Professional Documents

Culture Documents

Mid Size Generic Audit Report

Uploaded by

hugoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mid Size Generic Audit Report

Uploaded by

hugoCopyright:

Available Formats

Company X

Distribution Center Audit

Seymour, CT

Developed by

St. Onge Company

Specializing in the Planning, Engineering & Implementation of Advanced

Material Handling, Information & Control Systems Supporting

Manufacturing & Distribution Excellence.

1400 Williams Road, York, PA 17402

Phone: (717) 840-8181 FAX: (717) 840-8182

TABLE OF CONTENTS

1. INTRODUCTION .......................................................................................................................1

2. ST. ONGE COMPANY BACKGROUND..................................................................................2

3. EXECUTIVE SUMMARY .........................................................................................................3

3.1. Storage ................................................................................................................................3

3.2. Receiving ............................................................................................................................4

3.3. Shipping ..............................................................................................................................4

3.4. Systems ...............................................................................................................................4

3.5. Material Handling Equipment.............................................................................................4

4. DATA SUMMARY .....................................................................................................................5

4.1. Weights and Measures ........................................................................................................5

4.2. Inventory Report .................................................................................................................5

4.3. Category Item Assignment .................................................................................................5

4.4. Product Categories ..............................................................................................................5

4.5. Safety Stock Report ............................................................................................................5

4.6. Growth Rates ......................................................................................................................6

4.7. Inventory Growth ................................................................................................................6

4.8. Current Facility Capacity ....................................................................................................6

5. STORAGE ...................................................................................................................................7

5.1. Small Parts Storage Area for Components. ........................................................................7

5.2. UWS Product to PT2 building. ...........................................................................................8

5.3. Cantilever Rack for UWS Cartons. .....................................................................................9

5.4. Varying Storage Mediums for Corrugated .......................................................................10

5.5. Granby Space ....................................................................................................................11

5.6. Rack Numbering ...............................................................................................................11

5.7. Fill Cross-Aisle Tunnel Scheduled ................................................................................12

5.8. New Rack Locations .........................................................................................................13

5.9. Random Reserve vs. Ready Reserve ................................................................................13

5.10. Clean Out Obsolete Components ....................................................................................14

5.11. Additional Space / Product Assignment .........................................................................14

6. RECEIVING ..............................................................................................................................15

6.1. Slip Sheets .........................................................................................................................15

6.2. Inbound Pallet Movement .................................................................................................15

7. SHIPPING..................................................................................................................................16

7.1. Reconfigure Pack Out Lines .............................................................................................16

7.2. Improve Outbound Order Staging ....................................................................................17

7.3. Consolidate Carriers..........................................................................................................17

Page i St. Onge Company

8. SYSTEM RELATED.................................................................................................................18

8.1. Locator System for Finished Goods .................................................................................18

8.2. Voice Pick .........................................................................................................................18

9. MATERIAL HANDLING EQUIPMENT .................................................................................19

9.1. Order Picker Truck versus Turret Truck ...........................................................................19

9.2. Robo-wrapper ...................................................................................................................19

10. GENERAL ...............................................................................................................................20

10.1. Junk Pallets .....................................................................................................................20

11. APPENDIX ..............................................................................................................................21

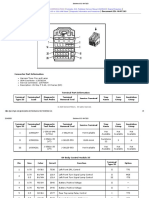

11.1. Cantilever Rack Information...........................................................................................21

Page ii St. Onge Company

1. INTRODUCTION

With a 6% projected annual growth rate and an increasing inventory level of larger truck boxes

and RV accessories, the Seymour, Connecticut facility is experiencing a storage crunch.

Currently 19,000 square feet of storage space is leased within the industrial park in the PT2

building. That space, coupled with the available storage space in the manufacturing facility is

still inadequate to handle the current inventory volume. We estimated, during our two day visit

on May 7th and 8th , that the facilities were operating with a greater than 100% storage utilization

rate, meaning that product was stored in aisles, on the receiving dock, the majority of racked

storage positions were filled, and product was sitting in trailers in the yard. This results in lost

inventory, additional labor costs to retrieve pallets, cycle counting problems, increased damages,

and overall higher labor costs to service the business.

With service level and brand recognition being the driving force behind product growth, it is

imperative that finished goods be available for shipments to distributors and out of stock

conditions are reduced to their lowest possible level.

The current available storage is 18,910 square feet in the PT building and 34,780 square feet,

including the shipping dock expansion, in the main manufacturing plant. Both manufacturing

components and finished goods are stored in both facilities.

One main congestion point exists in the manufacturing plant. The intersection point of the

receiving dock, the manufacturing operation, component storage, and finished goods storage

creates crossing traffic patterns and congestion for all operations. The congestion is also

manifested by the amount of inventory residing in the facility.

