Professional Documents

Culture Documents

Annex6 IncomefromEmployment (IncomeTax D 16-02-0860) English1172014100110AM

Uploaded by

Artha Sarokar0 ratings0% found this document useful (0 votes)

19 views1 pageAnnex6 IncomefromEmployment(IncomeTax D 16-02-0860)English1172014100110AM

Original Title

Annex6 IncomefromEmployment(IncomeTax D 16-02-0860)English1172014100110AM

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAnnex6 IncomefromEmployment(IncomeTax D 16-02-0860)English1172014100110AM

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views1 pageAnnex6 IncomefromEmployment (IncomeTax D 16-02-0860) English1172014100110AM

Uploaded by

Artha SarokarAnnex6 IncomefromEmployment(IncomeTax D 16-02-0860)English1172014100110AM

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

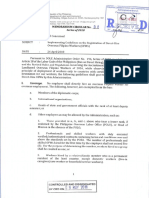

Form Income Tax-D-16-02-0860

INCOME TAX RETURN

ANNEX 6

INCOME FROM EMPLOYMENT

Fiscal Year: ________________________________

IRO Name __________________________________________________

Source Country (if other than Nepal): _____________________________

Estimate Return

Revised Estimate Return

Self-Assessment Return as per Income Tax Act 2002, Section 96.5

Final Self-Assessment Return

Review/Appeal

Instalment Revision, Jeopardy / Amended Assessment

TAXPAYER DETAILS

PAN

Name

CALCULATION OF REMUNERATION

REMUNERATION FROM EMPLOYMENT FOR THIS INCOME YEAR

1

Salary and Wages (Section 8.2.a)

Leave Pay (Section 8.2.a)

Over Time Payment (Section 8.2.a)

Fees (Section 8.2.a)

Prizes, Gifts (Section 8.2.a)

Bonuses (Section 8.2.a)

Payment for other Facilitations (Section 8.2.a)

Commissions (Section 8.2.a)

Dearness Allowances (Section 8.2.a)

Amount

10

Cost of Living Allowances (Section 8.2.a)

11

Rent Allowances (Section 8.2.b)

12

Entertainment and Transportation Allowances (Section 8.2.b)

13

Other personal Allowances (Section 8.2.b)

14

Discharge or Reimbursements of personal Costs (Section 8.2.c)

15

Payment to the Agreement to any Conditions of the Employment (Section 8.2.d)

16

Payment for Redundancy or Loss or Termination of the Employment (Section 8.2.e)

17

Retirement Contributions and Retirement Payments (Section 8.2.f)

18

Other Payments made in Respect of the Employment (Section 8.2.g)

19

Fringe Benefit for Vehicle Facility (Section 27.1.b.1)

20

Fringe Benefit for House Facility (Section 27.1.b.2)

21

Fringe Benefit for Housekeeper, Chauffeur, Gardener, or other domestic Assistant (Section 27.1.c.1)

22

Fringe Benefit for any Meal, Refreshment, or Entertainment (Section 27.1.c.2)

23

Fringe Benefit for Drinking Water, Electricity, Telephone, and similar Utilities (Section 27.1.c.3)

24

Difference of actual Interest and Interest as per Market Rate in Case of a Soft Loan (Section 25.1.d)

25

Other Amounts to be included in remuneration (as per attached List)

26

TOTAL of Lines 1 to 25

Put row 26 into column 2 of the rows of the tax calculation table where you fill in the income from employment.

TAXPAYER / TAX OFFICER CERTIFICATION

Taxpayer

Tax Officer

Signature Taxpayer/Representative

Signature Tax Officer

Date

Date

Signature Auditor

Date

***For Instructions, read Brochure Income Tax Forms Instructions***

Page 1 of 1

You might also like

- Income Tax Return: 1 Taxpayer DetailsDocument2 pagesIncome Tax Return: 1 Taxpayer DetailsArtha SarokarNo ratings yet

- Income Tax Return: Annex 2 Calculation of Tax For EntitiesDocument1 pageIncome Tax Return: Annex 2 Calculation of Tax For EntitiesArtha SarokarNo ratings yet

- Calculate your income tax with this formDocument1 pageCalculate your income tax with this formknmodiNo ratings yet

- Individual Income Tax ReturnDocument2 pagesIndividual Income Tax ReturnMNCOOhioNo ratings yet

- FORM NO. 16" (See Rule 31 (1) (A) : B) CGEGIS/Group Insurance: C) SpbyDocument6 pagesFORM NO. 16" (See Rule 31 (1) (A) : B) CGEGIS/Group Insurance: C) SpbyHem Ch DeuriNo ratings yet

- Income Tax Declaration Form 2022-2023Document2 pagesIncome Tax Declaration Form 2022-2023ARUN CHAUHANNo ratings yet

