012 Building Intl Bridges (03!28!2013)Jk McCreaNo ratings yet

- Sample Protest LetterDocument2 pagesSample Protest LetterConsciousness Vivid100% (1)

- Sample Protest LetterDocument2 pagesSample Protest LetterLyceum WebinarNo ratings yet

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns Onlinepdizypdizy0% (1)

- Section24-Prior Year Salary OverpaymentsDocument8 pagesSection24-Prior Year Salary OverpaymentsP45 TesterNo ratings yet

- Securities and Exchange Commission (SEC) - Formn-27d-1Document2 pagesSecurities and Exchange Commission (SEC) - Formn-27d-1highfinanceNo ratings yet

- CH 02Document30 pagesCH 02AhsanNo ratings yet

- VAT Return 2015 SAP LibraryDocument17 pagesVAT Return 2015 SAP LibraryTatyana KosarevaNo ratings yet

- Financial InformationDocument2 pagesFinancial Informationeprints cebuNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- TP 1.r V (2012 01) d8Document2 pagesTP 1.r V (2012 01) d8Liviu FerariuNo ratings yet

- Annexure Gstam-ViiiDocument17 pagesAnnexure Gstam-ViiiHarsh ManiNo ratings yet

- Vat Relief Bir Transmittal Form Annex A 1Document1 pageVat Relief Bir Transmittal Form Annex A 1Gil DelenaNo ratings yet

- JCSD Investor Instruction Form Revised November 2022Document2 pagesJCSD Investor Instruction Form Revised November 2022kenrick mitchellNo ratings yet

- Integration Test Cases: Test Scenario NO: FM - 08Document2 pagesIntegration Test Cases: Test Scenario NO: FM - 08joseph davidNo ratings yet

- BFE Local Taxi ExepensesDocument15 pagesBFE Local Taxi ExepensesNantukina TeshomeNo ratings yet

- sd13 Using Income Tax InformationDocument9 pagessd13 Using Income Tax InformationAngela JoyceNo ratings yet

- C2012 Guidebook 2Document144 pagesC2012 Guidebook 2Selva Bavani SelwaduraiNo ratings yet

- Claim Voucher Form (SAP Computerised System) : Account CodeDocument3 pagesClaim Voucher Form (SAP Computerised System) : Account CodeHayat RahiNo ratings yet

- Tds NotesDocument15 pagesTds NotesnaysarNo ratings yet

- WK4 Abm2 QuizDocument2 pagesWK4 Abm2 QuizMelanie MirandaNo ratings yet

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- Rsm324 Week 1Document18 pagesRsm324 Week 1Rudy GuNo ratings yet

- Financial Analysis Sample (Excel File)Document6 pagesFinancial Analysis Sample (Excel File)YL GohNo ratings yet

- Elt122 1Document73 pagesElt122 1JsmnvllaNo ratings yet

- CINDocument74 pagesCINJanki RawatNo ratings yet

- United States Securities and Exchange Commission Washington, D.C. 20549 Form 1-K General Instructions A. Rules As To Use of Form 1-KDocument6 pagesUnited States Securities and Exchange Commission Washington, D.C. 20549 Form 1-K General Instructions A. Rules As To Use of Form 1-KJavier JRNo ratings yet

- Chapter 16 QuizDocument3 pagesChapter 16 Quizbeckkl05No ratings yet

- DR0112X 2023Document7 pagesDR0112X 2023y.zdrazhevskayaNo ratings yet

- Report Formats BranchesDocument104 pagesReport Formats Branchesabayineh dinkuNo ratings yet

- Ch. 1 Introduction To TaxationDocument14 pagesCh. 1 Introduction To TaxationYousef M. Aqel100% (1)

- Vat 213Document2 pagesVat 213Sridhar EluvakaNo ratings yet

- Application For Permanent Account Number (Pan)Document4 pagesApplication For Permanent Account Number (Pan)Artha SarokarNo ratings yet

- Income Tax Return: 1 Taxpayer DetailsDocument2 pagesIncome Tax Return: 1 Taxpayer DetailsArtha SarokarNo ratings yet

- Income Tax Return: 1 Taxpayer DetailsDocument2 pagesIncome Tax Return: 1 Taxpayer DetailsArtha SarokarNo ratings yet

- Income Tax Return: 1 Taxpayer DetailsDocument2 pagesIncome Tax Return: 1 Taxpayer DetailsArtha SarokarNo ratings yet

- In Come Tax D 0401738302016123223 PMDocument2 pagesIn Come Tax D 0401738302016123223 PMArtha SarokarNo ratings yet

- BranchDetails (English) 1172014102329AMDocument1 pageBranchDetails (English) 1172014102329AMArtha SarokarNo ratings yet

- Sfa' JFLX/SF) Kl/L:Yltdf B:T'/ LDGXF Dagwl LGJ) BG: CG' "RL - 13Document1 pageSfa' JFLX/SF) Kl/L:Yltdf B:T'/ LDGXF Dagwl LGJ) BG: CG' "RL - 13Artha SarokarNo ratings yet

- PartnerIdentification (English) 1172014102329AMDocument1 pagePartnerIdentification (English) 1172014102329AMArtha SarokarNo ratings yet