Company X has asked St. Onge Company to prepare a storage audit of the Seymour, CT facility.

The report that follows represents the documentation of that audits findings.

Page 1 St. Onge Company

2. ST. ONGE COMPANY BACKGROUND

The St. Onge Company is a logistics engineering and project management company. We have

been in business since 1983 and have grown to a staff of over 80 people. Our primary business

is planning, engineering, specification, implementation management, and control system

integration of logistics networks and advanced material handling systems in support of

manufacturing and distribution. Our work is typically offered in a three-phased approach and

encompasses efforts ranging from supply chain planning and within the walls engineering to

work process definitions and standardization to specific material handling systems design

including horizontal transportation, storage and retrieval, process/fabrication, system

development and packaging/assembly line design.

We are not a turnkey contractor. We feel that we play a vital role in engineering the best

solution without a bias to particular processes, equipment or vendor selected. After the network

analysis and the initial design phase, we move into the detailed design and specification phase

where selected vendors competitively bid to a well-defined and specified system. As bids are

received, we actively support the evaluation and negotiation process between the client and

selected vendors. This second phase is crucial in the development of documentation, training,

performance, acceptance field service, and warranty requirements as well as the development of

the Functional Systems Design Document and control system specifications. We then move into

the third phase, which is the monitoring of vendor/system performance and/or the actual site

management of contractors. Beyond the three phase design, procurement and implementation

work, we also perform operations planning management projects which both define best

practices and standards within an operation, as well as train management and line associates in

those best practices if so desired by our clients.

Our work is evenly distributed between manufacturing and distribution and is supported through

three primary in-house functions, which are distribution engineering, manufacturing engineering

and controls engineering. Where significant facilities engineering work is required, we will

provide or work with client selected firms. Since our inception, we have worked for numerous

industries and completed over 1,000 assignments for 300 client companies.

We have been most fortunate over the years with most of our work coming from repeat business

and references. We maintain a strong reputation for excellence based upon progressive attitudes,

creativity, leadership, integrity, work ethic and knowledge. We feel that we make a superior

contribution.

Page 2 St. Onge Company

3. EXECUTIVE SUMMARY

The nature of this project was a 2 day site visit and audit report. Limited data analysis was

conducted on high level inventory storage requirements. Recommendations are made based on

our observations and past experience. Sample testing, or due diligence justification should be

performed for all recommendations to make sure they are applicable to Company Xs unique

operating environment and future business strategies. The recommendations, divided into X

discrete sections are as follows:

1. Storage areas of concern or modifications primarily related to the storage of

components and finished goods

2. Receiving recommendations related to the inbound operation

3. Shipping recommendations related to the outbound operation

4. Systems recommendations relating to computer systems designed to assist in the

operational aspect of the facility

5. Material Handling Equipment Recommendations related to the movement of product

3.1. Storage

1. Install bins for storage of small parts. Allows for easier retrieval of small quantities.

2. Move UWS product to the PT2 facility. Receive and ship UWS product directly from PT2

and avoid having it in the manufacturing facility.

3. Install Cantilever rack for UWS product, based on the oversized pallet configurations.

4. Store corrugated pallets in a different configuration. Larger quantities of the same product

are better suited for drive in or bulk floor storage.

5. Complete rack numbering project. Not all locations are numbered in the component side

of the warehouse.

6. Fill one of the Cross Aisle Tunnels in the finished goods warehouse to increase pallet

storage capacity by 72 positions.

7. Add additional selective racking at existing pack out station locations once the stations are

relocated to the shipping expansion.

8. Migrate to a random reserve storage operation versus a ready reserve storage system.

9. Remove obsolete product from the facility.

10. Potential transfer of product categories to other facilities to reduce storage requirement in

Seymour.

Page 3 St. Onge Company

3.2. Receiving

1. Migrate to a slip sheet environment wherever possible for container shipments.

2. Hold inbound pallets on the receiving dock until the component warehouse can process

and putaway.

3.3. Shipping

1. Move pack out operation to shipping expansion. This will allow for conveyorized case

loading directly into the UPS trailers and free up higher clear space for additional racking

in the warehouse.

2. Install drive in rack for outbound pallet staging along the shipping dock wall.

3. Consolidate outbound LTL carriers for volume discounts and ease of loading.

3.4. Systems

1. Install a locator system for finished goods to replace todays manual operation.

2. Voice picking for customer orders will improve picking and provide performance tracking

capabilities.