- Annex7 IncomefromInvestment (IncomeTax D 17-02-0860) English1172014100110AMDocument1 pageAnnex7 IncomefromInvestment (IncomeTax D 17-02-0860) English1172014100110AMArtha SarokarNo ratings yet

- Annex5 IncomefromBusiness (IncomeTax D 15-02-0860) English1172014100110AMDocument1 pageAnnex5 IncomefromBusiness (IncomeTax D 15-02-0860) English1172014100110AMArtha SarokarNo ratings yet

- POLICY SERVICING REQUEST 2 - With StandardDocument3 pagesPOLICY SERVICING REQUEST 2 - With Standardsarwar shamsNo ratings yet

- Certificate of Collection or Deduction of Tax: (See Rule 42)Document1 pageCertificate of Collection or Deduction of Tax: (See Rule 42)Ali ButtNo ratings yet

- SBIapplicationformDocument5 pagesSBIapplicationformSufi DarweshNo ratings yet

- Financial QuestionnaireDocument4 pagesFinancial QuestionnairePankajNo ratings yet

- Hemarus Industries Income Tax Declaration Form SummaryDocument4 pagesHemarus Industries Income Tax Declaration Form SummaryShashi NaganurNo ratings yet

- Last Pay CertificateDocument2 pagesLast Pay Certificateankita.nigam3112No ratings yet

- Application For Abatement or Cancellation of Tax, Penalties And/or Interest Under Rev. Reg. No.Document2 pagesApplication For Abatement or Cancellation of Tax, Penalties And/or Interest Under Rev. Reg. No.anamergalNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- 145905Document1 page145905Tarun GodiyalNo ratings yet

- The Revised VAT Forms, Which Are Now Operative Under The Punjab VAT Act & Rules, 2005Document6 pagesThe Revised VAT Forms, Which Are Now Operative Under The Punjab VAT Act & Rules, 2005Dinamite ThestrikerNo ratings yet

- MC 08 2018Document8 pagesMC 08 2018genevieve santosNo ratings yet

- Salary Deduction Certificate Us 149 FormatDocument1 pageSalary Deduction Certificate Us 149 FormatAbdul Qadir Inventory ContollerNo ratings yet

- PDF 934654820260123Document1 pagePDF 934654820260123Sanjay SabharwalNo ratings yet

- Income Tax Declaration FormDocument3 pagesIncome Tax Declaration Formnagrat27No ratings yet

- Multipurpose FormDocument1 pageMultipurpose Formcustodian.archiveNo ratings yet

- FOIIDocument1 pageFOIINadra DanwerNo ratings yet

- Tax - Guides For IndividualDocument85 pagesTax - Guides For IndividualViki VaishaviNo ratings yet

- Final Compution of Income Tax 2008-09Document2 pagesFinal Compution of Income Tax 2008-09Vimal Patel100% (4)

- GPF PDFDocument24 pagesGPF PDFHimanshuKaushikNo ratings yet

- Circular / Office OrderDocument10 pagesCircular / Office OrderrockyrrNo ratings yet

- AY 2005-06 Saral Form 2DDocument2 pagesAY 2005-06 Saral Form 2DVinod VarmaNo ratings yet

- New Company Registration Online Guide: WWW - Cipc.co - ZaDocument25 pagesNew Company Registration Online Guide: WWW - Cipc.co - ZaSasha OhlmsNo ratings yet

- Tax Return Form Traders 2015-2018Document1 pageTax Return Form Traders 2015-2018Salman KhalidNo ratings yet

- The Payment of Bonus Act Annual ReturnDocument4 pagesThe Payment of Bonus Act Annual ReturnNasir AhmedNo ratings yet

- Subject: Demand of C-Forms As Per The Relevant Provisions of CENTRAL SALES TAX, 1956 (CST) PENDING FOR THE YEARDocument2 pagesSubject: Demand of C-Forms As Per The Relevant Provisions of CENTRAL SALES TAX, 1956 (CST) PENDING FOR THE YEARveena sharmaNo ratings yet

- Form 121Document3 pagesForm 121aks.heerani.akNo ratings yet

- BFE Local Taxi ExepensesDocument15 pagesBFE Local Taxi ExepensesNantukina TeshomeNo ratings yet

- FORM-13 - Transfer of EPFDocument2 pagesFORM-13 - Transfer of EPFravichandraNo ratings yet

- PTCL Vendor Registration FormDocument30 pagesPTCL Vendor Registration FormHarisAslam100% (1)

- Pilot Pilot Fata Examination: (Before Filling Up The Application Form, Please Read CAR Section 7 Series B Part I)Document1 pagePilot Pilot Fata Examination: (Before Filling Up The Application Form, Please Read CAR Section 7 Series B Part I)Suraz AleyNo ratings yet