- Income Tax Return: 1 Taxpayer DetailsDocument2 pagesIncome Tax Return: 1 Taxpayer DetailsArtha SarokarNo ratings yet

- Annual Remuneration Return 1172014100110 AmDocument1 pageAnnual Remuneration Return 1172014100110 AmknmodiNo ratings yet

- Annex11 MedicalTaxCreditClaim (IncomeTax C 02-03-0162) English1172014100110AMDocument1 pageAnnex11 MedicalTaxCreditClaim (IncomeTax C 02-03-0162) English1172014100110AMArtha SarokarNo ratings yet

- Annex5 IncomefromBusiness (IncomeTax D 15-02-0860) English1172014100110AMDocument1 pageAnnex5 IncomefromBusiness (IncomeTax D 15-02-0860) English1172014100110AMArtha SarokarNo ratings yet

- Annex9 RepatriatedIncome (IncomeTax D 19-01-0262) 1172014100110AMDocument1 pageAnnex9 RepatriatedIncome (IncomeTax D 19-01-0262) 1172014100110AMArtha SarokarNo ratings yet

- Annex7 IncomefromInvestment (IncomeTax D 17-02-0860) English1172014100110AMDocument1 pageAnnex7 IncomefromInvestment (IncomeTax D 17-02-0860) English1172014100110AMArtha SarokarNo ratings yet

- Annual Remuneration Return Instruction 1172014100110 AmDocument1 pageAnnual Remuneration Return Instruction 1172014100110 AmArtha SarokarNo ratings yet

- Annex1 CalculationofTaxforIndividuals (IncomeTax D 10-04-0762) Nepali1172014100109AMDocument1 pageAnnex1 CalculationofTaxforIndividuals (IncomeTax D 10-04-0762) Nepali1172014100109AMArtha SarokarNo ratings yet

- Rent Tax Form7152015 105329 AMDocument1 pageRent Tax Form7152015 105329 AMArtha SarokarNo ratings yet

- KF"RF) + /fli6 O S/ LBJ Ejotfsf Fy DKGG: /FH:J +SNG $ K - LTZTN) J (L4Document20 pagesKF"RF) + /fli6 O S/ LBJ Ejotfsf Fy DKGG: /FH:J +SNG $ K - LTZTN) J (L4Artha SarokarNo ratings yet

- CFGTL/S /FH:J Sfof (Nox?Sf) Lg/Lif0FDocument12 pagesCFGTL/S /FH:J Sfof (Nox?Sf) Lg/Lif0FArtha SarokarNo ratings yet

- Annex2 CalculationofTaxforEntities (IncomeTax D 01-04-0762) Nepali1172014100109AMDocument1 pageAnnex2 CalculationofTaxforEntities (IncomeTax D 01-04-0762) Nepali1172014100109AMArtha SarokarNo ratings yet

- "RGF CFBFG K - BFG Ug) ( Demf) TF: /FH:J +SNG $% K - LTZTN) J (l4Document12 pages"RGF CFBFG K - BFG Ug) ( Demf) TF: /FH:J +SNG $% K - LTZTN) J (l4Artha SarokarNo ratings yet

- Sfo ( DKFBG Demf) TF DKGG: /FH:J +SNG # K - LTZTN) J (L4Document12 pagesSfo ( DKFBG Demf) TF DKGG: /FH:J +SNG # K - LTZTN) J (L4Artha SarokarNo ratings yet

- CFGTL/S /FH:J Ljefu / /SF/L Jlsnalr CGTLQM (OfDocument12 pagesCFGTL/S /FH:J Ljefu / /SF/L Jlsnalr CGTLQM (OfArtha SarokarNo ratings yet

- Fs (:T/Lo S/ Dagwl ) LDGF/ DKGG: /FH:J +SNG @ K - LTZTN) J (L4Document12 pagesFs (:T/Lo S/ Dagwl ) LDGF/ DKGG: /FH:J +SNG @ K - LTZTN) J (L4Artha SarokarNo ratings yet

- Dfgglo PKK - WFGDGQL Tyf Cy (DGQL S (I0Faxfb'/ Dx/F4F/F: CFGTL/S /FH:J Ljefusf) Lg/Lif0FDocument12 pagesDfgglo PKK - WFGDGQL Tyf Cy (DGQL S (I0Faxfb'/ Dx/F4F/F: CFGTL/S /FH:J Ljefusf) Lg/Lif0FArtha SarokarNo ratings yet

- @! A'"B) 3F) If0Ffkq HF/L Ub) (Joj:Yfkg Uf) I7L DKGG: /FH:J +SNG @! K - LTZTN) J (L4Document12 pages@! A'"B) 3F) If0Ffkq HF/L Ub) (Joj:Yfkg Uf) I7L DKGG: /FH:J +SNG @! K - LTZTN) J (L4Artha SarokarNo ratings yet

- Sfo ( DKFBG Demf) TF DKGG: Ljefu Cgtu (TSF J) Sfof (Nox?AlrDocument16 pagesSfo ( DKFBG Demf) TF DKGG: Ljefu Cgtu (TSF J) Sfof (Nox?AlrArtha SarokarNo ratings yet