3.5. Material Handling Equipment

1. Order picker truck versus turret truck for case picking.

2. Robo wrapper for odd shaped UWS pallets.

Page 4 St. Onge Company

4. DATA SUMMARY

4.1. Weights and Measures

1,329 Records

272 had Skid Quantity Values

o Finished Good 217.9 average

o Raw 420 Average

o RTS 308.3 Average

Assumed 6 units per pallet for UWS product

4.2. Inventory Report

4,815 Records(unique SKUs) on the Inventory File

69 Had zero or negative values (4,746 carried forward)

619 Finished Goods

7 No Data

3,007 Raw

512 RTS

670 Semi Finished

Matching this file to the weights and measurements file yielded 175 matches or less

than 4% of the SKU count on the inventory file.

Removed 381 Industrial Items (4,366 Remaining)

Based on limited data analysis, inventory projections are:

o 1,903 pallets of finished goods/RTS

o 2,468 pallets of components and raw materials

4.3. Category Item Assignment

14,063 records

4.4. Product Categories

279 category codes

4.5. Safety Stock Report

2,187 records

521 had values

Page 5 St. Onge Company

4.6. Growth Rates

Core Business 6% annually

Pro and RV 10% annually 75 SKUs coded as RV totaling 53 pallets of inventory or

3% of finished goods pallet inventory.

4.7. Inventory Growth

Throughput growth of 6% annually will yield an estimated inventory growth of 70% of the

throughput growth, or 4.2% inventory growth per year. That growth will yield the following

storage requirements for the CT operation, based on the current SKU profile.

2008 2009 2010 2011 2012 2013 2014 2015

Inventory 4,371 4,555 4,746 4,945 5,153 5,369 5,595 5,830

Pallet Inventory by Year

4.8. Current Facility Capacity

Total available pallet positions for the Seymour operation 4,401

Manufacturing facility 3,576 pallet positions

o Component Side 1,614 pallet positions

o Finished Goods Side - 1,962 pallet positions

PT2 Facility 825 pallet positions

Based on the limited component and finished goods packing information available, the pallet

inventory appears to be about equal to the capacity of the two facilities. A more detailed

analysis, including verification of all packing information, would show that the actual

inventory is slightly higher than shown here. During our audit visit, it was apparent that the

pallet inventory was higher than the actual capacity of the two facilities.

Page 6 St. Onge Company

5. STORAGE

5.1. Small Parts Storage Area for Components.

Install bin shelving or drawer storage for smaller component items. Currently, multiple

components are stored on pallet positions in rack storage. Bags and small boxes are

prone to falling between pallet boards or getting lost among the numerous items on a

single pallet. Picking also becomes easier, and more efficient, as single items are assigned

to single locations.

Existing Small Part Storage

Recommended Small Part Storage

Page 7 St. Onge Company

Storage drawers, installed with movable dividers, are ideal for smaller quantities and can

be located within the racking or located in a controlled area. The above example fits in

the space of a standard pallet and is used to store the plastic bins in the above example.

5.2. UWS Product to PT2 building.

Relocate Truck boxes (UWS) and accessories to the PT2 building. The majority of box

orders are for only UWS product. Inventory records show that approximately 231 pallets

are on hand of UWS product. This is based on the assumption that 6 finished goods

cartons will fit on each pallet.

Receipt and shipment of this product should occur from the PT2 site, without ever hitting

the main manufacturing facility. From time to time, a carrier may need to make a two

stop pick up, when the order calls for UWS and non UWS product. The other option is to

transfer the UWS product back to the manufacturing site for a consolidated order pick up.

The 231 pallets of inventory will fill approximately half of the available space in PT2,

based on four high pallet storage. Standard selective rack, currently installed in PT2

should be replaced with cantilever racking to better handle the length of odd sized

product.

Page 8 St. Onge Company

Based on the quantity of lengthy material, a side load truck can be used to access the

racking, while still maintaining a reasonable aisle width.

5.3. Cantilever Rack for UWS Cartons.

Regardless of the location of the UWS product, sections of single deep selective rack

should be removed and replaced with cantilever racking. This will allow for vertical

storage on the longer boxes and facilitate a reduction in damage via warehouse abuse.

UWS product has been designed for full pallet and truckload quantities and the individual

cartons do not contain any corner protection and are prone to damage during normal

warehousing operations.

The average dimension of a UWS product is 58.5 X 21.5 X 18.4. This will yield

approximately 6 cases on a 60 wide pallet, 42 deep and 55 high.

187 items had inventory totaling 1,386 pieces. At 6 pieces per pallet, we need to store

approximately 231 wide pallets. About 72 wide pallets, four high can be stored in each

aisle in PT2. This would require about half of the building, or 3.5 aisles to be configured

with cantilever rack.

The cantilever racking should be designed to handle pallet storage, if and when UWS

product is located in another facility.