- DAR+ +LUC+FORM+J+ +Assessment+of+Performance+Bond+(as+of+13Aug2019)Document1 pageDAR+ +LUC+FORM+J+ +Assessment+of+Performance+Bond+(as+of+13Aug2019)Blessy BaldeoNo ratings yet

- Staff Settlement Form - NewDocument9 pagesStaff Settlement Form - NewBaban GaigoleNo ratings yet

- Branch Office - Dholewal - : 4a.notional Concessions For 6 MonthsDocument7 pagesBranch Office - Dholewal - : 4a.notional Concessions For 6 Monthsifb.ludhianaNo ratings yet

- ACC 109 QUIZ: CASH FLOWS, ERRORS AND EVENTSDocument6 pagesACC 109 QUIZ: CASH FLOWS, ERRORS AND EVENTSJonela VintayenNo ratings yet

- INCOMEDocument6 pagesINCOMEMaris Joy BartolomeNo ratings yet

- PDF 979375070110323Document1 pagePDF 979375070110323Aditi GoelNo ratings yet

- TABLESDocument6 pagesTABLESLouise jedNo ratings yet

- Payroll Format 1Document1 pagePayroll Format 1Synchrotek CorporationNo ratings yet

- APTC form-40-A-GPFDocument2 pagesAPTC form-40-A-GPFvijay_dilse100% (1)

- Ruling: Before The Authority For Advance Rulings (Income Tax) New Delhi PresentDocument31 pagesRuling: Before The Authority For Advance Rulings (Income Tax) New Delhi PresentSushil GuptaNo ratings yet

- Declaration TDS On SalaryDocument4 pagesDeclaration TDS On SalaryCharles WeberNo ratings yet

- Section24-Prior Year Salary OverpaymentsDocument8 pagesSection24-Prior Year Salary OverpaymentsP45 TesterNo ratings yet

- Questionnaire For Business Review: Gregory Scot WestDocument3 pagesQuestionnaire For Business Review: Gregory Scot WestBen WongNo ratings yet

- Financial InformationDocument2 pagesFinancial Informationeprints cebuNo ratings yet

- Application of An Existing Partnership To Do Business Under The Foreign Investments Act of 1991Document3 pagesApplication of An Existing Partnership To Do Business Under The Foreign Investments Act of 1991Althaea Rose B. RamosNo ratings yet

- SINDA Fund Opt-Out Form PDFDocument1 pageSINDA Fund Opt-Out Form PDFeric0% (9)

- PAYE Return SampleDocument42 pagesPAYE Return Sampleoyesigye DennisNo ratings yet

- Arn EuinDocument1 pageArn EuinharshitNo ratings yet

- All About GST Annual ReturnsDocument9 pagesAll About GST Annual ReturnsinfoNo ratings yet

- J.K. Lasser's Small Business Taxes 2024: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2024: Your Complete Guide to a Better Bottom LineNo ratings yet

- BranchDetails (English) 1172014102329AMDocument1 pageBranchDetails (English) 1172014102329AMArtha SarokarNo ratings yet

- Sfa' JFLX/SF) Kl/L:Yltdf B:T'/ LDGXF Dagwl LGJ) BG: CG' "RL - 13Document1 pageSfa' JFLX/SF) Kl/L:Yltdf B:T'/ LDGXF Dagwl LGJ) BG: CG' "RL - 13Artha SarokarNo ratings yet

- Application For Permanent Account Number (Pan)Document4 pagesApplication For Permanent Account Number (Pan)Artha SarokarNo ratings yet

- Income Tax Return: 1 Taxpayer DetailsDocument2 pagesIncome Tax Return: 1 Taxpayer DetailsArtha SarokarNo ratings yet

- Income Tax Return: 1 Taxpayer DetailsDocument2 pagesIncome Tax Return: 1 Taxpayer DetailsArtha SarokarNo ratings yet

- Annex9 RepatriatedIncome (IncomeTax D 19-01-0262) 1172014100110AMDocument1 pageAnnex9 RepatriatedIncome (IncomeTax D 19-01-0262) 1172014100110AMArtha SarokarNo ratings yet

- In Come Tax D 0401738302016123223 PMDocument2 pagesIn Come Tax D 0401738302016123223 PMArtha SarokarNo ratings yet

- PartnerIdentification (English) 1172014102329AMDocument1 pagePartnerIdentification (English) 1172014102329AMArtha SarokarNo ratings yet

- Annual Remuneration Return 1172014100110 AmDocument1 pageAnnual Remuneration Return 1172014100110 AmknmodiNo ratings yet