Page 9 St. Onge Company

To reduce the aisle width requirement, a side loading fork truck should be used. The

following is one example of a side loader.

Side Load Example

A detailed cantilever rack document is included as an appendix to this document. It is

intended as informational and is not a recommendation for one supplier over another.

5.4. Varying Storage Mediums for Corrugated

There are a numerous pallets of corrugated located in both the main manufacturing plant,

as well as PT2. Our inventory snapshot did not include corrugated, but it appears that

certain corrugated items may be able to benefit from a denser form of storage. Either

drive-in rack or bulk floor storage may suit higher volume items rather than multiple

locations of selective racking. A separate inventory analysis will need to be completed to

determine the optimal storage medium based on actual inventory levels.

Current Corrugated Storage

Page 10 St. Onge Company

5.5. Granby Space

During our audit visit, Hugo Berube mentioned that Granby has available space and is

looking for product lines to handle, in an attempt to relieve Seymour of volume, while

increasing Granbys volume. While the idea has merit, moving product to Canada, only to

ship the majority back to the States, would involve import and export issues, while increasing

transportation costs. With fuel prices increasing daily, we are not recommending product

lines moving north, at this point.

5.6. Rack Numbering

An earlier initiative to number pallet locations within the facility was not completed. On the

component side of the business, pickers are required to search certain full rack bays to locate

product needed for a manufacturing cell. The entire facility should have bay and pallet

location numbers to assist pickers in locating product.

No Pallet Location Numbers Present

Page 11 St. Onge Company

Pallet Locations Identified

5.7. Fill Cross-Aisle Tunnel Scheduled

The finished goods portion of the manufacturing site has two sets of cross-aisle tunnels to

allow for aisle changes without traveling to the dock side of the facility. Filling in one of

those tunnels, which is already planned, will increase pallet storage by 72 positions. Only 24

pallet beams are required for this modification.

Additional Pallet Positions

Page 12 St. Onge Company

5.8. New Rack Locations

Newly installed racks near the current pack out station are not lagged to the floor. These

should be lagged as soon as possible, particularly since they are located adjacent to

unprotected individuals working the pack out line. Our recommendation regarding the pack

out line is covered in a future section and involves adding additional racking once the pack

out line moves. All of the rack bays should be lagged down, as soon as possible.

5.9. Random Reserve vs. Ready Reserve

With the finished goods portion of the facility operating in a manual mode, the overhead

reserve storage locations are held for product slotted in the floor level pick locations. While

this makes replenishment easier and reduces the time necessary to locate reserve pallets, it

adds to the issue of an over utilized facility. The few pallet positions that are sitting empty

are being held for particular product, while pallets of other product is sitting in aisles and

stored on trailers in the yard.

The facility should operate with a true random reserve locator system, which allows for

product to reside anywhere in the overhead locations. When replenishment is needed the

pallet is moved from its reserve location to its assigned pick location.

A locator system or full WMS system would facilitate this conversion to a true random

reserve operation.

Page 13 St. Onge Company

5.10. Clean Out Obsolete Components

During our audit tour, it was mentioned that some obsolete product is located in the storage

area. Removing this product from the rack and discarding it goes without saying. Any

additional pallet positions that can be gained, even if its one, is a help for the current

operation. Every additional pallet we can locate in the racking versus on the floor is a

potential savings when it comes to retreiving a particular pallet. When the aisles are full,

retrieving a single pallet can result in 20+ pallet moves to retrieve one single pallet. Ten

pallets moving out of the way, retrieve the required pallet, and 10 pallets moving back into

the aisle.

Product in Aisles

5.11. Additional Space / Product Assignment

Several alternatives exist for transfer of product categories to other facilities, in an effort to

relieve some of the pressure currently being experienced in the Seymour operation. One

scenario is to move the RV product to the Chicago area. This is estimated to be around 300

to 400 pallets of product. The UWS product could also move to another facility. This is

approximately 250 pallets.

Based on the projected growth, this would allow the two existing Seymour facilities to

function for approximately three more years before experiencing the same pain they are

currently experiencing with their inventory levels.

Without moving any product categories, Seymour is in need of additional warehouse space to

support the shipments to distributors. Actual configuration of the space will be dependent on

corporate direction regarding category movement. Ideally, we want to store locally

manufactured product local.

Page 14 St. Onge Company

6. RECEIVING

6.1. Slip Sheets

Migrating from floor loaded trailers to slip sheeted loads would reduce the amount of labor

needed to unload a trailer. In addition to the reduction in labor costs, the receiving dock door

availability will improve with a more efficient inbound process.