- Annual Remuneration Return Instruction 1172014100110 AmDocument1 pageAnnual Remuneration Return Instruction 1172014100110 AmArtha SarokarNo ratings yet

- "RGF CFBFG K - BFG Ug) ( Demf) TF: /FH:J +SNG $% K - LTZTN) J (l4Document12 pages"RGF CFBFG K - BFG Ug) ( Demf) TF: /FH:J +SNG $% K - LTZTN) J (l4Artha SarokarNo ratings yet

- Annex7 IncomefromInvestment (IncomeTax D 17-02-0860) English1172014100110AMDocument1 pageAnnex7 IncomefromInvestment (IncomeTax D 17-02-0860) English1172014100110AMArtha SarokarNo ratings yet

- Annex11 MedicalTaxCreditClaim (IncomeTax C 02-03-0162) English1172014100110AMDocument1 pageAnnex11 MedicalTaxCreditClaim (IncomeTax C 02-03-0162) English1172014100110AMArtha SarokarNo ratings yet

- Income Tax Return: 1 Taxpayer DetailsDocument2 pagesIncome Tax Return: 1 Taxpayer DetailsArtha SarokarNo ratings yet

- Annex1 CalculationofTaxforIndividuals (IncomeTax D 10-04-0762) Nepali1172014100109AMDocument1 pageAnnex1 CalculationofTaxforIndividuals (IncomeTax D 10-04-0762) Nepali1172014100109AMArtha SarokarNo ratings yet

- KF"RF) + /fli6 O S/ LBJ Ejotfsf Fy DKGG: /FH:J +SNG $ K - LTZTN) J (L4Document20 pagesKF"RF) + /fli6 O S/ LBJ Ejotfsf Fy DKGG: /FH:J +SNG $ K - LTZTN) J (L4Artha SarokarNo ratings yet

- Annex2 CalculationofTaxforEntities (IncomeTax D 01-04-0762) Nepali1172014100109AMDocument1 pageAnnex2 CalculationofTaxforEntities (IncomeTax D 01-04-0762) Nepali1172014100109AMArtha SarokarNo ratings yet

- Annex5 IncomefromBusiness (IncomeTax D 15-02-0860) English1172014100110AMDocument1 pageAnnex5 IncomefromBusiness (IncomeTax D 15-02-0860) English1172014100110AMArtha SarokarNo ratings yet

- Sfo ( DKFBG Demf) TF DKGG: /FH:J +SNG # K - LTZTN) J (L4Document12 pagesSfo ( DKFBG Demf) TF DKGG: /FH:J +SNG # K - LTZTN) J (L4Artha SarokarNo ratings yet

- @! A'"B) 3F) If0Ffkq HF/L Ub) (Joj:Yfkg Uf) I7L DKGG: /FH:J +SNG @! K - LTZTN) J (L4Document12 pages@! A'"B) 3F) If0Ffkq HF/L Ub) (Joj:Yfkg Uf) I7L DKGG: /FH:J +SNG @! K - LTZTN) J (L4Artha SarokarNo ratings yet

- Rent Tax Form7152015 105329 AMDocument1 pageRent Tax Form7152015 105329 AMArtha SarokarNo ratings yet

- Dfgglo PKK - WFGDGQL Tyf Cy (DGQL S (I0Faxfb'/ Dx/F4F/F: CFGTL/S /FH:J Ljefusf) Lg/Lif0FDocument12 pagesDfgglo PKK - WFGDGQL Tyf Cy (DGQL S (I0Faxfb'/ Dx/F4F/F: CFGTL/S /FH:J Ljefusf) Lg/Lif0FArtha SarokarNo ratings yet

- Fs (:T/Lo S/ Dagwl ) LDGF/ DKGG: /FH:J +SNG @ K - LTZTN) J (L4Document12 pagesFs (:T/Lo S/ Dagwl ) LDGF/ DKGG: /FH:J +SNG @ K - LTZTN) J (L4Artha SarokarNo ratings yet

- Sfo ( DKFBG Demf) TF DKGG: Ljefu Cgtu (TSF J) Sfof (Nox?AlrDocument16 pagesSfo ( DKFBG Demf) TF DKGG: Ljefu Cgtu (TSF J) Sfof (Nox?AlrArtha SarokarNo ratings yet

- CFGTL/S /FH:J Ljefu / /SF/L Jlsnalr CGTLQM (OfDocument12 pagesCFGTL/S /FH:J Ljefu / /SF/L Jlsnalr CGTLQM (OfArtha SarokarNo ratings yet

- CFGTL/S /FH:J Sfof (Nox?Sf) Lg/Lif0FDocument12 pagesCFGTL/S /FH:J Sfof (Nox?Sf) Lg/Lif0FArtha SarokarNo ratings yet