Two to three containers per week are unloaded in Seymour. It is estimated that six to eight

hours per trailer could be saved by utilizing slip sheeted loads. At three containers per week,

18 to 24 hours, or half an FTE, could be saved by a conversion to slip sheeting.

6.2. Inbound Pallet Movement

Currently, as components are received, they are transported to the staging area within the

component warehouse. Once that staging area is full, the pallets continue to flow into the

warehouse and are set in the cross aisle tunnels. While this relieves the pallet congestion on

the dock, it complicates the operation within the warehouse. This congestion adds to the

time required to retrieve product for the manufacturing operation and results in additional

pallets moves that would not be necessary if the pallets were held on the dock.

Our recommendation is to meter the received pallets into the component facility, if at all

possible, based on the rate of putaway. This will need to be a joint effort between the

receiving operation and the component putaway operation to work towards a better solution

for the facility, as a whole.

Page 15 St. Onge Company

7. SHIPPING

7.1. Reconfigure Pack Out Lines

The current pack out line runs perpendicular to the pick aisles and requires UPS cartons to be

palletized and wrapped prior to transport into the trailer. Once the cartons arrive at the UPS

terminal, the pallets are broken down and individual cases are again handled. Configuring

the pack out station to allow for loose case conveying directly into the trailer will eliminate

the need for palletizing and stretch wrapping.

Moving the pack out line to the lower clear height shipping expansion creates additional

storage space in the higher clear warehouse portion of the building. This space will be better

utilized with racked storage.

The pack out line also acts as a barricade to expanding the racking towards the dock.

Relocating and reconfiguring the pack out operation into the shipping expansion will allow

for:

Direct conveyance of cartons into the UPS trailer

Additional rack storage, thus increasing the capacity of the facility

Reduce congestion with the elimination of the UPS pallets

Improve safety with pack out staff removed from the storage area

Current Pack Out configuration

Page 16 St. Onge Company

Recommended Pack Out Configuration

7.2. Improve Outbound Order Staging

The current staging for outbound orders is floor storage in the shipping expansion. Product is

only double stacked for full pallets and the majority of the vertical cube is lost. By moving

the pack out line into the shipping expansion, we gain higher clear space in the storage

facility. To gain additional staging positions, 2 deep, 4 high, drive in racking can be installed

next to the docks for outbound staged pallets. Additionally, the front bays of selective rack

can be used for staging outbound loads.

7.3. Consolidate Carriers

Current outbound shipments are being transported via six different LTL carriers based on

final destination, weight and freight rates. Negotiations with one or two carriers to become

your primary freight vendor will most likely result in favorable rates, regardless of

destination, while streamlining the loading process. Fewer and larger shipments will result in

better dock utilization and improved loading rates for larger loads.

Page 17 St. Onge Company

8. SYSTEM RELATED

8.1. Locator System for Finished Goods

Installation of a basic locator system would allow for true random reserve storage, while

aiding in the replenishment and picking operation. The locator system could be interfaced via

an RF application or voice application. Both would yield real time location and availability

of product. Empty pallet locations positioned above assigned pick locations could be used

for any reserve product, thus reducing the amount of multiple handles and reduce the amount

of product in the aisles.

8.2. Voice Pick

Installing a voice pick application would allow for system assisted batching of customer

orders with matching SKUs, grouping single piece orders within the same picking aisle, and

reduce the learning curve necessary for new order pickers.

Voice picking would also trigger real time replenishment based on pick slot quantity, create a

potential hands free picking environment, as well as creating the ability to track individual

performance of employees. Performance tracking of individuals can improve production

from as low as a 10% to as high as 40%.

Page 18 St. Onge Company

9. MATERIAL HANDLING EQUIPMENT

9.1. Order Picker Truck versus Turret Truck

Case picking for product moving to the manufacturing cells and case replenishment is

currently being completed using a man up turret truck. Turret trucks are designed for full

pallet moves and are not necessarily designed for case picking. Man up order picker trucks

are better designed for case picking from upper positions and are substantially cheaper than

turret trucks. ($80,000 versus $35,000).

Our recommendation is that if additional trucks are required, order picker trucks should be

considered for future purchases. Utilize the turret trucks for full pallet putaway and full pallet

picking.

9.2. Robo-wrapper

Odd size pallets, particularly the UWS product can be wrapped with a robo wrapper. This

will eliminate the need for a manual wrapping of every pallet. A staging area is needed to

place the pallet for the robotic wrapper to travel around the target pallet. While the pallet is

being wrapped, the order selector can continue with his next pallet.

CT Packaging Systems in Cheshire, Connecticut is the local source for the robo wrapper.

Page 19 St. Onge Company

10. GENERAL

10.1. Junk Pallets

Minor mention of the fact that junk pallets are being thrown into the trash bin. Not only can

scrap wood be sold, or donated to recyclers, you would avoid the cost of paying to dispose of

the junk wood via trash hauling. Most trash is costed at a full can pull or by the ton. Either

way, the junk pallets are filling up the trash, when they are a potential source of income.

Page 20 St. Onge Company

11. APPENDIX

11.1. Cantilever Rack Information

The attached file is not a recommendation for a particular rack supplier, but simply an

explanation of cantilever racking and should be used as an information tool only.

Page 21 St. Onge Company

You might also like

- ICAO Annex 6Document188 pagesICAO Annex 6lev albarece100% (1)

- R2R - Asset Accounting BPTDocument107 pagesR2R - Asset Accounting BPTShazia Afrin100% (1)

- Chapter 14 - Planned - Maintenance - SystemDocument33 pagesChapter 14 - Planned - Maintenance - SystemAman Raj100% (2)

- Deepwater ArchaeologyDocument193 pagesDeepwater Archaeologyzrinka_vekic100% (2)

- Practical Process Control for Engineers and TechniciansFrom EverandPractical Process Control for Engineers and TechniciansRating: 5 out of 5 stars5/5 (3)

- Six Sigma: Advanced Tools for Black Belts and Master Black BeltsFrom EverandSix Sigma: Advanced Tools for Black Belts and Master Black BeltsNo ratings yet

- Drawworks MaintenanceOK enDocument46 pagesDrawworks MaintenanceOK envichusega_809319337100% (1)

- PT Student GuideDocument438 pagesPT Student GuideMakwana Nainesh100% (2)

- The Pursuit of New Product Development: The Business Development ProcessFrom EverandThe Pursuit of New Product Development: The Business Development ProcessNo ratings yet

- Strategic Mine Planning SurpacWhittleDocument308 pagesStrategic Mine Planning SurpacWhittlebruktawit100% (1)

- Land O Lakes Inspirage OTM-GTM Cloud SOW 2018-06-27 V11 PDFDocument45 pagesLand O Lakes Inspirage OTM-GTM Cloud SOW 2018-06-27 V11 PDFRahul Harsh RajéNo ratings yet

- AXMSummary BFSOU FinalReportMar17Document126 pagesAXMSummary BFSOU FinalReportMar17Santiago TazónNo ratings yet

- 2012 Qms Asphalt ManualDocument502 pages2012 Qms Asphalt Manualistiar100% (1)

- Tanker Cargo Calculations Jan-2018 2019Document9 pagesTanker Cargo Calculations Jan-2018 2019Gurjit Singh100% (4)

- Strategic Mine Planning SurpacWhittle v20Document316 pagesStrategic Mine Planning SurpacWhittle v20NurlanOruziev100% (1)

- IATA Message FormsDocument20 pagesIATA Message FormsServet Basol95% (41)

- SampleDocument103 pagesSamplegpcrao143No ratings yet

- SIG WG2 Research Report 1 Damages of Segmental Lining 2019Document119 pagesSIG WG2 Research Report 1 Damages of Segmental Lining 2019Season100% (3)

- Fuzzy Logic for Embedded Systems ApplicationsFrom EverandFuzzy Logic for Embedded Systems ApplicationsRating: 4 out of 5 stars4/5 (1)

- Hendricks, David W - Fundamentals of Water Treatment Unit Processes - Physical, Chemical, and Biological-CRC Press (2011)Document930 pagesHendricks, David W - Fundamentals of Water Treatment Unit Processes - Physical, Chemical, and Biological-CRC Press (2011)Héctor RomeroNo ratings yet

- Questionnaire MMDocument111 pagesQuestionnaire MMapi-3781101100% (9)

- Cat 621G 623G 627G NpiDocument51 pagesCat 621G 623G 627G NpiMahmmod Al-QawasmehNo ratings yet

- Cisco CCNA/CCENT Exam 640-802, 640-822, 640-816 Preparation KitFrom EverandCisco CCNA/CCENT Exam 640-802, 640-822, 640-816 Preparation KitRating: 2.5 out of 5 stars2.5/5 (8)

- HINAI - Business Architecture DocumentDocument50 pagesHINAI - Business Architecture DocumentICT HEALTHNo ratings yet

- Battery Charging Technologies For Advanced Submarine RequirementsDocument4 pagesBattery Charging Technologies For Advanced Submarine Requirementsjwpaprk1100% (1)

- Anotec - Foundries OverviewDocument69 pagesAnotec - Foundries OverviewAnotec Pty Ltd100% (1)

- Liebherr Hight Standards PDFDocument23 pagesLiebherr Hight Standards PDFmordidomi0% (1)

- South Africa’s Renewable Energy IPP Procurement ProgramFrom EverandSouth Africa’s Renewable Energy IPP Procurement ProgramNo ratings yet

- Logistic Req BMWDocument21 pagesLogistic Req BMWRene TapiaNo ratings yet

- Oracle OPM InventoryDocument378 pagesOracle OPM InventoryAnudeep KNo ratings yet

- ATMA Business PlanDocument42 pagesATMA Business PlanGODWIN IRIMORENNo ratings yet

- IPac AI Manual PDFDocument84 pagesIPac AI Manual PDFJose SilvaNo ratings yet

- DE Plan 10 Nov 04Document24 pagesDE Plan 10 Nov 04Nouredine KoufiNo ratings yet

- SmartAX OT928G Single Business Unit User Guide PDFDocument123 pagesSmartAX OT928G Single Business Unit User Guide PDFNom Mon0% (1)

- AquaTROLL 100 200 ManualDocument94 pagesAquaTROLL 100 200 ManualBerry CasanovaNo ratings yet

- T5L TA AIoT LCM Platform Instruction Screen Development GuideDocument54 pagesT5L TA AIoT LCM Platform Instruction Screen Development GuideZillaIllozNo ratings yet

- E63490 - Oracle RODOD Bookshelf - 12.2Document480 pagesE63490 - Oracle RODOD Bookshelf - 12.2Vinay D CNo ratings yet

- No. 2 MOS3000 Online CMS Software User Manual 2018.7Document66 pagesNo. 2 MOS3000 Online CMS Software User Manual 2018.7Saeed BashirNo ratings yet

- 115 CzdugDocument408 pages115 CzdugOlgalicia SGNo ratings yet

- PHMSA 2007 0038 0004 - Attachment - 5Document17 pagesPHMSA 2007 0038 0004 - Attachment - 5Guadalupe Correa CruzNo ratings yet

- Case StudyDocument91 pagesCase StudyAya MDEMAGHNo ratings yet

- Руководство 750-830Document360 pagesРуководство 750-830Abdallah AbdelrehimNo ratings yet

- AuditorDocument266 pagesAuditorAkin AkinmosinNo ratings yet

- It's Alive! Getting To Successful R-PHY Deployment - Do's and Don'TsDocument22 pagesIt's Alive! Getting To Successful R-PHY Deployment - Do's and Don'TsmjurczukNo ratings yet

- 115 EccimDocument408 pages115 Eccimpragna_dasNo ratings yet

- Oracle® Audit Vault and Database Firewall: Auditor's Guide Release 12.1.2Document266 pagesOracle® Audit Vault and Database Firewall: Auditor's Guide Release 12.1.2rais lassaadNo ratings yet

- Final ProjectDocument45 pagesFinal ProjectTimothyNo ratings yet

- Atollic TrueSTUDIO For ARM User Guide PDFDocument414 pagesAtollic TrueSTUDIO For ARM User Guide PDFMmeli NtwanaYebhoza DubeNo ratings yet

- Os6450 HDW RevlDocument172 pagesOs6450 HDW Revlamel632No ratings yet

- SCP WhitePaper v1.0Document27 pagesSCP WhitePaper v1.0Omar Sedano PachecoNo ratings yet

- OUI E12255Document210 pagesOUI E12255aibot aibotNo ratings yet

- Selenio 6800 ManualDocument48 pagesSelenio 6800 ManualqiqeonNo ratings yet

- Oracle9iAS Personalization (User Giude)Document58 pagesOracle9iAS Personalization (User Giude)Dawood Adel DhakallahNo ratings yet

- XMLDocument214 pagesXMLKarunakarreddy DesireddyNo ratings yet

- 115 MvstatugDocument202 pages115 Mvstatugkuttush1No ratings yet

- Rich Media SOP - 8.10 PDFDocument191 pagesRich Media SOP - 8.10 PDFAvez AhmedNo ratings yet

- Atollic TrueSTUDIO For STMicroelectronics STM32 QuickstartGuideDocument124 pagesAtollic TrueSTUDIO For STMicroelectronics STM32 QuickstartGuideThanh nhaNo ratings yet

- Oracle Enterprise Asset Management: User's GuideDocument422 pagesOracle Enterprise Asset Management: User's GuidehacenegadmiNo ratings yet

- 115 ArtaxwDocument118 pages115 ArtaxwOlgalicia SGNo ratings yet

- Datastage TutorialDocument177 pagesDatastage TutorialYoussef LachirNo ratings yet

- Communication Server: IP Attendant Soft Phone - User GuideDocument62 pagesCommunication Server: IP Attendant Soft Phone - User Guideissa galalNo ratings yet

- Supplied PLSQL Packages Reference - A76936Document1,036 pagesSupplied PLSQL Packages Reference - A76936aguirrezalemNo ratings yet

- Admas University: A Senior Essay Submitted TotheDocument19 pagesAdmas University: A Senior Essay Submitted TotheHabteweld EdluNo ratings yet

- 31501956-OptiX OSN 7500 Commissioning Guide (V100R007 - 01)Document112 pages31501956-OptiX OSN 7500 Commissioning Guide (V100R007 - 01)nguyenbaviet89No ratings yet

- Product Development User GuideDocument21 pagesProduct Development User Guidesudhirpatil15No ratings yet

- Business Control Center User's Guide: Oracle ATG One Main Street Cambridge, MA 02142 USADocument62 pagesBusiness Control Center User's Guide: Oracle ATG One Main Street Cambridge, MA 02142 USADheeraj TripathiNo ratings yet

- Users GuideDocument155 pagesUsers GuideAdrian Manuel Lopez AlmejoNo ratings yet

- Guide To Computer Security Log Management: Recommendations of The National Institute of Standards and TechnologyDocument72 pagesGuide To Computer Security Log Management: Recommendations of The National Institute of Standards and TechnologyMadanNo ratings yet

- D P P & P: ATA Rotection Olicy RoceduresDocument33 pagesD P P & P: ATA Rotection Olicy RoceduresKoshalNo ratings yet

- Physical Property Data 11.1Document390 pagesPhysical Property Data 11.1AgustinAlvarezAlvarezNo ratings yet

- Body Control Module X5Document3 pagesBody Control Module X5Men PanhaNo ratings yet

- De Shaw - Mock - DDocument0 pagesDe Shaw - Mock - DAkshay RawatNo ratings yet

- LTWP - Road - Rehabilitation - ESIA - AddendumDocument43 pagesLTWP - Road - Rehabilitation - ESIA - AddendumPrince AliNo ratings yet

- Bicycle Motorcycle Car/ Private Type Jeep Pedicab Tricycle Jeepney Multicab & RuscoDocument5 pagesBicycle Motorcycle Car/ Private Type Jeep Pedicab Tricycle Jeepney Multicab & Ruscokim suarezNo ratings yet

- 2007 Ashrae Handbook Parking Garages - p1 3Document3 pages2007 Ashrae Handbook Parking Garages - p1 3Sergio Motta GarciaNo ratings yet

- Mobility Aids Vehicles BizHouse - UkDocument3 pagesMobility Aids Vehicles BizHouse - UkAlex BekeNo ratings yet

- C7&C9 - Notes - S12Document64 pagesC7&C9 - Notes - S12Kareem RadwanNo ratings yet

- Plano Electrico PDFDocument11 pagesPlano Electrico PDFNoelia ApazaNo ratings yet

- Policy Assessment Using Real-World Emissions Data From Vehicles in Scottish CitiesDocument3 pagesPolicy Assessment Using Real-World Emissions Data From Vehicles in Scottish CitiesThe International Council on Clean TransportationNo ratings yet

- Long Range Navigation & North Atlantic OperationsDocument20 pagesLong Range Navigation & North Atlantic Operationsvostok3KA100% (1)

- Väderstad News 2019Document35 pagesVäderstad News 2019martynjoyceNo ratings yet

- SB1012 Fresh Air Duct Sutrak AC 35 Rooftop UnitDocument6 pagesSB1012 Fresh Air Duct Sutrak AC 35 Rooftop UnittchernserNo ratings yet

- New Bedford First Edition Rules-1Document28 pagesNew Bedford First Edition Rules-1daironnerosario6798No ratings yet

- Offshore Owner Orderbook Monitor - September 2013 PDFDocument20 pagesOffshore Owner Orderbook Monitor - September 2013 PDFJoherNo ratings yet

- No Division Name Officer Name Officer Mob No. Landline No. Email Id Division AddressDocument2 pagesNo Division Name Officer Name Officer Mob No. Landline No. Email Id Division AddressAnkush Soni KatailihaNo ratings yet

- Surface Drain Channels: Jeevan Bhar Ka Saath..Document2 pagesSurface Drain Channels: Jeevan Bhar Ka Saath..arjun 11No ratings yet

- Motor Vehicles Act 1988Document18 pagesMotor Vehicles Act 1988Rashmi RaghavanNo ratings yet

- The Fertilisers and Chemicals Travancore LimitedDocument31 pagesThe Fertilisers and Chemicals Travancore LimitedBrandon AllenNo ratings yet

- (ACI 544.3r-93) - Guia para El Proporcionamiento, Mezclado Del CRFDocument10 pages(ACI 544.3r-93) - Guia para El Proporcionamiento, Mezclado Del CRFJohan LamasNo ratings yet